Electric Motor Market Research, 2032

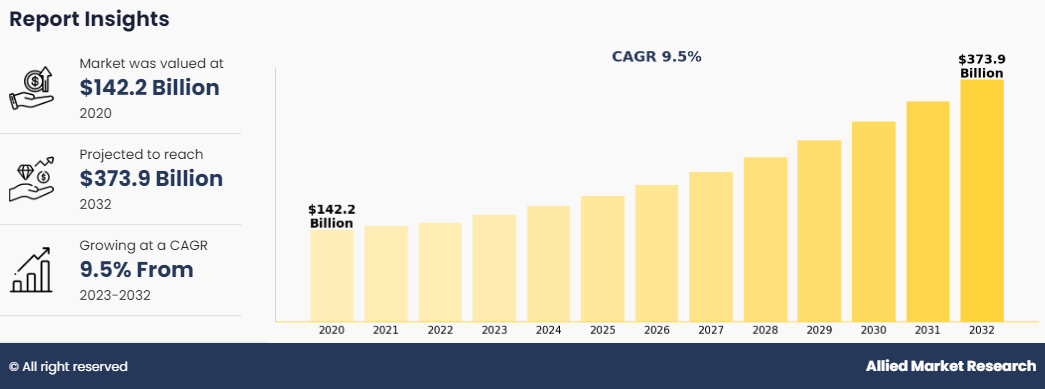

The Global Electric Motor Market size was valued at $142.2 billion in 2020, and is projected to reach $373.9 billion by 2032, growing at a CAGR of 9.5% from 2023 to 2032.

An electric motor is an electromechanical device that transforms electrical energy into mechanical rotational energy. Widely employed across diverse applications, these motors range from small household items like fans, electric shavers, and washing machines to industrial equipment such as robots and pumps. Motors are primarily categorized on the basis of type of electricity they utilize, including AC (Alternating Current) and DC (Direct Current).

Report Key Highlighters

- The electric motor market studies more than 16 countries. The analysis includes a country-by-country breakdown analysis in terms of value ($million) available from 2022 to 2032.

- The research combined high-quality data, professional opinion and research, with significant independent opinion. The research methodology aims to provide a balanced view of the global market, and help stakeholders make educated decisions to achieve ambitious growth objectives.

- The research reviewed more than 3,700 product catalogs, annual reports, industry descriptions, and other comparable resources from leading industry players to gain a better understanding of the market.

- The electric motor market share is marginally fragmented, with players such as ABB, Denso Corporation, Emerson Electric Co., Johnson Electric Holdings Limited, Maxon, NIDEC CORPORATION, Regal Rexnord Corporation, Rockwell Automation Inc., Siemens AG, Arc Systems Inc., Brose Fahrzeugteile SE & Co. KG, Coburg, and TAIGENE inc. Major strategies such as product launch, partnerships, expansion, and other strategies of players operating in the market are tracked and monitored.

Market Dynamics

The electric motor industry is primarily driven by various factors such as a rise in the demand for new vehicles, electric vehicles, home appliances, industrial machinery, and all other products that make significant use of electric motors market. Global population growth has been an instrumental factor in the growth of various industrial and non-industrial sectors including the automotive industries. For example, despite the ongoing economic uncertainties in 2023, many consumers began to make purchases that had been put off during the COVID-19, which bolstered car sales. For instance, in the first half of 2023, Chinese auto sales grew by 9.8%. Similarly, in India, passenger vehicle sales rose by 27%, while commercial vehicle sales grew by 16%. The automotive industry is a major consumer of electric motors. On average, a typical car has nearly 40 electric motors. In addition, rising fuel prices and rising concerns related to environmental degradation have bolstered the demand for electric vehicles.

Moreover, the number of new residential and commercial buildings, development of water supply pipelines, increase in the number of wastewater treatment facilities, public agriculture irrigation systems, and other infrastructure in developing economies is rising eventually driving the demand for electric motors for pumping purpose. In addition, the rise in the number of industrial facilities including food and beverages, chemical and petrochemicals, pharmaceuticals, and other industrial facilities globally, also positively affects the electric motor market growth.

Moreover, rise in demand for electric motors has been witnessed in heating, ventilation, and air conditioning (HVAC) applications, owing to features such as high torque and lower noise level. According to the International Energy Agency (IEA), around 40% of electricity is being used for power electric motors. In addition, the electric motor is more efficient, lightweight, and has a high operating speed. In addition, rise in demand for higher efficiency electric motor market in the HVAC sector creates demand for lighter, compact, and silent electric motors.

It is noted that HVAC systems with electric motors have seasonal energy efficiency ratio (SEER) ratings of 13 and higher, which makes them up to 30% more efficient than systems with their brushed counterparts. All these factors collectively drive the growth of the global electric motor market. The cost of an electric motor essentially depends on factors such as the materials used for manufacturing and labor and other costs. The commonly used materials are copper, aluminum, cast iron and steel. The prices of these materials keep fluctuating and since COVID-19, the average prices of metals such as copper and steel have remained higher leading to increased cost of final product that is motors. Furthermore, various other components such as electronic switching controller to switch the voltage to the motor coils in synchronization with the motors rotation and others also add significantly to the final price of a motor.

Companies are increasingly participating in government-led energy management programs. By participating in such programs, apart from contributing to national energy and carbon savings, businesses directly take advantage from lower costs, reduced exposure to fluctuations in energy prices, and increased competitiveness. After July 1, 2023, implementation of stringent regulations for deployment of IE4 motors may be expected in industrial applications. Moreover, the U.S. amended and implemented the Energy Policy and Conservation Act in the country effective from September 29, 2023. This act prescribes energy conservation standards for various consumer products and certain commercial and industrial equipment, including electric motors. The introduction of such standards that promote the development of energy efficient electric motors are expected to be an opportunity for growth for the key players and electric motor market.

The economic slowdown is a major obstructing factor for the entire industry. The inflation, which is a direct result of the Ukraine-Russia war and few long-term impacts of the coronavirus pandemic, has introduced volatility in the prices of raw materials used for manufacturing electric motors. In addition, the cost of oil & gas has also increased, and many countries; especially, the countries in Europe, Latin America, North America, and Sub-Saharan Africa experience negative impacts in industrial production, including the production of electric motor. Such factors are expected to restrain growth of electric motor market. However, India and China are performing relatively well. In addition, economic slowdown is expected to worsen in the coming years, as the possibility of the ending of the war between Ukraine and Russia is less.

Segmental Overview

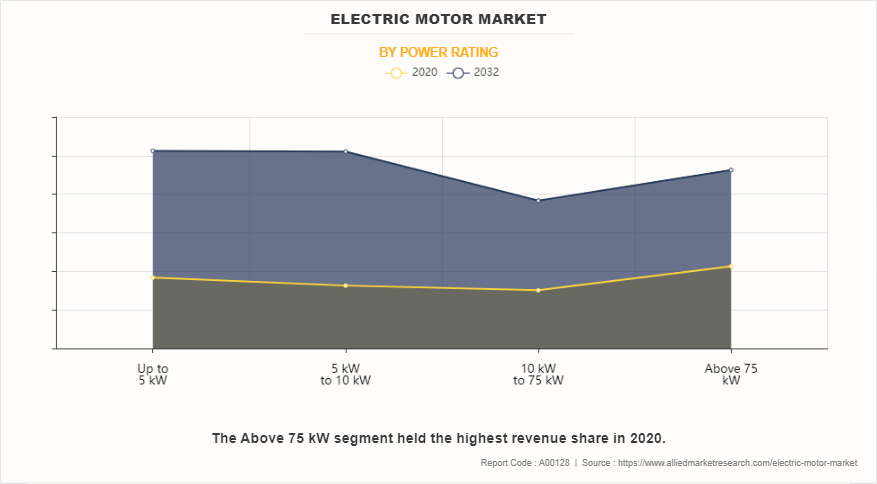

The electric motor market is segmented into motor type, application and power rating. On the basis of motor type, the market is divided into alternate current (AC) motor and direct current (DC) motor. By application, the market is classified into automobile-traction motor, automobile-non traction motor, HVAC, medical equipment, industrial machinery, home appliances, and others. By power rating, the electric motor market forecast is segmented into Up to 5 kW, 5 kW to 10 kW, 10 kW to 75 kW, and above 75 kW. Region-wise, it is analyzed across North America (U.S., Canada, and Mexico), Europe (Germany, France, Italy, UK, and rest of Europe), Asia-Pacific (China, India, Japan, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa).

By type:

The electric motor market is divided into alternate current (AC) motor, and direct current (DC) motor. In 2020, the AC motor segment dominated the electric motor market, in terms of revenue, and the direct current (DC) segment is expected to grow with a higher CAGR during the forecast period. An alternating current (AC) motor converts electric energy into mechanical energy. The major reason for the utilization of AC motors is the easy availability of AC power. In addition, these motors can be designed and built easily with a variety of features, and different sizes ranging from a few watts to thousand kilowatts. They are mainly used in industrial applications, aerospace, compressors, and machine tools. Furthermore, AC motors are classified as synchronous and induction motors based on working characteristics.

By power rating:

The electric motor market is divided into Up to 5 kW, 5 kW to 10 kW, 10 kW to 75 kW, and above 75 kW. In 2020, the above 75 kW segment dominated the electric motor market, in terms of revenue, and the 10 kW to 75 kW segment is expected to witness growth at a higher CAGR during the forecast period.

By application:

The electric motor market is categorized into automobile - traction motor, automobile - non-traction motors, HVAC, medical equipment, industrial machinery, household appliances, and others. The automobile - traction motor segment accounted for the highest market share in terms of revenue in 2020 mainly due to the increase in adoption of electric vehicles (EVs), and hybrid vehicles. Moreover, the same segment is expected to grow with the highest CAGR during the forecast period.

By region:

Asia-Pacific accounted for the highest market share in 2022 and LAMEA is expected to grow with a highest CAGR during the forecast period. Asia-Pacific is a highly developing region with the fastest growing population. According to the United Nations, nearly two-thirds of the world population resides in Asia-Pacific, with China and India alone accounting for one-third of the global population. In addition, the rate of urbanization in Asia-Pacific is also high. Thus, owing to high population growth and urbanization in the region, the industrial, automotive, and household sectors witness a rapid rise, thereby, demand for electric motors, which are extensively used in these sectors is anticipated to rise in the coming years. However, the manufacturing sector in LAMEA has a greater potential for growth, which is anticipated to be a major reason for the rise in demand for electric motors. In addition, countries in LAMEA have large concentrations of oil & gas, which are further expected to enhance the growth potential of the electric motor market in the region.

Competition Analysis

Key companies profiled in the electric motor market report include ABB, Denso Corporation, Emerson Electric Co., Johnson Electric Holdings Limited, Maxon, NIDEC CORPORATION, Regal Rexnord Corporation, Rockwell Automation Inc., Siemens AG, Arc Systems Inc., Brose Fahrzeugteile SE & Co. KG, Coburg, and TAIGENE inc.

The major players that operate in the global electric motor market have adopted key strategies such as acquisition, business expansion, product launch, and other strategies to strengthen their market outreach and sustain the stiff competition in the market. For instance, in July 2023, Innomotics was established as a distinct legal entity in Germany. This entity, which is the subsidiary of Siemens AG, unifies the diverse business operations of the motors and large drives supplier, incorporating activities related to low- to high-voltage motors, geared motors, medium-voltage converters, motor spindles, and associated project and service offerings, all under one umbrella. Moreover, in September 2023, Rockwell Automation, Inc. and Infinitum, the innovator behind sustainable air core motor technology, have entered into an exclusive agreement to collaboratively develop and distribute an innovative class of high-efficiency, integrated low voltage drive and motor technology. This groundbreaking solution is anticipated to bring substantial energy savings and cost reductions for industrial customers worldwide, facilitating a reduction in their carbon footprint and promoting sustainability.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the electric motor market analysis from 2020 to 2032 to identify the prevailing electric motor market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the electric motor market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the electric motor market players.

- The report includes the analysis of the regional as well as global electric motor market trends, key players, market segments, application areas, and market growth strategies.

Electric Motor Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 373.9 billion |

| Growth Rate | CAGR of 9.5% |

| Forecast period | 2020 - 2032 |

| Report Pages | 289 |

| By Motor type |

|

| By Application |

|

| By Power rating |

|

| By Region |

|

| Key Market Players | ABB, Regal Rexnord Corporation, Siemens AG, DENSO CORPORATION, Arc Systems Inc., Emerson Electric Co., Johnson Electric Holdings Limited, Brose Fahrzeugteile SE & Co. KG, Coburg, TAIGENE Inc., Rockwell Automation Inc., Maxon, NIDEC CORPORATION |

Analyst Review

The automobile sector is growing at a notable pace, even after a huge decline during COVID-19. The growth of the automobile sector is expected to have a positive impact on the electric motor market due to increase in penetration of EVs and hybrid vehicles. Furthermore, rise in concerns regarding environment degradation has boosted the adoption rate of energy-efficient motors.

The major players such as Rockwell Automation Inc. and Siemens AG have adopted acquisition as a key developmental strategy to improve the product portfolio of electric motor product. For instance, in October 2023, Rockwell Automation, Inc. successfully concluded the acquisition of Clearpath Robotics Inc., headquartered in Ontario, Canada. Clearpath Robotics is a notable player in the field of autonomous robotics, specializing in autonomous mobile robots (AMRs) designed for industrial applications. This strategic acquisition is poised to augment Rockwell's market position. Moreover, in May 2023, Siemens introduced the Sinamics S200, a new servo drive system tailored specifically for the battery and electronics industry.

The global electric motor market was valued at $142,148.3 million in 2020, and is projected to reach $373,910.3 million by 2032, registering a CAGR of 9.5% from 2023 to 2032.

The forecast period considered for the global electric motor market is 2020 to 2032, wherein, 2020-2021 are historic years, 2022 is the base year, 2023 is the estimated year, and 2032 is the forecast year.

The latest version of global electric motor market report can be obtained on demand from the website.

The base year considered in the global electric motor market report is 2022.

The major players profiled in the electric motor market include ABB, Denso Corporation, Emerson Electric Co., Johnson Electric Holdings Limited, Maxon, NIDEC CORPORATION, Regal Rexnord Corporation, Rockwell Automation Inc., Siemens AG, Arc Systems Inc., Brose Fahrzeugteile SE & Co. KG, Coburg, and TAIGENE Inc.

The top ten market players are selected based on two key attributes - competitive strength and market positioning.

The report contains an exclusive company profile section, where leading companies in the market are profiled. These profiles typically cover company overview, geographical presence, market dominance (in terms of revenue and volume sales), various strategies, and recent developments.

Based on power rating, the above 75 kW segment was the largest revenue generator in 2020.

Loading Table Of Content...

Loading Research Methodology...