ACCA 305 Extra Credit Assignment

Uploaded by

Cooper89ACCA 305 Extra Credit Assignment

Uploaded by

Cooper89INTERMEDIATE FINANCIAL ACCOUNTING II

2014

Extra Credit

Assignment

Tuesday, 04 March

Aleshia Cooper

Mr. Terrance Richards

A. Cooper 2

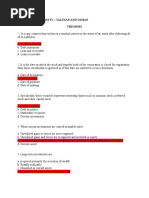

Multiply Choice Section

1. Answer: b. The par value of all capital stock issued.

Explanation: Legal Capital is the par value of all of a company's shares outstanding. Legal

capital may not be distributed as dividends, or as anything else. It is also called stated capital.

2. Answer: c. Bear the ultimate risks and uncertainties and receive the benefits of enterprise

ownership.

Explanation: Common stockholders are the residual owners of a corporation in that they have a

claim to what remains after every other party has been paid. The value of their claim depends on

the success of the firm. When you own common stock, your shares represent ownership in the

corporation and give you the right to vote for the company's board of directors and benefit from

its financial success.

3. Answer: c. A claim against a portion of the total assets of an enterprise.

Explanation: Stockholders' equity represents the equity stake currently held on the books by a

firm's equity investors .It is calculated either as a firm's total assets minus its total liabilities, or as

share capital plus retained earnings minus treasury shares.

4. Answer: c.May decrease but not increase retained earnings.

Explanation:

5. Answer: c.Redeemable

Explanation:

6. Answer: c.means that the shareholder can accumulate preferred stock until it is equal to the par

value of common stock at which time it can be converted into common stock.

Explanation:

7. Answer: c. Decrease No effect

Explanation:

A. Cooper 3

8. Answer: b.Liquidation preferences

Explanation:

9. Answer: c.Treasury Stock for $60,000 and Paid-in Capital from Treasury Stock for $16,000.

Explanation: 4,000 * $15 = $60,000 4,000 * $4 = $16,000.

10. Answer: c.$905,000

Explanation: 900,000 + 2,000 * 5 500 * 10 = $ 905,000

11. Answer: d.$3,330,000.

Explanation: 675,000 * 4 + 90,000 * 7 = $3,330,000

12. Answer: c.$ 7,000

Explanation: 2,000 * 50 * .06 = $6,000 ($6,000 $5,000) + $6,000 = $7,000

13. Answer: a.$15,000

Explanation: 5,000 * 100 * .05 = $25,000 (45,000 * 2) (25,000 * 3) = $15,000

14. Answer: a.reflected currently in income, but not as an extraordinary item.

Explanation:

15. Answer: d.treated as a direct reduction of retained earnings.

Explanation:

16. Answer: b.book value method.

Explanation:

17. Answer: d.based on the relative market values of the two securities involved.

A. Cooper 4

Explanation:

18. Answer: c. No Yes

Explanation:

19. Answer: b.the holder has to pay a certain amount of cash to obtain the shares.

Explanation:

20. Answer: a.credit of $136,000 to Paid-in Capital in Excess of Par

Explanation: $800,000 + 175,000 * .32 800 * 30 * 30 = $136,000.

21. Answer: b.$3,600 increase in paid-in capital in excess of par.

Explanation: 60,000 (1,200 45) 2,400 = $3,600

22. Answer: a. $330,000

Explanation: (2,400,000 1,000) * 40 * 20 = $1,920,000

(2,400,000 16,000,000) * 1,000,000 = $150,000

2,400,000 1,920,000 150,000 = $330,000.

23. Answer: c. $70,500.

Explanation: (3,000,000 2,883,000) 117 = $1,000

A. Cooper 5

(3,000,000 .09 3/12) + (1,000 3) = $70,500.

24. Answer: b.$21,600.

Explanation: $117,000 117 = $1,000

$117,000 (1,000 * 3) + (1,000 * 6) * $600,000/$3,000,000= $21,600

25. Answer: b. Cash 240,000

Paid-in CapitalStock Warrants 40,000

Common Stock 160,000

Paid-in Capital in Excess of Par 120,000

Explanation: Cash: 16,000 * 15 = $240,000

Paid-in CapitalStock Warrants: $100,000 * 16/40 = $40,000

Common Stock: 16,000* 10 = $160,000

Paid-in Capital in Excess of Par: 240,000+40,000-160,000= $120,000.

26. Answer b.$20,500

Explanation: 20,000 (20,000 + 180,000) * $205,000 = $20,500.

27. Answer: c.discount of $5,600.

Explanation: 500,000 * .96 + 500 * 20 * $2 = $500,000

500,000 494,400 = $5,600

A. Cooper 6

28. Answer: b. warrants.

Explanation: Securities which could be classified as held-to-maturity are warrants

29. Answer: c.trading.

Explanation: Unrealized holding gains or losses which are recognized in income are from

securities classified as trading.

30. Answer: a. make an adjusting entry to debit Interest Receivable and to credit Interest Revenue

for the amount of interest accrued since the last interest receipt date.

Explanation: The investor must make an adjusting entry to debit Interest Receivable and to

credit Interest Revenue for the amount of interest accrued since the last interest receipt date.

31. Answer: a. held-to-maturity debt securities.

Explanation: Debt securities that are accounted for at amortized cost, not fair value, are held-to-

maturity debt securities.

32. Answer: c. available-for-sale debt securities.

Explanation: Debt securities acquired by a corporation which are accounted for by recognizing

unrealized holding gains or losses and are included as other comprehensive income and as a

separate component of stockholders' equity are

33. Answer: b.a varying amount being recorded as interest income from period to period.

Explanation: Use of the effective-interest method in amortizing bond premiums and discounts

results in a varying amount being recorded as interest income from period to period.

34. Answer: a.available-for-sale securities where a company has holdings of less than 20%.

A. Cooper 7

Explanation: Equity securities acquired by corporations which are accounted for by recognizing

unrealized holding gains or losses as other comprehensive income and as a separate component

of stockholders' equity are available-for-sale securities where a company has holdings of less

than 20%.

35. Answer: d.All of these are required

Explanation: A requirement for a security to be classified as held-to-maturity is ability to hold the

security to maturity, positive intent and the security must be a debt security

36. Answer: b.acquisition cost plus amortization of a discount.

Explanation: Held-to-maturity securities are reported at acquisition cost plus amortization of a

discount.

37. Answer: c. a debit to Held-to-Maturity Securities at $315,000.

Explanation:

38. Answer: d. All of these are correct.

Explanation: In regard to trading securities they are held with the intention of selling them in a short

period of time. Unrealized holding gains and losses are reported as part of net income. Any

discount or premium is not amortized.

39. Answer: c . any discount or premium is not amortized

Explanation:

40. Answer: c. Available-for-Sale Securities 194,000

Interest Revenue 4,500

Cash 198,500

A. Cooper 8

Explanation:

41. Answer: b.$414,000

Explanation: ($400,000 * 1.02) + $6,000 = $414,000.

42. Answer: d.$686.

Explanation: ($376,100 * .055) ($400,000 * .05) = $686

43. Answer: b.$41,409.

Explanation: $376,100 * .055 = $20,686 ($376,100 + $686) * .055 - $20,723;

$20,686 + $20,723 = $41,409.

44. Answer: b. $20,000 loss

Explanation: $400,000 $380,000 = $20,000 loss.

45. Answer: c. $20,000 gain

Explanation: 320,000 $300,000 = $20,000 gain.

46. Answer: b. Securities Fair Value Adjustment 5,000

(Available-for-Sale)

Unrealized Holding Gain or Loss-Equity 5,000

A. Cooper 9

Explanation: ($40,000 $33,000) $2,000 = $5,000

47. Answer: b.$260,000

Explanation: + [($420,000 $180,000) .25] = $320,000 X + $60,000 =

$320,000 X = $260,000.

48. Answer: c. $50,000

Explanation: 200,000 * (25,000 100,000) = $50,000

49. Answer: c. $564,000

Explanation: $500,000 + [($800,000 $640,000) * (20,000 50,000)] = $564,000.

50. Answer: a.$320,000.

Explanation: $800,000 (20,000 50,000) = $320,000.

51. Answer: c. $195,000

Explanation: acquisition cost

52. Answer: b.$225,000

Explanation: acquisition cost

53. Answer: b.$135,000

Explanation: acquisition cost

54. Answer: b.$216,000

55. Explanation: $202,500 + ($75,000 * .3) ($30,000 *.3) = $216,000

A. Cooper 10

Problems Section

Problem 1.

(a) As of 12/31/11, it is desired to distribute $250,000 in dividends. How much will the preferred

stockholders receive if their stock is cumulative and nonparticipating?

Answer: ($400,000 * .06 * 3) = $72,000

(b) As of 12/31/11, it is desired to distribute $400,000 in dividends. How much will the preferred

stockholders receive if their stock is cumulative and participating up to 11% in total?

Answer: 72,000 + [(.11 -.06) =.05 * 400,000] =$92,000

(c) On 12/31/11, the preferred stockholders received a $120,000 dividend on their stock which is

cumulative and fully participating. How much money was distributed in total for dividends

during 2011?

Answer: $1,600,000 x .06 + [($120,000 - $72,000) $400,000)] x $1,600,000 =576,000-288,000 +

120,000=$ 408,000

A. Cooper 11

Problem 2.

Instructions

Prepare the general journal entries necessary to record these transactions.

ACCOUNT Debit Credit

No entry

No entry

Land 300,000

Common Stock 40,000

A.P.I.C 260,000

Cash 600,000

Preferred Stock 500,000

A.P.I.C 100,000

Organization Expense 6,000

Common Stock 500

A.P.I.C

5,500

A. Cooper 12

Problem 3.

The original sale of the $50 par value common shares of Gray Company was recorded as

follows:

Cash 290,000

Common Stock 250,000

Paid-in Capital in Excess of Par 40,000

ACCOUNT Debit Credit

Treasury Stock 18,600

Cash 18,600

Cash 4,800

Retained Earnings 160

Treasury Stock

4,960

Cash 2,720

Paid-in Capital from

Treasury Stock

240

Treasury Stock 2,480

A. Cooper 13

Problem 4.

Instructions

Compute the weighted average number of shares to be used in computing earnings per

share for 2010

Date Increase/Decrease Outstanding

shares

Months

Outstanding

Stock Split Share

Months

Jan. 1 1,000,000 2/12 2/1 333,333.3333

March 1 150,000 1,150,000 4/12 2/1 766,666.6666

July 1 1,150,000 2,300,000 3/12 575,000

Oct. 1 (600,000) 1,700,000 3/12 425,000

Weighted

Average

2,100,000

Problem 5.

A. Cooper 14

What accounting treatment is required for convertible debt? Why? What

accounting treatment is required for debt issued with stock warrants? Why?

Convertible debt is treated only as debt. Firstly, as convertible bonds usually carried

lower interest rate than ordinary debt because of the conversion option, the true opportunity cost

of financing the debt was not being recognized. Secondly, the financial position of the entity did

not present the fact that the entity had in effect issued share options as part of the convertible

debt arrangement. Upon maturity of the convertible bonds, the accounting treatment depends on

whether the conversion option is exercised or lapsed. If the conversion option is not exercised,

the company will have to pay the principal amount of the convertible bonds. Therefore, the

outstanding liability may be simply de-recognized. If however, the conversion option is

exercised, the company will have to issue shares to the bondholders. Hence, both liability and

equity components of the convertible bonds will need to be de-recognized and replaced by share

capital reserves as they are treated as consideration for the new shares issue.

When debt is issued with stock warrants, the warrants are given separate recognition.

After issue, the debt and the detachable warrants trade separately. The proceeds may be allocated

to the two elements based on the relative fair values of the debt security without the warrants and

the warrants at the time of issuance.

Problem 6

A. Cooper 15

For each of the unrelated transactions described below, present the entry (ies) required to

record the bond transactions.

ACCOUNT Debit Credit

1 Bonds Payable 8,000,000

Premium on Bonds Payable 700,000

Common Stock 6,400,000

A.P.I.C 2,300,000

2 Cash 2,910,000

Discount on Bonds Payable 90,000

Bonds Payable 3,000,000

3 Cash 5,050,000

Discount on Bonds Payable 253,000

Bonds Payable 5,000,000

A.P.I.C 303,000

Problem 7

A. Cooper 16

2010 2011 2012

Contract price $900,000 $900,000 $900,000

Less estimated cost:

Costs to date 270,000 450,000 610,000

Estimated cost to

complete

330,000 150,000

Estimated total cost 600,000 600,000 610,000

Estimated total gross

profit

$300,000 $300,000 $290,000

2010 2011 2012

$270,000/$600,000*300,000 $135,000

$450,000/$600,000*300,000 $225,000

2010 gross profit $135,000

Gross profit in 2011 $ 90,000 $290,000

20102011 gross profit 225,000

Gross profit in 2012 $ 65,000

Total billings $900,000

Total cost $610,000

Gross profit in 2012 $290,000

A. Cooper 17

Problem 8

2010 2011 2012

Contract price $3,000,000 $3,000,000 $3,000,000

Less estimated cost:

Costs to date $ 600,000 $1,560,000 $2,100,000

Estimated cost to

complete

$1,400,000 $520,000

Estimated total cost $2,000,000 2,080,000 2,100,000

Estimated total gross

profit

$1,000,000 $920,000 $900,000

2010 2011 2012

Percentage

completed to date

600,000/$2,000,000

30%

1,560,000/$2,080,000

75%

100%

Total gross profit 300,000 690,000 900,000

Gross profit in

previous years

0 300,000 690,000

Gross profit in

current year

300,000 $ 390,000 $ 210,000

ACCOUNT Debit Credit

Construction in Process 540,000

Materials 540,000

Accounts Receivable 1,000,000

Billings on Construction in

Process

1,000,000

Cash 900,000

Accounts Receivable 900,000

Construction Expenses 540,000

A. Cooper 18

Construction in process 210,000

Revenue from Long-Term

Contracts

750,000

Billings on Construction in

Process

Construction in Process 3,000,000

3,000,000

You might also like

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- Multiple Choice: Performance Measurement, Compensation, and Multinational ConsiderationsNo ratings yetMultiple Choice: Performance Measurement, Compensation, and Multinational Considerations13 pages

- This Study Resource Was: Multiple Choice QuestionsNo ratings yetThis Study Resource Was: Multiple Choice Questions8 pages

- Chap 11 Extra Problems Financial AccountingNo ratings yetChap 11 Extra Problems Financial Accounting71 pages

- Multiple Choice Questions Finance and AccountingNo ratings yetMultiple Choice Questions Finance and Accounting22 pages

- Chapter 20-Cash, Payables, and Liquidity Management: Multiple ChoiceNo ratings yetChapter 20-Cash, Payables, and Liquidity Management: Multiple Choice15 pages

- Alagos & Bayona - Advanced Accounting 1-6 MCQ100% (1)Alagos & Bayona - Advanced Accounting 1-6 MCQ24 pages

- ACC3100 Fall 2017 Mid Term 1 Exam Practice Question From Test BankNo ratings yetACC3100 Fall 2017 Mid Term 1 Exam Practice Question From Test Bank100 pages

- Control No 3 V MF XXVIII Tema B SolucionarioNo ratings yetControl No 3 V MF XXVIII Tema B Solucionario7 pages

- Mill A N CH A Pter 1 Business Combin A Tion P A RT 3 CompressNo ratings yetMill A N CH A Pter 1 Business Combin A Tion P A RT 3 Compress5 pages

- Final Assignment of Financial Accounting (Bus-18g-030) Muhammad FurqanNo ratings yetFinal Assignment of Financial Accounting (Bus-18g-030) Muhammad Furqan5 pages

- Reading 15 Analysis of Dividends and Share Repurchases - AnswersNo ratings yetReading 15 Analysis of Dividends and Share Repurchases - Answers31 pages

- Chapter 9 - Annand, D. (2018) :: Concept Self-Check: 1 To 6No ratings yetChapter 9 - Annand, D. (2018) :: Concept Self-Check: 1 To 66 pages

- Make Money With Dividends Investing, With Less Risk And Higher ReturnsFrom EverandMake Money With Dividends Investing, With Less Risk And Higher ReturnsNo ratings yet

- Chapter 4 - Completing The Accounting Cycle100% (3)Chapter 4 - Completing The Accounting Cycle142 pages

- Balance Sheet: Current Assets Current LiabilitiesNo ratings yetBalance Sheet: Current Assets Current Liabilities3 pages

- Calling For The Ban On Porn Text Base EssayNo ratings yetCalling For The Ban On Porn Text Base Essay4 pages

- Aleshia Cooper Thursday, 28 January, 2014 Accounts 305 - 01 Mr. Terrance Richards Homework Questions: E: 16-1, 2, 3, 7, 8, 16, and 19 Exercise 16-1No ratings yetAleshia Cooper Thursday, 28 January, 2014 Accounts 305 - 01 Mr. Terrance Richards Homework Questions: E: 16-1, 2, 3, 7, 8, 16, and 19 Exercise 16-17 pages

- Aleshia Cooper Thursday, 23 January, 2014 Accounts 305 - 01 Mr. Terrance Richards Homework Questions: E: 15-1, 15-2, 15-3, and 15-5No ratings yetAleshia Cooper Thursday, 23 January, 2014 Accounts 305 - 01 Mr. Terrance Richards Homework Questions: E: 15-1, 15-2, 15-3, and 15-55 pages

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your Life

- Multiple Choice: Performance Measurement, Compensation, and Multinational ConsiderationsMultiple Choice: Performance Measurement, Compensation, and Multinational Considerations

- This Study Resource Was: Multiple Choice QuestionsThis Study Resource Was: Multiple Choice Questions

- Chapter 20-Cash, Payables, and Liquidity Management: Multiple ChoiceChapter 20-Cash, Payables, and Liquidity Management: Multiple Choice

- ACC3100 Fall 2017 Mid Term 1 Exam Practice Question From Test BankACC3100 Fall 2017 Mid Term 1 Exam Practice Question From Test Bank

- Mill A N CH A Pter 1 Business Combin A Tion P A RT 3 CompressMill A N CH A Pter 1 Business Combin A Tion P A RT 3 Compress

- Final Assignment of Financial Accounting (Bus-18g-030) Muhammad FurqanFinal Assignment of Financial Accounting (Bus-18g-030) Muhammad Furqan

- Reading 15 Analysis of Dividends and Share Repurchases - AnswersReading 15 Analysis of Dividends and Share Repurchases - Answers

- Chapter 9 - Annand, D. (2018) :: Concept Self-Check: 1 To 6Chapter 9 - Annand, D. (2018) :: Concept Self-Check: 1 To 6

- Certified Cost Professional (CCP) Exam Practice TestFrom EverandCertified Cost Professional (CCP) Exam Practice Test

- Make Money With Dividends Investing, With Less Risk And Higher ReturnsFrom EverandMake Money With Dividends Investing, With Less Risk And Higher Returns

- Aleshia Cooper Thursday, 28 January, 2014 Accounts 305 - 01 Mr. Terrance Richards Homework Questions: E: 16-1, 2, 3, 7, 8, 16, and 19 Exercise 16-1Aleshia Cooper Thursday, 28 January, 2014 Accounts 305 - 01 Mr. Terrance Richards Homework Questions: E: 16-1, 2, 3, 7, 8, 16, and 19 Exercise 16-1

- Aleshia Cooper Thursday, 23 January, 2014 Accounts 305 - 01 Mr. Terrance Richards Homework Questions: E: 15-1, 15-2, 15-3, and 15-5Aleshia Cooper Thursday, 23 January, 2014 Accounts 305 - 01 Mr. Terrance Richards Homework Questions: E: 15-1, 15-2, 15-3, and 15-5