Quia - InS 21 Quiz 2 - Session Ins 21 Chapter 2

Quia - InS 21 Quiz 2 - Session Ins 21 Chapter 2

Uploaded by

toll_meCopyright:

Available Formats

Quia - InS 21 Quiz 2 - Session Ins 21 Chapter 2

Quia - InS 21 Quiz 2 - Session Ins 21 Chapter 2

Uploaded by

toll_meOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Quia - InS 21 Quiz 2 - Session Ins 21 Chapter 2

Quia - InS 21 Quiz 2 - Session Ins 21 Chapter 2

Uploaded by

toll_meCopyright:

Available Formats

Quia - INS 21 Quiz 2: session ins 21 chapter 2

http://www.quia.com/quiz/567684.html?AP_rand=764043494

Home

FAQ

About

Log in

Subscribe now

30-day free trial

INS 21 Quiz 2: session ins 21 chapter 2

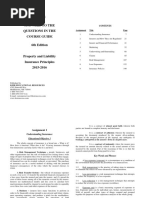

Thank you. Your responses have been automatically graded. Here are your results. Score Summary (Click on question number to jump to question.) Question 1 Question 2 Question 3 Question 4 Question 5 Question 6 Question 7 Question 8 Question 9 Question 10 Question 11 Question 12 Question 13 Question 14 Question 15 Question 16 correct correct incorrect correct correct correct correct correct correct incorrect correct incorrect correct correct correct correct Score: (81%) points earned 1 1 0 1 1 1 1 1 1 0 1 0 1 1 1 1 13 points possible 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 16

1. The National Association of Insurance Commissioners (NAIC) created a uniform financial statement for property and liability insurance companies. The purpose of the uniform statement is to Ensure that state insurance departments not mistake these companies for life insurers. Provide accounting expertise for those state insurance departments that do not have staff actuaries. Simplify the state insurance department's task of comparing the financial reports of many different insurers. (correct answer, your response)

Capture the essential criteria required for rate regulation. Points earned: 1 out of 1

2. All states require insurance agents to be licensed to transact insurance business in the state. Further, agents must meet continuing education requirements to maintain their licenses. All of these requirements have what purpose? To control the number of agents that transact business in a state to reduce the chance of over-aggressive competition. To ensure that these insurance company representatives have a prescribed minimum level of insurance knowledge. (correct answer, your response) To maintain a level of vigilance in protecting insurance companies against fraudulent behavior by the public.

To improve the image and public perception of the insurance profession.

Points earned: 1 out of 1

1 of 5

3/15/2014 8:00 PM

Quia - INS 21 Quiz 2: session ins 21 chapter 2

http://www.quia.com/quiz/567684.html?AP_rand=764043494

3. How does a stock insurance insurer differ from a reciprocal insurance exchange? a.Stockholders own a stock company. Subscribers own a reciprocal exchange (correct answer) A stock company provides insurance to its policyholder-owners. A reciprocal insurance provides insurance to investors. Each is owned by stockholders; however, the reciprocal insurance exchange provides coverage to investors. (your response) Each is formed to provide profit to investors; however, the stock insurer is managed through a board of directors.

Points earned: 0 out of 1

4. Which one of the following describes the characteristics of a mutual insurance company? A corporation owned by stockholders that earns profits for the stockholders. An unincorporated association that provides reciprocal coverage to subscribers. A corporation owned by policyholders that provides insurance to its policyholders. (correct answer, your response)

An unincorporated association that earns profits for its individual investors. Points earned: 1 out of 1

5. The type of insurance rating law that requires rate approval by the state insurance department before the rates can be used is Flex rating law. Open competition law. File-and-use law. Prior-approval law. (correct answer, your response) Points earned: 1 out of 1

6. Some federal government insurance programs provide coverage for loss exposures that private insurers have avoided largely because of the potential for catastrophic losses. An example of such a program is Workers compensation insurance funds Unemployment insurance programs Automobile insurance plans The National Flood Insurance Program (correct answer, your response) Points earned: 1 out of 1

7. Workers compensation insurance is offered through a residual market plan in some states, which means It is a state insurance plan that competes with private insurers to provide the insurance. It is a state fund that provides a system to pay the claims of insolvent insurers. It is a program that makes insurance available to those who cannot obtain coverage because private insurers will not voluntarily provide it. (correct answer, your response) It is an insurance plan that is the only source of workers compensation insurance allowed in the state.

Points earned: 1 out of 1

2 of 5

3/15/2014 8:00 PM

Quia - INS 21 Quiz 2: session ins 21 chapter 2

http://www.quia.com/quiz/567684.html?AP_rand=764043494

8. The Social Security program can be simply described as A federal program that provides retirement, survivorship, disability, and medical benefits to eligible individuals. (correct answer, your response) A federal welfare benefits program that provides a minimum level of housing, food, and income to eligible individuals and families. A state unemployment insurance program that provides income for a limited period of time to workers who become unemployed. A state program that provides a base level of income for retirement based on the level of income and duration of employment.

Points earned: 1 out of 1

9. Why would insurance regulators have a goal of assuring that the premiums charged by insurers are adequate? To maintain insurer solvency (correct answer, your response) To eliminate the potential of a monopoly To protect consumers from high insurance rates To promote equity among insurers Points earned: 1 out of 1

10. A ratemaking concept in which rates are based on calculated loss experience and insureds with similar characteristics are placed in the same rating class is called Unfair discrimination. Premium differential. Actuarial equity. (correct answer) Social equity. (your response) Points earned: 0 out of 1

11. States regulate the excess and surplus lines market by Establishing a monitoring board comprised of all insurers licensed to do business in the state. Licensing the excess and surplus lines brokers that transact business with the unlicensed insurers. (correct answer, your response)

Examining the market conduct practices of the unlicensed insurers.

Approving the policy forms and rates used by the unlicensed insurers. Points earned: 1 out of 1

12. One of the methods used by regulators to ensure insurance company solvency is through the Insurance Regulatory Information System (IRIS), which is The licensing system required for insurance companies that transact business in a state. The licensing process for alien insurers that are incorporated in another country. A periodic examination conducted by a team of state examiners, working at the insurer's home office to review activities including claims, underwriting, marketing, and accounting procedures. (your response) A system that gathers data from insurers financial statements and develops financial ratios to determine an insurers' overall financial condition. (correct answer)

Points earned: 0 out of 1

3 of 5

3/15/2014 8:00 PM

Quia - INS 21 Quiz 2: session ins 21 chapter 2

http://www.quia.com/quiz/567684.html?AP_rand=764043494

13. A reinsurance company Is formed to write all or part of the insurance for a parent company. Provides insurance for loss exposures that private insurers are unwilling to provide. Transfers losses to a primary insurer. Accepts loss exposures from a primary insurer. (correct answer, your response) Points earned: 1 out of 1

14. An automobile insurance policyholder has complained that her insurance premium is higher than her neighbor's premium. Both the policyholder and her neighbor have insurance with the same company, and they have identical vehicles. The policyholder feels that she is the subject of unfair discrimination. As the policyholder's agent, you know the policyholder has been responsible for several small auto accidents. The policyholder has mentioned that her neighbor has had no accidents or violation in the last three years. You must explain to the policyholder the objective of rate regulation ensuring that rates are not unfairly discriminatory, as it applies in her case. Which one of the following is an accurate explanation? Insureds with similar characteristics are usually placed in the same class and charged the same rate unless social equity required modification in that rate structure. This has probably occurred in your situation. Insureds with similar characteristics are placed in the same class and charged the same rate. However, your accidents have probably placed you in a different classification. Your premium is based on the loss experience for policyholders in your classification. (correct answer, your response) Your neighbor has probably received a credit based on the length of time he has had his policy with the company. This is not unfairly discriminatory because it is available to all policyholders over time. Your neighbor has been placed in a preferred category of policyholders, which gives him rights and privileges that you do not have. Your neighbor has been given a rate reduction based on excess profits that have been returned to policyholders. Points earned: 1 out of 1

15. In a northeastern state, Stable Insurance, an old and established insurance company that writes homeowners insurance in the northeast experienced three unprofitable years in a row. Large winter storms resulted in damage to homes that Stable insured. The losses for the last three years have drained the company's financial resources. At the end of the third year of the losses, Stable declared bankruptcy when it became insolvent. Stable was unable to pay for the claims that resulted from the last storm. Ted Van Wrinkle is a policyholder with Stable who filed a claim as a result of the last storm. Ted's house was damaged when the weight of snow and ice collapsed a portion of his roof. How will Ted be paid for his loss? Ted must join as a creditor in Stable's bankruptcy and receive a portion of his loss. The guaranty fund in Ted's state will pay for Ted's losses. (correct answer, your response) Ted will not be paid because there is no system to cover insolvency caused by underwriting losses.

The state government will provide compensation to Ted through the state's FAIR plan. Points earned: 1 out of 1

4 of 5

3/15/2014 8:00 PM

Quia - INS 21 Quiz 2: session ins 21 chapter 2

http://www.quia.com/quiz/567684.html?AP_rand=764043494

16. Some communities in the United States celebrate holidays with firecrackers. Firecracker vendors erect stands in the parking lot of shopping centers before the holidays.

One shopping center owner sponsoring a firecracker vendor's booth found that his insurance did not cover the exposure. He found that none of the insurers licensed to do business in the state sold insurance coverage for the exposures.

How can the shopping center owner obtain appropriate coverage for the exposure from the firecracker vendor's booth? By obtaining coverage through the excess and surplus lines market. (correct answer, your response)

By pooling the risk with other shopping center owners with similar exposures. Through a proportionate sharing arrangement with multipleinsurers. From alien insurers in countries that also celebrate holidays with firecrackers. Points earned: 1 out of 1

Done

Try again

5 of 5

3/15/2014 8:00 PM

You might also like

- Cpcu 520 TocDocument2 pagesCpcu 520 Tocshanmuga89No ratings yet

- Side by Side 1 Test 2Document3 pagesSide by Side 1 Test 2nlucy2226100% (1)

- Ains 21Document3 pagesAins 21Anonymous 0JhO3Kdj0% (1)

- INS 22 Chapter 1,2,3,4 With AnswersDocument26 pagesINS 22 Chapter 1,2,3,4 With Answerschinnipvp100% (2)

- Ins-24 Chapter - Wise - Question - Bank2Document181 pagesIns-24 Chapter - Wise - Question - Bank2Shubh100% (2)

- INS22 Revision GuideDocument58 pagesINS22 Revision GuideSABIR KHAN75% (4)

- CPCU 520 Mid Term Exam Answer Guide V 2Document9 pagesCPCU 520 Mid Term Exam Answer Guide V 2asdfsdfNo ratings yet

- Test - INS 21 - Chapter - QuizletDocument8 pagesTest - INS 21 - Chapter - QuizletHuma0% (1)

- Ins 21Document23 pagesIns 21Praveen NayakNo ratings yet

- Ins 21 DumpDocument28 pagesIns 21 DumpSourav Dhar100% (2)

- Ains 21 Answers To The Questions in The Course Guide 6th EditionDocument6 pagesAins 21 Answers To The Questions in The Course Guide 6th Editioncrazymanu4100% (1)

- INS21 - Revision GuideDocument112 pagesINS21 - Revision GuideManish Mahaseth100% (1)

- CPCU 500 2e TOCDocument2 pagesCPCU 500 2e TOCshanmuga89100% (1)

- INS21 Basic NotesDocument61 pagesINS21 Basic Notesashher.aamir1858100% (1)

- General Insurance INS21Document78 pagesGeneral Insurance INS21geoscribblesNo ratings yet

- UnderwritingDocument26 pagesUnderwritingAniruddh KeswaniNo ratings yet

- Miscellaneous Manual 1Document507 pagesMiscellaneous Manual 1shrey12467% (3)

- UGA RMIN 4000 Exam 3 Study GuideDocument30 pagesUGA RMIN 4000 Exam 3 Study GuideBrittany Danielle ThompsonNo ratings yet

- Nakshatra Flash CardsDocument9 pagesNakshatra Flash Cardstoll_me100% (1)

- TESLA India Marketing PlanDocument3 pagesTESLA India Marketing PlanAvinash SinhaNo ratings yet

- Lesson 8 Homework Practice Solve Systems of Equations Algebraically PDFDocument4 pagesLesson 8 Homework Practice Solve Systems of Equations Algebraically PDFChadNo ratings yet

- Ins 21Document77 pagesIns 21Adithya KumarNo ratings yet

- INS 21 QuestionsDocument9 pagesINS 21 QuestionskillerproNo ratings yet

- Ins - 21-1Document13 pagesIns - 21-1Siddharth Kulkarni100% (1)

- Ins21 9 10Document60 pagesIns21 9 10Kallal NathNo ratings yet

- Ins 21Document99 pagesIns 21Manoj Sanhotra0% (1)

- INS21 - Q N ADocument28 pagesINS21 - Q N AMiniP.Kumar100% (1)

- INS 21 - Chapter 1 - Insurance - What Is ITDocument9 pagesINS 21 - Chapter 1 - Insurance - What Is ITRaghuNo ratings yet

- CPCU 500 HandoutsDocument10 pagesCPCU 500 HandoutsGanesh RajNo ratings yet

- INS 21 - Basics of ClaimsDocument9 pagesINS 21 - Basics of ClaimsThirunavukkarasu AnandanNo ratings yet

- Assignment 1 Assignment 4Document3 pagesAssignment 1 Assignment 4shanmuga89100% (1)

- CPCU 520-Ch 8-Reinsurance-Notes Session QuestionsDocument6 pagesCPCU 520-Ch 8-Reinsurance-Notes Session QuestionsasdfsdfNo ratings yet

- Underwriting and Ratemaking: Why Underwriting? What Is Its Purpose?Document27 pagesUnderwriting and Ratemaking: Why Underwriting? What Is Its Purpose?vijaijohn100% (1)

- CPCU 520 Chapter 5 Risk Control and Premium Auditing Session QuizDocument2 pagesCPCU 520 Chapter 5 Risk Control and Premium Auditing Session QuizasdfsdfNo ratings yet

- CPCU 520 Chapter 1 Overview of Insurance OperationsDocument7 pagesCPCU 520 Chapter 1 Overview of Insurance OperationsasdfsdfNo ratings yet

- Ins 21 Dump - FinalDocument41 pagesIns 21 Dump - Finalanurag_goyal_1586% (7)

- Syllabus For INS ExamsDocument2 pagesSyllabus For INS ExamsNitin Kolte100% (1)

- CPCUScholarship CorporateCustomersDocument2 pagesCPCUScholarship CorporateCustomersShanmuganathan RamanathanNo ratings yet

- CPCU 520 Chapter 5 Risk Control and Premium Audit Session NotesDocument7 pagesCPCU 520 Chapter 5 Risk Control and Premium Audit Session NotesasdfsdfNo ratings yet

- Liability (Casualty) InsuranceDocument17 pagesLiability (Casualty) InsuranceMvn VinayNo ratings yet

- Chapter Definitions AINS 21Document38 pagesChapter Definitions AINS 21HumaKhursheedNo ratings yet

- Cpcu 500Document56 pagesCpcu 500Ann MungalNo ratings yet

- A Cat Bond Premium Puzzle?: Financial Institutions CenterDocument36 pagesA Cat Bond Premium Puzzle?: Financial Institutions CenterchanduNo ratings yet

- Ins 21Document6 pagesIns 21arun_thssNo ratings yet

- How To Prepare For Institute Exams HandbookDocument36 pagesHow To Prepare For Institute Exams Handbookbanu_mageswariNo ratings yet

- AINS 21 Assignment 5 UnderwritingDocument26 pagesAINS 21 Assignment 5 UnderwritingRowdy HbkNo ratings yet

- INS 21 Chapter 8-Loss ExposuresDocument20 pagesINS 21 Chapter 8-Loss Exposuresvenki_hinfotechNo ratings yet

- INS21 Chapter 5 PDFDocument30 pagesINS21 Chapter 5 PDFRakesh MalhotaraNo ratings yet

- INS21MOCQDocument37 pagesINS21MOCQcriespin0% (1)

- INS 21 Chapters 2-Insurers and How They Are RegulatedDocument22 pagesINS 21 Chapters 2-Insurers and How They Are Regulatedvenki_hinfotechNo ratings yet

- INS21 Chapter 4 PDFDocument32 pagesINS21 Chapter 4 PDFRakesh MalhotaraNo ratings yet

- WM Insurance Set 3 Insurance PricingDocument10 pagesWM Insurance Set 3 Insurance PricingRohit GhaiNo ratings yet

- Question Answer FINALDocument47 pagesQuestion Answer FINALLalit Barhate78% (9)

- Ains 22Document5 pagesAins 22blokeNo ratings yet

- 2016 The Institutes Full CatalogDocument40 pages2016 The Institutes Full CatalogJeremy JarvisNo ratings yet

- CPCU 500 1 Transcript 1Document11 pagesCPCU 500 1 Transcript 1asdfsdfNo ratings yet

- CA Casualty Educational ObjectivesDocument40 pagesCA Casualty Educational ObjectiveshasupkNo ratings yet

- Claim Settlement of GICDocument51 pagesClaim Settlement of GICSusilPandaNo ratings yet

- Team 3 Group InsuranceDocument42 pagesTeam 3 Group InsuranceAnonymous Ua8mvPkNo ratings yet

- INS21 Chapter 7 PDFDocument30 pagesINS21 Chapter 7 PDFRakesh Malhotara100% (1)

- Grievance Redressal Process: Click HereDocument7 pagesGrievance Redressal Process: Click HereRakshi BegumNo ratings yet

- Insurance and Pension Funds Class SlidesDocument49 pagesInsurance and Pension Funds Class Slidesrunescape3203No ratings yet

- PP20200318Document10 pagesPP20200318toll_meNo ratings yet

- Child: General Passport ApplicationDocument8 pagesChild: General Passport Applicationtoll_meNo ratings yet

- Rental Agency - HopestartDocument8 pagesRental Agency - Hopestarttoll_meNo ratings yet

- Ke Mo Natal Chart Ma As Su (Ju) Natal Chart D-9Document2 pagesKe Mo Natal Chart Ma As Su (Ju) Natal Chart D-9toll_meNo ratings yet

- (Sa) Ke As Ve (Sa) Ke As (Ju) Su: Vimsottari Dasa : Sat Merc Ket Ven Sun Moon Mars Rah JupDocument2 pages(Sa) Ke As Ve (Sa) Ke As (Ju) Su: Vimsottari Dasa : Sat Merc Ket Ven Sun Moon Mars Rah Juptoll_meNo ratings yet

- PP 2019 07 05 PDFDocument2 pagesPP 2019 07 05 PDFtoll_meNo ratings yet

- Prash An 20180729Document1 pagePrash An 20180729toll_meNo ratings yet

- As Ju Ve Su Mo Me Sa Me Mo Ra As Ve Ma Sa Su: PrashnaDocument2 pagesAs Ju Ve Su Mo Me Sa Me Mo Ra As Ve Ma Sa Su: Prashnatoll_meNo ratings yet

- As (Ju) (Sa) Ke (Sa) Ke As Ve (Ju) : Vimsottari Dasa : Ven Sun Moon Mars Rah Jup Sat Merc KetDocument2 pagesAs (Ju) (Sa) Ke (Sa) Ke As Ve (Ju) : Vimsottari Dasa : Ven Sun Moon Mars Rah Jup Sat Merc Kettoll_meNo ratings yet

- As As Ra Su Me Mo (Ju) : Vimsottari Dasa : Merc Ket Ven Sun Moon Mars Rah Jup SatDocument2 pagesAs As Ra Su Me Mo (Ju) : Vimsottari Dasa : Merc Ket Ven Sun Moon Mars Rah Jup Sattoll_meNo ratings yet

- PP 2019 07 05 PDFDocument5 pagesPP 2019 07 05 PDFtoll_meNo ratings yet

- As Mo (Ju) Ke As Ra Ve Mo (Ju) : Vimsottari Dasa : Rah Jup Sat Merc Ket Ven Sun Moon MarsDocument2 pagesAs Mo (Ju) Ke As Ra Ve Mo (Ju) : Vimsottari Dasa : Rah Jup Sat Merc Ket Ven Sun Moon Marstoll_meNo ratings yet

- As Su Mo Me Ju (Ve) Ma As Ju Sa Su: PrashnaDocument2 pagesAs Su Mo Me Ju (Ve) Ma As Ju Sa Su: Prashnatoll_meNo ratings yet

- Mo As Ra Su Me Ju Ve Ra As: PrashnaDocument3 pagesMo As Ra Su Me Ju Ve Ra As: Prashnatoll_meNo ratings yet

- (Ma) Ke As Mo Ke As (Ma) (Me) Ju: Vimsottari Dasa : Jup Sat Merc Ket Ven Sun Moon Mars RahDocument1 page(Ma) Ke As Mo Ke As (Ma) (Me) Ju: Vimsottari Dasa : Jup Sat Merc Ket Ven Sun Moon Mars Rahtoll_meNo ratings yet

- Ra As Su (Ve) Me Ju Su Mo As Sa Ju Ra: PrashnaDocument2 pagesRa As Su (Ve) Me Ju Su Mo As Sa Ju Ra: Prashnatoll_meNo ratings yet

- Legacy DesignDocument42 pagesLegacy Designtoll_meNo ratings yet

- Mo As Ra Su Me Ju Ve Ra As: PrashnaDocument2 pagesMo As Ra Su Me Ju Ve Ra As: Prashnatoll_meNo ratings yet

- Prash Na 20190105Document2 pagesPrash Na 20190105toll_meNo ratings yet

- (Ma) Ke As Ve As Ra Mo: PrashnaDocument1 page(Ma) Ke As Ve As Ra Mo: Prashnatoll_meNo ratings yet

- BCP Sampathkumar1Document1 pageBCP Sampathkumar1toll_meNo ratings yet

- Prash An A 07062018Document1 pagePrash An A 07062018toll_meNo ratings yet

- Prash An 20180729 ADocument1 pagePrash An 20180729 Atoll_meNo ratings yet

- As Su Me Ra (Ma) Ke Su Ve (Sa) As Mo Ra: PrashnaDocument1 pageAs Su Me Ra (Ma) Ke Su Ve (Sa) As Mo Ra: Prashnatoll_meNo ratings yet

- Forex Card RatesDocument3 pagesForex Card Ratestoll_meNo ratings yet

- Ke As Ju Me Mo As Ju Ma Ve Sa: GatesDocument2 pagesKe As Ju Me Mo As Ju Ma Ve Sa: Gatestoll_meNo ratings yet

- 1972 Walt Disney World Information GuideDocument19 pages1972 Walt Disney World Information GuideRusty Shackleford100% (1)

- Hydra 3000 PLUS: Instruction HandbookDocument36 pagesHydra 3000 PLUS: Instruction HandbookAlessandro CavalieriNo ratings yet

- Assignment 3 LRWIIDocument4 pagesAssignment 3 LRWIIAnonymous DxiKHQNo ratings yet

- Od 211803749331925000Document1 pageOd 211803749331925000rahulNo ratings yet

- Case StudyDocument9 pagesCase StudyKaushal AgrawalNo ratings yet

- 4 (A) - Financial AnalysistsDocument2 pages4 (A) - Financial AnalysistsAneesh KrishnaNo ratings yet

- N. G. L. Hammond - The Illyrian Atintani, The Epirotic Atintanes and The Roman ProtectorateDocument16 pagesN. G. L. Hammond - The Illyrian Atintani, The Epirotic Atintanes and The Roman ProtectorateHalil İbrahim ŞimşekNo ratings yet

- Instant Download Advances in Computational and Bio-Engineering: Proceeding of the International Conference on Computational and Bio Engineering, 2019, Volume 1 S. Jyothi PDF All ChaptersDocument62 pagesInstant Download Advances in Computational and Bio-Engineering: Proceeding of the International Conference on Computational and Bio Engineering, 2019, Volume 1 S. Jyothi PDF All Chapterszizimanaja100% (3)

- Project T 3Document23 pagesProject T 3khanhngoc08062010No ratings yet

- Piaggio Liberty 100 Liberty 100 4T (Vietnam) 2011-2014 PDFDocument82 pagesPiaggio Liberty 100 Liberty 100 4T (Vietnam) 2011-2014 PDFMegahahdy Anugrah0% (1)

- National AnthemDocument2 pagesNational AnthemCuon Scout GroupNo ratings yet

- Bakari832017ARJOM34769 PDFDocument7 pagesBakari832017ARJOM34769 PDFJc UyNo ratings yet

- Smog Check Inspection Procedures Visible Smoke TestDocument4 pagesSmog Check Inspection Procedures Visible Smoke TestmarcosperesNo ratings yet

- Photo and Video Voyeurism 1Document9 pagesPhoto and Video Voyeurism 1SJ BatallerNo ratings yet

- 1-Sabitsana JR Vs VillamorDocument7 pages1-Sabitsana JR Vs VillamorIra CanonizadoNo ratings yet

- Digital Logic Design: Dr. Kenneth WongDocument36 pagesDigital Logic Design: Dr. Kenneth WongRohit Kumar100% (1)

- Contract of Lease: LOLITA PAULO-OROZCO, of Legal Age, Married To SANTIAGO B. OROZCO, Filipino and WithDocument4 pagesContract of Lease: LOLITA PAULO-OROZCO, of Legal Age, Married To SANTIAGO B. OROZCO, Filipino and WithSanson OrozcoNo ratings yet

- Colonel Edward Buncombe of The Fifth NC RegimentDocument26 pagesColonel Edward Buncombe of The Fifth NC Regimentironmonger_captainNo ratings yet

- Grade 4.A Time To Remember - Postest.silentDocument2 pagesGrade 4.A Time To Remember - Postest.silentRoliet Jean TejadaNo ratings yet

- Insights After The WebinarDocument27 pagesInsights After The WebinarJENNY ESCOBIDONo ratings yet

- Thesis Statement Example ArtDocument5 pagesThesis Statement Example ArtScott Faria100% (2)

- Maryland Aquatic Nurseries: 2015 Retail Catalog &guideDocument56 pagesMaryland Aquatic Nurseries: 2015 Retail Catalog &guidejwarswolvesNo ratings yet

- Mariños Clase 12Document3 pagesMariños Clase 12Melany MariñosNo ratings yet

- Grade 9 - 2nd Quarter - Week 8 Day 3 - 4Document17 pagesGrade 9 - 2nd Quarter - Week 8 Day 3 - 4zero kakumaruNo ratings yet

- BOSLAND, VOTAVA, 2012 (E-Book) PDFDocument243 pagesBOSLAND, VOTAVA, 2012 (E-Book) PDFSilvio OrtolanNo ratings yet

- War HorseDocument2 pagesWar Horseapi-516308888No ratings yet

- Instructions Toyota Celica W50 5 Speed - Chrysler Valiant Slant 6cyl 170 2251Document1 pageInstructions Toyota Celica W50 5 Speed - Chrysler Valiant Slant 6cyl 170 2251leighroy87No ratings yet