0 ratings0% found this document useful (0 votes)

164 viewsProper Filing of New Saln Baseline Declaration Form

Proper Filing of New Saln Baseline Declaration Form

Uploaded by

Rubyrose TagumThis document provides guidance on properly filing the Statement of Assets, Liabilities and Net Worth (SALN) baseline declaration form for Philippine government employees. It discusses that the SALN consists of a baseline declaration form that must be filed within 30 days of starting employment, and annual declaration forms that must be filed by April 30 each year. The baseline declaration requires comprehensive reporting of assets, liabilities, business interests and other financial information as of the start date. Annual declarations require reporting only acquisitions and disposals since the previous filing. The document provides details on the reporting requirements and guidelines for valuing and classifying assets and liabilities.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Proper Filing of New Saln Baseline Declaration Form

Proper Filing of New Saln Baseline Declaration Form

Uploaded by

Rubyrose Tagum0 ratings0% found this document useful (0 votes)

164 views41 pagesThis document provides guidance on properly filing the Statement of Assets, Liabilities and Net Worth (SALN) baseline declaration form for Philippine government employees. It discusses that the SALN consists of a baseline declaration form that must be filed within 30 days of starting employment, and annual declaration forms that must be filed by April 30 each year. The baseline declaration requires comprehensive reporting of assets, liabilities, business interests and other financial information as of the start date. Annual declarations require reporting only acquisitions and disposals since the previous filing. The document provides details on the reporting requirements and guidelines for valuing and classifying assets and liabilities.

Original Description:

PROPER FILING OF NEW SALN BASELINE DECLARATION FORM

Original Title

SALN

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

This document provides guidance on properly filing the Statement of Assets, Liabilities and Net Worth (SALN) baseline declaration form for Philippine government employees. It discusses that the SALN consists of a baseline declaration form that must be filed within 30 days of starting employment, and annual declaration forms that must be filed by April 30 each year. The baseline declaration requires comprehensive reporting of assets, liabilities, business interests and other financial information as of the start date. Annual declarations require reporting only acquisitions and disposals since the previous filing. The document provides details on the reporting requirements and guidelines for valuing and classifying assets and liabilities.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

164 views41 pagesProper Filing of New Saln Baseline Declaration Form

Proper Filing of New Saln Baseline Declaration Form

Uploaded by

Rubyrose TagumThis document provides guidance on properly filing the Statement of Assets, Liabilities and Net Worth (SALN) baseline declaration form for Philippine government employees. It discusses that the SALN consists of a baseline declaration form that must be filed within 30 days of starting employment, and annual declaration forms that must be filed by April 30 each year. The baseline declaration requires comprehensive reporting of assets, liabilities, business interests and other financial information as of the start date. Annual declarations require reporting only acquisitions and disposals since the previous filing. The document provides details on the reporting requirements and guidelines for valuing and classifying assets and liabilities.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 41

PROPER FILING OF NEW SALN

BASELINE DECLARATION FORM

2009

PROPER FILING OF NEW SALN BASELINE DECLARATION FORM

Scope of Presentation

SALN AT A GLANCE

INTRODUCTION

FILING YOUR SALN

THE BASELINE DECLARATION

PERSONAL INFORMATION AND EMPLOYMENT

ASSETS, LIABILITIES, AND NET WORTH

BUSINESS INTERESTS AND FINANCIAL CONNECTIONS

RELATIVES IN GOVERNMENT SERVICE

STATEMENT

LIABILITIES AND PENALTIES

FREQUENTLY ASKED QUESTIONS

QUICK GUIDE ON NEW SALN BD FORM

ILLUSTRATIVE EXAMPLE ON PROPER FILLING UP OF SALN

FORM

PROPER FILING OF NEW SALN BASELINE DECLARATION FORM

THE SALN AT A GLANCE:

THE SALN CONSISTS OF TWO FORMS:

THE BASELINE DECLARATION (BD)

THE ANNUAL DECLARATION (AD)

PROPER FILING OF NEW SALN BASELINE DECLARATION FORM

THE SALN AT A GLANCE:

BASELINE DECLARATION (BD) MUST BE ACCOMPLISHED ONLY ONCE,

SHOULD CONTAIN A COMPREHENSIVE LISTING OF THE DECLA-

RANTS ASSETS, LIABILITIES, NET WORTH, BUSINESS INTERESTS,

FINANCIAL CONNECTION, AND RELATIVES IN GOVERNMENT

NEW ENTRANTS MUST SUBMIT THE BD WITHIN 30 DAYS AFTER

ASSUMPTION INTO OFFICE, TO CONTAIN INFORMATION AS OF THE

FIRST DAY OF GOVERNMENT SERVICE

PROPER FILING OF NEW SALN BASELINE DECLARATION FORM

THE SALN AT A GLANCE:

ANNUAL DECLARATION (AD) WHICH MUST BE ACCOMPLISHED

EVERY YEAR FOR SUBMISSION ON OR BEFORE APRIL 30, WHERE

THE EMPLOYEE HAS PREVIOUSLY SUBMITTED A BD

THE FIRST AD SHALL CONTAIN INFORMATION STARTING FROM

THE DAY IMMEDIATELY FOLLOWING THE CUT-OFF DATE OF AN

EMPLOYEES BD, UP TO DECEMBER 31 OF THE REPORTING YEAR.

THE SUBSEQUENT AD SHALL BE FOR THE PERIOD JANUARY 1 TO

DECEMBER 31 OF EACH SUCCEEDING YEAR

THE AD MUST ALSO BE ACCOMPLISHED WITHIN 30 DAYS FROM

SEPARATION FROM GOVERNMENT SERVICE, STATEMENTS OF

WHICH MUST COVER FROM JANUARY 1 UP TO THE EMPLOYEES

LAST DAY IN OFFICE

PROPER FILING OF NEW SALN BASELINE DECLARATION FORM

THE SALN AT A GLANCE:

ANNUAL DECLARATION (AD)

COMPREHENSIVE LISTING OF ALL ASSETS AND LIABILITIES IS NOT

NEEDED IN THE AD

ONLY ACQUISITIONS AND DISPOSALS OF ASSETS, INCURRENCE,

RETIREMENT, AND PAYMENT/REDUCTION OF LIABILITIES; CREATION

AND TERMINATION OF BUSINESS INTEREST AND FINANCIAL

CONNECTIONS; AND RELATIVES JOINING OR BEING SEPARATED

FROM THE GOVERNMENT; SINCE THE LAST SALN SUBMISSION.

ANNUAL DECLARATION IS JUST A PASSBOOK WHERE ONLY DEPO-

SITS AND WITHDRAWALS FROM YOUR ACCOUNT NEED TO BE DO-

CUMENTED

PROPER FILING OF NEW SALN BASELINE DECLARATION FORM

INTRODUCTION:

THE SALN CONTAINS INFORMATION ABOUT OWNERSHIP OF ASSETS AS

WELL AS ONES LIABILITIES.

EVERY GOVERNMENT EMPLOYEE IS REQUIRED BY LAWTO SUBMIT THIS

FORM.

THE GOVERNING LAW IS RA # 6713. THE LAW IS BASED ON THE CONS-

TITUTIONAL PROVISION THAT A PUBLIC OFFICER OR EMPLOYEE SHALL,

UPON ASSUMPTION OF OFFICE AND AS OFTEN THEREAFTER AS MAY BE

REQUIRED BY LAW, SUBMIT A DECLARATION UNDER OATH OF HIS ASSETS,

LIABILITIES AND NET WORTH.

PROPER FILING OF NEW SALN BASELINE DECLARATION FORM

INTRODUCTION:

THE CIVIL SERVICE COMMISSION (CSC) SHALL HAVE THE PRIMARY RES-

PONSIBILITY FOR THE ADMINISTRATION AND ENFORCEMENT OF THE

RA # 6713.

ON 10 SEPTEMBER 2007, THE CSC APPROVED THE REVISED FORM OF THE

SALN THROUGH CSC RESOLUTION NO. 071814.

THE OESPA-PN IS MANDATED UNDER CIRCULAR NR 05 HPN DTD 13 MAR

1998 TO COLLECT, ANALYZE AND COMPILE ALL SWORN STATEMENTS OF

ASSETS AND LIABILITIES OF MILITARY PERSONNEL AND CIVILIAN

EMPLOYEES OF THE PN.

PROPER FILING OF NEW SALN BASELINE DECLARATION FORM

FILING YOUR SALN:

WHY YOU MUST FILE

AS A GOVERNMENT EMPLOYEE, YOU OCCUPY A POSITION THAT IS

VESTED WITH PUBLIC TRUST. THIS REQUIRES YOU TO PUT THE PUBLIC IN-

TEREST OVER AND ABOVE YOUR OWN. THE PRIMARY USE OF THE INFOR-

MATION ON THE SALN FORM IS TO EXHIBIT TRANSPARENCY AND ACCOUNTA-

BILITY IN PUBLIC OFFICE.

THE SALN IS THE BADGE OF HONOR OF THE HONEST CIVIL SERVANT

THAT MUST BE ACCOMPLISHED WITH PRIDE. IT SHOWS THAT AN EMPLOYEE

DID NOT EXPLOIT HIS OR HER PUBLIC OFFICE FOR ILLEGAL GAIN.

WHO MUST FILE

ALL PUBLIC OFFICIALS AND EMPLOYEES, WHETHER REGULAR OR

UNDER TEMPORARY STATUS, ARE REQURED TO FILE THE SALN.

PROPER FILING OF NEW SALN BASELINE DECLARATION FORM

FILING YOUR SALN:

WHO DO NOT NEED TO FILE

PUBLIC OFFICIALS SERVING IN AN HONORARY CAPACITY, WITHOUT

CREDIT OR PAY;

TEMPORARY LABORERS; AND

CASUAL OR TEMPORARY (NOT IN THE REGULAR PLANTILLA OF

AGENCY) AND CONTRACTUAL WORKERS.

WHEN TO FILE

NEW ENTRANT FILING. DUE WITHIN 30 CALENDAR DAYS FROM

ASSUMING A POSITION OR EARLIER WHEN REQUESTED BY YOUR

AGENCY.

ANNUAL FILING. DUE NOT LATER WITHIN APRIL 30 OF EVERY YEAR.

THE REPORTING PERIOD STARTS FROM THE DAY FOLLOWING THE

CUT-OFF DATE OF THE PREVIOUS SALN DECLARATION, UP TO

DECEMBER 31 OF THE REPORTING PERIOD.

PROPER FILING OF NEW SALN BASELINE DECLARATION FORM

FILING YOUR SALN:

WHEN TO FILE

SEPARATION: DUE WITHIN 30 DAYS AFTER SEPARATION FROM

GOVERNMENT SERVICE.

PROPER FILING OF NEW SALN BASELINE DECLARATION FORM

FILING YOUR SALN:

WHERE TO FILE

ACCOMPLISH THE FORMS IN FIVE (5) ORIGINAL COPIES AND SUBMIT

THE SAME TO YOUR PERSONNEL, OR ADMINISTRATION OFFFICE.

BE SURE TO RETAIN A COPY OF YOUR SALN AND HAVE THE SAME

RECEIVED AS PROOF OF YOUR SALN SUBMISSION.

UNDER CSC RESOLUTION NO. 06-0231 DATED FEBRUARY 1, 2006, THE

CHIEF/HEAD OF THE PERSONNEL/ADMINISTRATIVE DIVISION OR UNIT

SHALL TRANSMIT ALL ORIGINAL COPIES OF THE SALN RECEIVED, ON

OR BEFORE JUNE 30 OF EVERY YEAR, TO THE CONCERNED OFFICES.

( PN UNITS ARE REQUIRED TO SUBMIT ACCOMPLISHED SALN COPIES TO

OESPA, PN ON OR BEFORE APRIL 30 FOR CONSOLIDATION PURPOSES

PRIOR SUBMISSION TO CONCERNED REPOSITORY AGENCIES)

PROPER FILING OF NEW SALN BASELINE DECLARATION FORM

FILING YOUR SALN:

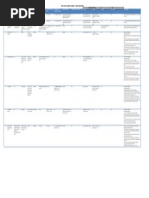

WHERE TO FILE OFFICIAL/EMPLOYEE CONCERNED

OFFICE OF THE

PRESIDENT

OFFICERS OF THE ARMED FORCES OF THE

PHILIPPINES FROM THE RANK OF COLONEL

OR NAVAL CAPTAIN

DEPUTY OMBUDSMAN

FOR MILITARY AFFAIRS

MEMBERS OF THE ARMED FORCES OF THE

PHILIPPINES BELOW THE RANK OF COLONEL

OR NAVAL CAPTAIN INCLUDING CIVILIAN

PERSONNEL OF THE AFP

CIVIL SERVICE

COMMISSION

(INTEGRATED RECORDS

MANAGEMENT OFFICE)

MEMBERS OF THE ARMED FORCES OF THE

PHILIPPINES BELOW THE RANK OF COLONEL

OR NAVAL CAPTAIN AS WELL AS CIVILIAN

PERSONNEL OF THE AFP

OESPA-AFP MEMBERS OF THE ARMED FORCES OF THE

PHILIPPINES REGARDLESS OF RANK

INCLUDING CIVILIAN PERSONNEL OF THE AFP

OESPA-PN MEMBERS OF THE PHILIPPINE NAVY AS WELL

AS CIVILIAN PERSONNEL OF THE PN

PROPER FILING OF NEW SALN BASELINE DECLARATION FORM

DECLARATIONS:

ANNUAL GROSS SALARY REFERS TO ALL FORMS OF COMPENSATION

(CASH ONLY) OF THE EMPLOYEE ACTUALLY

RECEIVED FROM GOVERNMENT SERVICE,

EXCEPT PER DIEMS

ANNUAL GROSS FAMILY INCOME REFERS TO ALL FORMS OF INCOME

(AGFI) (CASH AND NON-CASH) ACTUALLY RECEIVED

BY THE DECLARANT, SPOUSE, AND CHILDREN

LIVING IN HOUSEHOLD, RECEIVED FROM ALL

SOURCES, INCLUDING GRATUITOUS ACQUISI-

TIONS

REAL PROPERTIES AND VEHICLE OF THE DECLARANT, SPOUSE, AND

CHILDREN LIVING IN HOUSEHOLD MUST BE DECLARED REGARDLESS OF

VALUE.

PROPER FILING OF NEW SALN BASELINE DECLARATION FORM

EXAMPLE OF WHAT CONSTITUTE AGFI:

SALARIES FROM GOVERNMENT (WHICH INCLUDES YOUR ANNUAL GROSS

SALARY)

SALARIES AND OTHER REMUNERATION FROM OTHER EMPLOYMENT OR

ENGAGEMENT SUCH AS HONORARIA, ALLOWANCES, ETC.

INCOME FROM BUSINESSES AND ASSETS (e. g. RENTAL INCOME FOR REAL

PROPERTIES, VEHICLES)

COMMISSIONS

RETURN ON INVESTMENTS

GAINS FROM DISPOSALS OR LIQUIDATION OF ASSETS

INTEREST FROM DEPOSITS

DIVIDENDS FROM SHAREHOLDINGS

PROPER FILING OF NEW SALN BASELINE DECLARATION FORM

EXAMPLE OF WHAT CONSTITUTE AGFI:

INCOME FROM PARTNERSHIPS AND JOINT VENTURES

CASH DONATIONS

WINNINGS FROM SWEEPSTAKES AND OTHER ACTIVITIES OF CHANCE

DONATIONS AND INHERITANCES OF REAL AND PERSONAL PROPERTIES

(FAIR MARKET VALUE)

NOTE: UNCOLLECTED INCOME AND LOSSES FROM TRANSANCTIONS ARE

NOT REQUIRED TO BE REPORTED IN YOUR ANNUAL GROSS FAMILY INCOME.

PROPER FILING OF NEW SALN BASELINE DECLARATION FORM

DECLARATIONS:

FOR REAL PROPERTIES THE KIND OF REAL PROPERTY, THE LOCATION,

THE ESTIMATED FAIR MARKET VALUE, AND THE

ASSESSED VALUE MUST BE REPORTED;

FOR VEHICLES THE TYPE OF VEHICLE, PLATE NUMBER, CERTIFICATE

NUMBER, AND PLACE OF REGISTRATION MUST BE

REPORTED;

FOR BOTH REAL PROPERTIES AND VEHICLES THE MODE AND YEAR OF

ACQUISITION, AS WELL AS THE ACQUISITION COST, MUST

ALSO BE REPORTED

PROPER FILING OF NEW SALN BASELINE DECLARATION FORM

EXAMPLES OF REAL PROPERTIES:

VACANT LOT (WHETHER RESIDENTIAL, COMMERCIAL, AGRICULTURAL,

INDUSTRIAL, ETC.)

HOUSE AND LOT

IMPROVEMENTS

PRINTING PRESS EQUIPMENT ATTACHED TO THE GROUND

CONDOMINIUM UNIT

TOWNHOUSE

FRUIT PLANTATION

REAL RIGHTS OVER IMMOVABLE

PROPER FILING OF NEW SALN BASELINE DECLARATION FORM

EXAMPLES OF VEHICLES:

CAR

VAN

MOTORCYCLE

TRICYCLE

YACHT

HELICOPTER

SPEEDBOAT

NOTE: DO NOT REPORT AS VEHICLE, LIKE SCOOTER (FOOTBOARD

MOUNTED ON TWO WHEELS AND ALONG STEERING HANDLE

USED AS A TOY EVEN IF THE SAME MAY BE MOTORIZED) SINCE

THIS DOES NOT NEED TO BE REGISTERED WITH THE LTO.

HOWEVER, IF THE FAIR MARKET VALUE OF THE SCOOTER IS

PHP 50,000 OR MORE, THIS MUST BE REPORTED AS OTHER

PERSONAL PROPERTY.

PROPER FILING OF NEW SALN BASELINE DECLARATION FORM

MODE OF ACQUISITION WITH CORRESPONDING DETERMINATION

OF ACQUISITION COST:

MODE OF ACQUISITION ACQUISITION COST

CASH PURCHASE PURCHASE PRICE

ADD: OTHER EXPENDITURES REQUIRED IN

OBTAINING THE ASSET AND PREPARING IT FOR

USE

EXCHANGE FOR NON-

MONETARY ASSET

FAIR MARKET VALUE OF NEW ASSET

ACQUIRED, OR FAIR MARKET VALUE OF NON-

MONETARY ASSET GIVEN UP IN EXCHANGE,

WHICHEVER IS MORE CLEARLY DETERMINABLE

DEBT/EQUITY SWAP RECORD ACQUISITION COST OF ASSET

RECEIVED AT CURRENT FAIR MARKET VALUE

CONSTRUCTION ALL DIRECT EXPENDITURES INCURRED TO

BUILD THE ASSET AND MAKE IT READY FOR ITS

INTENDED USE (EXCEPT YOUR OWN LABOR)

PROPER FILING OF NEW SALN BASELINE DECLARATION FORM

SAMPLE SOURCES OF INFORMATION ON FAIR MARKET VALUE:

ITEM SOURCES OF INFORMATION ON FAIR MARKET VALUE

REAL PROPERTY REAL ESTATE COMPANIES, BROKERS, DEVELOPERS,

APPRAISERS, HISTORICAL TRANSACTIONS IN THE

SAME VICINITY

VEHICLES CAR DEALERS

STOCK, BONDS STOCK EXCHANGES, BROKERAGE FIRMS, FINANCIAL

INSTITUTIONS WEBSITES, NEWSPAPERS

MUTUAL FUNDS FINANCIAL INSTITUTIONS/BANKS INVESTMENT

DEPARTMENT, WEBSITES

TRUST FUNDS TRUSTEE, FUND MANAGER

TIME DEPOSITS FINANCIAL INSTITUTIONS, BANKS, THESE ENTITIES

WEBSITES

MONEY MARKET FINANCIAL INSTITUTIONS, BANKS, THESE ENTITIES

WEBSITES

EQUITY IN

PARTNERSHIP

FINANCIAL REPORT OF THE PARTNERSHIP

PROPER FILING OF NEW SALN BASELINE DECLARATION FORM

SAMPLE SOURCES OF INFORMATION ON FAIR MARKET VALUE: (cont.)

ITEM SOURCES OF INFORMATION ON FAIR MARKET VALUE

CASH IN BANK BANK STATEMENT, ATM RECEIPT, PASSBOOK

BALANCE

FURNITURE MALLS, APPLIANCE CENTERS, SECOND-HAND-

DEALERS

JEWELRY JEWELRY STORES, APPRAISERS, PAWNSHOPS,

ALAJERAS

PROPER FILING OF NEW SALN BASELINE DECLARATION FORM

EXAMPLE OF MODE OF ACQUISITION:

PURCHASE

DONATION

INHERITANCE

TRUST

EXCHANGE

AS A CONSEQUENCE OF CONTRACT (TRADITION) EXAMPLES ARE

LEASE, PLEDGE, DEPOSIT, PURCHASE OR SALE (WHETHER PAID IN

INSTALLMENT OR CASH)

OCCUPATION WHEN YOU SEIZE CORPOREAL/PHYSICAL THINGS;

LAND CANNOT BE ACQUIRED BY OCCUPATION

PROPER FILING OF NEW SALN BASELINE DECLARATION FORM

EXAMPLE OF MODE OF ACQUISITION: (cont.)

INTELLECTUAL CREATION THROUGH INTELLECTUAL PROPERTY

OWNERSHIP AS WHEN YOU ARE THE AUTHOR OF LITERARY WORK, COM-

POSER OF MUSIC, PAINTER, SCULPTOR, SCIENTIST

LAW AUTOMATICALLY VESTS OWNERSHIP OVER A PROPERTY WHEN

REQUISITES ARE MET AS IN THE CASE OF HIDDEN TREASURES OR

FRUITS NATURALLY FALLING FROM A TREE UPON AN ADJACENT LAND.

PRESCRIPTION THROUGH LAPSE OF TIME AS PROVIDED BY LAW

PROPER FILING OF NEW SALN BASELINE DECLARATION FORM

INVESTMENTS AND OTHER PERSONAL PROPERTIES:

EACH ITEM OF INVESTMENT OR OTHER PERSONAL PROPERTY OF THE

DECLARANT, SPOUSE, AND CHILDREN LIVING IN HOUSEHOLD WITH A

FAIR MARKET VALUE OF PHP 50,000.00 OR MORE MUST BE REPORTED

CHECKING THE APPROPRIATE BOX AND ENTERING THE ACQUISITION

COST.

IF AN ITEM HAS A FAIR MARKET VALUE OF LESS THAN PHP 50,000.00,

POOL ALL SUCH ITEMS TOGETHER, AND

IF THE AGGREGATE VALUE EXCEEDS PHP 50,000.00, THESE ITEMS MUST

BE LISTED EVEN IF THE INDIVIDUAL ITEMS ARE VALUED AT LESS THAN

PHP 50,000.00.

BUT IF THE AGGREGATE VALUE DOES NOT EXCEED PHP 50,000.00, YOU

MAY DECLARE THESE ITEMS COLLECTIVELY AS OTHERS, OR YOU MAY

OPT NOT TO DECLARE THESE ITEMS AT ALL SINCE THESE ARE NOT

CONSIDERED MATERIAL.

PROPER FILING OF NEW SALN BASELINE DECLARATION FORM

INVESTMENTS AND OTHER PERSONAL PROPERTIES: (cont.)

FOR INVESTMENTS AND OTHER PERSONAL PROPERTIES, WHICH ARE

PAID ON INSTALLMENT BASIS, YOU SHOULD DECLARE YOUR EQUITY SO

FAR PAID AS EQUITY IN INSTALLMENT PURCHASES, OR IN SOME OTHER

APPLICABLE CATEGORY (e.g. STOCKS, PRIVATE INSURANCE, EDUCATIONAL

PLANS, PRE-NEED PLANS).

PROPER FILING OF NEW SALN BASELINE DECLARATION FORM

EXAMPLE OF INVESTMENTS:

STOCKS

BONDS

MUTUAL FUNDS

INSURANCE POLICIES

EDUCATIONAL PLANS

PRE-NEED PLANS

TIME DEPOSIT

MONEY MARKET PLACEMENTS

EQUITY IN PARTNERSHIPS

SHARE IN JOINT VENTURES

PROPER FILING OF NEW SALN BASELINE DECLARATION FORM

EXAMPLES OF OTHER PERSONAL PROPERTIES:

CASH AND BANK ACCOUNTS

RECEIVABLES

DEPOSITS/ADVANCED PAYMENTS ON LEASES/RENTALS

FURNITURE

ANTIQUES

EQUITY IN INSTALLMENT PURCHASE

INTELLECTUAL PROPERTY

CLUB MEMBERSHIPS

NOTE: THE OTHER PERSONAL PROPERTY BOUGHT AND SOLD IN THE

SAME YEAR SHALL NOT BE INCLUDED IN THE REPORT BECAUSE

IT NO LONGER EXISTS AT DATE OF DECLARATION.

PROPER FILING OF NEW SALN BASELINE DECLARATION FORM

LIABILITIES:

IN THE SAME MANNER, EACH ITEM OF LIABILITY OF THE DECLARANT,

SPOUSE, AND CHILDREN LIVING IN HOUSEHOLD WITH AN OUTSTANDING

BALANCE OF PHP 50,000.00 OR MORE MUST BE REPORTED BY CHECKING

THE APPROPRIATE BOX AND ENTERING THE AMOUNT OF THE OUTSTANDING

BALANCE.

IF THE VALUE OF AN ITEM IS LESS THAN PHP 50,000.00, POOL ALL SUCH

ITEMS TOGETHER AND IF THE AGGREGATE VALUE EXCEEDS PHP 100,000.00,

THESE ITEMS MUST BE LISTED EVEN IF THE INDIVIDUAL ITEMS ARE VALUED

AT LESS THAN PHP 50,000.00. BUT IF THE AGGREGATE VALUE DOES NOT

EXCEED PHP 100,000.00, YOU MAY DECLARE THESE ITEMS COLLECTIVELY

AS OTHERS, OR YOU MAY OPT NOT TO DECLARE THESE ITEMS AT ALL

SINCE THESE ARE NOT CONSIDERED MATERIAL.

PROPER FILING OF NEW SALN BASELINE DECLARATION FORM

EXAMPLES OF LIABILITIES:

PERSONAL LOANS

BANK LOANS

ACCOUNT PAYABLE

GSIS, PAG-IBIG LOANS

MORTGAGE PAYABLES

SURETY LIABILITIES

JUDGMENT DEBTS

LOANS FROM OTHER INSTITUTIONS

PROPER FILING OF NEW SALN BASELINE DECLARATION FORM

BUSINESS INTERESTS AND FINANCIAL CONNECTIONS:

EACH ITEM OF BUSINESS INTEREST OR FINANCIAL CONNECTION OF THE

DECLARANT, SPOUSE, AND CHILDREN LIVING IN HOUSEHOLD WHICH GIVES

GROSS ANNUAL RECEIPTS OF PHP50,000.00 OR MORE MUST BE REPORTED

BY PROVIDING APPROPRIATE DETAILS THE NAME OF THE OWNER OF THE

ITEM, THE NAME ADDRESS, AND NATURE OF THE BUSINESS ENTITY OR

FINANCIAL CONNECTION, AND THE DATE OF ACQUISITION THEREOF.

IF AN ITEM GENERATES GROSS ANNUAL RECEIPTS OF LESS THAN

PHP 50,000.00, POOL ALL SUCH ITEMS TOGETHER AND IF THE AGGREGATE

RECEIPTS EXCEED PHP100,000.00 THESE ITEMS MUST BE LISTED EVEN IF

THE INDIVIDUAL ITEMS ARE VALUED AT LESS THAN PHP 50,000.00. BUT

IF THE AGGREGATE RECEIPTS DO NOT EXCEED PHP100,000.00, YOU MAY

DECLARE THESE ITEMS COLLECTIVELY AS OTHERS, OR YOU MAY OPT

NOT TO DECLARE THESE ITEMS AT ALL SINCE THESE ARE NOT CONSIDERED

MATERIAL.

PROPER FILING OF NEW SALN BASELINE DECLARATION FORM

RELATIVES IN GOVERNMENT:

THE DECLARANTS AND SPOUSES RELATIVES IN GOVERNMENT, UP TO THE

FOURTH CIVIL DEGREE OF CONSANGUINITY OR AFFINITY, INCLUDING

BILAS, INSO, AND BALAE, MUST BE REPORTED, BY PROVIDING THE NAME,

RELATIONSHIP, POSITION, AND OFFICE/ADDRESS OF THE RELATIVE.

PROPER FILING OF NEW SALN BASELINE DECLARATION FORM

EXAMPLE OF RELATIVES WITHIN THE FOURTH DEGREE OF

CONSANGUINITY/AFFINITY:

GRANDFATHER

SISTER

YOU/YOUR

SPOUSE

1

ST

COUSIN 1

ST

COUSIN

AUNT

FATHER

CONSANGUINITY RELATIONSHIP BY BLOOD

AFFINITY RELATIONSHIP BY MARRIAGE

PROPER FILING OF NEW SALN BASELINE DECLARATION FORM

NET WORTH IN THE BD:

THE NET WORTH OF THE DECLARANT, SPOUSE, AND CHILDREN LIVING IN

HOUSEHOLD IS COMPUTED IN THE BD AS FOLLOWS:

ACQUISITION COST OF ALL REAL PROPERTIES AND

VEHICLES

PLUS ACQUISITION COST OF INVESTMENTS

PLUS ACQUISITION COST OF ALL OTHER PERSONAL

PROPERTIES

DEDUCT: TOTAL LIABILITIES

EQUALS: NET WORTH

NOTE: THE NET WORTH IS NO LONGER COMPUTED IN THE AD.

PROPER FILING OF NEW SALN BASELINE DECLARATION FORM

GRATUITOUS ACQUISITIONS OF ASSETS:

GRATUITOUS ACQUISITIONS (e.g. DONATIONS, INHERITANCE, WINNINGS) OF

THE DECLARANT, SPOUSE, OR CHILDREN LIVING IN THE HOUSEHOLD MUST

BE REPORTED AS FOLLOWS:

THE ACQUISITION MUST BE DECLARED AS AN ASSET (i. e., REAL

PROPERTY, VEHICLE, INVESTMENT, OR OTHER PERSONAL PROPER-

TY), WITH THE FAIR MARKET VALUE REPORTED AS OF DATE OF DE-

CLARATION, IF THE SAME IS PHP 50,000.00 OR MORE.

IF THE FAIR MARKET VALUE IS LESS THAN PHP 50,000.00, POOL THE

ITEM WITH OTHERS SIMILARY ACQUIRED, AND IF THE AGGREGATE VA-

LUE EXCEEDS PHP 100,000.00, THEN EACH ITEM MUST BE LISTED. IF

THE AGGREGATE VALUE DOES NOT EXCEED PHP 100,000.00, THE DE-

CLARANT MAY DECLARE THIS IN LUMP SUM AS OTHERS, ALTERNA-

TELY, IF THE AGGREGATE VALUE DOES NOT EXCEED PHP 100,000,00,

THE DECLARANT MAY OPT NOT TO DECLARE THESE ITEMS AT ALL.

FOR ALL ASSETS GRATUITOUSLY ACQUIRED WHICH ARE LISTED AS

AN ASSET (i. e., REAL PROPERTY, VEHICLE, INVESTMENT, OR OTHER

PERSONAL PROPERTY), THE FAIR MARKET VALUE MUST BE INCLU-

DED IN THE ANNUAL GROSS FAMILY INCOME.

PROPER FILING OF NEW SALN BASELINE DECLARATION FORM

STATEMENT:

THE DECLARANT ( AND SPOUSE IN GOVERNMENT SERVICE, IN CASE OF

JOINT FILING), MUST SIGN THE STATEMENT, PROVIDE THE DATE OF

SIGNING, TIN, AND CTC DETAILS, AND PERSONALLY SUBSCRIBE THE

SALN BEFORE A PERSON AUTHORIZED TO ADMINISTER OATH

NOTE: YOU DO NOT NEED TO GET THE SIGNATURE OF YOUR SPOUSE ON THE

SALN IF YOUR SPOUSE IS NOT IN THE GOVERNMENT SERVICE

YOU ALSO DO NOT NEED TO GET THE SIGNATURE OF YOUR SPOUSE

ON THE SALN IF YOUR SPOUSE IS IN THE GOVERNMENT SERVICE BUT

YOU WILL NOT MAKE A JOINT FILING

PROPER FILING OF NEW SALN BASELINE DECLARATION FORM

LIABILITIES AND PENALTIES:

NOT REQUIRED TO ATTACH ANY DOCUMENTS TO SUBSTANTIATE

INFORMATION DISCLOSED. HOWEVER, THE SALN IS MADE UNDER OATH

FALSIFICATION OF INFORMATION OR FAILURE TO FILE OR REPORT INFOR-

MATION REQUIRED TO BE REPORTED MAY BE SUBJECT TO DISCIPLINARY/CRI-

MINAL ACTION

PENALTIES UNDER RA # 6713 MAY BE ANY OF THE FOLLOWING:

IMPRISONMENT 5 YEARS OR LESS

FINE - PHP 5,000 OR LESS

DISMISSAL FROM THE SERVICE

PROPER FILING OF NEW SALN BASELINE DECLARATION FORM

FREQUENTLY ASKED QUESTIONS

PROPER FILING OF NEW SALN BASELINE DECLARATION FORM

QUICK FILING OF REVISED NEW SALN BD FORM

PROPER FILING OF NEW SALN BASELINE DECLARATION FORM

ILLUSTRATIVE EXAMPLE ON PROPER FILLING UP

OF NEW SALN FORM

You might also like

- Sample Letter of Intent LOIDocument2 pagesSample Letter of Intent LOIMuhamad Azizi50% (2)

- Business Plan For Burger KioskDocument30 pagesBusiness Plan For Burger Kiosksuneershin75% (16)

- Authorization To CI and Confirmation of Employer (Rev 03032020)Document1 pageAuthorization To CI and Confirmation of Employer (Rev 03032020)Rubyrose TagumNo ratings yet

- Zobel Vs ManilaDocument20 pagesZobel Vs Manilao6739No ratings yet

- BOOK I - Sovereignty and General AdministrationDocument9 pagesBOOK I - Sovereignty and General AdministrationRosa GamaroNo ratings yet

- CH 03 - SolutionsDocument17 pagesCH 03 - SolutionsLuong Hoang Vu80% (5)

- Master Plan - Samo Drum.137 Str. (37-60) 5xDocument137 pagesMaster Plan - Samo Drum.137 Str. (37-60) 5xRadovan Paunović100% (1)

- Atty. Marilyn E. Taldo: Regional Director, CSC-CARDocument78 pagesAtty. Marilyn E. Taldo: Regional Director, CSC-CARcrazzy foryouNo ratings yet

- Ra 9679 IrrDocument21 pagesRa 9679 IrrArbie Mae SalomaNo ratings yet

- The Philippines: Tax Assessment, Appeal and Dispute ResolutionDocument29 pagesThe Philippines: Tax Assessment, Appeal and Dispute ResolutionJBNo ratings yet

- Q. 1 Financial MarketDocument4 pagesQ. 1 Financial MarketMAHENDRA SHIVAJI DHENAKNo ratings yet

- Securities Market (Finance)Document11 pagesSecurities Market (Finance)Karina Blanco100% (1)

- Philpotts vs. Philippine Manufacturing Co. and Berry FactsDocument2 pagesPhilpotts vs. Philippine Manufacturing Co. and Berry Factswmovies18No ratings yet

- Sample Demand LetterDocument2 pagesSample Demand LetterDamanMandaNo ratings yet

- Ownership To Co OwnershipDocument179 pagesOwnership To Co OwnershipHNicdaoNo ratings yet

- Briefing On RA 10963 (TRAIN LAW)Document74 pagesBriefing On RA 10963 (TRAIN LAW)robertoii_suarez50% (2)

- Chattel MortgageDocument3 pagesChattel MortgageAdriano Bahian Jr.No ratings yet

- Deed of SaleDocument2 pagesDeed of SaleErin GamerNo ratings yet

- PDF Deed of Release Waiver Undertaking Deceased Depositor Michazel Malana OriginalDocument3 pagesPDF Deed of Release Waiver Undertaking Deceased Depositor Michazel Malana Originaljerick amparoNo ratings yet

- Law On Sales Module 16 17Document29 pagesLaw On Sales Module 16 17Mairene CastroNo ratings yet

- Land Reform LawDocument27 pagesLand Reform LawSABS RIDES AND LIFENo ratings yet

- Political Law Case DigestsDocument3 pagesPolitical Law Case DigestsSethNo ratings yet

- Bir Revenue Regulations No. 4-2007Document22 pagesBir Revenue Regulations No. 4-2007hirohonmaNo ratings yet

- Ready, Steady,: ForexDocument25 pagesReady, Steady,: ForexSrini VasanNo ratings yet

- International Finance PDFDocument16 pagesInternational Finance PDFnehaNo ratings yet

- Grievance and Appeal FormDocument1 pageGrievance and Appeal FormJonathan CalosaNo ratings yet

- Sales Cases RevalidaDocument71 pagesSales Cases RevalidaPaulo HernandezNo ratings yet

- MoneyDocument30 pagesMoneyEnchy100% (3)

- Ra 9679 Pag IbigDocument10 pagesRa 9679 Pag IbigManila LoststudentNo ratings yet

- Primary Product(s) /service(s) and Operations, and A Brief Description of The Department/function/product That Is The Main Focus of The StudyDocument3 pagesPrimary Product(s) /service(s) and Operations, and A Brief Description of The Department/function/product That Is The Main Focus of The StudyGeovanni Collantes DumpasanNo ratings yet

- PubcorpDocument14 pagesPubcorprbNo ratings yet

- Notice To Terminate - Carantes ProjectDocument2 pagesNotice To Terminate - Carantes ProjectDominador O. Matbagan100% (1)

- Tep's Tones Tax Notes 1 and 2Document80 pagesTep's Tones Tax Notes 1 and 2Paul Dean MarkNo ratings yet

- Yabes V FlojoDocument5 pagesYabes V FlojoanailabucaNo ratings yet

- NOTICE ChecklistDocument2 pagesNOTICE ChecklistAdrian50% (2)

- Philippines Ifrs ProfileDocument6 pagesPhilippines Ifrs Profilejsus22No ratings yet

- GR 191525 IAcademy Vs Litton and CoDocument9 pagesGR 191525 IAcademy Vs Litton and CoJP De La PeñaNo ratings yet

- Affidavit of Loss - JASPER JOHN A. VELOSODocument1 pageAffidavit of Loss - JASPER JOHN A. VELOSOAnjo AlbaNo ratings yet

- G.R. No. 186560 November 17, 2010 Government Service Insurance System, Petitioner, FERNANDO P. DE LEON, RespondentDocument34 pagesG.R. No. 186560 November 17, 2010 Government Service Insurance System, Petitioner, FERNANDO P. DE LEON, RespondentNoel SincoNo ratings yet

- Philippine's Land Registration AuthorityDocument9 pagesPhilippine's Land Registration AuthorityERNIL L BAWANo ratings yet

- Ra 9679 - Pag-Ibig HDMFDocument14 pagesRa 9679 - Pag-Ibig HDMFKYLA JANE BALOLOYNo ratings yet

- Navigating Ra 10963 Tax Reform For Acceleration Reform and Inclusion Train Law: Its Features and ImpactDocument2 pagesNavigating Ra 10963 Tax Reform For Acceleration Reform and Inclusion Train Law: Its Features and ImpactRushid Jay Samortin Sancon0% (1)

- SSS VS UbanaDocument22 pagesSSS VS UbanaViolet BlueNo ratings yet

- TaxxxxDocument3 pagesTaxxxxfaye gNo ratings yet

- Notes - Domestic Workers ActDocument4 pagesNotes - Domestic Workers ActVicelle QuilantangNo ratings yet

- Quiz 1 - Income Taxation 1st Sem 2016Document2 pagesQuiz 1 - Income Taxation 1st Sem 2016Jenny Malabrigo, MBANo ratings yet

- Letter of Representation FormatDocument5 pagesLetter of Representation FormatChethan VenkateshNo ratings yet

- Bangsamoro FaqDocument9 pagesBangsamoro FaqmariannecarmNo ratings yet

- Administrative LawDocument2 pagesAdministrative LawHanna FayeNo ratings yet

- History of CoopDocument23 pagesHistory of CoopMarites Domingo - PaquibulanNo ratings yet

- Affidavit of Loss-Sss-Ritchel Cerbo CastilloDocument1 pageAffidavit of Loss-Sss-Ritchel Cerbo CastilloAidalyn MendozaNo ratings yet

- Affidavit of SupportDocument1 pageAffidavit of SupportRaymund Christian Ong AbrantesNo ratings yet

- Registration of Corporations and Partnerships PDFDocument2 pagesRegistration of Corporations and Partnerships PDFJeremiash ForondaNo ratings yet

- Centennial PrayerDocument2 pagesCentennial PrayerKathleen Catubay SamsonNo ratings yet

- Application For RetirementDocument2 pagesApplication For RetirementcrisjavaNo ratings yet

- Absolute Deed of Sale of Truck VehicleDocument3 pagesAbsolute Deed of Sale of Truck Vehiclemel avecillaNo ratings yet

- Makati Rev CodeDocument6 pagesMakati Rev CodeHelena HerreraNo ratings yet

- Table 1: Reliefs in Case of Termination Without Prior NoticeDocument6 pagesTable 1: Reliefs in Case of Termination Without Prior NoticeMer CeeNo ratings yet

- Tax Remedies Final 4 SlidesDocument35 pagesTax Remedies Final 4 SlidesMisterpogi TalagaNo ratings yet

- Affidavit of One and The Same PersonDocument2 pagesAffidavit of One and The Same PersonmynameisvinciNo ratings yet

- New SALN PresentationDocument41 pagesNew SALN PresentationAlexander ObongNo ratings yet

- Guidelines in The Filling Out of The Statement of Assets, Liabilities and Net Worth (Saln) FormDocument45 pagesGuidelines in The Filling Out of The Statement of Assets, Liabilities and Net Worth (Saln) FormEnrico ReyesNo ratings yet

- SALN ManualDocument4 pagesSALN ManualCherry MendozaNo ratings yet

- Saln GuidelinesDocument45 pagesSaln GuidelinesFem Fem100% (1)

- Guidelines in The Filling Out of The Statement of Assets, (Saln) FormDocument45 pagesGuidelines in The Filling Out of The Statement of Assets, (Saln) FormMyra CoronadoNo ratings yet

- Impact of Covid-19 On Demand For Ppe in The Healthcare IndustryDocument1 pageImpact of Covid-19 On Demand For Ppe in The Healthcare IndustryRubyrose TagumNo ratings yet

- PPE Manufacturers ListDocument22 pagesPPE Manufacturers ListRubyrose Tagum100% (1)

- Business Proposal Online GroceryDocument21 pagesBusiness Proposal Online GroceryRubyrose TagumNo ratings yet

- Bone PathologyDocument103 pagesBone PathologyRubyrose Tagum100% (1)

- Mother's Day Interview - Floral OutsideDocument1 pageMother's Day Interview - Floral OutsideRubyrose TagumNo ratings yet

- Mother's Day Interview - Floral (Grandma)Document1 pageMother's Day Interview - Floral (Grandma)Rubyrose TagumNo ratings yet

- Mother's Day Interview - B&WDocument1 pageMother's Day Interview - B&WRubyrose TagumNo ratings yet

- Cancer ChemotherapyDocument37 pagesCancer ChemotherapyRubyrose TagumNo ratings yet

- Cancer Association of South Africa (CANSA)Document6 pagesCancer Association of South Africa (CANSA)Rubyrose TagumNo ratings yet

- Hematology: Dr. I. Quirt Adriana Cipolletti, Jeremy Gilbert and Susy Hota, Chapter Editors Leora Horn, Associate EditorDocument42 pagesHematology: Dr. I. Quirt Adriana Cipolletti, Jeremy Gilbert and Susy Hota, Chapter Editors Leora Horn, Associate EditorRubyrose Tagum100% (1)

- Consultation Dictation Template - Medicine UtahDocument1 pageConsultation Dictation Template - Medicine UtahRubyrose TagumNo ratings yet

- Review of Systems Past Family Social HistoryDocument2 pagesReview of Systems Past Family Social HistoryRubyrose TagumNo ratings yet

- Mental State Examination Form How To Fill ItDocument3 pagesMental State Examination Form How To Fill ItRubyrose Tagum0% (1)

- Saint Thomas AquinasDocument3 pagesSaint Thomas AquinasRubyrose TagumNo ratings yet

- TCA Suppression and DM1Document22 pagesTCA Suppression and DM1Rubyrose TagumNo ratings yet

- The Foundations of Booty Capitalism in The PhilippinesDocument31 pagesThe Foundations of Booty Capitalism in The PhilippinesRubyrose Tagum0% (1)

- YOGYA GROUP STRATEGIC OBJECTIVE AT RISK (Case Study)Document16 pagesYOGYA GROUP STRATEGIC OBJECTIVE AT RISK (Case Study)Arya Hidayat100% (1)

- ACC212FinalReq - Dela Cruz, Benz NeilsonDocument6 pagesACC212FinalReq - Dela Cruz, Benz NeilsonJuan BraveNo ratings yet

- Post Office Small Savings Ready ReckonerDocument1 pagePost Office Small Savings Ready Reckonerabhinav0115No ratings yet

- Investment Office ANRS: Project Profile On SMALL SCALE Pineapple PlantationDocument24 pagesInvestment Office ANRS: Project Profile On SMALL SCALE Pineapple PlantationJohn100% (1)

- Panjab National BankDocument9 pagesPanjab National BankVivid Geo BabuNo ratings yet

- W. H. Elliott & Sons Co., Inc. v. Charles J. Gotthardt, 305 F.2d 544, 1st Cir. (1962)Document6 pagesW. H. Elliott & Sons Co., Inc. v. Charles J. Gotthardt, 305 F.2d 544, 1st Cir. (1962)Scribd Government DocsNo ratings yet

- Citi Bank e StrategyDocument28 pagesCiti Bank e Strategydilip504No ratings yet

- All MCQ For Thompson 5eDocument47 pagesAll MCQ For Thompson 5eLindaLindyNo ratings yet

- 'Quant Replica Questions That Have Appeared in Cat in The Last 4 YearsDocument48 pages'Quant Replica Questions That Have Appeared in Cat in The Last 4 YearsNavneet Gulati100% (1)

- Can Slim Analysis Using On Line ToolsDocument8 pagesCan Slim Analysis Using On Line ToolsDeepesh Kothari100% (1)

- Accounting CH 8Document29 pagesAccounting CH 8Nguyen Dac ThichNo ratings yet

- What Are Futures and Options?Document14 pagesWhat Are Futures and Options?Happy SinghNo ratings yet

- Fixed DepositsDocument1 pageFixed DepositsTiso Blackstar GroupNo ratings yet

- Allianz - Wikipedia, The Free EncyclopediaDocument7 pagesAllianz - Wikipedia, The Free Encyclopediahgosai30No ratings yet

- The Wit and Wid Som of Peter LynchDocument4 pagesThe Wit and Wid Som of Peter LynchTami ColeNo ratings yet

- Theory Problem Contracts 2Document34 pagesTheory Problem Contracts 2Slay SleekNo ratings yet

- Oversight Hearing: Committee On Natural Resources U.S. House of RepresentativesDocument67 pagesOversight Hearing: Committee On Natural Resources U.S. House of RepresentativesScribd Government DocsNo ratings yet

- Aptitude FormulasDocument9 pagesAptitude FormulasGowtham DevarajNo ratings yet

- Performance Evaluation of Indian Mutual Funds: Symbiosis International UniversityDocument15 pagesPerformance Evaluation of Indian Mutual Funds: Symbiosis International UniversityRocks KiranNo ratings yet

- Crude Palm OilDocument19 pagesCrude Palm OilmarpadanNo ratings yet

- Nairobi Youth Business Plan: See Beyond BordersDocument46 pagesNairobi Youth Business Plan: See Beyond Bordersxhumaz50% (2)

- TransAsia Annual Report 2014Document428 pagesTransAsia Annual Report 2014erikainigoNo ratings yet

- Construction Contracts-My NotesDocument3 pagesConstruction Contracts-My Notesjhaeus enajNo ratings yet

- Sme Symposium Programme Booklet 2017 Caa31032017 David Wanted Photo ChangeDocument23 pagesSme Symposium Programme Booklet 2017 Caa31032017 David Wanted Photo Changeapi-309215991No ratings yet

- MRODocument128 pagesMROgamalazmi100% (1)

- Islamic Derivatives 2Document19 pagesIslamic Derivatives 2syedtahaaliNo ratings yet