CapAlertPDF 072508

CapAlertPDF 072508

Uploaded by

Russell KlusasCopyright:

Available Formats

CapAlertPDF 072508

CapAlertPDF 072508

Uploaded by

Russell KlusasCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

CapAlertPDF 072508

CapAlertPDF 072508

Uploaded by

Russell KlusasCopyright:

Available Formats

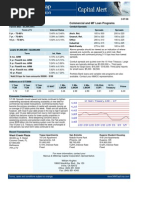

July 25, 2008

Multi-Family Loan Programs > $3 Million

Agency Lenders Portfolio Lenders*

Term Leverage Max. Interest Rates Leverage Max. Interest Rates

5 Yr. 80% 6.25% to 6.40% 75% 6.05% to 6.25%

7 Yr. 80% 6.26% to 6.41% 75% 6.40% to 6.65%

10 Yr. 80% 6.40% to 6.61% 75% 6.55% to 6.85%

15 Yr. 80% 6.82% to 7.42% 75% 6.85% to 7.35%

*Rates based on Act/360

Multi-Family Loan Programs < $3 Million

Fixed Rate Agency Lenders Portfolio Lenders*

Term Leverage Max. Interest Rates Leverage Max. Interest Rates

3 Yr. 80% 6.19% to 6.58% 75% 5.90% to 6.25%

5 Yr. 80% 6.17% to 6.55% 75% 6.05% to 6.35%

7 Yr. 80% 6.19% to 6.49% 75% 6.40% to 6.65%

10 Yr. 80% 6.33% to 6.63% 75% 6.55% to 6.85%

15 Yr. 80% 6.89% to 7.80% 75% 6.85% to 7.35%

*Rates based on Act/360

Commercial Loan Programs

Fixed Rate Portfolio Lenders* Index Rate as of 7/25/2008

Term Leverage Max. Interest Rates

5-Year Treasury: 3.49% 10-Year Treasury: 4.12%

5 Yr. 75% 6.25% to 6.55%

5-Year Swap: 4.34% 10-Year Swap: 4.79%

7 Yr. 75% 6.45% to 6.65%

Prime: 5.00% LIBOR: 3.11%

10 Yr. 75% 6.65% to 6.90%

15 Yr. 75% 6.95% to 7.45%

Bridge Floating Leverage Max. Spread Over Libor

Stabilized 75% 225 to 300

Re-Position 80% 275 to 350

(*Portfolio Lenders include Banks, Life Insurance Companies and Credit Unions)

Economic Commentary

7-25-08 Interest rates rose across the board 6 to 10 basis

points this week and the U.S. Treasury yield bounced back

today closing at 4.1 percent as investors reacted positively to

positive economic news. New home sales dropped less than

forecast and consumer confidence surprisingly was up during

the week, increasing speculation that the Fed may increase

rates later this year. Banks continued to tighten credit

standards as their loan allocations fill and they have a difficult

time selling loans.

Recent Transactions

Automotive Retail Multi-Family Mixed Use

STNIL Strip Center Student Housing Multi-Family/Retail

Montgomery, IL Lee's Summit, MO Tucson, AZ Seattle, WA

$1,1400,000 $1,698,559 $3,500,000 $2,100,000

6.26% Interest Rate 6.20% Interest Rate 5.94% Interest Rate 6.18% Interest Rate

120-mos. Term/360-mos. Amort. 10-mos. Term/360-Amort. 120-mos.Term/360-mos Amort. 360-mos. Term/360-mos. Amort.

For more information, contact:

William Hughes

Senior Vice President/Managing Director

Newport Beach, CA

Office: (949) 851-3030

whughes@marcusmillichap.com

You might also like

- Public Finance by BrionesDocument10 pagesPublic Finance by BrionesYnah LopezNo ratings yet

- Capital Markets - 6/30/2008Document1 pageCapital Markets - 6/30/2008Russell KlusasNo ratings yet

- Capital Alert - 7/3/2008Document1 pageCapital Alert - 7/3/2008Russell KlusasNo ratings yet

- Capital Markets - 4/25/2008Document1 pageCapital Markets - 4/25/2008Russell KlusasNo ratings yet

- Capital Alert 6/13/2008Document1 pageCapital Alert 6/13/2008Russell KlusasNo ratings yet

- Capital Alert - 8/29/2008Document1 pageCapital Alert - 8/29/2008Russell KlusasNo ratings yet

- Capital Alert - 7/12/2008Document1 pageCapital Alert - 7/12/2008Russell KlusasNo ratings yet

- Capital Alert - 5/30/2008Document1 pageCapital Alert - 5/30/2008Russell KlusasNo ratings yet

- Capital Markets - 8/15/2008Document2 pagesCapital Markets - 8/15/2008Russell KlusasNo ratings yet

- Capital Alert - 6/20/2008Document1 pageCapital Alert - 6/20/2008Russell KlusasNo ratings yet

- Capital Markets - 5/16/2008Document1 pageCapital Markets - 5/16/2008Russell KlusasNo ratings yet

- Capital Markets - 4/18/2008Document1 pageCapital Markets - 4/18/2008Russell KlusasNo ratings yet

- Multi-Family Loan Programs $3 MillionDocument1 pageMulti-Family Loan Programs $3 MillionRussell KlusasNo ratings yet

- Capital Alert - 8/22/2008Document1 pageCapital Alert - 8/22/2008Russell KlusasNo ratings yet

- HVD Web Interest 27.09.2024Document2 pagesHVD Web Interest 27.09.2024sharetradingrk88No ratings yet

- Website Disclosure Effective 05 Apr 2024Document4 pagesWebsite Disclosure Effective 05 Apr 2024Ab CdNo ratings yet

- Website Disclosure Effective 25 Jun 2024Document4 pagesWebsite Disclosure Effective 25 Jun 2024Saurabh KumarNo ratings yet

- Press Release Unity Bank Savings January 2024Document2 pagesPress Release Unity Bank Savings January 2024ksspshoppingNo ratings yet

- Capital Alert - 2/1/2008Document1 pageCapital Alert - 2/1/2008Russell KlusasNo ratings yet

- Website Disclosure Effective 02nd May 2023Document3 pagesWebsite Disclosure Effective 02nd May 2023Prathamesh PatikNo ratings yet

- Website Disclosure Effective 03 Feb 2024Document3 pagesWebsite Disclosure Effective 03 Feb 2024abhishek sharmaNo ratings yet

- Bank A: Housing Loan Property Equity LoanDocument6 pagesBank A: Housing Loan Property Equity LoanRaesa BadelNo ratings yet

- Tel No: 022-4215 9068Document3 pagesTel No: 022-4215 9068mamatha niranjanNo ratings yet

- Capital Markets - 3/14/2008Document2 pagesCapital Markets - 3/14/2008Russell KlusasNo ratings yet

- Capital Markets - 3/07/2008Document1 pageCapital Markets - 3/07/2008Russell KlusasNo ratings yet

- Capital Markets - 2/29/2008Document1 pageCapital Markets - 2/29/2008Russell KlusasNo ratings yet

- Website Disclosure Effective 30 Nov 2023Document3 pagesWebsite Disclosure Effective 30 Nov 2023bggbggNo ratings yet

- Administrative Office: ' Mahaveer ', Shree Shahu Market Yard, Kolhapur - 416 008Document3 pagesAdministrative Office: ' Mahaveer ', Shree Shahu Market Yard, Kolhapur - 416 008gmatweakNo ratings yet

- Yield CurveDocument3 pagesYield CurveRochelle Anne OpinaldoNo ratings yet

- Interest Rates On FDR: Monthly Benefit PlanDocument2 pagesInterest Rates On FDR: Monthly Benefit Planmushfik arafatNo ratings yet

- Bank A: Housing Loan Property Equity LoanDocument5 pagesBank A: Housing Loan Property Equity LoanRaesa BadelNo ratings yet

- Term Deposit Rate Sheet: ShajarDocument1 pageTerm Deposit Rate Sheet: ShajarchqaiserNo ratings yet

- DepositSheet PDFDocument1 pageDepositSheet PDFFakharNo ratings yet

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed Depositssaurav katarukaNo ratings yet

- Withdrawable FD RatesDocument4 pagesWithdrawable FD RatesDeepu AwasthiNo ratings yet

- HDFC RatesDocument4 pagesHDFC RatesdesikanttNo ratings yet

- IIFL Associate FD List September'2021Document4 pagesIIFL Associate FD List September'2021BHARAT SNo ratings yet

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed Depositssasi 'sNo ratings yet

- Debt Weekly Market Wrap-3Document1 pageDebt Weekly Market Wrap-3Ayush DubeyNo ratings yet

- Rates of Return On PLSDeposits OtherDepositsDocument2 pagesRates of Return On PLSDeposits OtherDepositsranamkhan553No ratings yet

- Capital Markets - 4/11/2008Document1 pageCapital Markets - 4/11/2008Russell KlusasNo ratings yet

- FD Leaflet - A5 - 13 Dec 23Document2 pagesFD Leaflet - A5 - 13 Dec 23Shaily Sinha100% (1)

- BankingDocument4 pagesBankingBhavin GhoniyaNo ratings yet

- Loan RatesDocument1 pageLoan RatesAndrew ChambersNo ratings yet

- HDFC Deposit FormDocument4 pagesHDFC Deposit FormnaguficoNo ratings yet

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed DepositsY_AZNo ratings yet

- allratesandcharges_pdfDocument3 pagesallratesandcharges_pdfrahulNo ratings yet

- Notice Revision in Interest Rates For Bulk Fixed DepositsDocument1 pageNotice Revision in Interest Rates For Bulk Fixed DepositsAmit JindalNo ratings yet

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed DepositsV NaveenNo ratings yet

- HVD-NW Webinterest 30.09.2024Document1 pageHVD-NW Webinterest 30.09.2024sharetradingrk88No ratings yet

- Interest Rates On Deposits Above Rs 2 Crs Wef 09082023Document5 pagesInterest Rates On Deposits Above Rs 2 Crs Wef 09082023Mohammed Eidrees RazaNo ratings yet

- HDFC FD FormDocument4 pagesHDFC FD FormManish KumarNo ratings yet

- Fixed and Saving Deposit Rate VACDocument8 pagesFixed and Saving Deposit Rate VACvinishchandraaNo ratings yet

- Week 2 Practice Questions SolutionDocument8 pagesWeek 2 Practice Questions SolutionCaroline FrisciliaNo ratings yet

- Slabs Profit Rate: Deposit and Prematurity RatesDocument1 pageSlabs Profit Rate: Deposit and Prematurity RatesJay KhanNo ratings yet

- Bruce Gregor - 2016APAConf - Finance Over 50 Life StagesDocument22 pagesBruce Gregor - 2016APAConf - Finance Over 50 Life StagesbruceNo ratings yet

- Interest Rates 4924e15c35Document3 pagesInterest Rates 4924e15c35Tatavarti AnandNo ratings yet

- Support-interest-rates_1Document6 pagesSupport-interest-rates_1thakralaviNo ratings yet

- FD Customer Leaflet-A4 - WEBDocument1 pageFD Customer Leaflet-A4 - WEBmyloan partnerNo ratings yet

- Atlas Investment CaseDocument3 pagesAtlas Investment CaseCalypso StarsNo ratings yet

- The Mathematics of Financial Models: Solving Real-World Problems with Quantitative MethodsFrom EverandThe Mathematics of Financial Models: Solving Real-World Problems with Quantitative MethodsNo ratings yet

- DesMoines Submarket - Retail - 10/1/2007Document2 pagesDesMoines Submarket - Retail - 10/1/2007Russell KlusasNo ratings yet

- Capital Alert - 8/22/2008Document1 pageCapital Alert - 8/22/2008Russell KlusasNo ratings yet

- Capital Markets - 8/15/2008Document2 pagesCapital Markets - 8/15/2008Russell KlusasNo ratings yet

- Milwaukee - Office - 8/7/08Document4 pagesMilwaukee - Office - 8/7/08Russell KlusasNo ratings yet

- Capital Alert - 7/12/2008Document1 pageCapital Alert - 7/12/2008Russell KlusasNo ratings yet

- Milwaukee - Retail Construction - 4/1/2008Document3 pagesMilwaukee - Retail Construction - 4/1/2008Russell Klusas100% (1)

- Chicago - Southwest Submarket - Retail - 1/1/2008Document2 pagesChicago - Southwest Submarket - Retail - 1/1/2008Russell KlusasNo ratings yet

- Milwaukee - Retail - 4/1/2008Document4 pagesMilwaukee - Retail - 4/1/2008Russell KlusasNo ratings yet

- Chicago - Industrial - 1/1/2008Document1 pageChicago - Industrial - 1/1/2008Russell KlusasNo ratings yet

- Chicago - Retail - 4/1/2008Document4 pagesChicago - Retail - 4/1/2008Russell KlusasNo ratings yet

- Milwaukee - South Milwaukee County Submarket - Retail - 10/1/2007Document2 pagesMilwaukee - South Milwaukee County Submarket - Retail - 10/1/2007Russell KlusasNo ratings yet

- Chicago - South Submarket - Retail - 7/1/2007Document2 pagesChicago - South Submarket - Retail - 7/1/2007Russell KlusasNo ratings yet

- Indianapolis - Retail - 4/1/2008Document4 pagesIndianapolis - Retail - 4/1/2008Russell Klusas100% (1)

- Chicago - Near West Submarket - Retail - 7/1/2007Document2 pagesChicago - Near West Submarket - Retail - 7/1/2007Russell KlusasNo ratings yet

- Evansville - Apartment - 1/1/2008Document2 pagesEvansville - Apartment - 1/1/2008Russell KlusasNo ratings yet

- Indianapolis - Apartment - Construction - 4/1/2008Document3 pagesIndianapolis - Apartment - Construction - 4/1/2008Russell Klusas100% (1)

- Quiz 1 - Limited CompaniesDocument2 pagesQuiz 1 - Limited CompaniesELIZABETH MARGARETHANo ratings yet

- Nancy - Mba - Sip ReportDocument36 pagesNancy - Mba - Sip Reportnancy jainNo ratings yet

- Obligations and Contracts ReviewerDocument24 pagesObligations and Contracts ReviewerSoothing BlendNo ratings yet

- A-Z Economic Terms (Part1)Document27 pagesA-Z Economic Terms (Part1)Srinivasan .MNo ratings yet

- Impacts and Examples: Ind As 19Document34 pagesImpacts and Examples: Ind As 19Richa McNo ratings yet

- Project Proposal For GC (Demissie)Document21 pagesProject Proposal For GC (Demissie)alemayehu tariku100% (1)

- HSBC FinalDocument80 pagesHSBC FinalAhmed ZakariaNo ratings yet

- IRS Demand Letter - 14 July 2022Document2 pagesIRS Demand Letter - 14 July 2022KPLC 7 News0% (1)

- Boeing ProspectusDocument50 pagesBoeing ProspectuscarecaNo ratings yet

- Chapter 13 Testbank: StudentDocument50 pagesChapter 13 Testbank: StudentNaomi SyNo ratings yet

- Project Report Siddhi 2222Document57 pagesProject Report Siddhi 2222narkozionsNo ratings yet

- WCM QuizzerDocument8 pagesWCM QuizzerkimNo ratings yet

- 978-1-5275-0721-0-sampleDocument30 pages978-1-5275-0721-0-sampleMaamar REDAOUIANo ratings yet

- Risk Management Beyond Asset Class Diversification (Page, 2013)Document8 pagesRisk Management Beyond Asset Class Diversification (Page, 2013)Francois-Xavier AdamNo ratings yet

- Foreign Debt, Economic Growth PDFDocument12 pagesForeign Debt, Economic Growth PDFdina juniNo ratings yet

- Tutorial5 RE1704 AY22 23Document37 pagesTutorial5 RE1704 AY22 23Lim JonathanNo ratings yet

- Santa Cruz Institute (Marinduque) IncDocument3 pagesSanta Cruz Institute (Marinduque) IncRichard Kate RicohermosoNo ratings yet

- Chapter 3Document19 pagesChapter 3Tofik SalmanNo ratings yet

- Ias 23Document2 pagesIas 23mnhammadNo ratings yet

- Liabilities Part 2Document4 pagesLiabilities Part 2Jay LloydNo ratings yet

- AccountingDocument8 pagesAccountingDarshan SomashankaraNo ratings yet

- Ekotek - Alfiano Fuadi2Document28 pagesEkotek - Alfiano Fuadi2Alfiano FuadiNo ratings yet

- Ix - Audit of Liabilities: QuestionsDocument3 pagesIx - Audit of Liabilities: QuestionsMark Michael LegaspiNo ratings yet

- Review Quiz For Chapter 9Document6 pagesReview Quiz For Chapter 9Tran Thuy DuongNo ratings yet

- Acctg For Special Transaction - Second Lesson PDFDocument6 pagesAcctg For Special Transaction - Second Lesson PDFDebbie Grace Latiban LinazaNo ratings yet

- PART III of The Hand-OutsDocument13 pagesPART III of The Hand-OutsAce Hulsey TevesNo ratings yet

- Reformina vs. Tomol Jr.Document2 pagesReformina vs. Tomol Jr.Sernande PenNo ratings yet

- Slide Midf Business LoanDocument21 pagesSlide Midf Business LoanIrfan DanialNo ratings yet

- C12-Bond MarketDocument46 pagesC12-Bond Marketsales11.stoneNo ratings yet