US Inflation Rises in March but Inflation Expectations Remain Moderate

- 1. Data for your Classroom from Ed Dolan’s Econ Blog Consumer Price Inflation Rises in March, but No Sign of an Increase in Inflation Expectations March 19, 2014 Terms of Use: These slides are provided under Creative Commons License Attribution—Share Alike 3.0 . You are free to use these slides as a resource for your economics classes together with whatever textbook you are using. If you like the slides, you may also want to take a look at my textbook, Introduction to Economics, from BVT Publishing.

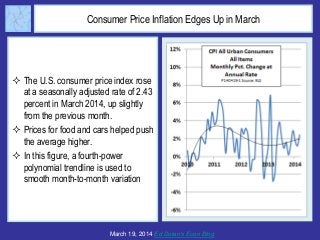

- 2. Consumer Price Inflation Edges Up in March The U.S. consumer price index rose at a seasonally adjusted rate of 2.43 percent in March 2014, up slightly from the previous month. Prices for food and cars helped push the average higher. In this figure, a fourth-power polynomial trendline is used to smooth month-to-month variation March 19, 2014 Ed Dolan’s Econ Blog

- 3. Core Inflation Rate Also Rises Another way to smooth month-to- month variation is to remove volatile food and energy prices from the all- items CPI The result is called the core CPI In March, an increase in food prices was almost entirely offset by a decrease in energy prices, so that core and all-items inflation was approximately the same March 19, 2014 Ed Dolan’s Econ Blog

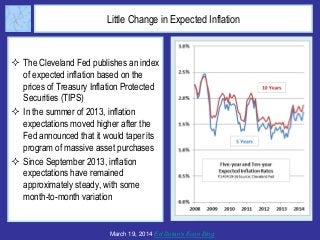

- 4. Little Change in Expected Inflation The Cleveland Fed publishes an index of expected inflation based on the prices of Treasury Inflation Protected Securities (TIPS) In the summer of 2013, inflation expectations moved higher after the Fed announced that it would taper its program of massive asset purchases Since September 2013, inflation expectations have remained approximately steady, with some month-to-month variation March 19, 2014 Ed Dolan’s Econ Blog

- 5. The Bottom Line The Federal Reserve has set a target of 2 percent inflation, as measured by the Personal Consumption Deflator, equivalent to about 2.5 percent inflation for the CPI The latest data on current and expected inflation show that the economy is still falling short of the Fed’s inflation target March 19, 2014 Ed Dolan’s Econ Blog

- 6. Click here to learn more about Ed Dolan’s Econ texts or visit www.bvtpublishing.com For more slideshows, follow Ed Dolan’s Econ Blog Follow @DolanEcon on Twitter