Practice Questions

Uploaded by

michmagsalinPractice Questions

Uploaded by

michmagsalinFINS 1613 Practice Questions 1

SCHOOL OF BANKING AND FINANCE

FINS1613 BUSINESS FINANCE

PRACTICE QUESTIONS

Note in some of these questions it may be possible to use tables instead of calculating the values

directly.

1. What is the corporate objective?

a. To maximise capital

b. To maximise shareholder wealth

c. To minimise capital

d. To minimise shareholder wealth

e. To minimise shareholder risk

2. Which of the following actions are likely to reduce agency conflicts between stockholders and

managers?

a. Paying managers a large fixed salary.

b. Increasing the threat of corporate takeover.

c. Placing restrictive covenants in debt agreements.

d. All of the statements above are correct.

e. Statements b and c are correct.

3. Which of the following statements is most correct?

a. The proper goal of the financial manager should be to maximize the firm's expected cash

flow, because this will add the most wealth to each of the individual shareholders (owners)

of the firm.

b. One way to state the decision framework most useful for carrying out the firm's objective

is as follows: "The financial manager should seek that combination of assets, liabilities, and

capital that will generate the largest expected projected after-tax income over the relevant

time horizon."

c. The riskiness inherent in a firm's earnings per share (EPS) depends on the characteristics

of the projects the firm selects, which means it depends upon the firm's assets, but EPS does

not depend on the manner in which those assets are financed.

d. Since large, publicly-owned firms are controlled by their management teams, and

typically, ownership is widely dispersed, managers have great freedom in managing the

firm. Managers may operate in stockholders' best interests, but they may also operate in

their own personal best interests. As long as managers stay within the law, there simply

aren't any effective controls over managerial decisions in such situations.

FINS 1613 Practice Questions 2

e. Agency problems exist between stockholders and managers, and between stockholders

and creditors.

4. Which of the following statements is most correct?

a. A 5-year $100 annuity due will have a higher present value than a 5-year $100 ordinary

annuity.

b. A 15-year mortgage will have larger monthly payments than a 30-year mortgage of the

same amount and same interest rate.

c. If an investment pays 10 percent interest compounded annually, its effective rate will also

be 10 percent.

d. Statements a and c are correct.

e. All of the statements above are correct.

5. Which of the following investments will have the highest future value at the end of 5 years?

Assume that the effective annual rate for all investments is the same.

a. A pays $50 at the end of every 6-month period for the next 5 years (a total of 10

payments).

b. B pays $50 at the beginning of every 6-month period for the next 5 years (a total of 10

payments).

c. C pays $500 at the end of 5 years (a total of one payment).

d. D pays $100 at the end of every year for the next 5 years (a total of 5 payments).

e. E pays $100 at the beginning of every year for the next 5 years (a total of 5 payments).

6. Your bank account pays an 8 percent nominal rate of interest. The interest is compounded

quarterly. Which of the following statements is most correct?

a. The periodic rate of interest is 2 percent and the effective rate of interest is 4 percent.

b. The periodic rate of interest is 8 percent and the effective rate of interest is greater than 8

percent.

c. The periodic rate of interest is 4 percent and the effective rate of interest is 8 percent.

d. The periodic rate of interest is 8 percent and the effective rate of interest is 8 percent.

e. The periodic rate of interest is 2 percent and the effective rate of interest is greater than 8

percent.

7. Suppose someone offered you the choice of two equally risky annuities, each paying $10,000 per

year for five years. One is an ordinary (or deferred) annuity, the other is an annuity due. Which of

the following statements is most correct?

a. The present value of the ordinary annuity must exceed the present value of the annuity

due, but the future value of an ordinary annuity may be less than the future value of the

annuity due.

b. The present value of the annuity due exceeds the present value of the ordinary annuity,

while the future value of the annuity due is less than the future value of the ordinary annuity.

c. The present value of the annuity due exceeds the present value of the ordinary annuity,

and the future value of the annuity due also exceeds the future value of the ordinary annuity.

d. If interest rates increase, the difference between the present value of the ordinary annuity

and the present value of the annuity due remains the same.

e. Statements a and d are correct.

8. You deposited $1,000 in a savings account that pays 8 percent interest, compounded quarterly,

planning to use it to finish your last year in college. Eighteen months later, you decide to go to the

FINS 1613 Practice Questions 3

Rocky Mountains to become a ski instructor rather than continue in school, so you close out your

account. How much money will you receive?

a. $1,171

b. $1,126

c. $1,082

d. $1,163

e. $1,008

9. You have the opportunity to buy a perpetuity that pays $1,000 annually. Your required rate of

return on this investment is 15 percent. You should be essentially indifferent to buying or not

buying the investment if it were offered at a price of

a. $5,000.00

b. $6,000.00

c. $6,666.67

d. $7,500.00

e. $8,728.50

10. Assume that you will receive $2,000 a year in Years 1 through 5, $3,000 a year in Years 6

through 8, and $4,000 in Year 9, with all cash flows to be received at the end of the year. If you

require a 14 percent rate of return, what is the present value of these cash flows?

a. $ 9,851

b. $13,250

c. $11,714

d. $15,129

e. $17,353

11. If a 5-year ordinary annuity has a present value of $1,000, and if the interest rate is 10 percent,

what is the amount of each annuity payment?

a. $240.42

b. $263.80

c. $300.20

d. $315.38

e. $346.87

12. Gomez Electronics needs to arrange financing for its expansion program. Bank A offers to lend

Gomez the required funds on a loan in which interest must be paid monthly, and the annual rate is 8

percent. Bank B will charge 9 percent, with interest due at the end of the year. What is the

difference in the effective annual rates charged by the two banks?

a. 0.25%

b. 0.50%

c. 0.70%

d. 1.00%

e. 1.25%

13. Bill plans to deposit $200 into a bank account at the end of every month. The bank account has

a nominal interest rate of 8 percent and interest is compounded monthly. How much will Bill have

in the account at the end of 2 and a half years (30 months)?

a. $ 6,617.77

b. $ 502.50

c. $ 6,594.88

FINS 1613 Practice Questions 4

d. $22,656.74

e. $ 5,232.43

14. You have been offered an investment that pays $500 at the end of every 6 months for the next 3

years. The nominal interest rate is 12 percent; however, interest is compounded quarterly. What is

the present value of the investment?

a. $2,458.66

b. $2,444.67

c. $2,451.73

d. $2,463.33

e. $2,437.56

15. You just put $1,000 in a bank account that pays 6 percent nominal annual interest, compounded

monthly. How much will you have in your account after 3 years?

a. $1,006.00

b. $1,056.45

c. $1,180.32

d. $1,191.00

e. $1,196.68

16. You plan to invest $5,000 at the end of each of the next 10 years in an account that has a 9

percent nominal rate with interest compounded monthly. How much will be in your account at the

end of the 10 years?

a. $ 75,965

b. $967,571

c. $ 84,616

d. $ 77,359

e. $ 80,631

17. Assume that a 10-year bond has a 12 percent annual coupon, while a 15-year bond has an 8

percent annual coupon. The yield curve is flat; all bonds have a 10 percent yield to maturity.

Which of the following statements is most correct?

a. The 10-year bond is selling at a discount, while the 15-year bond is selling at a premium.

b. The 10-year bond is selling at a premium, while the 15-year bond is selling at par.

c. If interest rates decline, the price of both bonds will increase, but the 15-year bond will

have a larger percentage increase in price.

d. If the yield to maturity on both bonds remains at 10 percent over the next year, the price

of the 10-year bond will increase, but the price of the 15-year bond will fall.

e. Statements c and d are correct.

18. A 12-year bond has an annual coupon rate of 9 percent. The coupon rate will remain fixed until

the bond matures. The bond has a yield to maturity of 7 percent. Which of the following

statements is most correct?

a. The bond is currently selling at a price below its par value.

b. If market interest rates decline today, the price of the bond will also decline today.

c. If market interest rates remain unchanged, the bond's price one year from now will be

lower than it is today.

d. All of the statements above are correct.

e. None of the statements above is correct.

FINS 1613 Practice Questions 5

19. A bond with 6 years to maturity and sells at par has an 8 percent semi-annual coupon (that is,

the bond pays a $40 coupon every six months). Another bond of equal risk and maturity pays 8

percent interest annually. Both bonds are non-callable and have face values of $1,000. What is the

price of the bond that pays annual interest?

a. $689.08

b. $712.05

c. $980.43

d. $986.72

e. $992.64

20. What annually compounded rate is equivalent to an interest rate of 12% compounded monthly?

a. 12.36

b. 12.55

c. 12.68

d. 12.73

e. 12.75

21. A stock's dividend is expected to grow at a constant rate of 5 percent a year. Which of the

following statements is most correct?

a. The expected return on the stock is 5 percent a year.

b. The stock's dividend yield is 5 percent.

c. The stock's price one year from now is expected to be 5 percent higher.

d. Statements a and c are correct.

e. All of the statements above are correct.

You are given the following information Bridges & Associates. Use this information for the next

two questions, numbers 22 and 23.

Bridges & Associates' stock is expected to pay a $0.75 per-share dividend at the end of the year.

The dividend is expected to grow 25 percent the next year and 35 percent the following year. After

t =3, the dividend is expected to grow at a constant rate of 6 percent a year. The company's cost of

common equity is 10 percent and it is expected to remain constant.

22. Refer to Bridges & Associates. What is the expected price of the stock today?

a. $18.75

b. $27.61

c. $30.77

d. $34.50

e. $35.50

23. Refer to Bridges & Associates. What is the expected price of the stock 10 years from today?

a. $47.58

b. $49.45

c. $50.43

d. $53.46

e. $55.10

24. Next year, ABC group will have earnings per share of $4. It expects to plowback 60% of its

earnings to fund new projects which offer a return on equity of 20%. If its required return is 16%,

what should be its current stock price?

a. $10

FINS 1613 Practice Questions 6

b. $20

c. $30

d. $40

e. $50

25. Assume a project has normal cash flows (that is, the initial cash flow is negative, and all other

cash flows are positive). Which of the following statements is most correct?

a. All else equal, a project's IRR increases as the cost of capital declines.

b. All else equal, a project's NPV increases as the cost of capital declines.

c. All else equal, a project's MIRR is unaffected by changes in the cost of capital.

d. Statements a and b are correct.

e. Statements b and c are correct.

26. Sacramento Paper is considering two mutually exclusive projects. Project A has an internal rate

of return (IRR) of 12 percent, while Project B has an IRR of 14 percent. The two projects have the

same risk, and when the cost of capital is 7 percent the projects have the same net present value

(NPV). Assume each project has an initial cash outflow followed by a series of inflows. Given this

information, which of the following statements is most correct?

a. If the cost of capital is 13 percent, Project B's NPV will be higher than Project A's NPV.

b. If the cost of capital is 9 percent, Project B's NPV will be higher than Project A's NPV.

c. If the cost of capital is 9 percent, Project B's modified internal rate of return (MIRR) will

be less than its IRR.

d. Statements a and c are correct.

e. All of the statements above are correct.

27. Two projects being considered by a firm are mutually exclusive and have the following

projected cash flows:

Year Project A Cash Flow Project B Cash Flow

0 -$100,000 -$100,000

1 39,500 0

2 39,500 0

3 39,500 133,000

Based only on the information given, which of the two projects would be preferred, and why?

a. Project A, because it has a higher IRR.

b. Project B, because it has a higher IRR.

c. Indifferent, because the projects have equal IRRs.

d. Include both in the capital budget, since the sum of the cash inflows exceeds the initial

investment in both cases.

e. Choose neither, since their NPVs are negative.

You are given the following information Garcia Paper. Use this information for the next four

questions, numbers 28, 29, 30 and 31.

Garcia Paper is deciding whether to build a new plant. The proposed project would have an up-

front cost (at t =0) of $30 million. The project's cost can be depreciated on a straight-line basis

over three years. Consequently, the depreciation expense will be $10 million in each of the first

three years, t =1, 2, and 3. Even though the project is depreciated over three years, the project has

an economic life of five years.

The project is expected to increase the company's sales by $20 million. Sales will remain at this

higher level for each year of the project (t =1, 2, 3, 4, and 5). The operating costs, not including

FINS 1613 Practice Questions 7

depreciation, equal 60 percent of the increase in annual sales. The project's interest expense is $5

million per year and the company's tax rate is 40 percent. The company is very profitable, so any

accounting losses on this project can be used to reduce the company's overall tax burden. The

project does not require any additions to net operating working capital. The company estimates that

the project's after-tax salvage value at t =5 will be $1.2 million. The project is of average risk, and,

therefore, the CFO has decided to discount the operating cash flows at the company's overall

weighted average cost of capital of 10 percent. However, the salvage value is more uncertain, so

the CFO has decided to discount it at 12 percent.

28. Refer to Garcia Paper. What is the operating cash flows in year 1?

a. $2.4 million

b. $3.2 million

c. $4.8 million

d. $6.0 million

e. $8.8 million

29. Refer to Garcia Paper. What is the operating cash flows in year 5?

a. $2.4 million

b. $3.2 million

c. $4.8 million

d. $6.0 million

e. $8.8 million

30. Refer to Garcia Paper. What is the present value of the projects after-tax salvage value?

a. $0.4272 million

b. $0.6809 million

c. $0.7451 million

d. $1.2 million

e. $2.4 million

31. Refer to Garcia Paper. What is the net present value (NPV) of the entire proposed project?

a. $11.86 million

b. $14.39 million

c. -$26.04 million

d. -$12.55 million

e. -$ 1.18 million

You are given the following information Bucholz Brands. Use this information for the next two

questions, numbers 32 and 33.

Bucholz Brands is considering the development of a new ketchup product. The ketchup will be

sold in a variety of different colours and will be marketed to young children. In evaluating the

proposed project, the company has collected the following information:

The company estimates that the project will last for four years.

The company will need to purchase new machinery that has an up-front cost of $300 million

(incurred at t =0). At t =4, the machinery has an estimated salvage value of $50 million.

The machinery will be depreciated on a 4-year straight-line basis.

Production on the new ketchup product will take place in a recently vacated facility that the

company owns. The facility is empty and Bucholz does not intend to lease the facility.

The project will require a $60 million increase in inventory at t =0. The company expects

that its accounts payable will rise by $10 million at t =0. After t =0, there will be no changes in

FINS 1613 Practice Questions 8

net operating working capital, until t =4 when the project is completed, and the net operating

working capital is completely recovered.

The company estimates that sales of the new ketchup will be $200 million each of the next

four years.

The operating costs, excluding depreciation, are expected to be $100 million each year.

The company's tax rate is 40 percent.

The project's WACC is 10 percent.

32. Refer to Bucholz Brands. What is the project's after-tax operating cash flow the first year (t =

1)?

a. $22.5 million

b. $45.0 million

c. $60.0 million

d. $72.5 million

e. $90.0 million

33. Refer to Bucholz Brands. What is the project's estimated net present value (NPV)?

a. -$10.07 million

b. -$25.92 million

c. -$46.41 million

d. -$60.07 million

e. +$ 5.78 million

34. Whalen Maritime Research Inc. regularly takes real options into account when evaluating its

proposed projects. Specifically, Whalen considers the option to abandon a project whenever it turns

out to be unsuccessful (the abandonment option). In addition, it usually evaluates whether it makes

sense to invest in a project today or whether to wait to collect more information (the investment

timing option). Assume the proposed projects can be abandoned at any time without penalty.

Which of the following statements is most correct?

a. The abandonment option tends to reduce a project's NPV.

b. The abandonment option tends to reduce a project's risk.

c. If there are important first-mover advantages, this tends to increase the value of waiting a

year to collect more information before proceeding with a proposed project.

d. Statements a and b are correct.

e. All of the statements above are correct.

You are given the following information Diplomat.com. Use this information for the next two

questions, numbers 35 and 36.

Diplomat.com is considering a project that has an up-front cost of $3 million and produces an

expected cash flow of $500,000 at the end of each of the next five years. The project's cost of

capital is 10 percent.

35. Refer to Diplomat.com. Based on this information what is the project's net present value?

a. -$ 875,203

b. -$ 506,498

c. $ 54,307

d. -$1,104,600

e. $ 105,999

FINS 1613 Practice Questions 9

36. Refer to Diplomat.com. If Diplomat goes ahead with this project today, the project will create

additional opportunities five years from now (t =5). The company can decide at t =5 whether or

not it wants to pursue these additional opportunities. Based on the best information that is available

today, the company estimates that there is a 35 percent chance that its technology will be successful,

in which case the future investment opportunities will have a net present value of $6 million at t =5.

There is a 65 percent chance that its technology will not succeed, in which case the future

investment opportunities will have a net present value of -$6 million at t =5. Diplomat.com does

not have to decide today whether it wants to pursue these additional opportunities. Instead, it can

wait until after it finds out if its technology is successful. However, Diplomat.com cannot pursue

these additional opportunities in the future unless it makes the initial investment today. What is the

estimated net present value of the project, after taking into account the future opportunities?

a. $ 199,342

b. $ 561,947

c. $ 898,205

d. -$1,104,600

e. -$2,222,265

37. Dumpty Inc is comparing the operating costs of two types of equipment

- Model A costs $50,000 and will have a useful life of 4 years. Operating costs are expected to

be $4,000 per year.

- Model B costs $90,000 and will have a useful life of 6 years. Its operating costs are expected

to be $2,500 per year.

Both models will be able to operate at the same level and quality of output and generate the same

cash flows. The applicable discount rate is 8 percent.

What annual cost saving will Dumpty achieve if it purchases the cheaper model?

a. $ 38.31

b. $ 410.30

c. $2,872.14

d. $3,665.34

e. $6,127.39

38. Which of the following statements is most correct? (Assume that the risk-free rate remains

constant.)

a. If the market risk premium increases by 1 percentage point, then the required return on all

stocks will rise by 1 percentage point.

b. If the market risk premium increases by 1 percentage point, then the required return will

increase for stocks that have a beta greater than 1.0, but it will decrease for stocks that have

a beta less than 1.0.

c. If the market risk premium increases by 1 percentage point, then the required return will

increase by 1 percentage point for a stock that has a beta equal to 1.0.

d. Statements a and c are correct.

e. None of the statements above is correct.

39. Stock X has a beta of 0.5 and stock Y has a beta of 1.5. Which of the following statements is

most correct?

a. Stock Ys return this year will be higher than stock Xs return.

b. Stock Ys return has a higher standard deviation than stock X.

c. If expected inflation increases (but the market risk premium is unchanged), the required

returns on the two stocks will increase by the same amount.

FINS 1613 Practice Questions 10

d. If the market risk premium declines (leaving the risk-free rate unchanged), stock X will

have a larger decline in its required return than will stock Y.

e. If you invest $50,000 in stock X and $50,000 in stock Y, your portfolio will have a beta

less than 1.0, provided the stock returns on the two stocks are not perfectly correlated.

40. Which of the following is not a difficulty concerning beta and its estimation?

a. Sometimes a security or project does not have a past history that can be used as a basis for

calculating beta.

b. Sometimes, during a period when the company is undergoing a change such as toward

more leverage or riskier assets, the calculated beta will be drastically different than the

true or expected future beta.

c. The beta of an average stock or the market can change over time, sometimes

drastically.

d. Sometimes the past data used to calculate beta do not reflect the likely risk of the firm for

the future because conditions have changed.

41. A money manager is holding a $10 million portfolio that consists of the following five stocks:

Stock Amount Invested Beta

A $4 million 1.2

B 2 million 1.1

C 2 million 1.0

D 1 million 0.7

E 1 million 0.5

The portfolio has a required return of 11 percent, and the market risk premium (k

M

k

RF

) is 5

percent. What is the required return on Stock C?

a. 7.2%

b. 10.0%

c. 10.9%

d. 11.0%

e. None of these answers

42. A money manager is holding the following portfolio:

Stock Amount Invested Beta

1 $300,000 0.6

2 300,000 1.0

3 500,000 1.4

4 500,000 1.8

The risk-free rate is 6 percent and the portfolios required rate of return is 12.5 percent. The

manager would like to sell all of her holdings of Stock 1 and use the proceeds to purchase more

shares of Stock 4. What would be the portfolios required rate of return following this change?

a. 13.63%

b. 10.29%

c. 11.05%

d. 12.52%

e. 14.33%

43. An analyst has estimated how a particular stocks return will vary depending on what will

happen to the economy

FINS 1613 Practice Questions 11

State of economy Prob. of occurring E(r) if the state occurs

Recession 0.1 -60%

Below average 0.2 -10%

Average 0.4 15%

Above average 0.2 40%

Boom 0.1 90%

What is the coefficient of variation (defined to be the standard deviation divided by the expected

value) on the companys stock?

a. 2.121

b. 2.201

c. 2.472

d. 3.334

e. 3.727

44. Which of the following statements is most correct?

a. If a companys tax rate increases but the yield to maturity of its noncallable bonds

remains the same, the companys marginal cost of debt capital used to calculate its weighted

average cost of capital will fall.

b. All else equal, an increase in a companys stock price will increase the marginal cost of

retained earnings, ks.

c. All else equal, an increase in a companys stock price will increase the marginal cost of

issuing new common equity, ke.

d. Statements a and b are correct.

e. Statements b and c are correct.

45. Which of the following statements is most correct?

a. In the weighted average cost of capital calculation, we must adjust the cost of preferred

stock for the tax exclusion of 70% of dividend income.

b. We ideally would like to use historical measures of the component costs from prior

financings in estimating the appropriate WACC.

c. The cost of a new equity issuance could possibly be lower than the cost of retained

earnings if the market risk premium and risk-free rate decline by a substantial amount.

d. Statements b and c are correct.

e. None of the statements above is correct.

46. The Barabas Company has an equal amount of low-risk projects, average-risk projects, and

high-risk projects. Barabas estimates that the overall companys WACC is 12%. This is also the

correct cost of capital for the companys average-risk projects. The companys CFO argues that,

even though the companys projects have different risks, the cost of capital for each project should

be the same because the company obtains its capital from the same sources. If the company follows

the CFOs advice, what is likely to happen over time?

a. The company will take on too many low-risk projects and reject too many high-risk

projects.

b. The company will take on too many high-risk projects and reject too many low-risk

projects.

c. Things will generally even out over time, therefore the risk of the firm should remain

constant over time.

d. Statements a and c are correct.

e. Statements b and c are correct.

FINS 1613 Practice Questions 12

47. Halls Corp. wants to calculate its WACC. The companys CFO has collected the following

information: The companys long-term bonds currently offer a yield to maturity of 8%. The

companys stock price is $32 per share. The companys recently paid a dividend of $2 per share.

The dividend is expected to grow at a constant rate of 6% per year. The company pays 10%

flotation cost whenever it issues new common stock. The companys target capital structure is 75%

equity and 25% debt. The companys tax rate is 40%. The firm will be able to use retained

earnings to fund the equity portion of its capital budget. What is the companys WACC?

a. 10.67%

b. 11.22%

c. 11.47%

d. 12.02%

e. 12.56%

48. Assume you are the director of capital budgeting for an all-equity firm. The firms current cost

of equity is 16%. The risk-free rate and the market risk premium are 10% and 5% respectively.

You are considering a new project that has 50% more beta risk than your firms assets currently

have. The expected return on the new project is 18%. Should the project be accepted if beta risk is

the appropriate measure?

a. Yes, its expected return is greater than the firms cost of capital.

b. Yes, the projects risk-adjusted required return is less than its expected return.

c. No, a 50% increase in beta risk gives risk-adjusted required return of 24%.

d. No, the projects risk-adjusted required return is 2% above its expected return.

e. No, the projects risk-adjusted required return is 1% above its expected return.

49. J ones Co. currently is 100 percent equity financed. The company is considering changing its

capital structure. More specifically, J ones' CFO is considering a recapitalization plan in which the

firm would issue long-term debt with a yield of 9 percent and use the proceeds to repurchase

common stock. The recapitalization would not change the company's total assets nor would it affect

the company's basic earning power, which is currently 15 percent. The CFO estimates that the

recapitalization will reduce the company's WACC and increase its stock price. Which of the

following is also likely to occur if the company goes ahead with the planned recapitalization?

a. The company's net income will increase.

b. The company's earnings per share will decrease.

c. The company's cost of equity will increase.

d. The company's ROA will increase.

e. The company's ROE will decrease.

50. A consultant has collected the following information regarding Young Publishing:

Total assets $3,000 million Tax rate 40%

Operating income (EBIT) $800 million Debt ratio 0%

Interest expense $0 million WACC 10%

Net income $480 million M/B ratio 1.00

Share price $32.00 EPS =DPS $3.20

The company has no growth opportunities (g =0), so the company pays out all of its earnings as

dividends (EPS =DPS). Young's stock price can be calculated by simply dividing earnings per

share by the required return on equity capital, which currently equals the WACC because the

company has no debt.

FINS 1613 Practice Questions 13

The consultant believes that the company would be much better off if it were to change its capital

structure to 40 percent debt and 60 percent equity. After meeting with investment bankers, the

consultant concludes that the company could issue $1,200 million of debt at a before-tax cost of 7

percent, leaving the company with interest expense of $84 million. The $1,200 million raised from

the debt issue would be used to repurchase stock at $32 per share. The repurchase will have no

effect on the firm's EBIT; however, after the repurchase, the cost of equity will increase to 11

percent. If the firm follows the consultant's advice, what will be its estimated stock price after the

capital structure change?

a. $32.00

b. $33.48

c. $31.29

d. $32.59

e. $34.72

51. Which of the following statements is most correct?

a. The bird-in-the-hand theory argues that investors prefer dividends because dividends are

taxed more favourably than capital gains.

b. Stock repurchases increase the number of outstanding shares.

c. The clientele effect can explain why companies tend to vary their dividends a lot on a

year-to-year basis.

d. Statements a and b are correct.

e. None of the statements above is correct.

52. A decrease in a firm's willingness to pay dividends is likely to result from an increase in its

a. Earnings stability.

b. Access to capital markets.

c. Profitable investment opportunities.

d. Collection of accounts receivable.

e. Stock price.

53. Which of the following statements is most correct?

a. The tax preference theory states that, all else equal, investors prefer stocks that pay low

dividends because retained earnings can lead to capital gains that are taxed at a lower rate.

b. An increase in the cost of equity capital (ks) when a company announces an increase in its

dividend per share, would be consistent with the bird-in-the-hand theory.

c. An increase in the stock price when a company decreases its dividend is consistent with

the signaling theory.

d. A dividend policy that involves paying a consistent percentage of net income is the best

policy if the clientele effect is correct.

e. Statements a and d are correct.

54. Which of the following statements is most correct?

a. A firm's business risk is solely determined by the financial characteristics of its industry.

b. The factors that affect a firm's business risk are determined partly by industry

characteristics and partly by economic conditions. Unfortunately, these and other factors

that affect a firm's business risk are not subject to any degree of managerial control.

c. One of the benefits to a firm of being at or near its target capital structure is that financial

flexibility becomes much less important.

d. The firm's financial risk may have both market risk and diversifiable risk components.

e. None of the statements above is correct.

FINS 1613 Practice Questions 14

55. The firm's target capital structure is consistent with which of the following?

a. Maximum earnings per share (EPS).

b. Minimum cost of debt (k

d

).

c. Minimum risk.

d. Minimum cost of equity (k

S

).

e. Minimum weighted average cost of capital (WACC).

56. Flood Motors is an all-equity firm with 200,000 shares outstanding. The company's EBIT is

$2,000,000, and EBIT is expected to remain constant over time. The company pays out all of its

earnings each year, so its earnings per share equals its dividends per share. The company's tax rate

is 40 percent.

The company is considering issuing $2 million worth of bonds (at par) and using the proceeds for a

stock repurchase. If issued, the bonds would have an estimated yield to maturity of 10 percent. The

risk-free rate in the economy is 6.6 percent, and the market risk premium is 6 percent. The

company's beta is currently 0.9, but its investment bankers estimate that the company's beta would

rise to 1.1 if it proceeds with the recapitalization.

Assume that the shares are repurchased at a price equal to the stock market price prior to the

recapitalization. What would be the company's stock price following the recapitalization?

a. $51.14

b. $53.85

c. $56.02

d. $68.97

e. $76.03

57. Which of the following statements is most correct?

a. If you were testing dividend theories and found that a dividend increase resulted in higher

stock prices, then you could rule out all other theories and conclude that the bird-in-the-hand

theory was most consistent with the evidence you found.

b. The clientele effect suggests that investors choose their investments based on firms' past

dividend policies and changes to established dividend policies may be costly to investors.

c. Dividends paid under a residual dividend policy might send conflicting signals to

investors.

d. Statements b and c are correct.

e. All of the statements above are correct.

58. Plato Inc. expects to have net income of $5,000,000 during the next year. Plato's target capital

structure is 35 percent debt and 65 percent equity. The company's director of capital budgeting has

determined that the optimal capital budget for the coming year is $6,000,000. If Plato follows a

residual dividend policy to determine the coming year's dividend, then what is Plato's payout ratio?

a. 38%

b. 42%

c. 58%

d. 33%

e. 22%

59. Which of the following statements is likely to encourage a firm to increase its debt ratio in its

capital structure?

FINS 1613 Practice Questions 15

a. Its sales become less stable over time.

b. Its corporate tax rate declines.

c. Management believes that the firm's stock is overvalued.

d. Statements a and b are correct.

e. None of the statements above is correct.

60. Zippy Pasta Corporation (ZPC) has a constant growth rate of 7 percent. The company retains

30 percent of its earnings to fund future growth. ZPC's expected EPS (EPS1) and ks for various

capital structures are given below. What is the optimal capital structure for ZPC?

Debt/Total Assets Expected EPS k

S

20% $2.50 15.0%

30 3.00 15.5

40 3.25 16.0

50 3.75 17.0

70 4.00 18.0

a. Debt/Total Assets =20%

b. Debt/Total Assets =30%

c. Debt/Total Assets =40%

d. Debt/Total Assets =50%

e. Debt/Total Assets =70%

61. Etchabarren Electronics has made the following forecast for the upcoming year based on the

company's current capitalization:

Interest expense $ 2,000,000

Operating income (EBIT) $20,000,000

Earnings per share $3.60

The company has $20 million worth of debt outstanding and all of its debt yields 10 percent. The

company's tax rate is 40 percent. The company's price earnings (P/E) ratio has traditionally been

12, so the company forecasts that under the current capitalization its stock price will be $43.20 at

year end.

The company's investment bankers have suggested that the company recapitalize. Their suggestion

is to issue enough new bonds at a yield of 10 percent to repurchase 1 million shares of common

stock. Assume that the stock can be repurchased at today's $40 stock price.

Assume that the repurchase will have no effect on the company's operating income; however, the

repurchase will increase the company's dollar interest expense. Also, assume that as a result of the

increased financial risk the company's price earnings (P/E) ratio will be 11.5 after the repurchase.

Given these assumptions, what would be the expected year-end stock price if the company

proceeded with the recapitalization?

a. $48.30

b. $42.56

c. $44.76

d. $40.34

e. $46.90

62. Which of the following statements is most correct?

a. The optimal capital structure minimizes the WACC.

FINS 1613 Practice Questions 16

b. If the after-tax cost of equity financing exceeds the after-tax cost of debt financing, firms

are always able to reduce their WACC by increasing the amount of debt in their capital

structure.

c. Increasing the amount of debt in a firms capital structure is likely to increase the costs of

both debt and equity financing.

d. Statements a and c are correct.

e. Statements b and c are correct.

63. Which of the following statements is most correct?

a. Since debt financing raises the firms financial risk, increasing a companys debt ratio will

always increase the companys WACC.

b. Since debt financing is cheaper than equity financing, increasing a companys debt ratio

will always reduce the companys WACC.

c. Increasing a companys debt ratio will typically reduce the marginal costs of both debt

and equity financing; however, it still may raise the companys WACC.

d. Statements a and c are correct.

e. None of the statements above is correct.

64. Which of the following statements is most correct?

a. The cost of retained earnings is the rate of return stockholders require on a firm's common

stock.

b. The component cost of preferred stock is expressed as k

P

(1 - T)

c. The higher the firm's flotation cost for new common stock, the more likely the firm is to

use preferred stock, which has no flotation cost.

d. All of these answers are correct

e. None of the statements above is correct.

65. Trenton Publishing follows a strict residual dividend policy. All else being equal, which of the

following factors are likely to cause an increase in the firm's per-share dividend?

a. An increase in its net income.

b. The company increases the proportion of equity financing in its target capital structure.

c. An increase in the number of profitable projects that it wants to fund this year.

d. Statements a and b are correct.

e. All of the statements above are correct.

66. Brock Brothers wants to maintain its capital structure that consists of 30 percent debt and 70

percent equity. The company forecasts that its net income this year will be $1,000,000. The

company follows a residual dividend policy and anticipates a dividend payout ratio of 40 percent.

What is the size of the company's capital budget?

a. $ 600,000

b. $ 857,143

c. $1,000,000

d. $1,428,571

e. $2,000,000

67. A decrease in a firm's willingness to pay dividends is likely to result from an increase in its

a. Earnings stability.

b. Access to capital markets.

c. Profitable investment opportunities.

FINS 1613 Practice Questions 17

d. Collection of accounts receivable.

e. Stock price.

68. Trenton Publishing follows a strict residual dividend policy. All else being equal, which of the

following factors are likely to cause an increase in the firm's per-share dividend?

a. An increase in its net income.

b. The company increases the proportion of equity financing in its target capital structure.

c. An increase in the number of profitable projects that it wants to fund this year.

d. Statements a and b are correct.

e. All of the statements above are correct.

69. Imagine that the government has passed a new tax law that reduces long-term capital gains tax

rates from 28 percent to 20 percent. The maximum tax rate for ordinary personal income is 38.6

percent. Which of the following statements is most correct for an investor in a high personal tax

bracket? (Assume the Classical taxation system is in place)

a. The stock of a company that pays high cash dividends and has a dividend reinvestment

plan (DRIP) is a good investment for this individual because he/she will receive more

money that can then be reinvested in the company's stock.

b. A 2-for-1 stock split is announced for a stock that the investor currently holds. The

company had split the stock because the stock price had increased beyond the optimal price

range and is expected to continue to grow. This is good news to the investor because it

means that any gains from increased stock value will be taxed at a new lower long-term

capital gains rate when the stock is sold.

c. One of the companies in the investor's portfolio recently announced that it will embark on

a stock repurchase plan. The lower long-term capital gains tax rate will reduce the investor's

taxes if he/she decides to tender some shares of stock in the company.

d. Statements b and c are correct.

e. All of the statements above are correct.

70. Stock dividends are often used to

a. Increase the firms stock price.

b. Reduce the number of available shares

c. Constrain the firms stock price.

d. All of these answers

e. None of these answers

71. Tarheel Computing's stock was trading at $150 per share before its recent 3-for-1 stock split.

The 3-for-1 split led to a 5 percent increase in Tarheel's market capitalization. (Market

capitalization equals the stock price times the number of shares.) What was Tarheel's price after the

stock split?

a. $472.50

b. $ 50.00

c. $ 47.62

d. $428.57

e. $ 52.50

72. Grant Grocers is considering the following independent, average-risk investment projects:

Project Size of Project Project IRR

Project V $1.0 million 12.0%

Project W 1.2 million 11.5%

FINS 1613 Practice Questions 18

Project X 1.2 million 11.0%

Project Y 1.2 million 10.5%

Project Z 1.0 million 10.0%

The company has a target capital structure that consists of 50 percent debt and 50 percent equity.

Its after-tax cost of debt is 8 percent, its cost of equity is estimated to be 13.5 percent, and its net

income is $2.5 million. If the company follows a residual dividend policy, what will be its payout

ratio?

a. 12%

b. 32%

c. 54%

d. 66%

e. 100%

73. You are an Australian resident taxpayer and you have just received a dividend cheque for

$1,400 from Telstra Corporation. The dividend is fully franked and carries franking credits at the

corporate rate of tax of 30%. If your personal tax rate is 46 percent in your next tax return you will,

as a consequence of this dividend:

a. Receive a tax refund of $600

b. Have to pay additional tax of $320

c. Have to pay additional tax of $224

d. There are no taxes on fully franked dividends.

e. None of the above.

Answers

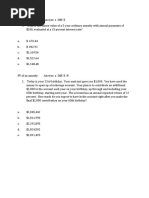

1. Answer is b.

2. Answer is b.

Corporate takeovers are most likely to occur when a firm is underperforming. Managers who fear

losing their jobs will try to maximize shareholder wealth. The other statements are false. Statement

a will exacerbate the agency conflict, while statement c reduces the agency conflict between

stockholders and bondholders.

3. Answer is e.

4. Answer is e.

5. Answer is e.

As the effective rate is the same, the correct answer must be the one that has the largest amount of

money compounding for the longest time. This would be statement e. The easiest way to see this is

to assume an effective annual rate and then do the calculations

Assuming an effective interest rate of 10% per annual.

For b, the interest rate should be use is

1/ 1/2

(1 ) 1

(1 ) 1 (1 10%) 1 4.88%

m Nom

m Nom

Per

i

EFF

m

i

i EFF

m

= +

= = + = + =

FINS 1613 Practice Questions 19

10

(1 ) 1

[ ](1 )

(1 4.88%) 1

50[ ](1 4.88%)

4.88%

$655.93

n

n

i

FVA PMT i

i

+

= +

+

= +

=

For e, the interest rate should be use is 10% directly

5

(1 ) 1

[ ](1 )

(1 10%) 1

100[ ](1 10%)

10%

$671.56

n

n

i

FVA PMT i

i

+

= +

+

= +

=

6. Answer is e.

If the nominal rate is 8 percent and there is quarterly compounding, the periodic rate must be 8%/4

=2%. The effective rate will be greater than the nominal rate; it will be 8.24 percent.

7. Answer is c.

By definition, an annuity due is received at the beginning of the year while an ordinary annuity is

received at the end of the year. Because the payments are received earlier, both the present and

future values of the annuity due are greater than those of the ordinary annuity.

8. Answer is b.

Time Line:

0 1 2 3 4 5 6

2% Qtrs

-1,000 FV=?

Future value calculation, remembering to adjust for quarterly compounding

( ) ( ) 16 . 1126 $ 2 . 0 1 1000 1

6

= + = + =

n

n

i PV FV

9. Answer is c

Present value of a perpetuity, 67 . 666 , 6 $

15 . 0

1000

= = =

i

PMT

PV

perpetuity

10. Answer is c.

0 1 2 3 4 5 6 7 8 9

14% Years

PV=? 2,000 2,000 2,000 2,000 2,000 3,000 3,000 3,000 3,000

Present value here is the sum of the discounted values of each cash flow:

n

i

CF

i

CF

i

CF PV

|

.

|

\

|

+

+ +

|

.

|

\

|

+

+

|

.

|

\

|

+

=

1

1

...

1

1

1

1

2 1

Calculating the discounted value of each cash flow gives:

FINS 1613 Practice Questions 20

Time Original amount Discounted value

1 2,000 1,754.386

2 2,000 1,538.935

3 2,000 1,349.943

4 2,000 1,184.161

5 2,000 1,038.737

6 3,000 1,366.760

7 3,000 1,198.912

8 3,000 1,051.677

9 4,000 1,230.032

Total of discounted values 1,1713.54

11. Answer is b.

Time line:

0 1 2 3 4 5

10% Years

PV=1,000 PMT=? PMT PMT PMT PMT

Financial calculator solution:

Inputs: N =5; I =10; PV =-1000; FV =0. Output: PMT =$263.80.

12. Answer is c.

Bank A: 8%, monthly.

% 3 . 8 1

12

08 . 0

1 1 1

12

= |

.

|

\

|

+ = |

.

|

\

|

+ =

m

Nom

m

i

EFF

Bank B: 9%, annual

% 9 = EFF

Therefore, difference in effect interest rates is 0.7%

13. Answer is a.

Convert the given interest rate to match the payment period:

Periodic rate % 667 . 0

12

% 8

= = =

m

i

i

Nom

Per

Now find the future value of the annuity

| | | |

77 . 6617

00667 . 0

1 00667 . 0 1

200

1 1

30

=

|

|

.

|

\

|

+

=

|

|

.

|

\

|

+

=

i

i

PMT FVA

n

n

14. Answer is c.

First, find the effective annual rate for a nominal rate of 12% with quarterly compounding

% 55 . 12 1

4

% 12

1 1 1

4

= |

.

|

\

|

+ = |

.

|

\

|

+ =

m

Nom

m

i

EFF

In order to discount the cash flows properly, it is now necessary to find the nominal rate with

semiannual compounding that corresponds to the effective rate calculated above

FINS 1613 Practice Questions 21

% 18 . 12 1

2

1 % 55 . 12

2

= |

.

|

\

|

+ =

Nom

Nom

i

i

Now find the Present value of the investment, adjusting the nominal rate calculated here to semi-

annual compounding

( ) ( )

73 . 2451 $

% 09 . 6 1 % 09 . 6

1

% 09 . 6

1

500

1

1 1

6

=

|

|

.

|

\

|

+

=

|

|

.

|

\

|

+

=

n

n

i i

i

PMT PVA

15. Answer is e.

( ) 68 . 1196 $

12

% 6

1 1000 1

36

= |

.

|

\

|

+ = + =

n

n

i PV FV

16. Answer is d.

Step 1: Find the effective annual rate:

% 3807 . 9 1

12

% 9

1 1 1

12

=

|

.

|

\

|

+ = |

.

|

\

|

+ =

m

Nom

m

i

EFF

Step 2: Calculate the FV of the $5,000 annuity at the end of 10 years:

| | | |

79 . 358 , 77

% 3807 . 9

1 % 3807 . 9 1

5000

1 1

10

=

|

|

.

|

\

|

+

=

|

|

.

|

\

|

+

=

i

i

PMT FVA

n

n

17. Answer is c.

Statement a is false; the reverse is true. Statement b is false; the 15-year bond is selling at a

discount because its coupon payment is less than the yield to maturity. Statement c is true; longer-

maturity and lower-coupon bonds have a larger percentage price change than short-maturity, high-

coupon bonds. Statement d is false; the reverse is true.

18. Answer is c.

If the yield to maturity is 7 percent, but the coupon rate is 9 percent, then investors are getting a

better coupon payment from this bond than they could from a new bond issued in the market today.

Therefore, this bond is more valuable and must be selling at a premium. Therefore, statement a is

false. Whenever interest rates fall, the price of a bond increases. Therefore, statement b is false. If

interest rates remain un-changed, as the bond gets closer to its maturity, its price will approach par

value. Since the bond is selling at a premium, its price must decline to its par value as it gets closer

to maturity. Therefore, statement c is true.

19. Answer is e.

2

(1 4%) 1 8.16% EffectiveR = + =

6

6

1 1

6 6

80 1000

(1 ) (1 ) (1 8.16%) (1 8.16%)

1 1

[ ]

(1 ) (1 )

1 1 1000

80[ ]

8.16% 8.16%(1 8.16%) (1 8.16%)

368.042 624.597 $992.64

N

B N N t

t t d d

N N

d d d d

INT M

V

k k

M

INT

k k k k

= =

= + = +

+ + + +

= +

+ +

= +

+ +

= + =

20. Answer is c.

FINS 1613 Practice Questions 22

12

12%

(1 ) 1 12.68%

12

+ =

21. Answer is c.

Statement c is true; the others are false. Statement a would be true only if the dividend yield were

zero. Statement b is false; we've been given no information about the dividend yield. Statement c

is true; the constant rate at which dividends are expected to grow is also the expected growth rate of

the stock's price.

Bridges & Associates

22. Answer is b.

Step 1: Determine dividends:

D1 =0.75

D2 =0.9375 (0.75 1.25 =0.9375)

D3 =1.265625 (0.9375 1.35 =1.265625)

Step 2: Determine terminal value in Year 3, using the Year 4 dividend:

D4 =1.3415625 (1.265625 1.06 =1.3415625)

4 1

3

(1 25%)(1 35%)(1 6%)

1.3415625

$33.5390625

10% 6%

s s

D D

P

k g k g

+ + +

= =

= =

Step 3: Compute price at time 0

3 3 1 2

0 2 3

2 3

(1 ) (1 ) (1 )

0.75 0.9375 1.265625 33.5390625

1.10 1.10 1.10

0.6818 0.7748 26.1493 $27.6059 $27.61

s s s

D P D D

P

k k k

+

= + +

+ + +

+

= + +

= + + = ~

23. Answer is c.

Take the terminal value

3

P calculated in the previous question and use the constant growth rate to

find

10

P :

7

10 3

7

(1 )

$33.5391 (1 6%)

$50.43

P P g = +

= +

=

24. Answer is d.

Dividend growth =plowback x ROE =0.6 x 20% =12%

Dividend paid out =40% x $4 =$1.60

Price =1.60/(0.16-0.12) =$40.

25. Answer is b.

A project's NPV increases as the cost of capital declines. A project's IRR is independent of its cost

of capital, while a project's MIRR is dependent on the cost of capital since the terminal value in the

MIRR equation is compounded at the cost of capital.

FINS 1613 Practice Questions 23

26. Answer is e.

Statement a is true because at any point to the right of the crossover point B will have a higher NPV

than A. Statement b is true for the same reason that statement a is true; at any point to the right of

the crossover point, B will have a higher NPV than A. Statement c is true. If B's cost of capital is 9

percent, the MIRR assumes reinvestment of the cash flows at 9 percent. When IRR is used, the IRR

calculation assumes that cash flows are reinvested at the IRR (which is higher than the cost of

capital). Since statements a, b, and c are true, statement e is the correct choice.

27. Answer is b.

Project A: NPV =0 =-100,000+39500(PVIFA ?, 3)

IRR =9%

Project B: NPV =0 =-100,000+0 +0 +133,000 (PVIF ?, 3)

IRR =10%

The firm's cost of capital is not given in the problem; so use the IRR decision rule. Since IRR

B

>

IRR

A

; Project B is preferred.

Garcia Paper

0 1 2 3 4 5

Initial invest. outlay -$30.0

Sales $20.0 $20.0 $20.0 $20.0 $20.0

Oper. Cost $12.0 $12.0 $12.0 $12.0 $12.0

Depreciation $10.0 $10.0 $10.0 $0.0 $0.0

Oper. Inc. before taxes -$2.0 -$2.0 -$2.0 $8.0 $8.0

Taxes (40%) -$0.8 -$0.8 -$0.8 $3.2 $3.2

Oper. Inc. after taxes -$1.2 -$1.2 -$1.2 $4.8 $4.8

Add Depreciation $10.0 $10.0 $10.0 $0.0 $0.0

Net oper. cash flows -$30.0 $8.8 $8.8 $8.8 $4.8 $4.8

28. Answer is e, $8.8 million

29. Answer is c, $4.8 million

30. Answer is b.

5

$1.2/(1.12) $0.6809million =

31. Answer is e.

Step 1: Determine the NPV of net operating cash flows:

2 3 4 5

$30 $8.8/1.10 $8.8(1.10) $8.8/(1.10) $4.8/(1.10) $4.8/(1.10)

-30 8 7.2727 6.6116 3.2785 2.9804

$1.8568

NPV

million

= + + + + +

= + + + + +

=

Step 2: Determine the NPV of the project's AT salvage value:

5

$1.2/(1.12) $0.6809million =

Step 3: Determine the project's NPV:

FINS 1613 Practice Questions 24

Add the PV of the salvage value to the NPV of the cash flows to get the project's NPV.

-$1.8568 $0.6809 -$1.1759 -$1.18 NPV million million = + = ~

Bucholz Brands

0 1 2 3 4

Up-front costs -300

Increase in NOWC -50

Sales 200 200 200 200

Operating costs -100 -100 -100 -100

Depreciation -75 -75 -75 -75

EBIT 25 25 25 25

Taxes (40%) -10 -10 -10 -10

EBIT(1 - T) 15 15 15 15

Depreciation 75 75 75 75

Operating CF 90 90 90 90

AT(SV) 30

NOWC recovery 50

Net CF -350 90 90 90 170

32. Answer is e; 90 million

33. Answer is a.

-350M +90/(1.1)1+90/(1.1)2+90/(1.1)3+170/(1.1)4 =-$10.07M

Note: After-tax salvage value AT(SV) =50 (0.40 x 50) =30M

34. Answer is b.

The correct answer is statement b. Statement a is incorrect; the abandonment option will tend to

increase a project's NPV. Statement b is correct; the abandonment option will tend to reduce a

project's risk. Statement c is incorrect; if there are first-mover advantages, it may be harmful

(lowers value) to wait a year to collect information.

Diplomat.com

35. Answer is d.

10%,5

3,000,000 500,000( )

3,000,000 500,000(3.7908)

$1,104,600

NPV PVIFA = +

= +

=

36. Answer is a.

Step 1: Find the NPV at t =0 of the first project:

10%,5

3,000,000 500,000( )

3,000,000 500,000(3.7908)

$1,104,600

NPV PVIFA = +

= +

=

Step 2: Find the NPV at t =0 of the new projects:

FINS 1613 Practice Questions 25

If at t =5 the firm's technology is not successful, the firm will choose to not do the additional

projects (since their NPV is -$6,000,000).

Therefore, the NPV at t =5 is calculated as 0.35($6,000,000) +0.65($0) =$2,100,000.

However, this is the NPV at t =5, so we need to discount this NPV to find the NPV of the

additional projects today.

5

2,100,000/(1.1) 1,303,942.87 PV = =

Step 3: Find the NPV of the entire project considering its future opportunities: -

1,104,600+1,303,942=$199,342

37. Answer is c.

8%,4

( ) 50,000 4,000 50,000 4,000 3.3121

63,248.4

PV A PVIFA = + = +

=

8%,4

( ) 63,248.4

EAC of A = =19,096.16

3.3121

PV A

PVIFA

=

8%,6

( ) 90,000 2,500 90,000 2,500 4.6229

101,557.25

PV B PVIFA = + = +

=

8%,6

( ) 202,557.25

EAC of B = =21,968.30

4.6229

PV B

PVIFA

=

EAC 21,968.30-19,096.16=2,872.14 A =

38. Answer is c.

39. Answer is c.

40. Answer is c.

41. Answer is c.

You are given the required return on the portfolio, the RPM, and enough information to calculate

the beta of the original portfolio. With this information you can find kRF. Once you have kRF, you

can find the required return on Stock C.

Step 1: Find the portfolio beta:

Take a weighted average of the individual stocks' betas to find the portfolio beta. The total

amount invested in the portfolio is:

$4 million +$2 million +$2 million +$1 million +$1 million =$10 million.

The weighted average portfolio beta is:

1

(4 1.2 2 1.1 2 1.0 1 0.7 1 0.5) 1.02

10

| = + + + + =

Step 2: Use the CAPM and the portfolio's required return to calculate kRF, the risk-free rate:

kp =kRF +RPM(bp)

11% =kRF +5%(1.02)

5.9% =kRF.

Step 3: Use the CAPM to calculate the required return on Stock C:

kC =kRF +RPM(bC)

k C =5.9% +5%(1.0)

kC =10.9%.

42. Answer is a.

Portfolio required return

FINS 1613 Practice Questions 26

Step 1: Find thebetaof theoriginal portfolio by takingaweightedaverage of the individual stocks betas.

We calculate a beta of 1.3.

(

|

|

.

|

\

|

+

|

|

.

|

\

|

+

|

|

.

|

\

|

+

|

|

.

|

\

|

( 1. 8)

$1, 600, 000

$500, 000

( 1. 4)

$1, 600, 000

$500, 000

( 1)

$1, 600, 000

$300, 000

( 0. 6)

$1, 600, 000

$300, 000

Step 2: Find the market risk premium using the original portfolio.

k

s

=0.125 =0.06 +(k

M

- k

RF

)1.3. If you substitute for all the values you know, you calculate a market

risk premium of 0.05.

Step 3: Calculate the new portfolios beta.

The question asks for the new portfolios required rate of return. We have all of the

necessary information except the new portfolios beta. Now, Stock 1 has 0 weight (we sold it) and

Stock 4 has a weight of $800,000/$1,600,000 =0.5. The portfolios new beta is:

+

|

|

.

|

\

|

( 1)

$1, 600, 000

$300, 000

+

|

|

.

|

\

|

( 1. 4)

$1, 600, 000

$500, 000

. 525 . 1 ( 1. 8)

$1, 600, 000

$800, 000

=

|

|

.

|

\

|

Step 4: Find the portfolios required return.

Thus, k

s

=0.06 +(0.05)1.525 =13.625% ~ 13.63%.

43. Answer is c.

The Coefficient of Variation is the standard deviation divided by the expected return. Therefore:

( ) ( ) ( ) ( ) ( )

1 1 2 2

1

...

0.1 0.60 0.2 0.10 0.4 0.15 0.2 0.40 0.1 0.90

15%

n

n n i i

i

k Pk P k P k Pk

=

= + + + =

= + + + +

=

( )

( ) ( ) ( )

( ) ( )

2

1

2 2 2

2 2

Standa

0.60 0.15 0.1 0.10 0.15 0.2 0.15 0.15 0.4

37.08%

0.40 0.15 0.2 0.90 0.15 0.1

n

i i

i

rd Deviation k k P o

=

= =

+ +

= =

+ +

37.081

Coefficient of Variation 2.472

15

CV

k

o

= = = =

44. Answer is a.

45. Answer is e.

46. Answer is b.

47. Answer is a.

Flotation cost is irrelevant as it can fund its capital budget from retained earnings.

The cost of existing equity:

0

0

(1 ) 2 (1 6%)

6% 12.625%

32

e

D g

k g

P

+ +

= + = + =

Thus WACC: WACC =w

d

k

d

(1 - T) +w

c

k

e

=(0.25)(0.11)(0.6) +(0.75)(0.12625) =10.67%.

FINS 1613 Practice Questions 27

48. Answer is e.

49. Answer is c.

The correct answer is statement c. The company will have higher debt interest payments, so net

income will decline. Thus, statement a is false. The effect on EPS is ambiguous. Earnings decline

(NI), but so will the number of shares. Therefore, statement b is false. The firm's recapitalization

will not change total assets. However, since net income declines, ROA will decrease; so statement

d is false. As long as the BEP ratio is greater than the cost of debt, ROE will increase. However,

you don't have enough information to determine the cost of debt, so you can make no determination

about ROE. Thus, statement e is false. The increase in debt will increase the risk to shareholders,

so the cost of equity will increase. Therefore, statement c is correct.

50. Answer is e.

Step 1: Find the current number of shares outstanding:

Shares =NI/EPS =$480 million/$3.20 =150 million shares.

Step 2: Find the number of shares after the repurchase:

New shares =150 - $1,200/$32 =150 - 37.5 =112.5 million shares.

Step 3: Find the new EPS after the repurchase:

EPS =[(EBIT - INT)(1 - T)]/New shares

=[($800 - $84) 0.6]/112.5 =$3.818667

Step 4:Find the new stock price:

Stock price =EPS/New cost of equity =$3.818667/0.11 =$34.72

51. Answer is e.

Statement a is false; the theory states that investors prefer dividends because they are more certain

about receiving dividends than they are about capital gains. In addition, the statement is false

because capital gains are taxed more favorably than dividends. Statement b is false because stock

repurchases decrease the number of outstanding shares. Statement c is false. If a company attracts

a particular clientele, it would want to keep that clientele. Changing its dividends frequently would

make it impossible for any one clientele to be happy. Therefore, the correct choice is statement e.

52. Answer is c.

53. Answer is a.

Statement a is true; the other statements are false. The bird-in-the-hand theory states that investors

prefer dividends; therefore, if dividends are increased, the cost of equity decreases. The signaling

theory states that dividend decreases are bad news, so stock price will decrease. Paying a consistent

percentage of net income will result in fluctuating dividends because net income fluctuates. The

clientele effect states that investors prefer a stock that has a high or low steady dividend, but not a

fluctuating one.

54. Answer is d.

55. Answer is e.

56. Answer is a.

First, find the company's current cost of capital, dividends per share, and stock price:

ks =0.066 +(0.06)0.9 =12%. To find the stock price, you still need the dividends per share or

DPS =($2,000,000(1 - 0.4))/200,000 =$6.00. Thus, the stock price is P0 =$6.00/0.12 =$50.00.

FINS 1613 Practice Questions 28

Thus, by issuing $2,000,000 in new debt the company can repurchase $2,000,000/$50.00 =40,000

shares.

Now after recapitalization, the new cost of capital, DPS, and stock price can be found:

ks =0.066 +(0.06)1.1 =13.20%. DPS for the remaining (200,000 - 40,000) =160,000 shares are

thus [($2,000,000 - ($2,000,000 0.10))(1 - 0.4)]/ 160,000 =$6.75. And, finally, P0 =$6.75/0.132

=$51.14.

57. Answer is d.

Statements b and c are true; therefore, statement d is the correct choice. A dividend increase

leading to an increase in stock price is consistent with signaling also.

58. Answer is e.

If the firm's optimal capital budget requires $6,000,000 in financing, then, to stay at its target capital

structure, Plato will retain earnings of $6,000,000 0.65 =$3,900,000. This leaves $5,000,000 -

$3,900,000 =$1,100,000 available for dividends. Thus, Plato's payout ratio is

$1,100,000/$5,000,000 =0.22 =22%.

59. Answer is e.

Less stable sales would lead a firm to reduce its debt ratio. A lower corporate tax rate reduces the

tax advantage of the deductibility of interest expense. This reduction in the tax shield provided by

debt would encourage less use of debt. If management believes the firm's stock is overvalued, then

it would want to issue equity rather than debt, thereby increasing the firm's equity ratio.

60. Answer is d.

The optimal capital structure maximizes the firm's stock price. When the debt ratio is 20%,

expected EPS is $2.50. Given the firm's policy of retaining 30% of earnings, the expected dividend

per share D1 is $2.50 0.70 =$1.75. The stock price P0 is $1.75/(15% - 7%) or $21.88. When the

debt ratio is 30%, expected EPS is $3.00 and expected D1 is $3.00 0.70 =$2.10. The stock price

P0 is $2.10/(15.5% - 7%) =$24.71. Similarly, when the debt ratio is 40%, D1 =$2.275 and P0 =

$25.28. When the debt ratio is 50%, D1 =$2.625 and P0 =$26.25. When the debt ratio is 70%, D1

=$2.80 and P0 =$25.45. The stock price is highest when the debt ratio is 50%.

61. Answer is a.

To answer this we need to determine the following:

1. How many shares are currently outstanding?

2. What are the interest expense and net income, before and after the change?

Before recapitalization:

EBIT $20,000,000

Interest 2,000,000

EBT $18,000,000

Taxes (40%) 7,200,000

NI $10,800,000

EPS =$3.60.

Shares outstanding =$10,800,000/$3.60 =3,000,000 shares.

After recapitalization:

New shares =3 million - 1 million =2 million shares.

FINS 1613 Practice Questions 29

Total debt =$20,000,000 +($1,000,000)($40) =$60,000,000.

Interest payment =($60,000,000)(0.1) =$6,000,000.

Net income:

EBIT $20,000,000

Interest 6,000,000

EBT $14,000,000

Taxes (40%) 5,600,000

NI $ 8,400,000

EPS =$8,400,000/2,000,000 =$4.20

P/E =11.5

P0 =($4.20)(11.5) =$48.30.

62. Answer is d.

63. Answer is e.

64. Answer is a.

65. Answer is a.

If net income increases, and all else are equal (that is, the same number of projects are available to

invest in as before, etc.), the company will have more money left over after making its investments

to pay out as dividends. Statement b is false. If the company increases the proportion of equity

financing in its target capital structure, it will need to either increase the proportion of equity (by

increasing retained earnings, therefore, leaving less money for dividends) or reduce the proportion

of debt it uses (meaning it will have less debt to finance new projects and will need more of its

retained earnings to make investments). Statement c is false. If the company has more profitable

projects, this will leave less money for dividends.

66. Answer is b.

The company expects to pay out 40% of net income or $400,000, it must expect to have $600,000

of retained earnings available for capital investment. Given that the firm will finance new

investment with 70% equity and 30% debt, $600,000 must represent 70 percent of the firm's capital

budget, that is, $600,000 =(0.7)CB or CB =$857,143.

67. Answer is c.

68. Answer is a.

Statement a is true. If net income increases, and all else is equal (that is, the same number of

projects are available to invest in as before, etc.), the company will have more money left over after

making its investments to pay out as dividends. Statement b is false. If the company increases the

proportion of equity financing in its target capital structure, it will need to either increase the

proportion of equity (by increasing retained earnings, therefore, leaving less money for dividends)

or reduce the proportion of debt it uses (meaning it will have less debt to finance new projects and

will need more of its retained earnings to make investments). Statement c is false. If the company

has more profitable projects, this will leave less money for dividends.

69. Answer is d.

FINS 1613 Practice Questions 30

Statements b and c are true; therefore, d is the correct answer. The dividends in a DRIP are still

taxed at the personal income tax rate; this would be a bad investment for an individual in a high tax

bracket. Stock splits are good signals because management believes the stock price will continue to

increase. The increases in the stock price will be taxed at the lower long-term capital gains tax rate

when the stock is sold. The investor will be taxed at the lower long-term capital gains rate if she

tenders her shares in a stock repurchase.

70. Answer is c.

71. Answer is e.

If the stock splits 3-for-1, there will be 3 shares now for each one that used to exist. If the number of

shares triples, the price of each share would be 1/3 of what it was before. Therefore, the price would

immediately be 1/3 of $150, or $50. However, the stock split also led to a 5 percent increase in the

stock price. Therefore, the new price would be $50 1.05 =$52.50.

72. Answer is b.

Residual dividend policy

The companys WACC is 8%(0.5) +13.5%(0.5) =10.75%. Comparing the WACC with the project

IRRs reveals that the company will undertake projects V, W, and X. Total financing costs for these

projects is $3,400,000. Of this amount, 0.5($3,400,000) =$1,700,000 will be financed from retained

earnings. Thus, $2,500,000 - $1,700,000 =$800,000 will be available for dividends. The payout

ratio is then $800,000/$2,500,000 =32%.

73. Answer is b.

Taxable income =1,400 / 70%

Additional personal income tax =Taxable income * (Personal tax rate Corporate tax rate)

=1,400 / 70% * (46% - 30%) =$320

You might also like

- Chapter 5 - Time Value of Money-Student Version100% (1)Chapter 5 - Time Value of Money-Student Version8 pages

- (6-2) Interest Rate Levels CH Answer: B MEDIUM100% (1)(6-2) Interest Rate Levels CH Answer: B MEDIUM9 pages

- Intermediate Accounting 3 Basic and Diluted Earnings Per Share: Quiz 11No ratings yetIntermediate Accounting 3 Basic and Diluted Earnings Per Share: Quiz 111 page

- Bond Investment - FVOCI: Subject Intermediate Accounting Teacher Dessa Dianna MadridNo ratings yetBond Investment - FVOCI: Subject Intermediate Accounting Teacher Dessa Dianna Madrid23 pages

- Requirements: Prepare Journal Entries To Record The Foregoing Transactions. Identify The Entries by Letter (A - F)No ratings yetRequirements: Prepare Journal Entries To Record The Foregoing Transactions. Identify The Entries by Letter (A - F)2 pages

- Accounting - Answer Key Quiz - Financial Assets and Amortized CostNo ratings yetAccounting - Answer Key Quiz - Financial Assets and Amortized Cost3 pages

- Summary Enhancing Qualitative Characteristics100% (1)Summary Enhancing Qualitative Characteristics3 pages

- Discussion Problems: FAR.2924-Other Investments OCTOBER 20200% (1)Discussion Problems: FAR.2924-Other Investments OCTOBER 20203 pages

- Far Eastern University - Makati: Discussion ProblemsNo ratings yetFar Eastern University - Makati: Discussion Problems2 pages

- Multiple Choice Theory: Choose The Best Answer. 1 Point EachNo ratings yetMultiple Choice Theory: Choose The Best Answer. 1 Point Each9 pages

- PRACTICAL MANUAL CASH Answer Key (Student Copy)No ratings yetPRACTICAL MANUAL CASH Answer Key (Student Copy)10 pages

- Full Download Principles of Cost Accounting 17th Edition Vanderbeck Solutions Manual All Chapter 2024 PDF100% (23)Full Download Principles of Cost Accounting 17th Edition Vanderbeck Solutions Manual All Chapter 2024 PDF44 pages

- "How Well Am I Doing?" Statement of Cash Flows: Managerial Accounting, 9/eNo ratings yet"How Well Am I Doing?" Statement of Cash Flows: Managerial Accounting, 9/e51 pages

- INSTRUCTIONS: Shade The Letter of Your Choice On The Answer Sheet Provided. If Your Answer Is Not in0% (1)INSTRUCTIONS: Shade The Letter of Your Choice On The Answer Sheet Provided. If Your Answer Is Not in8 pages

- COMPREHENSIVE QUIZ ON NPO ACCOUNTING StudentsNo ratings yetCOMPREHENSIVE QUIZ ON NPO ACCOUNTING Students7 pages

- Ch.5 Abc & MGMT: Emphasis. New York: Mcgraw-Hill Irwin (5-4)No ratings yetCh.5 Abc & MGMT: Emphasis. New York: Mcgraw-Hill Irwin (5-4)15 pages

- School of Banking and Finance: Fins1613 Business Finance Practice QuestionsNo ratings yetSchool of Banking and Finance: Fins1613 Business Finance Practice Questions30 pages

- Chapter 5_ Time Value of Money-Student VersionNo ratings yetChapter 5_ Time Value of Money-Student Version7 pages

- Intermediate Accounting 3 Basic and Diluted Earnings Per Share: Quiz 11Intermediate Accounting 3 Basic and Diluted Earnings Per Share: Quiz 11

- Bond Investment - FVOCI: Subject Intermediate Accounting Teacher Dessa Dianna MadridBond Investment - FVOCI: Subject Intermediate Accounting Teacher Dessa Dianna Madrid