The Day Ahead - April 10th 2013

The Day Ahead - April 10th 2013

Uploaded by

wallstreetfoolCopyright:

Available Formats

The Day Ahead - April 10th 2013

The Day Ahead - April 10th 2013

Uploaded by

wallstreetfoolCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

The Day Ahead - April 10th 2013

The Day Ahead - April 10th 2013

Uploaded by

wallstreetfoolCopyright:

Available Formats

THE DAY AHEAD

REUTERS NEWS

KEY ECONOMICS EVENTS Mortgage index for w/e 05/04 Refinancing index for w/e 05/04 Federal budget for Mar FOMC minutes March 19-20 meeting

North American Edition

ET/GMT 0700/1100 0700/1100 1400/1800 1400/1800 REUTERS POLL ---$112.5 bln -PRIOR 790.7 4189.0 -$204 bln -SOURCE

For Wednesday, April 10, 2013

Mortgage Bankers Association (MBA)

Federal Open Market Committee

MARKET RECAP

Stocks rose on Tuesday and the Dow reached a record intraday high as blue-chip technology shares gained, while Treasuries fell. Oil and gold gained on currency moves as the dollar fell across the board.

COMING UP

Constellation Brands reports quarterly earnings, one of several

consumer-focused companies posting results. Wall Street is looking for its profit to slip and will no doubt want to hear the company's view on negotiations with U.S. regulators over Anheuser Busch InBev's proposed takeover of Grupo Modelo. As part of that deal, Constellation will take over the Modelo business in the United States, giving the world's largest wine company a big footprint in the beer business. For a related Reuters Insider video, click here

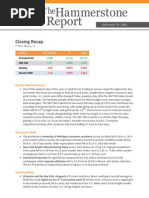

STOCKS DJIA Nasdaq S&P 500 Toronto Russell FTSE Eurofirst Nikkei Hang Seng

Close 14673.23 3237.86 1568.58 12484.05 929.46 6313.21 1165.35 13192.35 21870.34 Yield 1.7468 0.2341 0.6972

Change 59.75 15.61 5.51 139.49 -2.03 36.27 0.56 -0.24 152.29

% Chng 0.41 0.48 0.35 1.13 -0.22 0.58 0.05 0.00 0.70

Yr-high 14716.46 3270.30 1573.66 12904.71 954.00 6533.99 1209.05 13225.62 23944.74

Yr-low 12035.10 2726.68 1266.74 11209.55 729.75 5897.81 1132.73 10398.61 21612.05

Family Dollar's quarterly results will show whether its push to sell

more everyday goods from soda to cigarettes took a big bite out of its profits. Selling more of those goods is a trend for the so-called dollar stores including Family Dollar and larger rival Dollar General. While they boost shoppers' spending and might bring them into the stores more often, items such as cigarettes carry lower margins than much of the other merchandise such as apparel that the stores sell.

Bed Bath and Beyond and Carmax are expected to post imTREASURIES 10-year 2-year 5-year 30-year COMMODITIES May crude $ Spot gold (NY/oz) $ Copper U.S. (front month/lb) $ Reuters/Jefferies CRB Index Price FOREX -1 /32 Euro/Dollar 0 /32 Dollar/Yen 1 /32 Sterling/Dollar Last % Chng 1.3082 98.99 1.5320 1.0159 0.58 -0.36 0.45 -0.05

proved results, while Ruby Tuesdays earnings are seen slipping from the same period one year ago.

The Federal Reserves Federal Open Market Committee issues

minutes from its meeting of March 19-20. Investors will look for clues on whether Fed officials in March were warming to the idea of scaling back purchases of bonds, although a surprisingly weak report on U.S. employment since then could muddy any signal the minutes might otherwise send. The minutes have become even more important than the Feds rate statement, because policy is in a steady state. Keep in mind the meeting happened before the March jobs shocker, so well get a sense of how much appetite there was for tapering asset buys.

2.9331 -15 /32 Dollar/CAD Price 94.04 1585.06 3.4380 291.51 Price 39.35 0.64 13.93 6.95

$ change 0.68 11.97 0.0700 1.81 $ change 12.31 0.16 -1.94 -0.49

% change 0.73 0.76 2.08 0.63 % change 45.53 32.56 -12.22 -6.59

BIG MOVERS

First Solar Suntech Power J.C. Penney Spherix

President Barack Obama releases his budget proposal, which is

expected to offer cuts to Social Security and other entitlement programs, as he aims to sway Republicans to compromise on a deficit -reduction deal. Under a proposal that would cut the deficit by $1.8 trillion over 10 years, the president will offer to apply a less generous measure of inflation to calculate cost-of-living increases. However, the president will only accept these spending cuts if congressional Republicans agree to higher taxes.

For The Day Ahead - Canada, click here

Chevron, the second-largest U.S. oil company, updates investors

on its push to start growing production this year.

THE DAY AHEAD

For April 10, 2013

COMING UP (continued)

At the National Space Symposium in Colorado Springs,

Colorado, top U.S. and international experts gather to discuss military and civilian space and satellite programs, as well as cybersecurity challenges, against the backdrop of significant budget cuts in the United States and Europe. Top speakers include senior officers in charge of U.S. Strategic Command and Air Force Space Command, and senior executives from Boeing, Lockheed Martin, Northrop Grumman, Harris, ITT Exelis and other companies active in military and commercial space missions.

Bank of Montreal hosts its annual general meeting of shareholders in Saskatoon, Saskatchewan. Canada's No. 4 bank will discuss its growth strategies, with particular focus on its U.S. retail bank, which has nearly doubled in size thanks to the 2011 acquisition of Wisconsin lender Marshall & Illsley.

A federal judge will consider whether to give final approval to a

$115 million settlement with former AIG CEO Hank Greenberg and other related defendants in a lawsuit over alleged bid rigging and accounting fraud at the insurance giant. AIG has previously agreed to pay $725 million, and Pricewaterhousecoopers agreed to pay $97.5 million. The hearing is before U.S. District Judge Deborah Batts.

Federal Reserve Bank of Atlanta President Dennis Lockhart

gives welcome back remarks before the Federal Reserve Bank of Atlanta Financial Markets Conference in Stone Mountain, Ga. Also, Dallas Fed President Richard Fisher speaks at the University of Texas at El Paso.

MARKET MONITOR

Stocks advanced on Tuesday, with the Dow closing at a record high on a rally in cyclical shares and as the first impressions of the earnings season were positive. Microsoft shares ranked as the Dow's top percentage gainer, up 3.57 percent. Intel shares shot up 3.13 percent. Analysts said that the market has the momentum to push indexes higher, even with the Dow up about 12 percent and the S&P 500 up about 10 percent for the year. J.C. Penney tumbled 12.22 percent and shares of nutritional company Herbalife fell 3.75 percent. The Dow was up 0.41 percent, the S&P 500 Index was up 0.35 percent and Nasdaq was up 0.48 percent. Prices for longer-dated Treasuries dropped as investors extended a selloff after last week's rally and before debt auctions later in the week, but an undercurrent of worries about the global economy tempered losses. An auction of $32 billion in 3-year debt by the U.S. Treasury proved soft on Tuesday, with a weak bid-to-cover ratio and weak indirect takedown. Benchmark 10year Treasury notes last traded down 1/32 in price for a yield of 1.75 percent. Thirty-year bonds fell 16/32 in price to yield 2.93 percent after the auction. Also, the Federal Reserve bought $1.57 billion in government bonds that mature in Feb. 2037 to Feb. 2043. The dollar edged down from a near four-year high against the yen as traders booked profits on its sharp rally, but the yen's weakening trend remained intact following the Bank of Japan's aggressive monetary easing plan announced last week. "Given the breadth of yen bearishness, any reprieve would likely encourage investors to re-establish short yen positions at more favorable exchange rates," said Joe Manimbo, senior market analyst at Western Union Business Solutions in Washington, D.C. Dollar fell against the yen 0.34 percent at 99.01 yen. The euro extended gains against the dollar. It last traded at $1.3083, up 0.5 percent on the day. Against the yen, the euro reached a high of 129.97. It last traded at 129.53 yen, up 0.21 percent on the day. Click on the chart for full-size image

Crude oil futures rose, boosted by a weak dollar and Chinese inflation data that eased concerns about tightened money supply. "For WTI prices, the dollars under a lot of pressure, and that's given us a boost throughout the trading day," said Gene McGillian, an analyst at Tradition Energy in Stamford, Connecticut. May crude traded at $94.00, up 0.69 percent, a barrel, having recovered from a $92.86 session low. Gold rose as volatility in the currency market triggered by Japan's aggressive monetary easing plan lifted bullion's appeal as a hedge against inflation and currency fluctuations. Gold is now slowly sinking in to the news that Japan is printing a quick deal of money and liquidity is going to be abundant again, said Axel Merk, chief investment officer of Merk Funds, which oversees $630 million in mutual fund assets. Spot gold was up 0.75 percent at $1,584.90 an ounce. June delivery futures were up 0.76 percent at $1,584.70.

THE DAY AHEAD

For April 10, 2013

TOP NEWS

U.S. wholesale inventories post largest fall in 1-1/2 years U.S. wholesale inventories recorded their biggest decline in nearly 1-1/2 years in February, prompting some economists to lower their lofty first-quarter growth estimates. The Commerce Department said wholesale inventories fell 0.3 percent, the largest drop since September 2011, after a revised 0.8 percent rise in January. January sales were previously reported to have increased 1.2 percent and economists had expected stock to rise 0.5 percent in February. Meanwhile, confidence among U.S. small businesses fell in March, the latest indication that economic activity lost momentum as the first quarter ended. The National Federation of Independent Business said its optimism index fell 1.3 points to 89.5 last month. The overall tone of the survey was downbeat, with only two components of the index increasing. J.C. Penney board comes under fire for CEO switch The board of J.C. Penney is facing scathing criticism from investors and corporate governance experts after ousting Chief Executive Ron Johnson and replacing him with his own embattled predecessor, Myron Ullman. Hours after the switch was announced on Monday, there was at least one call for the entire board to resign, while others suggested shareholders might vote out current directors at the company's next annual meeting. "It was the wrong thing for the board to do to get rid of Johnson here. With the board firing Johnson now, at this stage in the game, they should tender their own resignation as well," said Brian McGough, managing director and head of the retail group at research firm Hedgeye Risk Management. FBI probes trading as KPMG quits as Herbalife, Skechers auditor In a case that could shake one of the world's largest accounting firms, KPMG said it resigned as auditor of two U.S. companies as the FBI began investigating insider trading allegations involving a former KPMG senior partner. The companies - nutritional products group Herbalife and footwear maker Skechers - said separately that KPMG had quit as their auditor in connection with alleged leaks of nonpublic information. The FBI's Los Angeles office is investigating the matter, according to a source familiar with the situation. Herbalife said in a statement that KPMG's resignation had nothing to do with the company's accounting practices or the integrity of its management - issues called into question by the high-stakes drama between hedge fund titans Bill Ackman and Carl Icahn over the company. Dell's evaluation of buyout bid flawed -shareholder Southeastern Asset Management, the activist investor that owns 8.4 percent of Dell, said the computer maker's evaluation of a $24.4 billion leveraged buyout deal with its founder and buyout firm Silver Lake was flawed. Citing excerpts from Dell's proxy statement, Southeastern said the company did not properly explain why it did not entertain a buyout offer that would allow shareholders to elect whether they wanted to be paid in cash or stock. It urged Dell's special committee to negotiate now "in good faith." Click on the chart for full-size image

Too early to call U.S. in a spring 'swoon' -Fed's Bullard A top Federal Reserve official downplayed the meager March jobs report, arguing he still expects unemployment to tick down to about 7 percent by year's end and suggesting the economy is not entering another spring "swoon." St. Louis Fed President James Bullard pointed to a stronger Europe and more positive U.S. economic data beyond the employment report, which last week showed only 88,000 jobs were created last month in the United States. Separately, Richmond Federal Reserve President Jeffrey Lacker said he was not concerned by a weaker-thanexpected March payroll report, which alarmed markets that the U.S. economy might suffer a 'spring swoon' when it was published last week. MasterCard under EU fire over payment card fees MasterCard is under investigation by the European Union over the level of fees tourists to the EU are charged when using cards to make purchases, which the EU competition regulator said could hamper cross-border trade. The EU watchdog said MasterCard's fees were a concern in view of the growing role of non-cash payments. "Fees charged for payments made by cardholders from non-European countries can be quite high. Actually, these types of fees are generally much higher than those charged within Europe," Commission spokesman Antoine Colombani said. Microsoft, Nokia demand EU action over Google's Android Companies including Microsoft and Nokia have stepped up pressure on EU antitrust regulators to take action against Google, accusing it of blocking competition in mobile telephony. In a complaint made public on Tuesday by their lobbying group FairSearch, Google's rivals accused the company of using Android to divert traffic to its search engine. Judge weighs fairness of Citigroup's $590 mln investor pact A federal judge grilled lawyers for Citigroup and shareholders on Monday over a proposed $590 million settlement of an investor lawsuit over its exposure to toxic mortgage assets, asking if the accord was fair given none of the bank executives named as defendants would contribute money to it. U.S. District Judge Sidney Stein in Manhattan said that Citigroup's current shareholders have been left to pay for the settlement under the current terms of the agreement.

THE DAY AHEAD

For April 10, 2013

TOP NEWS (continued)

Office Depot, OfficeMax get FTC request, pick CEO search panel Office Depot and OfficeMax both received a request for additional information from the Federal Trade Commission regarding their proposed merger, they said in a joint statement. The companies said they were optimistic about the regulatory process. Also, they said they formed a board committee to search for a chief executive for the combined company. It will consider external candidates as well as Office Depot CEO Neil Austrian and OfficeMax CEO Ravi Saligram. Wal-Mart to fund supplier training after deadly Bangladesh fire Wal-Mart Stores is making its biggest push yet to try to improve conditions at factories that produce its clothing after a fire at a Bangladesh factory killed 112 people last year. The company also said it would donate $1.6 million to help start a new Bangladesh training academy, and outlined its efforts to regain control over the complex and far-flung web of factories that make its products.

PIC OF THE DAY

A demonstrator holds up a picture depicting Russian President Vladimir Putin with make-up, during a protest by the gay community in Amsterdam, Netherlands.

ANALYSTS RECOMMENDATIONS

Company Name AMC Networks CBRE Group J.C. Penney Nasdaq OMX Group Qlik Technologies Action Stifel raised price target to $70 from $58 to reflect the continued ratings growth and the inclusion of $175mn of cash from the VOOM proceeds. JMP Securities raised target to $27 from $25, says the companys brand have become increasingly dominant on a global basis, which should continue to lead to a higher level of recurring fees. Baird cut target price to $17 from $20 after the departure of CEO Ron Johnson who lost key support from activist investors and board member. Sandler O'Neill cut price target by $2 to $33 to reflect softer-than-expected trading business and temporary suspension of the companys buyback program. Evercore Partners raised rating to overweight from equal weigh as the tone of business appears to remain solid based on partner feedback, says expectations are more realistic compared to one year back.

THE DAY AHEAD - CANADA

COMING UP

No major events are scheduled.

For April 10, 2013

MARKET MONITOR

Canada's main stock index recorded its biggest one-day percentage jump in more than four months on Tuesday as positive economic data from China fueled hopes for a global economic recovery and drove gains in the material and energy sectors. The Toronto Stock Exchange's S&P/TSX composite index was up 1.13 percent at 12,484.05. Barrick Gold climbed 1.49 percent and Goldcorp added 3.26 percent, playing the biggest role of any two stocks in leading the market higher. Suncor Energy rose 3.11 percent. The Canadian dollar was down 0.04 percent at $1.0160.

BIG MOVERS Niko Resources Romarco Minerals Aquila Resources Agrium

Price 7.14 0.75 0.13 96.53

C$ 0.88 0.09 -0.01 -2.80

% Change 14.06 13.64 -7.14 -2.82

TOP NEWS

Canada housing data suggests soft landing so far Canadian housing starts edged higher in March and building permits were weaker than expected in February, reports released showed, offering some reassurance that Canada's housing sector is simply cooling, not crashing. The seasonally adjusted annualized rate of housing starts was 184,028 units in March, up from 183,207 in February and well above the consensus forecast of analysts in a Reuters poll for 176,500. Meanwhile, data from Statistics Canada showed the value of Canadian building permits rose a weaker-than-expected 1.7 percent in February as a sharp decline in plans for multi-family housing partially offset strength in other projects. Market players had expected a February gain of 4.3 percent. For related graphic, click here Agrium sweeps proxy vote, Jana cries foul Canadian fertilizer company Agrium said its entire slate of directors had been elected to its board, defeating a rival slate nominated by dissident U.S. shareholder Jana Partners. Jana said the vote was tainted and should be investigated. Agrium said the result was "fair and square". Jana said votes cast for some of its five candidates for the 12-member board were revoked after Friday's deadline. Jana's managing partner, Barry Rosenstein, said the hedge fund had had enough votes as of Friday's deadline to elect one or more of its candidates, and that the vote was "tainted". Click on the chart for full-size image

Canada's Porter Airlines to finalize Bombardier plane deal Porter Aviation Holdings is set to announce an order for up to 30 C-Series jets made by Bombardier, the Wall Street Journal reported, citing two people familiar with the deal. Bombardier said in December an airline based in the Americas had signed a letter of intent to buy 12 C-Series aircraft, with options for another 18 narrow-body commercial planes, in a transaction worth up to $2.08 billion. The deal, which is expected to be announced as early as Wednesday, will finalize the letter of intent Porter signed with Bombardier in December, the Journal reported.

THE DAY AHEAD

For April 10, 2013

ANALYSIS AND INSIGHT

DEALTALK Activist investors find allies in mutual, pension funds By Jessica Toonkel and Soyoung Kim U.S. institutional investors, who used to shun activist investors and side with a company's management on most controversial issues, are starting to change their tune. Aggressive shareholders such as Carl Icahn and Bill Ackman, who agitate for change at companies they believe to be sub-par, are increasingly getting a hearing with institutions ranging from the most staid mutual fund to the state-run pension fund. Philip Larrieu, an investment officer at the California State Teachers Retirement System (CalSTRS), said activist investors have won more respect as their research has improved and their campaigns succeeded. "There are some that are very aggressive and people don't like them because they are so aggressive, but then it turns out they might have a point," Larrieu said in an interview, declining to give specifics. Last November, CalSTRS teamed up with Ralph Whitworth's Relational Investors LLC to urge for a breakup of diversified manufacturer Timken Co, the first time the California pension plan has participated in this kind of activism. In February, T. Rowe Price Group Inc opposed a $24 billion buyout bid for Dell Inc, one of only a handful of times in the past decade that the Baltimore-based money manager has publicly rejected a financial strategy endorsed by management. Activist investors, proxy advisers and fund managers say institutional support has emboldened some corporate gadflies to take on more and larger companies than they would have in the past - to the extent that even the likes of Apple and Procter & Gamble have come under attack. There were 241 activist campaigns in 2012 targeting a change in company strategy or board, up from 187 in 2009, according to FactSet SharkWatch. More than 20 percent of the campaigns last year targeted companies with at least $1 billion in market value, up from 7 percent in 2009. Data on institutional support for shareholder activism is hard to come by, but mutual fund managers say their interest is driven in part by the performance that activists have demonstrated in recent years. Increased focus on corporate governance is another driving factor. Dimensional Fund Advisors, the eighth largest U.S. mutual fund company with $262 billion in assets at the end of 2012, said it rarely engaged with activists before 2007 but formed a corporate governance group that year and started meeting with activist investors a few years ago. "We felt that we should be more proactive in gathering information and being informed so we could vote our proxies better," said Joseph Chi, co-head of portfolio management at the Austin, Texas-based DFA. "As a very large shareholder in companies that are engaged in proxy contests, this is a good opportunity to have our voice heard." PRESSURE TO PERFORM Activist investors focus on companies they believe can provide better shareholder returns through a change in strategy or management. With the U.S. economy in recovery mode, shareholders are putting more pressure on underperformers - especially companies with cash on the balance sheet that investors think can be put to better use, such as at Apple. "Three or four years ago everyone was in crisis and everyone had to be conservative and preserve cash but now you can see which companies aren't recovering," said Donna Anderson, a corporate governance specialist at T. Rowe Price. "I think more investors have been successful with achieving their objectives, whether it is to get a board seat or ultimately to lay out M&A," Anderson said. The financial crisis also jolted some passive investors into placing more emphasis on corporate governance. "The climate has changed and people are very focused on changing corporate conduct or more broadly around financial performance. If you are an activist hedge fund, you have the wind at your back," said Chris Cernich, executive director of mergers and acquisitions and proxy contest research at influential proxy advisor ISS. "I think the financial crisis has contributed to this climate and I think it's here to stay," Cernich said. Relational's Whitworth, who pressured industrial conglomerate ITT Corp to break up and last week was named interim chairman of Hewlett Packard, said institutional investors have evolved from "accepting" to "inviting" shareholder activism. "We do get a lot of calls from institutional investors," Whitworth said. "Institutional investors see the activity as beneficial and they're much more likely to be supportive." To be sure, some fund managers and index funds remain wary of engaging too closely with activist investors. "Our question is what is the long-term case. We are going to be permanent holders of the stock and it is not in our interest to support an initiative that will result in a short-term pop in stock price that isn't sustainable," said Glenn Booraem, controller of funds at the Vanguard Group. CAPITAL INFLOWS U.S. mutual funds and public pension plans together own 42 percent of all U.S. stocks, according to Bogle Financial Markets Research Center. Their willingness to listen to activist investors has emboldened some activists to buy stakes as small as 1 percent in their targets, and seek support to drive change. "More activists are spending more time with shareholders and research analysts, and they are spending less time with the company," said one industry banker, who wished to remain anonymous because he is not allowed to speak to the media. Over the past three years, activist hedge funds have outperformed more traditional hedge funds, according to Chicagobased Hedge Fund Research. Its activist index has returned 3.80 percent on an annualized basis, compared to its global hedge fund index, which has returned only 0.25 percent. That has drawn the attention of investors. Activist funds' assets under management doubled to more than $65 billion in 2012, from $32 billion in 2008, according to HFR. "Activism is a new asset class that people track," said Chris Young, head of contested situations at Credit Suisse Group. "Right now the view from pension funds is that we can get outsized returns." Last year, hedge fund TPG-Axon Capital urged oil and gas company SandRidge Energy to consider selling itself and asked Chief Executive Tom Ward to step down, marking only the second time the New York-based fund has filed an activist proposal. In March, TPG struck a deal with SandRidge that placed four of the hedge fund's nominees on the board. "You've got funds that were not activists but that have been increasingly willing to use that tool," Young said. "It is like a Pandora's box, once you opened it and used that tool, you realize you can use the tool again."

THE DAY AHEAD

For April 10, 2013

ANALYSIS AND INSIGHT (continued)

COLUMN Japan's big leak By James Saft The Bank of Japans massive new bid for inflation will create growth but to its chagrin much of it may well be concentrated in financial markets and outside of Japan. So long as Japanese consumers remained convinced that the new program will bring more inflation in what they buy rather than in what they earn, much of the benefit will be felt in Europe, the U.S. and the other economies into which the newly minted money will actually leak. The BOJ last week vowed to spend $1.4 trillion in less than two years buying up bonds and assets in a bid to hit its avowed 2.0 percent inflation goal. The central bank will create money and wade into markets, vacuuming up Japanese government debt and other assets while targeting the amount of money in the economy rather than the rate of interest at which it will make loans. While this is a step change in scale, the logic behind the plan is no different than the monetary policies followed over most of the past two decades in Japan, policies notable mostly for their lack of success. To break the self-reinforcing spiral of falling prices, wages and output, the BOJ must convince businesses and households that cash spent or invested today will buy more than that tucked away for tomorrow. By any standard this is a big plan, roughly three times the size of U.S. quantitative easing relative to the size of Japans government bond issuance. The question is where the money goes. Clearly the BOJ is already having a big impact on global markets, with the yen continuing to fall in value and Japanese government bond interest rates declining in sometimes frenetic and disorderly trading. The problem is in the pessimism entrenched in Japanese consumers thinking process after a generation of deflation and economic stagnation. A survey released by the BOJ last week showed that almost three-quarters of households expect prices to rise a year from now, the most since 2008. On the surface, this looks like a great victory for monetary policy. Households, seeing inflation, surely will part with money? Not necessarily. First off, expectations for rising prices are concentrated on the kinds of things which households must buy, notably food and energy. When it comes to durable goods, in other words the things one can choose not to buy, the expectation is still for falling prices in real terms. Even worse, only 9.5 percent expect their own wages to keep pace with inflation. The clear implication is that the money wont move, because households will cut back on spending to protect themselves from the rising cost of essentials. That might possibly change if Japanese businesses start hiking wages, but while newly aggressive monetary policy may drive the yen down and make exports more competitive, it does nothing to improve Japans poor allocation of capital and development of products. THE GREAT LEAK As with QE in the U.S., the real place to look for the impact of central bank action is in financial markets. The BOJ will succeed in driving down the value of the yen and rate of interest on Japanese bonds. That is good for exporters, but bad for the many investors who depend on income. It will also drive up the price of stocks, at least in part as savers take on more risk. If the great printing of money doesnt do much to move money around Japans domestic economy, that money will sit on deposit at banks, insurance companies and pension funds, all of which will have to decide what to do with it. Many, inevitably, will become increasingly desperate for extra yield and will choose to take risks by investing in overseas bond markets which offer higher returns, though also the additional risk of currency moves. That will help to drive down interest rates in places like France, the United States and emerging markets like Brazil. This will be especially welcome in the euro zone, and may go some way to explaining why there has been so little criticism of Japanese policy outside of Asia. A more committed Bank of Japan may have trouble defeating deflation, but will support riskier markets. Investors in high-yield bonds and equities alike will see prices supported by what should be a steady flow of money out of Japan and into just about anything but Japan. In some ways this is all reasonably good news. More money printing will help Japan a bit, and is generally stimulative everywhere. The real issue is the sustained, and widening, disconnection between financial markets and the worlds real economies. Japan may well be looking at a bull market but searching in vain for a recovering economy. (James Saft is a Reuters columnist. The opinions expressed are his own. At the time of publication, James Saft did not own any direct investments in securities mentioned in this article. He may be an owner indirectly as an investor in a fund.) BREAKINGVIEWS J.C. Penney exposes inefficiency valuing CEOs By Richard Beales The debacle at J.C. Penney exposes a glaring inefficiency in how the market values corporate chieftains. When the struggling U.S. retailer hired Apple whiz Ron Johnson in 2012, the company's equity value spiked by more than $1 billion. On Monday evening, news of his departure added $350 million. The return of ex-Chief Executive Mike Ullman the man Johnson replaced swiftly erased some $700 million. Such big swings make no sense. Less than two years ago, Johnson was given a savior's welcome. Bill Ackman, a board member and hedge fund manager whose Pershing Square Capital Management is J.C. Penney's biggest shareholder, championed the recruitment and touted Johnson's retail success at Apple and Target. Apple, in particular, always looked a shaky comparison. J.C. Penney lacks the desirable products, focus and brand image of the iPhone and iPad maker. As it turns out, J.C. Penney's shares are trading at less than half the price they were when Johnson took over. A year and a half isn't long enough to forge a major turnaround. Even Ackman, though, realized things weren't going well. He bluntly acknowledged the problems at a conference last week. Even if Johnson's ideas had been the right ones, big organizations with entrenched people and cultures are hard to turn around. That made the market exuberance for his arrival excessive. By the same token, the large discount applied to Ullman's second attempt is probably overdone. Part of the rap against Johnson is he tried to do too much, changing sale policies and alienating traditional customers. In that sense, a blast from the past might not be so bad. Although Ullman's seven-year tenure cost J.C. Penney 15 percent of its value as Ackman liked to point out the pressure from online rivals, the intervening recession and the more dramatic decline under Johnson make that record look less bad. J.C. Penney, now a $3.1 billion company, has struggled to keep up in a challenged industry. That may be where Ullman can

THE DAY AHEAD

For April 10, 2013

ANALYSIS AND INSIGHT (continued)

help. If anything, the fickle market has provided him with one advantage over Johnson: low expectations. CONTEXT NEWS J.C. Penney said on April 8 that Chief Executive Ron Johnson was stepping down and leaving the company, and that former CEO Myron (Mike) Ullman had rejoined the company as chief executive, effective immediately. Johnson, a former Target and Apple retail executive, took the helm at J.C. Penney on Nov. 1, 2011. Ullman ran the company for seven years before that. The company's stock, worth $3.5 billion at the close of the trading day on April 8, rose more than 10 percent in after-hours trading following news of Johnson's ouster. But after J.C. Penney said Ullman would return, the shares swung to a loss, and stood 10 percent lower in early New York trade on April 9. Hedge fund manager William Ackman of Pershing Square Capital Management, the largest shareholder in J.C. Penney with an 18 percent stake, said on April 5 that Johnson and his team had made "big mistakes" with an impact that has been "very close to a disaster." Ackman, who sits on the J.C. Penney board, championed the hiring of Johnson less than two years ago. (The author is a Reuters Breakingviews columnist. The opinions expressed are his own.)

KEY RESULTS vs. THOMSON REUTERS I/B/E/S ESTIMATES

Company Name Quarter EPS Estimates Year Ago Rev Estimates (mln)

Bed Bath & Beyond Fastenal Family Dollar CarMax Constellation Brands

Q4 Q1 Q2 Q4 Q4

$1.68 $0.37 $1.22 $0.46 $0.45

$1.48 $0.34 $1.15 $0.41 $0.69

$3,393 $818 $2,888 $2,730 $667

** Includes companies on S&P 500 index. Estimates may be updated or revised.

The Day Ahead - North American Edition is compiled by Naveen Mutnal, Benny Thomas and Chandrashekhar Modi in Bangalore; Franklin Paul and Meredith Mazzilli in New York. THE DAY AHEAD - North American Edition is produced by Reuters News For questions or comments about this report, email us at: TheDay.Ahead@thomsonreuters.com Or call us at +91 80 4135 5929 Visit the Thomson Reuters Equities Community Site at: http://customers.reuters.com/community/equities/ For more information about our products: http://thomsonreuters.com/products_services Or send us a sales enquiry at: http://thomsonreuters.com/products_services/financial/contactus/ or call us on North America: +1 800 758 5555 2013 Thomson Reuters. All rights reserved. This content is the intellectual property of Thomson Reuters and its affiliates. Any copying, distribution or redistribution of this content is expressly prohibited without the prior written consent of Thomson Reuters. Thomson Reuters shall not be liable for any errors or delays in content, or for any actions taken in reliance thereon. Thomson Reuters and its logo are registered trademarks or trademarks of the Thomson Reuters group of companies around the world.

You might also like

- Daily Affirmations Will Improve Your Trading100% (2)Daily Affirmations Will Improve Your Trading6 pages

- Hammerstone Report Closing ReCap-8/14/15No ratings yetHammerstone Report Closing ReCap-8/14/155 pages

- Regulators Shut 5 Banks As 2010 Tally Hits 78: 3 Fla. Banks, 1 Each in Nev., Calif. Shut Down (AP)No ratings yetRegulators Shut 5 Banks As 2010 Tally Hits 78: 3 Fla. Banks, 1 Each in Nev., Calif. Shut Down (AP)15 pages

- Buying Opportunity or Sucker Rally?: Simon Maierhofer (Archived On Website), On Tuesday June 22, 2010, 3:57 PM EDTNo ratings yetBuying Opportunity or Sucker Rally?: Simon Maierhofer (Archived On Website), On Tuesday June 22, 2010, 3:57 PM EDT26 pages

- HammerstoneReport Closing ReCap - 3/23/15No ratings yetHammerstoneReport Closing ReCap - 3/23/155 pages

- Inside Debt: Markets Today Chart of The DayNo ratings yetInside Debt: Markets Today Chart of The Day6 pages

- Ormalization: ECONOMIC DATA With Impact Positive ImpactsNo ratings yetOrmalization: ECONOMIC DATA With Impact Positive Impacts5 pages

- Economy Results With Srinivas Vadde's Positive Confidence & Positive Influence+No ratings yetEconomy Results With Srinivas Vadde's Positive Confidence & Positive Influence+1,724 pages

- Impact of U.S. Recession On India - An Empirical StudyNo ratings yetImpact of U.S. Recession On India - An Empirical Study22 pages

- Economic / Financial: Obama-Dodd-Frank Finreg Monstrosity Delays Derivatives Curbs Until 2022!No ratings yetEconomic / Financial: Obama-Dodd-Frank Finreg Monstrosity Delays Derivatives Curbs Until 2022!58 pages

- Flat Friday, But Stocks End Week Sharply Lower: Midnight Trader 4:16 PM, Jun 25, 2010No ratings yetFlat Friday, But Stocks End Week Sharply Lower: Midnight Trader 4:16 PM, Jun 25, 201030 pages

- Ranges (Up Till 11.38am HKT) : Currency CurrencyNo ratings yetRanges (Up Till 11.38am HKT) : Currency Currency3 pages

- Eekly Conomic Pdate: Consumer Sentiment Hits A 4-Year PeakNo ratings yetEekly Conomic Pdate: Consumer Sentiment Hits A 4-Year Peak2 pages

- HSIC January 13, 2018:: Holy Spirit Investment Club NotesNo ratings yetHSIC January 13, 2018:: Holy Spirit Investment Club Notes25 pages

- Santelli: $4 Gas, $150 Oil Coming This Summer..No ratings yetSantelli: $4 Gas, $150 Oil Coming This Summer..9 pages

- Energy Shares Lead Broad Rebound On Wall Street: .Dji .SPX .IxicNo ratings yetEnergy Shares Lead Broad Rebound On Wall Street: .Dji .SPX .Ixic2 pages

- Calm Before Another Global Market Storm Cooper ' and Given Just HowNo ratings yetCalm Before Another Global Market Storm Cooper ' and Given Just How12 pages

- The Recession Continues As The Multi-Year Bear Market RenewsNo ratings yetThe Recession Continues As The Multi-Year Bear Market Renews5 pages

- HammerstoneReport Closing ReCap 12/17/14No ratings yetHammerstoneReport Closing ReCap 12/17/146 pages

- Risk Aversion Stalls On Improved Housing Data and EuroNo ratings yetRisk Aversion Stalls On Improved Housing Data and Euro6 pages

- Moody's: Regional Banks On Review For Downgrade (AP) Consumer Confidence Dims (Reuters)No ratings yetMoody's: Regional Banks On Review For Downgrade (AP) Consumer Confidence Dims (Reuters)136 pages

- Change Is Coming Fortigent by Chris Maxey, Ryan Davis August 20, 2013No ratings yetChange Is Coming Fortigent by Chris Maxey, Ryan Davis August 20, 20136 pages

- Ranges (Up Till 11.55am HKT) : Currency CurrencyNo ratings yetRanges (Up Till 11.55am HKT) : Currency Currency2 pages

- Asian Stocks Climb As Baht Rebounds Palladium Declines:: May 23, 2014 9:23 AM GMT+0530No ratings yetAsian Stocks Climb As Baht Rebounds Palladium Declines:: May 23, 2014 9:23 AM GMT+05309 pages

- The Weekly Market Update For The Week of February 16, 2015.No ratings yetThe Weekly Market Update For The Week of February 16, 2015.2 pages

- Credit Card Setup Questionnaire: As Assigned by CC VendorNo ratings yetCredit Card Setup Questionnaire: As Assigned by CC Vendor6 pages

- Sharpening The Arithmetic of Active Management - AQR 2016No ratings yetSharpening The Arithmetic of Active Management - AQR 201614 pages

- Technical Study of Pharmaceutical StocksNo ratings yetTechnical Study of Pharmaceutical Stocks4 pages

- Money Market: TREASURY BILLS. Treasury Bills (T-Bills) Are Short-Term Notes Issued by The U.SNo ratings yetMoney Market: TREASURY BILLS. Treasury Bills (T-Bills) Are Short-Term Notes Issued by The U.S9 pages

- Supplemental Bond Info Sent To Gov LePage's Office From Maine TreasurerNo ratings yetSupplemental Bond Info Sent To Gov LePage's Office From Maine Treasurer2 pages

- SEBI Penetration of Mutual Funds in IndiaNo ratings yetSEBI Penetration of Mutual Funds in India62 pages

- Catherine Austin Fitts - Grappling With Chemtrails and General Wesley Clark Battle Plan After Nine ElevenNo ratings yetCatherine Austin Fitts - Grappling With Chemtrails and General Wesley Clark Battle Plan After Nine Eleven13 pages

- Regulators Shut 5 Banks As 2010 Tally Hits 78: 3 Fla. Banks, 1 Each in Nev., Calif. Shut Down (AP)Regulators Shut 5 Banks As 2010 Tally Hits 78: 3 Fla. Banks, 1 Each in Nev., Calif. Shut Down (AP)

- Buying Opportunity or Sucker Rally?: Simon Maierhofer (Archived On Website), On Tuesday June 22, 2010, 3:57 PM EDTBuying Opportunity or Sucker Rally?: Simon Maierhofer (Archived On Website), On Tuesday June 22, 2010, 3:57 PM EDT

- Ormalization: ECONOMIC DATA With Impact Positive ImpactsOrmalization: ECONOMIC DATA With Impact Positive Impacts

- Economy Results With Srinivas Vadde's Positive Confidence & Positive Influence+Economy Results With Srinivas Vadde's Positive Confidence & Positive Influence+

- Impact of U.S. Recession On India - An Empirical StudyImpact of U.S. Recession On India - An Empirical Study

- Economic / Financial: Obama-Dodd-Frank Finreg Monstrosity Delays Derivatives Curbs Until 2022!Economic / Financial: Obama-Dodd-Frank Finreg Monstrosity Delays Derivatives Curbs Until 2022!

- Flat Friday, But Stocks End Week Sharply Lower: Midnight Trader 4:16 PM, Jun 25, 2010Flat Friday, But Stocks End Week Sharply Lower: Midnight Trader 4:16 PM, Jun 25, 2010

- Eekly Conomic Pdate: Consumer Sentiment Hits A 4-Year PeakEekly Conomic Pdate: Consumer Sentiment Hits A 4-Year Peak

- HSIC January 13, 2018:: Holy Spirit Investment Club NotesHSIC January 13, 2018:: Holy Spirit Investment Club Notes

- Energy Shares Lead Broad Rebound On Wall Street: .Dji .SPX .IxicEnergy Shares Lead Broad Rebound On Wall Street: .Dji .SPX .Ixic

- Calm Before Another Global Market Storm Cooper ' and Given Just HowCalm Before Another Global Market Storm Cooper ' and Given Just How

- The Recession Continues As The Multi-Year Bear Market RenewsThe Recession Continues As The Multi-Year Bear Market Renews

- Risk Aversion Stalls On Improved Housing Data and EuroRisk Aversion Stalls On Improved Housing Data and Euro

- Moody's: Regional Banks On Review For Downgrade (AP) Consumer Confidence Dims (Reuters)Moody's: Regional Banks On Review For Downgrade (AP) Consumer Confidence Dims (Reuters)

- Change Is Coming Fortigent by Chris Maxey, Ryan Davis August 20, 2013Change Is Coming Fortigent by Chris Maxey, Ryan Davis August 20, 2013

- Asian Stocks Climb As Baht Rebounds Palladium Declines:: May 23, 2014 9:23 AM GMT+0530Asian Stocks Climb As Baht Rebounds Palladium Declines:: May 23, 2014 9:23 AM GMT+0530

- The Weekly Market Update For The Week of February 16, 2015.The Weekly Market Update For The Week of February 16, 2015.

- The New Depression: The Breakdown of the Paper Money EconomyFrom EverandThe New Depression: The Breakdown of the Paper Money Economy

- You Too Can Be Rich In Stock Market InvestmentFrom EverandYou Too Can Be Rich In Stock Market Investment

- Credit Card Setup Questionnaire: As Assigned by CC VendorCredit Card Setup Questionnaire: As Assigned by CC Vendor

- Sharpening The Arithmetic of Active Management - AQR 2016Sharpening The Arithmetic of Active Management - AQR 2016

- Money Market: TREASURY BILLS. Treasury Bills (T-Bills) Are Short-Term Notes Issued by The U.SMoney Market: TREASURY BILLS. Treasury Bills (T-Bills) Are Short-Term Notes Issued by The U.S

- Supplemental Bond Info Sent To Gov LePage's Office From Maine TreasurerSupplemental Bond Info Sent To Gov LePage's Office From Maine Treasurer

- Catherine Austin Fitts - Grappling With Chemtrails and General Wesley Clark Battle Plan After Nine ElevenCatherine Austin Fitts - Grappling With Chemtrails and General Wesley Clark Battle Plan After Nine Eleven