Adjustment of Modified Internal Rate of Return For Scale and Time Span Differences

Adjustment of Modified Internal Rate of Return For Scale and Time Span Differences

Uploaded by

Vishnu NairCopyright:

Available Formats

Adjustment of Modified Internal Rate of Return For Scale and Time Span Differences

Adjustment of Modified Internal Rate of Return For Scale and Time Span Differences

Uploaded by

Vishnu NairOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Adjustment of Modified Internal Rate of Return For Scale and Time Span Differences

Adjustment of Modified Internal Rate of Return For Scale and Time Span Differences

Uploaded by

Vishnu NairCopyright:

Available Formats

Allied Academies International Conference

page 57

ADJUSTMENT OF MODIFIED INTERNAL RATE OF RETURN FOR SCALE AND TIME SPAN DIFFERENCES

David Cary, California State University, Northridge david.cary@csun.edu Michael Dunn, California State University, Northridge mdunn@pacbell.net

ABSTRACT The use of the Internal Rate of Return (IRR) method of capital budgeting is popular as many managers prefer a rate of return method as a decision-making criterion for capital budgeting. However, the Net Present Value (NPV) method is preferred by academics since the rankings of mutually exclusive projects by IRR may not always select the project which will maximize the value of the firm, due to an implied reinvestment rate assumption by IRR. In response to this weakness, the Modified Internal Rate of Return (MIRR) was developed. However, MIRR may also lead to erroneous rankings when projects require different initial outflows to start the project, the scale problem, or the projects have different lives, the time span problem. This paper demonstrates how MIRR can be adjusted to give rankings that are consistent with NPV for projects in the same risk class, even with scale differences and for some types of time span differences. A secondary contribution is a simplified method of computing MIRR with examples to show the consistency with the NPV and with the goal of maximizing the value of the firm to its shareholders. INTRODUCTION While rates of return methods, in general, and the Internal Rate of Return (IRR) method in particular, have been found to be favored by a majority of companies (Gitman & Forrester, 1997), it has also been shown that the IRR method can lead to erroneous rankings of mutually exclusive projects when compared to the Net Present Value (NPV) method of capital budgeting (Fisher, 1930). The differences in rankings may be caused by the implied reinvestment rate assumption of the IRR method (Fisher, 1930), or by differences in the size of the projects, the scale problem, or in the life of the projects, the time span problem. Differences in the risk classes of the projects and capital rationing can also cause ranking differences. This paper will assume that all projects are in the same risk class as the firm and that capital rationing does not exist. The Modified Internal Rate of Return (MIRR) method of capital budgeting, or similarly the Financial Management Rate of Return method (Findlay & Messner, 1973), was developed to overcome the problem of the implied reinvestment rate assumption (Bierman & Smidt, 1984, Hirshleifer, 1970, Solomon, 1956). However, when scale or time span differences exist, the MIRR method may still give rankings of mutually exclusive projects that are different than NPV (Brigham & Gapenski, 1988). This paper presents an adjustment to the MIRR method that will give rankings that are consistent with NPV for scale differences and for non-repeatable projects, for time span differences. In addition, a simplified method of calculating MIRR is developed. MODIFIED INTERNAL RATE OF RETURN This paper assumes that an initial outflow is followed by a series of inflows. The method of calculating MIRR presented here can be used when there are future outflows by either discounting the outflows back to the present, at the cost of capital, and including them as part of the initial outflow or by letting future inflows offset the future outflows. As long as the largest initial outflow is used in the calculation of the MIRR's for all projects, the ranking between MIRR and NPV will remain consistent. The MIRR is computed in two steps by first compounding the future cash flows of a project to the end of the project at an explicitly assumed reinvestment rate "k" to get a Terminal Value of the Future Cash Flows (TVFCF).

Proceedings of the Academy of Accounting and Financial Studies, Volume 2, Number 2

Maui, Hawaii, 1997

Allied Academies International Conference

page 58

For firms which are not subject to capital rationing the reinvestment rate should be the cost of capital which represents the rate of return generally available for projects of equivalent risk (Dudley, 1972, Meyer, 1979, Nicol, 1981). The essence of the project is then represented in the Initial Outflow (IO) and the Terminal Value. Then the MIRR, the implied rate of return which equates these two values over time, is calculated. For "N" periods:

TVFCF ' j CFt (1 % k)N & t

N t'1

TVFCF ' IO (1 % MIRR)N MIRR ' TVCFF IO

1/N

thus

& 1

(Equation #1)

As presently used, MIRR, like other rates of return, is subject to problems. Rate of return is per dollar invested and per year. A small project with a high rate of return may contribute less to the wealth of the firm than a large project with a lower rate of return. A project which will last many years may be superior to a shorter duration project with a higher rate of return. As will be discussed below, a critical factor in the analysis of projects with different lives will be whether a project can be repeated in the future and if so, on what terms. Additional problems exist if the projects are in different risk classes and therefore have different costs of capital or if the discount rate is not constant over time. SCALE DIFFERENCES Exhibit 1 presents an example of the ranking conflict between NPV and IRR for two mutually exclusive projects because of scale differences. Ranking is important for mutually exclusive projects to determine which otherwise acceptable project should be chosen. Ranking may also be important if there is capital rationing. In all other cases, all acceptable projects should be selected. Although Project B is vastly superior to project L in terms of wealth maximization, it has a lower IRR.

Exhibit 1 Comparison of Projects with Different Initial Outflows (Scale Differences) Project L Project B Initial Outflow ($100.00) ($1,000.00) Period 1 40.00 350.00 Period 2 50.00 450.00 Period 3 60.00 550.00 Period 4 70.00 650.00 Cost of Capital 10.00% 10.00% Net Present Value 70.58 547.26 (Ranking) (2) (1) Internal Rate of Return 36.44% 30.72% (Ranking) (1) (2) (Rankings are reversed) Proceedings of the Academy of Accounting and Financial Studies, Volume 2, Number 2 Maui, Hawaii, 1997

Allied Academies International Conference

page 59

MIRR, as conventionally computed, has the same problem. Exhibit 2 illustrates the conventional calculation of Terminal Value (TVFCF) for project L. Exhibit 2 Calculation of Terminal Value for Project L Initial Outflow ($100.00) Period 1 40.00 x 1.3310 = Period 2 50.00 x 1.2100 = Period 3 60.00 x 1.1000 = Period 4 70.00 x 1.0000 = Terminal Value

53.24 60.50 66.00 70.00 $249.74

MIRRL '

249.74 100.00

1/4

& 1 ' 0.2571

The Terminal Value may be calculated in a way which is often more convenient. This simplified computational formula will be shown to also facilitate adjustments for differences in the size or temporal span of projects. The mathematics of time value of money imply that the Terminal Value is equal to the present value of the future cash flows compounded, at the cost of capital, to the terminal period. Reinvestment rates other than the cost of capital can be used to calculate the terminal value. However, if funds cannot be reinvested at the cost of capital, then the use of NPV may not be appropriate and the ranking between MIRR and NPV may not be consistent. Letting k be the reinvestment rate:

TVFCF ' PVFCF (1%k )N,

and

NPV ' PVFCF & IO, thus PVFCF ' (IO % NPV ), TVFCF ' (IO%NPV ) (1%k )N thus (equation #2)

Substituting #2 into #1 MIRR ' (IO%NPV) (1%k)N IO

1/N

&1

1/4

(equation #3)

MIRRL '

(100%70.58) (1%0.1)4 100

&1 ' 0.2571

A similar calculation for Project B results in a MIRRB of 0.2268 which is less than the MIRRL ( = 0.2571). Note that this conventional calculation of MIRR, unadjusted for size differences, gives a ranking that is inconsistent with NPV. Proceedings of the Academy of Accounting and Financial Studies, Volume 2, Number 2 Maui, Hawaii, 1997

Allied Academies International Conference

page 60

The solution to the ranking problem lies in the insight that the acceptance of the smaller project L also implies the acceptance of a shadow investment, equal to the difference in size between the smaller and larger projects, which earns the cost of capital. In this case, to accept project L (an investment of $100) is to reject B (an investment of $1,000). Having assumed a non-capital rationing situation, the firm should be accepting all non-mutually exclusive investments with a positive NPV. Thus, marginal project would earn the cost of capital. Since rates of return are per dollar and per year, they are only comparable for projects of the same size and the same time span. The MIRRs for L and B may be made comparable by assuming that taking the smaller project (L) also implies accepting a shadow investment which earns the cost of capital (has a zero NPV) with an initial outflow equal to the difference between the two projects. Exhibit #3 Inclusion of a Shadow Investment to Adjust for Scale Differences Project Shadow Combined L L Investment + Shadow Initial Outflow Period 1 Period 2 Period 3 Period 4 Cost of Capital NPV (Ranking) IRR (Ranking) MIRR (Ranking) $100.00 40.00 50.00 60.00 70.00 10.0% 70.58 $900.00 283.92 283.92 283.92 283.92 10.0% 0.00 $1,000.00 323.92 333.92 343.92 353.92 10.0% 70.58 (2) 13.17% (2) 11.89% (2)

Project B $1,000.00 350.00 450.00 550.00 650.00 10.0% 547.26 (1) 30.72% (1) 22.68% (1)

36.44%

10.00%

25.71%

10.00%

The appropriate comparison is between the MIRR of B and the MIRR of L plus the implied shadow investment. Other authors (Sweeney & Mantripragada, 1987) have suggested paired comparisons analogous to Fisher's Defender/Challenger approach to reconciling IRR with NPV. This is clearly a more complex process, particularly if numerous alternatives are under consideration. Exhibit 3 shows that in this example, the adjusted MIRR ranks consistently with NPV. (Appendix 1 has a general proof for the consistency) In practice, it is not necessary to estimate and include the shadow as in Exhibit 3. The shadow will always have a zero NPV. Using Equation #3, the calculation of MIRR for the smaller project would simply require the replacement of the initial outflow (IO) of the smaller project with the IO of the larger project in both the numerator and denominator. In fact, any number of mutually exclusive alternatives may be compared by simply assigning to each the same initial outflow as the largest of them.

Proceedings of the Academy of Accounting and Financial Studies, Volume 2, Number 2

Maui, Hawaii, 1997

Allied Academies International Conference

1/N

page 61

MIRRL ' MIRRL '

(NPVL % IOB)(1 % k)N IO B (70.58 % 1,000.00)(1.10)4 1,000 MIRR L ' 11.89%

& 1

1/4

& 1

DIFFERENCES IN TIME SPANS The adjustment for time span differences depends on the repeatability of the projects. For projects that can be repeated in the future, either a replacement chain to a common ending point or truncation of the longer project is necessary for a proper calculation of both NPV and MIRR. However, for non-repeatable projects, Equation #3 may be used by using the life of the longest project for N in the calculation of MIRR for shorter-lived rival projects. The proof of this assertion is directly analogous to that present in Appendix 1 for scale differences. Exhibit 4 Adjustment of MIRR for Time Span Differences Project P Project Q Initial Outflow ($1,000.00) ($1,000.00) Period 1 300.00 500.00 Period 2 350.00 600.00 Period 3 400.00 700.00 Period 4 450.00 Period 5 500.00 Period 6 550.00 Cost of Capital 10.00% 10.00% NPV 790.79 476.33 (Ranking) (1) (2) IRR 31.09% 33.87% (Ranking) (2) (1) MIRR's With Actual Life 21.22% 25.25% (Ranking) (2) (1) With Adjusted Life 21.22% 17.38% (Ranking) (1) (2) (Agrees with NPV) Exhibit 4 compares two non-repeatable, mutually exclusive projects, P and Q. It shows that the shorter project Q has a lower NPV but both a higher IRR and conventional MIRR than the longer project P. The adjusted life MIRR for project Q is calculated using Equation #3, with NPV equal to $476.33, IO equal to $1,000, and N equal to six, and Proceedings of the Academy of Accounting and Financial Studies, Volume 2, Number 2 Maui, Hawaii, 1997

Allied Academies International Conference

page 62

gives a ranking that is consistent with that of NPV. In effect, using a six year life for project Q assumes that the terminal value at the end of period three is compounded at the reinvestment rate (k) to the end of period six. BOTH SCALE AND TIME SPAN DIFFERENCES The analysis of two or more mutually exclusive, non-repeatable projects with both scale and time span differences may be easily accomplished by using the largest initial outflow and the largest number of periods in Equation #3 for the computation of MIRR for each project. This means that IO, k and N will be the same for all alternative projects. The NPV in Equation #3 will be the actual NPV for each project. Exhibit 5 illustrates three mutually exclusive, non-repeatable projects with different initial outflows and time spans. Note that based on NPV, the rankings are Z, Y, and then X. However, based on IRR and the unadjusted MIRR, the rankings are Y, X, and then Z. Using Equation #3 and adjusting for scale and time span differences, the adjusted MIRR is consistent with NPV. Exhibit 5 Adjustment of MIRR for Scale and Time Span Differences Project X Project Y Project Z Initial Outflow ($500.00) ($1,000.00) ($2,000.00) Period 1 150.00 500.00 750.00 Period 2 150.00 500.00 750.00 Period 3 150.00 500.00 750.00 Period 4 150.00 750.00 Period 5 150.00 Period 6 150.00 Cost of Capital 10.00% 10.00% 10.00% NPV $153.29 $243.43 $377.40 (Ranking) (3) (2) (1) IRR 19.91% 23.38% 18.45% (Ranking) (2) (1) (3) Unadjusted MIRR: Initial Outflow $500.00 $1,000.00 $2,000.00 Number of Periods 6 3 4 Unadjusted MIRR 15.01% 18.29% 14.86% (Ranking) (2) (1) (3) MIRR adjusted for scale and time differences: Initial Outflow $2,000.00 $2,000.00 $2,000.00 Number of Periods 6 6 6 Adjusted MIRR 11.36% 12.13% 13.22% (Ranking) (3) (2) (1) (Agrees with NPV Rankings) CONCLUSION This paper has shown how to calculate a rate of return measure that will give rankings that are consistent with NPV for mutually exclusive projects, even if the projects are of different sizes and in some cases, different lives. Since Proceedings of the Academy of Accounting and Financial Studies, Volume 2, Number 2 Maui, Hawaii, 1997

Allied Academies International Conference

page 63

managers tend to rely on rate of return calculations in capital budgeting, the consistency with NPV is an important contribution. An additional contribution is the simplified calculation formula for MIRR as presented in Equation #3. APPENDIX 1 For the proof that the shadow investment will give consistent rankings between NPV and MIRR, assume that NPVA > NPVB and IOA > IOB. Note that if IOB > IOA then use IOB in place of IOA in the proof below.

NPV A > NPVB NPVA % IO A > NPVB % IOA ' (NPVB % IO B) % (IOA & IOB) (NPVA % IO A) (1 % K)N > ((NPVB % IOB) % (IOA & IO B)) (1 % K)N TVFCF A > TVFCFB % (IOA &IOB) (1 % K)N

The left hand side is equal to the Terminal Value of the Future Flows (TVFCFA) for project A. The right hand side (RHS) is equal to the Terminal Value of the Future Cash Flows for project B plus the Terminal Value of the shadow investment that has an initial outflow equal to difference between the initial outflows of projects A and B. Call the RHS the Modified Terminal Value of project B (MTVB). Using the terminal values and equation #1:

MIRRA '

TVFCF A IO A

1/N

& 1 >

MTVB IOA

1/N

& 1 ' (MIRR B

where *MIRRB is the Modified Internal Rate of Return for project B, adjusted for the difference in the size of the initial outflows of the two projects. Note that the inequality is preserved and thus the MIRR methodology, when adjusted for differences in the initial outflow, will always agree with the NPV method. BIBLIOGRAPHY Bierman, Harold and Seymour Smidt, (1984) "The Capital Budgeting Decision, Sixth Edition," New York, Macmillen Publishing Company, 64-65. Brigham, Eugene F. and Louis C. Gapenski, (1988) "Financial Management, Theory and Practice, fifth edition," Chicago, Illinois: The Dryden Press, 272-273. Dudley, C.L., Jr. (1972) A Note on Reinvestment Assumption in choosing between Net Present Value and Internal Rate of Return, The Journal of Finance, September 1972, 907-915. Findlay, M. Chapman and Stephen D. Messner, (1973) "Determination and Usage of FM Rate of Return." Realtron Corporation, Detroit. Fisher, Irving, (1930) "The Theory of Interest" (The Macmillan Company; reprinted (Kelly) 1955). Gitman, Lawrence J. and John F. Forrester, Jr., (1977) "A Survey of Capital Budgeting Techniques Used by Major U.S. Firms" Financial Management, Fall 1977, 66-71. Hirshleifer, J., (1970) "Investment, Interest, and Capital," Englewood Cliffs, New Jersey, Prentice-Hall, Inc. Meyer, R.L., (1979) A Note on Capital Budgeting Techniques and the Reinvestment Rate, Journal of Finance, December 1979, 1251-1254. Nicol, D.J., (1981) A Note on Capital Budgeting Techniques and the Reinvestment Rate: Comment, The Journal of Finance, March 1981, pp. 193-195. Solomon, Ezra, (1956)"The Arithmetic of Capital-Budgeting Decisions," Journal of Finance, April, 1956, 124-129. Sweeney, L.E. & Mantripragada, K.G., (1987) Ranking Mutually Exclusive Investments: A Modified Internal Rae of Return Approach, Akron Business and Economic Review, Spring 1987, 19-25.

Proceedings of the Academy of Accounting and Financial Studies, Volume 2, Number 2

Maui, Hawaii, 1997

You might also like

- CH 10 Mini Case (Final)Document11 pagesCH 10 Mini Case (Final)Krystle KhanNo ratings yet

- A Blueprint For Building Sustainable OT Cyber Security ProgrammesDocument24 pagesA Blueprint For Building Sustainable OT Cyber Security Programmesev kaNo ratings yet

- Chapter 09 IM 10th EdDocument24 pagesChapter 09 IM 10th EdBenny KhorNo ratings yet

- The Dilemma at Day Pro-CaseDocument7 pagesThe Dilemma at Day Pro-CaseTheknower Ofitall50% (2)

- SouthwestDocument12 pagesSouthwestZaii Zai100% (1)

- Case 11Document10 pagesCase 11Trương Quốc VũNo ratings yet

- Solutions Nss NC 11Document19 pagesSolutions Nss NC 11saadullahNo ratings yet

- Earned Value Project Management (Fourth Edition)From EverandEarned Value Project Management (Fourth Edition)Rating: 1 out of 5 stars1/5 (2)

- Worship Leaders, We Are Not Rock Stars, C1Document5 pagesWorship Leaders, We Are Not Rock Stars, C1ArmandoVerbelDuque100% (1)

- Jeff Gundlach Fixed Income PlaybookDocument83 pagesJeff Gundlach Fixed Income PlaybookValueWalk100% (1)

- Financial Management IrrDocument6 pagesFinancial Management IrrSanjay PotterNo ratings yet

- Chap 11 Problem SolutionsDocument46 pagesChap 11 Problem SolutionsNaufal FigoNo ratings yet

- Net Present Value (NPV) vs. Internal Rate of Return (IRR)Document14 pagesNet Present Value (NPV) vs. Internal Rate of Return (IRR)Mahmoud MorsiNo ratings yet

- The Basics of Capital Budgeting: Answers To End-Of-Chapter QuestionsDocument46 pagesThe Basics of Capital Budgeting: Answers To End-Of-Chapter QuestionsAndrew ChipwaluNo ratings yet

- 2-4 2004 Jun ADocument15 pages2-4 2004 Jun AAjay TakiarNo ratings yet

- 12.conflict Reasons, EAA, Replacement ChainDocument10 pages12.conflict Reasons, EAA, Replacement Chainwasif ahmedNo ratings yet

- Financial Management Chapter 09 IM 10th EdDocument24 pagesFinancial Management Chapter 09 IM 10th EdDr Rushen SinghNo ratings yet

- IUP - Case 15 - Group 14Document8 pagesIUP - Case 15 - Group 14Steven Nathanael LiyantoNo ratings yet

- Strategic Financial Management EssayDocument19 pagesStrategic Financial Management EssayTafadzwa Muza100% (9)

- Jbe 2flawsDocument15 pagesJbe 2flawsDr. Muhammad Mazhar IqbalNo ratings yet

- IRR Vs MIRR Vs NPV (Finatics)Document4 pagesIRR Vs MIRR Vs NPV (Finatics)miranirfanNo ratings yet

- Application Analysis On Internal Rate of Return Rule For Investment DecisionDocument5 pagesApplication Analysis On Internal Rate of Return Rule For Investment DecisionAndro HutabaratNo ratings yet

- Tutorial Presentation EconomicsDocument46 pagesTutorial Presentation EconomicsgulshanlatifzadehNo ratings yet

- Rate of Returns-IRR, MIRRDocument3 pagesRate of Returns-IRR, MIRRsanits591No ratings yet

- Risk and Refinement in Capital BudgetingDocument51 pagesRisk and Refinement in Capital BudgetingRitesh Lashkery50% (2)

- Net Present Value and The Internal Rate of Return - CFA Level 1 - InvestopediaDocument9 pagesNet Present Value and The Internal Rate of Return - CFA Level 1 - InvestopediaPrannoyChakrabortyNo ratings yet

- Investment DecDocument29 pagesInvestment DecSajal BasuNo ratings yet

- The Analysis of Three Main Investment Criteria: NPV IRR and Payback PeriodDocument5 pagesThe Analysis of Three Main Investment Criteria: NPV IRR and Payback Periodedge.lppmundipNo ratings yet

- Comparison Between Net Present Value and PDFDocument11 pagesComparison Between Net Present Value and PDFKanza KhanNo ratings yet

- Lecture 5 - Capital BudgetingDocument26 pagesLecture 5 - Capital BudgetingJason LuximonNo ratings yet

- Capital BudgetingDocument6 pagesCapital BudgetingRuchika AgarwalNo ratings yet

- Finance Mini CaseDocument59 pagesFinance Mini Caseaudy100% (1)

- Introduction To Finance: Capital Budgeting Techniques: Certainty and RiskDocument35 pagesIntroduction To Finance: Capital Budgeting Techniques: Certainty and RisksunflowerNo ratings yet

- Acb III-conflict BW NPV Vs IrrDocument22 pagesAcb III-conflict BW NPV Vs IrrPrakash GowdaNo ratings yet

- Capital Budgeting Decision Rules: What Real Investments Should Firms Make?Document31 pagesCapital Budgeting Decision Rules: What Real Investments Should Firms Make?mkkaran90No ratings yet

- Risk and Refinements of Capital BudgetingDocument36 pagesRisk and Refinements of Capital BudgetingRichelle Copon-Toledo50% (2)

- Capital BugetingDocument6 pagesCapital BugetingMichael ReyesNo ratings yet

- Case Study RevisedDocument7 pagesCase Study Revisedbhardwaj_manish44100% (3)

- Acctg 505 - Decision Analysis II, Capital Budgeting Basics, Chapter 21 - Widdison S.V 1Document8 pagesAcctg 505 - Decision Analysis II, Capital Budgeting Basics, Chapter 21 - Widdison S.V 1masan01No ratings yet

- Capital Budgeting TechniquesDocument6 pagesCapital Budgeting TechniquesAnonymous f8tAzEb3oNo ratings yet

- Phase 2 Task 1 - DBDocument5 pagesPhase 2 Task 1 - DBDanita VaughanNo ratings yet

- Complex Investment DecisionsDocument36 pagesComplex Investment DecisionsAmir Siddiqui100% (1)

- They Discussed Discounted Cash Flow (DCF) Methods. What Was One We Used in Class?Document5 pagesThey Discussed Discounted Cash Flow (DCF) Methods. What Was One We Used in Class?bekza_159No ratings yet

- FM Section CDocument21 pagesFM Section CchimbanguraNo ratings yet

- Week 6 Discussion Question ResponseDocument3 pagesWeek 6 Discussion Question ResponseOpeyemi OyewoleNo ratings yet

- ASSIGNMENT 1 FM (11934 M, Wahaj Siddiqui)Document6 pagesASSIGNMENT 1 FM (11934 M, Wahaj Siddiqui)Sara SiddiquiNo ratings yet

- The Basics of Capital Budgeting: Evaluating Cash FlowsDocument3 pagesThe Basics of Capital Budgeting: Evaluating Cash Flowstan lee huiNo ratings yet

- Chapter 5Document63 pagesChapter 5Daniel BalchaNo ratings yet

- I5 Im10bDocument7 pagesI5 Im10btarick06No ratings yet

- RMontoya SolutaDocument21 pagesRMontoya SolutaTy Best CoonNo ratings yet

- 1cm8numoo 253914Document105 pages1cm8numoo 253914sagar sharmaNo ratings yet

- CapbudgetDocument31 pagesCapbudgetnaveen penugondaNo ratings yet

- Is 118 - ScriptDocument6 pagesIs 118 - Scriptgrayblack2803No ratings yet

- Capital Budgeting MethodsDocument13 pagesCapital Budgeting MethodsAmit SinghNo ratings yet

- Chapter 7: Net Present Value and Other Investment Criteria: FIN 301 Class NotesDocument8 pagesChapter 7: Net Present Value and Other Investment Criteria: FIN 301 Class NotesHema BhimarajuNo ratings yet

- Risk and Capital BudgetingDocument51 pagesRisk and Capital BudgetingSanaNaeemNo ratings yet

- Capital RationingDocument21 pagesCapital RationingEniolaNo ratings yet

- Main Project Capital Budgeting MbaDocument110 pagesMain Project Capital Budgeting Mbasushain koulNo ratings yet

- Project Analysis Using Decision Trees and OptionsDocument16 pagesProject Analysis Using Decision Trees and OptionsFungai MukundiwaNo ratings yet

- Fin311 Paper A All AnswersDocument17 pagesFin311 Paper A All Answerssuleman yousafzaiNo ratings yet

- A Financial Model Is Simply A Tool ThatDocument5 pagesA Financial Model Is Simply A Tool ThatHarshalKolhatkarNo ratings yet

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- BU IHRM Mod 2Document9 pagesBU IHRM Mod 2Vishnu NairNo ratings yet

- Ajith Ayyappan S Iind Year M.B.A Pims BangloreDocument5 pagesAjith Ayyappan S Iind Year M.B.A Pims BangloreVishnu NairNo ratings yet

- Apple, IncDocument9 pagesApple, IncVishnu NairNo ratings yet

- Jerin SangroseDocument37 pagesJerin SangroseVishnu NairNo ratings yet

- Managing International HR Activity - Training and Development &Document11 pagesManaging International HR Activity - Training and Development &Vishnu NairNo ratings yet

- BU IHRM Mod 1 - 3 T&D Performance, ExpatriatesDocument25 pagesBU IHRM Mod 1 - 3 T&D Performance, ExpatriatesVishnu NairNo ratings yet

- BU IHRM Mod 1 - 1Document21 pagesBU IHRM Mod 1 - 1Vishnu NairNo ratings yet

- It Extends To The Whole of India It Came Into Force in 1 April 1949Document17 pagesIt Extends To The Whole of India It Came Into Force in 1 April 1949Vishnu NairNo ratings yet

- The Workmen's Compensation Act, 1923Document9 pagesThe Workmen's Compensation Act, 1923Vishnu NairNo ratings yet

- BU IHRM - IntroductionDocument9 pagesBU IHRM - IntroductionVishnu NairNo ratings yet

- Strategic Business Units & Corporate Planning Process: Presented to:-Mr.R.R.Srivastava Presented By: - Vishnu Nair RDocument8 pagesStrategic Business Units & Corporate Planning Process: Presented to:-Mr.R.R.Srivastava Presented By: - Vishnu Nair RVishnu NairNo ratings yet

- Turn Around - Divestment and Liquidation StrategiesDocument10 pagesTurn Around - Divestment and Liquidation StrategiesVishnu Nair100% (1)

- Turn Around - Divestment and Liquidation StrategiesDocument10 pagesTurn Around - Divestment and Liquidation StrategiesVishnu Nair100% (1)

- Presented To:-Mrs - Neelima K Presented By: - Praveen and VishnuDocument15 pagesPresented To:-Mrs - Neelima K Presented By: - Praveen and VishnuVishnu NairNo ratings yet

- Organizational StudyDocument61 pagesOrganizational StudyVishnu Nair0% (1)

- Manmeet Resume Final PDFDocument5 pagesManmeet Resume Final PDFmanu2574No ratings yet

- Mandatory 1 - TraduccionDocument3 pagesMandatory 1 - TraduccionJulio alejoNo ratings yet

- Power PoliticsDocument39 pagesPower PoliticsSalman YousafNo ratings yet

- Maternal Child Nursing PDFDocument31 pagesMaternal Child Nursing PDFJonalene SoltesNo ratings yet

- ING Bank N.V. vs. CIR, 763 SCRA 359 (2015)Document2 pagesING Bank N.V. vs. CIR, 763 SCRA 359 (2015)Anonymous MikI28PkJc100% (2)

- Term Paper On Pran RFLDocument8 pagesTerm Paper On Pran RFLaflsiqhah100% (1)

- 5704 53 91 Module 2 HandoutsDocument29 pages5704 53 91 Module 2 HandoutsNANMA ZAKKEERNo ratings yet

- Basic Accounting ConceptsDocument17 pagesBasic Accounting ConceptsAmit SinhaNo ratings yet

- Future Noir 1 1Document4 pagesFuture Noir 1 1api-525763580No ratings yet

- Fob Definition: Shipping Terms of SaleDocument2 pagesFob Definition: Shipping Terms of SaleAdam FathuhyNo ratings yet

- The Merits of Muharram and The Day of AshuraDocument7 pagesThe Merits of Muharram and The Day of AshuraM.Adnad RiazNo ratings yet

- HIPPO 2018 Regulations FinalDocument14 pagesHIPPO 2018 Regulations FinalHellboy Gaming & FunNo ratings yet

- Module Urinary SystemDocument6 pagesModule Urinary SystemVynz Morales CosepNo ratings yet

- Manual Setup Packet 2024Document20 pagesManual Setup Packet 2024sergiusto1996No ratings yet

- Guarding Your Tongue From All HaaramDocument2 pagesGuarding Your Tongue From All HaaramARafat DomadoNo ratings yet

- Anissa 1BRDocument1 pageAnissa 1BRinigobonaNo ratings yet

- Ramsha Report Final Draft 02-12-2019Document91 pagesRamsha Report Final Draft 02-12-2019Khan MaseedNo ratings yet

- ASEAN Investment Report 2015Document250 pagesASEAN Investment Report 2015mhudzzNo ratings yet

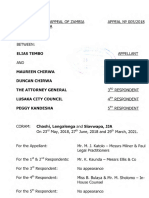

- App 005 2018 Elias Tembo Vs Maureen Chirwa 4 Others Coram Chashi Lengalenga Siavwapa JJADocument56 pagesApp 005 2018 Elias Tembo Vs Maureen Chirwa 4 Others Coram Chashi Lengalenga Siavwapa JJAchellakedriana161No ratings yet

- Transcript of Records - MODELDocument2 pagesTranscript of Records - MODELIrena RaluNo ratings yet

- Urdu, B.A.Degree 1 M.B. Sir Syed Ahmed Khan by AH, LS 21Document4 pagesUrdu, B.A.Degree 1 M.B. Sir Syed Ahmed Khan by AH, LS 21Abdul Hai100% (1)

- Spine HRDocument12 pagesSpine HRKaran SinghNo ratings yet

- Specific Registration Requirements For Construction Workhead (CW)Document4 pagesSpecific Registration Requirements For Construction Workhead (CW)Jianhua WuNo ratings yet

- FAA 2013 0865 0004 - Attachment - 2Document71 pagesFAA 2013 0865 0004 - Attachment - 2Tinh nguyenNo ratings yet

- IC Internal Audit Checklist 8624Document3 pagesIC Internal Audit Checklist 8624Tarun KumarNo ratings yet

- DGMS5Document2 pagesDGMS5AnbarasanNo ratings yet

- ENG3U CPT OutlineDocument5 pagesENG3U CPT OutlineΑθηνουλα ΑθηναNo ratings yet