Concept Checkers

Concept Checkers

Uploaded by

Anh Óng ÁnhCopyright:

Available Formats

Concept Checkers

Concept Checkers

Uploaded by

Anh Óng ÁnhCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Concept Checkers

Concept Checkers

Uploaded by

Anh Óng ÁnhCopyright:

Available Formats

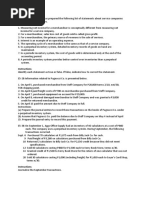

1. Which of the following statements least accurately describes a role of financial statement analysis? a.

Use the information in financial statements to make economics decisions. b. Provide reasonable assurance that the financial statements are free of material errors. c. Evaluate an entitys financial position and past performance to form opinions about its 2. A firms financial position at a specific point in time is reported in the: a. Balance sheet b. Income statement c. Cash flow statement 3. Information about accounting estimates, assumptions, and methods chosen for reporting is most likely found in: a. The auditors opinion b. Financial statement notes. c. Managements Discussion and analysis 4. If auditor finds that a companys financial statements have a specific exception to applicable accounting principles, she is most likely to issue a: a. Dissenting opinion b. Cautionary note c. Qualified opinion 5. Which of these steps is least likely to be a part of the financial statement analysis framework? a. State the purpose and context of the analysis. b. Determine whether the companys securities are suitable for the client c. Adjust the financial statement data and compare the company to its industry peers.

Financial Reporting Mechanics

1, Accounts receivable and accounts payable are most likely classified as which financial statement elements? Accounts receivable A. B. C. Assets Liabilities Revenue Accounts payable Liabilities Assets Liabilities

2. The accounting equation is least accurately stated as: A. openers equity = liabilities assets. B. ending retained earnings = assets contributed capital liabilities. C. Assets = liabilities + contributed capital + beginning retained earnings + revenue expenses dividends. 3. An electrician repaired the light fixtures in a retail shop on October 24 and sent the bill to the shop on November 3. If both the electrician and the shop prepare financial statement under the accrual method on October 31, how will they each record this transaction? Electrician A. B. C. Accrued revenue Accrued expense Unearned revenue Retail Shop Accrued expense Prepaid expense Accrued expense

4. If a firm raises $10 million by issuing new common stock, which of its financial statements will reflect the transactions? A. Income statement and statement of owners equity B. Balance sheet; income statement, and cash flow statement C. Balance sheet; cash flow statement, and statement of owners equity.

Paul was unemployed and unable to find a job. He therefore decided to open a business venture. New Year was approaching, and so he decided to buy gift wrapping paper from a local supplier and to sell it on the corner of his local high street. He felt that the price of wrapping paper in high street shops was too high. This provided him with a useful business opportunity. He began the venture with $40 of his own money, in cash. On Monday, Pauls first day of trading, he bought wrapping paper for $40 and sold three-quarter of it for $45 in cash. A, What cash movements took place during Monday? ( Cash flow statement) B, How much wealth ( that is, profit) was generated by the business during Monday? (Income statement) C, What is the accumulated wealth at Monday evening? ( Balance sheet) On Tuesday, Paul bought more wrapping paper for $20 cash. He managed to sell all of the new inventories and all of the earlier inventories, for a total of $48. What happened to the financial statements for Pauls business? On Wednesday, Paul bought more wrapping paper for $46 cash. However, it was raining hard for much of the day and sales were slow. After Paul had sold half of his total inventories for $32, he decided to stop trading until Thursday morning. Have a go at drawing up the three financial statements for Pauls business for Wednesday.

Statement of cash flows for Monday Opening balance (cash introduced) Cash from sales of wrapping paper Cash paid to buy wrapping paper (40) Closing balance of cash 45 The statement shows that Paul placed 40 cash into the business. The business received 45 cash from customers, but paid 40 cash to buy the wrapping paper. This left 45 of cash by Monday evening. How much wealth (that is, profit) was generated by the business during Monday? Income statement (profit and loss account) for Monday Sales revenue 45 Cost of goods sold ( 3/4 of 40) (30) Profit 15 Note that it is only the cost of the wrapping paper sold that is matched against (and deducted from) the sales 40 45

revenue in order to find the profit, not the whole of the cost of wrapping paper acquired. Any unsold inventories (in this case 1/4 of 40 = 10) will be charged against the future sales revenue that they generate. What is the accumulated wealth at Monday evening? Statement of financial position (balance sheet) as at Monday evening Cash (closing balance) 45 Inventories of goods for resale ( 1/4 of 40) 10 Total assets 55 Equity 55 Let us now continue with our example. On Tuesday, Paul bought more wrapping paper for 20 cash. He managed to sell all of the new inventories and all of the earlier inventories, for a total of 48. The statement of cash flows for Tuesday will be as follows:

Statement of cash flows for Tuesday Opening balance (from Monday evening) 45 Cash from sales of wrapping paper 48 Cash paid to buy wrapping paper (20) Closing balance 73 The income statement for Tuesday will be as follows: Income statement for Tuesday Sales revenue 48 Cost of goods sold (20 + 10) (30) Profit 18 The statement of financial position as at Tuesday evening will be: Statement of financial position as at Tuesday evening

Cash (closing balance) 73 Inventories Total assets 73 Equity 73 On Wednesday, Paul bought more wrapping paper for 46 cash. However, it was raining hard for much of the day and sales were slow. After Paul had sold half of his total inventories for 32, he decided to stop trading until Thursday morning. Have a go at drawing up the three financial statements for Pauls business for Wednesday. Statement of cash flows for Wednesday Opening balance (from Tuesday evening) 73 Cash from sales of wrapping paper 32 Cash paid to buy wrapping paper (46) Closing balance 59

Income statement for Wednesday Sales revenue 32 Cost of goods sold ( 1/2 of 46) (23) Profit 9 Statement of financial position as at Wednesday evening Cash (closing balance) Inventories ( 1/2 of 46) Total assets Equity

59 23 82 82

You might also like

- JaipurDocument233 pagesJaipurvishalNo ratings yet

- Third Element of The Blood, Antoine Béchamp, 1994, Unless IndicatedDocument5 pagesThird Element of The Blood, Antoine Béchamp, 1994, Unless IndicatedChris ChristodoulidisNo ratings yet

- Change Capture Stage - Lookup StageDocument10 pagesChange Capture Stage - Lookup Stagevin_hiworldNo ratings yet

- Bayley Scales of Infant and Toddler Development - Third Edition (Bayley-III)Document2 pagesBayley Scales of Infant and Toddler Development - Third Edition (Bayley-III)Mihaela Grigoroiu100% (2)

- Practice Test Chap 56Document8 pagesPractice Test Chap 56Jayr OcoyNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Prophet Muhammad (P.b.u.h) Exorcised People Possessed by Jinns.Document12 pagesProphet Muhammad (P.b.u.h) Exorcised People Possessed by Jinns.al_tauheedNo ratings yet

- P14B28 International Accounting: The Principal Financial Accounting StatementsDocument42 pagesP14B28 International Accounting: The Principal Financial Accounting StatementsPang ColasaNo ratings yet

- Incomplete RecordsDocument13 pagesIncomplete RecordsSylvan Muzumbwe MakondoNo ratings yet

- Chapter 4 5 6Document4 pagesChapter 4 5 6nguyen2190No ratings yet

- Profit and Loss AccountDocument32 pagesProfit and Loss AccountBayezid Hossain100% (1)

- Harrison Chapter 6 StudentDocument48 pagesHarrison Chapter 6 StudentDakshin SooryaNo ratings yet

- Taller Seis Acco 111Document44 pagesTaller Seis Acco 111api-274120622No ratings yet

- Chap 5 All DoneDocument3 pagesChap 5 All DoneDavid100% (1)

- Chapter 4,5,6 QuizzesDocument22 pagesChapter 4,5,6 QuizzesAnonymous aPQWrwo3iiNo ratings yet

- Business Junior CertDocument9 pagesBusiness Junior CertCathal O' GaraNo ratings yet

- Budgeted Cash Disbursements For Merchandise PurchasesDocument27 pagesBudgeted Cash Disbursements For Merchandise PurchasesMavis LiuNo ratings yet

- Chap 004Document45 pagesChap 004Yuti XianNo ratings yet

- Final Exam Finacc1Document11 pagesFinal Exam Finacc1Grace A. ManaloNo ratings yet

- Master BudgetDocument32 pagesMaster BudgetxodiacNo ratings yet

- Group Assignment BRF FinalDocument4 pagesGroup Assignment BRF Finalramgarhiad48No ratings yet

- BA 115 - Master Budgeting ExercisesDocument2 pagesBA 115 - Master Budgeting ExercisesLance EstopenNo ratings yet

- CH 6 (2023-Markup)Document43 pagesCH 6 (2023-Markup)Савелий СмирновNo ratings yet

- Excercises MerchandisingDocument4 pagesExcercises MerchandisingRenz AbadNo ratings yet

- POA1-Assignment - Chapter 5 - QDocument5 pagesPOA1-Assignment - Chapter 5 - QAuora Bianca100% (1)

- Inventories QuestionnaireDocument9 pagesInventories QuestionnaireKristine JavierNo ratings yet

- Acct 220 Final Exam UmucDocument10 pagesAcct 220 Final Exam UmucOmarNiemczyk0% (2)

- Exam #2Document5 pagesExam #2Anonymous AMfLQKpjklNo ratings yet

- Merchandising CompaniesDocument8 pagesMerchandising Companiesmagdy kamelNo ratings yet

- BF Test 04-03-2022Document7 pagesBF Test 04-03-2022florin.fleetNo ratings yet

- Completing The Merchandising Accounting CycleDocument40 pagesCompleting The Merchandising Accounting CycleChloe LynnesseNo ratings yet

- The Gross Profit Method For Estimated Ending InventoryDocument4 pagesThe Gross Profit Method For Estimated Ending InventoryKeith Joanne Santiago100% (2)

- Mbb7008M - Accounting and Finance For Decision Making Assessment I (Resit) Part A - Multiple Choice Questions (2 Marks Each)Document7 pagesMbb7008M - Accounting and Finance For Decision Making Assessment I (Resit) Part A - Multiple Choice Questions (2 Marks Each)Musa HijazeenNo ratings yet

- Budgeted Cash Disbursements For Merchandise Purchases Course Project ADocument19 pagesBudgeted Cash Disbursements For Merchandise Purchases Course Project AitlnkickerNo ratings yet

- Advance Financial Accounting Group Assig. by Gurmu EphremDocument5 pagesAdvance Financial Accounting Group Assig. by Gurmu Ephremsosina eseyew100% (1)

- ACCT Midterm 2Document26 pagesACCT Midterm 2Gene'sNo ratings yet

- Cash Flow Forecasts: Business StudiesDocument5 pagesCash Flow Forecasts: Business StudiesimzzzzNo ratings yet

- Man Acc Qs 1Document6 pagesMan Acc Qs 1Tehniat Zafar0% (1)

- CB Practice ProblemsDocument18 pagesCB Practice ProblemsAllan Leo Paran17% (6)

- InventoriesDocument47 pagesInventoriesMarjorie NepomucenoNo ratings yet

- Cost II Chap3Document11 pagesCost II Chap3abelNo ratings yet

- Lecture Notes Chapters 1-4Document28 pagesLecture Notes Chapters 1-4BlueFireOblivionNo ratings yet

- 201 - 19-20 Practice FinalDocument21 pages201 - 19-20 Practice FinalRahadian ToramNo ratings yet

- ACC1002X Optional Questions - SOLUTIONS CHP 2Document6 pagesACC1002X Optional Questions - SOLUTIONS CHP 2edisonctrNo ratings yet

- Introduction To Accounting - AbeDocument17 pagesIntroduction To Accounting - AbePatriqKaruriKimbo100% (1)

- Aptitude Test 1Document19 pagesAptitude Test 1Ngọc Hà NguyễnNo ratings yet

- As Practice Paper 4Document9 pagesAs Practice Paper 4FarrukhsgNo ratings yet

- Entrepreneurship Week 11Document32 pagesEntrepreneurship Week 11Muhammad AzharNo ratings yet

- Retail Inventory Concepts and CalculationsDocument21 pagesRetail Inventory Concepts and CalculationsSanghamitra KalitaNo ratings yet

- Chapter 5 Inventory AccountingDocument57 pagesChapter 5 Inventory Accountinghosie.oqbe100% (1)

- Chapter 7Document26 pagesChapter 7EricKHLeawNo ratings yet

- AE24 Lesson 5Document9 pagesAE24 Lesson 5Majoy BantocNo ratings yet

- Ch05-Accounting PrincipleDocument9 pagesCh05-Accounting PrincipleEthanAhamed100% (2)

- Unit 2 TestDocument7 pagesUnit 2 TestThetMon HanNo ratings yet

- Master Budgeting Video SlidesDocument35 pagesMaster Budgeting Video SlidesArefeen HridoyNo ratings yet

- Financial AccountingDocument20 pagesFinancial AccountingVarun SoniNo ratings yet

- Chap008 Budgets ProfitPLanningDocument89 pagesChap008 Budgets ProfitPLanningStack1nPaperNo ratings yet

- Diskusi Mid Test - Meeting 7Document26 pagesDiskusi Mid Test - Meeting 7Jimmy LimNo ratings yet

- This Activity Contains 30 QuestionsDocument19 pagesThis Activity Contains 30 QuestionsSylvan Muzumbwe MakondoNo ratings yet

- Sales Tax: Calculation of Sales Tax Double Entries Ledger Accounts of Sales Tax Practice Questions Answer BankDocument10 pagesSales Tax: Calculation of Sales Tax Double Entries Ledger Accounts of Sales Tax Practice Questions Answer BankUmar Sageer100% (1)

- Drills - Comprehensive BudgetingDocument11 pagesDrills - Comprehensive BudgetingDan RyanNo ratings yet

- Very Awkward Tax: A bite-size guide to VAT for small businessFrom EverandVery Awkward Tax: A bite-size guide to VAT for small businessNo ratings yet

- Introduction to Business English (Words and Their Secrets)From EverandIntroduction to Business English (Words and Their Secrets)No ratings yet

- Operating a Business and Employment in the United Kingdom: Part Three of The Investors' Guide to the United Kingdom 2015/16From EverandOperating a Business and Employment in the United Kingdom: Part Three of The Investors' Guide to the United Kingdom 2015/16No ratings yet

- A.jjeb.s.6 Cre Paper 1Document2 pagesA.jjeb.s.6 Cre Paper 1gimbodaphine24No ratings yet

- Lecture 32Document40 pagesLecture 32Abdesselem BoulkrouneNo ratings yet

- Top 10 Payroll Interview Questions and AnswersDocument16 pagesTop 10 Payroll Interview Questions and Answersmanrijonha100% (2)

- 14 Chapter 08Document55 pages14 Chapter 08Anil DNo ratings yet

- How Can I Build A Powerful Electromagnet Using A Nine Volt Battery and Easily Available Material - Yahoo! AnswersDocument2 pagesHow Can I Build A Powerful Electromagnet Using A Nine Volt Battery and Easily Available Material - Yahoo! AnswersDayal SaranNo ratings yet

- Vijay Singh & Anr Vs State of M.P On 25 March, 1947 PDFDocument4 pagesVijay Singh & Anr Vs State of M.P On 25 March, 1947 PDFSandeep Kumar VermaNo ratings yet

- Pembaharuan System Pendidikan Di Pesantren: (Studi Kasus Di Pondok Pesantren An-Nur Rejosari, Pakis, Magelang)Document18 pagesPembaharuan System Pendidikan Di Pesantren: (Studi Kasus Di Pondok Pesantren An-Nur Rejosari, Pakis, Magelang)Ade RoinwowanNo ratings yet

- A Companion To Plautus - (Chapter 22 Gender and Sexuality in Plautus)Document16 pagesA Companion To Plautus - (Chapter 22 Gender and Sexuality in Plautus)Roberto SuazoNo ratings yet

- One Page Strategic PlanDocument3 pagesOne Page Strategic Planrajenrao51777564No ratings yet

- Arseny TarkovskyDocument9 pagesArseny TarkovskyGazeta_int100% (2)

- The Sankhya DarshanaDocument109 pagesThe Sankhya DarshanajayantsNo ratings yet

- In The U.S. Navy-Marine Corps Court of Criminal Appeals Washington Navy Yard Washington, D.C. Before W.L. Ritter C.L. Scovel M.J. SuszanDocument4 pagesIn The U.S. Navy-Marine Corps Court of Criminal Appeals Washington Navy Yard Washington, D.C. Before W.L. Ritter C.L. Scovel M.J. Suszananon-725581No ratings yet

- Consortium of National Law Universities: Provisional 4th List - CLAT 2022 - UGDocument6 pagesConsortium of National Law Universities: Provisional 4th List - CLAT 2022 - UGArshi SachanNo ratings yet

- Ahle Bait Fil QuranDocument264 pagesAhle Bait Fil QuranSWHRZ'sNo ratings yet

- This Study Resource WasDocument2 pagesThis Study Resource Wasabhi74No ratings yet

- Critical Analysis of A Spanish Lover by Joanna TrollopeDocument4 pagesCritical Analysis of A Spanish Lover by Joanna TrollopemmvrochaNo ratings yet

- Impact of Business Communication On Organizational Performance in Nigerian CompaniesDocument1 pageImpact of Business Communication On Organizational Performance in Nigerian CompaniesJayakar GadiNo ratings yet

- Seven Key Challenges in Assessing SME Credit Risk: WhitepaperDocument4 pagesSeven Key Challenges in Assessing SME Credit Risk: WhitepaperatiqNo ratings yet

- Economics and Optimization TechniquesDocument163 pagesEconomics and Optimization TechniquesKiran KuppaNo ratings yet

- Interpreting Measures of PositionDocument13 pagesInterpreting Measures of PositionKristine HensonNo ratings yet

- Interaction Process AnalysisDocument3 pagesInteraction Process AnalysisAngie MandeoyaNo ratings yet

- MATLAB Code For Amplitude ModulationDocument2 pagesMATLAB Code For Amplitude ModulationKazi Barakat50% (2)

- The Affecting Factors of Reject Bottles in Bottle Washing MachineDocument7 pagesThe Affecting Factors of Reject Bottles in Bottle Washing MachineInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Features FNCP:: Health Nursing ProblemsDocument12 pagesFeatures FNCP:: Health Nursing Problemsrodeliza100% (2)

- Sura Tin BanglaDocument1 pageSura Tin Bangladrshahidul777No ratings yet