Introduction:-: Mission & Vision

Introduction:-: Mission & Vision

Uploaded by

zalaksCopyright:

Available Formats

Introduction:-: Mission & Vision

Introduction:-: Mission & Vision

Uploaded by

zalaksOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Introduction:-: Mission & Vision

Introduction:-: Mission & Vision

Uploaded by

zalaksCopyright:

Available Formats

INTRODUCTION:-

UltraTech Cement Limited is leading cement company and the country’s largest exporter of

cement clinker based in Mumbai, India. It has an annual capacity of 23.1 million tonnes. It

manufactures and markets Ordinary Portland Cement, Portland Blast Furnace Slag Cement and

Portland Pozzalana Cement. It also manufactures ready mix concrete (RMC). The export

markets span countries around the Indian Ocean, Africa, Europe and the Middle East. It is part

of Grasim Group.

UltraTech Cement Limited has five integrated plants, six grinding units and three terminals two

in India and one in Sri Lanka.

UltraTech’s subsidiaries are Dakshin Cement Limited, UltraTech Cement Lanka (Pvt.) Ltd. and

UltraTech Cement Middle East Investments Limited

MISSION & VISION:-

Vision of the company:

To be a premium global conglomerate with a clear focus on each business.

To become world most big company of cement and concrete.

Mission of the company:

To deliver superior value to the customers, shareholders, employees and society at

large.KUMAR MANGALAM BIRLA SAYS

“our goal is to become a US $65 billion group by 2015 from US $30 billion company

today.we expect company to contribute significally to this growth and earnings.”

HISTORY:-

2001 -Grasim acquires 10 per cent stake in L&T. Subsequently increases stake

1

to 15.3 per cent by October 2002 -Durgapur grinding unit

Page

2002 -Grasim increases its stake in L&T to 14.15 per cent -Arakkonam grinding

unit -The Grasim Board approves an open offer for purchase of up to 20 per cent

of the equity shares of Larsen & Toubro Ltd (L&T), in accordance with the

provisions and guidelines issued by the Securities & Exchange Board of India

(SEBI) Regulations, 1997.

2003 The board of Larsen & Toubro Ltd (L&T) decides to demerge its cement

business into a separate cement company (CemCo). Grasim decides to acquire

an 8.5 per cent equity stake from L&T and then make an open offer for 30 per

cent of the equity of CemCo, to acquire management control of the company

B.R.C.M COLLEGE OF BUSINESS ADMINISTRATION

2004 Completion of the implementation process to demerge the cement

business of L&T and completion of open offer by Grasim, with the latter

acquiring controlling stake in the newly formed company UltraTech 2006

-Narmada Cement Company Limited amalgamated with UltraTech pursuant to a

Scheme of Amalgamation being approved by the Board for Industrial & Financial

Reconstruction (BIFR) in terms of the provision of Sick Industrial Companies Act

(Special Provisions) - Formerly known as Ultratech Cemco Limited. The Group's

principal activities are to manufacture and market clinker and cement in India

2009

-UltraTech to absorb Samruddhi to form India's biggest cement firm

-Ultratech to be the lead sponsors of Rajasthan Royals

-UltraTech to consider Grasim merger proposal

PLANTS:-

Andhra Pradesh Cement Works Arakkonam Cement Works

Awarpur Cement Works Jharsuguda Cement Works

Gujarat Cement Works Magdalla Cement Works

Hirmi Cement Works Ratnagiri Cement Works

Jafrabad Cement Works West Bengal Cement Works

Ginigera Cement Works

ORGANISATIONAL STRUCTURE:-

Board of Directors Executives

Kumar Mangalam Birla R. K. Shah(CFO of mfg & projects)

2

(Chairman)

Page

Mrs. Rajashree Birla S. N. Jajoo (Chief Marketing Officer)

R. C. Bhargava C. B. Tiwari (Chief People Officer)

G. M. Dave Mr. S. K. Chatterjee (Company

Secretary)

N. J. Jhaveri

S. B. Mathur

V. T. Moorthy

S. Rajgopal

B.R.C.M COLLEGE OF BUSINESS ADMINISTRATION

O. P. Puranmalka

(Whole-time Director)

D. D. Rathi

:-

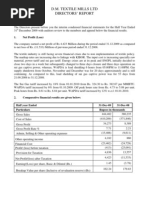

Profit and loss account as on 31 March 2009

Rs. in crore

Schedule Previous year

Income

Gross sales 7,160.42 6,285.80

Less: excise duty 777.34 777.02

Net sales 6,383.08 5,508.78

Interest and dividend income 13 45.15 37.47

Other income 14 58.41 63.24

Increase / (decrease) in stocks 15 88.76 26.63

6,575.40 5,636.12

Expenditure

Raw materials consumed 16 684.96 536.77

Manufacturing expenses 17 2,420.17 1,828.87

Purchase of finished products 19.50 13.68

Payments to and provision for

18 217.67 167.59

employees

Selling, distribution,

administration and other 19 1,431.51 1,276.03

expenses

3

Interest and finance charges 20 125.51 82.31

Page

Depreciation and obsolescence 323.00 237.23

5,222.32 4,142.48

Less : Captive consumption of (8.38) (13.37)

cement {net of excise duty Rs.

6.48 crore (Previous year Rs.

5.13 crore)}

5,213.94 4,129.11

Profit before tax expenses 1,361.46 1,507.01

B.R.C.M COLLEGE OF BUSINESS ADMINISTRATION

Income tax expenses

Provision for current tax 197.54 510.24

{including provision for wealth

tax Rs. 0.46 crore (Previous

year Rs. 0.18 crore) and interest

of Rs. Nil (Previous year Rs.

4.25 crore)}

Deferred tax 180.58 (16.71)

Provision for fringe benefit tax 6.32 5.87

Profit after tax 977.02 1,007.61

Balance brought forward from

1,598.12 775.16

previous year

Profit available for

2,575.14 1,782.77

appropriation

Appropriations

Proposed dividend 62.24 62.24

Corporate dividend tax 10.58 10.58

Debenture redemption reserve (36.08) (8.17)

General reserve 100.00 120.00

Balance carried to balance

2,438.40 1,598.12

sheet

2,575.14 1,782.77

Basic earnings per equity

share (in Rs.) {See Note B 20 78.48 80.94

(A)}

Diluted earnings per equity

4

share (in Rs.) {See Note B 20 78.48 80.91

Page

(B)}

B.R.C.M COLLEGE OF BUSINESS ADMINISTRATION

:-

Balance sheet as on 31 March 2009

Rs. in crore

Schedul As on 31

e March 2008

Sources of funds

Shareholders' funds

Share capital 1A 124.49 124.49

Employees stock options outstanding 1B 1.68 0.77

Reserves and surplus 2 3,475.93 2,571.73

3,602.10 2,696.99

Loan funds

Secured loans 3 1,175.80 982.66

Unsecured loans 4 965.83 757.84

2,141.63 1,740.50

Deferred tax liabilities (net) 722.93 542.35

Total 6,466.66 4,979.84

Application of funds

Fixed assets

Gross block 5 7,401.02 4,972.60

Less: depreciation 2,765.33 2,472.14

Net block 4,635.69 2,500.46

Capital work-in-progress 677.28 2,283.15

5,312.97 4,783.61

5

Investments 6 1,034.80 170.90

Page

Current assets, loans and advances

Inventories 7 691.97 609.76

Sundry debtors 8 186.18 216.61

Cash and bank balances 9 104.49 100.69

Loans and advances 10 378.97 376.83

1,361.61 1,303.89

Less:

B.R.C.M COLLEGE OF BUSINESS ADMINISTRATION

Current liabilities and provisions

Current liabilities 11 1,120.92 1,153.01

Provisions 12 121.80 125.55

1,242.72 1,278.56

Net current assets 118.79 25.33

Total 6,466.66 4,979.84

ANALYSIS OF FINAL ACCOUNT:-

Net Profit

Net profit for FY10 stood at Rs. 1,093 crores as Compared to Rs. 977 crores in FY09.

Net Turnover

Net Turnover rose by 10%, attributable to higher domestic sales volume. Exports and Ready

Mix Concrete (RMC), each, contributed to around 7% of your Company’s net turnover.

Other Income

Other income increased by 16% from Rs.106 crores in FY09 to Rs.123 crores in FY10 mainly on

account of increased earnings on surplus funds invested in various debt schemes of mutual funds

and exchange gain on account of appreciation of rupee to dollar.

Employee costs

Employee costs rose by 15% from Rs. 218 crores in FY09 to Rs. 251 crores in FY10 on account

of increase in manpower for new projects and annual increment.

Income Tax

Income tax increased from Rs. 384 crores in FY09 to Rs. 495 crores in FY10 linked to higher

taxable income. Effective tax rate is up from 28% in FY09 to 31% in FY10.

6

Page

Depreciation

Depreciation mounted by 20% from Rs. 323 crores in FY09 to Rs. 388 crores in FY10 as a result

of the full year impact of capitalisation of new projects in FY09.

GRAPH OF NET EARNING OF ULTRATECH CEMENT:-

B.R.C.M COLLEGE OF BUSINESS ADMINISTRATION

NET EARNINGS

1200

1000

800

NET EARNINGS

600

400

200

0

2005-06 2006-07 2007-08 2008-09 2009-10

This is the chart of the company’s last 5 years net earnings which indicates that company’s net earnings

has increase constantly except 1 year 2008-09.The chart indicate that net earning of company has increase

last year.so we can say that company was on good growth. Also we can conclude from chart that

company’s growth in last 3 years as compare to that of starting’s 2 year is low but overall earnings of the

company has increase very well.

COMPETITIORS:-

Kalyanpur cement, andhra cement, j k lakshmi cement ltd

Burnpur cement ltd, ambuja cements ltd, gujarat sidhee cement ltd., shree

cements ltd., binani cements ltd.., acc ltd., heidelberg cement india ltd., india

cements ltd. Mangalam cement ltd. Nirman cements ltd, birla corporation

7 Page

ltd,sanghi industries ltd, ambala cements ltd.

SWOT ANALYSIS OF THE ULTRATECH CEMENT:-

B.R.C.M COLLEGE OF BUSINESS ADMINISTRATION

-STRENGTHS:

-Double digit growth rate

-Cement demand has grown in tandem with strong economic growth;

derived from:

-Growth in housing sector (over 30%) key demand driver;

-Infrastructure projects like ports, airports, power projects, dam & irrigation

projects

-National Highway Development Programme

-Bharat Nirman Yojana for rural infrastructure

-Rise in industrial projects

-Export potential also demand driver

-Capacity utilization over 90%

-WEAKNESS:

- Low value commodity

-Cement Industry is highly fragmented

-Industry is also highly regionalized

-Low – value commodity makes transportation over long distances un-

Economical

-OPPORTUNITIES:

-Demand–supply gap

-Substantially lower per capita cement consumption as compared to

-developing countries (1/3 rd of world average) Per capita cement

-consumption in India is 82 kgs against a global average of 255 kgs

8

and Asian average of 200 kgs.

Page

-Additional capacity of 20 million tons per annum will be required to

match the demand

- Limited green field capacity addition in pipeline for next two years,

leading to favorable demand – supply scenario

-THREATS:

-Rising input costs

B.R.C.M COLLEGE OF BUSINESS ADMINISTRATION

-Government intervention to adjust cement prices

-Possibility of over bunching of capacities in the long term as some of

the players have already announced new capacities

-Transportation cost is scaling high; bottleneck due to loading

Restrictions

CONCLUSION

It has succinctly analyzed the present state of affairs at UltraTech cement

and thus identified its strengths and problem areas through a variety of

tools. While its raw material sourcing, financial and human resource pools

are sources of competitive advantage, UltraTech has to improve in terms of

fuel costs in order to beat ACC to the top position in the low margin

industry. This can also be achieved by leveraging futuristic trends like

branded retailing, exports and new products like ready concrete mix.

According to me ULTRATECH company is really performing well. And it

really has vast era to grow and become the world’s leading cement

manufacturer. This company really has potential to become rally good

company by its production capacity and its human resource.

“THE ULTRATECH CEMENT PVT LTD IS THE

NINTH-LARGEST CEMENT PRODUCER IN

9

THE WORLD.”

Page

B.R.C.M COLLEGE OF BUSINESS ADMINISTRATION

10Page

B.R.C.M COLLEGE OF BUSINESS ADMINISTRATION

You might also like

- Project Report On Ultratech Cement Limited PDFDocument45 pagesProject Report On Ultratech Cement Limited PDFRamesh PatilNo ratings yet

- Research On Effectiveness of Ultratech Trade Connect App by Ayush MauryavanshiDocument52 pagesResearch On Effectiveness of Ultratech Trade Connect App by Ayush MauryavanshiAyush Mauryavanshi100% (1)

- Swot Analysis of Ultratech Cement LimitedDocument23 pagesSwot Analysis of Ultratech Cement Limitedtarunnayak11100% (3)

- Eco Analysis Tata SteelDocument79 pagesEco Analysis Tata SteelRavNeet KaUrNo ratings yet

- India Cements LTDDocument24 pagesIndia Cements LTDqwertyNo ratings yet

- A Study On Dalmia CementDocument4 pagesA Study On Dalmia Cementkingsley_psbNo ratings yet

- Final Report Tata MotorsDocument72 pagesFinal Report Tata MotorsShubham KumarNo ratings yet

- Aditya Birla Group FinalDocument27 pagesAditya Birla Group Finalchinmay451100% (1)

- 162-Cement Industry in IndiaDocument33 pages162-Cement Industry in Indiapiyushbhatia10_28338100% (2)

- RequestFREE (Elf)Document10 pagesRequestFREE (Elf)EdsonnSPBrNo ratings yet

- AristocratDocument19 pagesAristocratNoreen LagmanNo ratings yet

- IEOR E4707 Spring 2016 SyllabusDocument2 pagesIEOR E4707 Spring 2016 SyllabusrrrreeeNo ratings yet

- Chapter 6 Problems PDFDocument4 pagesChapter 6 Problems PDFThinh Doan100% (1)

- ASF Model RMBS Representations and WarrantiesDocument21 pagesASF Model RMBS Representations and WarrantiesModel RepsNo ratings yet

- Ultratech CementDocument53 pagesUltratech CementManjunath@116100% (2)

- Ultratech CementsDocument29 pagesUltratech CementsSandeep King SwainNo ratings yet

- Ultratech ProjectDocument48 pagesUltratech ProjectSubrat Swain100% (2)

- Ultratech Cement LTD - SAPM AssignmentDocument25 pagesUltratech Cement LTD - SAPM AssignmentTushar PatilNo ratings yet

- UltraTech Cement Group Project CE-VDocument27 pagesUltraTech Cement Group Project CE-VAniruddh Singh ThakurNo ratings yet

- Company Profile - UltraTechDocument49 pagesCompany Profile - UltraTechlnm sidhiNo ratings yet

- JK Mysore Intership ReportDocument41 pagesJK Mysore Intership ReportSumanth Gowda100% (1)

- SCM of UltratechDocument29 pagesSCM of UltratechDisha GanatraNo ratings yet

- Comparative Statement Analysis of Select Paint Companies in IndiaDocument6 pagesComparative Statement Analysis of Select Paint Companies in IndiaMerajud Din100% (1)

- Pestel Analysis On Ultratech Cement AssignmentDocument7 pagesPestel Analysis On Ultratech Cement AssignmentNick Sharma50% (2)

- Cement Marketing in India: Challenges & Opportunities: SRM University, ChennaiDocument8 pagesCement Marketing in India: Challenges & Opportunities: SRM University, ChennaiAkram JavedNo ratings yet

- Orient Cements: Company ProfileDocument7 pagesOrient Cements: Company ProfileAkshay SharmaNo ratings yet

- Overview of Indian Cement Industry 2010Document17 pagesOverview of Indian Cement Industry 2010shubhav1988100% (2)

- Corporate Finance - MRF CompanyDocument24 pagesCorporate Finance - MRF CompanyAneesh GargNo ratings yet

- UltratechDocument93 pagesUltratechlokesh_045No ratings yet

- Working Capital & Ratio Analysis at Dalmia Cement (Bharat) LTDDocument75 pagesWorking Capital & Ratio Analysis at Dalmia Cement (Bharat) LTDSumit Yadav100% (4)

- Swot Analysis of Ultratech CementDocument31 pagesSwot Analysis of Ultratech Cementtarunnayak11100% (7)

- MRF (Company) : Madras Rubber Factory Commonly Known As MRF orDocument6 pagesMRF (Company) : Madras Rubber Factory Commonly Known As MRF orAjudiya Meet0% (1)

- SWOT Analysis For TATA MotorsDocument12 pagesSWOT Analysis For TATA Motorsnaveenasekhar100% (1)

- Project Report On CciDocument62 pagesProject Report On CciShilank Sharma100% (2)

- Summer Internship Report On JK TyreDocument127 pagesSummer Internship Report On JK Tyrevarun jhaNo ratings yet

- Financial Analysis of Ultratech CementDocument23 pagesFinancial Analysis of Ultratech Cementsanchit1170% (2)

- Maruti Suzuki India LimitedDocument40 pagesMaruti Suzuki India LimitedGokul KrishnakumarNo ratings yet

- JSW SteelsDocument41 pagesJSW SteelsAthira100% (1)

- A Project Report On Customer Satisfaction and Market Potential of Ambuja CementsDocument11 pagesA Project Report On Customer Satisfaction and Market Potential of Ambuja CementsmanoranjanNo ratings yet

- Main ProjectDocument64 pagesMain Projectsandy1586No ratings yet

- Marketing Project Report - Ultratech CementfinalDocument18 pagesMarketing Project Report - Ultratech Cementfinalnileshsomkuwar75% (4)

- Heidelberg Cement India LTD.: Summer Internship PresentationDocument8 pagesHeidelberg Cement India LTD.: Summer Internship PresentationKajal GulatiNo ratings yet

- Tata Motors Ratio AnalysisDocument18 pagesTata Motors Ratio AnalysisAbhishek VashishthNo ratings yet

- Summer Internship Project Report TTTTDocument60 pagesSummer Internship Project Report TTTTAnonymous Ut4ourcNo ratings yet

- Ultra Tech CementDocument14 pagesUltra Tech CementRaunak Doshi71% (14)

- Pink - Abstract GD Topic - Group Discussion Ideas PDFDocument5 pagesPink - Abstract GD Topic - Group Discussion Ideas PDFAshutosh SharmaNo ratings yet

- A Summer Training Project ReportDocument65 pagesA Summer Training Project Reportnaqeebluv75% (4)

- My PPT Presentation On ULTRA TECH CEMENTDocument13 pagesMy PPT Presentation On ULTRA TECH CEMENTAshish Kumar Pani67% (3)

- Global Operations of TATA GroupDocument28 pagesGlobal Operations of TATA GroupbhavanaNo ratings yet

- Ultra Tech ReportDocument30 pagesUltra Tech ReportnileshsomkuwarNo ratings yet

- TCHFL Annual Report Fy 2023 24Document263 pagesTCHFL Annual Report Fy 2023 24CSC WALANo ratings yet

- Electrosteel Steels Limited - Annual Report 2018-19Document88 pagesElectrosteel Steels Limited - Annual Report 2018-19dilip kumarNo ratings yet

- JINDALSAW 16012024141843 FinancialHighlightDocument7 pagesJINDALSAW 16012024141843 FinancialHighlightPrithu RajNo ratings yet

- Director ReportDocument3 pagesDirector ReportZeeshan AzizNo ratings yet

- Annual Report FY2022-23Document173 pagesAnnual Report FY2022-23Ramprasad BanothuNo ratings yet

- Ultratech Cement Bse: 532538 Nse: Ultracemco Isin: Ine481G01011 Industry: Cement - Major Directors Report Year End: Mar '10Document7 pagesUltratech Cement Bse: 532538 Nse: Ultracemco Isin: Ine481G01011 Industry: Cement - Major Directors Report Year End: Mar '10Anushree Harshaj GoelNo ratings yet

- ACC Financial ResultsDocument12 pagesACC Financial ResultsKKVSBNo ratings yet

- FM Merger and AquesDocument6 pagesFM Merger and AquesMayank Singh RawatNo ratings yet

- Boc Annual Report 2008Document70 pagesBoc Annual Report 2008luv_y_kush3575No ratings yet

- Financial Results Q1 August 2018Document13 pagesFinancial Results Q1 August 2018shakeelahmadjsrNo ratings yet

- Vraj Iron and Steel LimitedDocument5 pagesVraj Iron and Steel Limiteddeepak lachhwaniNo ratings yet

- CR AssignmentDocument16 pagesCR AssignmentWaleed KhalidNo ratings yet

- Profit & Loss, Balance Sheet and Cash Flow StatementDocument13 pagesProfit & Loss, Balance Sheet and Cash Flow Statementshivuch20No ratings yet

- 96th Annual Report Ingersoll RandDocument122 pages96th Annual Report Ingersoll Randanon_587007360No ratings yet

- Financial Results Q1 August 2018Document40 pagesFinancial Results Q1 August 2018shakeelahmadjsrNo ratings yet

- Research Proposal For Portfolio Management in Banking, IT and Pharmaceutical SectorDocument6 pagesResearch Proposal For Portfolio Management in Banking, IT and Pharmaceutical Sectorzalaks67% (3)

- Factors Affecting Sanand Tata Nano PlantDocument6 pagesFactors Affecting Sanand Tata Nano Plantzalaks100% (2)

- Counseling Schedule MbaDocument1 pageCounseling Schedule MbazalaksNo ratings yet

- Dhara Soap and CosmeticsDocument10 pagesDhara Soap and CosmeticszalaksNo ratings yet

- OTTDocument3 pagesOTTzalaksNo ratings yet

- Rice Bran OilDocument23 pagesRice Bran OilzalaksNo ratings yet

- Balance Sheet As at March 31, 2010: Sources of FundsDocument15 pagesBalance Sheet As at March 31, 2010: Sources of FundszalaksNo ratings yet

- NiitDocument9 pagesNiitzalaksNo ratings yet

- NiitDocument9 pagesNiitzalaksNo ratings yet

- Investments Test 2 Study GuideDocument30 pagesInvestments Test 2 Study GuideLaurenNo ratings yet

- 9-4b Yield To Call: Price of BondDocument7 pages9-4b Yield To Call: Price of BondRina DutonNo ratings yet

- FREE Chapter 20 Group Cash Flow StatementsDocument28 pagesFREE Chapter 20 Group Cash Flow StatementsImran MobinNo ratings yet

- 1 s2.0 S1877050913011046 MainDocument6 pages1 s2.0 S1877050913011046 MainRahma BellanyNo ratings yet

- BMRE ProjectDocument27 pagesBMRE ProjectJadid HoqueNo ratings yet

- Dividend Policy - 072 - MBS - 1st - Year PDFDocument5 pagesDividend Policy - 072 - MBS - 1st - Year PDFRasna ShakyaNo ratings yet

- Investment in The Era of Unintended Bets: Joseph Mezrich Nomura Securities International, IncDocument23 pagesInvestment in The Era of Unintended Bets: Joseph Mezrich Nomura Securities International, IncblacksmithMGNo ratings yet

- Option Trading WorkbookDocument26 pagesOption Trading WorkbookMuhammad Ahsan MukhtarNo ratings yet

- Society NOC Home Loans With Share Certificate - NEWDocument2 pagesSociety NOC Home Loans With Share Certificate - NEWMayur VyasNo ratings yet

- Restructuring and ReschedulingDocument16 pagesRestructuring and ReschedulingJeyashankar Ramakrishnan100% (1)

- ADM 2350 N Syllabus Winter 2016Document10 pagesADM 2350 N Syllabus Winter 2016saadNo ratings yet

- Infiniti Capital Four Moment Risk DecompositionDocument19 pagesInfiniti Capital Four Moment Risk DecompositionPeter UrbaniNo ratings yet

- About The Fund Fund DetailsDocument2 pagesAbout The Fund Fund DetailsFooyNo ratings yet

- Idr Bjfin@in 091115 105311Document68 pagesIdr Bjfin@in 091115 105311NikhilKapoor29No ratings yet

- Dividend Policy and Retained EarningDocument28 pagesDividend Policy and Retained EarningMd Abusaied AsikNo ratings yet

- NNFX Strategy Flow ChartDocument2 pagesNNFX Strategy Flow ChartruwanzNo ratings yet

- Solution Manual Advanced Financial Accounting 8th Edition Baker Chap010 PDFDocument51 pagesSolution Manual Advanced Financial Accounting 8th Edition Baker Chap010 PDFYopie ChandraNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página883Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página883franzmartiniiNo ratings yet

- Resource Estimate Report For: Author (S)Document71 pagesResource Estimate Report For: Author (S)riecuantiqueNo ratings yet

- Assignment OffshoreDocument16 pagesAssignment OffshorelionalleeNo ratings yet

- Capital Market: Final ModuleDocument16 pagesCapital Market: Final ModuleEduardo VerdilloNo ratings yet

- Chapter 9Document37 pagesChapter 9Baby KhorNo ratings yet

- DRHP of PB - SebiDocument418 pagesDRHP of PB - SebiRhea DhallNo ratings yet

- Punjab National Bank: HistoryDocument5 pagesPunjab National Bank: HistoryPayal SikkaNo ratings yet

- Tugas 11 - C15 - Capital Structure and LeverageDocument7 pagesTugas 11 - C15 - Capital Structure and LeverageIqbal BaihaqiNo ratings yet