New York State Fbla: Please Do Not Open This Test Until Directed To Do So

Uploaded by

drosbeastCopyright:

Available Formats

New York State Fbla: Please Do Not Open This Test Until Directed To Do So

Uploaded by

drosbeastOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

New York State Fbla: Please Do Not Open This Test Until Directed To Do So

Uploaded by

drosbeastCopyright:

Available Formats

NYS FBLA SLC 2009 ACCOUNTING 1

NEW YORK STATE FBLA ACCOUNTING 1

2009

PLEASE DO NOT OPEN THIS TEST UNTIL DIRECTED TO DO SO Test Directions 1. Complete the information requested on the answer sheet. PRINT YOUR NAME on the Name line. PRINT the name of the event, ACCOUNTING 1 on the Subject line. PRINT the name of your CHAPTER on the DATE line. 2. All answers will be recorded on the answer sheet. Please do not write on the test booklet. Scrap paper will be provided. 3. Read each question completely before answering. With a NO. 2 pencil, blacken in your choices completely on the answer sheet. Do not make any other marks on the answer sheet, or the scoring machine will reject it. 4. You will be given 60 minutes for the test. You will be given a starting signal and a signal after 50 minutes have elapsed. 5. Tie will be broken using the last 10 questions of the test.

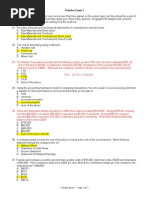

NYS FBLA SLC 2009 ACCOUNTING 1

1. A system in which people are free to produce the goods and services they choose is called a __________ system. a. Communist b. Free enterprise c. Proprietorship d. Socialist 2. People who transform ideas for products or services into real-world businesses are called __________. a. Employees b. Entrepreneurs c. Laborers d. Stockholders 3. Which of the following is NOT an advantage to being an entrepreneur? a. You are your own boss. b. You create and control your work schedule. c. You select the people who work with you. d. You will able to work few hours. 4. A business that buys finished products and resells them is known as a __________ business. a. Manufacturing b. Merchandising c. Not-for-profit d. Service 5. A real estate office, a medical center, and a repair shop are examples of __________ businesses. a. Manufacturing b. Merchandising c. Not-for-profit d. Service 6. A business owned by one person is called a __________. a. Corporation b. Free enterprise c. Partnership d. Sole proprietorship 7. A business in which the owner(s) have limited liability is a __________.

NYS FBLA SLC 2009 ACCOUNTING 1

a. b. c. d.

Corporation Free enterprise Partnership Sole proprietorship

8. Legal permission for a corporation to operate in a state is given in the form of a __________. a. Charter b. DBA c. Partner agreement d. Permission slip 9. All accountants use the same set of rules, called GAAP. GAPP stands for __________. a. General Accounting Assumption Principles b. Generally Accepted Accounting Principles c. Generic Actuarial Accounting Procedures d. Government Acquired Accounting Procedures 10. Accounting, which focuses on reporting information to internal users, is referred to as __________ accounting. a. Actuarial b. Cost c. Financial d. Managerial 11. The accounting assumption which states that a business exists independently of its owners personal holdings is known as __________. a. Accounting period b. Business entity c. Going concern d. Matching 12. Which of the following equations is NOT correct? a. Assets Liabilities = Owners Equity b. Assets = Liabilities + Owners Equity c. Assets + Owners Equity = Liabilities d. Assets Owners Equity = Liabilities

13. Which of the following is an example of a liability account?

NYS FBLA SLC 2009 ACCOUNTING 1

a. b. c. d.

Income Summary Land Payroll Tax Expense Salaries Payable

14. Which of the following is a temporary account? a. Accounts Payable b. Cash in Bank c. Fees d. J. McClure, Capital Use the following information to answer questions 15 and 16. Assume that this is a complete list of accounts for the business. Cash in Bank......................................$ 9,000 Office Equipment...............................$11,000 T. Clayton, Capital.............................$20,000 Accounts Receivable..........................$ 500 Supplies..............................................$ 1,500 15. What is the amount of total assets? a. $20,000 b. $22,000 c. $40,500 d. $42,000 16. What is the amount of total liabilities? a. $ 500 b. $ 2,000 c. $13,000 d. $20,000 17. A companys list of all of their accounts and their assigned account numbers is called a __________. a. Chart of accounts b. Journal c. Ledger d. T account 18. The normal balance of an account is always on the __________ side of the account. a. Credit

NYS FBLA SLC 2009 ACCOUNTING 1

b. Debit c. Decrease d. Increase 19. Purchases Returns and Allowances is a(n) __________ account. a. Contra Cost of Merchandise b. Contra Liability c. Other Expense d. Revenue Use the transaction below to answer questions 20-24. Bought a $300 scanner for the office computer from E-solutions, on account. 20. What account should be debited? a. Accounts Payable b. Accounts Receivable c. Cash in Bank d. Office Equipment 21. The account debited is classified as a(n) __________ account. a. Asset b. Expense c. Liability d. Revenue 22. What account should be credited? a. Accounts Payable b. Accounts Receivable c. Cash in Bank d. Office Equipment 23. The account credited is classified as a(n) __________ account. a. Asset b. Expense c. Liability d. Revenue 24. What type of source document would prove as evidence of this transaction? a. Check stub b. Invoice

NYS FBLA SLC 2009 ACCOUNTING 1

c. Memorandum d. Receipt Use the transaction below to answer questions 25-27. Bought $2,000 in video equipment by making a down payment of $500 and agreeing to pay the rest in two installments. 25. What account should be debited? a. Accounts Payable b. Accounts Receivable c. Cash in Bank d. Video Equipment 26. What amount should be applied to the Video Equipment account? a. $ 500 b. $1,500 c. $2,000 d. $2,500 27. What amount should be applied to the Cash in Bank account? a. $ 500 b. $1,500 c. $2,000 d. $2,500

Use the information below to answer question 28. A. Journalize and post closing entries

NYS FBLA SLC 2009 ACCOUNTING 1

B. C. D. E. F. G. H. I.

Analyze each transaction Journalize each transaction Post to the ledger Prepare a worksheet Prepare a trial balance Collect and verify source documents Prepare a post-closing trial balance Prepare financial statements

28. Which of the following puts the steps of the accounting cycle, listed above, in the correct order? a. A, C, B, I, H, G, F, D, E b. B, G, D, C, E, F, A, I, H c. C, B, I, E, G, H, A, D, F d. G, B, C, D, F, E, I, A, H Use the information below to answer questions 29-31. The final general ledger balances for a company are listed below. Cash in Bank......................................$ 4,700 Accounts Receivable..........................$ 1,600 Airplanes............................................$90,000 Accounts Payable...............................$ 2,680 A. Halstead, Capital...........................$68,650 A. Halstead, Withdrawals..................$ 3,000 Flying Fees.........................................$40,000 Advertising Expense..........................$ 150 Fuel and Oil Expense.........................$ 5,600 Repairs Expense.................................$ 6,200 29. The owner has told you that the balance of Accounts Payable is incorrect but all of the other balances are correct. What is the correct balance of Accounts Payable? a. $2,000 b. $2,600 c. $2,700 d. $3,000 30. How many of the accounts listed have a normal debit balance? a. 3 b. 5

NYS FBLA SLC 2009 ACCOUNTING 1

c. 7 d. 8 31. If these accounts were used to create a trial balance, what would be the amount of total debits? a. $108,250 b. $108,650 c. $111,250 d. $113,850 32. The purpose of the trial balance is to __________. a. Determine the net income or net loss for the period b. Prove the equality of the accounting equation c. Prove the equality of debits and credits d. Show the changes in the owners equity accounts during the period 33. The purpose of the balance sheet is to __________. a. Determine the net income or net loss for the period b. Prove the equality of the accounting equation c. Prove the equality of debits and credits d. Show the changes in the owners equity accounts during the period 34. On the worksheet, the Income Summary account is extended to the __________ section. a. Balance Sheet b. Income Statement c. Statement of Changes in Owners Equity d. Trial Balance 35. A measure of the relationship between short-term assets and current liabilities is the __________. a. Price-earnings ratio b. Profitability ratio c. Quick ratio d. Return on sales

36. Which of the following questions is NOT answered in the heading of a financial statement? a. What? b. When? c. Where?

NYS FBLA SLC 2009 ACCOUNTING 1

d. Who? Use the information below to answer questions 37-38. The balances listed below are the balances before closing entries are posted. Accounts Payable...............................$ 1,204 Cash in Bank......................................$ 2, 834 Accounts Receivable..........................$ 384 Office Supplies...................................$ 307 E. Garofalo, Capital...........................$20,419 Office Equipment...............................$ 5,902 Office Furniture.................................$ 2,804 E. Garofalo, Withdrawals..................$ 1,800 Computer Equipment.........................$ 3,295 Hiking Equipment..............................$ 922 Rafting Equipment.............................$ 8,351 37. What is the companys profit/loss for the period? a. Net income of $3,176 b. Net income of $4,976 c. Net loss of $3,176 d. Net loss of $4,976 38. After closing the revenue and expense accounts into Income Summary, what will the balance of the Income Summary account be? a. Credit balance of $3,176 b. Credit balance of $4,976 c. Debit balance of $3,176 d. Debit balance of $4,976 39. Which of the following does NOT affect the capital account? a. Decreases in Cash in Bank b. Investments by owner c. Net income d. Withdrawals by owner 40. Which of the following is an external cash control? a. Limiting the number of persons handling cash. b. Bonding (insuring) employees who handle cash or cash records. c. Depositing cash receipts in the bank daily. d. Verifying accuracy of signatures on checks.

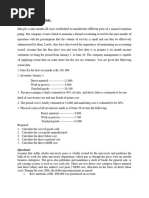

NYS FBLA SLC 2009 ACCOUNTING 1

10

41. The person who signs a check is referred to as the __________. a. Creditor b. Drawee c. Drawer d. Payee 42. Which of the following is usually NOT included on a bank statement? a. A list of all checks paid by the bank b. A list of deposits made by the business during the period c. A list of outstanding checks d. The checking account balance at the beginning of the period 43. Which of the following payroll deductions is voluntary? a. Federal income tax b. FICA c. Medicare d. Union dues Use the information below to answer questions 44-4. Social security tax rate...................................6.20% Medicare tax rate............................................1.45% State income tax rate......................................2.00% Federal income tax.........................................????? Gross Earnings...............................................$957.56 Net Earnings...................................................$808.15 44. What is the total FICA tax for the period? a. $13.88 b. $33.03 c. $59.37 d. $73.25 45. Assume that the list above includes all of the taxes that are deducted for the period. What is the federal income tax for the period? a. $57.01 b. $90.04 c. $149.41 d. $163.29 46. What is the pay before taxes?

NYS FBLA SLC 2009 ACCOUNTING 1

11

a. b. c. d.

$149.41 $808.15 $957.56 $,1765.71

Use the information below to answer questions 47-50. The Lodge pays employees either an hourly wage or a salary plus commission based on rental revenue. Hourly wage employees can earn overtime. The overtime rate is 1 times the regular hourly rate of pay for hours over 40 in a week. 47. Cheyenne Thorington earns an hourly wage of $6.80 and worked 43 hours this week. What is her gross pay for the week? a. $292.40 b. $302.60 c. $428.40 d. $438.60 48. Kenny Keller receives a salary of $250 per week plus a 3% commission on rental revenue. Kenny had $760 of rental revenue this week. What is his gross pay for the week? a. $30.30 b. $272.80 c. $767.50 d. $1,010.00 49. Arnelle Slater earns an hourly wage of $7.35. He worked 39 hours this week. What is his gross pay for the week? a. $257.25 b. $286.65 c. $294.00 d. $429.98 50. Sean Scofield receives a salary of $185 per week plus 3% commission. He had rental revenue of $1,235 this week. What is his gross pay for the week? a. $113.60 b. $222.05 c. $1,240.55 d. $1,420.00 Use the information below to answer questions 51-55.

NYS FBLA SLC 2009 ACCOUNTING 1

12

Marabelle Publishers reported the following amounts for the week ending April 20. The total amount earned by all employees is $2,193.40. The amount withheld for federal income tax is $263.00. Social security tax is $136.00, and Medicare tax is $31.80. Three employees each have $11.25 deducted for hospital insurance. The amount withheld for state income tax is $38.70. 51. What entry should be recorded in the Salary Expense account? a. Credit of $1,690.15 b. Credit of $2,193.40 c. Debit of $1,690.15 d. Debit of $2,193.40 52. What entry should be recorded to account for the medicare taxes? a. Credit of $31.80 to Medicare Tax Expense b. Credit of $31.80 to Medicare Tax Payable c. Debit of $31.80 to Medicare Tax Expense d. Debit of $31.80 to Medicare Tax Payable 53. What is the total amount of liabilities for the weekly payroll? a. $430.80 b. $503.25 c. $1,690.15 d. $2,193.40 54. What is the entry to the Hospital Insurance Premiums Payable account? a. Credit of $11.25 b. Credit of $33.75 c. Debit of $11.25 d. Debit of $33.75

55. What is the entry to the Cash in Bank account? a. Credit of $1,690.15 b. Credit of $2,193.40 c. Debit of $1,690.15 d. Debit of $2,193.40 56. The Form __________ reports employers quarterly tax returns. a. 940 b. 941 c. W-2

NYS FBLA SLC 2009 ACCOUNTING 1

13

d. W-3 Use the information below to answer questions 57-60. General Ledger Cash in Bank Accounts Receivable Merchandise Inventory Sales Tax Payable Accounts Payable Sales

Sales Discounts Sales Returns and Allowances Purchases Purchases Discounts Purchases Returns and Allowances

April 2 Sold $600 in merchandise plus $36 sales tax to Dawn Brown on account, Sales Slip 102. 19 Dawn Brown telephoned the manager of the store and said that the zipper on the jacket she purchased is broken. The manager agreed to give her a $40 credit on her purchase, plus a $2.40 sales tax credit, Credit Memorandum 13. 57. What entry should be recorded on April 2? a. Debit Accounts Receivable, $636; Credit Purchases, $600, and Sales Tax Payable, $36 b. Debit Accounts Receivable, $636; Credit Sales, $600, and Sales Tax Payble, $36 c. Debit Purchases, $600, and Sales Tax Payable, $36; Credit Accounts Receivable, $636 d. Debit Sales, $600, and Sales Tax Payable, $36; Credit Accounts Receivable, $636

58. What entry should be recorded on April 19? a. Debit Accounts Receivable, $42.40; Credit Sales Returns and Allowances, $40, and Sales Tax Payable, $2.40 b. Debit Purchases Discounts, $40, and Sales Tax Payable, $2.40; Credit Accounts Receivable, $42.40 c. Debit Sales Discounts, $40, and Sales Tax Payable, $2.40; Credit Accounts Receivable, $42.40 d. Debit Sales Returns and Allowances, $40, and Sales Tax Payable, $2.40; Credit Accounts Receivable, $42.40

NYS FBLA SLC 2009 ACCOUNTING 1

14

59. Assuming that the balance of the Sales Tax Payable was $100 before these transactions, what is the ending balance? a. $62.40 b. $100.00 c. $133.60 d. $142.40 60. Assuming that the ending balance, after these transactions, of the Purchases Discounts account is $250, what is the beginning balance? a. $210.00 b. $250.00 c. $290.00 d. $292.40 Use the information below to answer questions 61-63. April 22 Junges Supplies purchased $1,500 worth of merchandise on account, with credit terms of 3/15, n/30. 61. What is the date that the invoice must be paid by in order to receive a discount? a. April 25 b. May 6 c. May 7 d. May 22 62. What amount will be paid if the invoice is paid within the discount period? a. $30 b. $225 c. $1,275 d. $1,455 63. What account will be debited on April 22? a. Accounts Payable b. Accounts Receivable c. Cash in Bank d. Purchases 64. When the shipping costs are paid by the supplier, the shipping terms are FOB __________. a. Buyer b. Destination c. Shipping point

NYS FBLA SLC 2009 ACCOUNTING 1

15

d. Supplier 65. The __________ account is always used in the Sales Journal. a. Accounts Receivable credit b. Sales credit c. Sales Discounts debit d. Sales Tax Payable debit Use the information below to answer questions 66-68. The Shepard Firm, a manufacturer, has a general ledger account balance of $73,395 for Merchandise Inventory as of July 1. On the following June 30, at the end of the fiscal period, a physical inventory determined there was $74,928 in merchandise on hand. 66. What is the amount of the inventory adjustment? a. $1,533 b. $73,395 c. $74,928 d. $148,323 67. What account would be debited in the adjusting entry? a. Cash in Bank b. Income Summary c. Inventory Expense d. Merchandise Inventory

68. What account would be credited in the adjusting entry? a. Cash in Bank b. Income Summary c. Inventory Expense d. Merchandise Inventory 69. Which of the following is NOT an important characteristic of financial statements? a. Comparability b. Matching c. Relevance d. Reliability

NYS FBLA SLC 2009 ACCOUNTING 1

16

70. The sale of 100 shares of stock, for $8,500, by the Taper Corporation is recorded as a credit to which account? a. Capital Stock b. Retained Earnings c. Taper Corporation, Capital d. Taper Corporation, Withdrawals 71. __________ equals revenue minus cost of merchandise sold. a. Gross profit on sales b. Net Income c. Net loss d. Operating expenses 72. Which of the following accounts is NOT included in the Cost of Merchandise Sold section of the Income Statement? a. Beginning Inventory b. Purchases c. Sales d. Transportation In 73. When comparing each dollar amount reported on a financial statement as a percentage of another amount __________ analysis is being used. a. Horizontal b. Trickle-down c. Ratio d. Vertical

74. __________ equals current assets minus current liabilities. a. Cash reserves b. Net sales c. Operating profit d. Working capital Use the transaction below to answer question 75. On January 5, Noynoi Corporation issued 5,000 shares of $10 par common stock at $11.50 per share, Memorandum 368. 75. What is the correct entry for this transaction?

NYS FBLA SLC 2009 ACCOUNTING 1

17

a. Debit Cash in Bank, $57,500; Credit Common Stock, $50,000, and Paid-In Capital in Excess of Par, $7,500 b. Debit Cash in Bank, $50,000, and Paid-In Capital in Excess of Par, $7,500; Credit Common Stock, $57,500 c. Debit Common Stock, $50,000, and Paid-in Capital in Excess of Par, $7,500; Credit Cash in Bank $57,500 d. Debit Common Stock, $57,500; Credit Cash in Bank, $50,000, and Paid-in Capital in Excess of Par, $7,500 76. A list of stockholders entitled to receive a dividend is prepared on the date of __________. a. Declaration b. Entry c. Payment d. Record Use the transaction below to answer questions 77-78. December 15 Issued a check for $1,500 in payment of the dividend on preferred stock. 77. Assuming that the necessary entries were made on the date of declaration, what account should be debited? a. Capital Stock b. Cash in Bank c. DividendsPreferred d. Dividends PayablePreferred 78. Assuming the necessary entries were made on the date of declaration, what account should be credited? a. Capital Stock b. Cash in Bank c. DividendsPreferred d. Dividends PayablePreferred 79. When replenishing the petty cash fund, which account is NEVER used? a. Cash in Bank b. Cash Short and Over c. Miscellaneous Expense d. Petty Cash Fund 80. Which of the following is a current asset?

NYS FBLA SLC 2009 ACCOUNTING 1

18

a. b. c. d.

Buildings Delivery Equipment Merchandise Inventory Accounts Payable

81. The __________ depreciation method equally distributes the depreciation over the useful life of the asset. a. Accelerated b. Double-declining balance c. Straight-line d. Units of production 82. Which of the following accounts has a normal credit balance? a. Accounts Receivable b. Allowance for Uncollectible Accounts c. Depreciation Expense d. Uncollectible Accounts Expense

Use the information below to answer questions 83-85. The balances below are before the adjusting entries have been made on December 31 Accounts Receivable......................................$10,450 Allowance for Uncollectible Accounts..........$ 650 Uncollectible Accounts Expense...................$ 2,350 December 31 Z & S Industries estimates its uncollectible accounts expense for the year ended December 31 to be $1,350. April 18 After many attempts to collect the amount owed, Z & S decides to write off the account of Travis Youngs for $150. November 19 Z & S received a check for $150 from Travis Youngs, whose account was written off April 18.

NYS FBLA SLC 2009 ACCOUNTING 1

19

83. What should the adjusting entry made on December 31 be? a. Debit Accounts Receivable, $2,350; Credit Allowance for Uncollectible Accounts, $2,350 b. Debit Allowance for Uncollectible Accounts, $1,000; Credit Accounts Receivable, $1,000 c. Debit Uncollectible Accounts Expense, $700; Credit Accounts Receivable, $700 d. Debit Uncollectible Accounts Expense, $1,350; Credit Allowance for Uncollectible Accounts, $1,350 84. What entry should be made on April 18? a. Debit Accounts Receivable, $150; Credit Allowance for Uncollectible Accounts, $150 b. Debit Allowance for Uncollectible Accounts, $150; Credit Accounts Receivable, $150 c. Debit Allowance for Uncollectible Accounts, $150; Credit Uncollectible Accounts Expense, $150 d. Debit Uncollectible Accounts Expense, $150; Credit Allowance for Uncollectible Accounts, $150 85. After entries are journalized and posted for all three transactions, what is the balance of the Allowance for Uncollectible Accounts? a. Credit balance of $1,850 b. Credit balance of $2,000 c. Debit balance of $1,850 d. Debit balance of $2,000 86. The __________ method of accounting for uncollectible accounts matches the estimated uncollectible accounts expense with the sales made during the same period. a. Allowance b. Direct write-off c. Specific identification d. Uncollectible accounts 87. A formal policy of rules and standards that describes the behaviors that a company expects from its management is generally known as a(n) __________. a. Behavioral plan b. Code of ethics c. Creed d. Internal business plan 88. Under the perpetual inventory system, all purchases of merchandise are debited to the __________ account.

NYS FBLA SLC 2009 ACCOUNTING 1

20

a. b. c. d.

Cost of Merchandise Available for Sale Cost of Merchandise Merchandise Inventory Purchases

89. Which account would normally NOT require an adjusting entry? a. Accounts Receivable b. Accumulated Depreciation c. Merchandise Inventory d. Salaries Expense 90. The __________ basis of accounting recognizes and records revenues when money is received and expenses only when money is paid out. a. Accrual b. Cash c. Periodic d. Perpetual 91. The division of a partnerships net income or net loss is often shown on the __________. a. Balance Sheet b. Income Statement c. Partnerships tax return d. Work Sheet 92. All of the following factors affect the estimate of depreciation EXCEPT the __________. a. Accumulated depreciation of the asset b. Cost of the asset c. Depreciation method used d. Estimated useful life of the asset 93. The cost of land in not depreciated because __________. a. Federal regulations prohibit it b. Land is assumed to have an unlimited useful life c. Land values only increase d. There is no appropriate depreciation method that could be used 94. Interest on an 8%, $5,000 promissory note for 6 months is __________. a. $33 b. $100 c. $200

NYS FBLA SLC 2009 ACCOUNTING 1

21

d. $400 95. The term of a promissory note is the __________. a. Date on which the note is due b. Date on which the note was issued c. Interest rate charged on the note d. Length of time the maker has to repay the note 96. Employees of CPA firms may not accept more than a token gift because of the principle of __________. a. Confidentiality b. Ethical values c. Independence d. Reliability 97. Any partner may enter into agreements that are binding on the partnership through the element known as __________. a. Equitable duty b. Mutual agency c. Partnership agreement d. Partnership liquidation

98. The form prepared by the petty cashier to request cash for replenishing the petty cash fund is the __________. a. Cash proof b. Petty cash register c. Petty cash requisition d. Voucher 99. The interest plus principal of a note is called the __________. a. Bank discount b. Face value c. Maturity value d. Proceeds 100. When a business issues an interest-bearing note to borrow money, the accounts affected are __________. a. Cash in Bank, Interest Expense, and Notes Receivable b. Cash in Bank, Interest Expense, and Notes Payable c. Cash in Bank, Interest Income, and Notes Payable

NYS FBLA SLC 2009 ACCOUNTING 1

22

d. Cash in Bank and Notes Payable

NYS FBLA SLC 2009 ACCOUNTING 1

23

ANSWER KEY

62.B 63.B 64.D 65.B 66.D 67.D 68.A 69.A 70.B 71.D 72.B 73.C 74.D 75.C 76.B 77.B 78.A 79.D 80.A 81.D 82.A 83.A 84.C 85.B 86.D 23. D 24.C 25.C 26.D 27.D 28.A 29.C 30.B 31.B 32.B 33.B 34.D 35.B 36.B 37.B 38.A 39.B 40.B 41.D 42.C 43.B 44.C 45.D 46.D 47.B 1. D 2. C 3. C 4. B 5. D 6. B 7. B 8. A 9. B 10.C 11.A 12.B 13.B 14.A 15.B 16.C 17.D 18.C 19.B 20.C 21.C 22. B

You might also like

- Financial & Managerial Accounting For Mbas, 5Th Edition by Easton, Halsey, Mcanally, Hartgraves & Morse Practice QuizNo ratings yetFinancial & Managerial Accounting For Mbas, 5Th Edition by Easton, Halsey, Mcanally, Hartgraves & Morse Practice Quiz3 pages

- Final Exam Review: 1. Identify Managers' Three Primary Responsibilities. A. Planning B. Directing C. ControllingNo ratings yetFinal Exam Review: 1. Identify Managers' Three Primary Responsibilities. A. Planning B. Directing C. Controlling4 pages

- Mike Johnson The Rules of Engagement Life-Work Balance and Employee Commitment 2004100% (1)Mike Johnson The Rules of Engagement Life-Work Balance and Employee Commitment 2004225 pages

- TN - Chapter 3 Systems Documentation TechniquesNo ratings yetTN - Chapter 3 Systems Documentation Techniques25 pages

- Practice Q'S - Chapter 2 True-False Statements100% (1)Practice Q'S - Chapter 2 True-False Statements13 pages

- Cancelled Check of Nice Corporation Returned With The Sept. Bank Statement of Nile Corporation and Recorded Thereon: Br. 98No ratings yetCancelled Check of Nice Corporation Returned With The Sept. Bank Statement of Nile Corporation and Recorded Thereon: Br. 982 pages

- The Expenditure Cycle Purchases and Cash Disbursements ProceduresNo ratings yetThe Expenditure Cycle Purchases and Cash Disbursements Procedures30 pages

- IAS 21 - The Effects of Changes in Foreign Exchange Rates - Lecture Notes For Students 2021No ratings yetIAS 21 - The Effects of Changes in Foreign Exchange Rates - Lecture Notes For Students 202162 pages

- MA Midterm Set A Revision T2 2023-2024 - SolutionNo ratings yetMA Midterm Set A Revision T2 2023-2024 - Solution10 pages

- Chapter 10-Statement of Cash Flows: Multiple ChoiceNo ratings yetChapter 10-Statement of Cash Flows: Multiple Choice26 pages

- Incomplete Records - Principles of Accounting100% (2)Incomplete Records - Principles of Accounting8 pages

- Principles of Finance: Exam Information Credit RecommendationsNo ratings yetPrinciples of Finance: Exam Information Credit Recommendations3 pages

- C. Identification, Recording, Communication.: ExceptNo ratings yetC. Identification, Recording, Communication.: Except9 pages

- Accounting Principles Question Paper, Answers and Examiner's CommentsNo ratings yetAccounting Principles Question Paper, Answers and Examiner's Comments30 pages

- Corporate Finance Practice Questions MidNo ratings yetCorporate Finance Practice Questions Mid9 pages

- Introductory Financial Accounting - Mock Paper100% (1)Introductory Financial Accounting - Mock Paper12 pages

- 9-Principles of Accounting Multiple Choice Questions For All ExamsNo ratings yet9-Principles of Accounting Multiple Choice Questions For All Exams12 pages

- 8 - 9 Test Bank For Intermediate Accounting, Fourteenth Edition100% (1)8 - 9 Test Bank For Intermediate Accounting, Fourteenth Edition22 pages

- Database Design & Application-ProductionNo ratings yetDatabase Design & Application-Production6 pages

- Government of India Office of The Assistant Commissioner of Service Tax: Division - INo ratings yetGovernment of India Office of The Assistant Commissioner of Service Tax: Division - I10 pages

- Code of Business Conduct For Suppliers To The Coca-Cola CompanyNo ratings yetCode of Business Conduct For Suppliers To The Coca-Cola Company1 page

- Reading 11 - Getting It Right - Lessons From The St. Clair Streetcar For The Implementation of Transit CityNo ratings yetReading 11 - Getting It Right - Lessons From The St. Clair Streetcar For The Implementation of Transit City14 pages

- Sworn Statement of Assets, Liabilities and Net Worth: Joint Filing Separate Filing Not ApplicableNo ratings yetSworn Statement of Assets, Liabilities and Net Worth: Joint Filing Separate Filing Not Applicable6 pages

- Studi Kasus C K Tang Singapore - Corporate Governance75% (4)Studi Kasus C K Tang Singapore - Corporate Governance19 pages

- Annual Management Consulting Rankings - 2010 - 2011 - Firmsconsulting - About Management ConsultingNo ratings yetAnnual Management Consulting Rankings - 2010 - 2011 - Firmsconsulting - About Management Consulting10 pages

- Midterm WWW Compiled 2016 - Atty. Espedido100% (1)Midterm WWW Compiled 2016 - Atty. Espedido50 pages

- Disclosure On Interested Party TransactionNo ratings yetDisclosure On Interested Party Transaction2 pages

- Verification & Certification of Non Forum ShoppingNo ratings yetVerification & Certification of Non Forum Shopping35 pages

- Accenture G20 YEA 2015 Open Innovation Executive Summary100% (1)Accenture G20 YEA 2015 Open Innovation Executive Summary24 pages

- Financial & Managerial Accounting For Mbas, 5Th Edition by Easton, Halsey, Mcanally, Hartgraves & Morse Practice QuizFinancial & Managerial Accounting For Mbas, 5Th Edition by Easton, Halsey, Mcanally, Hartgraves & Morse Practice Quiz

- Final Exam Review: 1. Identify Managers' Three Primary Responsibilities. A. Planning B. Directing C. ControllingFinal Exam Review: 1. Identify Managers' Three Primary Responsibilities. A. Planning B. Directing C. Controlling

- Mike Johnson The Rules of Engagement Life-Work Balance and Employee Commitment 2004Mike Johnson The Rules of Engagement Life-Work Balance and Employee Commitment 2004

- Cancelled Check of Nice Corporation Returned With The Sept. Bank Statement of Nile Corporation and Recorded Thereon: Br. 98Cancelled Check of Nice Corporation Returned With The Sept. Bank Statement of Nile Corporation and Recorded Thereon: Br. 98

- The Expenditure Cycle Purchases and Cash Disbursements ProceduresThe Expenditure Cycle Purchases and Cash Disbursements Procedures

- IAS 21 - The Effects of Changes in Foreign Exchange Rates - Lecture Notes For Students 2021IAS 21 - The Effects of Changes in Foreign Exchange Rates - Lecture Notes For Students 2021

- Chapter 10-Statement of Cash Flows: Multiple ChoiceChapter 10-Statement of Cash Flows: Multiple Choice

- Principles of Finance: Exam Information Credit RecommendationsPrinciples of Finance: Exam Information Credit Recommendations

- C. Identification, Recording, Communication.: ExceptC. Identification, Recording, Communication.: Except

- Accounting Principles Question Paper, Answers and Examiner's CommentsAccounting Principles Question Paper, Answers and Examiner's Comments

- 9-Principles of Accounting Multiple Choice Questions For All Exams9-Principles of Accounting Multiple Choice Questions For All Exams

- 8 - 9 Test Bank For Intermediate Accounting, Fourteenth Edition8 - 9 Test Bank For Intermediate Accounting, Fourteenth Edition

- Government of India Office of The Assistant Commissioner of Service Tax: Division - IGovernment of India Office of The Assistant Commissioner of Service Tax: Division - I

- Code of Business Conduct For Suppliers To The Coca-Cola CompanyCode of Business Conduct For Suppliers To The Coca-Cola Company

- Reading 11 - Getting It Right - Lessons From The St. Clair Streetcar For The Implementation of Transit CityReading 11 - Getting It Right - Lessons From The St. Clair Streetcar For The Implementation of Transit City

- Sworn Statement of Assets, Liabilities and Net Worth: Joint Filing Separate Filing Not ApplicableSworn Statement of Assets, Liabilities and Net Worth: Joint Filing Separate Filing Not Applicable

- Studi Kasus C K Tang Singapore - Corporate GovernanceStudi Kasus C K Tang Singapore - Corporate Governance

- Annual Management Consulting Rankings - 2010 - 2011 - Firmsconsulting - About Management ConsultingAnnual Management Consulting Rankings - 2010 - 2011 - Firmsconsulting - About Management Consulting

- Verification & Certification of Non Forum ShoppingVerification & Certification of Non Forum Shopping

- Accenture G20 YEA 2015 Open Innovation Executive SummaryAccenture G20 YEA 2015 Open Innovation Executive Summary