Abstract

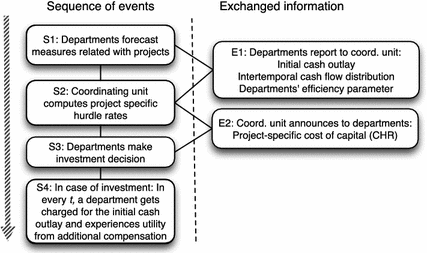

The efficient allocation of scarce financial resources lies at the core of financial management. Whenever humans are involved in the allocation process, it would be reasonable to consider abilities, in order to assure efficiency. For the context of coordinating investment decisions, the competitive hurdle rate (CHR) mechanism (Baldenius et al. in Account Rev 82(4):837–867, 2007) is well established for allocating resources. This mechanism is derived from an agency model, which, as is the nature of agency models, assumes agents as being fully competent. We employ the agentization approach (Guerrero and Axtell in Emergent results of artificial economics, Lect Notes Econ Math, vol 652. Springer, Berlin, pp 139–150, 2011) and transfer the logic behind the CHR mechanism into a simulation model, and account for individual incapabilities by adding errors in forecasting the initial cash outlay, the cash flow time series, and the departments’ ability to operate projects. We show that increasing the number of project proposals, and decreasing the investment alternatives diversity (in terms of their profitability only), significantly decreases the fault tolerance of our CHR mechanism. For misforecasting cash outlays, this finding is independent from the error’s dimension, while for larger errors in forecasting cash flows, and the departmental ability, the impact of diversity reverses. On the basis of our results, we provide decision support on how to increase the robustness of the CHR mechanism with respect to errors.

Similar content being viewed by others

Notes

Agentization is the exercise of rendering neoclassical models into computational ones. In our case, it allows us to get rid of a neoclassical core assumption: agents are no more homogeneous [corresponding to the representative agent assumption, see, e.g., Kirman (1992)]. Moreover, we drop the assumption of agents being fully informed, presume that agents are not fully capable to execute their plans, and perceive agents to be able to interact (in spite of the fact that interaction is excluded between department managers, while the coordinating unit of a business organization interacts with all of its departments).

Note that we do not refer to all investment opportunities within a cooperation, but only to those that compete for the same pot of funding.

In order to avoid negative forecasts, we limit the error terms to \(\pm 3\sigma \).

Please notice that the introduced types of errors are independent of each other. I.e., to build up a simulator, we first generate the investment alternatives with all their associated measures upon realization. Then, second, the agents have to forecast these (unknown) measures whereby the forecasts are always based on the error-free case. Thus, errors are independent so that, for example, an erroneous forecast of the initial cash outlay (cf. Eq. 5) does not affect the basis for forecasting the cash flow time series, \(\chi _{it}\), in Eq. 6.

Note that agency problems are excluded in the approach presented here. Thus, any deliberate misreporting from the departmental side can be ignored. Agents are ‘incompetent’ but not dishonest.

Notice that changes \(H=[\underline{\eta },\overline{\eta }]\) affect each and every project.

Recall that project homogeneity only indicates that projects are similar in their returns on investment, ceteris paribus. Thus, if projects are more homogenous this does not imply that the money necessary to launch a project, the cash flow time series, and the departmental ability to operate a project are becoming more similar.

References

Axtell RL (2007) What economic agents do: how cognition and interaction lead to emergence and complexity. Rev Austrian Econ 20(2–3):105–122

Baldenius T, Dutta S, Reichelstein S (2007) Cost allocation for capital budgeting decisions. Account Rev 82(4):837–867

Behrens DA, Berlinger S, Wall F (2014) Phrasing and timing information dissemination in organizations: results of an agent-based simulation. In: Leitner S, Wall F (eds) Artificial economics and self organization, Lect Notes Econ Math, vol 669. Springer International, pp 179–190

Brigham EF (1975) Hurdle rates for screening capital expenditure proposals. Financ Manage 4(3):17–26

Christensen M, Knudsen T (2007) Design of decision-making organization. Manage Sci 56(1):71–89

Eisenhardt KM (1989) Agency theory: an assessment and review. Acad Manage Rev 14(1):57–74

Fisher FM (1989) Games economists play: a noncooperative view. RAND J Econ 20(1):113–124

Fremgen JM (1973) Capital budgeting practices: a survey. Manage Account 54(11):19–25

Furubotn EG, Richter R (2000) Institutions and economic theory, 3rd edn. University of Michigan Press, Ann Arbor, Michigan

Ghoshal S, Moran P (1996) Bad for practice: a critique of the transaction cost theory. Acad Manage Rev 21(1):13–47

Guerrero OA, Axtell RL (2011) Using agentization for exploring firm and labor dynamics. A methodological tool for theory exploration and validation. In: Osinga S, Hofstede GJ, Verwaart T (eds) Emergent results of artificial economics, Lect Notes Econ Math, vol 652. Springer, Berlin, pp 139–150

Hendry J (2002) The principal’s other problems: honest incompetence and the specification of objectives. Acad Manage Rev 27(1):98–113

Kahneman D, Tversky A (1979) Prospect theory: an analysis of decision under risk. Econometrica 47(2):263–292

Kirman AP (1992) Whom or what does the representative individual represent? J Econ Persp 6(2):117–136

Laffont JJ, Martimort D (2002) The theory of incentives. The principal-agent problem. Princeton University Press, Princeton

Leitner S (2012) A simulation analysis of interactions among intended biases in costing systems and their effects on the accuracy of decision-influencing information. Cent Eur J Operat Res. doi:10.1007/s10100-012-0275-2

Leitner S (2013) Information quality and management accounting, Lect Notes Econ Math, vol 664. Springer, Berlin

Leitner S, Behrens DA (2013a) Coordination of distributed investment decisions: the agentization of the competitive hurdle rate mechanism. Working paper. Alpen-Adria Universität Klagenfurt (in submission)

Leitner S, Behrens DA (2013b) Residual income measurement & the emergence of cooperation: results of an agent-based simulation of budget coordination. In: Leopold-Wildburger U et al. (eds) Proceedings of the EURO mini-conference graz. Graz: EWG-E.CUBE, EWG-DSS, EWG-MCSP, EWG-ORAFM

Leitner S, Behrens DA (2014) On the robustness of coordination mechanisms involving incompetent agents. In: Leitner S, Wall F (eds) Artificial economics and self organization, Lect Notes Econ Math, vol 669. Springer, International, pp 191–203

Leitner S, Wall F (2011a) Effectivity of multi criteria decision-making in organisations: Results of an agent-based simulation. In: Osinga S, Hofstede GJ, Verwaart T (eds) Emergent results of artificial economics, Lect Notes Econ Math, vol 652. Springer, Berlin, pp 79–90

Leitner S, Wall F (2011b) Unexpected positive effects of complexity on performance in multiple criteria setups. In: Hu B, Morasch K, Pickl S, Siegle M (eds) Operations research proceedings 2010. Operat Res Proceed. Springer, Berlin, pp 577–582

Ma T, Nakamori Y (2005) Agent-based modeling on technological innovation as an evolutionary process. Eur J Oper Res 166(3):741–755

Martin R (1993) The new behaviorism: a critique of economics and organization. Hum Relat 46(9):1085–1101

Meier H, Christofides N, Salkin G (2001) Capital budgeting under uncertainty—an integrated approach using contingent claims analysis and integer programming. Oper Res 49:196–206

Miller JH (1960) A glimpse at practice in calculating and using return on investment. NAA Bull (Manage Account) June:65–76

Miller P, O’Leary T (2005) Capital budgeting, coordination, and strategy: a field study of interfirm and intrafirm mechanisms. In: Chapman CS (ed) Controlling strategy: management, accounting, and performance measurement. Oxford University Press, Oxford, pp 151–191

Minton BA, Schrand C, Walther B (2002) The role of volatility in forecasting. Rev Account Stud 7:195–215

Rogerson WP (1997) Intertemporal cost allocation and managerial investment incentives: a theory explaining the use of economic value added as a performance measure. J Polit Econ 105:770–795

Rogerson WP (2008) Intertemporal cost allocation and investment decisions. J Polit Econ 116(5):931–950

Ross SA (1973) The economic theory of agency: the principal’s problem. Am Econ Rev 63(2):134–139

Ryan PA, Ryan GP (2002) Capital budgeting practices of the fortune 1000: how have things changed? J Bus Manage 8(4):355

Schall LD, Sundem GL, Geijsbeek WR (1978) Survey and analysis of capital budgeting methods. J Financ 33(1):281–287

Simon HA (1991) Organizations and markets. J Econ Perspect 5(2):25–44

Stark O, Behrens DA (2010) An evolutionary edge of knowing less (or: on the curse of global information). J Evol Econ 20(1):77–94

Tesfatsion L (2006) Agent-based computational economics: a constructive approach to economic theory. In: Tesfatsion L, Judd KL (eds) Handbook of computational economics. Agent-based computational economics, vol 2. Elsevier, Amsterdam, pp 831–880

Young SD, O’Byrne SF (2002) EVA and value-based management. A practical guide to implementation, 6th edn. McGraw-Hill, New York

Acknowledgments

In parts, the work of Doris A. Behrens was carried out within the SOSIE project, supported by Lakeside Labs GmbH, and partly funded by the European Regional Development Fund (ERDF) and the Carinthian Economic Promotion Fund (KWF) under grant no. 20214/23793/35529.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

See Tables 1, 2, 3, 4, 5, 6, 7, 8, and 9.

Rights and permissions

About this article

Cite this article

Leitner, S., Behrens, D.A. On the fault (in)tolerance of coordination mechanisms for distributed investment decisions. Cent Eur J Oper Res 23, 251–278 (2015). https://doi.org/10.1007/s10100-013-0333-4

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10100-013-0333-4