Abstract

When analyzing the relative performance of mutual funds, current data envelopment analysis (DEA) models with diversification ignore the performance change in consecutive periods or the dynamic dependence among investment periods. This paper introduces a novel multi-period network DEA approach with diversification and directional distance function. The new approach decomposes the overall efficiency of a mutual fund in the whole investment interval into efficiencies at individual periods. At each period, mutual funds consume exogenous inputs and intermediate products produced from the preceding period to produce exogenous outputs and intermediate products for the next period to use. Efficiency decomposition reveals the time at which the inefficiency occurs. The new model can provide expected inputs, outputs and intermediate variables at individual periods, which are helpful for managers to find factors causing the overall inefficiency of a fund. Under the assumption of discrete return distributions and a proper choice of inputs, outputs and intermediate variables, the proposed models can be transformed into linear programs. The applicability and reasonability of the proposed method are demonstrated by applying it to assess the relative performance of funds in Chinese security market and European security market, respectively.

Similar content being viewed by others

References

Atkinson C, Alvarez MJ (2001) The influence of perceived stock value price histories in the mean-variance-instability model. Eur J Oper Res 128:185–191

Banker RD, Charnes A, Cooper WW (1984) Some models for estimating technical and scale efficiencies in data envelopment analysis. Manag Sci 30:1078–1092

Basso A, Funari S (2001) A data envelopment analysis approach to measure the mutual fund performance. Eur J Oper Res 135:477–492

Basso A, Funari S (2003) Measuring the performance of ethical mutual funds: a DEA approach. J Oper Res Soc 54:521–531

Branda M (2013) Diversification-consistent data envelopment analysis with general deviation measures. Eur J Oper Res 226:626–635

Branda M (2015) Diversification-consistent data envelopment analysis based on directional-distance measures. Omega Int J Manag S 52:65–76

Branda M (2016) Mean-value at risk portfolio efficiency: approaches based on data envelopment analysis models with negative data and their empirical behaviour. 4OR-Q J. Oper Res 14:77–99

Branda M, Kopa M (2014) On relations between DEA-risk models and stochastic dominance efficiency tests. Cent Eur J Oper Res 22:13–35

Branda M, Kopa M (2016) DEA models equivalent to general N-th order stochastic dominance efficiency tests. Oper Res Lett 44:285–289

Briec W, Kerstens K (2009) Multi-horizon Markowitz portfolio performance appraisals: a general approach. Omega Int J Manag S 37:50–62

Briec W, Kerstens K, Lesourd JB (2004) Single-period Markowitz portfolio selection, performance gauging, and duality: a variation on the Luenberger shortage function. J OptimTheory App 120:1–27

Chambers RG, Chung Y, Färe R (1998) Profit, directional distance functions and Nerlovian efficiency. J Optim Theory App 98:351–364

Charnes A, Cooper WW, Rhodes E (1978) Measuring the efficiency of decision making units. Eur J Oper Res 2:429–444

Chen Z, Lin R (2006) Mutual fund performance evaluation using data envelopment analysis with new risk measures. OR Spectr 28:375–398

Chen KH, Guan JC (2012) Measuring the efficiency of China’s regional innovation systems: application of network data envelopment analysis (DEA). Reg Stud 46:355–377

Chen Y, Du J, Huo J (2013) Super-efficiency based on a modified directional distance function. Omega Int J Manag S 41:621–625

Chung YH, Färe R, Grosskopf S (1997) Productivity and undesirable outputs: A directional distance function approach. J Environ manag 51:229–240

Cook WD, Zhu J, Bi G, Yang F (2010) Network DEA: additive efficiency decomposition. Eur J Oper Res 207:1122–1129

Cooper WW, Seiford LM, Tone K (2007) Data envelopment analysis. Springer, New York

Färe R, Grosskopf S (1996) Intertemporal production frontiers: with dynamic DEA. Kluwer, Boston

Fukuyama H, Weber WL (2009) A directional slacks-based measure of technical inefficiency. Soc Econ Plan Sci 43:274–287

Fukuyama H, Weber WL (2010) A slacks-based inefficiency measure for a two-stage system with bad outputs. Omega Int J Manag S 38:398–409

Galagedera DUA (2013) A new perspective of equity market performance. Int Financ Mark Inst Money 26:333–357

Joro T, Na P (2006) Portfolio performance evaluation in a mean-variance-skewness framework. Eur J Oper Res 175:446–461

Kao C (2013) Dynamic data envelopment analysis: A relational analysis. Eur J Oper Res 227:325–330

Kao C, Liu ST (2014) Multi-period efficiency measurement in data envelopment analysis: the case of Taiwanese commercial banks. Omega Int J Manag S 47:90–98

Lamb JD, Tee KH (2012) Data envelopment analysis models of investment funds. Eur J Oper Res 216:687–696

Liang L, Cook WD, Zhu J (2008) DEA models for two-stage processes: game approach and efficiency decomposition. Nav Res Logist 55:643–653

Lin R, Chen Z (2008) New DEA performance evaluation indices and their applications in the American fund market. Asia Pac J Oper Res 25:421–450

Lozano S, Gutiérrez E (2008a) Data envelopment analysis of mutual funds based on second-order stochastic dominance. Eur J Oper Res 189:230–244

Lozano S, Gutiérrez E (2008b) TSD-consistent performance assessment of mutual funds. J Oper Res Soc 59:1352–1362

Lozano S, Gutiérrez E, Moreno P (2013) Network DEA approach to airports performance assessment considering undesirable outputs. Appl Math Model 37:1665–1676

Morey MR, Morey RC (1999) Mutual fund performance appraisals: a multi-horizon perspective with endogenous benchmarking. Omega-Int J Manag S 27:241–258

Murthi BPS, Choi YK, Desai P (1997) Efficiency of mutual funds and portfolio performance measurement: a non-parametric approach. Eur J Oper Res 98:408–418

Ogryczak W, Ruszczynski A (2002) Dual stochastic dominance and related mean-risk models. SIAM J Optim 13:60–78

Portela MCAS, Thanassoulis E, Simpson G (2004) Negative Data in DEA: A directional distance approach applied to bank branches. J Oper Res Soc 55(10):1111–1121

Premachandra IM, Zhu J, Watson J, Galagedera DUA (2012) Best-performing US mutual fund families from 1993 to 2008: Evidence from a novel two-stage DEA model for efficiency decomposition. J Bank Financ 36:3302–3317

Ray SC (2008) The directional distance function and measurement of super-efficiency: an application to airlines data. J Oper Res Soc 59:788–797

Ray SC, Desli E (1997) Productivity growth, technical progress and efficiency changes in industrialised countries: Comment. Am Econ Rev 87:1033–1039

Rockafellar RT, Uryasev S, Zabarankin M (2006) Generalized deviations in risk analysis. Financ Stoch 10:51–74

Ruiz JL (2013) Cross-efficiency evaluation with directional distance functions. Eur J Oper Res 228:181–189

Sharp JA, Meng W, Liu W (2007) A modified slacks-based measure model for data envelopment analysis with ’natural’ negative outputs and inputs. J Oper Res Soc 58(12):167–1677

Sueyoshi T (1992) Comparisons and Analyses of Managerial Efficiency and Returns to Scale of Telecommunication Enterprises by using DEA/WINDOW. Commun Oper Res Soc Jpn 37:210–219 (in Japanese)

Tone K, Tsutsui M (2010) Dynamic DEA: a slacks-based measure approach. Omega Int J Manag S 38:145–156

Tone K, Tsutsui M (2014) Dynamic DEA with network structure: a slacks-based measure approach. Omega Int J Manag S 42:124–131

Author information

Authors and Affiliations

Corresponding author

Additional information

This work is supported by the Natural Science Foundation of Zhejiang Province, China (Grant No. LY17G010004) and the National Natural Science Foundation of China (Grant Nos. 11301395, 71371152 and 11571270). The authors appreciate the important comments made by Dr. Martin Branda. The authors are grateful to two anonymous reviewers and the editor for their constructive comments, which have helped us to improve the paper significantly in both content and style.

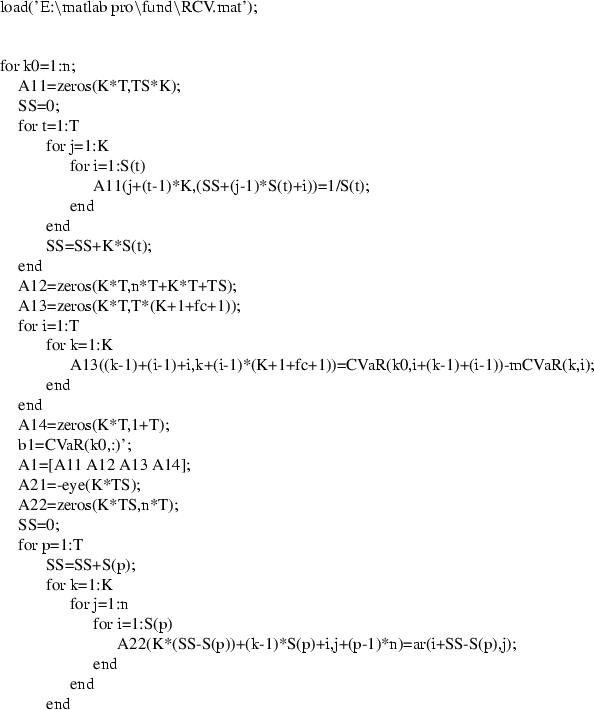

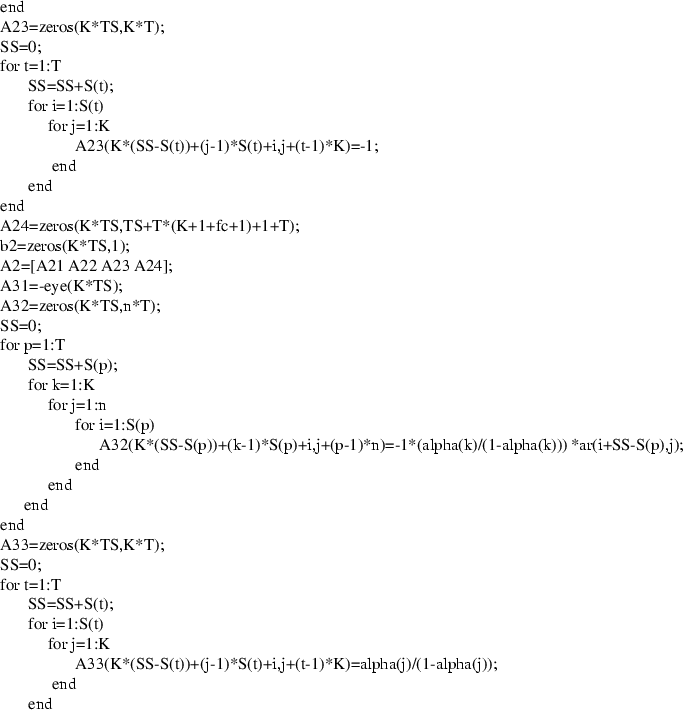

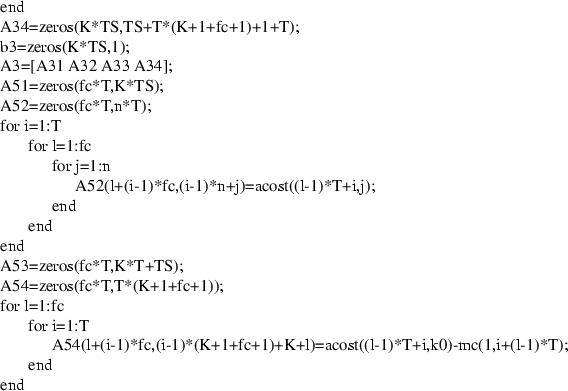

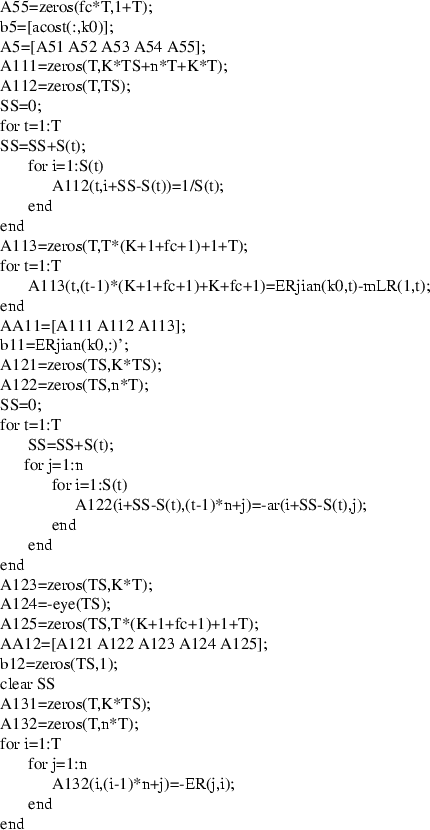

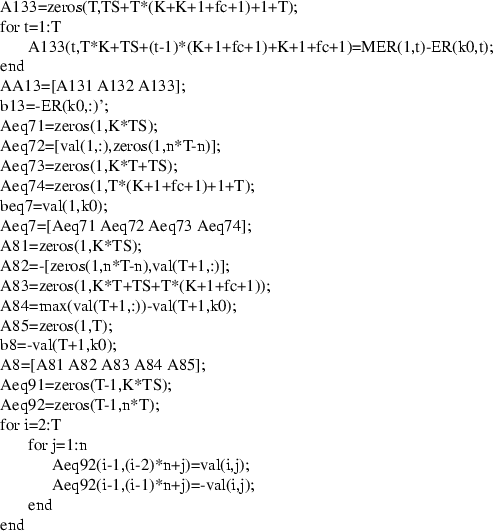

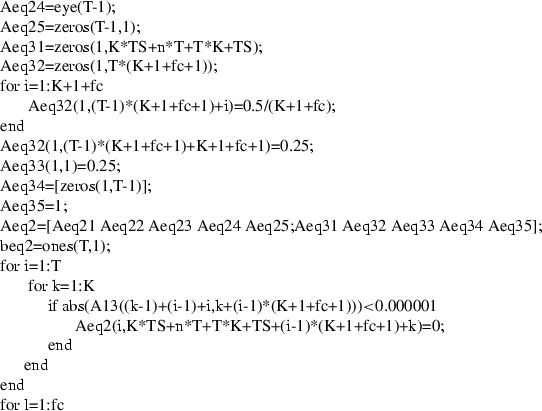

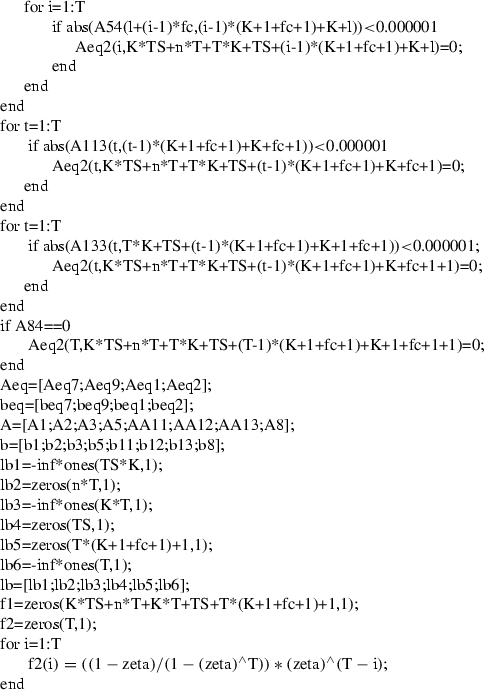

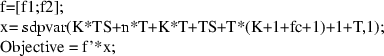

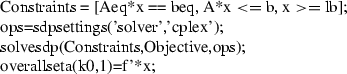

Appendix A: the chief MATLAB code for solving problem \((M^{O'})\)

Appendix A: the chief MATLAB code for solving problem \((M^{O'})\)

Rights and permissions

About this article

Cite this article

Lin, R., Chen, Z., Hu, Q. et al. Dynamic network DEA approach with diversification to multi-period performance evaluation of funds. OR Spectrum 39, 821–860 (2017). https://doi.org/10.1007/s00291-017-0475-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00291-017-0475-1