Academia.edu no longer supports Internet Explorer.

To browse Academia.edu and the wider internet faster and more securely, please take a few seconds to upgrade your browser.

10 best performing US stocks in last 10 years

10 best performing US stocks in last 10 years

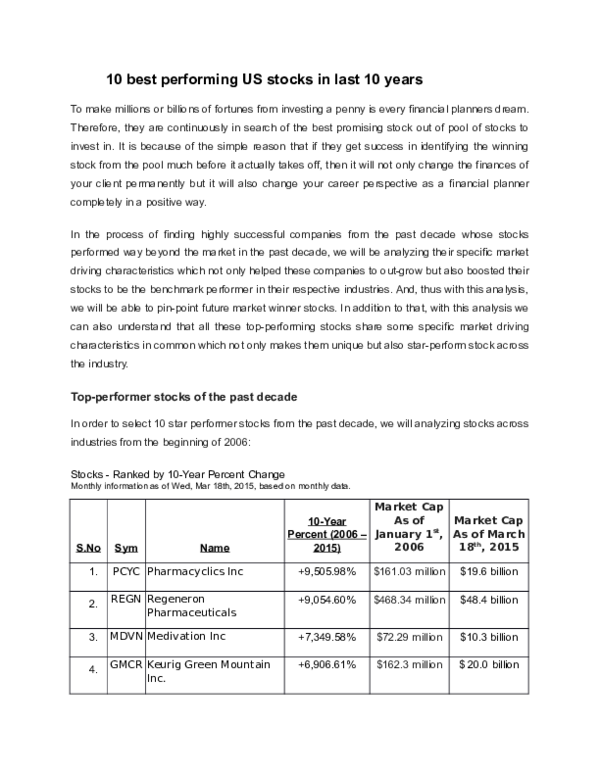

To make millions or billions of fortunes from investing a penny is every financial planners dream. Therefore, they are continuously in search of the best promising stock out of pool of stocks to invest in. It is because of the simple reason that if they get success in identifying the winning stock from the pool much before it actually takes off, then it will not only change the finances of your client permanently but it will also change your career perspective as a financial planner completely in a positive way. In the process of finding highly successful companies from the past decade whose stocks performed way beyond the market in the past decade, we will be analyzing their specific market driving characteristics which not only helped these companies to out-grow but also boosted their stocks to be the benchmark performer in their respective industries. And, thus with this analysis, we will be able to pin-point future market winner stocks. In addition to that, with this analysis we can also understand that all these top-performing stocks share some specific market driving characteristics in common which not only makes them unique but also star-perform stock across the industry.

Related Papers

Floriculture, Ornamental and Plant Biotechnology: Advances and Topical Issues Vol. III

Cross Talk between Nitric Oxide and Growth Regulators2006 •

Nitric oxide (NO) is a free radical gas formed endogenously in several biological systems, including plants, in which it performs a wide range of functions. Although many aspects of the physiological role of NO in plants remain to be elucidated, evidence is emerging that NO plays an important regulatory role in numerous processes, including stomatal closure, root development, stem elongation, seed germination, the host responses to infection, programmed cell death and senescence. In addition, it is now widely accepted that NO functions as a signal for hormonal responses in plants. Nonetheless, the mechanisms by which NO interacts with growth regulators is still far from clear, although considerable progress has been made during the last decade in our understanding of NO within the entire plant and in plant organelles. Herein, we specifically explore the role of NO and its cross talk with growth regulators in plants.

Near Eastern Archaeology

DeGrado, Jessie and Richey, Madadh. 2021. Discovering Early Syrian Magic: New Aramaic Sources for a Long-Lost Art. Near Eastern Archaeology 84.4: 282–292.2021 •

Few magical texts have been recovered from the Levant dating to the first millennium BCE. Three recently published early Aramaic inscriptions help fill this lacuna: an inscribed cosmetic container from Zincirli, a Lamaštu amulet from the same site, and an Aramaic-inscribed Pazuzu statuette. These texts, dated paleographically to the ninth and eighth centuries BCE, afford a window onto local traditions in the Levant and their interactions with Mesopotamian magic. They also provide an impetus for a reanalysis of the infamous Arslan Tash amulets, offering further context for their texts and iconography.

Financial and Credit Activity Problems of Theory and Practice

DIGITAL TRANSFORMATION OF THE NATIONAL ECONOMY OF UKRAINE: CHALLENGES AND OPPORTUNITIESStender, S., Bulkot, O., Iastremska, O., Saienko, V., & Pereguda, Y. (2024). Digital transformation of the national economy of Ukraine: challenges and opportunities. Financial and Credit Activity Problems of Theory and Practice, 2(55), 333-345. DOI:10.55643/fcaptp.2.55.2024.4328 (Scopus, Web of Science Core Collection) This study aims to dissect the direct effects of digital transformation on key economic and social segments in Ukraine. It underscores the critical role of adaptable digital solutions in sustaining economic viability. The investigation focuses on public service provision, entrepreneurial ventures, infrastructure development, mental health, and societal unity, all examined through the prism of digital resilience. Utilizing a comprehensive methodology involving formalization, abstract reasoning, and the Pareto principle, the research employs ABC analysis and linear scaling to assess and prioritize the impact of various digital aspects in the context of the current war scenario. The findings reveal nuanced impacts across different sectors: Public service dissemination scores a modest 0.32, indicating the need for urgent enhancement. Entrepreneurial activity demonstrates moderate adaptability with a rating of 0.43. Infrastructure reconstruction lags at 0.28, revealing critical vulnerabilities. Mental health recovery (0.56) and social cohesion (0.51) reflect more robust digital integration. The study suggests that prioritizing and investing in digital initiatives, especially in the higher-scoring areas, can provide substantial support for maintaining stability and fostering growth. These actionable insights are particularly relevant for policymakers and stakeholders, emphasizing the immediate and measurable benefits of targeted digital strategies in a wartime setting.

Osho Zen Tarot

Osho Zen TarotLa existencia del tarot se remonta a hace miles de años, desde el Antiguo Egipto o, tal vez, incluso antes. No obstante, su primer uso conocido data de la Edad Media: en aquellos tiempos turbulentos, sus imágenes se utilizaron a modo de códigos para transmitir las enseñanzas de las Escuelas de Misterio Medievales. Con el tiempo, el tarot ha sido utilizado de muchas formas: como herramienta para predecir el futuro, como un divertido juego de salón, como una forma de buscar información oculta sobre diferentes situaciones, etc. Algunos dicen que el número de cartas se usa en el número de pasos que dio el pequeño Siddhartha ¿quien más tarde se convertiría en Gautama el Buda¿ en el momento de su nacimiento. Dice la leyenda que fueron siete pasos hacia adelante y otros siete hacia atrás, siguiendo cada vez la dirección de cada uno de los cuatro puntos cardinales; y esto se convirtió en el modelo para las cartas menores del tarot. Además de estas 56 cartas de los llamados Arcanos Menores, el tarot tiene otras 22 adicionales (los Arcanos Mayores) que proporcionan una descripción completa del viaje espiritual del ser humano. Desde el primer paso inocente del El Loco a la culminación de la travesía representada por la carta Conclusión, en los Arcanos Mayores descubrimos imágenes arquetípicas que nos conectan a todos como seres humanos. Ellas nos describen un camino de autodescubrimiento que es absolutamente único para cada individuo, si bien las verdades profundas que deben descubrirse son las mismas, independientemente de raza, género, clase o religión. En la baraja del tarot tradicional, este viaje de autodescubrimiento se realizaba según una trayectoria espiral, por lo que la carta Conclusión llevaba a un nuevo nivel en el camino, a un nuevo comienzo, con la entrada otra vez de El Loco. En esta edición, sin embargo, se ha añadido la carta de El Maestro, pues ella nos permite dejar atrás la espiral y dar un salto fuera de la rueda.

В сборник включены доклады участников Международной научной конференции «IX Супруновские чтения» (Минск, 17–18 сентября 2014 г.), посвященной памяти видного белорусского ученого, профессора Адама Евгеньевича Супруна (1928–1999). Тематика докладов отражает круг научных интересов А. Е. Супруна в области языкового контакта: сопоставительное изучение славянских языков, палеославистика, контактология, проблемы билингвизма и др. Рекомендуется специалистам в области ареальной и контактной лингвистики, диалектологии, психолингвистики, а также диахронного языкознания.

Practice in Clinical Psycholoy

Investigating the Relationship Between the Use of Social Media, Educational Decline, and Student Mental HealthThe widespread presence of students in Telegram virtual social networks (VSNs) has provided a unique opportunity to track the effects of using this medium on their academic failure and mental health. Accordingly, this study explores whether the use of social media has a relationship with educational decline and student mental health. Methods: This correlation study was conducted in high schools in Khaf City, Iran, in the 2018-2019 academic year and included 1250 students (550 girls and 700 boys) who were selected via simple stratified random sampling. The data collection tools comprised a researcher-made questionnaire on the use of Telegram VSNs and the Keyes (2005) model of mental health. The data were analyzed using the SPSS software, version 22, and related tests. Results: We found a significant relationship between the use of the Telegram network and educational decline. There is also a significant relationship between the use of the Telegram network and mental health. As the use of Telegram VSNs increases, there is an increase in fatigue in class and a reduction in study hours. Hence, this affects students' educational decline directly and mental health adversely. Conclusion: We recommend that information about the positive and negative effects of Telegram VSNs should be provided to users, and measures should be taken in schools to introduce and create a culture and useful and scientific use of Telegram VSNs.

Engineering Failure Analysis

Investigation of scaffolding accident in a construction site: A case study analysis2021 •

Routledge: New York

The Routledge Handbook of Architecture, Urban Space and Politics: Ecology, Social Participation and Marginalities by Nikolina Bobic (Editor), Farzaneh Haghighi (Editor2024 •

Architecture and the urban are connected to challenges around violence, security, race and ideology, spectacle and data. The first volume of this Handbook extensively explored these oppressive roles. The second volume illustrates that escaping the corporatized and bureaucratized orders of power, techno-managerial and consumer-oriented capitalist economic models is more urgent and necessary than ever before. Herein lies the political role of architecture and urban space, including the ways through which they can be transformed and alternative political realities constituted. This volume explores the methods and spatial practices required to activate the political dimension and the possibility for alternative practices to operate in the existing oppressive systems while not being swallowed by these structures. Fostering new political consciousness is explored in terms of the following themes: Events and Dissidence; Biopolitics, Ethics and Desire; Climate and Ecology; Urban Commons and Social Participation; and Marginalities and Postcolonialism. Volume II embraces engagement across disciplines and offers a wide range of projects and critical analyses across the so-called Global North and South. This multidisciplinary collection of 36 chapters provides the reader with an extensive resource of case studies and ways of thinking for architecture and urban space to become more emancipatory.

Revista de Arheologie, Antropologie și Studii Interdisciplinare

Abnormalities of the first cervical vertebra in a Muslim community from Dobruja (Southeastern Romania): a case study2023 •

The individuals buried in the 18th-19th century Muslim cemetery from Constanța Boreal show, in addition to numerous dental and bone pathological changes, traumas, and anomalies, some congenital defects identified in two skeletons, after the examination of a third of the individuals. The lack of fusion identified in the middle of the anterior arch of the atlas vertebra is an unusual condition, especially since malformations of the first cervical vertebra are not commonly found in human skeletal material. The two anterior clefts presented in this study are the first anomalies of this type identified in ancient Romania`s populations. Nevertheless, defects of the anterior arch of the atlas could represent asymptomatic incidental findings on routine radiographs. Knowledge of this abnormality and its causative factors will contribute to a better understanding of spinal variations and malformations.

RELATED PAPERS

Submerged Heritage

Bekić, L - A Remarkable Discovery at the Cape Franina wreck site, Submerged Heritage 12 / 2022.2022 •

Journal of Electrical Engineering, Energy, and Information Technology (J3EIT)

Network Kpi Analysis in Network Sharing Technology Configuration Based on Multi-Operator Core Network (Mocn)Pathogens and Disease

Leaf extract ofAzadirachta indica(neem): a potential antibiofilm agent forPseudomonas aeruginosa2013 •

2008 •

2016 •

Türkiye Eğitim Dergisi

Said Paşa’nın Hatırât’ı ve Modern Eğitim Sorununa Bakışı2021 •

2017 •

2017 •

Biodiversitas Journal of Biological Diversity

Evaluation of the advanced yield trial on tropical wheat (Triticum aestivum) mutant lines using selection index and multivariate analysis