0 ratings0% found this document useful (0 votes)

10 viewsBalance Sheet As On Nov. 2, 2001 & On March 30

Balance Sheet As On Nov. 2, 2001 & On March 30

Uploaded by

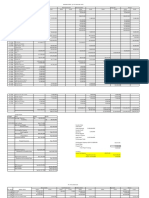

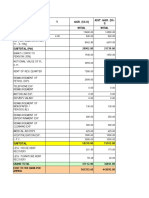

Abhishek KumarThe balance sheet compares the assets and liabilities of a business on November 2, 2005 and March 30, 2006. On both dates, the largest asset was equipment valued at $53,200 on the earlier date and $50,755 after depreciation. Liabilities included $48,000 of owner capital and $21,000 of bank borrowings on the earlier date, which was reduced to $18,900 after a $2,100 payment. The business operated at a $10,854 loss for the period. Total assets and liabilities were equal on both dates at $69,000, showing the business maintained balance sheet equality over the months.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Balance Sheet As On Nov. 2, 2001 & On March 30

Balance Sheet As On Nov. 2, 2001 & On March 30

Uploaded by

Abhishek Kumar0 ratings0% found this document useful (0 votes)

10 views1 pageThe balance sheet compares the assets and liabilities of a business on November 2, 2005 and March 30, 2006. On both dates, the largest asset was equipment valued at $53,200 on the earlier date and $50,755 after depreciation. Liabilities included $48,000 of owner capital and $21,000 of bank borrowings on the earlier date, which was reduced to $18,900 after a $2,100 payment. The business operated at a $10,854 loss for the period. Total assets and liabilities were equal on both dates at $69,000, showing the business maintained balance sheet equality over the months.

Original Description:

b

Original Title

Closing BS

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

The balance sheet compares the assets and liabilities of a business on November 2, 2005 and March 30, 2006. On both dates, the largest asset was equipment valued at $53,200 on the earlier date and $50,755 after depreciation. Liabilities included $48,000 of owner capital and $21,000 of bank borrowings on the earlier date, which was reduced to $18,900 after a $2,100 payment. The business operated at a $10,854 loss for the period. Total assets and liabilities were equal on both dates at $69,000, showing the business maintained balance sheet equality over the months.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

10 views1 pageBalance Sheet As On Nov. 2, 2001 & On March 30

Balance Sheet As On Nov. 2, 2001 & On March 30

Uploaded by

Abhishek KumarThe balance sheet compares the assets and liabilities of a business on November 2, 2005 and March 30, 2006. On both dates, the largest asset was equipment valued at $53,200 on the earlier date and $50,755 after depreciation. Liabilities included $48,000 of owner capital and $21,000 of bank borrowings on the earlier date, which was reduced to $18,900 after a $2,100 payment. The business operated at a $10,854 loss for the period. Total assets and liabilities were equal on both dates at $69,000, showing the business maintained balance sheet equality over the months.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

BALANCE SHEET AS ON NOV.

2 ,2001 & ON MARCH 30

LIABILITY OR NOV. 2, 2005 MARCH 30, 06 ASSETS OR NOV.2,2005 30MARCH

SOURSES OF FUNDS APPLICATION OF FUNDS 2006

CAPITAL EQUIPMENTS- 53200 50755

Mr. ANTOINE 16000 CLOSING STOCK OF FOOD 2800 2430

Mrs. ANTOINE 16000 CASH REGISTER 1400 1400

Mrs. LANDERS 16000 48000 48 000 OPERATING LICENCES 1428 833

.BANK BORROWINGS 21000 18900 (BALANCE UNUTILIZE)

(21000-2100 PAID) (UNEXPIRED PORTION)

.ACCOUNT PAYABLE OR - 1583

CREDITORS

.BANK 10172 1030

DEBTORS OR A/R - 870

.CASH BALANCE - 311

.BUSINESS LOSS - 10854

TOTAL 69000 68483 69000 68483

( 53200-2445)

= 50755

(69000- 53200+2800+1400+1428)

1341

You might also like

- ACC106 Financial Statements Worked ExampleDocument4 pagesACC106 Financial Statements Worked Examplegiafazirah100% (6)

- FORT FrameworkDocument7 pagesFORT FrameworkAbhishek KumarNo ratings yet

- Align Technology IncDocument16 pagesAlign Technology IncAbhishek Kumar0% (1)

- Dune 1Document2 pagesDune 1ADITHYA KOVILINo ratings yet

- Exam PracticeDocument91 pagesExam Practicesreelekshmiprasanthi1234No ratings yet

- Share Holders EquityDocument21 pagesShare Holders Equityjmkad583No ratings yet

- Ast Activities AsnwerDocument176 pagesAst Activities AsnwerChristen HerceNo ratings yet

- Neraca Lajur Jaya KartaDocument41 pagesNeraca Lajur Jaya KartaWendelyn ShieNo ratings yet

- Miftahur Rahmi Soal Latihan Neraca LajurDocument10 pagesMiftahur Rahmi Soal Latihan Neraca LajurMiftahur RahmiNo ratings yet

- It Projection Pdf2023-2024Document3 pagesIt Projection Pdf2023-2024Sumit SanjanNo ratings yet

- Comp. 23-24Document1 pageComp. 23-24sk0687830No ratings yet

- David Rivera Hernandez: Cuentas Por Cobrar Por ClienteDocument9 pagesDavid Rivera Hernandez: Cuentas Por Cobrar Por ClienteFermín RiveraNo ratings yet

- Ribbon An' Bow Inc. Profit and Loss Statement For The Period Ending 30Th June 2006 (Income Statement) Revenue AMTDocument7 pagesRibbon An' Bow Inc. Profit and Loss Statement For The Period Ending 30Th June 2006 (Income Statement) Revenue AMTAnurita PariraNo ratings yet

- Manual ExcelDocument3 pagesManual ExcelGenesis OrdoñezNo ratings yet

- Overview of Power Generation: Central Electricity AuthorityDocument11 pagesOverview of Power Generation: Central Electricity AuthorityDeepak ThomasNo ratings yet

- Laporan Keuangan Muhammad RiskiDocument10 pagesLaporan Keuangan Muhammad RiskiRizkyNo ratings yet

- P88, 2-1BDocument3 pagesP88, 2-1Bshersingh42kNo ratings yet

- afn (1)Document4 pagesafn (1)domitiooNo ratings yet

- Balance SheetDocument17 pagesBalance Sheetyqb9kxr86hNo ratings yet

- Dr. Nick Marasigan Medical Clinic General Journal For The Month Ended October 2020 Date Account Titles and Explanation P.R. Debit CreditDocument10 pagesDr. Nick Marasigan Medical Clinic General Journal For The Month Ended October 2020 Date Account Titles and Explanation P.R. Debit CreditRuthchell CiriacoNo ratings yet

- Ismail BillingDocument16 pagesIsmail BillingLosta NataNo ratings yet

- P.Saralakshmi: Head Clerk LW MSD PerDocument4 pagesP.Saralakshmi: Head Clerk LW MSD Permayur1980No ratings yet

- Inventario de Stock: Comaort, S.LDocument1 pageInventario de Stock: Comaort, S.LENCARNANo ratings yet

- LANDDocument2 pagesLANDRERREFAITNo ratings yet

- CRQS Final AccountsDocument54 pagesCRQS Final AccountsAtka FahimNo ratings yet

- Accounts: Trial Balance Adjustments Adjusted T.BDocument2 pagesAccounts: Trial Balance Adjustments Adjusted T.BJaqueline Sarkis IssaNo ratings yet

- Arrears: 302 - 2000 (Long Pending) : Treasurer Joint TreasurerDocument2 pagesArrears: 302 - 2000 (Long Pending) : Treasurer Joint TreasurerRajesh RanganathanNo ratings yet

- All Baalance SsheetDocument8 pagesAll Baalance SsheetMozammel HossainNo ratings yet

- CHATTELSDocument5 pagesCHATTELSADITHYA KOVILINo ratings yet

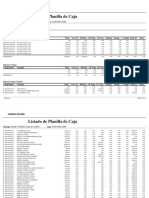

- Listado de Planilla de Caja: IngresosDocument47 pagesListado de Planilla de Caja: Ingresosfede gomezNo ratings yet

- Acca Single EntryDocument10 pagesAcca Single Entrythakkert25No ratings yet

- Mananquil, Julieta P. - Jeths JefrenDocument12 pagesMananquil, Julieta P. - Jeths JefrenMarissa Bucad GomezNo ratings yet

- File 01052023152738148Document3 pagesFile 01052023152738148Arun RajangamNo ratings yet

- Septya Neraca Saldo KlasikDocument4 pagesSeptya Neraca Saldo KlasikwongtawengtawengNo ratings yet

- Abstract Collection Balances 1Document2 pagesAbstract Collection Balances 1Frailyn TabuclaoNo ratings yet

- Suppliers Customers Tax DiscussionDocument25 pagesSuppliers Customers Tax Discussionnena cabañesNo ratings yet

- Assets Liabilities Date Cash + Accounts Receivable + Equipment Accounts PayableDocument11 pagesAssets Liabilities Date Cash + Accounts Receivable + Equipment Accounts PayableAadit AggarwalNo ratings yet

- CRQS ConsolidationDocument54 pagesCRQS ConsolidationAtka FahimNo ratings yet

- Estados de Cambio en El PatrimonioDocument3 pagesEstados de Cambio en El PatrimonioklvelizpNo ratings yet

- Laporan KeuanganDocument15 pagesLaporan Keuanganakunaditya359No ratings yet

- Calculator New Pay ScaleDocument4 pagesCalculator New Pay Scalerocky_ecNo ratings yet

- Munna KhanDocument4 pagesMunna Khanpocox5inNo ratings yet

- Chapter 1 Problem 5 To 7Document2 pagesChapter 1 Problem 5 To 7XienaNo ratings yet

- P03'24 Beauty Wholesale Cosmetics Customers Scheme IncentiveDocument11 pagesP03'24 Beauty Wholesale Cosmetics Customers Scheme IncentivechatwithisaacNo ratings yet

- Changes in Income Tax RatesDocument4 pagesChanges in Income Tax RatesdivajainNo ratings yet

- Kunci - Menyusun Lap. Keuangan - p1Document14 pagesKunci - Menyusun Lap. Keuangan - p1joke nisNo ratings yet

- MGR. (SC-II) Stage Asst. Mgr. (Sc-I) : % Initial InitialDocument1 pageMGR. (SC-II) Stage Asst. Mgr. (Sc-I) : % Initial Initialshassija_1No ratings yet

- Vetan Deyak Praptra Vittiya Niyam Sangrah, Khand-5, Bhag-1 See Chapter 6 Para-108, Chapter 7 Para-131Document9 pagesVetan Deyak Praptra Vittiya Niyam Sangrah, Khand-5, Bhag-1 See Chapter 6 Para-108, Chapter 7 Para-131Madan ChaturvediNo ratings yet

- Corporation TaxDocument13 pagesCorporation TaxADITHYA KOVILINo ratings yet

- EXAM 2(1)Document7 pagesEXAM 2(1)domitiooNo ratings yet

- Judiciary Development Fund Report 2024 04-04-16!44!29Document10 pagesJudiciary Development Fund Report 2024 04-04-16!44!29xpokemongo0001No ratings yet

- My CPC Arrear Calculator Ver 2Document17 pagesMy CPC Arrear Calculator Ver 2rahulbrooNo ratings yet

- Cash Loan Supply Expense Tools Salary Expense Down Payment Bills Paypable Tool Expense Services Telephone Ex Office Supplies Petrol Ex Recieable RentDocument4 pagesCash Loan Supply Expense Tools Salary Expense Down Payment Bills Paypable Tool Expense Services Telephone Ex Office Supplies Petrol Ex Recieable RenttanimaNo ratings yet

- SL Bill No Description of Expenses Amount: Treasurer Joint TreasurerDocument2 pagesSL Bill No Description of Expenses Amount: Treasurer Joint TreasurerRajesh RanganathanNo ratings yet

- K-008 ( 20001) - Engine - 060000 Valve and Rocker Arm ## K-008 ( 20001)Document2 pagesK-008 ( 20001) - Engine - 060000 Valve and Rocker Arm ## K-008 ( 20001)Martin LindbergNo ratings yet

- Asset Liability Expenses Income Owner's CapitalDocument4 pagesAsset Liability Expenses Income Owner's Capitalamitmehta29No ratings yet

- Active Portfolio ManagementDocument7 pagesActive Portfolio ManagementAbhishek KumarNo ratings yet

- Antecedent Verification ProcessDocument4 pagesAntecedent Verification ProcessAbhishek KumarNo ratings yet

- Chapter 10 Regression SlidesDocument46 pagesChapter 10 Regression SlidesAbhishek KumarNo ratings yet

- Invoice OD109172599294660000Document2 pagesInvoice OD109172599294660000Abhishek KumarNo ratings yet

- An Example of Attribute Based MDS Using Discriminant AnalysisDocument17 pagesAn Example of Attribute Based MDS Using Discriminant AnalysisAbhishek KumarNo ratings yet

- Anova and The Design of Experiments: Welcome To Powerpoint Slides ForDocument22 pagesAnova and The Design of Experiments: Welcome To Powerpoint Slides ForAbhishek KumarNo ratings yet

- Indian Institute of Management Indore: MT ET CP AssignmentDocument2 pagesIndian Institute of Management Indore: MT ET CP AssignmentAbhishek KumarNo ratings yet

- Nifty: Trading StrategiesDocument2 pagesNifty: Trading StrategiesAbhishek KumarNo ratings yet

- Marketing of ServicesDocument6 pagesMarketing of ServicesAbhishek KumarNo ratings yet

- INOX Leisure LTD., - Location ListDocument2 pagesINOX Leisure LTD., - Location ListAbhishek KumarNo ratings yet

- Nifty: Trading StrategiesDocument2 pagesNifty: Trading StrategiesAbhishek KumarNo ratings yet

- Overview of HR FunctionsDocument24 pagesOverview of HR FunctionsAbhishek KumarNo ratings yet

- BC Sec CDocument2 pagesBC Sec CAbhishek KumarNo ratings yet

- Pharmacy Service Improvement atDocument5 pagesPharmacy Service Improvement atAbhishek KumarNo ratings yet

- GatiDocument13 pagesGatiAbhishek KumarNo ratings yet

- 1) in Your Marketing Plan, What Elements Are Strategic and What Elements Are Tactical?Document2 pages1) in Your Marketing Plan, What Elements Are Strategic and What Elements Are Tactical?Abhishek KumarNo ratings yet

- Practice Set-2Document7 pagesPractice Set-2Abhishek Kumar100% (2)

- JSPLDocument14 pagesJSPLAbhishek KumarNo ratings yet

- Summer Preparatory Session: Club KaizenDocument40 pagesSummer Preparatory Session: Club KaizenAbhishek KumarNo ratings yet

- Daimler ChryslerDocument13 pagesDaimler ChryslerAbhishek KumarNo ratings yet

- GammonDocument13 pagesGammonAbhishek KumarNo ratings yet