Aoa Sample Commented

Aoa Sample Commented

Uploaded by

xYrIsCopyright:

Available Formats

Aoa Sample Commented

Aoa Sample Commented

Uploaded by

xYrIsOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Aoa Sample Commented

Aoa Sample Commented

Uploaded by

xYrIsCopyright:

Available Formats

THE COMPANIES ACT, 1956 AND THE COMPANIES ACT, 2013 (Both Acts to the extent applicable) A COMPANY

LIMITED BY SHARES ARTICLES OF ASSOCIATION OF <COMPANY NAME>

PRELIMINARY 1. Subject as hereinafter otherwise provided, the regulations contained in Table 'A ' in Schedule I to the Companies Act, 1956, and Companies Act, 2013 both hereinafter referred to as the Act to the extent applicable, shall apply to this Company as far as they are applicable to private companies except as otherwise provided/ modified impliedly or expressly by the following Articles. INTERPRETATION 2. In the interpretation of these Articles, the following words and expression shall have the following meanings, unless repugnant to the subject or context: (i) "The Act" means the Companies Act, 1956 or Companies Act, 2013 (both to the extent applicable). "The Board" or "The Board of Directors" in relation to a company, means the collective body of the directors of the company "The Company" or "This Company" means COMPANY NAME Called-Up Capital means such part of the capital, which has been called for payment; Employees Stock Option means the option given to the directors, officers or employees of a company or of its holding company or subsidiary company or companies, if any, which gives such directors, officers or employees, the benefit or right to purchase, or to subscribe for, the shares of the company at a future date at a pre-determined price;

(ii)

(iii) (iv)

(v)

(vi)

"Financial Year" means the period in respect of which any profit and loss account of the Company laid before the Annual General Meeting is made up, whether that period is a year or not. Issued Capital means such capital as the company issues from time to time for subscription; Member" in relation to a company, means (i) the subscriber to the memorandum of the company who shall be deemed to have agreed to become member of the company, and on its registration, shall be entered as member in its register of members; (ii) every other person who agrees in writing to become a member of the company and whose name is entered in the register of members of the company; (iii) every person holding shares of the company and whose name is entered as a beneficial owner in the records of a depository; "Month" shall mean the Calendar month. "The Office" means the Registered Office of the Company. Paid-Up Share Capital or Share Capital Paid-Up means such aggregate amount of money credited as paid-up as is equivalent to the amount received as paid up in respect of shares issued and also includes any amount credited as paid-up in respect of shares of the company, but does not include any other amount received in respect of such shares, by whatever name called "Persons" shall include any Corporation as well as individuals. "These Presents" or "Regulations" means these Articles of Association as originally framed or altered from time to time and in force for the time being and include the Memorandum of Association where the context so requires. "The Seal" means the Common Seal for the time being of the Company. "Section" means Section of the Companies Act, 1956 or Companies Act, 2013 (both Acts to the extent applicable). Sweat Equity Shares means such equity shares as are issued by a company to its directors or employees at a discount or for consideration, other than cash, for providing their know-how or making available rights in the nature of intellectual property rights or value additions, by whatever name called

(vii)

(viii)

(ix) (x) (xi)

(xii) (xiii)

(xiv) (xv)

(xvi)

(xvii) "Year" means English Calendar year.

Words importing the singular shall include the plural and words importing the plural shall include the singular. Words importing the masculine gender shall include the feminine gender and vice versa. CONSTITUTION OF THE COMPANY 3. The Company is a Private Limited Company as per Section 2(68) of the Companies Act, 2013 means a company having a minimum paid-up share capital of One Lakh rupees or such higher paid-up share capital as may be prescribed, and which by its articles, (i) restricts the right to transfer its shares; (ii) except in case of One Person Company, limits the number of its members to two hundred: Provided that where two or more persons hold one or more shares in a company jointly, they shall, for the purposes of this clause, be treated as a single member: Provided further that (A) persons who are in the employment of the company; and (B) persons who, having been formerly in the employment of the company, were members of the company while in that employment and have continued to be members after the employment ceased, shall not be included in the number of members; and (iii) prohibits any invitation to the public to subscribe for any securities of the company; CAPITAL 4. The Authorised Capital of the Company shall be such amount and be divided into such shares as may, from time to time, be provided in Clause V of Memorandum of Association payable in the manner as may be determined by the Directors, from time to time, with power to increase, reduce, sub-divide or to repay the same or to divide the same into several classes and to attach thereto such preferential, qualified or special rights, privileges and conditions as may be determined by or in accordance with the Companies Act 1956 and to consolidate or sub-divide or reorganise the shares subject to the provisions of the Act, to vary, modify or abrogate any such rights, privileges or conditions in such manner as may be determined in accordance with the regulation of the Company. The Equity Share capital of the Company shall be with voting rights; or with differential rights as to dividend, voting or otherwise in accordance with such rules and subject to such conditions as may be prescribed.

5.

6.

The company shall have power to issue preference shares carrying a right of redemption out of profits or out of the proceeds of a fresh issue of share or liable to be redeemed at the option of the Company and the Directors may subject to the provision of the Companies Act, 1956 exercise such power in any manner as they may think fit. The Company in General Meeting may from time to time increase the capital by the creation of new shares, such increase to be such aggregate amount and to be divided into shares of such respective amounts, as the resolution shall prescribe. The new shares shall be issued upon the such terms and conditions and with rights and privileges annexed thereto, as the resolution shall prescribe and in particular, such shares may be issued with a preferential or qualified right to dividends, and/or in the distribution of assets of the Company, and with a right of voting at general meetings of the Company in conformity with the Act. Except so far as otherwise provided by the condition of issue or by these Presents, any Capital raised by the creation of new shares shall be considered as part of the existing capital and shall be subject of the provisions herein contained, with reference to the payment of calls and installments, forfeiture, lien, surrender, transfer and transmission, voting and otherwise. (1) The Company in general meeting may, upon the recommendation of the Board, resolve a. That it is desirable to capitalize any part of the amount for the time being standing to the credit of any of the Companys reserve accounts or to the credit of the profit and loss account, or otherwise available for distribution; and b. That the sum be accordingly set free for distribution in the manner specified in clause (2) amongst the members who would have been entitled thereto, if distributed by the way of dividend and in the same proportions. (2) The sum aforesaid shall not be paid in cash but shall be applied, subject to the provision contained in clause (3), either in or towards: (i) Paying up any amounts for the time being unpaid on any shares held by such members respectively. (ii) Paying up in full, unissued shares of the company to be allotted and distributed, credited as fully paid up to and amongst such members in the proportion aforesaid; (iii) Partly in the way specified in sub-clause (i) and partly in that specified in sub clause (ii)

7.

8.

9.

(3)

A securities premium amount and a capital redemption reserve account may, for the purposes of this regulation be applied in the paying up of unissued shares to be issued to members of the Company as fully paid bonus shares. The Board shall give effect to the resolution passed by the Company in pursuance of this regulation.

(4)

10.

The Company may from time to time by special resolution reduce its capital in any manner for the time being authorized by Law and in particular may (a) extinguish or reduce the liability on any of its shares in respect of share capital not paid up; or (b) either with or without extinguishing or reducing liability on any of its shares, (i) cancel any paid up share capital which is lost or is unrepresented by its available assets or (ii) pay off any paid up share capital which is in excess of the wants of the Company. alter its memorandum by reducing the amount of its share capital and of its shares accordingly: Provided that no such reduction shall be made if the company is in arrears in the repayment of any deposits accepted by it, or the interest payable thereon.

11.

Subject to these presents and the provisions of the Act, the shares of the Company whenever issued shall be under the control of and the disposal of the Directors, who may allot, issue or otherwise dispose of the same or any of them to such persons and on such terms and conditions and at such times and par or premium or discount as they may from time to time think fit and proper and may also allot and issue shares in capital of the Company in payment or part payment for any property sold or transferred to or its business, and the shares which rate allotted may be issued as fully paid up shares, and if so issued, shall be deemed to be fully paid up shares. If any shares stand in the name of two or more persons, the persons first named in the register or to such person and to such address as the holder or joint holders may in writing direct shall be intimated, as regards payment of dividend or bonus or service of notice and all or and other matters connected with the Company, except voting at meeting be treated as the holders of the Share but the joint holders of a share shall be severally as well as jointly liable for the payment of all installments and call due in respect of such shares and for all the other incidence thereof according to the Companys regulations. Except as required by law, no person shall be recognised by the company as holding any share upon any trust, and the company shall not be bound by, or be compelled in any way to recognise (even when having notice thereof) any equitable, contingent, future or partial interest in any share, or any interest in any fractional part of a share, or (except only as by these regulations or by law

12.

13.

otherwise provided) any other rights in respect of any share except an absolute right to the entirety thereof in the registered holder. 14. Subject to the provisions of the Companies Act, 2013 and / or other statutory modifications thereof, the Company may buyback any of its own shares or other specified securities whether or not they are redeemable and may make a payment out of its free reserves or securities premium account of the Company or proceeds of the issue of any shares or other specified securities or from such other sources as may be permitted by Law and on such terms, conditions and in such manner as may be prescribed by the Law from time to time in respect of such buy-back. If and to the extent permitted by law, the Company shall also have power to re-issue the shares so bought back. TRANSFER OF SHARES 15. (a) The instrument of transfer of any share in the Company shall be executed by or on behalf of both the transferor and transferee. The transferor shall be deemed to remain a holder of the share until the name of the transferee is entered in the register of members in respect thereof.

(b)

16.

The instrument of transfer shall be in writing and all the provisions of Section 108 of the Companies Act, 1956 shall be complied with in respect of all transfer of shares and the registration thereof. The Board may, subject to the right of appeal conferred by the Act, decline to register (a) the transfer of a share, not being a fully-paid share, to a person to whom they do not approve; or (b) any transfer of shares on which the company has a lien.

17.

18.

The Board may also decline to recognize any instrument of transfer unless (a) the instrument of transfer is in the form as prescribed in Rules; (b) the instrument of transfer is accompanied by the certificate of the shares to which it relates, and such other evidence as the Board may reasonably require to show the right of the transferor to make the transfer; and (c) the instrument of transfer is in respect of only one class of shares.

19.

Subject to the provisions of Section 22 of the Companies Act 2013, on giving not less than seven days previous notice in accordance with section 91and rules made thereunder,the registration of transfers may be suspended at such times and for such periods as the Board may from time to time determine:

Provided that such registration shall not be suspended for more than thirty days at any one time or for more than forty-five days in the aggregate in any year. TRANSMISSION OF SHARES 20. (a) On the death of a member, the survivor or survivors where the member was a joint holder, and his nominee or nominees or legal representatives where he was a sole holder, shall be the only persons recognized by the Company as having any title to his interest in the shares. Nothing in clause (a) shall release the estate of a deceased joint holder from any liability in respect of any share which had been jointly held by him with other persons. Any person becoming entitled to a share in consequence of the death or insolvency of a member may, upon such evidence being produced as may from time to time properly be required by the Board and subject as hereinafter provided, elect, either (i) to be registered himself as holder of the share; or (ii) to make such transfer of the share as the deceased or insolvent member could have made. (b) The Board shall, in either case, have the same right to decline or suspend registration as it would have had, if the deceased or insolvent member had transferred the share before his death or insolvency. GENERAL MEETINGS 22. The Company shall in each year hold a General Meeting in addition to any other Meeting in that year. All General Meetings other than Annual General Meeting shall be called Extraordinary General Meetings. Every Annual General Meeting shall be called in accordance with the provisions of the Act and the notices calling the Meeting shall specify it as the Annual General Meeting. A General Meeting of the Company may be called by giving not less than clear twenty-one days notice in such manner as may be prescribed: Provided that a general meeting may be called after giving a shorter notice if consent is given by not less than such percent of the members (as may be prescribed in the Act) and entitled to vote at such meeting. (a) Every notice of a General Meeting of the Company shall specify the place, date, day and hour of the Meeting and shall contain a statement of the business to be transacted thereat.

(b)

21.

(a)

23.

24.

(b)

In every notice there shall appear with reasonable prominence a statement that a Member entitled to attend and vote is entitled to appoint a proxy , or, where that is allowed, one or more proxies, to attend and vote instead of himself and that a proxy need not be a Member of the Company. The notice shall be given to such persons as are entitled to receive notice from the Company under the provisions of the Act.

(c)

PROCEEDINGS AT GENERAL MEETINGS Meeting not to transact business not mentioned in Notice 25. No General Meeting, Annual or Extraordinary, shall be competent to enter upon, discuss, or transact any business which has not been mentioned in the notice or notices upon which it is convened. Quorum at General Meeting 26. Two members present in person shall be the quorum for a General Meeting. Chairman of General Meeting 27. The Chairman, if any, of the Board shall preside as Chairman at every general meeting of the Company. If there is no such Chairman, or if he is not present within fifteen minutes after the time appointed for holding the meeting, or is unwilling to act as Chairman of the meeting, the Directors present shall elect one of their number to be Chairman of the meeting. If at any meeting no Director is willing to act as Chairman or if no Director is present within fifteen minutes after the time appointed for holding the meeting, the members present shall choose one of their provided one of the member number to be Chairman of the meeting.

in the meeting shall be a director.

Questions at General Meeting how decided 28. At any General Meeting a resolution put to the vote of the meeting shall, unless a poll is demanded under section 109 of the Companies Act, 2013 or the voting is carried out electronically, be decided on a show of hands. Minutes of General Meeting 29. The Company shall cause minutes of all proceedings of every General Meeting to be kept in accordance with the applicable provisions of the Act. BOARD OF DIRECTORS 30. The First Directors of the Company are:

1. DIRECTOR NAME 2. DIRECTOR NAME All the Directors shall be the Executive Directors and shall be authorized to sign on official communication of the Company. The number of Directors of the Company shall not be less than two (2) and not more than such number as provided in the Act and shall not be liable to retire by rotation. 31. Subject to the provisions of the Act, the Board shall have the power, at any time and from time to time, to appoint a person to be a Director either to fill a casual vacancy or as an addition to the Board, but so that the total number of Directors shall not at any time exceed the maximum fixed above. Any Director, so appointed, shall hold office only till the next following annual general meeting but shall be eligible thereof for election as Director. Subject to provisions of the Act, the Board of the Company shall have the power to appoint an alternate Director to function in the original Director during his absence. Remuneration of Directors 33. The remuneration payable to the Directors of the Company other than Managing Directors or Whole time Directors of the Company for attendance at Meetings of the Board or any Committee thereof shall be such fee or amount determined by the Board from time to time within the limits, if any, permitted under or pursuant to the Act for the time being. Such remuneration may be in any manner whether as monthly payments, commission, and bonus, fully paid up shares or any other manner as may be permitted under the Act. Directors may contract with Company 34. Subject to the provision of Section 297, 299 and 302 of the Companies Act, 1956 the Directors (including Managing Director) shall not be disqualified by reasons of his or their office, as such from contracting with the Company either as vendor, purchaser, lender, agent, broker, lessor or lessee or otherwise, nor shall any such contract or arrangement entered into by or on behalf of the Company with any Director or with any company or partnership firm in which any Director shall be a member or a partner or otherwise interested be void, nor shall any director so contracting or being such member or so interested be liable to account to the Company for any profit realized by such contract or arrangement by reason only such director holding that office or of the fiduciary relation thereby established but the nature of the interest must be disclosed by him or them at the meeting of Directors at which contract or arrangement is determined if the interest then exists or in any other case at the first meeting of the Directors after the acquisition of the interest.

32.

35.

Subject to Section 58A and 292 of the Companies Act, 1956 and the Regulations made there under and Directions issued by the R.B.I., the Directors shall have the power, from time to time and their discretion, to borrow, raise or to secure the payment of any sum of money for the purpose of the Company in such manner and upon such terms and conditions in all respects as they think fit and in particular by the issue of Debentures or bonds of the Company or by the mortgage charged upon all or any of the properties of the Company both present and future including its uncalled capital for the time being. The Directors shall have the power to invest and deal with any moneys of the Company not immediately required for the purpose thereof upon such securities and in such manner as they think fit, and from time to time to vary or realize such investments. PROCEEDINGS OF BOARD Meetings of Directors

36.

37.

The Directors may meet together as a Board for the dispatch of business from time to time, and shall so meet at least once in every three months on normal business day and at least four such Meetings shall be held in every year. Quorum at Board Meetings

38.

Subject to the provisions of the Act the quorum for a meeting of the Board shall be one-third (1/3) of its total strength (any fraction contained in that one-third being rounded off as one), or two Directors, whichever is higher. Provided that where at any time the number of interested Directors exceeds or is equal to two- thirds (2/3) of the total strength, the number of the remaining Directors, that is to say, the number of Directors who are not interested, present at the meeting, or in a manner permitted under applicable law for the purpose of quorum, being not less than two (2), shall be the quorum during such time. Subject to the provisions of the Act, questions arising at any meeting shall be decided by majority of votes, in case of an equality of votes, the Chairman shall have a second or casting vote. Power of Board Meetings

39.

A meeting of the Board for the time being at which a quorum is present shall be entitled to exercise all powers and to do all such acts and things which by or under the Act or the Articles of the Company are for the time being vested in or exercisable by the Board generally, except however the approval /permission to sell / transfer / gift or otherwise alienate and deal in Immovable properties owned by company which mandatorily requires prior permission of the majority share holders in an ordinary resolution. Resolution by circulation

10

40.

No resolution shall be deemed to have been duly passed by the Board or by a Committee thereof by circulation, unless the resolution has been circulated in draft together with the necessary papers, if any; to all the Directors, or to all the members of the Committee, at their usual address and has been approved by such Directors as are then in India or by a majority of such of them as are entitled to vote on the resolution. Minutes of Board Meetings

41.

The Company shall cause minutes of all proceedings of every meeting of the Board and Committee thereof to be kept in accordance with the applicable provisions of the Act. General Powers of Board

42.

The Board may exercise all such powers of the Company and do all such acts and things as are not, by the Act, or any other Act, or by the Memorandum or by the Articles of the Company required to be exercised or done by the Company in General Meeting, subject nevertheless to these Articles and to the provisions as may be prescribed by the Company in General Meeting, but no regulations made by the Company in General Meeting shall invalidate any prior act of the Board which would have been valid if that regulation had not been made; provided that the Board shall not, exercise the powers which under the Act require the consent of the Company in General Meeting without such consent. DIVIDEND AND RESERVES

43.

The company in general meeting may declare dividends as per the provisions of the Act. The board may from time to time pay to the members such interim dividends as appear to it to be justified by the profits of the company. The Board may, before recommending any dividend, set aside out of the profits of the Company such sums as it thinks proper as a reserve which shall, at the discretion of the Board, by applicable for any purpose to which the profits of the Company may be properly applied including provision for meeting contingencies or for equalizing dividends; and pending such applications may at the discretion, either be employed in the business of the Company or be invested is such investments as the Board may from time to time think fit.

44.

45.

11

THE COMMON SEAL 46. (a) The Board shall provide a Common Seal for the purposes of the Company. (b) The seal of the company shall not be affixed to any instrument except by the authority of a resolution of the Board or of a committee of the Board authorized by it in that behalf, and except in the presence of at least one of the directors who shall sign every instrument to which the seal of the company is so affixed in their presence. INDEMNITY 47. Subject to provisions of the Act, the Chairman, Directors, Secretary, Treasurer, Agents, Auditor, Manager and other Officers and their heirs, executors and administrators, shall be indemnified out of the assets and funds of the Company from or against all benefit suits, proceedings, costs, charges, losses, damages and expenses which they or any of them shall or may incur or sustain by reason of any act done or committed in or about the execution of their duties in their respective offices except those done through their willful neglect or default or decent. SECRECY 48. Every Director, Manager, Secretary, Auditor, Trustee, Members of a Committee, Officer, Servant, Agent, Accountant or other persons employed in the business of the company, shall if so, required by the Directors, before entering upon his duties, or any time during his term of office, sign a declaration pledging himself to observe strict secrecy respecting all transaction of the Company and the State of Accounts and in the matters relating thereto, and shall by such declaration pledge himself not to reveal any of the matters which may come to his knowledge in the discharge of duties, except when required to do so by the board or by court of Law or by the person to whom such matters relate and except so far as may be necessary in order to comply with any of the provisions contained in these Articles.

12

You might also like

- Film Production Service AgreementDocument7 pagesFilm Production Service Agreementlonghornsteve50% (2)

- Abstract of The Contract LabourDocument6 pagesAbstract of The Contract LabourKirti Patil100% (3)

- No Objection Certificate For Wife - A Sample Letter For EmbassyDocument1 pageNo Objection Certificate For Wife - A Sample Letter For EmbassyBlazeDream Technologies Pvt LtdNo ratings yet

- Busla 1Document13 pagesBusla 1Just Jhex100% (1)

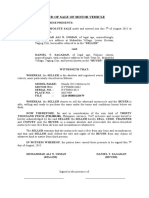

- CONDITIONAL SALE - VintarDocument2 pagesCONDITIONAL SALE - Vintarjoan maricel de la cruzNo ratings yet

- Deed of Conditional SaleDocument2 pagesDeed of Conditional SaleMarvin Rhick BulanNo ratings yet

- Punjab National Bank Vs Mithilanchal Industries PvGJ202001092015405363COM765549Document18 pagesPunjab National Bank Vs Mithilanchal Industries PvGJ202001092015405363COM765549Sakshi ShettyNo ratings yet

- Republic of The Philippines) Province of Occidental Mindoro Municipality of Sablayan) S.SDocument2 pagesRepublic of The Philippines) Province of Occidental Mindoro Municipality of Sablayan) S.Sbhem silverioNo ratings yet

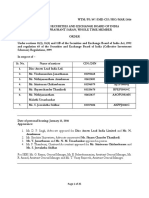

- Order in The Matter of Disc Assets Lead India LTDDocument25 pagesOrder in The Matter of Disc Assets Lead India LTDShyam SunderNo ratings yet

- Deed of Absolute Sale of BusinessDocument2 pagesDeed of Absolute Sale of BusinesskeitoNo ratings yet

- Legal Forms Syllabus 2020 2021Document8 pagesLegal Forms Syllabus 2020 2021Jorrel BautistaNo ratings yet

- Walpole HS Bullying LawsuitDocument12 pagesWalpole HS Bullying LawsuitDanLibonNo ratings yet

- Articles of Association As Per New Companies Act 2013Document14 pagesArticles of Association As Per New Companies Act 2013greeshmaNo ratings yet

- Joint Venture Agreement - Jireh - CapoteDocument5 pagesJoint Venture Agreement - Jireh - Capotejack timothy quinonesNo ratings yet

- Antichreses - SanchezDocument2 pagesAntichreses - SanchezJo SanchezNo ratings yet

- Articles of Association and MOADocument12 pagesArticles of Association and MOAmasoodNo ratings yet

- DEED OF CONDITIONAL SALe PiatDocument2 pagesDEED OF CONDITIONAL SALe PiatHannahQuilangNo ratings yet

- Deed of Sale of Motor Vehicle With Assumption of Mortgage 1Document3 pagesDeed of Sale of Motor Vehicle With Assumption of Mortgage 1Richelle TanNo ratings yet

- SPL Articles of Association As at 22 October 2012Document27 pagesSPL Articles of Association As at 22 October 2012HirsutePursuitNo ratings yet

- Affidavit of Non OperationDocument1 pageAffidavit of Non OperationMärinël VëlmöntëNo ratings yet

- Affidavit Admission of PaternityDocument1 pageAffidavit Admission of PaternityBelle SalasNo ratings yet

- Deed of Donation (Sly)Document2 pagesDeed of Donation (Sly)Luigi Marvic FelicianoNo ratings yet

- Forged Document - Jurisprudence - CastilloDocument6 pagesForged Document - Jurisprudence - CastilloMyrna Paneda-OlleroNo ratings yet

- Affidavit of No Income JaucianDocument1 pageAffidavit of No Income JaucianMCDDA SERVENo ratings yet

- Spa 2Document1 pageSpa 2Deoferd Rodriguez PaulinNo ratings yet

- Affidavit of Loss BalacanaoDocument2 pagesAffidavit of Loss BalacanaoethelandicoNo ratings yet

- Pdic Certification-FinalDocument1 pagePdic Certification-FinalmutedchildNo ratings yet

- DEED of Conditional SALE AcevedoDocument3 pagesDEED of Conditional SALE AcevedolienujNo ratings yet

- DEED OF AGREEMENT SureshDocument4 pagesDEED OF AGREEMENT SureshKajal GargNo ratings yet

- Deed of Agreement: Made This ..Day Of, 2014Document4 pagesDeed of Agreement: Made This ..Day Of, 2014viva6926No ratings yet

- Articles of AssociationDocument13 pagesArticles of AssociationSamiksha PawarNo ratings yet

- Deed of Absolute SaleDocument2 pagesDeed of Absolute SalegilbertNo ratings yet

- Draft - Deed of Agreement & Gurantee - Hungary ScholarshipDocument6 pagesDraft - Deed of Agreement & Gurantee - Hungary ScholarshipMuhammad SanaNo ratings yet

- Deed of AssignmentDocument5 pagesDeed of Assignmentsean contrerasNo ratings yet

- Contract To Sell Edited ReguaDocument20 pagesContract To Sell Edited ReguaFlorabel LazaroNo ratings yet

- This Draft of Deed of Partnership': Lawyer atDocument4 pagesThis Draft of Deed of Partnership': Lawyer atTANUNo ratings yet

- Partnership For Cake ShopDocument6 pagesPartnership For Cake ShopRaja huli50% (2)

- PromissoryDocument1 pagePromissoryDiyames RamosNo ratings yet

- Escrow AgreementDocument49 pagesEscrow AgreementkarthikeyanwebtelNo ratings yet

- The Divisional Manager: .ShankaranandaDocument5 pagesThe Divisional Manager: .ShankaranandaBharathNo ratings yet

- Special Power of Attorney For Appearing Before CourtDocument2 pagesSpecial Power of Attorney For Appearing Before CourtTANUNo ratings yet

- Model Simple Mortgage DeedDocument3 pagesModel Simple Mortgage Deedritu bansodeNo ratings yet

- Cancellation of Contract To SellDocument2 pagesCancellation of Contract To Sellconnel judeNo ratings yet

- SPECIAL POWER OF ATTORNEY - RequestDocument2 pagesSPECIAL POWER OF ATTORNEY - Requestprince762No ratings yet

- Deed of Quitclaim and WaiverDocument2 pagesDeed of Quitclaim and WaivermaryNo ratings yet

- Copyright Assignment AgreementDocument4 pagesCopyright Assignment AgreementKarina GutierrezNo ratings yet

- Deed of Sale of Motor Vehicle Know All MDocument2 pagesDeed of Sale of Motor Vehicle Know All MMarcos Bumagat Gardoce Jr.No ratings yet

- Agreement To Sell (Auto)Document3 pagesAgreement To Sell (Auto)SYED MANSOOR ALI SHAHNo ratings yet

- Mortgage Under Transfer of Property ActDocument16 pagesMortgage Under Transfer of Property Actdiksha chouhanNo ratings yet

- Application Form For Community Broadcasting Licence 1Document15 pagesApplication Form For Community Broadcasting Licence 1euniceNo ratings yet

- Affidavit of Adverse Claim Vendor Breach On Contract To SellDocument2 pagesAffidavit of Adverse Claim Vendor Breach On Contract To SellSofia PoloyapyNo ratings yet

- Deed of Conditional Sale ReaperDocument2 pagesDeed of Conditional Sale ReaperRandolf Forster DeeNo ratings yet

- Irrevocable Special Power of AttorneyDocument2 pagesIrrevocable Special Power of AttorneySunrise Manning Agency, Inc.No ratings yet

- SEC Form 17 C As AmendedDocument12 pagesSEC Form 17 C As AmendedcamileholicNo ratings yet

- Affidavit of SponserDocument1 pageAffidavit of SponserMazhar JavedNo ratings yet

- Affidavit of Adverse ClaimDocument1 pageAffidavit of Adverse ClaimJungkook JeonNo ratings yet

- Affidavit of Support and ConsentDocument1 pageAffidavit of Support and ConsentAniceta Bansag-TidonNo ratings yet

- SpaDocument3 pagesSpaAhcai SepetNo ratings yet

- Deed of PartitionDocument2 pagesDeed of PartitionRagul Sivanand100% (1)

- Cancellation of Rem-Kumala MendozaDocument2 pagesCancellation of Rem-Kumala MendozaNicolo Jay PajaritoNo ratings yet

- Date - Insert A Company or Real Person Who Will Serve As Consultant-Insert Company Being SoldDocument6 pagesDate - Insert A Company or Real Person Who Will Serve As Consultant-Insert Company Being Soldlinh nguyenNo ratings yet

- Articles of AssociationDocument21 pagesArticles of Associationsheikh mohiuddinNo ratings yet

- RSR AOA FinalDocument18 pagesRSR AOA Finaladesh_naharNo ratings yet

- CH 7 Global Ethical Issues M6Document24 pagesCH 7 Global Ethical Issues M6Mehrehmat KohliNo ratings yet

- Moot Problem Civil B.A.LL.B., B.B.A.LL.B., LL.B.Document15 pagesMoot Problem Civil B.A.LL.B., B.B.A.LL.B., LL.B.ishitaNo ratings yet

- RTI Case StudyDocument15 pagesRTI Case StudyHarsha VardhanaNo ratings yet

- Rudolf Rocker Nationalism and CultureDocument246 pagesRudolf Rocker Nationalism and CultureJorge Palmeira100% (1)

- Rule 76. Allowance or Disallowance of WillDocument8 pagesRule 76. Allowance or Disallowance of WillczarinasheilahNo ratings yet

- Big Chris v. Jeezy - Skeptical About Personal Jurisdiction PDFDocument3 pagesBig Chris v. Jeezy - Skeptical About Personal Jurisdiction PDFMark JaffeNo ratings yet

- Leave Policy Related To Staff of Future Generation School SystemDocument5 pagesLeave Policy Related To Staff of Future Generation School SystemhamzaNo ratings yet

- Republic Act 83-WPS OfficeDocument5 pagesRepublic Act 83-WPS OfficePASION Jovelyn M.No ratings yet

- Writ of Habeas DataDocument24 pagesWrit of Habeas DataResci Angelli Rizada-Nolasco100% (3)

- Hazing Refers To Any Act That Results in Physical or Psychological Suffering, Harm, or InjuryDocument6 pagesHazing Refers To Any Act That Results in Physical or Psychological Suffering, Harm, or InjuryAngelNo ratings yet

- The Madrid AgreementDocument3 pagesThe Madrid Agreementr3424915No ratings yet

- Petitioners vs. vs. Respondents: Second DivisionDocument11 pagesPetitioners vs. vs. Respondents: Second Divisionlorelei louiseNo ratings yet

- 1922 Bispham The Principles of EquityDocument1,112 pages1922 Bispham The Principles of EquityremNo ratings yet

- Case Assignments Conflict of LawsDocument8 pagesCase Assignments Conflict of LawsJoshua CabaccanNo ratings yet

- Padma Order 9 Rule 7 ExparteDocument4 pagesPadma Order 9 Rule 7 Expartesaleem syed100% (2)

- Real View v. 20-20 Technologies (Real View Pretrial Brief D. Mass. 2010, Copyright)Document29 pagesReal View v. 20-20 Technologies (Real View Pretrial Brief D. Mass. 2010, Copyright)gesmerNo ratings yet

- People Vs Go PinDocument2 pagesPeople Vs Go PinEzekiel T. MostieroNo ratings yet

- Fred Hill Letter To Allen City Manager Peter VargasDocument2 pagesFred Hill Letter To Allen City Manager Peter VargasjpeeblesNo ratings yet

- Full Text CaseDocument10 pagesFull Text CaseAron MenguitoNo ratings yet

- SKF H 3124 SpecificationDocument3 pagesSKF H 3124 SpecificationMuhammad JunaidNo ratings yet

- The Law On Arson: (Bernardo, R Castillo, A Fernando, A Mirabel, F Sambile, J and Santos, J.)Document3 pagesThe Law On Arson: (Bernardo, R Castillo, A Fernando, A Mirabel, F Sambile, J and Santos, J.)Jay Mark Albis SantosNo ratings yet

- A-2203 Hariram Dayanand Sale Agreement - Dayanand Sagar FamilyDocument20 pagesA-2203 Hariram Dayanand Sale Agreement - Dayanand Sagar Familynaveen KumarNo ratings yet

- Harrison Motors Corporation, Petitioner, vs. Rachel A. NAVARRO, RespondentDocument14 pagesHarrison Motors Corporation, Petitioner, vs. Rachel A. NAVARRO, RespondentBelle FabeNo ratings yet

- Deterrence Theory PDFDocument5 pagesDeterrence Theory PDFmelizzeNo ratings yet

- Imbong v. Ochoa-Yap, K. C2020Document2 pagesImbong v. Ochoa-Yap, K. C2020Krystoffer YapNo ratings yet

- THE CIVIL SERVICE V G. Steam Navigation CODocument11 pagesTHE CIVIL SERVICE V G. Steam Navigation COshez ChoonaraNo ratings yet