Professional Documents

Culture Documents

Ba1727 Security Analysis and Portfolio Management

Ba1727 Security Analysis and Portfolio Management

Uploaded by

bhuvanesh87Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ba1727 Security Analysis and Portfolio Management

Ba1727 Security Analysis and Portfolio Management

Uploaded by

bhuvanesh87Copyright:

Available Formats

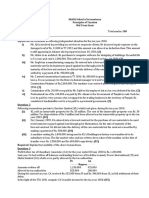

BA1727 SECURITY ANALYSIS AND PORTFOLIO MANAGEMENT

UNIT I: INVESTMENT SETTING

Investment setting – Securities – Sources of investment information – Security market

indications – Security Contract regulation Act. Investor Protection.

UNIT II: CAPITAL MARKETS

Over view of capital market, Institutional structure in capital market, Reforms and state

of capital market, New issue market and problems, Securities and Exchange Board of

India (SEBI), Debt Market.

UNIT III: FUNDAMENTAL ANALYSIS

Economic Analysis – Economic forecasting and stock Investment Decisions –

Forecasting techniques. Industry Analysis – Industry classification. Economy and

Industry Analysis. Industry life cycle – Company Analysis Measuring Earnings –

Forecasting Earnings – Applied Valuation Techniques – Graham and Dodds investor

ratios.

UNIT IV: TECHNICAL ANALYSIS

Fundamental Analysis Vs Technical Analysis – Charting methods – Market Indicators.

Trend – Trend reversals – Patterns - Moving Average – Exponential moving Average –

Oscillators – ROC Momentum – MACD – RSI – Stoastics.

UNIT V: PORTFOLIO MANAGEMENT

Portfolio Theory – Portfolio Construction – Diagnostics Management – Performance

Evaluation – Portfolio revision- Mutual Funds.

Total 45 periods

TEXT BOOKS

1. Donald E.Fischer & Ronald J.Jordan, ‘Security Analysis & Portfolio Management’,

Prentice Hall of India Private Ltd., New Delhi 2000.

2. V.A.Avadhani – ‘Securities Analysis and Portfolio Management’, Himalaya

Publishing House, 1997.

3. V.K.Bhalla, ‘Investment Management’, S.Chand & Company Ltd., Seventh Edition,

2000.

REFERENCE:

1. Punithavathy Pandian, ‘Security Analysis & Portfolio Management’ – Vikas

Publishing House Pvt., Ltd., 2001.

You might also like

- Foundational Theories and Techniques for Risk Management, A Guide for Professional Risk Managers in Financial Services - Part II - Financial InstrumentsFrom EverandFoundational Theories and Techniques for Risk Management, A Guide for Professional Risk Managers in Financial Services - Part II - Financial InstrumentsNo ratings yet

- Chapter 8Document30 pagesChapter 8carlo knowsNo ratings yet

- Sample Solution Manual For Management Accounting 2nd Edition by Leslie G. EldenburgDocument40 pagesSample Solution Manual For Management Accounting 2nd Edition by Leslie G. EldenburgAshwin Thiyagarajan100% (1)

- Ias 2Document16 pagesIas 2TeyNo ratings yet

- FM CH 1natureoffinancialmanagement 120704104928 Phpapp01 PDFDocument28 pagesFM CH 1natureoffinancialmanagement 120704104928 Phpapp01 PDFvasantharao100% (1)

- Guide to Contract Pricing: Cost and Price Analysis for Contractors, Subcontractors, and Government AgenciesFrom EverandGuide to Contract Pricing: Cost and Price Analysis for Contractors, Subcontractors, and Government AgenciesNo ratings yet

- Internship Report On: Financial Analysis of KDS Accessories LimitedDocument50 pagesInternship Report On: Financial Analysis of KDS Accessories Limitedshohagh kumar ghoshNo ratings yet

- Fertiliser Sector Report - PINC ResearchDocument72 pagesFertiliser Sector Report - PINC Researchsatish_xpNo ratings yet

- Solvay Adv Acc Case 6 Wapiti Group ConsolidationDocument24 pagesSolvay Adv Acc Case 6 Wapiti Group ConsolidationlolaNo ratings yet

- Chpater 6 - Debt Service FundDocument7 pagesChpater 6 - Debt Service FundYinan LuNo ratings yet

- Aptitude Test Answer Key: Tìm hiểu về khoá học tạiDocument20 pagesAptitude Test Answer Key: Tìm hiểu về khoá học tạiBùi Hải ĐăngNo ratings yet

- Financial Statement Analysis ControlDocument7 pagesFinancial Statement Analysis ControlTareq MahmoodNo ratings yet

- Chapter 7 - The Revenue Cycle Processes (Student Copy)Document85 pagesChapter 7 - The Revenue Cycle Processes (Student Copy)Mei Chun Tan100% (1)

- Nokia Analysis Report: András Csizmár, Quyen Vu, Stefanie WethDocument32 pagesNokia Analysis Report: András Csizmár, Quyen Vu, Stefanie Wethjason7sean-30030No ratings yet

- NBS Non Performing LoansDocument28 pagesNBS Non Performing LoansGreg ZuccariniNo ratings yet

- Fauji Fertilizer Company (FFC) : Target Price StanceDocument17 pagesFauji Fertilizer Company (FFC) : Target Price StanceAli CheenahNo ratings yet

- AppendixA SpoilageDocument19 pagesAppendixA SpoilageMohamad Nur HadiNo ratings yet

- B7110-001 Financial Statement Analysis and Valuation PDFDocument3 pagesB7110-001 Financial Statement Analysis and Valuation PDFLittleBlondie0% (2)

- Question and Answer - 1Document31 pagesQuestion and Answer - 1acc-expertNo ratings yet

- Ch01 SMDocument33 pagesCh01 SMcalz_ccccssssdddd_550% (1)

- Chp-4 Capital Project FundDocument8 pagesChp-4 Capital Project FundkasimNo ratings yet

- George Foster Financial Statement AnalysisDocument2 pagesGeorge Foster Financial Statement AnalysisdnesudhudhNo ratings yet

- Tutorial 5Document5 pagesTutorial 5RUHDRANo ratings yet

- Camel Rating FrameworkDocument3 pagesCamel Rating FrameworkAmrita GhartiNo ratings yet

- Chapter 9Document33 pagesChapter 9Annalyn Molina0% (1)

- cd8cd552db28943f022096d821b9a279 (1)Document12 pagescd8cd552db28943f022096d821b9a279 (1)Azri LunduNo ratings yet

- Engl 341 Report WritingDocument37 pagesEngl 341 Report WritingNaveed Karim BakshNo ratings yet

- Advanced Financial Reporting Strathmore University Notes and Revision KitDocument590 pagesAdvanced Financial Reporting Strathmore University Notes and Revision Kitsamnjiru466No ratings yet

- Managerial (Cost) Accounting Chapter's LecutersDocument710 pagesManagerial (Cost) Accounting Chapter's LecutersMuhammad Fahim Khan100% (1)

- Linguaskill - Special Requirements - Print For Braille VersionDocument4 pagesLinguaskill - Special Requirements - Print For Braille VersionMar DiazNo ratings yet

- Multiple Choice Questions (40%) : Lebanese Association of Certified Public Accountants - IFRS July Exam 2019Document8 pagesMultiple Choice Questions (40%) : Lebanese Association of Certified Public Accountants - IFRS July Exam 2019jad NasserNo ratings yet

- Cost of CapitalDocument4 pagesCost of Capitalshan50% (2)

- Horngren ch06Document45 pagesHorngren ch06Moataz MaherNo ratings yet

- Module 1 PDFDocument13 pagesModule 1 PDFWaridi GroupNo ratings yet

- CH 01 - Inter Corporate Acquisitions and Investments in Other EntitiesDocument37 pagesCH 01 - Inter Corporate Acquisitions and Investments in Other EntitiesMerriam Leirose Daganta Cabidog100% (3)

- Chapter 5 - Solution CasesDocument85 pagesChapter 5 - Solution CasesAgus Triana PutraNo ratings yet

- Notes Capital Revenue AnsDocument3 pagesNotes Capital Revenue AnsMuhammad JavedNo ratings yet

- Consolidated Financial Statements and Outside Ownership: Chapter OutlineDocument44 pagesConsolidated Financial Statements and Outside Ownership: Chapter OutlineJordan Young100% (2)

- 5.1 Questions: Chapter 5 Relevant Information For Decision Making With A Focus On Pricing DecisionsDocument37 pages5.1 Questions: Chapter 5 Relevant Information For Decision Making With A Focus On Pricing DecisionsLiyana ChuaNo ratings yet

- Pe04c AnswersDocument3 pagesPe04c AnswersMarian Emmanuelle CristobalNo ratings yet

- 100 149 PDFDocument53 pages100 149 PDFSamuelNo ratings yet

- Chap 006Document51 pagesChap 006kel458100% (1)

- Financial Accounting 1 Unit 2Document22 pagesFinancial Accounting 1 Unit 2AbdirahmanNo ratings yet

- Solved - United Technologies Corporation (UTC), Based in Hartfor...Document4 pagesSolved - United Technologies Corporation (UTC), Based in Hartfor...Saad ShafiqNo ratings yet

- What Is The Difference Between Marginal Costing and Absorption Costing Only HeadingsDocument10 pagesWhat Is The Difference Between Marginal Costing and Absorption Costing Only HeadingsLucky ChaudhryNo ratings yet

- Business CombinationsDocument6 pagesBusiness CombinationsralphalonzoNo ratings yet

- Question-1 I) : SKANS School of Accountancy Principles of Taxation Mid Term ExamDocument4 pagesQuestion-1 I) : SKANS School of Accountancy Principles of Taxation Mid Term ExamMuhammad ArslanNo ratings yet

- Coby Harmon: Prepared by University of California, Santa Barbara Westmont CollegeDocument46 pagesCoby Harmon: Prepared by University of California, Santa Barbara Westmont CollegeDeeb. DeebNo ratings yet

- Forecasting Financial StatementsDocument58 pagesForecasting Financial StatementsEman KhalilNo ratings yet

- ch#5 of CFDocument2 pagesch#5 of CFAzeem KhalidNo ratings yet

- Chapter VIII Accounting For Internal Revenue FundsDocument27 pagesChapter VIII Accounting For Internal Revenue Fundsnatnaelsleshi3No ratings yet

- Decoding DCF: A Beginner's Guide to Discounted Cash Flow AnalysisFrom EverandDecoding DCF: A Beginner's Guide to Discounted Cash Flow AnalysisNo ratings yet

- Corporate Financial Analysis with Microsoft ExcelFrom EverandCorporate Financial Analysis with Microsoft ExcelRating: 5 out of 5 stars5/5 (1)

- Financial ManagementDocument3 pagesFinancial ManagementSowndaryadeviNo ratings yet

- Syllabus SAPMDocument1 pageSyllabus SAPMSulthanNo ratings yet

- Security Analysis & Portfolio ManagementDocument3 pagesSecurity Analysis & Portfolio ManagementNeelam PandeyNo ratings yet