REG Exam Format - CPA

REG Exam Format - CPA

Uploaded by

gavkaCopyright:

Available Formats

REG Exam Format - CPA

REG Exam Format - CPA

Uploaded by

gavkaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

REG Exam Format - CPA

REG Exam Format - CPA

Uploaded by

gavkaCopyright:

Available Formats

REG Exam Format

The REG (Regulation) section of the CPA exam tests your knowledge on business law,

business ethics, and federal taxation. The REG exam is comprised of 3 testlets consisting of

24 multiple choice questions each. This amounts to a total of 72 MCQ which account for

60% of your grade.

The remaining 40% comes from 6 Task-Based Simulations, otherwise known as the SIMS,

which require you to generate answers on your own rather than choose from a list of

possible choices. You are given 3 hours to complete the exam need to get an overall score

of 75% or higher to pass.

Business Law

17% to 21% of the exam

Examples include Uniform Commercial Code and concepts on Debtor-Creditor

Relationships, Agency, Contracts and Government Regulation

Ethics & Professional and Legal Responsibilities

15% to 19% of the exam

Examples include concepts regarding Independence and Due Care as well as Liability and

Legal Responsibility, and Code of Conduct

Federal Taxation on Entities

18% to 24% of the exam

Examples include Tax Reporting with regards to the 3 different types of Legal Trusts and

Entities

Federal Taxation on Individuals

13% to 19% of the exam

Examples include Adjustments and Deductions, Tax Computations, Gross Income Inclusion

and Exclusions, Exemptions and Alternative Minimum Tax (AMT)

Federal Taxation on Property

12% to 16% of the exam

Examples include Related Tax Implications and Types of Assets

Accounting and Federal Tax Procedures

11% to 15% of the exam

Examples include Percentage of Completion, Installment Sales, Cash versus Accrual

Accounting, Inventory Methods and Completed Contracts

You might also like

- General JournalDocument2 pagesGeneral JournalJacob SnyderNo ratings yet

- Gravel Road Design To AASHTO 1993Document3 pagesGravel Road Design To AASHTO 1993Robeatul Adawiah OsmanNo ratings yet

- NTS CPA ExamDocument2 pagesNTS CPA ExamMrudula V.No ratings yet

- 2013 REG Last Minute Study Notes (Bonus)Document47 pages2013 REG Last Minute Study Notes (Bonus)olegscherbina100% (3)

- Notes Chapter 2 REGDocument7 pagesNotes Chapter 2 REGcpacfa100% (10)

- Auditing and AttestationDocument1 pageAuditing and AttestationQuiana FrazierNo ratings yet

- WME Exam Prep Questions: CSI/Foran WME Quiz Workbook and Case Study WorkbookDocument3 pagesWME Exam Prep Questions: CSI/Foran WME Quiz Workbook and Case Study WorkbookPetraneoNo ratings yet

- CPA ExamsDocument9 pagesCPA ExamsAnsar AhmadNo ratings yet

- BEC MaggieDocument48 pagesBEC MaggieJame NgNo ratings yet

- BEC 3 Outline - 2015 Becker CPA ReviewDocument4 pagesBEC 3 Outline - 2015 Becker CPA ReviewGabrielNo ratings yet

- CPA Exam Prep:Bus Envr & Cncpt-Q2Document7 pagesCPA Exam Prep:Bus Envr & Cncpt-Q2DominickdadNo ratings yet

- BEC 1 Outline - 2015 Becker CPA ReviewDocument4 pagesBEC 1 Outline - 2015 Becker CPA ReviewGabriel100% (1)

- BEC 4 Outline - 2015 Becker CPA ReviewDocument6 pagesBEC 4 Outline - 2015 Becker CPA ReviewGabrielNo ratings yet

- CPA REG Entity BasisDocument4 pagesCPA REG Entity BasisManny MarroquinNo ratings yet

- 2019 Cpa Bec AnswersDocument14 pages2019 Cpa Bec AnswerssuryaNo ratings yet

- Cpa NotesDocument120 pagesCpa Notesjobir2008No ratings yet

- Reg Flash CardsDocument3,562 pagesReg Flash Cardsmohit2ucNo ratings yet

- CPA TestDocument22 pagesCPA Testdani13_335942No ratings yet

- BEC Final Review NotesDocument38 pagesBEC Final Review NotessheldonNo ratings yet

- Uniform CPA Exam Guide Rev 082913Document4 pagesUniform CPA Exam Guide Rev 082913fluffynutz123No ratings yet

- Cpa ReviewDocument31 pagesCpa ReviewlordaiztrandNo ratings yet

- 655 Week 12 Notes PDFDocument63 pages655 Week 12 Notes PDFsanaha786No ratings yet

- Chapter 9 & 10 Financial (FAR) NotesDocument7 pagesChapter 9 & 10 Financial (FAR) NotesFutureMsCPANo ratings yet

- Notes Chapter 8 FARDocument7 pagesNotes Chapter 8 FARcpacfa100% (9)

- AUD Notes Chapter 2Document20 pagesAUD Notes Chapter 2janell184100% (1)

- FinQuiz - Smart Summary - Study Session 10 - Reading 34Document2 pagesFinQuiz - Smart Summary - Study Session 10 - Reading 34RafaelNo ratings yet

- ACC110 Course Outline Fall 2011Document13 pagesACC110 Course Outline Fall 2011Umer FarooqNo ratings yet

- Notes Chapter 3 REGDocument7 pagesNotes Chapter 3 REGcpacfa90% (10)

- BEC Study Guide 4-19-2013Document220 pagesBEC Study Guide 4-19-2013Valerie Readhimer100% (1)

- BEC Notes Chapter 3Document13 pagesBEC Notes Chapter 3bobby100% (1)

- REG 3 Text NotesDocument6 pagesREG 3 Text NotesJeffrey WangNo ratings yet

- AICPA Released Questions AUD 2015 DifficultDocument26 pagesAICPA Released Questions AUD 2015 DifficultTavan ShethNo ratings yet

- Wiley CPAexcel - BEC - Assessment Review - 2Document20 pagesWiley CPAexcel - BEC - Assessment Review - 2ABCNo ratings yet

- Uniform CPA Examination May 1983-May 1987 Selected Questions &Document675 pagesUniform CPA Examination May 1983-May 1987 Selected Questions &Abdelmadjid djibrineNo ratings yet

- BEC CPA Formulas November 2015 Becker CPA Review PDFDocument20 pagesBEC CPA Formulas November 2015 Becker CPA Review PDFsasyedaNo ratings yet

- CPA BEC Virtural Class NOTESDocument19 pagesCPA BEC Virtural Class NOTESRamach100% (1)

- Free BEC NotesDocument6 pagesFree BEC Notesxcrunner87No ratings yet

- Cfa Level I - Us Gaap Vs IfrsDocument4 pagesCfa Level I - Us Gaap Vs IfrsSanjay RathiNo ratings yet

- Cpa Textbook: Ethics and Responsibility in Tax PracticeDocument5 pagesCpa Textbook: Ethics and Responsibility in Tax PracticeLE AicragNo ratings yet

- Pederson CPA Review REG Study Notes Business StructureDocument12 pagesPederson CPA Review REG Study Notes Business StructureJaffery143No ratings yet

- AICPA Released Questions AUD 2015 ModerateDocument25 pagesAICPA Released Questions AUD 2015 ModerateTavan ShethNo ratings yet

- CPA Exam - Aud Flashcards - QuizletDocument16 pagesCPA Exam - Aud Flashcards - QuizletWilliam SusetyoNo ratings yet

- Miles CPA Roadmap PDFDocument20 pagesMiles CPA Roadmap PDFDhdjjdNo ratings yet

- BEC Formula Sheet Mini TestDocument7 pagesBEC Formula Sheet Mini Testcpacfa73% (11)

- CPA BEC 1 - Corporate GovernanceDocument3 pagesCPA BEC 1 - Corporate GovernanceGabrielNo ratings yet

- Notes Chapter 7 REGDocument9 pagesNotes Chapter 7 REGcpacfa100% (6)

- Audit 2015 AICPA Released QuestionDocument71 pagesAudit 2015 AICPA Released QuestionPassion for CPA100% (3)

- Notes Chapter 4 REGDocument7 pagesNotes Chapter 4 REGcpacfa100% (7)

- 2 - Economics - Formula Sheet Mini TestDocument6 pages2 - Economics - Formula Sheet Mini Testcpacfa100% (1)

- AICPA Released Questions REG 2015 DifficultDocument22 pagesAICPA Released Questions REG 2015 DifficultKhalil JacksonNo ratings yet

- ch04 Accounting Systems Solution ManualDocument16 pagesch04 Accounting Systems Solution ManualLindsey Clair Royal100% (2)

- Developing Project Cash Flow Statement: Lecture No. 23 Fundamentals of Engineering EconomicsDocument24 pagesDeveloping Project Cash Flow Statement: Lecture No. 23 Fundamentals of Engineering EconomicsAyman SobhyNo ratings yet

- Weekly Progress & Evaluation Test 26: D. 2 & 3 OnlyDocument3 pagesWeekly Progress & Evaluation Test 26: D. 2 & 3 OnlyAbhinav GuptaNo ratings yet

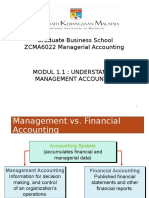

- M1-1 MGT Accounting & OrgDocument19 pagesM1-1 MGT Accounting & OrgKetoisophorone WongNo ratings yet

- FinQuiz - Smart Summary - Study Session 9 - Reading 30Document5 pagesFinQuiz - Smart Summary - Study Session 9 - Reading 30RafaelNo ratings yet

- Notes Chapter 6 REGDocument8 pagesNotes Chapter 6 REGcpacfa90% (10)

- Income Taxation Chapter 14 SolutionsDocument2 pagesIncome Taxation Chapter 14 SolutionsENo ratings yet

- ACCA Study Guide and Exam TipsDocument8 pagesACCA Study Guide and Exam TipsSelva Bavani SelwaduraiNo ratings yet

- CPA Review Notes 2019 - BEC (Business Environment Concepts)From EverandCPA Review Notes 2019 - BEC (Business Environment Concepts)Rating: 4 out of 5 stars4/5 (9)

- QuestionnarieDocument3 pagesQuestionnarieAshish ThakurNo ratings yet

- dct4 Operator CodesDocument14 pagesdct4 Operator Codesapi-26122926No ratings yet

- Which Is The Best Choice After Tooth Extraction, Immediate ImplantDocument10 pagesWhich Is The Best Choice After Tooth Extraction, Immediate Implantjuanita enriquezNo ratings yet

- (Birkhauser Advanced Texts) Pavel Drabek, Jaroslav Milota - Methods of Nonlinear Analysis - Applications To Differential Equations-Birkhäuser (2007)Document575 pages(Birkhauser Advanced Texts) Pavel Drabek, Jaroslav Milota - Methods of Nonlinear Analysis - Applications To Differential Equations-Birkhäuser (2007)Omar Guzman0% (1)

- Application of Data ScienceDocument8 pagesApplication of Data SciencepallaB ghoshNo ratings yet

- Research Paper Sa Filipino 2Document7 pagesResearch Paper Sa Filipino 2gz8reqdc100% (3)

- Economics A: Pearson Edexcel Level 3 GCEDocument40 pagesEconomics A: Pearson Edexcel Level 3 GCEevansNo ratings yet

- WellInsight Help Tutorial PDFDocument472 pagesWellInsight Help Tutorial PDFKonul AlizadehNo ratings yet

- Harsh E-ComDocument14 pagesHarsh E-ComBUZZ GAMINGNo ratings yet

- AgronomyDocument99 pagesAgronomyrgopinath5100% (1)

- Proces VerbalDocument2 pagesProces VerbalLiviu CovaciuNo ratings yet

- Recent Developments in Zoning, Land Use and Building Controls "Navigating A Development Project Through Multiple Land Use Approvals" Presented by Howard S. Weiss, Esq. Davidoff Malito & Hutcher LLPDocument16 pagesRecent Developments in Zoning, Land Use and Building Controls "Navigating A Development Project Through Multiple Land Use Approvals" Presented by Howard S. Weiss, Esq. Davidoff Malito & Hutcher LLPHoward WeissNo ratings yet

- Katelyn Turner ResumeDocument2 pagesKatelyn Turner Resumeapi-401943774No ratings yet

- Lemon Grass-Shruti RanadeDocument6 pagesLemon Grass-Shruti RanadeMarites ParaguaNo ratings yet

- UniversallyDocument15 pagesUniversallyDaniel ThomasNo ratings yet

- Ukay2x RhotilesDocument14 pagesUkay2x RhotilesRozelle Ann Marie LicuranNo ratings yet

- 123Document184 pages123ShekharNo ratings yet

- Manual RAR502Document11 pagesManual RAR502mihaela_calin_24No ratings yet

- Tes PhalenDocument17 pagesTes PhalenJoko MunandarNo ratings yet

- Meli Marine CaseDocument5 pagesMeli Marine CaseScribdTranslationsNo ratings yet

- Maryam Asenuga YT ApplicationDocument5 pagesMaryam Asenuga YT ApplicationNathan LuzumNo ratings yet

- Non-Metals: Csec ChemistryDocument58 pagesNon-Metals: Csec ChemistryDarrion BruceNo ratings yet

- Engine Room Simulators: Leif Pentti HalvorsenDocument24 pagesEngine Room Simulators: Leif Pentti Halvorsenstevani liuNo ratings yet

- Level 1, Module 1 Hot Spot Extra ReadingDocument3 pagesLevel 1, Module 1 Hot Spot Extra ReadingMarina VoiculescuNo ratings yet

- Sample New Fidelity Acnt STMT Pages 7Document1 pageSample New Fidelity Acnt STMT Pages 7Temp 123No ratings yet

- Eastron SDM230-LoRaWAN Protocol V1.0Document3 pagesEastron SDM230-LoRaWAN Protocol V1.0Alejandro DemitiNo ratings yet

- Brochure JClass TriSealDocument20 pagesBrochure JClass TriSealEduardo MendozaNo ratings yet

- Exaktalenslist201811b PDFDocument46 pagesExaktalenslist201811b PDFAnonymous z5EIDvQdNo ratings yet