CCVO Template

CCVO Template

Uploaded by

johnopigoCopyright:

Available Formats

CCVO Template

CCVO Template

Uploaded by

johnopigoCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

CCVO Template

CCVO Template

Uploaded by

johnopigoCopyright:

Available Formats

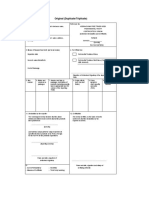

FEDERATION OF NIGERIA

Combined Form of Certificate of Value and of Origin and Invoice for

Goods Exported to the Federation of Nigeria. – (Form C16)

(1) State here general nature INVOICE of(1 )

or class of goods.

(2) Full name and address of by(2)

(Place and Date)

consigned

manufacturer, supplier or

exporter.

(3) Full name of business

and address (not P.O. Box or to(3)

Private Mail Bag) of the

importer.

to be shipped per

Order Number

Country of Origin Marks and numbers Quantity and description of goods Selling price to purchaser.

on packages.

@ Amount.

(US$)

Total FOB Value

Freight

Total CFR Value

Form M No.:

BA No.:

Bill of Lading No:

Bill of Lading Date:

WE CERTIFY THAT IMPORTERS ARE NOT ASSOCIATED WITH EXPORTERS AS DEFINED IN FEDERAL GOVT. NOTICE 1467 DATED 1958. THIS CERTIFIES THAT SUPPLIERS AND/OR MANUFACTURERS INVOICES HAVE BEEN

PRODUCED AND COMPARED WITH THE CONSIGNING FIRMS INVOICES AND THE LATER REPRESENTS PARTICULARS OF THE GOODS AND SELLING PRICE

Enumerate the following charges and state whether each amount has been in or excluded from the selling price to purchaser:-

Amount in currency of State if included in above Amount in currency of State if included in above

exporting country. selling price to purchaser. exporting country. selling price to purchaser.

(1) Cartage to rail and/or docks…… (5) If the goods are subject to any charge by way of

(2) Inland freight (rail or canal) and other royalties……………………………………

charges to the dock area including Inland (6) OCEAN FREIGHT…………………… INCLUDED

Insurance………………………… (7) OCEAN INSURANCE………………………

(3) Labour in packing the goods into outside (8) Commission, establishment and other charges of

packages………………………… a like nature…………………………

(4) Value of outside packages………… (9) Other costs, dues, charges and expenses

incidental to the delivery of the articles…………

I,……… ……… ………………………(1) AUTH. SIGNATORY … ……………………………….…………………of (2)… ………………………………………………………………………………………………………

of (3)… …………………………………………………………………………………………(manufacturers/suppliers/exporters) of the goods enumerated in this Invoice amounting to…… ……………………………..……………………

hereby declare that I have the authority to make and sign this Certificate on behalf of the aforesaid (manufacturers/suppliers/exporters) and that I have the means of knowing and do hereby certify as follows:-

1. That this invoice is in all respects correct and contains a true and full statement of the price actually paid or to be paid for the said goods, and the actual quantity thereof.

2. That no different invoice of the goods mentioned in the said invoice has been or will be furnished to anyone.

3. That no arrangements or understanding affecting the purchase price of the said goods has been or will be made or entered into between the said exporter and purchaser, or by anyone on behalf of either of them either by way of discount, rebate, compensation

or in any manner whatever other than as fully shown on this invoice.

ORIGIN

1. That all the goods mentioned in this invoice have been wholly produced or manufactured in………………………… ……………………….. ……………………………………

2. That all the goods mentioned in this invoice have been either wholly or partially produced or manufactured in…………………………………………………………

3. That as regards those goods only partially produced or manufactured,

(a) the final process or processes of manufacture have been performed in……………………………………………………………………………………………………

(b) the expenditure in material produced and/or labour performed in…………………………………………………………………………………… calculated subject to qualifications hereunder, in the case of all such goods is not less than 25 per cent of

the factory or works costs of all such goods in their finished state. *(See Note below.)

4. That in the calculation of such proportion of material produced and/or labour performed none of the following items has been included or considered:-

Manufacturer’s profit or remuneration of any trader, agent, broker or other person dealing in the articles in there finished condition; royalties; cost of outside packages or any cost of packing the goods thereinto; and cost of conveying, insuring, or shipping

the goods subsequent to their manufacture.

Dated at…………………….. ……………this…… ………. ……day of…………… . . . . . ………. …………………

Signature……………………………………………………………………………………………Signature of Witness…………………………………………………………………………

(1) Here insert Manager, Chief Clerk, or as the case may be. (2) Here insert name of firm or company. (3) Here insert name of city or country.

NOTE. 1. The person making the declaration should be a principal or a manager, chief clerk, secretary or responsible employee.

2. The place or country of origin of imports is that in which the goods were produced or manufactured and, in the case of partly manufactured goods, the place or country in which any final operation, has altered to any appreciable extent the character, composition and value of goods

imported into that country.

3. In the case of goods which have at some stage entered into the commerce of, or undergone a process of manufacture in a foreign country, only that labour and material which is expended on or added to the goods after their return to the exporting territory shall be regarded as the

produce or manufacture of the territory in calculating the proportion of labour and material in the factory or works cost of the finished article.

4. * Delete the inapplicable.

You might also like

- Sample Wine Marketing PlanDocument19 pagesSample Wine Marketing PlanWande Alli67% (3)

- Proforma Invoice FormatDocument1 pageProforma Invoice Formatarjun1698100% (1)

- CCVODocument2 pagesCCVOJason Chau71% (7)

- The Shipbroker’s Working Knowledge: Dry Cargo Chartering in PracticeFrom EverandThe Shipbroker’s Working Knowledge: Dry Cargo Chartering in PracticeRating: 5 out of 5 stars5/5 (1)

- Pricing Strategy of Dove SummaryDocument7 pagesPricing Strategy of Dove SummaryAJSINo ratings yet

- GST-II Problems and SolutionDocument112 pagesGST-II Problems and SolutionSukruth SNo ratings yet

- Individual Distributor Agreement - India (Final) V1 WebDocument11 pagesIndividual Distributor Agreement - India (Final) V1 WebFahïma MannanNo ratings yet

- Form A1Document2 pagesForm A1api-370689094% (16)

- Commercial Invoice TemplateDocument2 pagesCommercial Invoice TemplatedukuhwaruNo ratings yet

- APPCOMDocument114 pagesAPPCOMHaryotomo Wiryasono100% (1)

- Export DocumentsDocument22 pagesExport DocumentsHarano PothikNo ratings yet

- ICL-000-Goods Receipt Cum InspectionDocument1 pageICL-000-Goods Receipt Cum InspectionAdithi RNo ratings yet

- Purchase Order Confirmation ReportDocument1 pagePurchase Order Confirmation ReportPrabhatNo ratings yet

- Vendor Registration FormDocument2 pagesVendor Registration FormTtafain TafaNo ratings yet

- No Dues Certificate 1Document1 pageNo Dues Certificate 1Tariq AdnanNo ratings yet

- Seoul-Korea: CSL Co,.Ltd 92 Nguyen Dinh Chieu ST, Dist 1-TphcmDocument2 pagesSeoul-Korea: CSL Co,.Ltd 92 Nguyen Dinh Chieu ST, Dist 1-TphcmThiên Đường Tình IuNo ratings yet

- Psp-Gtpogt-033 - Shipping and Packing ProcedureDocument53 pagesPsp-Gtpogt-033 - Shipping and Packing ProcedureSam LowNo ratings yet

- Reliance Work OrderDocument11 pagesReliance Work Orderbalaji2kNo ratings yet

- VES-1100 General Requirements For Third Party Inspection ServicesDocument12 pagesVES-1100 General Requirements For Third Party Inspection ServicesDwiadi CahyabudiNo ratings yet

- JV AgreementDocument59 pagesJV AgreementManisha SinghNo ratings yet

- FormeDocument2 pagesFormeBULLY CHANNELNo ratings yet

- ASEAN India OCP PDFDocument2 pagesASEAN India OCP PDFCha CahNo ratings yet

- Details of Goods Imported or To Be Imported Into India Section A: Import Licence ParticularsDocument2 pagesDetails of Goods Imported or To Be Imported Into India Section A: Import Licence ParticularsRavindra BabuNo ratings yet

- Att. To Appendix 1 To Annex 3 CO Form AK Overleaf ASEAN Version 15may06 FinalDocument2 pagesAtt. To Appendix 1 To Annex 3 CO Form AK Overleaf ASEAN Version 15may06 FinalDINI KUSUMAWATINo ratings yet

- Form AJDocument2 pagesForm AJhongmean2002No ratings yet

- Form VN-CUDocument2 pagesForm VN-CUkatacumiNo ratings yet

- Operational Procedures For Imports Under The Asean-India Free Trade Area (Aifta) Trade in Goods (Tig) AgreementDocument4 pagesOperational Procedures For Imports Under The Asean-India Free Trade Area (Aifta) Trade in Goods (Tig) AgreementDio MaulanaNo ratings yet

- Appendix 1 - Attachment C - Contoh SKADocument2 pagesAppendix 1 - Attachment C - Contoh SKAJundiNo ratings yet

- Appendix 02 - Logistics Requisition Form - V1.0Document2 pagesAppendix 02 - Logistics Requisition Form - V1.0Jaime PinedaNo ratings yet

- Airway Bill (AWB) 27300327305Document2 pagesAirway Bill (AWB) 27300327305operasional.gateway01No ratings yet

- Air Waybill 1Document2 pagesAir Waybill 1havyduongthi1205No ratings yet

- A1 FC PDFDocument6 pagesA1 FC PDFMuhammed SheriefNo ratings yet

- Proforma Invoice With General ConditionsDocument6 pagesProforma Invoice With General ConditionsambrosialnectarNo ratings yet

- JKT 2Document2 pagesJKT 2galuh xshoterNo ratings yet

- Itc00099 CooDocument3 pagesItc00099 CooSaro InboxNo ratings yet

- Air - Way - Bill - Sample 2Document2 pagesAir - Way - Bill - Sample 2myventas1No ratings yet

- Certificate of Origin - FORM ADocument2 pagesCertificate of Origin - FORM ARivanda MilaNo ratings yet

- (To Be Published in The Gazette of India, Extraordinary, Part Ii, Section 3, Sub-Section (I) )Document47 pages(To Be Published in The Gazette of India, Extraordinary, Part Ii, Section 3, Sub-Section (I) )HimanshuKaushikNo ratings yet

- Form A-1 (For Import Payments Only) : Open General LicenceDocument6 pagesForm A-1 (For Import Payments Only) : Open General LicenceAmit MittalNo ratings yet

- Form A1Document3 pagesForm A1gaytri mandapNo ratings yet

- Form EDocument1 pageForm EHarenNo ratings yet

- CO Form D AtigaDocument2 pagesCO Form D AtigaDustin SangNo ratings yet

- Ccvo FormatDocument3 pagesCcvo FormatHarish KapoorNo ratings yet

- Airway Bill (AWB) 27300322548Document1 pageAirway Bill (AWB) 27300322548galuh xshoterNo ratings yet

- Fta - Draft R245607966410008Document1 pageFta - Draft R245607966410008Nilton Ramos EstebanNo ratings yet

- Import Licence ApplicationDocument1 pageImport Licence ApplicationAnthony BasantaNo ratings yet

- China FJ fj3 enDocument7 pagesChina FJ fj3 enjverdugo272015No ratings yet

- Proforma InvoiceDocument1 pageProforma Invoicetkdwt7h6jgNo ratings yet

- Hawb Sgnae2400024Document2 pagesHawb Sgnae2400024nguyenhaan.wNo ratings yet

- Exp ExporterDocument1 pageExp ExporterFarhan Ahmed JoyNo ratings yet

- Form AKDocument6 pagesForm AKkatacumiNo ratings yet

- Form AKDocument6 pagesForm AKtanpmps42111No ratings yet

- Pajar JKTDocument1 pagePajar JKTgaluh xshoterNo ratings yet

- Form-Ii (See Regulation 4) Postal Bill of Export - II (To Be Submitted in Duplicate)Document1 pageForm-Ii (See Regulation 4) Postal Bill of Export - II (To Be Submitted in Duplicate)mrthilagamNo ratings yet

- Draft Shipping Bill and Bill Export Regulations 2017 Sb1Document19 pagesDraft Shipping Bill and Bill Export Regulations 2017 Sb1Anand Jay100% (1)

- Air Way Bill Sample PDF (Converted Converted)Document2 pagesAir Way Bill Sample PDF (Converted Converted)Rizal BachtiarNo ratings yet

- Exp ExporterDocument1 pageExp Exportersudiptasaha2814No ratings yet

- Phu Luc IIDocument3 pagesPhu Luc IIphonghd04No ratings yet

- Shipper'S Domestic Truck Bill of Lading: Company: Prepaid Address: City: Collect State: Zip: Third PartyDocument1 pageShipper'S Domestic Truck Bill of Lading: Company: Prepaid Address: City: Collect State: Zip: Third PartyishreNo ratings yet

- Mau C o Mau D Moi Nam 2022 - 0606154711Document5 pagesMau C o Mau D Moi Nam 2022 - 0606154711vohongoanh09No ratings yet

- Exchange Control Declaration (GR) Form No.Document5 pagesExchange Control Declaration (GR) Form No.iqbal sNo ratings yet

- Asean Trade in Goods Agreement Asean Industrial Cooperation Scheme Certificate of Origin (Combined Declaration and Certificate) Form DDocument1 pageAsean Trade in Goods Agreement Asean Industrial Cooperation Scheme Certificate of Origin (Combined Declaration and Certificate) Form DAndrew NatanaelNo ratings yet

- Form AKDocument6 pagesForm AKnxxuanhai2112No ratings yet

- FORM A 1-For Import Payments OnlyDocument6 pagesFORM A 1-For Import Payments OnlyAnonymous rPwwJGksANo ratings yet

- Costguide Contents SampleDocument5 pagesCostguide Contents Sampleapi-352851688100% (1)

- Chapter 6 - The Search For Business OpprotunitiesDocument22 pagesChapter 6 - The Search For Business OpprotunitiesKin FallarcunaNo ratings yet

- Glaser - Devin The Zero Price Effect On Public Transportation ChoicesDocument7 pagesGlaser - Devin The Zero Price Effect On Public Transportation ChoicesDevin GlaserNo ratings yet

- Group 5: Jeera May Firm Up On High Demand, Low RainsDocument8 pagesGroup 5: Jeera May Firm Up On High Demand, Low RainsShivam KatiyarNo ratings yet

- Us Consumer Business Consumer Products Industry Outlook 2024Document24 pagesUs Consumer Business Consumer Products Industry Outlook 2024pollycliffyNo ratings yet

- Yutivo Sons Harwdware v. CTA PDFDocument9 pagesYutivo Sons Harwdware v. CTA PDFHannah AngelesNo ratings yet

- ACEINT1 - Inventory SW SolutionDocument4 pagesACEINT1 - Inventory SW SolutionJosh DavidNo ratings yet

- Formulae For The Computation of The VariancesDocument5 pagesFormulae For The Computation of The VariancesGkæ E. GaleakelweNo ratings yet

- Changing Their Tune: How Consumers' Adoption of Online Streaming Affects Music Consumption and DiscoveryDocument18 pagesChanging Their Tune: How Consumers' Adoption of Online Streaming Affects Music Consumption and DiscoveryShafira Putri IndikaNo ratings yet

- Lesson 3 - Supply and DemandDocument43 pagesLesson 3 - Supply and DemandCharles Corporal ReyesNo ratings yet

- Topic 3 - Responsibility Acctg TPDocument51 pagesTopic 3 - Responsibility Acctg TPFunyoungNo ratings yet

- Escalation Estimating Principles and Methods Using IndicesDocument4 pagesEscalation Estimating Principles and Methods Using IndicesAlejandro RuizNo ratings yet

- Chapter 5 InflationDocument42 pagesChapter 5 InflationCha Boon KitNo ratings yet

- Ebook The Trading AcademyDocument39 pagesEbook The Trading AcademyblizzfulcoinNo ratings yet

- Materi Dosen Tamu - Ikshan Alfahmi - 261020 PDFDocument22 pagesMateri Dosen Tamu - Ikshan Alfahmi - 261020 PDFLinaNo ratings yet

- International Market Entry Strategies: Ministry of Economic Development, Job Creation and TradeDocument31 pagesInternational Market Entry Strategies: Ministry of Economic Development, Job Creation and Tradele an haiNo ratings yet

- Business Communication-AdoptingDocument16 pagesBusiness Communication-Adoptingsk.monirNo ratings yet

- Responsibility Accounting and Transfer Pricing ReviewerDocument44 pagesResponsibility Accounting and Transfer Pricing ReviewerMaxyne Dheil CastroNo ratings yet

- Bubble CryptoDocument12 pagesBubble CryptoAhmed YusufNo ratings yet

- Section 4 Schedule of Compensation - 200013Document18 pagesSection 4 Schedule of Compensation - 200013Mohammad Amin AliNo ratings yet

- IFRS 5 Non Current Assets Held For SaleDocument8 pagesIFRS 5 Non Current Assets Held For Saleharir22No ratings yet

- Moving Average Price - Learn How It Functions and Figure Out How To Explain The UnexplainableDocument32 pagesMoving Average Price - Learn How It Functions and Figure Out How To Explain The UnexplainableguigashmNo ratings yet

- Department of Agribusiness and Value Chain Management Analysis of Mango Value Chain: The Case of Gozamn Woreda, EthiopiaDocument33 pagesDepartment of Agribusiness and Value Chain Management Analysis of Mango Value Chain: The Case of Gozamn Woreda, EthiopiaMehari Temesgen67% (3)

- Chapter 30Document26 pagesChapter 30totoNo ratings yet

- Srushti Pawar-23BA085 - Ecosoc Research TaskDocument9 pagesSrushti Pawar-23BA085 - Ecosoc Research Tasksrushti pawarNo ratings yet

- Twenty First Century Science Online Homework AnswersDocument7 pagesTwenty First Century Science Online Homework Answersg3j8bj22100% (1)