Fieo

Fieo

Uploaded by

paridhi9Copyright:

Available Formats

Fieo

Fieo

Uploaded by

paridhi9Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Fieo

Fieo

Uploaded by

paridhi9Copyright:

Available Formats

Presentation on EXPORT INCENTIVE SCHEMES

R. Asokan Jt. Director FIEO Southern Region

DUTY EXEMPTION & REMISSION SCHEMES

Duty Exemption Schemes enable duty free import of inputs required for export production. Duty Exemption Schemes consist of (a) Advance Authorisation and (b) Duty Free Import Authorisation (DFIA). A Duty Remission Scheme enables post export replenishment / remission of duty on inputs used in export product. Duty Remission Schemes consist of (a) Duty Entitlement Passbook Scheme (DEPB) and (b) Duty Drawback (DBK) Scheme.

Re-import of exported goods under Duty Exemption Remission Scheme

Goods exported under Advance Authorisation / DFIA / DEPB may be Re-imported in same or substantially same form subject to / DoR specified conditions. Value addition (VA) for the purpose (Except for Gems and Jewellery Sector) shall be:A-B VA = x 100, where B A = FOB value of export realised / FOR value of supply received. B = CIF value of inputs covered by authorisation, plus any other imported materials used on which benefit of DBK is claimed.

ADVANCE AUTHORISATION SCHEME

An Advance Authorisation is issued to allow duty free import of inputs, which are physically incorporated in export product (making normal allowance for wastage). In addition, fuel, oil, energy, catalysts which are consumed / utilised to obtain export product, may also be allowed. DGFT, by means of Public Notice, may exclude any product(s) from purview of Advance Authorisation. Duty free import of mandatory spares upto 10% of CIF value of Authorisation which are required to be exported / supplied with resultant product are allowed under Advance Authorisation. Advance Authorisations are issued for inputs and export items given under SION. These can also be issued on the basis of Adhoc norms or self declared norms as per para 4.7 of HBP v1.

ADVANCE AUTHORISATION SCHEME contd

Advance Authorisation can be issued either to a manufacturer exporter or merchant exporter tied to supporting manufacturer(s) for:

i) Physical exports (including exports to SEZ); and / or ii) Intermediate supplies; and /or iii) supply of goods to the categories mentioned in paragraph 8.2 (b), (c), (d), (e), (f), (g), (i) and (j) of FTP ; iv) supply of stores on board of foreign going vessel / aircraft subject to condition that there is specific SION in respect of item(s) supplied.

Fulfillment Period of EO under an Advance Authorisation shall commence from Authorisation issue date. EO shall be fulfilled within 24 months except in case of supplies to projects / turnkey projects in India / abroad under deemed exports category where EO must be fulfilled during contracted duration.

ADVANCE AUTHORISATION SCHEME contd

Request for extension in EOP may be made in ANF 4E. RA shall grant one extension for six months from expiry date with payment of composition fee of 2% of duty saved on all unutilized imported items as per Authorisation. Request for a further extension of six months may be considered by RA with payment of composition fee of 5% of duty saved, based on all unutilized imported items as per Authorisation. Application for obtaining credit shall be filed within a period of twelve months from the date of exports or the date of up linking of EDI shipping bill details in the DGFT website, or within six months from the date of realisation, or within three months from the date of printing / release of shipping bill, whichever is later, in respect of shipments for which claim has been filed.

DUTY ENTITLEMENT PASSBOOK (DEPB) SCHEME

Objective of DEPB is to neutralise incidence of customs duty on import content of export product. Component of Special Additional Duty and customs duty on fuel shall also be allowed under DEPB (as brand rate) factored in DEPB rate in case of non-availment of CENVAT credit. Neutralisation shall be provided by way of grant of duty credit against export product. An exporter may apply for credit, at specified percentage of FOB value of exports, made in freely convertible currency or payment made from foreign currency account of SEZ unit / SEZ Developer in case of supply by DTA. Credit shall be available against such export products and at such rates as may be specified by DGFT by way of public notice. Credit may be utilized for payment of Customs Duty on freely importable items. DEPB Scrips can also be utilized for payment of duty against imports under EPCG Scheme w.e.f 1.1.2009. DEPB holder shall have option to pay additional customs duty in cash as well. Validity period of DEPB for import shall be as prescribed in HBP v1.

DEPB contd-

DEPB and / or items imported against it are freely transferable. Transfer of DEPB shall however be for import at specified port, which shall be the port from where exports have been made. Imports from a port other than the port of export shall be allowed under TRA facility as per terms and conditions of DOR notification. Additional customs duty / Excise Duty and Special Additional Duty paid in cash or through debit under DEPB may also be adjusted as CENVAT Credit or Duty Drawback as per DoR rules.

DUTY FREE IMPORT AUTHORISATION (DFIA) SCHEME

DFIA is issued to allow duty free import of inputs, fuel, oil, energy sources, catalyst which are required for production of export product. DGFT, by means of Public Notice, may exclude any product(s) from purview of DFIA. This scheme is in force from 1st May, 2006. A minimum 20% value addition shall be required for issuance of such authorisation except for items in gems and jewellery sector for which value addition would be as per paragraph 4A.2.1 of HBP v1. Items for which higher value addition is prescribed under Advance Authorisation Scheme, shall be applicable.

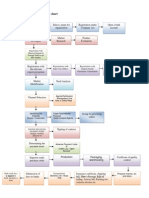

Capital Goods & Raw materials

Bonded Area

Domestic tariff Area EOU/STP/EHTP/BTP SEZs

Raw material

Capital Goods

On Payment of duty On payment of duty EPCG Advance License Drawback from Customs

DEPB

DFRC

Duty Exemption Scheme

What the scheme allows to import

Inputs that are physically incorporated in the export product Also items which are consumed /utilized in the course of their use to obtain the export product

Duty Exemption Scheme

Exports count from the day of filing of application Flexibility of operation ...

Execute Bond..import..export..discharge of Bond or Export..waiver of Bond.. Published Norms -- Any body can use such Norms (applicable to all) Norms available e.g 1Shirt 2 sq. mtrs fabric; 1 Kg export of Processed product import 1.05 kg raw material (5 percent wastage)

Duty Exemption Scheme

If NO NORMS

Then make an application to ALC for fixation of norms and then apply Make an application under 4.7 of handbook of procedures Give undertaking that you would accept the decision of the committee. If there is any difference then pay back the duties along with interest. Thus one need not wait..Norms or No Norms one can file an application.

Extension in export obligation ..

Beyond 24 months..

Ist Extension for 6 months

payment of penalty equal to 2 percent of the duty saved on all unutilized imported items

2nd extension further 6 months

On payment of penalty equal to 2 percent of the duty saved on all unutilized imported items

proportionate to the balance export obligation.

Further Any further extension beyond 36 months - penalty of 2% per month of duty saved imports

Regularization of shortfall

If the shortfall in Quantity - Pay Customs duty on the unutilized

material along with interest at the rate of 15% per annum thereon

If the shortfall in terms of value- No payments if positive value

addition. If no then pay so that Payment plus FOB done together account for min Value Addition

Duty Entitlement Passbook Scheme(DEPB)

Shipping bill and bank certificate.

Post export- Transferable license -Need to submit To neutralize the import content of the export product It is calculated by taking into account the deemed import content of the said export product as per the SION and the basic customs duty payable on such imports Questioned for WTO compatibility

DRAWBACK

Drawback in relation to any goods manufactured in India and exported, means rebate of duty chargeable on any imported material or excisable material used in manufacture of such goods in India. Goods include imported spares, if supplied with capital goods manufactured in India.

EXPORT PROMOTION CAPITAL GOODS (EPCG) SCHEME

EPCG scheme allows import of capital goods for pre production, production and post production (including CKD / SKD thereof as well as computer software systems) at 3% Customs duty, subject to an export obligation equivalent to 8 times of duty saved on capital goods imported under EPCG scheme, to be fulfilled in 8 years reckoned from Authorisation issue-date. For SSI units, import of capital goods at 3% Customs duty shall be allowed, subject to fulfillment of export obligation equivalent to 6 times of duty saved on capital goods, in 8 years from Authorisation issue-date, provided the landed cif value of such imported capital goods under the scheme does not exceed Rs.50 lakhs and total investment in plant and machinery after such imports does not exceed SSI limit. However, in respect of EPCG Authorisations with a duty saved amount of Rs. 100 crores or more, export obligation shall be fulfilled in 12 years.

EXPORT PROMOTION CAPITAL GOODS (EPCG) SCHEME

The Authorisation holder under the EPCG scheme shall fulfill the export obligation over the specified period in the following proportions:

Block of 1st to 6th year 50% Block of 7th and 8th year 50%

In respect of Authorisations, on which the value of duty saved is Rs.100 crore or more, the export obligation shall be fulfilled over a period of 12 years in the following proportion:

Block of 1st to 10th year 50% Block of 11th and 12th year 50%

EXPORT ORIENTED UNITS (EOUs)

Units undertaking to export their entire production of goods and services (except permissible sales in DTA), may be set up under the Export Oriented Unit (EOU) Scheme, Electronic Hardware Technology Park (EHTP) Scheme, Software Technology Park (STP) Scheme or Bio-Technology Park (BTP) Scheme for manufacture of goods, including repair, re-making, reconditioning, re-engineering and rendering of services. Trading units are not covered under these schemes. Investment Criteria Only projects having a minimum investment of Rs.1 Crore in Plant & Machinery shall be considered for establishment as EOUs . This shall, however, not apply to existing units and units in EHTP / STP / BTP, Handicrafts / Agriculture / Floriculture / Aquaculture / Animal Husbandry / Information Technology, Services, Brass Hardware and Handmade jewellery sectors. Board of Approval (BoA) may also allow establishment of EOUs with a lower investment criteria. Entire production of EOU / EHTP / STP / BTP units other than gems and jewellery units, may sell goods upto 50% of FOB value of exports, subject to fulfilment of positive NFE, on payment of concessional duties. An EOU / EHTP / STP / BTP unit may export goods manufactured/ software developed by it through another exporter or any other EOU / EHTP / STP / SEZ unit, subject to conditions mentioned in para 6.19 of HBP v1.

DEEMED EXPORTS

Deemed Exports refers to those transactions in which goods supplied do not leave country, and payment for such supplies is received either in Indian rupees or in free foreign exchange. Deemed exports shall be eligible for any / all of following benefits in respect of manufacture and supply of goods qualifying as deemed exports subject to terms and conditions as in HBP v1:

Advance Authorisation / Advance Authorisation for annual requirement/ DFIA. Deemed Export Drawback. Exemption from terminal excise duty where supplies are made against ICB. In other cases, refund of terminal excise duty will be given.

EXPORT AND TRADING HOUSES

Merchant as well as Manufacturer Exporters, Service Providers, Export Oriented Units (EOUs) and Units located in Special Economic Zones (SEZs), Agri Export Zones (AEZs), Electronic Hardware Technology Parks (EHTPs), Software Technology Parks (STPs) and Bio-Technology Parks (BTPs) shall be eligible for Status. Applicant shall be categorized depending on his total FOB (FOR for deemed exports) export performance during current plus previous three years (taken together) upon exceeding limit given below. For Export House (EH) Status, export performance is necessary in at least two out of four years (i.e., current plus previous three years).

Export House (EH) 20 Star Export House (SEH) 100 Trading House (TH) 500 Star Trading House (STH) 2500 Premier Trading House (PTH) 10000

EXPORT AND TRADING HOUSES

A Status Holder shall be eligible for following facilities:

Authorisation and Customs clearances for both imports and exports on self-declaration basis; Fixation of Input-Output norms on priority within 60 days; Exemption from compulsory negotiation of documents through banks. Remittance / Receipts, however, would be received through banking channels; 100% retention of foreign exchange in EEFC account; Enhancement in normal repatriation period from 180 days to 360 days; Exemption from furnishing of Bank Guarantee in Schemes under FTP; and SEHs and above shall be permitted to establish Export Warehouses, as per DoR guidelines. For status holders, a decision on conferring of ACP Status shall be communicated by Customs within 30 days from receipt of application with Customs. As an option, for Premier Trading House (PTH), the average level of exports under EPCG Scheme shall be the arithmetic mean of export performance in last 5 years, instead of 3 years.

FOCUS MARKET SCHEME (FMS)

Objective is to offset high freight cost and other externalities to select international markets with a view to enhance our export competitiveness in these countries. Exporters of all products to notified countries (as in Appendix 37C of HBP v1) shall be entitled for Duty Credit scrip equivalent to 2.5% of FOB value of exports for each licensing year commencing from 1st April, 2006. However New additional Markets notified in Appendix 37C of HBP v1 shall be entitled for Duty Credit scrip on exports w.e.f 1.4.2008.

HIGH-TECH PRODUCTS EXPORT PROMOTION SCHEME (HTPEPS)

Objective is to incentivise export of High Technology products. Exports of High Technology products (as notified in Appendix 37E of HBP v1) in free foreign exchange to all countries, shall be entitled for Duty Credit Scrip equivalent to:

Exporter may opt for either (a) or (b) above. However, applicants with nil exports in base year shall not be eligible. 3.11.2.1 Exports made by EOUs / EHTPs / BTPs who do not avail direct tax benefits / exemption shall be eligible, provided the same is not covered under paragraph 3.11.4.

1.25 % of FOB value of exports; or 5% of incremental growth in FOB value (realized as per BRC/FIRC) of exports of notified products for current year (i.e., 2008-09) over previous year (i.e., 2007-08) (all taken together) and similarly for each subsequent licensing year.

FIEO-INDIAs PREMIER INSTITUTION FOR INTERNATIONAL TRADE Set up in October, 1965, the Federation, popularly known as FIEO, has kept pace with the countrys evolving economic and trade policies, and has been providing the content, direction and thrust to Indias expanding international trade.

As the apex body of all Indian export promotion organisations, FIEO acts as an interface between the Govt. and trade to promote exports. Its members, largely comprising of professional exporting firms viz. Government recognised Star Export Houses, besides consultancy & contracting firms; service exporting firms contribute around 70 per cent of the total exports of India. FIEO represents directly or indirectly, all exporters of India. FIEO members Export a wide spectrum of products. To any foreign investor, user or seller, FIEO is the one-stop organisation which acts as match maker. FIEO is registered with UNCTAD as a national non-Government organisation, and has direct access to information / data originating from UN bodies and world agencies like the IMF, ADB, ESCAP, WORLD BANK, FAO, UNIDO and others. FIEO has bilateral arrangements for exchange of information as well as for liasioning with several overseas chambers of commerce, trade & industrial associations.

WHAT FIEO SPECIFICALLY ACHIEVES

POSTED WITH

LATEST DEVELOPMENTS IN EXPORT/IMPORT DEVELOPMENTS ORGANISING SEMINARS / OPEN HOUSES / INTERACTIVE SESSIONS WORKSHOPS / TRAINING PROGRAMMES SPONSORING TRADE DELEGATIONS INVITING DELEGATIONS ORGANISING BUYERS-SELLERS MEET IN INDIA AND ABROAD.

PROVIDING ADVISORY SERVICES CONSTANT INTERACTION BETWEEN MEMBER EXPORTERS AND VARIOUS GOVERNMENT DEPARTMENTS

WHAT FIEO DOES

Wider exchange of views between allied industries in the public as well as the private sectors; Apprising all concerned bodies on status of exports; Monitoring the effects of Government policies on ExportsImports; Interacting with the Government on behalf of the exporting community. IT FULFILS THE ABOVE BY- Sending representations on policy matters to Central and State (Regional) Governments Providing a wide range of services designed to help member companies; Creating and setting up contacts between Government and Commercial bodies both in India and overseas.

BENEFITS OF FIEO MEMBERSHIP

As a member of FIEO, you virtually involve yourself in the national export promotion efforts. Any general / specific issues impeding in your export promotional efforts would be taken up with authorities concerned for possible reddressal. Every member gets a free issue of FIEOs monthly trade bulletin, FIEO News, which carries reports of latest activities and programmes, as well as trade developments; FIEOs versatile website www.fieo.com OR www.fieo.org - offers members direct access to buyers around the world, and helps buyers abroad to home in precisely on members of their interest. In addition, the website offers a regular weekly Chat Service with Director General, FIEO, where members can seek clarifications, advice and guidance on international trade related issues.

You might also like

- 57427bos46506mod4cp8 U2 PDFDocument43 pages57427bos46506mod4cp8 U2 PDFAmnNo ratings yet

- TB ch07Document31 pagesTB ch07ajaysatpadi100% (1)

- Duty Entitlement Pass BookDocument3 pagesDuty Entitlement Pass BookSunail HussainNo ratings yet

- EU: Articles of Stationery - Market Report. Analysis and Forecast To 2020Document9 pagesEU: Articles of Stationery - Market Report. Analysis and Forecast To 2020IndexBox MarketingNo ratings yet

- Advance LicenceDocument42 pagesAdvance LicenceAnoop NautiyalNo ratings yet

- Export Promotion SchemesDocument45 pagesExport Promotion Schemesasifanis100% (1)

- Authorisation Is Issued To Allow Duty Free Import of InputsDocument8 pagesAuthorisation Is Issued To Allow Duty Free Import of InputsHirdayesh VermaNo ratings yet

- Export.... 2012Document15 pagesExport.... 2012adiNo ratings yet

- Exim PolicyDocument5 pagesExim PolicyRavi_Kumar_Gup_7391No ratings yet

- A Brief Note On Export Promotion Capital Goods Scheme (EPCG Scheme) - Taxguru - inDocument6 pagesA Brief Note On Export Promotion Capital Goods Scheme (EPCG Scheme) - Taxguru - inshailendraNo ratings yet

- Export Incentive AbhishekDocument7 pagesExport Incentive Abhishekpramodbms1369No ratings yet

- Epcg Scheme: (Export Promotion Capital Goods (EPCG) )Document18 pagesEpcg Scheme: (Export Promotion Capital Goods (EPCG) )Milna JosephNo ratings yet

- Post ExpotDocument8 pagesPost ExpotaditibrijptlNo ratings yet

- EPCGDocument10 pagesEPCGJay PatelNo ratings yet

- Duty ExemptionDocument49 pagesDuty ExemptionPaul013No ratings yet

- Customs Law and ProceduresDocument12 pagesCustoms Law and ProceduresSunilkumar Sunil KumarNo ratings yet

- Export Promotion Capital Goods Scheme PresentationDocument32 pagesExport Promotion Capital Goods Scheme PresentationDakshata SawantNo ratings yet

- Duty Exemption Scheme: Prestige Institute of Management and Research, IndoreDocument14 pagesDuty Exemption Scheme: Prestige Institute of Management and Research, IndoreSatyam SharmaNo ratings yet

- Export Management: Module 8/9Document84 pagesExport Management: Module 8/9Sheikh YajidulNo ratings yet

- Export Promotion Capital Goods (Epcg) Scheme: Submitted By: Rama Sangal Mba, Ib-Sec B A1802010277Document21 pagesExport Promotion Capital Goods (Epcg) Scheme: Submitted By: Rama Sangal Mba, Ib-Sec B A1802010277Khushi Sagar AhujaNo ratings yet

- Various Schemes Like EOUDocument14 pagesVarious Schemes Like EOUranger_passionNo ratings yet

- FTP 2Document13 pagesFTP 2Sachi Bani PerharNo ratings yet

- Advance Authorization SchemeDocument3 pagesAdvance Authorization SchemeganeshNo ratings yet

- FMS, FPS, MLFPS Schemes & Documents Reqd.Document7 pagesFMS, FPS, MLFPS Schemes & Documents Reqd.bibhas1No ratings yet

- Type Shipping Bill: 1. Duty Entitlement Pass BookDocument12 pagesType Shipping Bill: 1. Duty Entitlement Pass BookSuraj KanhaiyNo ratings yet

- DEPB SchemeDocument4 pagesDEPB SchemeHarshada PawarNo ratings yet

- Deec DepbDocument2 pagesDeec DepbKalpesh ThakerNo ratings yet

- Export & Import Management FinalDocument15 pagesExport & Import Management FinalNisha MenonNo ratings yet

- Foreign Trade Policy, 2009-14Document13 pagesForeign Trade Policy, 2009-14Niraj PatelNo ratings yet

- Free Trade Zones (FTZ) : Electronics Computer HardwareDocument3 pagesFree Trade Zones (FTZ) : Electronics Computer HardwareMansi0% (1)

- Circular No. 11 /2009-CusDocument6 pagesCircular No. 11 /2009-CusrpadmakrishnanNo ratings yet

- FTP 2015-20Document30 pagesFTP 2015-20chandrajeet yadavNo ratings yet

- Com.Document24 pagesCom.MALAYALY100% (1)

- EpcgDocument6 pagesEpcgWajid AliNo ratings yet

- EPCGDocument18 pagesEPCGAaditya MathurNo ratings yet

- Duty DrawbackDocument9 pagesDuty DrawbackshubhamNo ratings yet

- Chapter-5 Export Promotion Capital Goods Scheme EPCG SchemeDocument4 pagesChapter-5 Export Promotion Capital Goods Scheme EPCG SchemePankaj ChaudhariNo ratings yet

- Siam Indian Auto IndustryDocument40 pagesSiam Indian Auto IndustryAtul BansalNo ratings yet

- Export Promotion and Incentives: International Marketing Marzieh Arianfar Bims-University of Mysore APRIL 2013Document21 pagesExport Promotion and Incentives: International Marketing Marzieh Arianfar Bims-University of Mysore APRIL 2013Jai KeerthiNo ratings yet

- Procedural & Documentary Formalities (As Per Import Policy) FORDocument21 pagesProcedural & Documentary Formalities (As Per Import Policy) FORSamrita SinghNo ratings yet

- Export IncentivesDocument3 pagesExport IncentivesmahavirjainNo ratings yet

- Deemed ExportsDocument3 pagesDeemed ExportsHimanshuAgrawalNo ratings yet

- Customs SchemesDocument4 pagesCustoms Schemesshreyans singhNo ratings yet

- Highlight 09Document5 pagesHighlight 09nadeem549No ratings yet

- Dfia SchemeDocument11 pagesDfia SchemeSaurabh शास्त्रीNo ratings yet

- Current Trends and Govt ActionsDocument3 pagesCurrent Trends and Govt ActionsRohit RoyNo ratings yet

- C CC CCCCC CCCC C CCC C CCCCCCCC C!CCDocument10 pagesC CC CCCCC CCCC C CCC C CCCCCCCC C!CCravi_umang2001No ratings yet

- FAQ2Document27 pagesFAQ2Neeraj VohraNo ratings yet

- Duty Drawback India Presentation 2003Document10 pagesDuty Drawback India Presentation 2003dinkar13375No ratings yet

- India Export PromotionDocument8 pagesIndia Export PromotionUdit PradeepNo ratings yet

- Duty Drawback Scheme: Hemen Ruparel 1Document11 pagesDuty Drawback Scheme: Hemen Ruparel 1Ritu JainNo ratings yet

- Regulatory Requirements For ExportsDocument57 pagesRegulatory Requirements For Exportslaponad628No ratings yet

- Scheme 1Document19 pagesScheme 1Jayesh ValwarNo ratings yet

- Epcg and Sez BenefitsDocument2 pagesEpcg and Sez BenefitsRajiv GuptaNo ratings yet

- Presentation ON The Customs Act, 1962, and The Customs Tariff Act, 1975Document32 pagesPresentation ON The Customs Act, 1962, and The Customs Tariff Act, 1975ClanlordNo ratings yet

- Export House, Trading House, Star Trading House and Super Star Trading HouseDocument15 pagesExport House, Trading House, Star Trading House and Super Star Trading HouseUlsasiNo ratings yet

- Import of Capital GoodsDocument24 pagesImport of Capital GoodsPranav KumarNo ratings yet

- Selection of Best Suited Scheme Under FTP - PUNE - ICAIDocument41 pagesSelection of Best Suited Scheme Under FTP - PUNE - ICAIpramodmurkya13No ratings yet

- Documents Availing For Export IncentivesDocument13 pagesDocuments Availing For Export IncentivesArun MannaNo ratings yet

- China's ExportDocument84 pagesChina's ExportCurieHNo ratings yet

- Performance Task ImperialismDocument2 pagesPerformance Task ImperialismSandra MouaNo ratings yet

- 33 PDFDocument144 pages33 PDFkushalNo ratings yet

- Invoice FedexDocument5 pagesInvoice FedexThisisme Nguyen Thanh ThuongNo ratings yet

- 6 The Circular Flow of Economic ActivityDocument16 pages6 The Circular Flow of Economic Activityrommel legaspiNo ratings yet

- Export ProcedureDocument42 pagesExport Procedurevenkataswamynath channa85% (13)

- What Is Biggest Import From China To India - and How To Import From China To India - QuoraDocument33 pagesWhat Is Biggest Import From China To India - and How To Import From China To India - Quoraemail2priyanNo ratings yet

- Impact of Food Technology On The Economy of PakistanDocument2 pagesImpact of Food Technology On The Economy of PakistanM Zahid Gondal100% (5)

- Facilities Provided by Bank To Export and Import: A Project Report OnDocument70 pagesFacilities Provided by Bank To Export and Import: A Project Report OnVinidra WattalNo ratings yet

- Pon Sanger ExportsDocument11 pagesPon Sanger ExportsTaruna BhadanaNo ratings yet

- Procedure and Steps Involved in Import of GoodsDocument13 pagesProcedure and Steps Involved in Import of GoodsDevNo ratings yet

- An Overview of Textile Industry in India - Textile LearnerDocument4 pagesAn Overview of Textile Industry in India - Textile LearnerRSBALAKUMARNo ratings yet

- Chapter 7 International StrategyDocument16 pagesChapter 7 International StrategyTamara PutriNo ratings yet

- Import ExportDocument23 pagesImport ExportManish Dev PatelNo ratings yet

- User Guide Market Access MapDocument54 pagesUser Guide Market Access MaprudyNo ratings yet

- BBP Document EximDocument23 pagesBBP Document EximSantosh BeheraNo ratings yet

- Portuguese Attempts at Monopoly On The Upper Guinea Coast 1580-1650 - by Waltner Rodney (1965)Document17 pagesPortuguese Attempts at Monopoly On The Upper Guinea Coast 1580-1650 - by Waltner Rodney (1965)AbuAbdur-RazzaqAl-MisriNo ratings yet

- Brazil As An Export Economy, 1880-1930Document36 pagesBrazil As An Export Economy, 1880-1930Alexandre Freitas100% (1)

- Anti Dumping CaseDocument5 pagesAnti Dumping CaseKate PamularNo ratings yet

- Goods & Services Tax (GST) Supply - Time, Place and Value: Concurrent Session 1DDocument23 pagesGoods & Services Tax (GST) Supply - Time, Place and Value: Concurrent Session 1Damighul_saharNo ratings yet

- Export GuideDocument107 pagesExport GuideanujbirjuNo ratings yet

- Country Profile - BrazilDocument19 pagesCountry Profile - BrazilSSBaughNo ratings yet

- LessonPlan PDFDocument9 pagesLessonPlan PDFvlabrague6426No ratings yet

- Economica Analysis Almond IndustryDocument13 pagesEconomica Analysis Almond IndustryGinger SevillaNo ratings yet

- The Craft Industry Dec 2008Document29 pagesThe Craft Industry Dec 2008kimmisharmaNo ratings yet

- Chap 5 Identifying and Analyzing Domestic and International OpportunitiesDocument33 pagesChap 5 Identifying and Analyzing Domestic and International Opportunitiesanilyram100% (1)

- Derek H. Aldcroft - The Development of British Industry and Foreign Competition, 1875-1914-University of Toronto Press (2018)Document383 pagesDerek H. Aldcroft - The Development of British Industry and Foreign Competition, 1875-1914-University of Toronto Press (2018)Inda Fernandez100% (1)

- Commercial Policy: Chapter# 4Document24 pagesCommercial Policy: Chapter# 4Alamgir KhanNo ratings yet