10000016855

10000016855

Uploaded by

Chapter 11 DocketsCopyright:

Available Formats

10000016855

10000016855

Uploaded by

Chapter 11 DocketsCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

10000016855

10000016855

Uploaded by

Chapter 11 DocketsCopyright:

Available Formats

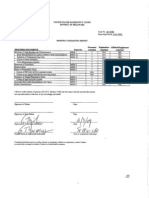

UNITED STATES BANKRUPTCY COURT DISTRICT OF DELAWARE In re: Gotland Oil, Inc.

Debtor MONTHLY OPERATING REPORT Case No. 09-10792 Reporting Period: November2010

kO1J11ED

Schedule of Cash Receipts and Disbursements Bank Reconciliation (or copies of debtors bank reconciliations) Schedule of Professional Fees Paid Copies of bank statements Cash disbursements journals Statement of Operations Balance Sheet Status of Postpetition Taxes of IRS Form 6123 or payment receipt Copies of tax returns filed during reporting period Summary of Unpaid Postpetition Debts Listing of aged accounts payable Accounts Receivable Reconciliation and Aging Debtor Questionnaire

MOR-I MOR-la MOR-lb

I

/

MOR-2 MOR-3 MOR-4

V V V

/

N/A N/A MOR-4 MOR-4 MOR-5 MOR-5

/ /

V V

N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A

N/A N/A N/A N/A N/A N/A N/A N N/A N/A N/A N/A N/A N/A

I declare under penalty of perjury (28 U.S.C. Section 1746) that this report and the attached documents are true and correct to the best of my knowledge and belief.

Signature of Debtor

Date

Signature of Joint Debtor

Date

SifAuthized Individual*

December 21, 2010 Date

Jennifer Kuntz Printed Name of Authorized Individual

Treasurer Title of Authorized Individual

Authonzed individual must bean officer, director or shareholder if debtor is a corporation; a partner if debtor is a partnership; a manager or member ifdebtor is a limited liability company.

MOR

(OO7)

In re: Gotland Oil. Inc. Debtor

Case No. 09-10792 Reporting Period: November 2010

SCHEDULE OF CASH RECEIPTS AND DISBURSEMENTS

II

Gotland Oil. Inc. does not maintain any cash accounts. TOTAL RECEIPTS

TOTAL DISBURSEMEN1S S

rr

THE FOLLOWING SECTION MUST BE COMPLETED

FOSMMOR- I (O4O1)

In to: Gotland Oil. inc. Debtor BANK RECONCILIATIONS Continuation Sheet for MOR-I

Case No, 09.10792 Reporting Period: November2010

FBALANCE PER BOOKS

I

BANK BALANCE

1 +)DEPOSITS

11 TN TRANSIT (ATTACH LIST)

(-)OUTSTANDING CHECKS (ATTACK LIST) ADJUSTED BANK BALANCE Adjusted bank balance must equal balance per books tj

Gotland Oil, Inc. does not maintain any cash accounts.

FORM MOe.!,

(oeu

hare: Gotland Oil, Inc. Debtor SCHEDULE OF PROFESSIONAL FEES AND EXPENSES PAID

Case No. 09-10792 Reporting Period: November 20l

rrJx

post-petition. No profesional fees wereiJT

FORM MOR-ib (04/07)

In re: Gotland Oil, Inc. Debtor

Case No. 09-10792 Reporting Period: November 2010 STATEMENT OF OPERATIONS

(Income Statement)

-. vn

Oil and gas production revenue Royalty payments Not Revenue

RON-

0V1rNG

Repairs and maintenance Salaries/commissions/fees Transportation expense Utilities Insurance mployee benefit programs Taxes productiou I nventory change Rent and lease expense Travel and entertainment S upplies Advertising Auto and truck Bad debt Contributions I nsider compensation Management fees/bonuses Office expenses Pensioii& profit sharing plans Taxes - payroll Taxes - real estate Taxes - other General and administrative Depreciation, depletion and amortization Net Profit (Loss) Before Other Income & Expenses Accretion of discounts and amortization of deferred financing costs

Interest expense- non-cash - paid in kind S tock compensation expense I nterest and dividends Realized gain/(loss) on derivatives

Interest expense- cash Other revenue General exploration expense Net Profit (Loss) Before Reoranization Items Professional Fees Reorganization Interest Net Profit (Loss)

$ $

FORM MOM (04/07)

In to: (lolland Oil. Debtor

IncBALANCE SHEET

Case No. 09-10792 Repotljtsg Penod: November 2010

M, 4

1

Unrestricted Ce1- and Equivalents IRes tri cted Cash and Cash Equivalents Accounts Receivable (Net) Inventories Prepaid Expenses Expenses (epiona1 Retainers I0cherCnt Assets (See Attached Schedule) TOTAL CURRENT ASSETS

400 400

S S

frepycd Properties Including lease and Well Equipment

Asset Retirement Costs Its Process Development Unproved Properties Office Equipment and Software Vehicles Other Equipment and Leasehold Improvements Pipeline Equipment Lass Acctsniulated Depreciation TOTAL PROPERTY & EU!PMENT

MIR

OTth8T4 AS8r

Other Assets (See Attached Schedule?

UTO Accounts Payable and Accrued Liabilities Taxes Payable Wages Payable Notes Payable. Deblor-in-possession financing Rent /Leases - Building/Equipment Secured Debt /Adequate Protection Payments Professional Fees Intercompany Payables Asset Relireinent Obligations Accrued Interest Other Liabilities TOTAL POSTPETITION Se=ed Debt Priority Debt Unsecured Debt Intercompany Paysbles TOTAL PRE-PETITION LIABILITIES

LIABILITIES$

} -

I

TOTAL LIABILITIES Ishure Capital IContabeted Surplus Warrants Additional Paid In Capital 1AcI1nuIated Other Comprehensive Loss !Partners Capital Account Qps Equity Account c!ined Eamin8s - Pre-Petilion Retained Earnings - Posipelition Adjustment to owner Equity (attach schedule) Postpeition Contributions (Distributions (Draws) (attach scliedale) NET SHAREHOLDERS EQUITY

S

ii)

iI

Is

$

400

$

V

400

TOThLLLB1LTE8 A N U OQ(fly..

MW

YMM Mott.)

In re: Gotland Oil, Inc. Debtor

Case No. 09-10792 Reporting Period: _Novernber 2010_

BALANCE SHEET - continuation sheet

:

Intercompany Receivables Derivative Assets Advances Other Receivables Total Other Current Assets

400

-

400

FORM MOR-3 CONID

(04)07)

In re: Gotland Oil, Inc. Debtor STATUS OF POSTPETITION TAXES

Case No. 09-10792 Reporting Period: November 2010

Withholding FICA-Employee FICA-Employer Unemployment Income Total Federal Taxes tate idc Withholding Sales Excise Unemployment Real Property Personal Property Total State and Local Total Taxes

N Not Applicable

ry

Not Applicable

SUMMARY OF UNPAID POSTPETITION DEBTS

IN

Accounts Payable Wages Payable Taxes Payable Rent/Leases-Building RcntlLeases-Eguipment Secured Debt/Adequate Protection Payments Professional Fees Total Postpetltion Debts

I

Not Applicable

FORM MOR-4 (04107)

In re: Gotland Oil, Inc. Debtor

Case No. 09-10792 Reporting Period: November 2010

ACCOUNTS RECEIVABLE RECONCILIATION AND AGING

Total Accounts Receivable at the beginning of the reporting period + Amounts billed during the period - Amounts collected during the period Total Accounts Receivable at the end of the reporting period

I

Not Applicable

0-30 days old 31 - 60 days old 61- 90 days old 91+ days old Total Accounts Receivable Accounts Receivable (Net)

I

Not Applicable

I

DEBTOR QUESTIONNAIRE

1. Have any assets been sold or transferred outside the normal course of business this reporting period? If yes, provide an explanation below. 2. Have any fluids been disbursed from any account other than a debtor in possession account this reporting period? If yes, provide an explanation below. 3. Have all postpetition tax returns been timely filed? If no, provide an explanation below. 4. Are workers compensation, general liability and other necessary insurance coverages in effect? If no, provide an explanation below. Note: We carry only fiduciary liability insurance. Company has no employees. Workers comp not requred. 5. Has any bank account been opened during the reporting period? If yes, provide documentation identifying the opened account(s). If an investment account has been opened provide the required documentation pursuant to the Delaware Local Rule 4001-3.

No

No

Yes Yes

No

FORM MOR.S (04107)

You might also like

- Accoun1 SpaceDocument25 pagesAccoun1 SpacePerlas Flordeliza100% (1)

- Chapter 2 Homework Template (Fixed)Document15 pagesChapter 2 Homework Template (Fixed)chanyoung4951100% (1)

- 2 - Special IssuesDocument18 pages2 - Special IssuesMoe AdelNo ratings yet

- Status: Schedule and Disbursements MOR-1 N/A Bank Copies Bank N/ADocument9 pagesStatus: Schedule and Disbursements MOR-1 N/A Bank Copies Bank N/AChapter 11 DocketsNo ratings yet

- Monthly Operating Report: MOR (O4fl)Document12 pagesMonthly Operating Report: MOR (O4fl)Chapter 11 DocketsNo ratings yet

- .7 Imor 4: Ui - CH Irfd I1 ('IDocument9 pages.7 Imor 4: Ui - CH Irfd I1 ('IChapter 11 DocketsNo ratings yet

- Debtor: Unjted States Bankruptcy Court District of DelawareDocument9 pagesDebtor: Unjted States Bankruptcy Court District of DelawareChapter 11 DocketsNo ratings yet

- R'Loljilfld Documems Forr No Affached Attiched Attached: - 1) Quit I XPL Affldqv - Yppcn, IpntDocument9 pagesR'Loljilfld Documems Forr No Affached Attiched Attached: - 1) Quit I XPL Affldqv - Yppcn, IpntChapter 11 DocketsNo ratings yet

- In Re: Petrocal Acquisition Corp.: If Is Is CompanyDocument9 pagesIn Re: Petrocal Acquisition Corp.: If Is Is CompanyChapter 11 DocketsNo ratings yet

- R!Iet Qrocumnts.. Sinq: 1Hcd N/ADocument9 pagesR!Iet Qrocumnts.. Sinq: 1Hcd N/AChapter 11 DocketsNo ratings yet

- Debtor: I I I IDocument9 pagesDebtor: I I I IChapter 11 DocketsNo ratings yet

- United States Bankruptcy Court District of DelawareDocument9 pagesUnited States Bankruptcy Court District of DelawareChapter 11 DocketsNo ratings yet

- United States Bankruptcy Court District of Delaware: MOR (041W)Document9 pagesUnited States Bankruptcy Court District of Delaware: MOR (041W)Chapter 11 DocketsNo ratings yet

- United States Bankrupt (:Y Court District of Delaware: An Is A orDocument9 pagesUnited States Bankrupt (:Y Court District of Delaware: An Is A orChapter 11 DocketsNo ratings yet

- Monthly Operating ReportDocument9 pagesMonthly Operating ReportChapter 11 DocketsNo ratings yet

- N/A N/A: T'DwonluisDocument9 pagesN/A N/A: T'DwonluisChapter 11 DocketsNo ratings yet

- Monthly Operating ReportDocument12 pagesMonthly Operating ReportChapter 11 DocketsNo ratings yet

- Doeunpnt Explaiation Afiudavit/Suppieniqnt !uequired DocumentsDocument9 pagesDoeunpnt Explaiation Afiudavit/Suppieniqnt !uequired DocumentsChapter 11 DocketsNo ratings yet

- Debtor: ReturnsDocument9 pagesDebtor: ReturnsChapter 11 DocketsNo ratings yet

- United States Bankruptcy Court District of Delaware: or Isa A If Isa A IsaDocument9 pagesUnited States Bankruptcy Court District of Delaware: or Isa A If Isa A IsaChapter 11 DocketsNo ratings yet

- Reqi'Ireh Docl..Men Is Form Attached Ktraehc, 1: 1N1'FEI)Document9 pagesReqi'Ireh Docl..Men Is Form Attached Ktraehc, 1: 1N1'FEI)Chapter 11 DocketsNo ratings yet

- At Eli.y: I 'Foio A AebdDocument9 pagesAt Eli.y: I 'Foio A AebdChapter 11 DocketsNo ratings yet

- Documentexplanation Affida%Itjsuppiexuviii Rf:U1Red Docume Is Form No. Att Ichcd Attached CiiedDocument9 pagesDocumentexplanation Affida%Itjsuppiexuviii Rf:U1Red Docume Is Form No. Att Ichcd Attached CiiedChapter 11 DocketsNo ratings yet

- Mor-3 VDocument9 pagesMor-3 VChapter 11 DocketsNo ratings yet

- Monthly Operating ReportDocument12 pagesMonthly Operating ReportChapter 11 DocketsNo ratings yet

- Requid Documnts Attched Attched: DocentDocument9 pagesRequid Documnts Attched Attched: DocentChapter 11 DocketsNo ratings yet

- Reouired Do (Ijmfn Is Form No T1iachclDocument9 pagesReouired Do (Ijmfn Is Form No T1iachclChapter 11 DocketsNo ratings yet

- United States Bankruptcy Court: RN Re: Pacific Energy Alaska Holdings. Inc. Reporting Period: Mav 2009Document9 pagesUnited States Bankruptcy Court: RN Re: Pacific Energy Alaska Holdings. Inc. Reporting Period: Mav 2009Chapter 11 DocketsNo ratings yet

- Required) Ocuments: I Na EhDocument11 pagesRequired) Ocuments: I Na EhChapter 11 DocketsNo ratings yet

- Date (L I: 5 (Vi R-C (ÓDocument9 pagesDate (L I: 5 (Vi R-C (ÓChapter 11 DocketsNo ratings yet

- Si ,,LL: I/l HfoDocument9 pagesSi ,,LL: I/l HfoChapter 11 DocketsNo ratings yet

- 10000015289Document9 pages10000015289Chapter 11 DocketsNo ratings yet

- Qocumeqt Expjna (Icn Tffidvit/$Qpplemnt: Rpflij1Tili) Nneilmi'NiqDocument11 pagesQocumeqt Expjna (Icn Tffidvit/$Qpplemnt: Rpflij1Tili) Nneilmi'NiqChapter 11 DocketsNo ratings yet

- 'Dtcunu Avppiencn .Orni No... T (Accd Atlached. Attached Mor-1Document12 pages'Dtcunu Avppiencn .Orni No... T (Accd Atlached. Attached Mor-1Chapter 11 DocketsNo ratings yet

- VT ¡Cfõ: Requidí) OcusDocument9 pagesVT ¡Cfõ: Requidí) OcusChapter 11 DocketsNo ratings yet

- N, Il ¡ /-Y¡: Requid DocumntsDocument9 pagesN, Il ¡ /-Y¡: Requid DocumntsChapter 11 DocketsNo ratings yet

- Exp!Nn (In MF - Daviusuppicrnent Required Documents:: Oeqt.Document12 pagesExp!Nn (In MF - Daviusuppicrnent Required Documents:: Oeqt.Chapter 11 DocketsNo ratings yet

- Eq'Ujr1'Bocljments Yjo":: CH ofDocument12 pagesEq'Ujr1'Bocljments Yjo":: CH ofChapter 11 DocketsNo ratings yet

- L R L¡ V-C (Ó: Attchd Attch DDocument9 pagesL R L¡ V-C (Ó: Attchd Attch DChapter 11 DocketsNo ratings yet

- I) .Oeurnent Lsibiiaiin Aftidaviiisuppleiuciit Reqcl1Ud 1) O (I:Ments Form No. Attached. Attached AutichedDocument12 pagesI) .Oeurnent Lsibiiaiin Aftidaviiisuppleiuciit Reqcl1Ud 1) O (I:Ments Form No. Attached. Attached AutichedChapter 11 DocketsNo ratings yet

- U.S. Government Standard General Ledger Chart of Accounts: Fiscal Year 2012 Reporting Supplement Section IDocument22 pagesU.S. Government Standard General Ledger Chart of Accounts: Fiscal Year 2012 Reporting Supplement Section IMirela LeonteNo ratings yet

- Office of The United States Trustee - Region 3 Post-Confirmation Quarterly Summary ReportDocument2 pagesOffice of The United States Trustee - Region 3 Post-Confirmation Quarterly Summary ReportChapter 11 DocketsNo ratings yet

- Ggiii X : Authori D Is Partnership A or Member If Debtor Is Limited Liability CompanyDocument14 pagesGgiii X : Authori D Is Partnership A or Member If Debtor Is Limited Liability CompanyChapter 11 DocketsNo ratings yet

- Balance Sheet As Per New Schedule ViDocument11 pagesBalance Sheet As Per New Schedule ViVelayudham ThiyagarajanNo ratings yet

- 10000003278Document16 pages10000003278Chapter 11 DocketsNo ratings yet

- ./ N/a ./ N/aDocument9 pages./ N/a ./ N/aChapter 11 DocketsNo ratings yet

- United States Bankruptcy Court Southern District of New YorkDocument11 pagesUnited States Bankruptcy Court Southern District of New YorkChapter 11 Dockets100% (1)

- Pac Ver Finalans KeyDocument10 pagesPac Ver Finalans KeyArun LalNo ratings yet

- 6018 P3 Lembar Jawaban Kosong AkuntansiDocument54 pages6018 P3 Lembar Jawaban Kosong AkuntansiEvanya Rachma OctavyaNo ratings yet

- Petters Bankruptcy Monthly Operating ReportDocument24 pagesPetters Bankruptcy Monthly Operating ReportCamdenCanaryNo ratings yet

- Accounting in Kazakhstan (Draft)Document67 pagesAccounting in Kazakhstan (Draft)PREMIER ICT CONSULTING (PICTC)No ratings yet

- $"'y-B/?' Sa /Ð-, Y: United States SSankruptcy CourtDocument9 pages$"'y-B/?' Sa /Ð-, Y: United States SSankruptcy CourtChapter 11 DocketsNo ratings yet

- Monthly Operating Report: L1,11111 Afl (I Lmfni Q FNRM No Auhi, Aflai'Haii Aftac'HeiDocument11 pagesMonthly Operating Report: L1,11111 Afl (I Lmfni Q FNRM No Auhi, Aflai'Haii Aftac'HeiChapter 11 DocketsNo ratings yet

- DRRADocument2 pagesDRRAShahaan ZulfiqarNo ratings yet

- Reporting: DebtorDocument15 pagesReporting: DebtorChapter 11 DocketsNo ratings yet

- Chart of Accounts and Budgetary AccountsDocument27 pagesChart of Accounts and Budgetary AccountsErika MonisNo ratings yet

- Ding of Accounting Standards 1-15Document25 pagesDing of Accounting Standards 1-15Moeen MakNo ratings yet

- ..P,.4.Ffykp:P) Ein:Ent Fqulrd Docum Is FormDocument11 pages..P,.4.Ffykp:P) Ein:Ent Fqulrd Docum Is FormChapter 11 DocketsNo ratings yet

- Financial StatementsDocument20 pagesFinancial StatementsOmnath Bihari100% (1)

- How to Read a Financial Report Workbook: Wringing Vital Signs Out of the NumbersFrom EverandHow to Read a Financial Report Workbook: Wringing Vital Signs Out of the NumbersNo ratings yet

- Appellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document28 pagesAppellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsNo ratings yet

- Appellees/Debtors' Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document69 pagesAppellees/Debtors' Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsNo ratings yet

- Wochos V Tesla OpinionDocument13 pagesWochos V Tesla OpinionChapter 11 DocketsNo ratings yet

- SEC Vs MUSKDocument23 pagesSEC Vs MUSKZerohedge100% (1)

- Roman Catholic Bishop of Great Falls MTDocument57 pagesRoman Catholic Bishop of Great Falls MTChapter 11 DocketsNo ratings yet

- Appendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document47 pagesAppendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsNo ratings yet

- NQ Letter 1Document3 pagesNQ Letter 1Chapter 11 DocketsNo ratings yet

- PopExpert PetitionDocument79 pagesPopExpert PetitionChapter 11 DocketsNo ratings yet

- National Bank of Anguilla DeclDocument10 pagesNational Bank of Anguilla DeclChapter 11 DocketsNo ratings yet

- NQ LetterDocument2 pagesNQ LetterChapter 11 DocketsNo ratings yet

- Energy Future Interest OpinionDocument38 pagesEnergy Future Interest OpinionChapter 11 DocketsNo ratings yet

- District of Delaware 'O " !' ' ' 1 1°, : American A Arel IncDocument5 pagesDistrict of Delaware 'O " !' ' ' 1 1°, : American A Arel IncChapter 11 DocketsNo ratings yet

- Zohar AnswerDocument18 pagesZohar AnswerChapter 11 DocketsNo ratings yet

- Home JoyDocument30 pagesHome JoyChapter 11 DocketsNo ratings yet

- Kalobios Pharmaceuticals IncDocument81 pagesKalobios Pharmaceuticals IncChapter 11 DocketsNo ratings yet

- Quirky Auction NoticeDocument2 pagesQuirky Auction NoticeChapter 11 DocketsNo ratings yet

- United States Bankruptcy Court Voluntary Petition: Southern District of TexasDocument4 pagesUnited States Bankruptcy Court Voluntary Petition: Southern District of TexasChapter 11 DocketsNo ratings yet

- My Views On Whether Customers Are Treated Fairly in Retailer BankruptciesDocument3 pagesMy Views On Whether Customers Are Treated Fairly in Retailer BankruptciesChapter 11 DocketsNo ratings yet

- Local Corp Chapter 11 Bankruptcy PetitionDocument18 pagesLocal Corp Chapter 11 Bankruptcy PetitionChapter 11 DocketsNo ratings yet

- Solutions9 13Document16 pagesSolutions9 13Atonu Tanvir Hossain100% (1)

- Catalan PhrasesDocument12 pagesCatalan PhrasesYoong Shin LeeNo ratings yet

- CF Final (1) On PTR Restaurant Mini CaseDocument23 pagesCF Final (1) On PTR Restaurant Mini Caseshiv029No ratings yet

- Working Capital ManagementDocument46 pagesWorking Capital ManagementYogesh AnaghanNo ratings yet

- Concept Map T8.2Document2 pagesConcept Map T8.2ScribdTranslationsNo ratings yet

- PPT-5 Ratio Analysis 05092023Document31 pagesPPT-5 Ratio Analysis 05092023Fan FollowingNo ratings yet

- HE1002 Tutorial1 QuestionsDocument2 pagesHE1002 Tutorial1 QuestionsCraproNo ratings yet

- JFP463E - Chapter 4Document6 pagesJFP463E - Chapter 4mirajosriNo ratings yet

- 001.CB Lecture FundamentalsDocument28 pages001.CB Lecture FundamentalskunyangNo ratings yet

- Abm 3 Exam ReviewerDocument7 pagesAbm 3 Exam Reviewerjoshua korylle mahinayNo ratings yet

- Web QuizDocument4 pagesWeb QuizMISRET 2018 IEI JSCNo ratings yet

- Six SigmaDocument79 pagesSix SigmaJishan ShoyebNo ratings yet

- Tax Law Exam NotesDocument1 pageTax Law Exam NotesSanjeevParajuliNo ratings yet

- Ias 21Document22 pagesIas 21Jayesh S BoharaNo ratings yet

- Case Digest Missing CasesDocument9 pagesCase Digest Missing CasesXhome ZomNo ratings yet

- 9 Preparation and Execution of TransfersDocument14 pages9 Preparation and Execution of Transfersapi-3803117100% (2)

- 2021 Financial Inclusion ReportDocument101 pages2021 Financial Inclusion ReportQoudifoNo ratings yet

- MCQ NegoDocument20 pagesMCQ NegoMark Hiro NakagawaNo ratings yet

- 2016 Minutes Chicago Police Pension FundDocument12 pages2016 Minutes Chicago Police Pension FundTrue News-usaNo ratings yet

- This Study Resource Was: Problems For Commercial Bank ManagementDocument6 pagesThis Study Resource Was: Problems For Commercial Bank ManagementPhạm Thành ĐạtNo ratings yet

- Starting Primary School PDFDocument292 pagesStarting Primary School PDFTwilightNo ratings yet

- Iowa Professional Fire Fighters PAC - 9790 - DR1 - 07-29-2010Document2 pagesIowa Professional Fire Fighters PAC - 9790 - DR1 - 07-29-2010Zach EdwardsNo ratings yet

- Statistic ExampleDocument3 pagesStatistic ExampleMohamad KhairiNo ratings yet

- Module in Investment and Portfolio ManagementDocument5 pagesModule in Investment and Portfolio ManagementRichard Kate RicohermosoNo ratings yet

- Global Financial SystemDocument22 pagesGlobal Financial SystemManoj ThadaniNo ratings yet

- Sri Fitri Wahyuni, SE.,M.M., Muhammad Shareza Hafiz.,SE.,M.AccDocument19 pagesSri Fitri Wahyuni, SE.,M.M., Muhammad Shareza Hafiz.,SE.,M.AccSuci JuniartikaNo ratings yet

- Organization of American States General Secretariat Secretariat For Administration and Finance Office of General ServicesDocument23 pagesOrganization of American States General Secretariat Secretariat For Administration and Finance Office of General ServicesthirumalNo ratings yet

- 12 Eco Material EngDocument161 pages12 Eco Material EngYASHU SINGHNo ratings yet

- Chyz (2013)Document18 pagesChyz (2013)MUC kediriNo ratings yet