2 Theory

2.1 Introduction to forecasting theory2

The theory of forecasting is based on the premise that current and past knowledge can be used to make predictions about the future. In particular for time series, there is the belief that it is possible to identify patterns in the historical values and successfully implement them in the process of predicting future values. However, the exact prediction of futures values is not expected. Instead, among the many options for a forecast of a single time series at a future time period are an expected value (known as a point forecast), a prediction interval, a percentile and an entire prediction distribution. This set of results collectively could be considered to be “the forecast”. There are numerous other potential outcomes of a forecasting process. The objective may be to forecast an event, such as equipment failure, and time series may play only a small role in the forecasting process. Forecasting procedures are best when they relate to a problem to be solved in practice. The theory can then be developed by understanding the essential features of the problem. In turn, the theoretical results can lead to improved practice.

In this introduction, it is assumed that forecasting theories are developed as forecasting methods and models. A forecasting method is defined here to be a predetermined sequence of steps that produces forecasts at future time periods. Many forecasting methods, but definitely not all, have corresponding stochastic models that produce the same point forecasts. A stochastic model provides a data generating process that can be used to produce prediction intervals and entire prediction distributions in addition to point forecasts. Every stochastic model makes assumptions about the process and the associated probability distributions. Even when a forecasting method has an underlying stochastic model, the model is not necessarily unique. For example, the simple exponential smoothing method has multiple stochastic models, including state space models that may or may not be homoscedastic (i.e., possess constant variance). The combining of forecasts from different methods has been shown to be a very successful forecasting method. The combination of the corresponding stochastic models, if they exist, is itself a model. Forecasts can be produced by a process that incorporates new and/or existing forecasting methods/models. Of course, these more complex processes would also be forecasting methods/models.

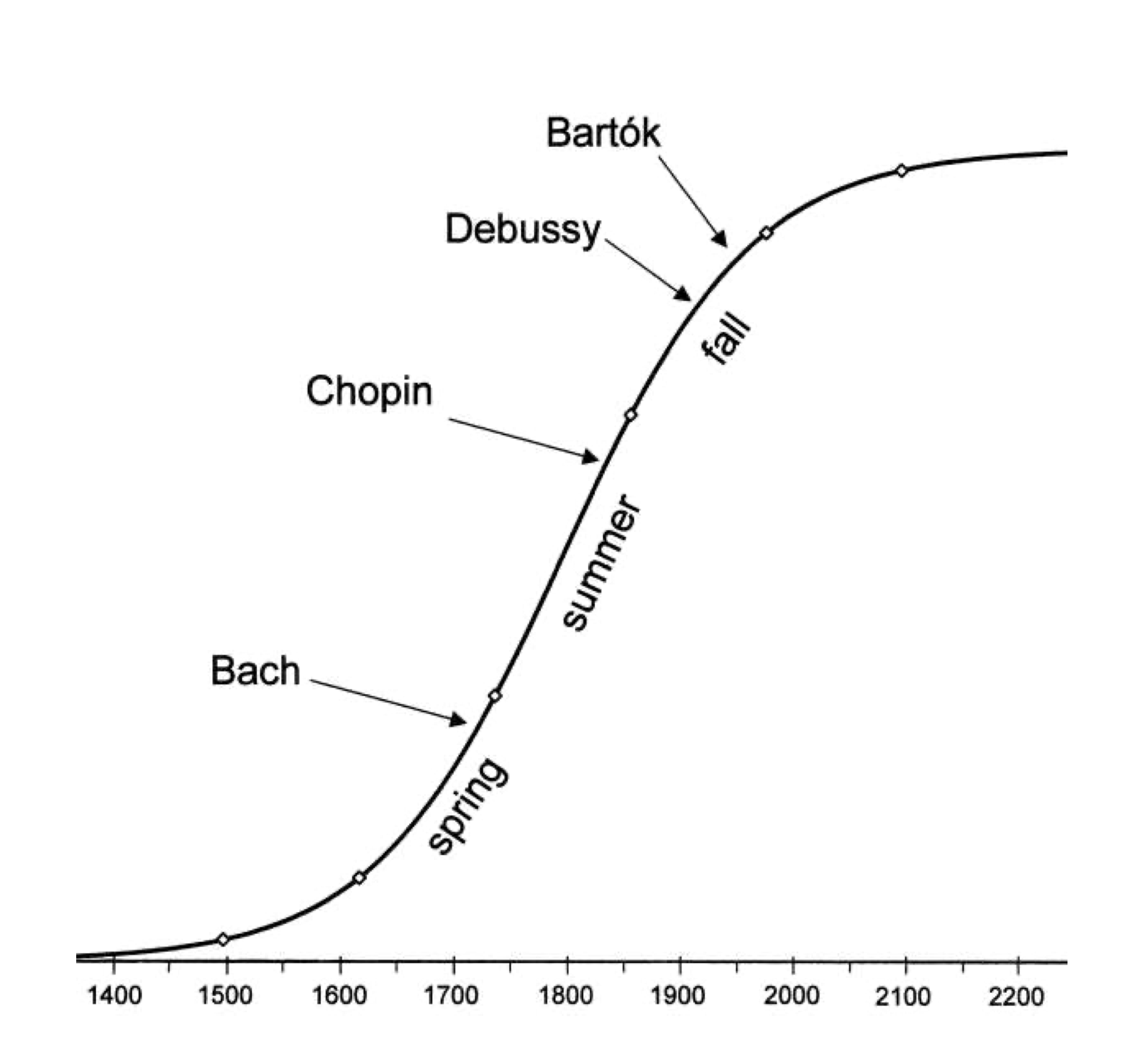

Consideration of the nature of the variables and their involvement in the forecasting process is essential. In univariate forecasting, the forecasts are developed for a single time series by using the information from the historical values of the time series itself. While in multivariate forecasting, other time series variables are involved in producing the forecasts, as in time series regression. Both univariate and multivariate forecasting may allow for interventions (e.g., special promotions, extreme weather). Relationships among variables and other types of input could be linear or involve nonlinear structures (e.g., market penetration of a new technology). When an explicit functional form is not available, methodologies such as simulation or artificial neural networks might be employed. Theories from fields, such as economics, epidemiology, and meteorology, can be an important part of developing these relationships. Multivariate forecasting could also mean forecasting multiple variables simultaneously (e.g., econometric models).

The data or observed values for time series come in many different forms that may limit or determine the choice of a forecasting method. In fact, there may be no historical observations at all for the item of interest, when judgmental methods must be used (e.g., time taken to complete construction of a new airport). The nature of the data may well require the development of a new forecasting method. The frequency of observations can include all sorts of variations, such as every minute, hourly, weekly, monthly, and yearly (e.g., the electricity industry needs to forecast demand loads at hourly intervals as well as long term demand for ten or more years ahead). The data could be composed of everything from a single important time series to billions of time series. Economic analysis often includes multiple variables, many of which affect one another. Time series for businesses are likely to be important at many different levels (e.g., stock keeping unit, common ingredients, or common size container) and, consequently, form a hierarchy of time series. Some or many of the values might be zero; making the time series intermittent. The list of forms for data is almost endless.

Prior to applying a forecasting method, the data may require pre-processing. There are basic details, such as checking for accuracy and missing values. Other matters might precede the application of the forecasting method or be incorporated into the methods/models themselves. The treatment of seasonality is such a case. Some forecasting method/models require de-seasonalised time series, while others address seasonality within the methods/models. Making it less clear when seasonality is considered relative to a forecasting method/model, some governmental statistical agencies produce forecasts to extend time series into the future in the midst of estimating seasonal factors (i.e., X-12 ARIMA).

Finally, it is extremely important to evaluate the effectiveness of a forecasting method. The ultimate application of the forecasts provides guidance in how to measure their accuracy. The focus is frequently on the difference between the actual value and a point forecast for the value. Many loss functions have been proposed to capture the “average” of these differences. Prediction intervals and percentiles can be used to judge the value of a point forecast as part of the forecast. On the other hand, the quality of prediction intervals and prediction distributions can themselves be evaluated by procedures and formulas that have been developed (e.g., ones based on scoring rules). Another assessment tool is judging the forecasts by metrics relevant to their usage (e.g., total costs or service levels).

In the remaining subsections of section §2, forecasting theory encompasses both stochastic modelling and forecasting methods along with related aspects.

2.2 Pre-processing data

2.2.1 Box-Cox transformations3

A common practice in forecasting models is to transform the variable of interest \(y\) using the transformation initially proposed by Box & Cox (1964) as \[y^{(\lambda)}=\begin{cases} (y^\lambda-1)/\lambda&\lambda\neq 0\\ \log(y)&\lambda = 0 \end{cases}\,.\]

The range of the transformation will be restricted in a way that depends on the sign of \(\lambda\), therefore Peter J. Bickel & Doksum (1981) propose the following modification \[y^{(\lambda)}=\begin{cases} (|y|^\lambda sign(y_i)-1)/\lambda&\lambda\neq 0\\ \log(y)&\lambda = 0 \end{cases}\,,\] which has a range from \((-\infty,\infty)\) for any value of \(\lambda\). For a recent review of the Box-Cox (and other similar) transformations see Atkinson, Riani, & Corbellini (2021).

The initial motivation for the Box-Cox transformation was to ensure data conformed to assumptions of normality and constant error variance that are required for inference in many statistical models. The transformation nests the log transformation when \(\lambda=0\) and the case of no transformation (up to an additive constant) when \(\lambda=1\). Additive models for \(\log(y)\) correspond to multiplicative models on the original scale of \(y\). Choices of \(\lambda\) between \(0\) and \(1\) therefore provide a natural continuum between multiplicative and additive models. For examples of forecasting models that use either a log or Box-Cox transformation see §2.3.5 and §2.3.6 and for applications see §3.2.5, §3.6.2, and §3.8.4.

The literature on choosing \(\lambda\) is extensive and dates back to the original Box & Cox (1964) paper - for a review see Sakia (1992). In a forecasting context, a popular method for finding \(\lambda\) is given by Guerrero (1993). The method splits the data into blocks, computes the coefficient of variation within each block and then computes the coefficent of variation again between these blocks. The \(\lambda\) that minimises this quantity is chosen.

Since the transformations considered here are monotonic, the forecast quantiles of the transformed data will, when back-transformed, result in the correct forecast quantiles in terms of the original data. As a result finding prediction intervals in terms of the original data only requires inverting the transformation. It should be noted though, that prediction intervals that are symmetric in terms of the transformed data will not be symmetric in terms of the original data. In a similar vein, back-transformation of the forecast median of the transformed data returns the forecast median in terms of the original data. For more on using the median forecast see §2.12.2 and references therein.

The convenient properties that apply to forecast quantiles, do not apply to the forecast mean, something recognised at least since the work of Granger & Newbold (1976). Back-transformation of the forecast mean of the transformed data does not yield the forecast mean of the original data, due to the non-linearity of the transformation. Consequently forecasts on the original scale of the data will be biased unless a correction is used. For some examples of bias correction methods see Granger & Newbold (1976), J. M. Taylor (1986), Pankratz & Dudley (1987) and Guerrero (1993) and references therein.

The issues of choosing \(\lambda\) and bias correcting are accounted for in popular forecasting software packages. Notably, the method of Guerrero (1993) both for finding \(\lambda\) and bias correcting is implemented in the R packages forecast and fable (see Appendix B).

2.2.2 Time series decomposition4

Time series decomposition is an important building block for various forecasting approaches (see, for example, §2.3.3, §2.7.6, and §3.8.3) and a crucial tools for statistical agencies. Seasonal decomposition is a way to present a time series as a function of other time series, called components. Commonly used decompositions are additive and multiplicative, where such functions are summation and multiplication correspondingly. If logs can be applied to time series, any additive decomposition method can serve as multiplicative after applying log transformation to the data.

The simplest additive decomposition of a time series with single seasonality comprises three components: trend, seasonal component, and the “remainder”. It is assumed that the seasonal component has a repeating pattern (thus sub-series corresponding to every season are smooth or even constant), the trend component describes the smooth underlying mean and the remainder component is small and contains noise.

The first attempt to decompose time series into trend and seasonality is dated to 1847 when Buys-Ballot (1847) performed decomposition between trend and seasonality, modelling the trend by a polynomial and the seasonality by dummy variables. Then, in 1884 Poynting (1884) proposed price averaging as a tool for eliminating trend and seasonal fluctuations. Later, his approach was extended by Hooker (1901), Spencer (1904) and Anderson & Nochmals (1914). Copeland (1915) was the first who attempted to extract the seasonal component, and Macaulay (1931) proposed a method which is currently considered “classical”.

The main idea of this method comes from the observation that averaging a time series with window size of the time series seasonal period leaves the trend almost intact, while effectively removes seasonal and random components. At the next step, subtracting the estimated trend from the data and averaging the result for every season gives the seasonal component. The rest becomes the remainder.

Classical decomposition led to a series of more complex decomposition methods such as X-11 (Shishkin, Young, & Musgrave, 1967), X-11-ARIMA (Dagum, 1988; Ladiray & Quenneville, 2001), X-12-ARIMA (Findley, Monsell, Bell, Otto, & Chen, 1998), and X-13-ARIMA-SEATS (Findley, 2005); see also §2.3.4.

Seasonal trend decomposition using Loess (STL: Cleveland, Cleveland, McRae, & Terpenning, 1990) takes iterative approach and uses smoothing to obtain a better estimate of the trend and seasonal component at every iteration. Thus, starting with an estimate of the trend component, the trend component is subtracted from the data, the result is smoothed along sub-series corresponding to every season to obtain a “rough” estimate of the seasonal component. Since it might contain some trend, it is averaged to extract this remaining trend, which is then subtracted to get a detrended seasonal component. This detrended seasonal component is subtracted from the data and the result is smoothed again to obtain a better estimate of the trend. This cycle repeats a certain number of times.

Another big set of methods use a single underlining statistical model to perform decomposition. The model allows computation of confidence and prediction intervals naturally, which is not common for iterative and methods involving multiple models. The list of such methods includes TRAMO/SEATS procedure (Monsell, Aston, & Koopman, 2003), the BATS and TBATS models (De Livera, Hyndman, & Snyder, 2011), various structural time series model approaches (Commandeur, Koopman, & Ooms, 2011; Harvey, 1990), and the recently developed seasonal-trend decomposition based on regression (STR: Dokumentov, 2017; Dokumentov & Hyndman, 2018); see also §2.3.2. The last mentioned is one of the most generic decomposition methods allowing presence of missing values and outliers, multiple seasonal and cyclic components, exogenous variables with constant, varying, seasonal or cyclic influences, arbitrary complex seasonal schedules. By extending time series with a sequence of missing values the method allows forecasting.

2.2.3 Anomaly detection and time series forecasting5

Temporal data are often subject to uncontrolled, unexpected interventions, from which various types of anomalous observations are produced. Owing to the complex nature of domain specific problems, it is difficult to find a unified definition for an anomaly and mostly application-specific (Unwin, 2019). In time series and forecasting literature, an anomaly is mostly defined with respect to a specific context or its relation to past behaviours. The idea of a context is induced by the structure of the input data and the problem formulation (Chandola, Banerjee, & Kumar, 2007, 2009; Hand, 2009). Further, anomaly detection in forecasting literature has two main focuses, which are conflicting in nature: one demands special attention be paid to anomalies as they can be the main carriers of significant and often critical information such as fraud activities, disease outbreak, natural disasters, while the other down-grades the value of anomalies as it reflects data quality issues such as missing values, corrupted data, data entry errors, extremes, duplicates and unreliable values (P. D. Talagala et al., 2020a).

In the time series forecasting context, anomaly detection problems can be identified under three major umbrella themes: detection of (i) contextual anomalies (point anomalies, additive anomalies) within a given series, (ii) anomalous sub-sequences within a given series, and (iii) anomalous series within a collection of series (Gupta, Gao, Aggarwal, & Han, 2013; P. D. Talagala et al., 2020b). According to previous studies forecast intervals are quite sensitive to contextual anomalies and the greatest impact on forecast are from anomalies occurring at the forecast origin (C. Chen & Liu, 1993a).

The anomaly detection methods in forecasting applications can be categorised into two groups: (i) model-based approaches and (ii) feature-based approaches. Model-based approaches compare the predicted values with the original data. If the deviations are beyond a certain threshold, the corresponding observations are treated as anomalies (Jian Luo et al., 2018a, 2018c; Sobhani, Hong, & Martin, 2020). Contextual anomalies and anomalous sub-sequences are vastly covered by model-based approaches. Limitations in the detectability of anomalous events depend on the input effects of external time series. Examples of such effects are included in SARIMAX models for polynomial approaches (see also §2.3.4). In nonlinear contexts an example is the generalised Bass model (Bass, Krishnan, & Jain, 1994) for special life cycle time series with external control processes (see §2.3.18). SARMAX with nonlinear perturbed mean trajectory as input variable may help separating the mean process under control effects from anomalies in the residual process. Feature-based approaches, on the other hand, do not rely on predictive models. Instead, they are based on the time series features measured using different statistical operations (see §2.7.4) that differentiate anomalous instances from typical behaviours (Fulcher & Jones, 2014). Feature-based approaches are commonly used for detecting anomalous time series within a large collection of time series. Under this approach, it first forecasts an anomalous threshold for the systems typical behaviour and new observations are identified as anomalies when they fall outside the bounds of the established anomalous threshold (Talagala, Hyndman, Leigh, Mengersen, & Smith-Miles, 2019; Talagala et al., 2020b). Most of the existing algorithms involve a manual anomalous threshold. In contrast, Burridge & Robert Taylor (2006) and Talagala et al. (2020b) use extreme value theory based data-driven anomalous thresholds. Approaches to the problem of anomaly detection for temporal data can also be divided into two main scenarios: (i) batch processing and (ii) data streams. The data stream scenario poses many additional challenges, due to nonstationarity, large volume, high velocity, noisy signals, incomplete events and online support (Luo et al., 2018c; Talagala et al., 2020b).

The performance evaluation of the anomaly detection frameworks is typically done using confusion matrices (Luo et al., 2018c; Sobhani et al., 2020). However, these measures are not enough to evaluate the performance of the classifiers in the presence of imbalanced data (Hossin & Sulaiman, 2015). Following Ranawana & Palade (2006) and Talagala et al. (2019), Leigh et al. (2019) have used some additional measures such as negative predictive value, positive predictive value and optimised precision to evaluate the performance of their detection algorithms.

2.2.4 Robust handling of outliers in time series forecasting6

Estimators of time series processes can be dramatically affected by the presence of few aberrant observations which are called differently in the time series literature: outliers, spikes, jumps, extreme observations (see §2.2.3). If their presence is neglected, coefficients could be biasedly estimated. Biased estimates of ARIMA processes will decrease the efficiency of predictions (Bianco, Garcı́a Ben, Martı́nez, & Yohai, 2001). Moreover, as the optimal predictor of ARIMA models (see §2.3.4) is a linear combination of observed units, the largest coefficients correspond to observations near the forecast origin and the presence of outliers among these units can severely affect the forecasts. Proper preliminary analysis of possible extreme observations is an unavoidable step, which should be carried out before any time series modelling and forecasting exercise (see §2.3.9). The issue was first raised in the seminal paper by (Fox, 1972), who suggests a classification of outliers in time series, separating additive outliers (AO) from innovation outliers (IO). The influence of different types of outliers on the prediction errors in conditional mean models (ARIMA models) is studied by C. Chen & Liu (1993a, 1993b) and Ledolter (1989, 1991), while the GARCH context (see also §2.3.11) is explored by Franses & Ghijsels (1999) and Catalán & Trı́vez (2007). Abraham & Box (1979) propose a Bayesian model which reflects the presence of outliers in time series and allows to mitigate their effects on estimated parameters and, consequently, improve the prediction ability. The main idea is to use a probabilistic framework allowing for the presence of a small group of discrepant units.

A procedure for the correct specification of models, accounting for the presence of outliers, is introduced by Tsay (1986) relying on iterative identification-detection-removal of cycles in the observed time series contaminated by outliers. The same issue is tackled by Abraham & Chuang (1989): in this work non-influential outliers are separated from influential outliers which are observations with high residuals affecting parameter estimation. Tsay’s procedure has been later modified Balke (1993) to effectively detect time series level shifts. The impulse- and step-indicator saturation approach is used by Marczak & Proietti (2016) for detecting additive outliers and level shifts estimating structural models in the framework of nonstationary seasonal series. They find that timely detection of level shifts located towards the end of the series can improve the prediction accuracy.

All these works are important because outlier and influential observations detection is crucial for improving the forecasting performance of models. The robust estimation of model parameters is another way to improve predictive accuracy without correcting or removing outliers (see §3.4.2, for the application on energy data). Sakata & White (1998) introduce a new two-stage estimation strategy for the conditional variance based on Hampel estimators and S-estimators. Park (2002) proposes a robust GARCH model, called RGARCH exploiting the idea of least absolute deviation estimation. The robust approach is also followed for conditional mean models by Gelper, Fried, & Croux (2009) who introduce a robust version of the exponential and Holt-Winters smoothing technique for prediction purposes and by Cheng & Yang (2015) who propose an outlier resistant algorithm developed starting from a new synthetic loss function. Very recently, Beyaztas & Shang (2019) have introduced a robust forecasting procedure based on weighted likelihood estimators to improve point and interval forecasts in functional time series contaminated by the presence of outliers.

2.2.5 Exogenous variables and feature engineering7

Exogenous variables are those included in a forecasting system because they add value but are not being predicted themselves, and are sometimes called ‘features’ (see §2.7.4). For example, a forecast of county’s energy demand may be based on the recent history of demand (an endogenous variable), but also weather forecasts, which are exogenous variables. Many time series methods have extensions that facilitate exogenous variables, such as autoregression with exogenous variables (ARX). However, it is often necessary to prepare exogenous data before use, for example so that it matches the temporal resolution of the variable being forecast (hourly, daily, and so on).

Exogenous variables may be numeric or categorical, and may be numerous. Different types of predictor present different issues depending on the predictive model being used. For instance, models based on the variable’s absolute value can be sensitive to extreme values or skewness, whereas models based on the variable value’s rank, such as tree-based models, are not. Exogenous variables that are correlated with one another also poses a challenge for some models, and techniques such as regularisation and partial leased squares have been developed to mitigate this.

Interactions between exogenous variables my also be important when making predictions. For example, crop yields depend on both rainfall and sunlight: one without the other or both in excess will result in low yields, but the right combination will result in high yields. Interactions may be included in linear models by including product of the two interacting exogenous as a feature in the model. This is an example of feature engineering, the process of creating new features based on domain knowledge or exploratory analysis of available data. In machine learning (see §2.7.10), many features may be created by combining exogenous variables speculatively and passed to a selection algorithm to identify those with predictive power. Combinations are not limited to products, or only two interacting variables, and where many exogenous variables are available, could include summary statistics (mean, standard deviation, range, quantiles...) of groups of variables.

Where exogenous variables are numerous dimension reduction may be applied to reduce the number of features in a forecasting model (see also §2.5.3). Dimension reduction transforms multivariate data into a lower dimensional representation while retaining meaningful information about the original data. Principal component analysis (PCA) is a widely used method for linear dimension reduction, and non-linear alternatives are also available. PCA is useful when the number of candidate predictors is greater than the number of time series observations, as is often the case in macroeconomic forecasting (Stock & Watson, 2002). It is routinely applied in applications from weather to sales forecasting. In retail forecasting, for example, past sales of thousands of products may be recorded but including them all as exogenous variables in the forecasting model for an individual product may be impractical. Dimension reduction offers an alternative to only using a subset of the available features.

Preparation of data for forecasting tasks is increasingly important as the volume of available data is increasing in many application areas. Further details and practical examples can be found in Kuhn & Johnson (2019) and Albon (2018) among other texts in this area. For deeper technical discussion of a range of non-linear dimension reduction algorithms, see Hastie, Tibshirani, & Friedman (2009).

2.3 Statistical and econometric models

2.3.1 Exponential smoothing models8

Exponential smoothing is one of the workhorses of business forecasting. Despite the many advances in the field, it is always a tough benchmark to bear in mind. The development of exponential smoothing dates back to 1944, where Robert G. Brown through a mechanical computing device estimated key variables for fire-control on the location of submarines (Gardner, 1985). More details about the state of the art of exponential smoothing can be found in Gardner (2006).

The idea behind exponential smoothing relies on the weighted average of past observations, where that weight decreases exponentially as one moves away from the present observations. The appropriate exponential smoothing method depends on the components that appear in the time series. For instance, in case that no clear trend or seasonal pattern is present, the simplest form of exponential smoothing methods known as Simple (or Single) Exponential Smoothing (SES) is adequate, such as: \[f_{t+1} = \alpha y_t + (1-\alpha)f_t\]

In some references, is also known as Exponentially Weighted Moving Average (Harvey, 1990). The formula for SES can be obtained from minimising the discounted least squares error function and expressing the resulting equation in a recursive form (Harvey, 1990). If observations do not have the same weight, the ordinary least squares cannot be applied. On the other hand, the recursive form is very well-suited for saving data storage.

In order to use SES, we need to estimate the initial forecast (\(f_1\)) and the exponential smoothing parameter (\(\alpha\)). Traditionally, the initialisation was done by using either ad hoc values or a heuristic scheme (Hyndman, Koehler, Ord, & Snyder, 2008), however nowadays it is standard to estimate both the initial forecast and the optimal smoothing parameter by minimising the sum of squares of the one-step ahead forecast errors. The estimation of the smoothing parameter usually is restricted to values between 0 and 1. Once SES is defined, the method only provides point forecasts, i.e., forecasts of the mean. Nonetheless, it is of vital importance for many applications to provide density (probabilistic) forecasts. To that end, Hyndman, Koehler, Snyder, & Grose (2002) extended exponential smoothing methods under State Space models using a single source of error (see §2.3.6) to equip them with a statistical framework capable of providing future probability distributions. For example, SES can be expressed in the State Space as a local level model: \[\begin{aligned} \label{eq:subtasks} y_t &=& \ell_{t-1} + \epsilon_t, \nonumber \\ \ell_t &=& \ell_{t-1} + \alpha \epsilon_t. \nonumber \end{aligned}\]

where the state is the level (\(\ell\)) and \(\epsilon\) is the Gaussian noise. Note the difference between traditional exponential smoothing methods and exponential smoothing models (under the state space approach). The former only provide point forecasts, meanwhile the latter also offers probabilistic forecasts, which obviously includes prediction intervals. In addition, some exponential smoothing models can be expressed an ARIMA models (see also §2.3.4).

So far, we have introduced the main exponential smoothing using SES, however real time series can include other components as trends, seasonal patterns, cycles, and the irregular (error) component. In this sense, the exponential smoothing version capable of handling local trends is commonly known as Holt’s method (Holt, 2004 originally published in 1957) and, if it also models a seasonality component, which can be incorporated in an additive or multiplicative fashion, it is called Holt-Winters method (Winters, 1960). Exponential smoothing models have been also extended to handle multiple seasonal cycles; see §2.3.5.

Fortunately, for various combinations of time series patterns (level only, trended, seasonal, trended and seasonal) a particular exponential smoothing can be chosen. Pegels (1969) proposed a first classification of exponential smoothing methods, later extended by Gardner (1985) and James W Taylor (2003a). The state space framework mentioned above, developed by Hyndman et al. (2002), allowed to compute the likelihood for each exponential smoothing model and, thus, model selection criteria such as AIC could be used to automatically identify the appropriate exponential smoothing model. Note that the equivalent state space formulation was derived by using a single source of error instead of a multiple source of error (Harvey, 1990). Hyndman et al. (2008) utilised the notation (E,T,S) to classify the exponential smoothing models, where those letters refer to the following components: Error, Trend, and Seasonality. This notation has gained popularity because the widely-used forecast package (R. Hyndman et al., 2020), recently updated to the fable package, for R statistical software, and nowadays exponential smoothing is frequently called ETS.

2.3.2 Time-series regression models9

The key idea of linear regression models is that a target (or dependent, forecast, explained, regress) variable, \(y\), i.e., a time series of interest, can be forecast through other regressor (or independent, predictor, explanatory) variables, \(x\), i.e., time series or features (see §2.2.5), assuming that a linear relationship exists between them, as follows

\[y_t = \beta_{0} + \beta_{1} x_{1_{t}} + \beta_{2} x_{2_{t}} + \dots + \beta_{k} x_{k_{t}} + e_t,\]

where \(e_t\) is the residual error of the model at time \(t\), \(\beta_{0}\) is a constant, and coefficient \(\beta_{i}\) is the effect of regressor after taking into account the effects of all \(k\) regressors involved in the model. For example, daily product sales may be forecast using information related with past sales, prices, advertising, promotions, special days, and holidays (see also §3.2.4).

In order to estimate the model, forecasters typically minimise the sum of the squared errors (ordinary least squares estimation, OLS), \(\text{SSE}=\sum_{t=1}^{n} e_t^2\), using the observations available for fitting the model to the data (Ord, Fildes, & Kourentzes, 2017) and setting the gradient \(\frac{\partial \text{SSE}}{\partial \beta_{i}}\) equal to zero. If the model is simple, consisting of a single regressor, then two coefficients are computed, which are the slope (coefficient of the regressor) and the intercept (constant). When more regressor variables are considered, the model is characterised as a multiple regression one and additional coefficients are estimated.

A common way to evaluate how well a linear regression model fits the target series, reporting an average value of \(\bar{y}\), is through the coefficient of determination, \(R^2=\frac{\sum_{t=1}^{n} (f_t-\bar{y})^2}{\sum_{t=1}^{n} (y_t-\bar{y})^2}\), indicating the proportion of variation in the dependent variable explained by the model. Values close to one indicate sufficient goodness-of-fit, while values close to zero insufficient fitting. However, goodness-of-fit should not be confused with forecastability (Harrell, 2015). When the complexity of the model is increased, i.e., more regressors are considered, the value of the coefficient will also rise, even if such additions lead to overfitting (see §2.5.2). Thus, regression models should be evaluated using cross-validation approaches (see §2.5.5), approximating the post-sample accuracy of the model, or measures that account for model complexity, such as information criteria (e.g., AIC, AICc, and BIC) and the adjusted coefficient of determination, \(\bar{R}^2 = 1-(1-R^2)\frac{n-1}{n-k-1}\) (James, Witten, Hastie, & Tibshirani, 2013). Other diagnostics are the standard deviation of the residuals and the t-values of the regressors. Residual standard error, \(\sigma_e = \sqrt{\frac{\sum_{t=1}^{n} (y_t-f_t)^2}{n-k-1}}\), summarises the average error produced by the model given the number of regressors used, thus accounting for overfitting. The t-values measure the impact of excluding regressors from the model in terms of error, given the variation in the data, thus highlighting the importance of the regressors.

To make sure that the produced forecasts are reliable, the correlation between the residuals and the observations of the regressors must be zero, with the former displaying also insignificant autocorrelation. Other assumptions suggest that the residuals should be normally distributed with an average value of zero and that their variability should be equal across time (no heteroscedasticity present). Nevertheless, in practice, it is rarely necessary for residuals to be normally distributed in order for the model to produce accurate results, while the homoscedasticity assumption becomes relevant mostly when computing prediction intervals. If these assumptions are violated, that may mean that part of the variance of the target variable has not been explained by the model and, therefore, that other or more regressors are needed. In case of non-linear dependencies between the target and the regressor variables, data power transformations (see §2.2.1) or machine learning approaches can be considered (see §2.7.10).

Apart from time series regressors, regression models can also exploit categorical (dummy or indicator) variables (Hyndman & Athanasopoulos, 2018) which may e.g., inform the model about promotions, special events, and holidays (binary variables), the day of the week or month of the year (seasonal dummy variables provided as one-hot encoded vectors), trends and structural changes, and the number of trading/working days included in the examined period. In cases where the target series is long and displays complex seasonal patterns, additional regressors such as Fourier series and lagged values of both the target and the regressor variables may become useful. Moreover, when the number of the potential regressor variables is significant compared to the observations available for estimating the respective coefficients (see §2.7.1), step-wise regression (James et al., 2013) or dimension reduction and shrinkage estimation methods (see §2.5.3) can be considered to facilitate training and avoid overfitting. Finally, mixed data sampling (MIDAS) regression models are a way of allowing different degrees of temporal aggregation for the regressors and predictand (see also §2.10.2 for further discussions on forecasting with temporal aggregation).

2.3.3 Theta method and models10

In the age of vast computing power and computational intelligence, the contribution of simple forecasting methods is possibly not en vogue; the implementation of complicated forecasting systems becomes not only expedient but possibly desirable. Nevertheless forecasting, being a tricky business, does not always favour the complicated or the computationally intensive. Enter the theta method. From its beginnings 20 years back in Assimakopoulos & Nikolopoulos (2000) to recent advances in the monograph of Nikolopoulos & Thomakos (2019), to other work in-between and recently too, the theta method has emerged as not only a powerfully simple but also enduring method in modern time series forecasting. The reader will benefit by reviewing §2.3.1, §2.3.4, and §2.3.9 for useful background information.

The original idea has been now fully explained and understood and, as Nikolopoulos & Thomakos (2019) have shown, even the revered AR(1) model forecast is indeed a theta forecast – and it has already been shown by Hyndman & Billah (2003) that the theta method can represent SES (with a drift) forecasts as well. In its simplest form the method generates a forecast from a linear combination of the last observation and some form of “trend” function, be that a constant, a linear trend, a non-parametric trend or a non-linear trend. In summary, and under the conditions outlined extensively in Nikolopoulos & Thomakos (2019), the theta forecasts can be expressed as functions of the “theta line”: \[Q_t(\theta) = \theta y_t + (1-\theta)T_{t+1}\]

where \(T_{t+1}\) is the trend function, variously defined depending on the modelling approach and type of trend one is considering in applications. It can be shown that the, univariate, theta forecasts can given either as \[f_{t+1|t} = y_t + \Delta Q_t(\theta)\]

when the trend function is defined as \(T_{t+1}= \mu t\) and as \[f_{t+1|t} = Q_t(\theta) + \theta \Delta \mathbb{E}(T_{t+1})\]

when the trend function is left otherwise unspecified. The choice of the weight parameter \(\theta\) on the linear combination of the theta line, the choice and number of trend functions and their nature and other aspects on expanding the method have been recently researched extensively.

The main literature has two strands. The first one details the probabilistic background of the method and derives certain theoretical properties, as in Hyndman & Billah (2003), Thomakos & Nikolopoulos (2012), Thomakos & Nikolopoulos (2015) and a number of new theoretical results in Nikolopoulos & Thomakos (2019). The work of Thomakos and Nikolopoulos provided a complete analysis of the theta method under the unit root data generating process, explained its success in the M3 competition (Makridakis & Hibon, 2000), introduced the multivariate theta method and related it to cointegration and provided a number of other analytical results for different trend functions and multivariate forecasting. The second strand of the literature expands and details various implementation (including hybrid approaches) of the method, as in the theta approach in supply chain planning of Nikolopoulos, Assimakopoulos, Bougioukos, Litsa, & Petropoulos (2012), the optimised theta models and their relationship with state space models in Fioruci, Pellegrini, Louzada, & Petropoulos (2015) and Fiorucci, Pellegrini, Louzada, Petropoulos, & Koehler (2016), hybrid approaches as in Theodosiou (2011) and Spiliotis et al. (2019a), to the very latest generalised theta method of Spiliotis et al. (2020a). These are major methodological references in the field, in addition to many others of pure application of the method.

The theta method is also part of the family of adaptive models/methods, and a simple example illustrates the point: the AR(1) forecast or the SES forecast are both theta forecasts but they are also both adaptive learning forecasts, as in the definitions of the recent work by Kyriazi, Thomakos, & Guerard (2019). As such, the theta forecasts contain the basic building blocks of successful forecasts: simplicity, theoretical foundations, adaptability and performance enhancements. Further research on the usage of the theta method within the context of adaptive learning appears to be a natural next step. In the context of this section, see also §2.3.16 on equilibrium correcting models and forecasts.

Given the simplicity of its application, the freely available libraries of its computation, its scalability and performance, the theta method should be considered as a critical benchmark henceforth in the literature – no amount of complexity is worth its weight if it cannot beat a single Greek letter!

2.3.4 Autoregressive integrated moving average (ARIMA) models11

Time series models that are often used for forecasting are of the autoregressive integrated moving average class (ARIMA – Box, George, Jenkins, & Gwilym, 1976). The notation of an ARIMA(\(p\), \(d\), \(q\)) model for a time series \(y_t\) is \[(1 - \phi_1L - \dots - \phi_pL^p)(1-L)^d y_t = c + (1 + \theta_1L + \dots + \theta_qL^q)+\epsilon_t,\]

where the lag operator \(L\) is defined by \(L^k y_t=y_{t-k}\). The \(\epsilon_t\) is a zero-mean uncorrelated process with common variance \(\sigma_\epsilon^2\). Some exponential smoothing models (see §2.3.1) can also be written in ARIMA format, where some ETS models assume that \(d=1\) or \(d=2\). For example, SES is equivalent to ARIMA(0,1,1) when \(\theta_1 = \alpha - 1\).

The parameters in the ARIMA model can be estimated using Maximum

Likelihood, whereas for the ARIMA(\(p\), \(d\), 0) Ordinary Least Squares

can be used. The iterative model-building process (Franses, Dijk, & Opschoor, 2014)

requires the determination of the values of \(p\), \(d\), and \(q\). Data

features as the empirical autocorrelation function and the empirical

partial autocorrelation function can be used to identify the values of

\(p\) and \(q\), in case of low values of \(p\) and \(q\). Otherwise, in

practice one relies on the well-known information criteria like AIC and

BIC (see §2.5.4). The function auto.arima of the

forecast package (R. Hyndman et al., 2020) for R statistical software

compares models using information criteria, and has been found to be

very effective and increasingly being used in ARIMA modelling.

Forecasts from ARIMA models are easy to make. And, at the same time, prediction intervals can be easily computed. Take for example the ARIMA(1,0,1) model: \[y_t = c + \phi_1 y_{t-1} + \epsilon_t + \theta_1 \epsilon_{t-1}.\] The one-step-ahead forecast from forecast origin \(n\) is \(f_{n+1 | n} = c + \phi_1 y_n + \theta_1 \epsilon_n\) as the expected value \(E(\epsilon_{n+1}) = 0\). The forecast error is \(y_{n+1} - f_{n+1 | n} = \epsilon_{n+1}\) and, hence, the forecast error variance is \(\sigma_\epsilon^2\). The two-steps-ahead forecast from \(n\) is \(f_{n+2 | n} = c + \phi_1 f_{n+1 | n}\) with the forecast error equal to \(\epsilon_{n+2}+\phi_1 \epsilon_{n+1}\) and the forecast error variance \((1+\phi_1^2)\sigma_\epsilon^2\). These expressions show that the creation of forecasts and forecast errors straightforwardly follow from the model expressions, and hence can be automated if necessary.

An important decision when using an ARIMA model is the choice for the value of \(d\). When \(d=0\), the model is created for the levels of the time series, that is, \(y_t\). When \(d=1\), there is a model for \((1-L)y_t\), and the data need to be differenced prior to fitting an ARMA model. In some specific but rare cases, \(d=2\). The decision on the value of d is usually based on so-called tests for unit roots (Dickey & Fuller, 1979; Dickey & Pantula, 1987). Under the null hypothesis that \(d=1\), the data are non-stationary, and the test involves non-standard statistical theory (Phillips, 1987). One can also choose to make \(d=0\) as the null hypothesis (Hobijn, Franses, & Ooms, 2004; Kwiatkowski, Phillips, Schmidt, & Shin, 1992). The power of unit root tests is not large, and in practice one often finds signals to consider \(d=1\) (Nelson & Plosser, 1982).

For seasonal data, like quarterly and monthly time series, the ARIMA model can be extended to Seasonal ARIMA (SARIMA) models represented by ARIMA(\(p\), \(d\), \(q\))(\(P\), \(D\), \(Q\))\(_s\), where \(P\), \(D\), and \(Q\) are the seasonal parameters and the \(s\) is the periodicity. When \(D = 1\), the data are transformed as \((1-L^s)y_t\). It can also be that \(D = 0\) and \(d = 1\), and then one can replace \(c\) by \(c_1 D_{1,t} + c_2 D_{2,t} + \dots + c_s D_{s,t}\) where the \(D_{i,t}\) with \(i = 1, 2, \dots, s\) are seasonal dummies. The choice of \(D\) is based on tests for so-called seasonal unit roots (Franses, 1991; Ghysels, Lee, & Noh, 1994; Hylleberg, Engle, Granger, & Yoo, 1990).

Another popular extension to ARIMA models is called ARIMAX, implemented by incorporating additional exogenous variables (regressors) that are external to and different from the forecast variable. An alternative to ARIMAX is the use of regression models (see §2.3.2) with ARMA errors.

2.3.5 Forecasting for multiple seasonal cycles12

With the advances in digital data technologies, data is recorded more frequently in many sectors such as energy (P. Wang et al., 2016 and §3.4), healthcare (Whitt & Zhang, 2019, and 3.6.1), transportation (Gould et al., 2008), and telecommunication (Nigel Meade & Islam, 2015a). This often results in time series that exhibit multiple seasonal cycles (MSC) of different lengths. Forecasting problems involving such series have been increasingly drawing the attention of both researchers and practitioners leading to the development of several approaches.

Multiple Linear Regression (MLR) is a common approach to model series with MSC (Kamisan, Lee, Suhartono, Hussin, & Zubairi, 2018; Rostami-Tabar & Ziel, 2020); for an introduction on time-series regression models, see §2.3.2. While MLR is fast, flexible, and uses exogenous regressors, it does not allow to decompose components and change them over time. Building on the foundation of the regression, Facebook introduced Prophet (S. J. Taylor & Letham, 2018), an automated approach that utilises the Generalised Additive Model (Hastie & Tibshirani, 1990). Although the implementation of Prophet may be less flexible, it is easy to use, robust to missing values and structural changes, and can handles outliers well.

Some studies have extended the classical ARIMA (see §2.3.4) and Exponential Smoothing (ETS; see §2.3.1) methods to accommodate MSC. Multiple/multiplicative Seasonal ARIMA (MSARIMA) model is an extension of ARIMA for the case of MSC (James W Taylor, 2003b). MSARIMA allows for exogenous regressors and terms can evolve over time, however, it is not flexible, and the computational time is high. Svetunkov & Boylan (2020) introduced the Several Seasonalities ARIMA (SSARIMA) model which constructs ARIMA in a state-space form with several seasonalities. While SSARIMA is flexible and allows for exogenous regressors, it is computationally expensive, especially for high frequency series.

James W Taylor (2003b) introduced Double Seasonal Holt-Winters (DSHW) to extend ETS for modelling daily and weekly seasonal cycles. Following that, Taylor (2010) proposed a triple seasonal model to consider the intraday, intraweek and intrayear seasonalities. Gould et al. (2008) and James W Taylor & Snyder (2012) instead proposed an approach that combines a parsimonious representation of the seasonal states up to a weekly period in an innovation state space model. With these models, components can change, and decomposition is possible. However, the implementation is not flexible, the use of exogenous regressors is not supported, and the computational time could be high.

An alternative approach for forecasting series with MSC is TBATS (De Livera et al., 2011, see also §2.2.2). TBATS uses a combination of Fourier terms with an exponential smoothing state space model and a Box-Cox transformation (see §2.2.1), in an entirely automated manner. It allows for terms to evolve over time and produce accurate forecasts. Some drawbacks of TBATS, however, are that it is not flexible, can be slow, and does not allow for covariates.

In response to shortcomings in current models, Forecasting with Additive Switching of Seasonality, Trend and Exogenous Regressors (FASSTER) has been proposed by O’Hara-Wild & Hyndman (2020). FASSTER is fast, flexible and support the use of exogenous regressors into a state space model. It extends state space models such as TBATS by introducing a switching component to the measurement equation which captures groups of irregular multiple seasonality by switching between states.

In recent years, Machine Learning (ML; see §2.7.10) approaches have also been recommended for forecasting time series with MSC. MultiLayer Perceptron (MLP: Dudek, 2013; Zhang & Qi, 2005), Recurrent Neural Networks (RNN: Lai, Chang, Yang, & Liu, 2018), Generalised Regression Neural Network (GRNN: Dudek, 2015), and Long Short-Term Memory Networks (LSTM Zheng, Xu, Zhang, & Li, 2017) have been applied on real data (Bandara et al., 2020a; Xie & Ding, 2020) with promising results. These approaches are flexible, allow for any exogenous regressor and suitable when non-linearity exists in series, however interpretability might be an issue for users (Makridakis, 2018).

2.3.6 State-space models13

State Space (SS) systems are a very powerful and useful framework for time series and econometric modelling and forecasting. Such systems were initially developed by engineers, but have been widely adopted and developed in Economics as well (Durbin & Koopman, 2012; Harvey, 1990). The main distinguishing feature of SS systems is that the model is formulated in terms of states (\(\mathbf{\alpha}_t\)), which are a set of variables usually unobserved, but which have some meaning. Typical examples are trends, seasonal components or time varying parameters.

A SS system is built as the combination of two sets of equations: (i) state or transition equations which describe the dynamic law governing the states between two adjacent points in time; and (ii) observation equations which specify the relation between observed data (both inputs and outputs) and the unobserved states. A linear version of such a system is shown in Equation (1). \[\begin{equation} \begin{array}{cc} \mathbf{\alpha}_{t+1}=\mathbf{T}_t \mathbf{\alpha}_t+\mathbf{\Gamma}_t+\mathbf{R}_t \mathbf{\eta}_t, & \mathbf{\eta}_t \sim N(0,\mathbf{Q}_t)\\ \mathbf{y}_t=\mathbf{Z}_t \mathbf{\alpha}_t+\mathbf{D}_t+\mathbf{C}_t \mathbf{\epsilon}_t, & \mathbf{\epsilon}_t \sim N(0,\mathbf{H}_t)\\ \mathbf{\alpha}_1 \sim N(\boldsymbol{a}_1,\mathbf{P}_1) & \\ \end{array} \tag{1} \end{equation}\]

In this equations \(\mathbf{\eta}_t\) and \(\mathbf{\epsilon}_t\) are the state and observational vectors of zero mean Gaussian noises with covariance \(\mathbf{S}_t\). \(\mathbf{T}_t\), \(\mathbf{\Gamma}_t\), \(\mathbf{R}_t\), \(\mathbf{Q}_t\), \(\mathbf{Z}_t\), \(\mathbf{D}_t\), \(\mathbf{C}_t\), \(\mathbf{H}_t\) and \(\mathbf{S}_t\) are the so-called (time-varying) system matrices, and \(\boldsymbol{a}_1\) and \(\mathbf{P}_1\) are the initial state and state covariance matrix, respectively. Note that \(\mathbf{D}_t\) and \(\mathbf{\Gamma}_t\) may be parameterised to include some input variables as linear or non-linear relations to the output variables \(\mathbf{y}_t\).

The model in Equation (1) is a multiple error SS model. A different formulation is the single error SS model or the innovations SS model. This latter is similar to (1), but replacing \(\mathbf{R}_t \mathbf{\eta}_t\) and \(\mathbf{C}_t \mathbf{\epsilon}_t\) by \(\mathbf{K}_t \mathbf{e}_t\) and \(\mathbf{e}_t\), respectively. Then, naturally, the innovations form may be seen as a restricted version of model (1), but, conversely, under weak assumptions, (1) may also be written as an observationally equivalent innovations form (see, for example, Casals, Garcia-Hiernaux, Jerez, Sotoca, & Trindade, 2016, pp. 12–17)

Once a SS system is fully specified, the core problem is to provide optimal estimates of states and their covariance matrix over time. This can be done in two ways, either by looking back in time using the well-known Kalman filter (useful for online applications) or taking into account the whole sample provided by smoothing algorithms (typical of offline applications) (Anderson & Moore, 1979).

Given any set of data and a specific model, the system is not fully specified in most cases because it usually depends on unknown parameters scattered throughout the system matrices that define the SS equations. Estimation of such parameters is normally carried out by Maximum Likelihood defined by prediction error decomposition (Harvey, 1990).

Non-linear and non-Gaussian models are also possible, but at the cost of a higher computational burden because more sophisticated recursive algorithms have to be applied, like the extended Kalman filters and smoothers of different orders, particle filters (Doucet & Gordon, 2001), Unscented Kalman filter and smoother (Julier & Uhlmann, 1997), or simulation of many kinds, like Monte Carlo, bootstrapping or importance sampling (Durbin & Koopman, 2012).

The paramount advantage of SS systems is that they are not a particular model or family of models strictly speaking, but a container in which many very different model families may be implemented, indeed many treated in other sections of this paper. The following is a list of possibilities, not at all exhaustive:

Univariate models with or without inputs: regression (§2.3.2), ARIMAx (§2.3.4), transfer functions, exponential smoothing (§2.3.1), structural unobserved components, Hodrick-Prescott filter, spline smoothing.

Fully multivariate: natural extensions of the previous ones plus echelon-form VARIMAx, Structural VAR, VECM, Dynamic Factor models, panel data (§2.3.9).

Non-linear and non-Gaussian: TAR, ARCH, GARCH (§2.3.11), Stochastic Volatility (Durbin & Koopman, 2012), Dynamic Conditional Score (A. C. Harvey, 2013), Generalised Autoregressive Score (Creal, Koopman, & Lucas, 2013), multiplicative unobserved components.

Other: periodic cubic splines, periodic unobserved components models, state dependent models, Gegenbauer long memory processes (Dissanayake, Peiris, & Proietti, 2018).

Once any researcher or practitioner becomes acquainted to a certain degree with the SS technology, some important advanced issues in time series forecasting may be comfortably addressed (Casals et al., 2016). It is the case, for example, of systems block concatenation, systems nesting in errors or in variables, treating errors in variables, continuous time models, time irregularly spaced data, mixed frequency models, time varying parameters, time aggregation, hierarchical and group forecasting (Villegas & Pedregal, 2018) (time, longitudinal or both), homogeneity of multivariate models (proportional covariance structure among perturbations), etc.

All in all, the SS systems offer a framework capable of handling many modelling and forecasting techniques available nowadays in a single environment. Once the initial barriers are overcome, a wide panorama of modelling opportunities opens up.

2.3.7 Models for population processes14

Over the past two centuries, formal demography has established its own, discipline-specific body of methods for predicting (or projecting15) populations. Population sciences, since their 17th century beginnings, have been traditionally very empirically focused, with strong links with probability theory (Courgeau, 2012). Given the observed regularities in population dynamics, and that populations are somewhat better predictable than many other socio-economic processes, with reasonable horizons possibly up to one generation ahead (Keyfitz, 1972, 1981), demographic forecasts have become a bestselling product of the discipline (Xie, 2000). Since the 20th century, methodological developments in human demography have been augmented by the work carried out in mathematical biology and population ecology (Caswell, 2019a).

The theoretical strength of demography also lies almost exclusively in the formal mathematical description of population processes (Burch, 2018), typically growth functions and structural changes. Historically, such attempts started from formulating the logistic model of population dynamics, inspired by the Malthusian theory (Pearl & Reed, 1920; Verhulst, 1845). Lotka (1907)’s work laid the foundations of the stable population theory with asymptotic stability under constant vital rates, subsequently extended to modelling of interacting populations by using differential equations (Lotka, 1925; V Volterra, 1926). By the middle of the 20th century, the potential and limitations of demographic forecasting methods were already well recognised in the literature (Brass, 1974; Hajnal, 1955).

In the state-of-the-art demographic forecasting, the core engine is provided by matrix algebra. The most common approach relies on the cohort-component models, which combine the assumptions on fertility, mortality and migration, in order to produce future population by age, sex, and other characteristics. In such models, the deterministic mechanism of population renewal is known, and results from the following demographic accounting identity (population balancing equation, see Rees & Wilson, 1973; Bryant & Zhang, 2018): \[P[x+1, t+1] = P[x, t] - D[(x, x+1), (t, t+1)] + I[(x, x+1), (t, t+1)] - E[(x, x+1), (t, t+1)]\]

where \(P[x, t]\) denotes population aged \(x\) at time \(t\), \(D[(x, x+1), (t, t+1)]\) refer to deaths between ages \(x\) and \(x+1\) in the time interval \(t\) to \(t+1\), with \(I\) and \(E\) respectively denoting immigration (and other entries) and emigration (and other exits). In addition, for the youngest age group, births \(B[(t, t+1)]\) need to be added. The equation above can be written up in the general algebraic form: \(\mathbf{P}_{t+1} = \mathbf{G} \mathbf{P}_t\), where \(\mathbf{P}_t\) is the population vector structured by age (and other characteristics), and \(\mathbf{G}\) is an appropriately chosen growth matrix (Leslie matrix), closely linked with the life table while reflecting the relationship above, expressed in terms of rates rather than events (Caswell, 2019a; Leslie, 1945, 1948; Preston, Heuveline, & Guillot, 2000).

In the cohort-component approach, even though the mechanism of population change is known, the individual components still need forecasting. The three main drivers of population dynamics — fertility, mortality, and migration — differ in terms of their predictability (National Research Council, 2000): mortality, which is mainly a biological process moderated by medical technology, is the most predictable; migration, which is purely a social and behavioural process is the least; while the predictability of fertility — part-biological, part-behavioural – is in the middle (for component forecasting methods, see §3.6.3, §3.6.4, and §3.6.5). In practical applications, the components can be either projected deterministically, following judgment-based or expert assumptions (for example, Lutz, Butz, & Samir, 2017), or extrapolated by using probabilistic methods, either for the components or for past errors of prediction (Alho & Spencer, 1985, 2005; De Beer, 2008). An impetus to the use of stochastic methods has been given by the developments in the UN World Population Prospects (Azose, Ševčı́ková, & Raftery, 2016; Gerland et al., 2014). Parallel, theoretical advancements included a stochastic version of the stable population theory (Keiding & Hoem, 1976), as well as coupling of demographic uncertainty with economic models (Alho, Hougaard Jensen, & Lassila, 2008).

Since its original formulation, the cohort-component model has been subject to several extensions (see, for example, Stillwell & Clarke, 2011). The multiregional model (Rogers, 1975) describes the dynamics of multiple regional populations at the same time, with regions linked through migration. The multistate model (Schoen, 1987) generalises the multiregional analysis to any arbitrary set of states (such as educational, marital, health, or employment statuses, and so on; see also state-space models in §2.3.6). The multiregional model can be in turn generalised to include multiple geographic levels of analysis in a coherent way (Kupiszewski & Kupiszewska, 2011). Recent developments include multifocal analysis, with an algebraic description of kinship networks (Caswell, 2019b, 2020). For all these extensions, however, data requirements are very high: such models require detailed information on transitions between regions or states in a range of different breakdowns. For pragmatic reasons, microsimulation-based methods offer an appealing alternative, typically including large-sample Monte Carlo simulations of population trajectories based on available transition rates (Bélanger & Sabourin, 2017; Zaidi, Harding, & Williamson, 2009).

Aside of a few extensions listed above, the current methodological developments in the forecasting of human populations are mainly concentrated on the approaches for predicting individual demographic components (see §3.6.3, §3.6.4, and §3.6.5), rather than the description of the population renewal mechanism. Still, the continuing developments in population ecology, for example on the algebraic description of transient and asymptotic population growth (Nicol-Harper et al., 2018), bear substantial promise of further advancements in this area, which can be additionally helped by strengthened collaboration between modellers and forecasters working across the disciplinary boundaries on the formal descriptions of the dynamics of human, as well as other populations.

2.3.8 Forecasting count time series16

Probabilistic forecasts based on predictive mass functions are the most natural way of framing predictions of a variable that enumerates the occurrences of an event over time; i.e. the most natural way of predicting a time series of counts. Such forecasts are both coherent, in the sense of being consistent with the discrete support of the variable, and capture all distributional – including tail – information. In contrast, point forecasts based on summary measures of central location (e.g., a (conditional) mean, median or mode), convey no such distributional information, and potentially also lack coherence as, for example, when the mean forecast of the integer-valued count variable assumes non-integer values. These comments are even more pertinent for low count time series, in which the number of rare events is recorded, and for which the cardinality of the support is small. In this case, point forecasts of any sort can be misleading, and continuous (e.g., Gaussian) approximations (sometimes adopted for high count time series) are particularly inappropriate.

These points were first elucidated in Freeland & McCabe (2004), and their subsequent acceptance in the literature is evidenced by the numerous count data types for which discrete predictive distributions are now produced; including counts of: insurance claims (McCabe & Martin, 2005), medical injury deaths (Bu & McCabe, 2008), website visits (Bisaglia & Canale, 2016), disease cases (Bisaglia & Gerolimetto, 2019; Mukhopadhyay & Sathish, 2019; Rao & McCabe, 2016), banking crises (Dungey, Martin, Tang, & Tremayne, 2020), company liquidations (Homburg, Weiß, Alwan, Frahm, & Göb, 2020), hospital emergency admissions (Sun, Sun, Zhang, & McCabe, 2021), work stoppages (Weiß, Homburg, Alwan, Frahm, & Göb, 2021), and the intermittent product demand described in §2.8 (Berry & West, 2020; Kolassa, 2016; Snyder, Ord, & Beaumont, 2012).

The nature of the predictive model for the count variable, together with the paradigm adopted (Bayesian or frequentist), determine the form of the probabilistic forecast, including the way in which it does, or does not, accommodate parameter and model uncertainty. As highlighted in §2.4.1 and §2.4.2, the Bayesian approach to forecasting is automatically probabilistic, no matter what the data type. It also factors parameter uncertainty into the predictive distribution, plus model uncertainty if Bayesian model averaging is adopted, producing a distribution whose location, shape and degree of dispersion reflect all such uncertainty as a consequence. See McCabe & Martin (2005), Neal & Kypraios (2015), Bisaglia & Canale (2016), Frazier, Maneesoonthorn, Martin, & McCabe (2019), Berry & West (2020) and Lu (2021), for examples of Bayesian probabilistic forecasts of counts.

In contrast, frequentist probabilistic forecasts of counts typically adopt a ‘plug-in’ approach, with the predictive distribution conditioned on estimates of the unknown parameters of a given count model. Sampling variation in the estimated predictive (if acknowledged) is quantified in a variety of ways. Freeland & McCabe (2004), for instance, produce confidence intervals for the true (point-wise) predictive probabilities, exploiting the asymptotic distribution of the (MLE-based) estimates of those probabilities. Bu & McCabe (2008) extend this idea to (correlated) estimates of sequential probabilities, whilst Jung & Tremayne (2006) and Weiß et al. (2021) exploit bootstrap techniques to capture point-wise sampling variation in the forecast distribution. McCabe, Martin, & Harris (2011), on the other hand, use subsampling methods to capture sampling fluctuations in the full predictive distribution, retaining the non-negativity and summation to unity properties of the probabilities (see also Harris, Martin, Perera, & Poskitt, 2019 for related, albeit non-count data work). Model uncertainty is catered for in a variety of ways: via nonparametric (McCabe et al., 2011) or bootstrapping (Bisaglia & Gerolimetto, 2019) methods; via (frequentist) model averaging (Sun et al., 2021); or via an informal comparison of predictive results across alternative models (Jung & Tremayne, 2006). Methods designed explicitly for calibrating predictive mass functions to observed count data – whether those functions be produced using frequentist or Bayesian methods – can be found in Czado, Gneiting, & Held (2009) and Wei & Held (2014); see also §2.12.4 and §2.12.5.

Finally, whilst full probabilistic forecasts are increasingly common, point, interval and quantile forecasts are certainly still used. The need for such summaries to be coherent with the discrete nature of the count variable appears to be now well-accepted, with recent work emphasising the importance of this property (for example, Bu & McCabe, 2008; Homburg, Weiß, Alwan, Frahm, & Göb, 2019; Homburg et al., 2020; Mukhopadhyay & Sathish, 2019).

2.3.9 Forecasting with many variables17

Multivariate models – regression models with multiple explanatory variables – are often based on available theories regarding the determination of the variable to be forecast, and are often referred to as structural models. In a stationary world without structural change, then it would be anticipated that the best structural model would provide the best forecasts, since it would provide the conditional mean of the data process (see, for example, Clements & Hendry, 1998). In a non-stationary world of unit roots and structural breaks, however, this need not be the case. In such situations, often simple forecast models can outperform structural models, especially at short forecast horizons (see, for example, D. F. Hendry & Clements, 2001). Multivariate forecast models require that explanatory variables also be forecast – or at least, scenarios be set out for them. These may be simplistic scenarios, for example all explanatory variables take their mean values. Such scenarios can play a useful role in formulating policy making since they illustrate in some sense the outcomes of different policy choices.

Since the 1980s and Sims (1980), vector autoregressive (VAR) models have become ubiquitous in macroeconomics, and common in finance (see, for example, Hasbrouck, 1995). A VAR model is a set of linear regression equations (see also §2.3.2) describing the evolution of a set of endogenous variables. Each equation casts each variable as a function of lagged values of all the variables in the system. Contemporaneous values of system variables are not included in VAR models for identification purposes; some set of identifying restrictions are required, usually based on economic theory, and when imposed the resulting model is known as a structural VAR model. VAR models introduce significantly greater levels of parameterisation of relationships, which increases the level of estimation uncertainty. At the same time VAR models afford the forecaster a straightforward way to generate forecasts of a range of variables, a problem when forecasting with many variables. As with autoregressive methods, VAR models can capture a significant amount of variation in data series that are autocorrelated, and hence VAR methods can be useful as baseline forecasting devices. VAR-based forecasts are often used as a benchmark for complex models in macroeconomics like DSGE models (see, for example, Del Negro & Schorfheide, 2006). The curse of dimensionality in VAR models is particularly important and has led to developments in factor-augmented VAR models, with practitioners often reducing down hundreds of variables into factors using principal component analysis (see, for example, Bernanke, Boivin, & Eliasz, 2005). Bayesian estimation is often combined with factor-augmented VAR models.

Often, significant numbers of outliers and structural breaks require many indicator variables to be used to model series (see also §2.2.3 and §2.2.4). Indicator saturation is a method of detecting outliers and structural breaks by saturating a model with different types of indicator, or deterministic variables (J. L. Castle et al., 2015a; Johansen & Nielsen, 2009). The flexibility of the approach is such that it has been applied in a wide variety of contexts, from volcanic eruptions (Pretis, Schneider, & Smerdon, 2016) to prediction markets and social media trends (Vaughan Williams & Reade, 2016).

A particularly important and ever-expanding area of empirical analysis involves the use of panel data sets with long time dimensions: panel time series (Eberhardt, 2012). The many variables are then extended across many cross sectional units, and a central concern is the dependence between these units, be they countries, firms, or individuals. At the country level one approach to modelling this dependence has been the Global VAR approach of, for example, Dees, Mauro, Pesaran, & Smith (2007). In more general panels, the mean groups estimator has been proposed to account for cross-section dependence (Pesaran, Shin, & Smith, 1999).

Outliers, structural breaks, and split trends undoubtedly also exist in panel time series. The potential to test for common outliers and structural changes across cross sectional units would be useful, as would the ability to allow individual units to vary individually, e.g., time-varying fixed effects. Nymoen & Sparrman (2015) is the first application of indicator saturation methods in a panel context, looking at equilibrium unemployment dynamics in a panel of OECD countries, but applications into the panel context are somewhat constrained by computer software packages designed for indicator saturation (§3.3.3 discusses further the case of forecasting unemployment). The gets R package of Pretis, Reade, & Sucarrat (2017; Pretis et al., 2018) can be used with panel data.

2.3.10 Functional time series models18

Functional time series consist of random functions observed at regular time intervals. Functional time series can be classified into two categories depending on if the continuum is also a time variable. On the one hand, functional time series can arise from measurements obtained by separating an almost continuous time record into consecutive intervals (e.g., days or years, see Horváth & Kokoszka, 2012). We refer to such data structure as sliced functional time series, examples of which include daily precipitation data (Gromenko, Kokoszka, & Reimherr, 2017). On the other hand, when the continuum is not a time variable, functional time series can also arise when observations over a period are considered as finite-dimensional realisations of an underlying continuous function (e.g., yearly age-specific mortality rates, see D. Li et al., 2020a).

Thanks to recent advances in computing storage, functional time series in the form of curves, images or shapes is common. As a result, functional time series analysis has received increasing attention. For instance, Bosq (2000) and Bosq & Blanke (2007) proposed the functional autoregressive of order 1 (FAR(1)) and derived one-step-ahead forecasts that are based on a regularised Yule-Walker equations. FAR(1) was later extended to FAR(\(p\)), under which the order \(p\) can be determined via Kokoszka & Reimherr (2013)’s hypothesis testing. Horváth, Liu, Rice, & Wang (2020) compared the forecasting performance between FAR(1), FAR(\(p\)), and functional seasonal autoregressive models of Ying Chen et al. (2019).

To overcome the curse of dimensionality (see also §2.2.5, §2.5.2 and §2.5.3), a dimension reduction technique, such as functional principal component analysis (FPCA), is often used. Aue, Norinho, & Hörmann (2015) showed asymptotic equivalence between a FAR and a VAR model (for a discussion of VAR models, see §2.3.9). Via an FPCA, Aue et al. (2015) proposed a forecasting method based on the VAR forecasts of principal component scores. This approach can be viewed as an extension of Hyndman & Shang (2009), in which principal component scores are forecast via a univariate time series forecasting method. With the purpose of forecasting, Kargin & Onatski (2008) proposed to estimate the FAR(1) model by using the method of predictive factors. Johannes Klepsch & Klüppelberg (2017) proposed a functional moving average process and introduced an innovations algorithm to obtain the best linear predictor. J. Klepsch et al. (2017) extended the VAR model to the vector autoregressive moving average model and proposed the functional autoregressive moving average model. The functional autoregressive moving average model can be seen as an extension of autoregressive integrated moving average model in the univariate time series literature (see §2.3.4).

Extending short-memory to long-memory functional time series analysis, Li, Robinson, & Shang (2021; Li et al., 2020a) considered local Whittle and rescale-range estimators in a functional autoregressive fractionally integrated moving average model. The models mentioned above require stationarity, which is often rejected. Horváth, Kokoszka, & Rice (2014) proposed a functional KPSS test for stationarity. Chang, Kim, & Park (2016) studied nonstationarity of the time series of state densities, while Beare, Seo, & Seo (2017) considered a cointegrated linear process in Hilbert space. Nielsen, Seo, & Seong (2019) proposed a variance ratio-type test to determine the dimension of the nonstationary subspace in a functional time series. D. Li et al. (2020b) studied the estimation of the long-memory parameter in a functional fractionally integrated time series, covering the functional unit root.

From a nonparametric perspective, Besse, Cardot, & Stephenson (2000) proposed a functional kernel regression method to model temporal dependence via a similarity measure characterised by semi-metric, bandwidth and kernel function. Aneiros-Pérez & Vieu (2008) introduced a semi-functional partial linear model that combines linear and nonlinear covariates. Apart from conditional mean estimation, Hörmann, Horváth, & Reeder (2013) considered a functional autoregressive conditional heteroscedasticity model for estimating conditional variance. Rice, Wirjanto, & Zhao (2020) proposed a conditional heteroscedasticity test for functional data. Kokoszka, Rice, & Shang (2017) proposed a portmanteau test for testing autocorrelation under a functional generalised autoregressive conditional heteroscedasticity model.

2.3.11 ARCH/GARCH models19

Volatility has been recognised as a primary measure of risks and uncertainties (Gneiting, 2011a; Markowitz, 1952; Sharpe, 1964; Taylor, McSharry, & Buizza, 2009); for further discussion on uncertainty estimation, see §2.3.21. Estimating future volatility for measuring the uncertainty of forecasts is imperative for probabilistic forecasting. Yet, the right period in which to estimate future volatility has been controversial as volatility based on too long a period will make irrelevant the forecast horizon of our interests, whereas too short a period results in too much noise (Engle, 2004). An alternative to this issue is the dynamic volatility estimated through the autoregressive conditional heteroscedasticity (ARCH) proposed by Engle (1982), and the generalised autoregressive conditional heteroscedasticity (GARCH) model proposed by Bollerslev (1987). The ARCH model uses the weighted average of the past squared forecast error whereas the GARCH model generalises the ARCH model by further adopting past squared conditional volatilities. The GARCH model is the combination of (i) a constant volatility, which estimates the long-run average, (ii) the volatility forecast(s) in the last steps, and (iii) the new information collected in the last steps. The weightings on these components are typically estimated with maximum likelihood. The models assume a residual distribution allowing for producing density forecasts. One of the benefits of the GARCH model is that it can model heteroscedasticity, the volatility clustering characteristics of time series (Mandelbrot, 1963), a phenomenon common to many time series where uncertainties are predominant. Volatility clustering comes about as new information tends to arrive time clustered and a certain time interval is required for the time series to be stabilised as the new information is initially recognised as a shock.