0 ratings0% found this document useful (0 votes)

AF102 Sem 2

AF102 Sem 2

Uploaded by

horse9118Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

AF102 Sem 2

AF102 Sem 2

Uploaded by

horse91180 ratings0% found this document useful (0 votes)

Original Title

AF102.Sem.2

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

AF102 Sem 2

AF102 Sem 2

Uploaded by

horse9118Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1/ 10

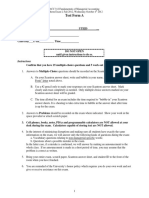

The University of the South Pacific

Faculty of Business and Economics

School of Accounting and Finance

USP LIBRARY

AF102 [On-campus]

INTRODUCTION TO ACCOUNTING & FINANCIAL, MANAGEMENT

PART 2

SEMESTER 2 2006

FINAL EXAMINATION

INSTRUCTIONS TO CANDIDATES

‘© Read the paper carefully.

«sThere are four sections on this paper. Note the choice in Section Band C.

«Time Allowed: 3 hours plus 10 minutes reading time.

«Answer all questions on the answer book provided. Multiple Choice questions to be

answered on the multiple choice grid provided.

«Start each question on a new page.

«Answers NOT numbered will receive a zero mark

«Silent non-programmable calculators allowed but not supplied

OUTLINE OF PAPER.

"A | Ten Multiple Choice Questions

[Q1-10] _| - All Compulsory

B *Fhree Short Answer Questions | -

jqu-13_ | -Do any two i 7 7

Cc Four Short Problem Solving ~

fqid.a7 _| Questions - Do any three 45 a1

D ‘One Comprehensive Question

jo 1s)_|-Compulsory 25 45

TOTAL 100 180

Part A

Multiple Choice -Compulsory 10 Marks

Circle the one best answer on Answer grid provided. Each question is worth 1 mark

Question 1

Which one of the following transactions does not affect cash?

eeiscquisition and retirement of bonds payable

f Welteoff of an uncollectible accounts receivable

C. Acquisition of treasury stock

1D. Payment of cash dividend

Question 2

tp responsibility center that incurs costs (and expenses) and generates revenues is classified as

a(n)

‘A. cost center.

B. revenue center.

C. profit center.

—D. investment center.

Question 3

‘The most useful measure for evaluating @ manager's performance in controlling revenues and

costs in a profit center is

‘A. contribution margin.

B. contribution net income.

C. contribution gross profit.

D. controllable margin.

Question 4

Rertncome under absorption costing is higher than net income under variable costing when:

units produced exceed units sold.

‘units produced equal units sold.

* (pnts produced are less than units sold.

regardless ofthe relationship between units produced and units sold.

pOpP

Use the following inforiation for questions 5 and 6.

-Thorton Company estimates its sales at 80,000 unis, in the first quarter and that sales will

snerease by 8,000 units each quarter over the yar They have, and desire, a 25% ending

dnventory of finished goods. Each unit sefls for $25. 40% of the sales are for cash. 70% of the

peat customers pay within the quarter. The Temainder is received in the quarter following

sale.

Question 5

Cash collections for the third quarter are budgeted at

A. $1,356,000.

B. $1,968,000.

C. $2,364,000.

D. $2,736,000.

Question 6

Preduction in units for the third quartet should be budgeted at

A. 98,000.

B. 92,000.

CC. 122,000.

D. 96,000.

Question 7

Under the absorption cost approach, all of the following are included in the cost base except

A. direct materials.

B. fixed manufacturing overhead.

. selling and administrative cost

D. variable manufacturing overhead.

estion 8

Which of the following statements about overhead variances is false?

A, Standard hours allowed are used in calculating the controllable variance.

B. Standard hours allowed are used in calculating the volume variance.

Cc. The controllable variance pertains ‘solely to fixed costs.

D. The total overhead variance pertains to ‘poth variable and fixed costs.

Use the following table for questions 9 and 10.

Present Value of an Annuity of 1

8%_ 9% 10%

917 Ow

1.759 1.736

2.531 2487

Question 9

'A company has a minimum required rate of retum of 9% and is considering jnvesting in @

project that costs $140,000 and is expected to generate cash inflows of $56,000 at the end of

each year for three years. The ‘net present value of this project is

A. $141,736.

B. $28,000.

C. $14,174.

D. $1,736.

Question 10

’\ company has a minimum required rate of return of 8% and is considering investing in 8

project that costs $68,337 ig expected to generate cash inflows of $27,000 each yeat for

three years. The approximate ormel rate of return on this project is

A. 8%.

C. 10%.

D. less than the required 8%.

Part B

Short Discussion Questions 20 marks

‘Attempt any two of the three- Each question is worth 10 marks

Question 11

How does the system of responsibility reporting Work? What occurs at each level? Ts

Paanagement by exception possible oie esponsibility Teporting system? Explain.

(10 marks}

Budgeting can be an important management tool if implemented properly. Identify several

positive results when budgets of resed properly. Since budgets affect ‘people, identify several

egative aspect if budgets are Rot implemented properly.

(10 marks}

m3,

Sam Stanton is on the capital budgeting committee for his company Canton Tile. Ed Rhodes

amy engineer for the firm. Ed expres ‘hig disappointment to Sam that project that was

given to him to review before 8 Ganission looks extremely good on PART ‘{ really hoped that

he cost projections wouldn't pan out,” be tells his friend. "The technology used in this is pie

in the sky Kind of stufl. There are © "aundred things that could go TONE: ‘But the figures are

very convincing. J haven't sent it on ‘yet, though I probably should.”

you can keep it if it's really that ‘bad," assures Sam. "Anyway, YO" can probably get it shot

out of the water pretty casily, and not have the £uy who submitted it mad at you for not

fuming it in. Just fix the numbers, if you figure, for instance, that a cost is only 50% likely to

‘be that low, then double it. We do it all the time, informally. Best of all, the rank and file

don't get to come to those sessions. Your engineering genius: need never know. He'll just

think someone else's project was even. better than his.”

Required:

Ttyho are the stakeholders in this situation?

3, sit ethical to adjust the figures * compensate for risk? Explain.

3. Isit ethical to change the proposal before submitting i? Explain.

(10 marks}

Part C

Short Problem Solving Questions

Marks 45,

‘Attempt any three questions of the four. Fach question is worth 15 marks

Question 14 Part A

Macks Bikes. manufactures a basic road bicycle. Production and sales data for the most recent

year are as follows (no beginning inventory):

Variable production costs

Fixed production costs

Variable selling & administrative costs

Fixed selling & administrative costs

Selling price

Production

Sales

Required

390 per bike

$450,000

$22 per bike

$500,000

$200 pet bike

20,000 bikes

17,000 bikes

(a) Prepare a prief income statement using variable costing (7 marks).

(b) Compute the amount to be reported for inventory in the year end variable costing balance

sheet. (1 marks)

Question 14 Part B

‘Trail King manufactures mountain bikes. Its sales mix and contribution margin information

per unit is shown as follows:

Sales mix

Destroyer 15%

Voyager 60%

Rebel 25%

Tthas fixed costs of $5,440,000.

Required

Contribution margin

$120

$ 60

$ 40

Compute the number of each type of bike hat the company would need to sell in order fo

break-even under this product mix (7 marks).

{Total 15 marks}

Question 15

Ducker Company has developed the following standard costs for its product for 2006:

DUCKER COMPANY

Standard Cost Card

Product A

Cost Blement Standard Quantity * Standard Price * Standard Cost

Direct materials 2 kilogram 36 siz

Direct labor 1.5 hours 16 24

Manufacturing overhead 1-5 ours 8 12

$48

‘The company expected to produce 30,000 units of Product A in 2006 and work 90,000 direct

labor hours.

‘Actual results for 2006 are as follows:

“31,000 units of Product A were produced.

Actual direct labor costs were $759,000 for 46,000 direct labor bours worked.

| Actual direct materials purchased and used during the year cost $352,800 for 63.000

kilogram.

«Actual variable overhead incurred was §155,000 and actual fixed overhead incurred was

$205,000.

Required

Compute the following variances showing all computations to support Your answers.

Indicate whether the variances are favorable or unfavorable.

(2) Direct materials quantity variance.

(by Total direet labor variance.

(© Direot labor quantity varianee-

(a) Direot materials price variance:

(@) Total overhead variance.

[B marks cach]

{Total 15 marks}

Question 16

Schiling Corp. is thinking about opening & paseball camp in Florida. In order to start the

camp, the company would need f° purchase land, build five baseball fields, and a dormitory-

type sleeping and dining facility to house 100 players. Each year the camp would be run for

10 sessions of 1 week each. The company would hire college baseball players as coaches.

“The eamp attendees would be baseball players 26° 12-18. Property values in Florida have

enjoyed a steady increase in value. Itis expected that after using the facility for 20 years,

oiling can sell the property for more than st was originally purchased for. ‘The following

amounts have been estimated:

Cost of land $ 600,000

Cost to build dorm and dining facility 2,100,000

‘Annual cash inflows assuming 100 players and 10 weeks 2,520,000

‘Annual cash outflows 2,250,000

Fstimated useful life 20 years

Salvage value 3,900,000

Discount rate 10%

Present value of an annuity of $1 854

present value of $1 0.149

Required

(a) Caloulate the net present valve of the project. (5 marks)

(b) To gauge the sensitivity of the project to these estimates, assume that if only 80 campers

attend each week, revenues will be §2,085,000 and expenses will be ST 875,000. What is

the net present value using these ahemative estimates? Discuss your findings. (5 marks)

(© Assuming the original facts, what ss the net present value if the project is actually riskier

than first assumed, and a 12% diseount raie jg more appropriate? The present value of

$1 at 12% is 0.104 and the present value of an annuity of $1 is 7.469. 6 marks)

[Total 15 marks}

Question 17

Savanna Company is considering two capital investment proposals. Relevant data on each

project are as follows:

ProjectRed Project Blue

Capital investment $400,000 $560,000

‘Annual net income 30,000 50,000

Estimated useful life 8 years 8 years

Depreciation is computed by the straight-line method with no salvage value, Savanna

requires an 8% rate of return on all new investments. The present value of SI for 8 periods at

8% is 0.540 and the present value of an annuity of $1 for 8 periods is 5.747

Required

(2) Compute the cash payback period for each project. (4 marks)

(6) Compute the net present value for each project. (4 marks)

(©) Compute the annual rate of return for each project. (4 marks)

(a) Which project should Savanna select? (3 marks)

[Total 15 marks}

PartC

Comprehensive Question - Compulsory Marks 25

Question 18

03 Small Company needs your help in preparing budgets for the first four months of 2006.

“The company's controller has provided you with the following information and assumptions:

1. The April 1, 2006 cash balance is expected to be $1 1,000.

>, All sales are on account, Credit sales are collected over a three-month period—-50 percent

in the month of sale, 35 percent in the month following sale, and 15 percent in the second

month following sale. Budgeted sales for January, February and March are $80,000,

$100,000 and $90,000, respectively. April and May sales are budgeted at $110,000 and

$115,000 respectively.

3. The unit selling price is $10.00

44. Ending finished goods inventory is 5% of next month's sales.

5. Marketable securities are expected to be sold for $25,000 during the month of April.

6. The controller estimates that direct materials totaling $44,000 will be purchased during

Apri. Sixty percent of a month’s Taw materials purchases are paid in the month of

purchase with the remaining 40 pereent paid in the following month. Accounts payable

for March purchases total $9,000, which will be paid in April.

7. During April, direct labor costs are estimated to be $19,000.

§, Mamufacturing overhead is estimated to be 40 percent of direct labor costs, Further, the

controller estimates that approximately 10 percent of the manufacturing overhead is

depreciation on the factory building and equipment

9. Selling and administrative expenses are budgeted at $22,000 for April. Of this amount,

$7,000 is for depreciation.

10. Daring April, OF Small Company plans to buy a new delivery van costing $25,000. The

company will pay cash for the van.

11, OF Small Company owes $35,000 in income tax. which must be paid in April.

12. OJ Small Company must maintain a minimum cash balance of $10,000. To bolster the

cash position as needed, an open line of credit is available from the bank.

Required:

Prepare the following:

1

2.

Sales budget for each month of the first quarter of 2006. (2 marks)

Production budget for February 2006. (2 marks)

A schedule of cash collections for April 2006. (3 marks)

‘A schedule of cash payments for raw materials for April 2006. (2 marks)

A cash budget for the month of April 2006. Indicate in the financing section any

borrowing that will be necessary during the month. (15 marks)

. A schedule showing the Accounts Receivable balance as at 30 April 2006. (1 Mark)

[SHOW ALL WORKINGS ‘TO SUPPORT YOUR DERIVED VALUES}

END OF PAPER

You might also like

- MCQ-CMA Part 1 - Question+Answer - 20210321No ratings yetMCQ-CMA Part 1 - Question+Answer - 2021032152 pages

- CMA 2013 SampleEntranceExam Revised May 15 2013No ratings yetCMA 2013 SampleEntranceExam Revised May 15 201377 pages

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2019 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2019 Edition)5/5 (1)

- P1 Management Accounting Performance EvaluationNo ratings yetP1 Management Accounting Performance Evaluation31 pages

- Jimma University Construction Economics (CEGN 6108)No ratings yetJimma University Construction Economics (CEGN 6108)7 pages

- BSMAN3009 Accounting For Managers 20 June 2014 Exam Paper0% (1)BSMAN3009 Accounting For Managers 20 June 2014 Exam Paper8 pages

- IE 360 Engineering Economic Analysis: Name: Read The Following Instructions CarefullyNo ratings yetIE 360 Engineering Economic Analysis: Name: Read The Following Instructions Carefully11 pages

- ACC 312 - Exam 1 - Form A - Fall 2012 PDFNo ratings yetACC 312 - Exam 1 - Form A - Fall 2012 PDF14 pages

- Part 2 - Liquidity and Profitability Ratios (Exercises)_Qs 04 Jul 2021No ratings yetPart 2 - Liquidity and Profitability Ratios (Exercises)_Qs 04 Jul 202126 pages

- Real Estate Math Express: Rapid Review and Practice with Essential License Exam CalculationsFrom EverandReal Estate Math Express: Rapid Review and Practice with Essential License Exam CalculationsNo ratings yet

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2019 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2019 Edition)

- Jimma University Construction Economics (CEGN 6108)Jimma University Construction Economics (CEGN 6108)

- BSMAN3009 Accounting For Managers 20 June 2014 Exam PaperBSMAN3009 Accounting For Managers 20 June 2014 Exam Paper

- IE 360 Engineering Economic Analysis: Name: Read The Following Instructions CarefullyIE 360 Engineering Economic Analysis: Name: Read The Following Instructions Carefully

- Part 2 - Liquidity and Profitability Ratios (Exercises)_Qs 04 Jul 2021Part 2 - Liquidity and Profitability Ratios (Exercises)_Qs 04 Jul 2021

- Practice Problems in Statistics and Data ReductionFrom EverandPractice Problems in Statistics and Data Reduction

- Real Estate Math Express: Rapid Review and Practice with Essential License Exam CalculationsFrom EverandReal Estate Math Express: Rapid Review and Practice with Essential License Exam Calculations