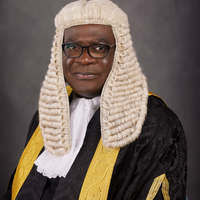

Theodore B Maiyaki, SAN

MAIYAKI THEODORE BALA, SAN Ph.D., BL, FCIMC, FCIArb (UK).

Maiyaki Theodore Bala, SAN attended the prestigious Government Science School Kuru. He obtained a Diploma and then a Degree in Law; LLB (Hons) from the prestigious Ahmadu Bello in University Zaria. He was called to the Nigeria Bar in 1993, after which he proceeded to obtain his Master of Laws (LL.M) Degree from the University of Jos – Nigeria in 1996. He capped his academic pursuit when he obtained a Doctor of Laws Degree (Ph.D.) in International Economic Law from the University of Jos – Nigeria in 2012.

He worked as a Legal Officer and rose to be the Company Secretary/Legal Adviser of Imani Mortgage Finance from 1993-1998. He was engaged as the Executive Director (Corporate Affairs) of Duncan Maritime Ventures Ltd between 1998-2000 after which he returned to full legal practice. He was the Special Assistant (legal), to the Governor of Plateau State, from 2002-2007. He is an Associate Professor of International Economic Law with the Faculty of Law and is currently the Head of Department, Department of Jurisprudence and the International Law, University of Abuja-Nigeria.

An Alumnus of Harvard University, he attended and presented papers at several local and International Seminars and workshops on Law, Politics, and Business. He has to his credit 3 books; ‘A hand Book on Mortgage Law and Banking in Nigeria’, ‘A Hand Book on the ECOWAS Treaty and Financial Institutions’ and ‘Modern Practice of Civil Litigation in Nigeria’, all of which are available on Amazon and Ebay platforms. He is also an accomplished researcher with published works in many renowned local and International Journals.

He is the Principal Partner of KWO Chambers, Abuja, and a member of the Nigeria Bar Association (NBA); International Bar Association(IBA); Association for Nigerian Law Teachers (NALT); Fellow, Chartered Institute of Arbitrators (FCIArb UK); Fellow, Chartered Institute of Mediators and Conciliators (FICMC); Member, Chartered Institute of Stockbrokers of Nigeria (ACIS); Member, Institute of Directors (IoD), Member, Institute of Chartered Secretaries and Administrators (ICSAN), Member, IBB International Gulf and Country Club, Secretary-General of the Northern Reawakening Forum (NRF); International Member, Amnesty International and a regular commentator and policy analyst on national and international affairs. He is a Senior Advocate of Nigeria (SAN).

Maiyaki Theodore Bala sits on the Boards of TeasyPay Ltd as Chairman, and Director of Duncan Maritime Ventures Ltd, WCG Consultancy Limited, The Colloquium Consults and Investments Ltd, and KWO Properties and Investments Ltd, among others. He is a Trustee of The Maiyaki Foundation; A Trustee of the Gamai Literacy and Bible Translation Trust; A lifelong Rotarian and a Major Donor of the Rotary Foundation.

Supervisors: Prof K M Waziri

Address: Suite 305, Bahamas Plaza

Plot 1080, Joseph Gomwalk Street

Gudu District, Abuja-Nigeria

Maiyaki Theodore Bala, SAN attended the prestigious Government Science School Kuru. He obtained a Diploma and then a Degree in Law; LLB (Hons) from the prestigious Ahmadu Bello in University Zaria. He was called to the Nigeria Bar in 1993, after which he proceeded to obtain his Master of Laws (LL.M) Degree from the University of Jos – Nigeria in 1996. He capped his academic pursuit when he obtained a Doctor of Laws Degree (Ph.D.) in International Economic Law from the University of Jos – Nigeria in 2012.

He worked as a Legal Officer and rose to be the Company Secretary/Legal Adviser of Imani Mortgage Finance from 1993-1998. He was engaged as the Executive Director (Corporate Affairs) of Duncan Maritime Ventures Ltd between 1998-2000 after which he returned to full legal practice. He was the Special Assistant (legal), to the Governor of Plateau State, from 2002-2007. He is an Associate Professor of International Economic Law with the Faculty of Law and is currently the Head of Department, Department of Jurisprudence and the International Law, University of Abuja-Nigeria.

An Alumnus of Harvard University, he attended and presented papers at several local and International Seminars and workshops on Law, Politics, and Business. He has to his credit 3 books; ‘A hand Book on Mortgage Law and Banking in Nigeria’, ‘A Hand Book on the ECOWAS Treaty and Financial Institutions’ and ‘Modern Practice of Civil Litigation in Nigeria’, all of which are available on Amazon and Ebay platforms. He is also an accomplished researcher with published works in many renowned local and International Journals.

He is the Principal Partner of KWO Chambers, Abuja, and a member of the Nigeria Bar Association (NBA); International Bar Association(IBA); Association for Nigerian Law Teachers (NALT); Fellow, Chartered Institute of Arbitrators (FCIArb UK); Fellow, Chartered Institute of Mediators and Conciliators (FICMC); Member, Chartered Institute of Stockbrokers of Nigeria (ACIS); Member, Institute of Directors (IoD), Member, Institute of Chartered Secretaries and Administrators (ICSAN), Member, IBB International Gulf and Country Club, Secretary-General of the Northern Reawakening Forum (NRF); International Member, Amnesty International and a regular commentator and policy analyst on national and international affairs. He is a Senior Advocate of Nigeria (SAN).

Maiyaki Theodore Bala sits on the Boards of TeasyPay Ltd as Chairman, and Director of Duncan Maritime Ventures Ltd, WCG Consultancy Limited, The Colloquium Consults and Investments Ltd, and KWO Properties and Investments Ltd, among others. He is a Trustee of The Maiyaki Foundation; A Trustee of the Gamai Literacy and Bible Translation Trust; A lifelong Rotarian and a Major Donor of the Rotary Foundation.

Supervisors: Prof K M Waziri

Address: Suite 305, Bahamas Plaza

Plot 1080, Joseph Gomwalk Street

Gudu District, Abuja-Nigeria

less

InterestsView All (6)

Uploads

Books by Theodore B Maiyaki, SAN

Papers by Theodore B Maiyaki, SAN

The body of our jurisprudence is the compendium upon which our laws rest. It propels the dispensation of justice through the intervention and actions of personnel stemming from the Judges of the courts, the administrative officers down to the most unnoticed and obscure officers of the court. Collectively they give the administration of justice some meaning and efficacy. Together, they pool their human resources in different ways to achieve the ends of justice for the common man and the common good. The Court bailiffs are a part of this structure of judicial service who perhaps have received the least attention in the discharge of their assignments, but who are of course very critical to the course of justice. Without the services of the court bailiff, litigation would have been a sham and uncoordinated engagement with litigants completely disconnected or uninformed about their suits or the expected outcomes of their suits dovetail into an academic exercises. This paper acknowledges the critical role these personnel play in the dispensation of justice and accords to it the desired pride of place by eliciting the salient roles they play in the dispensation of justice and advancing pungent prescriptions on how to better their services with a view to bringing them in line with best practices and enhance their capacity in the discharge of their duties so as to engender a better and distilled outcomes for justice.

The end goal of the Economic Community of West African States as a strategy encapsulated in the treaty of ECOWAS is the establishment of an economic union through the adoption of common policies in the economic, financial, socio-cultural sectors, that would ultimately engender the creation of a monetary union. In pursuit of the foregoing objective the community engaged a myriad of approaches to facilitate its early realization. Prominent amongst these has been the fast track establishment of a second monetary zone in the ECOWAS region with a view to harmonizing the respective national currencies of the English-speaking countries into a single currency to be called the Eco. In order to promote the foregoing, the Institutional framework of the West African Monetary Institute (WAMI) was set up with the task of serving as the precursor to the establishment of the West African Central Bank. Pursuant to its mandate to harmonize these respective national currencies of the English speaking West African countries into the Eco, it advanced a bouquet of micro- and macro-economic convergence parameters that must be met by the respective countries as a precondition for the convergence and indeed the take off of the Eco. It was considered that by so doing, it would then be easy to merge the Eco with the CFA Franc, which is already in use by all the French-speaking Countries of West Africa. A number of target dates have been missed and this paper agitates the need to rethink the parameters set as possible inhibition to the realization of this dream this dream.

Economic activities has developed into a cross-border concern, which means that people and institutions from different cultures with different legal backgrounds and different business expectations will have to learn to work with each other. Disputes are an inevitable product of business transactions and resolution of those disputes to enhance phenomenal productive domestic and commercial international investment relationship cannot be over emphasized. However, despite increasing globalization and internationalization of businesses, interventions designed to attract domestic and foreign investment sometimes excludes procedures for resolving commercial disputes and litigation has not effectively handled the plethora of cases that arise as a result of commercial transactions.

In contemporary societies, delay combined with the cost of litigation has put justice beyond the reach of the ordinary man. The incomprehensibility and adversarial nature of the process with a resulting lack of control (party’s participation indirectly through counsel) leads to a sense of frustration and disempowerment. Litigation often creates winners and losers given the limited nature of many legal remedies imposed from a limited range of win and lose options. Against this backdrop, the need for a more cost effective, time bound and less technical means of settling disputes and decongesting cause-lists in courts resulted in a move towards the alternative dispute resolution mechanisms which are mediation, negotiation, arbitration, early neutral evaluation, conciliation, among others. ADR has since been gaining relevance as a mechanism for resolving disputes fairly and expeditiously, and maintaining relationships.

ABSTRACT

We live in a shrinking world where local concerns become regional, and regional become global.

Economic activities has developed into a cross-border concern, which means that people and institutions from different cultures with different legal backgrounds and different business expectations will have to learn to work with each other. Disputes are an inevitable product of business transactions and resolution of those disputes to enhance phenomenal productive domestic and commercial international investment relationship cannot be over emphasized. However, despite increasing globalization and internationalization of businesses, interventions designed to attract domestic and foreign investment sometimes excludes procedures for resolving commercial disputes and litigation has not effectively handled the plethora of cases that arise as a result of commercial transactions.

In contemporary societies, delay combined with the cost of litigation has put justice beyond the reach of the ordinary man. The incomprehensibility and adversarial nature of the process with a resulting lack of control (party’s participation indirectly through counsel) leads to a sense of frustration and disempowerment. Litigation often creates winners and losers given the limited nature of many legal remedies imposed from a limited range of win and lose options. Against this backdrop, the need for a more cost effective, time bound and less technical means of settling disputes and decongesting cause-lists in courts resulted in a move towards the alternative dispute resolution mechanisms which are mediation, negotiation, arbitration, early neutral evaluation, conciliation, among others. ADR has since been gaining relevance as a mechanism for resolving disputes fairly and expeditiously, and maintaining relationships.

ABSTRACT

We live in a shrinking world where local concerns become regional, and regional become global.

Economic activities has developed into a cross-border concern, which means that people and institutions from different cultures with different legal backgrounds and different business expectations will have to learn to work with each other. Disputes are an inevitable product of business transactions and resolution of those disputes to enhance phenomenal productive domestic and commercial international investment relationship cannot be over emphasized. However, despite increasing globalization and internationalization of businesses, interventions designed to attract domestic and foreign investment sometimes excludes procedures for resolving commercial disputes and litigation has not effectively handled the plethora of cases that arise as a result of commercial transactions.

In contemporary societies, delay combined with the cost of litigation has put justice beyond the reach of the ordinary man. The incomprehensibility and adversarial nature of the process with a resulting lack of control (party’s participation indirectly through counsel) leads to a sense of frustration and disempowerment. Litigation often creates winners and losers given the limited nature of many legal remedies imposed from a limited range of win and lose options. Against this backdrop, the need for a more cost effective, time bound and less technical means of settling disputes and decongesting cause-lists in courts resulted in a move towards the alternative dispute resolution mechanisms which are mediation, negotiation, arbitration, early neutral evaluation, conciliation, among others. ADR has since been gaining relevance as a mechanism for resolving disputes fairly and expeditiously, and maintaining relationships.

The 21st century ushered in a high level of scientific inventions and technological innovation, leading to sustainable national development and economic stability for diverse countries of the world. The judiciary in these countries have also metamorphosed through diverse phases in a bid to meet up with the dynamics and interpretations of the law, in the light of these developments. Notwithstanding the occasional challenges and setbacks encountered, the role of the judiciary in national development cannot be overemphasised. This article gives a brief history of the Nigerian judiciary, analyse the roles of the judiciary, adumbrates on its challenges and recommends the way forward for sustainable national development.

Conference Presentations by Theodore B Maiyaki, SAN

The body of our jurisprudence is the compendium upon which our laws rest. It propels the dispensation of justice through the intervention and actions of personnel stemming from the Judges of the courts, the administrative officers down to the most unnoticed and obscure officers of the court. Collectively they give the administration of justice some meaning and efficacy. Together, they pool their human resources in different ways to achieve the ends of justice for the common man and the common good. The Court bailiffs are a part of this structure of judicial service who perhaps have received the least attention in the discharge of their assignments, but who are of course very critical to the course of justice. Without the services of the court bailiff, litigation would have been a sham and uncoordinated engagement with litigants completely disconnected or uninformed about their suits or the expected outcomes of their suits dovetail into an academic exercises. This paper acknowledges the critical role these personnel play in the dispensation of justice and accords to it the desired pride of place by eliciting the salient roles they play in the dispensation of justice and advancing pungent prescriptions on how to better their services with a view to bringing them in line with best practices and enhance their capacity in the discharge of their duties so as to engender a better and distilled outcomes for justice.

The end goal of the Economic Community of West African States as a strategy encapsulated in the treaty of ECOWAS is the establishment of an economic union through the adoption of common policies in the economic, financial, socio-cultural sectors, that would ultimately engender the creation of a monetary union. In pursuit of the foregoing objective the community engaged a myriad of approaches to facilitate its early realization. Prominent amongst these has been the fast track establishment of a second monetary zone in the ECOWAS region with a view to harmonizing the respective national currencies of the English-speaking countries into a single currency to be called the Eco. In order to promote the foregoing, the Institutional framework of the West African Monetary Institute (WAMI) was set up with the task of serving as the precursor to the establishment of the West African Central Bank. Pursuant to its mandate to harmonize these respective national currencies of the English speaking West African countries into the Eco, it advanced a bouquet of micro- and macro-economic convergence parameters that must be met by the respective countries as a precondition for the convergence and indeed the take off of the Eco. It was considered that by so doing, it would then be easy to merge the Eco with the CFA Franc, which is already in use by all the French-speaking Countries of West Africa. A number of target dates have been missed and this paper agitates the need to rethink the parameters set as possible inhibition to the realization of this dream this dream.

Economic activities has developed into a cross-border concern, which means that people and institutions from different cultures with different legal backgrounds and different business expectations will have to learn to work with each other. Disputes are an inevitable product of business transactions and resolution of those disputes to enhance phenomenal productive domestic and commercial international investment relationship cannot be over emphasized. However, despite increasing globalization and internationalization of businesses, interventions designed to attract domestic and foreign investment sometimes excludes procedures for resolving commercial disputes and litigation has not effectively handled the plethora of cases that arise as a result of commercial transactions.

In contemporary societies, delay combined with the cost of litigation has put justice beyond the reach of the ordinary man. The incomprehensibility and adversarial nature of the process with a resulting lack of control (party’s participation indirectly through counsel) leads to a sense of frustration and disempowerment. Litigation often creates winners and losers given the limited nature of many legal remedies imposed from a limited range of win and lose options. Against this backdrop, the need for a more cost effective, time bound and less technical means of settling disputes and decongesting cause-lists in courts resulted in a move towards the alternative dispute resolution mechanisms which are mediation, negotiation, arbitration, early neutral evaluation, conciliation, among others. ADR has since been gaining relevance as a mechanism for resolving disputes fairly and expeditiously, and maintaining relationships.

ABSTRACT

We live in a shrinking world where local concerns become regional, and regional become global.

Economic activities has developed into a cross-border concern, which means that people and institutions from different cultures with different legal backgrounds and different business expectations will have to learn to work with each other. Disputes are an inevitable product of business transactions and resolution of those disputes to enhance phenomenal productive domestic and commercial international investment relationship cannot be over emphasized. However, despite increasing globalization and internationalization of businesses, interventions designed to attract domestic and foreign investment sometimes excludes procedures for resolving commercial disputes and litigation has not effectively handled the plethora of cases that arise as a result of commercial transactions.

In contemporary societies, delay combined with the cost of litigation has put justice beyond the reach of the ordinary man. The incomprehensibility and adversarial nature of the process with a resulting lack of control (party’s participation indirectly through counsel) leads to a sense of frustration and disempowerment. Litigation often creates winners and losers given the limited nature of many legal remedies imposed from a limited range of win and lose options. Against this backdrop, the need for a more cost effective, time bound and less technical means of settling disputes and decongesting cause-lists in courts resulted in a move towards the alternative dispute resolution mechanisms which are mediation, negotiation, arbitration, early neutral evaluation, conciliation, among others. ADR has since been gaining relevance as a mechanism for resolving disputes fairly and expeditiously, and maintaining relationships.

ABSTRACT

We live in a shrinking world where local concerns become regional, and regional become global.

Economic activities has developed into a cross-border concern, which means that people and institutions from different cultures with different legal backgrounds and different business expectations will have to learn to work with each other. Disputes are an inevitable product of business transactions and resolution of those disputes to enhance phenomenal productive domestic and commercial international investment relationship cannot be over emphasized. However, despite increasing globalization and internationalization of businesses, interventions designed to attract domestic and foreign investment sometimes excludes procedures for resolving commercial disputes and litigation has not effectively handled the plethora of cases that arise as a result of commercial transactions.

In contemporary societies, delay combined with the cost of litigation has put justice beyond the reach of the ordinary man. The incomprehensibility and adversarial nature of the process with a resulting lack of control (party’s participation indirectly through counsel) leads to a sense of frustration and disempowerment. Litigation often creates winners and losers given the limited nature of many legal remedies imposed from a limited range of win and lose options. Against this backdrop, the need for a more cost effective, time bound and less technical means of settling disputes and decongesting cause-lists in courts resulted in a move towards the alternative dispute resolution mechanisms which are mediation, negotiation, arbitration, early neutral evaluation, conciliation, among others. ADR has since been gaining relevance as a mechanism for resolving disputes fairly and expeditiously, and maintaining relationships.

The 21st century ushered in a high level of scientific inventions and technological innovation, leading to sustainable national development and economic stability for diverse countries of the world. The judiciary in these countries have also metamorphosed through diverse phases in a bid to meet up with the dynamics and interpretations of the law, in the light of these developments. Notwithstanding the occasional challenges and setbacks encountered, the role of the judiciary in national development cannot be overemphasised. This article gives a brief history of the Nigerian judiciary, analyse the roles of the judiciary, adumbrates on its challenges and recommends the way forward for sustainable national development.