Bookkeeping (Second Part)

Bookkeeping (Second Part)

Uploaded by

Thuzar LwinCopyright:

Available Formats

Bookkeeping (Second Part)

Bookkeeping (Second Part)

Uploaded by

Thuzar LwinOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Bookkeeping (Second Part)

Bookkeeping (Second Part)

Uploaded by

Thuzar LwinCopyright:

Available Formats

1 Accruals and prepayments expenses

Exercise 1 On 1 January Year 4, the following were 3 of the account balances in E Parkers ledger: Rent 230 Dr Insurance 65 Dr Advertising 110 Cr During the year ended 31 December Year 4, he paid the following amounts by cheque: 110 460 690 690 180 250

31 Jan 28 Feb 31 May 31 Aug 31 Aug 30 Sep

Advertising Rent Rent Rent Insurance Rent

Additional information: (1) The monthly rent was increased to 250 from 1 October Year 4. (2) An advertising bill amounting to 85 had not been paid by 31 December Year 4. (3) The insurance premium paid on 31 August Year 4 covered the year ended 31 August Year 5. Required Prepare accounts in the ledger of E Parker for the year ended 31 December Year 4, for: (i) rent (ii) insurance (iii) advertising. Give particular attention to dates, and show, in each account, the transfer to the Profit & Loss Account for the year ended 31 December Year 4.

Exercise 2 The following details are from the books of Melville & Co for the year ended 30 September Year 9: 279,300 118,650 20,470 17,320 83,540 2,530 9,860 11,940 3,970 1

Sales Purchases Stock at 1 Oct Yr 8 Stock at 30 Sep Yr 9 Wages and salaries Heating and lighting Rent and rates Motor-vehicle expenses Office expenses

In addition, at 30 September Year 9: wages and salaries owing amount to 620 rent payable accrued due, 250 rates prepaid amount to 180 heating and lighting accrued due, 60 office stationery is in stock amounting to 380.

Required Prepare for Melville & Co a Trading and Profit & Loss Account for the year ended 30 September Year 9.

Exercise 3 The following are details relating to N Tullochs Rent Payable Account: Year 5 30 Jun 8 Sep 27 Nov Year 6 9 Apr Balance on the account of 300, representing 2 months rent paid in advance Paid 450 by cheque, being rent for the 3 months ended 30 November Year 5 Paid 720 by cheque, being rent for the 4 months ended 31 March Year 6

Paid 360 by cheque, being rent for the 2 months ended 31 May Year 6

Required Prepare for N Tulloch the Rent Payable Account for the year ended 30 JuneYear 6. Balance the account at the year end and show the transfer to the Profit & Loss Account.

Exercise 4 Tan Lian, a sole trader, had the following account balances on 1 January Year 5: Insurance 70 Dr Office expenses 160 Dr Rent payable 240 Cr During Year 5, the following payments were made by cheque: Year 5 26 Jan 9 Feb 25 Feb 12 Apr 8 Jun 25 Aug 6 Nov 11 Dec

Office expenses: purchase of stationery, 63 Rent for 4 months ended 31 March Year 5, 960 Insurance for 6 months ended 31 August Year 5, 210 Office expenses, 92 Rent for 4 months ended 31 July Year 5, 1,040 Insurance for 6 months ended 28 February Year 6, 240 Rent for 4 months ended 30 November Year 5, 1,040 Office expenses, 280 2

At 31 December Year 5, there was a stock of stationery valued at a cost of 90.There was no further increase in the monthly charge for rent in December Year 5. Required Open the 3 accounts listed above and enter the transactions that occurred in Year 5. Balance the accounts and make the appropriate transfers to the Profit & Loss Account for the year ended 31 December Year 5.

2 Accruals and prepayments income

Exercise 1 M Paine, a sole trader, is about to prepare his final accounts. As book-keeper, you need to adjust the figures shown in certain accounts. M Paines financial year ends on 31 December Year 5. At that date, certain accounts carry the following balances: Rates 1,960 (Dr) Telephone 215 (Dr) Insurance 760 (Dr) Rent receivable 3,840 (Cr) Wages 45,630 (Dr) You ascertain the following information relating to the accounts above. (1) Rates included in the Rates Account is a payment of 900 for the half-year to 31 March Year 6. (2) Telephone the amount accrued due, not yet paid to 31 December Year 5, is 47. (3) Insurance a premium of 720 paid for the year to 31 January Year 6 is included in the Insurance Account. (4) Rent receivable the tenant owes 160 for rent outstanding at 31 December Year 5. (5) Wages the amount accrued due at 31 December Year 5 was 840. Required (a) Open these accounts, enter the balances given, deal with the accrual or prepayment as necessary, and show the transfers to the Profit & Loss Account. (b) Show how any remaining balances on the above accounts would appear in the balance sheet of M Paine at 31 December Year 5.

Exercise 2 L Reinholdt is a theatrical agent whose accounting year ends on 31 December. He provides 3

the following details for the year ended 31 December Year 10: (1) On 1 January, 3 months rent had been paid in advance 1,200. On 1 April, he paid 6 months rent in advance 2,400. On 1 October, he paid rent for the 6 months ending 31 March Year 11 2,700. (2) On 1 January, commission due to Reinholdt, and not yet received, amounted to 3,200. JanuaryDecember: commission received 64,300. At 31 December, commission due and not yet received in respect of Year 10 amounted to 4,700. (3) On 1 January, the estimated amount outstanding on the Telephone Account was 320. On 31 March, he paid the telephone bill in respect of the previous 6 months, 510. On 30 September, he paid the telephone bill in respect of the previous 6 months, 520. On 31 December, the estimated amount outstanding on the Telephone Account was 300. Required (a) Prepare the following accounts for Reinholdt for the year ended 31 December Year 10: (i) Rent Account (ii) Commission Receivable Account (iii) Telephone Account. (b) Prepare a balance sheet extract for Reinholdt at 31 December Year 10, showing how the 3 balances would appear.

Exercise 3 At 1 January Year 8, L Johnston, a trader, owed 320 for rent, but her rates were prepaid by 110. During Year 8, she made the following payments by cheque: Rent 2 Apr 28 Sep Rates 7 Apr 5 Oct 600 630

160 180

At 31 December Year 8 there was accrued rent of 350 and rates were prepaid by 120. Required Prepare L Johnstons combined Rent & Rates Account for Year 8, showing the transfer to the Profit & Loss Account and the account fully balanced.

Exercise 4 The following information relates to some of the expense and income accounts of 4

Jan Goldsmith for the year ended 31 December Year 5: Insurance Paid by cheque Prepaid Prepaid 23 Feb Yr 5 31 Dec Yr 4 31 Dec Yr 5 630 85 95

Stationery Paid by cheque 19 Mar Yr 5 Stock 31 Dec Yr 4 Stock 31 Dec Yr 5 Owing to stationery suppliers 31 Dec Yr 5 Telephone Paid by cheque Paid by cheque Owing Owing Rent payable Paid by cheque Paid by cheque Owing Prepaid Rent receivable Received by cheque Received by cheque Owing Owing Required

765 130 160 45

11 Jun Yr 5 4 Dec Yr 5 31 Dec Yr 4 31 Dec Yr 5

295 285 64 56

16 Feb Yr 5 12 Aug Yr 5 31 Dec Yr 4 31 Dec Yr 5

2,160 2,510 360 740

31 Mar Yr 5 30 Sep Yr 5 31 Dec Yr 4 31 Dec Yr 5

450 375 75 150

(a) Prepare the 5 ledger accounts, incorporating the information given above, for the year ended 31 December Year 5. In each account, show the transfer to the Profit & Loss Account and bring down the balance(s) at 1 January Year 6. (b) Show how the balances on the accounts would be displayed in Jan Goldsmiths balance sheet at 31 December Year 5.

Exercise 5 In the books of Frank Napier, a sole trader, the following account balances were brought forward on 1 July Year 4: 260 (Cr) 40 (Dr) 260 (Cr) 350 (Dr) 5

Advertising Insurance Office cleaning Rent receivable

During the year ended 30 June Year 5, the following amounts were paid by cheque: Year 4 25 Jul 1 Aug 5 Sep 24 Oct Year 5 26 Jan 1 Feb 8 Mar 21 Apr 390 270 260 390

Office cleaning (3 months to 31 Jul Yr 4) Insurance premium (6 months to 31 Jan Yr 5) Advertising Office cleaning (3 months to 31 Oct Yr 4)

Office cleaning (3 months to 31 Jan Yr 5) Insurance premium (6 months to 31 Jul Yr 5) Advertising Office cleaning (3 months to 30 Apr Yr 5)

420 300 210 420

The following amounts were received by cheque during the year ended 30 June Year 5: Year 4 17 Aug 3 Oct 15 Dec Year 5 12 Jan 3 Mar 19 May Rent (1 May 31 Aug Yr 4) Rent (1 Sep 31 Oct Yr 4) Rent (1 Nov 31 Dec Yr 4) 700 350 380

Advertising (part refund) Rent (1 Jan 31 Mar Yr 5) Rent (1 Apr 31 Jul Yr 5)

40 570 760

Frank Napier was aware that, at the end of his financial year, 30 June Year 5, there was an outstanding advertising bill for 190 and 2 months payment outstanding on the office cleaning account, at 140 per month. Required (a) Open the following accounts: (i) Advertising (ii) Insurance (iii) Office Cleaning (iv) Rent Receivable. (b) Post the various items to the accounts. (c) Show the transfer entries to the Profit & Loss Account for the year ended 30 JuneYear 5. (d) Balance the accounts at 30 June Year 5. Note You are not required to show the Profit & Loss Account.

Exercise 6 The following information is from the books of Enterprise Services in respect of the year ended 30 June Year 9: 6

Rent Receivable Year 8 1 Jul 1 Oct Year 9 1 Apr 3 months rent prepaid 630 8 months rent received by cheque 6 months rent received by cheque at revised rate of 2,960 per annum Rates Year 8 1 Jul 1 Oct Year 9 1 Apr 3 months rates prepaid Paid 6 months rates by cheque Paid 6 months rates by cheque Advertising Year 8 1 Jul 28 Aug Year 9 15 May 1,260

1,480

780 1,680 1,680

Accrued due Paid by cheque Paid by cheque Printing and Stationery

370 1,250 2,100

Year 8 1 Jul 14 Sep Year 9 12 Feb At 30 June Year 9:

Stock of stationery Purchased stationery by cheque Paid printing account by cheque

3,400 850 420

(1) Payments for advertising during the year included 580 for poster advertising that was due to be carried out in August Year 9. (2) The stock of stationery was valued at 3,100. There was also an unpaid invoice for 615 for printing. Required (a) Prepare the following accounts for the year ended 30 June Year 9, including transfers to the Profit & Loss Account and year-end balances. (i) Rent Receivable (ii) Rates (iii) Advertising (iv) Printing and Stationery (b) Show, in the form of a balance sheet extract, how the balances on these accounts would appear at 30 June Year 9. 7

Question 1 From the following information prepare T Swintons office stationery account for the tow year ended 31 December Year 3 and 31 December Year 4 respectively. Year 3 Jan 1 Jan 1 Dec 31 Dec 31 Year 4 Jan 1 Dec 31 Dec 31

Balance of stationery in stock 615 Office stationery purchased by cheque during the year 2,020. Stock of office stationery valued at 490.

Office stationery purchased by cheque during the year 1, 960 Stock of office stationery valued at 580.

Question 2 From the following details prepare K Laports rent account for the year ended 31 December Year 5. Balance the account at the year-end, showing the transfer to profit and loss account. Year 5 Jan 1 Mar 25 Oct 2

balance on the account 240, representing one quarters rent paid in advance. Paid by cheque 480, rent for the half-year ended 30 September year 5. Paid by cheque 540, rent for the half-year ended 31 March year 6.

Question 3 From the following particulars prepare office cleaning account for the year ended 30 September Year 6. 30 September Year 5 -Invoice for 160 received from cleaning company for 2 months ended 30 September year 5and not yet entered in the books. -Accounts paid by cheque for office cleaning 990.

October Year 5September Year 6 30 September Year 6

-Invoice for 170 received from cleaning company for 2months ended 30 September Year 6and not yet entered in the books.

Question 4 P Jones, a sole trader, had the following account balances on 1 January Year 7: 8

Rent payable Cr 70 Insurance Dr 40 Telephone Cr 45 Rates Dr 210

During the year, the following payments were made by cheque: Year 7 Jun Feb Feb Mar May May Jun Aug Sep Nov Nov Dec 1 Rent payable (quarterly, in advance) 1 1 1 1 1 1 1 1 1 1 1 Insurance premium for year to 31 January Year 8 Telephone bill Rent payable (increased amount) Telephone bill rates for half year to 30 Sep year 7 rent payable Telephone bill Rent payable rates for the half year to 31 March Year 8 Telephone bill Rent payable 210 600 127 300 146 540 300 163 300 540 184 300

P Jones calculates that at the end of the financial year, 31 December Year 7, he owes 60 for telephone cells. Required Open the four accounts listed above, and post the necessary items to them. Balance the accounts and make the appropriate transfers to the profit and loss account for the year ended 31 December Year 7.

Question 5 On 1 January Year 6, the following were 3 of the account balances in K jordans ledger: Insurance Rent 130 Dr 320 Dr 9

Commission Receivable

170 Dr

During the year ended 31 December Year 6, K Jordans received and paid the following amounts by cheque. Receipts 26 8 26 12 3 9 5 4 Jan Feb Mar Apr July Aug Sept Nov commission Rent Insurance Rent Rent Commission Rent Rent 165 720 1,080 170 640 780 960 720 Payments

Additional Information: (1) -The insurance premium paid on 26 March Year 6 covered the period until 31 march year 7. The premium was treated as evenly spread over the year. (2) -The monthly rent was increased to 360 from 1 July Year 6. The payment on 4 November covered the period until 31 January Year 7. (3) Year 6. - 210 of commission which was due had not been received by 31 December

Required (a) Prepare Accounts in the Ledger of K Jordan for the year ended 31 December Year 6, for: (i) (ii) (iii) (iv) (b) Show how the balances on the above accounts would be displayed in K Jordans balance sheet at 31 December Year 6. Insurance Rent Commission Receivable

3 Depreciation of fixed assets

Exercise 1 10

Jack Millard commenced business on 1 January Year 3 and on that date purchased a motor vehicle for 10,400. On 31 December Year 3, he wished to determine the depreciation expense for the year just completed. He is unsure whether to use the: (a) straight line method the vehicle would have a 3-year life with an estimated resale value of 4,100; (b) reducing balance method using a rate of 40% on cost. Required To help Jack Millard decide between the 2 methods, draw up and complete the following table: Depreciation charge in Profit & Loss Account for the year ended 31 Dec Year 3 Method (a) (b)

Net book value at 31 Dec Year 3

Exercise 2 Charles Day started a business on 1 January Year 4. On that date, he purchased by cheque a motor van costing 9,600 from Greenaway Motors Ltd. He decided to depreciate this asset, using the rate of 40% per annum on the reducing balance method. He also Purchased, on the same day, on credit, fixtures and fittings costing 15,000 from P J Shop Fitters Ltd. He decided to depreciate these fixtures and fittings using the straight line method. He estimated that they would have a useful life of 15 years, and would have a scrap value of 2,100. He kept the asset accounts at cost, and used a provision for depreciation account for each asset. Required Prepare for Charles Day the following accounts for each of Years 4, 5, 6, and 7: (i) Motor Van (ii) Provision for Depreciation of Motor Van (showing calculations to the nearest ) (iii) Fixtures and Fittings (iv) Provision for Depreciation of Fixtures and Fittings.

Exercise 3 Required With reference to T/15.2, prepare an extract to show how both assets would appear in Charles Days balance sheet at 31 December Year 7. 11

Exercise 4 On 8 February Year 5, Southern Stores bought a computer for use in the office, paying 8,600 by cheque. It was decided to provide for depreciation by use of the straight line method. It was estimated that, at the end of 5 years, the residual (scrap) value would be 600. On 12 September Year 5, Southern Stores purchased a motor vehicle for use in the business, paying 10,000 by cheque. The vehicle was to be depreciated at the rate of 40% per annum, using the reducing balance method. The business retained the asset accounts at cost and dealt with depreciation using a separate Provision for Depreciation Account for each asset.The financial year ends on 31 December. Any asset purchased in the first 6 months of a year has a whole years depreciation provided, while any asset purchased in the second half of the year has only half a years depreciation written off. Required (a) Prepare the following accounts for the years ended 31 December Years 5, 6, and 7: (i) Computer Equipment (ii) Provision for Depreciation of Computer Equipment (iii) Motor Vehicle (iv) Provision for Depreciation of Motor Vehicle. (b) Show a balance sheet extract at 31 December Year 7 for both the Computer Equipment and Motor Vehicle Accounts.

Exercise 5 D Amos purchased fixtures and fittings for 6,000 by cheque on 1 January Year 3. On 1 July of the same year, he purchased by cheque a motor vehicle for 18,000. He decided to depreciate his fixed assets as follows: (1) Fixtures and fittings using the straight line method. He estimated that they would have a working life of 8 years, with a residual (scrap) value of 1,000. (2) Motor vehicle using the reducing balance method. He set the rate at 40% on reducing balance each full year. He kept the asset accounts at cost and kept accumulated depreciation of each type of asset in a separate Provision for Depreciation Account. Assets acquired during the year were depreciated from the date of purchase. Required In the books of D Amos, prepare the following accounts for the 3 financial years ended 31 December Year 3,Year 4, and Year 5, balancing the accounts at the end of each year: 12

(i) Fixtures and Fittings (ii) Provision for Depreciation of Fixtures and Fittings (iii) Motor Vehicle (iv) Provision for Depreciation of Motor Vehicle.

Exercise 6 On 1 January Year 4, Frank Saunders purchased furniture and equipment by cheque for 11,000. He decided to provide for depreciation on this asset using the straight line method over 8 years. He estimated that the scrap value at the end of that time would be 600. On 14 February Year 4, he purchased a motor van by cheque for 8,400, for use in the business. He decided to provide for depreciation on this asset at the rate of 40% per annum, using the reducing balance method. He allowed a full years depreciation in the year of purchase and calculated the depreciation to the nearest . On 31 December Year 6, he sold the motor van for 3,200 and was paid by cheque. His practice is to record and leave the asset accounts at cost and to accumulate the depreciation in a Provision for Depreciation Account for each asset. His financial year ends on 31 December. Required In the books of Frank Saunders, open the following accounts and enter the transactions for the years ended 31 December Years 4, 5, and 6: (i) Furniture and Equipment (ii) Provision for Depreciation of Furniture and Equipment (iii) Motor Van (iv) Provision for Depreciation of Motor Van (v) Disposal of Motor Van.

Question: 1 A motor vehicle is bought for 12,800. It is planned to be used for 5 years and then sold for 400. Calculate the depreciation for each year using (a) The straight ling method; and (b) The reducing balance method; applying a depreciation rate of 50%

Question: 2 A machine costing 20,000 was purchased by R Silvester by cheque on 1 July Year 3. He decided to depreciate it at the rate of 40 % per annum using the reducing balance method. a) Show the 13

i) ii)

Machine account Provision for depreciation of machine account for the three years ending 30 June Years 4, 5 and 6.

b) Show how the asset would appear in the balance sheet of R Silvester on 30 June Year 6.

Question: 3 On 1 January year 6, Tanya Green bought a motor vehicle for 6,500 by cheque. She decided to depreciate the motor vehicle by 25 % per annum using the straight line method of depreciation. She sold the motor vehicle on 31 December Year 8 for 1,750 received in ash. Show the (a) Motor vehicle account (b) Provision for depreciation of motor vehicle account, and (c) Disposal account for financial years ending 31 December year 6, 7 and 8.

4 Bad debts and provision for doubtful debts

Exercise 1 F Openshaw submitted the following information at 31 March for Years 4, 5, and 6: Total debtors before writing off bad debts 18,640

Date 31 Mar Yr 4

Bad debts to be written off F Dale T Wylie 117 163

31 Mar Yr 5 31 Mar Yr 6

20,835

G Block

315

17,694

A Dolt E Fox

78 216

Openshaw provides for doubtful debts at the rate of 21/2% of the remaining debtors at the end of each financial year. At 31 March Year 3, the provision for doubtful debts was 380. Required 14

(a) In the books of F Openshaw, prepare the following accounts for the years ended 31 March Years 4, 5, and 6, including the transfers to the Profit & Loss Account at the end of each financial year: (i) Bad Debts (ii) Provision for Doubtful Debts. (b) Show extracts from the balance sheets of F Openshaw at 31 March Years 4, 5, and 6, placing debtors under current assets.

Exercise 2 (a) It is the practice of Coniston & Son to write off bad debts as they occur and to provide for doubtful debts. For the 3 years from the commencement of business to 31 December Year 3, the following information is available: At year ended 31 December: Year 1 Balance of debtors before writing off bad debts Bad debts to be written off Provision for doubtful debts, as a percentage of debtors 47,800 800 Year 2 76,300 1,100 Year 3 91,400 1,500

3%

4%

2%

Required (i) Prepare the following accounts for Years 1, 2, and 3, showing the transfers to the Profit & Loss Account at the end of each year: Bad Debts Provision for Doubtful Debts. (ii) Show the balance sheet extract in respect of debtors at 31 December each year. (b) On 7 June Year 4, Coniston & Son received a payment of 129 from S Atkins for an outstanding debt of 320. Coniston wrote off the balance as a bad debt. Required Show the account of S Atkins in Conistons ledger.

Exercise 3 At 31 December Year 8, AB & Co has debtors totalling 42,560. Debts amounting to 760 have yet to be written off as bad. A specific provision is to be created covering in full the following debts: D 620 E 570 F 710 15

A general doubtful debts provision of 4% of remaining debts is also to be created. No provision exists as yet. Required (a) Show in a statement: (i) how the 2 provisions are calculated (ii) the amount of net debtors. (b) Show as an extract how the item debtorswould appear in the balance sheet of AB & Co at 31 December Year 8.

Exercise 4 Donald Lisher, a sole trader, maintains a provision for doubtful debts that he adjusts at the end of each financial year. At 1 January Year 8, the balance on the account was 860. The following additional information is available: Bad debts written off during year 1,235 1,640 1,320

Year ended 31 Dec Yr 8 31 Dec Yr 9 31 Dec Yr 10

Debtor year-end balances 25,300 29,600 28,800

Provision for doubtful debts % 4 6 5

On 12 October Year 10, Donald Lisher received a cheque for 240 in respect of a debt which had been written off in Year 9. Required (a) From the above information, prepare for the years ended 31 December Years 8, 9, and 10: (i) the Bad Debts Account, including the closing entries; (ii) the Provision for Doubtful Debts Account, showing the balance carried forward each year. (b) Show, in a brief statement, the entries which would be made in the books of Donald Lisher to record the recovery of 240 for the debt written off in Year 9. Note Bad debts written off should not be taken to the Provision for Doubtful Debts Account.

Exercise 5 The accounting year of R Cleaver, a trader, ends on 31 December.At 31 December Year 3, his trade debtors amounted to 37,500 and he had a provision for doubtful debts amounting to 2% of debtors. 16

During Year 4, Cleaver wrote off debts as follows: (1) The whole of the debt of 460, due from L Paul, was written off as irrecoverable on 15 August Year 4. (2) Another debtor,K Sang, who owed 220, paid a contribution of 25%; the balance was immediately written off as irrecoverable on 26 November Year 4. At 31 December Year 4, debtors amounted to 41,000 and the provision for doubtful debts was adjusted to 2.5% of this figure. In Year 5, bad debts written off amounted to 560. In addition, on 20 October, K Sang paid the balance of his debt, which had been written off in Year 4. It was the practice of Cleaver to keep a Bad Debts Recovered Account for recording debts recovered in a year following the one in which they were written off. At 31 December Year 5, debtors amounted to 39,000 and the Provision for Doubtful Debts was adjusted to 2% of this figure. Required Prepare the following accounts to include the above information relating to the years ended 31 DecemberYear 4 and 31 December Year 5: (i) L Paul (ii) K Sang (iii) Bad Debts (iv) Provision for Doubtful Debts (v) Bad Debts Recovered.

Question: 1 On 30 June Year 4, the end of his financial year, T Smithers found that his debtors mounted to 26,760. Included in this figure were debts amounting to 460 which Smithers regarded as irrecoverable and which he now decided to write off. He also decided to create a rovision for doubtful debts at 4% of total debtors. Prepare: (a) The bad debts account; and (b) The provision for doubtful debts account in both cases balanced at the end of the financial year.

Question: 2 At 31 March 2002 William johns trade debtors amounted to 60,000. Included in this amount were irrecoverable debts of 5,000, which William decided to write off following this write off, William adjusted his Provision for doubtful Debts to 2% of debtors.

17

At 31 March 2003, Williams debtors had increased in total to 80,000 and included in this amount were irrecoverable debts of 10,000, which William decided to write off as bad debts. The Provision for Doubtful debts was than adjusted to 4% of debtors. At 31 March 2004, Williams debtors had increased further in total to 90,000 and this was after writing off bad debts of 250. The Provision for doubtful debts was reduced to 3% of debtors. Required: Prepare the following accounts for each of the years ended 31 March 2002, 2003 and 2004: (i) Bad Debts (ii) Provision for Doubtful Debts The balance on the provision for doubtful Debts account at 1 April 2001 was 800.

Question: 3 B Tanner owns a wholesaling business. He adjusts the provision for doubtful debts at the end of each financial year. Irrecoverable debts are written off debtors accounts as they become known. The following information is available: B debts Net total Percentage rate For the Written off debtors of provision Year ended during year at year end for doubtful debts 31 March year 5 1,120 19,700 6% 31 March year 6 2,370 26,500 5% 31 march year 7 1,680 24,300 4% Required: From the above information, prepare: (a) The bad debts account including the closing entries for the years ended 31 march year 5, 6 and 7. (b) The provision for doubtful debts account for the same years showing the provision carried forward each year. The balance on the account at 1 April Year 4 was 910. (c) An extract from each years balance sheet, showing the entry for debtors.

Question: 4 Ruper Tancred, whose financial year end is 31 March, summarized the following information in respect of the last three trading years: Year 13 year 14 year 15 18

Customer balances at 31 March Bad debts: written off during the year To be written off at 31 march

122,000

138,000

14,000

962 240

1,739 1,010

1,248 850

Doubtful debts: Specific provision required at 31 March1, 260 General Provision at 31 march to be adjusted to: 2%

1,090 2%

350 2.5%

At 1 April year 12, the provision for doubtful debts brought forward was 1, 970. Required: (a) Prepare ledger accounts for each of the three years for: (i) had debts: and (ii) provision for doubtful debts. (b) Show how debtors would appear in the balance sheet at 31 March year 15.

5 Bank reconciliation statements

Exercise 1 The following information is available in respect of A Wolfson, a trader: CASH BOOK (bank only) Year 5 2,806 4 Sep Purchases (915) 1,020 9 Sep Wages (916) 857 16 Sep N Victor (917) 1,370 24 Sep Rent (918) 524 26 Sep Wages (919) 413 27 Sep N Hills (920) 1,245 29 Sep S Twitchin (921) 30 Sep Purchases (922) 540 30 Sep Balance ? Bank statement Paid out Balance Cash: 915 234 Credit Cash: 916 635 Credit Credit transfer P Mott

Year 5 1 Sep Balance b/f 5 Sep Sales 10 Sep T Swithin 15 Sep Sales 23 Sep K Smart 25 Sep T Hunt 28 Sep Sales

234 635 526 370 680 416 285

Year 5 1 Sep 7 Sep 9 Sep 12 Sep 15 Sep 17 Sep

Paid in

1,020 857 271

Balance 2,806 Cr 2,572 Cr 3,592 Cr 2,957 Cr 3,814 Cr 4,085 Cr 19

19 Sep 21 Sep 23 Sep 26 Sep 28 Sep 30 Sep Required

Credit Standing order Minster 96 Publications Credit transfer T Lennox 870 Direct debit Insurance 230 Cash: 919 680 Bank interest

1,370

5,455 Cr 5,359 Cr 4,489 Cr 4,259 Cr 3,579 Cr 3,587 Cr

(a) Calculate the missing balance in the Cash Book and enter it in your answer book as the balance brought down at 30 September Year 5. (b) Bring the Cash Book up to date by entering in it the items you consider appropriate from the bank statement. Balance the Cash Book and bring down the new balance at 1 October Year 5. (c) Prepare the bank reconciliation statement at 30 September Year 5.

Exercise 2 The following is a copy of F Holmes Cash Book for April Year 5: CASH BOOK Bank 3,240 1,250 2,610 1,925 1,368 1,701 450 1,116 Cheque no Year 5 3 Apr Purchases 6 Apr Rates 9 Apr Electricity 12 Apr Purchases 15 Apr Telephone 18 Apr Stationery 20 Apr Travelling 25 Apr Salary 27 Apr G Stewart 29 Apr D Usher 29 Apr Fixtures 30 Apr Balance c/d 10648 10649 10650 10651 10652 10653 10654 10655 10656 10657 10658 Bank 1,060 650 196 1,400 245 98 72 1,057 746 2,360 2,200 3,576 13,660

Year 5 1 Apr Balance b/d 4 Apr Sales 10 Apr Sales 16 Apr Sales 24 Apr Sales 28 Apr Sales 30 Apr F Tait 30 Apr Sales

13,660 1 May Balance b/d 3,576 He received the following bank statement for April Year 5: Bank statement Paid out 1,060 260 1,250

Date Year 5 1 Apr 3 Apr 4 Apr 5 Apr

Details Balance Cash:10648 Standing order Insurance Co Credit

Paid in

Balance 3,240 Cr 2,180 Cr 1,920 Cr 3,170 Cr 20

9 Apr 11 Apr 12 Apr 13 Apr 16 Apr 17 Apr 19 Apr 22 Apr 23 Apr 25 Apr 27 Apr 29 Apr 30 Apr 30 Apr Required

10649 Credit 10651 10650 Direct debit Water Credit 10652 Credit transfer John Bates 10654 Credit Dividends 10655 Credit Charges

650 2,610 1,400 196 50 1,925 245 360 72 1,368 400 1,057 1,701 60

2,520 Cr 5,130 Cr 3,730 Cr 3,534 Cr 3,484 Cr 5,409 Cr 5,164 Cr 5,524 Cr 5,452 Cr 6,820 Cr 7,220 Cr 6,163 Cr 7,864 Cr 7,804 Cr

(a) Starting with the balance of 3,576, bring F Holmes Cash Book up to date by posting to it the items you consider appropriate from the bank statement. Balance the Cash Book and bring down the new balance on 1 May Year 5. (b) Prepare a bank reconciliation statement at 30 April Year 5, commencing with the bank statement balance of 7,804.

Exercise 3 The following information relates to the business of M Rhodes: Bank statement at 30 June Year 5 Debits Credits

Date 1 Jun 5 Jun 5 Jun 8 Jun 11 Jun 13 Jun 15 Jun 15 Jun 19 Jun 24 Jun 26 Jun 29 Jun 30 Jun

Details

Balance 10659 230 10658 176 Counter credits Standing order Ajax Insurance 242 10660 459 Counter credits 10661 150 Standing order L White Direct debit Town Council 517 10663 324 10665 138 Charges 74

813

Balance 4,619 4,389 4,213 5,026 4,784 4,325 5,446 5,296 5,758 5,241 4,917 4,779 4,705

Cr Cr Cr Cr Cr Cr Cr Cr Cr Cr Cr Cr Cr

1,121 462

1 Jun 1 Jun

10658 10659

Cheque book counterfoils A Parry 176 C Harris 230 21

7 Jun 11 Jun 22 Jun 23 Jun 23 Jun 25 Jun 29 Jun

10660 10661 10662 10663 10664 10665 10666

L Goddard A Parry D Fletcher Lines Ltd Star & Co A Parry C Thorpe

459 150 376 324 289 138 247

8 Jun S Moon G Race 15 Jun Rayne & Co C Mills T Orchard

Paying-in book counterfoils 611 202 813 129 325 667 1,121

Note Cheques are paid into the bank on the day they are received. Required (a) Write up the bank account in the books of M Rhodes starting with a debit balance of 4,619 on 1 June Year 5. Entries should be in date order. (b) Prepare a bank reconciliation statement at 30 June Year 5, commencing with the bank statement balance of 4,705.

Exercise 4 You are required to prepare a bank statement from the details below. Thomas Snodden banks at Wilmster Bank, 46 High Street, Ledbury, Eastshire LE2 5SR account number 96015. On 1 September Year 2, he had a balance at the bank of 126.00 (Dr).The following were his transactions with the bank during Setpember Year 2: 4 Sep Received cheque from R Grafton for 57.00 6 Sep Drew cheque no 100567 payable to T Lucas for 95.50 This was debited to Snoddens account on 11 September 9 Sep The bank made a standing order payment to Moody Publishers for 162.00 12 Sep Drew cheque no 100568 payable to N Swift for 73.00 This was debited to Snoddens account on 16 September 14 Sep Received by credit transfer from K Hanson 214.00 17 Sep Drew cheque no 100569 payable to T Cavendish for 106.50 This was debited to Snoddens account on 21 September 20 Sep Received cheque from N Speedy for 165.00 22 Sep The bank made direct debit payment to Eastwise Electricity for 89.00 25 Sep The bank made credit transfer payment to Spacewell Ltd for 105.00 27 Sep Received cheque from L Morsewell for 235.00 30 Sep The bank charged interest of 17.00 Note Any cheques received by Thomas Snodden are paid into the bank on the day of receipt. In 22

each instance above, the bank credited Snoddens account on the same day.

Question: 1 Suppose that Sandra Rentons cash book for the month of March Year 3 appears as follows: Cash Book (Bank Columns) Year 3 Year 3

Mar 1 Mar 4 Mar 10 Mar 20 Mar 30

Balance J ogden A Lancaster N Wells T Malone

560 150 215 86 54

Mar 6 Mar 14 Mar 24 Mar 28

T Lyle (236715) R Brown (236716)

320 180

T Brentomre (236717) 95 F wragg (236718) 120

The balance at this state, shown as a separate note, is a debit balance of 350. Sandra receives the following bank statement. Dr Cr Balance

Year 3 Mar 1 Mar 6 Mar 8 Mar 10 Mar 12 Mar 14 Mar 19 Mar 21 Mar 26 balance b/f J Ogden Standing order Block & Trent T Lyle (236715) A Lancaster Credit transfer: A Zimm R Brown (236716) N Wells Direct debit: B Traders Association

560 Cr Cr Cr Cr Cr Cr Cr Cr Cr 23

150 80 320 215 110 180 86 90

710 630 310 525 635 455 541 451

Question: 2 The following information relates to the banking transactions of N Swann for the month of August year 5: Cash book (bank columns only) Year 5 balance b/d Sales sales R Quaile sales 2,420 835 716 185 640 Aug 2 Aug 9 Aug 12 Aug 15 Aug 24 Aug 25 Aug 27

Year 5 Aug 1 Aug 4 Aug 23 Aug 29 Aug 31

General expenses (1012) wages (1013) drawings (1014) purchases (1015) rent (1016) wages (1017) T Wagstaffe (1018) 67 330 140 406 290 345 502

Provisional Dr balance 2,716 Bank statement Dr

Cr

Balance

Year 5 Aug 1 Aug 3 Aug 4 Aug 7 Aug 11 Aug 15 Aug 20 Aug 22 Aug 23 Aug 27 Aug 29 Aug30

Balance 1012 Credit standing order (rates) 1013 1014 1015 direct debit (insurance) Credit 1017 Credit transfer T Palmer Bank interest 67

835 136 330 140 406 153 716 345 268 8

2,420 Cr 2,353 3,188 3,052 2,722 2,582 2,176 2,023 2,739 2,394 2662 2,670

Required: a) Starting with the cash book balance of 2,716 on 31 August year 5, bring the cash book up to date by entering the appropriate items at the end of August and bring down the revised balance at 1 September year 5. 24

b) Prepare the bank reconciliation statement for N Swann at 31 August Year 5, starting with the bank statement balance.

6 Capital and revenue expenditure

Exercise 1 State whether each of the following is capital expenditure or revenue expenditure.You only have to write one word, either capital or revenue in each case. (1) Purchase of a motor van for use within the business. (2) Purchase of goods intended for resale in the normal course of business. (3) Purchase of petrol for the motor van. (4) Purchase of materials to be used in building an extension to the firms business premises. (5) Payment of insurance on the business premises.

Exercise 2 Matthew Dawalla owns a restaurant and the following were some of his transactions during the year ended 31 October Year 7: (1) Purchase of flour for immediate use in the kitchen. (2) Purchase, in September Year 7, of a motor van for delivery of prepared foods to customers. (3) Payment for advertising. (4) Payment for carriage inwards in respect of foodstuffs for the kitchen. (5) Payment of 6,400 for work done on the restaurant premises. 5,100 was for an extension to the restaurant seating area, while the remainder was for painting and decorating the restaurant. (6) Payment for heating and lighting. (7) Purchase, in July Year 7, of new ovens for the kitchen. (8) Payment for expenses of running the motor van. Required State whether each of the 8 transactions is revenue expenditure, capital expenditure, or both. If an item is both capital and revenue expenditure, you should state the respective amounts.

25

Exercise 3 JK Distributors Ltd purchases motor vehicles from manufacturers and sells them to other companies and to the general public. Jameson Partners is a firm of accountants. Required Classify the following transactions into either capital expenditure or revenue expenditure. Transactions by JK Distributors Ltd: (1) Purchase of motor vehicles for resale. (2) Purchase of a transporter lorry for moving vehicles. (3) Payments for the building of a showroom extension. (4) Salaries and commission paid to showroom sales staff. (5) Purchase of a computer for stock control purposes. Transactions by Jameson Partners: (1) Purchase of motor vehicles for use in the business. (2) Purchase of an office safe. (3) Rent paid for use of office premises. (4) Payment of course fees for staff training. (5) Payment of staff salaries and travelling expenses.

Exercise 4 P Arkan is a builder. He designs and builds superior houses to meet individual customer specification. The following invoices were received from suppliers in October Year 4: Invoice 1 From Mellow Brick Company: 40,000 high quality bricks Delivery charge From Premier Equipment Company: One earth moving machine 4 replacement tyres for existing machine From Excel Office Supplies: One photocopier for use within the firm 10 reams of copier paper 24,800 375 25,175 42,700 890 43,590 1,460 62 1,522 26

Invoice 2

Invoice 3

Invoice 4

From Arbor Construction Company: Building an extension to the cement storage area Repairs to fencing as instructed: Fencing panels and other materials Labour charges

12,400 1,475 1,060 14,935

Required Analyse the amount of each invoice and apportion it to capital expenditure and revenue expenditure. Present your answer in a table as follows: Capital expenditure Invoice 1 Invoice 2 Invoice 3 Invoice 4 Revenue expenditure Total expenditure

Exercise 5 Show the effect of the way each of the following transactions was recorded in the accounts of a retailer of electrical equipment. If there was no effect, state no effect. Effect on Net profit

Transaction (1) Purchase of motor vehicle for deliveries to customers entered in Purchases Account (2) Invoice for electricity wrongly entered in Water Supply Account (3) Payment for repairs to premises entered in Premises Account (4) Bill for petrol for delivery vehicle entered in Motor Vehicle Account (5) Invoice for legal services in respect of the purchase of premises entered in Office Expenses Account (6) The cost of installing new shop fittings was charged to Wages Account

Gross profit

Balance sheet

27

Exercise 6 This question has reference to the information given in exercise 2 (Matthew Dawalla). Matthew Dawalla makes no provision for depreciation in respect of fixed assets purchased in the last 6 months of any financial year. Using the format shown below, indicate by means of a tick which of the Trading Account, Profit & Loss Account, or balance sheet prepared at 31 October Year 7 would be affected by each of the transactions. In the case of item (5), also state the amount. Trading Account Profit & Loss Account

Items (1) (2) (3) (4) (5) (6) (7) (8)

Balance sheet

Exercise 7 Andrew Smithers has recently prepared the following Trading and Profit & Loss Account: Andrew Smithers Trading and Profit & Loss Account for the year ended 30 September Year 3 Sales less Cost of goods sold: Opening stock Purchases less Closing stock Gross profit less Expenses: Rent Wages General expenses Net loss 73,200 3,860 49,750 53,610 4,200

49,410 23,790

4,400 18,900 860

24,160 (370)

On reviewing his books of account you find that: (1) The item Purchases includes: 28

a desktop computer bought for use in the office for 2,200; a new delivery van bought for use in the business for 7,600; the purchase of materials for extending the shop premises 2,350.

(2) The sales figure includes the sale of the old delivery van for 1,600. This figure had been shown in the books at 3,400. (3) The closing stock includes 300 of materials in hand for work on extending the shop premises. (4) Rent accrued 400. (5) The figure for wages includes 2,100 for building work on extending the shop premises. Andrew Smithers tells you that he wishes to allow 1,500 first-year depreciation on the new delivery van. Required Prepare a revised Trading and Profit & Loss Account for Andrew Smithers for the year ended 30 September Year 3.

Exercise 8 John Bradford ended his first year of trading on 31 DecemberYear 4. He has no knowledge of book-keeping and accounts but has prepared what he calls his profit statement for the year: John Bradford Profit statement at 31 December Year 4 Cash takings from customers 22,664 Purchases Goods for resale 14,173 Motor vehicle, bought 1 Jan Yr 4 2,200 16,373 Advertising 838 Vehicle running costs 1,092 Wages paid 2,640 Insurances 310 Heat and light 429 Cash taken for own use 394 22,076 Profit 588 Other information at 31 December Year 4: (1) Customers invoiced for 1,082 had not yet paid their accounts. (2) Wages accrued due 286. (3) Purchases that had cost 1,730 were still unsold (stock). (4) John Bradford expects the motor vehicle to last 3 years and to have a trade-in value then of 700. Required (a) State what important distinction John Bradford has failed to make in his treatment of the motor-vehicle purchase. 29

(b) Prepare a revised Trading and Profit & Loss Account for John Bradford for the year ended 31 December Year 4.

Question: 1 Compupro is a small computer and data processing bureau. In a certain trading period it enters into the following transactions: (a) (b) (c) (d) (e) The purchases of supplies of computer print-out paper, all of which is expected to be used within the current trading period The renewal of insurance on the computer hardware Expenditure on increasing the security to the building in which the bureaus facilities are situated The wages of the computer operators The adding of extra storage capacity to computer used within the bureau

Required: State in respect of the above whether you would treat the item as capital expenditure or revenue expenditure, giving the reason for your choice. Set out your answer in two columns as follows:

Capital or Revenue Expenditure (A) (B) (C) (D)

Reason

Question: 2 (a) Required Briefly explain (I) capital expenditure and (ii) revenue expenditure. (b) During the year, the following transactions took place for a business which operates as a general store: (1) Purchase by cheque of a motor vehicle costing 4,620, to be used to make deliveries to customers. 30

(2)

(3) (4) (5) (6)

Payment by cheque of 3,550 for work done on the shop premises owned by the firm. 2,800 was for an improvement to the shop front, whilst 750 was for paining and decorating the inside of the shop premises. Payment by cheque 160 for stationery. Expenses for three months for the motor vehicle, paid by cheque 230 Purchase of goods on credit at a cost of 3,460. These goods were intended for resale in the normal course of business. Wages of 250 and materials costing 240, used by the firms own employees, in building a store at the rear of the business shop.

Required: Indicate for each of the six transactions whether it is capital expenditure, revenue expenditure or both, stating the mount.

7 Final accounts and adjustments further considered

Exercise 1 J Salmon, a sole trader, prepared the following trial balance from her books at 30 June Year 6: Dr Cr Motor vehicles at cost 80,000 Fixtures and fittings at cost 82,000 Purchases and purchases returns 263,500 7,300 Sales and sales returns 3,400 370,000 Stock (1 Jul Yr 5) 15,700 Discounts 2,300 1,600 Provision for doubtful debts 600 Bad debts 650 Debtors and creditors 35,000 27,400 Capital 108,000 Drawings 28,200 Provision for depreciation: Motor vehicles 23,000 Fixtures and fittings 19,000 Rent 12,000 Motor-vehicle running expenses 3,360 Rates and insurances 3,420 Salaries 12,300 Cash at bank 10,720 Cash in hand 420 Lighting and heating 3,930 556,900 556,900 At 30 June Year 6: 31

(1) Depreciation is to be provided as follows: Motor vehicles Fixtures and fittings 25% on cost 10% on cost

(2) Stock was valued at cost 17,400. (3) The provision for doubtful debts is to be set at 2% of the debtors. (4) Motor-vehicle running expenses at 510 and lighting and heating at 420 were accrued. (5) The rates and insurances were prepaid by 120. Required Prepare for J Salmon: (a) a Trading and Profit & Loss Account for the year ended 30 June Year 6 (b) a balance sheet at 30 June Year 6.

Exercise 2 Hilda Braquette prepared the following trial balance at 31 October Year 5: Dr Cr Stock at 1 Nov Yr 4 6,820 Fixtures and fittings at cost 14,000 Provision for depreciation of fixtures and fittings at 1 Nov Yr 4 2,800 Bank 3,200 Cash in hand 148 Debtors and creditors 10,300 6,920 Motor vehicles at cost 24,000 Provision for depreciation of motor vehicles at 1 Nov Yr 4 7,200 Purchases and sales 75,820 161,360 Discounts allowed and received 2,140 1,580 Drawings 13,200 Motor-vehicle running expenses 5,860 Wages 43,972 Bad debts 390 Provision for doubtful debts 210 Returns inwards and outwards 1,180 850 Rent 10,400 Light and heat 650 Insurance 1,080 Office expenses 2,100 Capital 34,340 215,260 215,260 32

Additional information at 31 October Year 5: (1) Stock at cost (2) Insurance prepaid (3) Accrued due: Light and heat 80 Office expenses 140 (4) Depreciation is provided as follows: Fixtures and fittings 10% per annum on cost Motor vehicles 20% per annum on cost (5) Provision for doubtful debts is to be adjusted to 4% of debtors Required For Hilda Braquette, prepare: (a) the Trading and Profit & Loss Account for the year ended 31 October Year 5 (b) a balance sheet at 31 October Year 5. 8,460 240

220

Exercise 3 The following trial balance was extracted from the ledger of P Lippis, a sole trader, on 31 March Year 12: Dr Cr Business premises at cost 85,000 Purchases and sales 39,800 64,650 Capital 93,420 Stock at 1 Apr Yr 11 8,310 Purchases returns 285 Fixtures and fittings at cost 12,700 Provision for depreciation of fixtures and fittings 2,540 Trade debtors: R Prince 480 K Evitts 1,010 J Carr 180 Archway Supplies 370 Trade creditors: K Porter 2,210 Archway Supplies 4,096 Cash in hand 47 Cash at bank 1,093 Wages 8,942 Advertising 110 Heat and light 1,092 Insurances 368 Other expenses 459 Drawings 7,240 167,201 167,201 33

The following additional information is to be taken into account: (1) Stock valued at cost on 31 March Year 12, 7,935. (2) Accruals at 31 March Year 12: wages 230; heat and light 98. (3) Prepayment at 31 March Year 12, Insurances 46. (4) Lippis received a bank statement, showing that there was a balance in his favour on 31 March Year 12, amounting to 1,140.A creditor had not yet presented a cheque drawn by Lippis for 79, and the bank applied bank charges amounting to 32. (5) Depreciation was to be provided on fixtures and fittings at 10% per annum on cost. (6) Archway Supplies was Lippis main supplier.Unusually,Archway purchased goods from Lippis, and it was agreed that the debtor balance should be a contra against the creditor balance. Required Prepare for P Lippis: (a) a Trading and Profit & Loss Account for the year ended 31 March Year 12 (b) a balance sheet at 31 March Year 12.

Exercise 4 At 31 December Year 3, the end of her first year of trading, Hilda Braquette produced the following list of stock items and asked for your help: Original cost 2.00 5.00 1.00 3.00 4.00 3.00 2.00 Selling price 3.00 7.50 1.50 2.50 6.00 4.50 3.00 Stock value

Item (i) (ii) (iii) (iv) (v) (vi) (vii)

Quantity 200 500 1,200 50 75 350 450

Comments 20 broken to be thrown away 40 damaged saleable at half price old stock 20 damaged saleable at half price

Required Calculate the stock valuation of each item and total to show the value of Hilda Braquettes closing stock at 31 December Year 3.

Exercise 5 The following balances were included in the trial balance of James Hanson at 31 March Year 4: Debit Credit Purchases and sales 18,620 29,410 34

Returns Stock at 1 Apr Yr 3

238 1,146

194

At 31 March Year 4, James Hanson counted and valued his stock in hand at cost, 1,382. This included the following 3 items of stock: Cost price 120 72 80 Net realizable value 140 60 45

Item 1 Item 2 Item 3

Required (a) Prepare a statement, starting with the stock value of 1,382, showing any necessary adjustments in respect of the 3 items of stock above, to show a new stock valuation at 31 March Year 4. (b) Prepare a Trading Account for James Hanson for the year ended 31 March Year 4.

Exercise 6 The financial year of F Lang, a trader, ends on 31 March. F Lang sells goods at a mark-up of 331/3% on cost price. On 31 March Year 4, the value of his stock at cost was 12,360. On 17 March Year 5, he provisionally valued his stock at 14,220. Between 18 March Year 5 and the end of that financial year, the following took place: (1) Lang bought goods to a purchase invoice value of 740. (2) He returned goods to suppliers that had been invoiced to him at 273. (3) He sold goods to a selling value of 1,320. (4) Lang took goods that had cost 195 for his own private use. Required (a) Prepare a statement adjusting the value of stock at 31 March Year 5 for entry into the Stock Account at cost price. (b) Calculate the effect of the adjustment of the value of stock on the amount of the gross profit 94,800 for the year ended 31 March Year 5. (c) Prepare the Stock Account for the years ended 31 March Years 5 and 6 respectively, assuming that the value of stock at 31 March Year 6 was 15,300.

Question: 1 Moon, a sole trader, extracted the following trial balance from his books at the cost of business on 31 May year 8. Dr Cr Balance at Bank 15,900 35

Cash in hand Stock 1 June year 7 Office furniture and equipment cost Discounts allowed and received Motor vehicle (cost) Debtors and creditors Drawings 6,000 Provision for Depreciation (at 1 June year 7) Office furniture and equipment Motor vehicle Purchases and sales Provision for doubtful debt Wages and salaries Rents Rate and insurance Lighting and heating Sales returns and purchases returns Motor vehicle expenses Postage and stationery Sundry expenses Capital at 1June year 7

120 3,850 8,000 620 7,500 9,600

380 3,220

124,760 18,200 6,000 1200 580 210 1,960 270 490

2,400 3,000 165,970 200

90

30,000 205260 205260

In addition the following information should be taken into account. (1) (2) (3) (4) Closing stock at 31 may year 8 valued at 4,200. Accrued due but unpaid wages and salaries 1,320. Rates and insurances prepaid by 160. The depreciation provision for the fixed assets is to be increased as followings: Office furniture and equipment 800 Motor vehicle 1500 (5) Provision for doubtful debt is to be increased by 40. Required: Prepare, in respect of J Moon, the (a) Trading and profit and loss accounts for the year ended 31 May year 8. (b) Balance sheet at 31 May year 8.

Question: 2 John Cleaver has just completed his second year of trading. His trial balance, extracted from ledger at 31 December year 2, is as follows: 36

John Cleaver Trial balance at 31 December year 2 Dr Cr Capital 26,120 Loan from brother 8,000 Purchases and sales 49,370 82,578 Returns inwards and outwards 188 326 Stock 1 January year 2 3,930 Drawings 12,300 Debtors and creditors 22,100 9,380 Bank overdraft 1,196 Bank interest 245 Wages 5,593 Rent 1,860 Insurance 270 Heat and light 440 Advertising 265 Delivery costs 1,803 Bad debts 436 Fixed assets (at cost) 32000 Accumulated depreciation on fixed assets to 31 December year 1 3,200 130,800 The following adjustments are to be taken into account: (1) Stock at 31 December year 2 2,876. (2) Cleaver borrowed the 8,000 from his brother on 1 January year 2. He has agreed to pay 15% interest per annum but no payment has yet been made. (3) Provide for annual depreciation of fixed assets at 10% on cost. Required: Prepare cleavers trading and profit and loss account for the year ended 31 December year 2 and a balance sheet at that date. 13,800

Question: 3 M Tiong, a sole trader engaged in wholesaling, extracted the following trial balance from his books at the close of business on 30 April year 5:

M Tiong 37

Trial Balance at 30 April year 5 Dr Office furniture and equipment Discounts 1,170 Cash at bank 3,240 Cash in hand 160 Stock 1 May year 4 2,970 Purchases and sales 13,890 Rent, rates and insurance 2,340 Delivery vehicle, at cost 7,400 Provision for depreciation on delivery vehicle Debtors and creditors 8,400 Wages and salaries 9,350 Provision for doubtful debts Capital 1 May year 4 Drawings 4,500 Vehicle running expenses 1,840 Sundry expenses 410 61,670

Cr 6,000 390

35,030

2,000 3,650 600 20,000

61,670

Addition, Tiong has noted the following points: (1) Stock at 30 April year 5 has been valued at 3,160. (2) (3) Wages accrued amount to 280. The depreciation provision on the delivery vehicle is to be increased by 1,200. A provision of 500 is to be created in respect of depreciation on office furniture and equipment. (4) (5) The provision for doubtful debts is to be set at 5% of debtors. During the year, Tiong took goods, at a cost price of 90, for his own use. He has not yet recorded this in the books of account. (6) Insurance paid in advance is 120.

Required: Prepare, in respect of M Tiong: (a) The trading and profit and loss account for the year ended 30 April year 5 (b) A balance sheet at 30 April year 5.

38

You might also like

- +-LCCI Level 1 - How To Pass Book-Keeping (Recommeded Book) - +Document334 pages+-LCCI Level 1 - How To Pass Book-Keeping (Recommeded Book) - +rock300785% (26)

- Seminar 2-3Document8 pagesSeminar 2-3Nguyen Hien0% (1)

- 2008 LCCI Level 1 (1017) Specimen Paper QuestionsDocument6 pages2008 LCCI Level 1 (1017) Specimen Paper QuestionsTszkin Pak100% (2)

- Titling of Land ProcedureDocument18 pagesTitling of Land ProcedureJunyvil TumbagaNo ratings yet

- The NickB Method - 'Averaging 100 Pips A Week On GBPJPY'Document42 pagesThe NickB Method - 'Averaging 100 Pips A Week On GBPJPY'Tawau Trader100% (1)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- K-A-K Accruals & Prepayments QuestionsDocument3 pagesK-A-K Accruals & Prepayments QuestionsUmer Farooq0% (1)

- 0129450730004260Document3 pages0129450730004260Deependra Singh100% (1)

- Accruals and PrepaymentsDocument2 pagesAccruals and PrepaymentsPriya Nair100% (1)

- Book-Keeping and Accounts/Series-3-2004 (Code2006)Document16 pagesBook-Keeping and Accounts/Series-3-2004 (Code2006)Hein Linn Kyaw100% (1)

- 2007 LCCI Level 2 Series 3 (HK) Model AnswersDocument12 pages2007 LCCI Level 2 Series 3 (HK) Model AnswersChoi Kin Yi Carmen67% (3)

- 2008 LCCI Level 1 (1017) Specimen Paper AnswersDocument4 pages2008 LCCI Level 1 (1017) Specimen Paper AnswersTszkin PakNo ratings yet

- LCCI Examination Timetable 2021 - FINAL v2Document9 pagesLCCI Examination Timetable 2021 - FINAL v2Khin Zaw HtweNo ratings yet

- Chap05 Balancing-Off AccountsDocument9 pagesChap05 Balancing-Off AccountsLinh Le Thi ThuyNo ratings yet

- Pearson LCCI: Certificate in Bookkeeping and Accounting (VRQ)Document20 pagesPearson LCCI: Certificate in Bookkeeping and Accounting (VRQ)Aung Zaw Htwe100% (2)

- Plumpton Leisure CenterDocument2 pagesPlumpton Leisure CenterDaine Thomas Jr.50% (2)

- FA2 Bad Debt TestDocument4 pagesFA2 Bad Debt Testamna zamanNo ratings yet

- Cash Budgets 2Document2 pagesCash Budgets 2Prince TshepoNo ratings yet

- Solution Past Paper Higher-Series4-08hkDocument16 pagesSolution Past Paper Higher-Series4-08hkJoyce LimNo ratings yet

- ManufacturingDocument6 pagesManufacturingapi-3034896990% (1)

- FMA Question PackDocument67 pagesFMA Question PackAhamed NabeelNo ratings yet

- CH 12 Irrecoverable Debts and Allowance v3Document8 pagesCH 12 Irrecoverable Debts and Allowance v3BuntheaNo ratings yet

- F2 Mock 5Document9 pagesF2 Mock 5deepakNo ratings yet

- 2011 E2Document81 pages2011 E2Rehman MuzaffarNo ratings yet

- 02 MA1 LRP Questions 2014Document34 pages02 MA1 LRP Questions 2014Yahya KaimkhaniNo ratings yet

- Workbook1 PDFDocument73 pagesWorkbook1 PDFSchool FilesNo ratings yet

- 6 CDP LabourDocument6 pages6 CDP LabourTAPK67% (3)

- Proposal To Conduct Accounting Courses: Diploma in Book-Keeping and Accounts Level 2Document2 pagesProposal To Conduct Accounting Courses: Diploma in Book-Keeping and Accounts Level 2Bhutan Chay100% (3)

- Accounting ExamDocument14 pagesAccounting ExamSally SalehNo ratings yet

- Day 1 - Capital Gain TaxDocument20 pagesDay 1 - Capital Gain TaxAbdullah EjazNo ratings yet

- TOPIC Practice Questions: Question: TableDocument3 pagesTOPIC Practice Questions: Question: Tableayesha abidNo ratings yet

- 2006 LCCI Cost Accounting Level 2 Series 4 Model AnswersDocument15 pages2006 LCCI Cost Accounting Level 2 Series 4 Model AnswersHon Loon SeumNo ratings yet

- F2 - Mock A - QuestionsDocument21 pagesF2 - Mock A - QuestionsgernalcreationNo ratings yet

- ACCA CAT Paper T5 Managing People and Systems Solved Past PapersDocument139 pagesACCA CAT Paper T5 Managing People and Systems Solved Past Papersdastgeer007100% (1)

- F3FFA Chapter 9 TANGIBLE NON CURRENT ASSET.Document31 pagesF3FFA Chapter 9 TANGIBLE NON CURRENT ASSET.Md Enayetur Rahman100% (1)

- Cost Accounting - June 2010 Dec 2010 and June 2011Document71 pagesCost Accounting - June 2010 Dec 2010 and June 2011Mwila ChambaNo ratings yet

- Chapter 03Document12 pagesChapter 03Asim NazirNo ratings yet

- Chapter 11 Partnership DissolutionDocument19 pagesChapter 11 Partnership DissolutionAira Nhaire Cortez MecateNo ratings yet

- Financial Accounting Sample Paper 21Document31 pagesFinancial Accounting Sample Paper 21Jayasankar SankarNo ratings yet

- Control Accounts Reconciliation PractiseDocument2 pagesControl Accounts Reconciliation Practisendumiso100% (1)

- ACCADocument12 pagesACCAanon-502587No ratings yet

- Accountant in Business Mock Exam 2: (Duration: 3 Hours)Document14 pagesAccountant in Business Mock Exam 2: (Duration: 3 Hours)Man Ish K DasNo ratings yet

- 07-ACCA-FA2-Chp 07Document28 pages07-ACCA-FA2-Chp 07SMS PrintingNo ratings yet

- Question - Chapter 6. Basis of AssessmentDocument5 pagesQuestion - Chapter 6. Basis of AssessmentTâm TốngNo ratings yet

- Accruals Questions - Further QuestionsDocument4 pagesAccruals Questions - Further QuestionsqasimNo ratings yet

- Ex. 3-171-Adjusting EntriesDocument2 pagesEx. 3-171-Adjusting EntriesEli KrismayantiNo ratings yet

- MK 2102-BAE2020 - Aje - ReDocument2 pagesMK 2102-BAE2020 - Aje - ReAngela ThrisanandaNo ratings yet

- LCCI Chp02Document11 pagesLCCI Chp02richardchan001100% (1)

- P4Document3 pagesP4Trisyall TriyonoputraNo ratings yet

- ANSWER KEY Adjustments Quiz 2Document6 pagesANSWER KEY Adjustments Quiz 2Christine Mae BurgosNo ratings yet

- Accounting Accn3: General Certificate of Education Advanced Level Examination June 2010Document8 pagesAccounting Accn3: General Certificate of Education Advanced Level Examination June 2010Sam catlinNo ratings yet

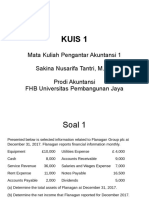

- Kuis 1: Mata Kuliah Pengantar Akuntansi 1 Sakina Nusarifa Tantri, M.Sc. Prodi Akuntansi FHB Universitas Pembangunan JayaDocument8 pagesKuis 1: Mata Kuliah Pengantar Akuntansi 1 Sakina Nusarifa Tantri, M.Sc. Prodi Akuntansi FHB Universitas Pembangunan JayaSakina Nusarifa TantriNo ratings yet

- Homework For Next ClassDocument3 pagesHomework For Next ClassSimo El Kettani20% (5)

- 5 6188442313212035099Document19 pages5 6188442313212035099JamieNo ratings yet

- Lugo Z. Accounting Cycle Adjusting Entries, Financial Statements, Closing Entries, Reversing EntriesDocument78 pagesLugo Z. Accounting Cycle Adjusting Entries, Financial Statements, Closing Entries, Reversing EntriesCar Mela50% (2)

- Adjusting Journal Entries Are Entries Used To Update The Accounts Prior To The Preparation of Financial StatementsDocument4 pagesAdjusting Journal Entries Are Entries Used To Update The Accounts Prior To The Preparation of Financial Statementsjemima manzanoNo ratings yet

- Soal Asis PA2Document2 pagesSoal Asis PA2Fahmi HaritsNo ratings yet

- Cfab - Acc - LN - Chapter 9Document9 pagesCfab - Acc - LN - Chapter 9Huy NguyenNo ratings yet

- Bram Wear CaseDocument2 pagesBram Wear CaseHabtamu Ye Asnaku Lij89% (9)

- 162 001Document1 page162 001Christian Mark AbarquezNo ratings yet

- Single Entry & ErrorsDocument3 pagesSingle Entry & ErrorsAlellie Khay D JordanNo ratings yet

- Seeds of The Nations Accounting Quiz ON Basic AccountingDocument25 pagesSeeds of The Nations Accounting Quiz ON Basic AccountingHershey GalvezNo ratings yet

- Quiz Audit of Shareholders Equity 2 PDF FreeDocument10 pagesQuiz Audit of Shareholders Equity 2 PDF FreeRio Cyrel CelleroNo ratings yet

- Individual Assignment Fundamentals of Acct ch-2Document5 pagesIndividual Assignment Fundamentals of Acct ch-2Gutema BekeleNo ratings yet

- F - T 4.15PM T N 5 2009 All Completed Answers To Be Dropped in The Economics Post Box On The Ground Floor of Rhetoric HouseDocument3 pagesF - T 4.15PM T N 5 2009 All Completed Answers To Be Dropped in The Economics Post Box On The Ground Floor of Rhetoric Houseghu5926No ratings yet

- ျမန္မာႏိုင္ငံစာရင္းကိုင္မ်ားအသင္းDocument22 pagesျမန္မာႏိုင္ငံစာရင္းကိုင္မ်ားအသင္းThuzar Lwin100% (5)

- Lcci Level I Que and Ans (1606) MALDocument13 pagesLcci Level I Que and Ans (1606) MALThuzar Lwin100% (2)

- Book-Keeping Level 1Document13 pagesBook-Keeping Level 1Hein Linn Kyaw88% (17)

- 2008 LCCI Level1 Book-Keeping (1517-4)Document13 pages2008 LCCI Level1 Book-Keeping (1517-4)JessieChuk100% (2)

- General Journal PowerpivotDocument1,917 pagesGeneral Journal PowerpivotJeanNo ratings yet

- Capital Gain TemplateDocument27 pagesCapital Gain TemplateNayan WadhwaniNo ratings yet

- How To Get Rich Without Being LuckyDocument9 pagesHow To Get Rich Without Being Luckybrijsing100% (1)

- Asset 2Document151 pagesAsset 2Abhijeet ZawareNo ratings yet

- Arithmetical Essentials v3 1000216294 PDFDocument326 pagesArithmetical Essentials v3 1000216294 PDFPeggy Bracken Stagno100% (1)

- SWOT AnalysisDocument3 pagesSWOT AnalysisGlydel ReyesNo ratings yet

- Banking Operation - Chapter 1Document7 pagesBanking Operation - Chapter 1Thanh HuyenNo ratings yet

- Cost of Capital Tut. MemoDocument2 pagesCost of Capital Tut. MemoSEKEETHA DE NOBREGANo ratings yet

- Mind Maps of Assurance and Other Standards (Updated)Document10 pagesMind Maps of Assurance and Other Standards (Updated)arifNo ratings yet

- Hengyuan2018 PDFDocument156 pagesHengyuan2018 PDFChee Haw YapNo ratings yet

- Ad31296951 06052021095104Document1 pageAd31296951 06052021095104MayankNo ratings yet

- Project Finance of Bandra Worli Sea LinkDocument64 pagesProject Finance of Bandra Worli Sea LinkAarti Sharma75% (8)

- Document 1Document4 pagesDocument 1cassildaNo ratings yet

- CH3 SolutionDocument10 pagesCH3 SolutionGabriel Aaron DionneNo ratings yet

- Unhedged 31.12.2019Document2 pagesUnhedged 31.12.2019NOOR E MOHAMMAD SHAIKNo ratings yet

- IMF Article IV Report On ItalyDocument68 pagesIMF Article IV Report On ItalyYannis KoutsomitisNo ratings yet

- Tavera Vs El HogarDocument2 pagesTavera Vs El HogarJohnson Mito LontokNo ratings yet

- Deadpool ResumeDocument5 pagesDeadpool Resumeafiwierot100% (2)

- Paper SecondPlace FINAL PDFDocument45 pagesPaper SecondPlace FINAL PDFArpit SaveNo ratings yet

- Model Questions BBM Third Semester Business Finance - 2 PDFDocument4 pagesModel Questions BBM Third Semester Business Finance - 2 PDFKusum GopalNo ratings yet

- HSBC - Finding Optimal Value in Real Yield 2013-12-13Document16 pagesHSBC - Finding Optimal Value in Real Yield 2013-12-13Ji YanbinNo ratings yet

- FIMunit 2 Part 3Document7 pagesFIMunit 2 Part 3ShailjaNo ratings yet

- Current Affairs Q&A PDF April 4 2024 by Affairscloud 1Document20 pagesCurrent Affairs Q&A PDF April 4 2024 by Affairscloud 1BinayNo ratings yet

- HRM in Banking (100 Marks Project)Document62 pagesHRM in Banking (100 Marks Project)Shekhar Nm85% (13)

- Model Question Paper - Industrial Engineering and Management - First Semester - DraftDocument24 pagesModel Question Paper - Industrial Engineering and Management - First Semester - Draftpammy313No ratings yet

- The Tire IndustryDocument6 pagesThe Tire IndustryKavish BarapatreNo ratings yet

- Consolidated Statements After Acquisition: 2238 Financial Reporting - 2021/2022 T1Document20 pagesConsolidated Statements After Acquisition: 2238 Financial Reporting - 2021/2022 T1Tommaso SpositoNo ratings yet