0 ratings0% found this document useful (0 votes)

82 viewsPrice Earnings Ratio: Definition: PE Market Price Per Share / Earnings Per Share

Price Earnings Ratio: Definition: PE Market Price Per Share / Earnings Per Share

Uploaded by

Anuradha SharmaThis document discusses price-earnings (PE) ratios and their relationship to fundamentals. It begins by defining the PE ratio and noting variants based on how price and earnings are defined. It then discusses how PE ratios relate to growth, risk, and payout/return on equity based on discounted cash flow models. The document provides examples of how expected growth, risk, and payout affect PE ratios. It also compares PE ratios across markets and over time to illustrate how macroeconomic factors can influence PE ratios.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Price Earnings Ratio: Definition: PE Market Price Per Share / Earnings Per Share

Price Earnings Ratio: Definition: PE Market Price Per Share / Earnings Per Share

Uploaded by

Anuradha Sharma0 ratings0% found this document useful (0 votes)

82 views81 pagesThis document discusses price-earnings (PE) ratios and their relationship to fundamentals. It begins by defining the PE ratio and noting variants based on how price and earnings are defined. It then discusses how PE ratios relate to growth, risk, and payout/return on equity based on discounted cash flow models. The document provides examples of how expected growth, risk, and payout affect PE ratios. It also compares PE ratios across markets and over time to illustrate how macroeconomic factors can influence PE ratios.

Original Description:

earn mult

Original Title

Earn Mult

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

This document discusses price-earnings (PE) ratios and their relationship to fundamentals. It begins by defining the PE ratio and noting variants based on how price and earnings are defined. It then discusses how PE ratios relate to growth, risk, and payout/return on equity based on discounted cash flow models. The document provides examples of how expected growth, risk, and payout affect PE ratios. It also compares PE ratios across markets and over time to illustrate how macroeconomic factors can influence PE ratios.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

82 views81 pagesPrice Earnings Ratio: Definition: PE Market Price Per Share / Earnings Per Share

Price Earnings Ratio: Definition: PE Market Price Per Share / Earnings Per Share

Uploaded by

Anuradha SharmaThis document discusses price-earnings (PE) ratios and their relationship to fundamentals. It begins by defining the PE ratio and noting variants based on how price and earnings are defined. It then discusses how PE ratios relate to growth, risk, and payout/return on equity based on discounted cash flow models. The document provides examples of how expected growth, risk, and payout affect PE ratios. It also compares PE ratios across markets and over time to illustrate how macroeconomic factors can influence PE ratios.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 81

Aswath Damodaran 12

Price Earnings Ratio: Denition

PE = Market Price per Share / Earnings per Share

! There are a number of variants on the basic PE ratio in use. They are based upon how

the price and the earnings are dened.

! Price:

is usually the current price (though some like to use average price over last 6

months or year)

EPS:

Time variants: EPS in most recent nancial year (current), EPS in most recent four

quarters (trailing), EPS expected in next scal year or next four quartes (both called

forward) or EPS in some future year

Primary, diluted or partially diluted

Before or after extraordinary items

Measured using different accounting rules (options expensed or not, pension fund

income counted or not)

Aswath Damodaran 13

Characteristic 1: Skewed Distributions

PE ratios for US companies in January 2012

Aswath Damodaran 14

Characteristic 2: Biased Samples

PE ratios in January 2012

Aswath Damodaran 15

Characteristic 3: Across Markets

PE Ratios: US, Europe, Japan and Emerging Markets

January 2012

Aswath Damodaran 16

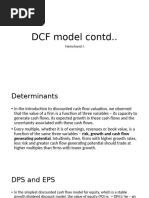

PE Ratio: Understanding the Fundamentals

! To understand the fundamentals, start with a basic equity discounted cash ow

model. With a stable growth dividend discount model:

! Dividing both sides by the current earnings per share or forward EPS:

Current EPS Forward EPS

! If this had been a FCFE Model,

P

0

=

DPS

1

r ! g

n

P

0

EPS

0

= PE=

Payout Ratio * (1 + g

n

)

r-g

n

P

0

=

FCFE

1

r ! g

n

!

P

0

EPS

0

= PE =

(FCFE/Earnings) *(1+ g

n

)

r-g

n

!

P

0

EPS

1

= PE =

Payout Ratio

r-g

n

Aswath Damodaran 17

PE Ratio and Fundamentals

! Proposition: Other things held equal, higher growth rms will have

higher PE ratios than lower growth rms.

! Proposition: Other things held equal, higher risk rms will have lower PE

ratios than lower risk rms

! Proposition: Other things held equal, rms with lower reinvestment needs

will have higher PE ratios than rms with higher reinvestment rates.

! Of course, other things are difcult to hold equal since high growth rms, tend

to have risk and high reinvestment rats.

Aswath Damodaran 18

Using the Fundamental Model to Estimate PE For a High

Growth Firm

! The price-earnings ratio for a high growth rm can also be related to

fundamentals. In the special case of the two-stage dividend discount model,

this relationship can be made explicit fairly simply:

For a rm that does not pay what it can afford to in dividends, substitute FCFE/

Earnings for the payout ratio.

! Dividing both sides by the earnings per share:

P

0

=

EPS

0

* Payout Ratio*(1+ g)* 1 !

(1+ g)

n

(1+ r)

n

"

#

$

%

&

r - g

+

EPS

0

* Payout Ratio

n

*(1+ g)

n

*(1+ g

n

)

(r -g

n

)(1+ r)

n

P

0

EPS

0

=

Payout Ratio * (1 + g) * 1 !

(1 + g)

n

(1+ r)

n

"

#

$

%

&

'

r - g

+

Payout Ratio

n

*(1+ g)

n

* (1 + g

n

)

(r - g

n

)(1+ r)

n

Aswath Damodaran 19

Expanding the Model

! In this model, the PE ratio for a high growth rm is a function of growth, risk

and payout, exactly the same variables that it was a function of for the stable

growth rm.

! The only difference is that these inputs have to be estimated for two phases -

the high growth phase and the stable growth phase.

! Expanding to more than two phases, say the three stage model, will mean that

risk, growth and cash ow patterns in each stage.

Aswath Damodaran 20

A Simple Example

! Assume that you have been asked to estimate the PE ratio for a rm which has

the following characteristics:

Variable High Growth Phase Stable Growth Phase

Expected Growth Rate 25% 8%

Payout Ratio 20% 50%

Beta 1.00 1.00

Number of years 5 years Forever after year 5

! Riskfree rate = T.Bond Rate = 6%

! Required rate of return = 6% + 1(5.5%)= 11.5%

Aswath Damodaran 21

PE and Growth: Firm grows at x% for 5 years, 8% thereafter

PE Ratios and Expected Growth: Interest Rate Scenarios

0

20

40

60

80

100

120

140

160

180

5% 10% 15% 20% 25% 30% 35% 40% 45% 50%

Expected Growth Rate

P

E

R

a

t

i

o

r =4%

r =6%

r =8%

r=10%

Aswath Damodaran 22

PE Ratios and Length of High Growth: 25% growth for n

years; 8% thereafter

Aswath Damodaran 23

PE and Risk: Effects of Changing Betas on PE Ratio:

Firm with x% growth for 5 years; 8% thereafter

PE Ratios and Beta: Growth Scenarios

0

5

10

15

20

25

30

35

40

45

50

0.75 1.00 1.25 1.50 1.75 2.00

Beta

P

E

R

a

t

i

o

g=25%

g=20%

g=15%

g=8%

Aswath Damodaran 24

PE and Payout/ ROE

Aswath Damodaran 25

The perfect under valued company

! If you were looking for the perfect undervalued asset, it would be one

With a low PE ratio (it is cheap)

With high expected growth in earnings

With low risk (and a low cost of equity)

And with high ROE

In other words, it would be cheap with no good reason for being cheap.

! In the real world, most assets that look cheap on a multiple of earnings basis

deserve to be cheap. In other words, one or more of these variables works

against the company (It has low growth, high risk or a low ROE).

! When presented with a cheap stock (low PE), here are the key questions:

What is the expected growth in earnings?

What is the risk in the stock?

How efciently does this company generate its growth?

Aswath Damodaran 26

I. Comparing PE ratios across Emerging Markets

Aswath Damodaran 27

II. An Old Example with Emerging Markets: June 2000

Country PE Ratio Interest

Rates

GDP Real

Growth

Country

Risk

Argentina 14 18.00% 2.50% 45

Brazil 21 14.00% 4.80% 35

Chile 25 9.50% 5.50% 15

Hong Kong 20 8.00% 6.00% 15

India 17 11.48% 4.20% 25

Indonesia 15 21.00% 4.00% 50

Malaysia 14 5.67% 3.00% 40

Mexico 19 11.50% 5.50% 30

Pakistan 14 19.00% 3.00% 45

Peru 15 18.00% 4.90% 50

Phillipines 15 17.00% 3.80% 45

Singapore 24 6.50% 5.20% 5

South Korea 21 10.00% 4.80% 25

Thailand 21 12.75% 5.50% 25

Turkey 12 25.00% 2.00% 35

Venezuela 20 15.00% 3.50% 45

Aswath Damodaran 28

Regression Results

! The regression of PE ratios on these variables provides the following

PE = 16.16 - 7.94 Interest Rates

+ 154.40 Growth in GDP

- 0.1116 Country Risk

R Squared = 73%

Aswath Damodaran 29

Predicted PE Ratios

Country PE Ratio Interest

Rates

GDP Real

Growth

Country

Risk

Predicted PE

Argentina 14 18.00% 2.50% 45

13.57

Brazil 21 14.00% 4.80% 35

18.55

Chile 25 9.50% 5.50% 15

22.22

Hong Kong 20 8.00% 6.00% 15

23.11

India 17 11.48% 4.20% 25

18.94

Indonesia 15 21.00% 4.00% 50

15.09

Malaysia 14 5.67% 3.00% 40

15.87

Mexico 19 11.50% 5.50% 30

20.39

Pakistan 14 19.00% 3.00% 45

14.26

Peru 15 18.00% 4.90% 50

16.71

Phillipines 15 17.00% 3.80% 45

15.65

Singapore 24 6.50% 5.20% 5

23.11

South Korea 21 10.00% 4.80% 25

19.98

Thailand 21 12.75% 5.50% 25

20.85

Turkey 12 25.00% 2.00% 35

13.35

Venezuela 20 15.00% 3.50% 45

15.35

Aswath Damodaran 30

III. Comparisons of PE across time: PE Ratio for the S&P

500

Aswath Damodaran 31

Is low (high) PE cheap (expensive)?

! A market strategist argues that stocks are cheap because the PE ratio today is

low relative to the average PE ratio across time. Do you agree?

! Yes

! No

! If you do not agree, what factors might explain the lower PE ratio today?

Aswath Damodaran 32

E/P Ratios , T.Bond Rates and Term Structure

Aswath Damodaran 33

Regression Results

! There is a strong positive relationship between E/P ratios and T.Bond rates, as

evidenced by the correlation of 0.69 between the two variables.,

! In addition, there is evidence that the term structure also affects the PE ratio.

! In the following regression, using 1960-2011 data, we regress E/P ratios

against the level of T.Bond rates and a term structure variable (T.Bond - T.Bill

rate)

E/P = 3.16% + 0.597 T.Bond Rate 0.213 (T.Bond Rate-T.Bill Rate)

(3.98) (5.71) (-0.92)

R squared = 40.92%

Given the treasury bond rate and treasury bill rate today, is the market under or

over valued today?

Aswath Damodaran 34

IV. Valuing one company relative to others

Relative valuation with comparables

! Ideally, you would like to nd lots of publicly traded rms that look just like

your rm, in terms of fundamentals, and compare the pricing of your rm to

the pricing of these other publicly traded rms. Since, they are all just like

your rm, there will be no need to control for differences.

! In practice, it is very difcult (and perhaps impossible) to nd rms that share

the same risk, growth and cash ow characteristics of your rm. Even if you

are able to nd such rms, they will very few in number. The trade off then

becomes:

Small sample of

firms that are

just like your

firm

Large sample

of firms that are

similar in some

dimensions but

different on

others

Aswath Damodaran 35

Techniques for comparing across rms

! Direct comparisons: If the comparable rms are just like your rm, you can compare

multiples directly across the rms and conclude that your rm is expensive (cheap) if it

trades at a multiple higher (lower) than the other rms.

! Story telling: If there is a key dimension on which the rms vary, you can tell a story

based upon your understanding of how value varies on that dimension.

An example: This company trades at 12 times earnings, whereas the rest of the

sector trades at 10 times earnings, but I think it is cheap because it has a much

higher growth rate than the rest of the sector.

! Modied multiple: You can modify the multiple to incorporate the dimension on which

there are differences across rms.

! Statistical techniques: If your rms vary on more than one dimension, you can try using

multiple regressions (or variants thereof) to arrive at a controlled estimate for your

rm.

Aswath Damodaran 36

Example 1: Lets try some story telling

Comparing PE ratios across rms in a sector

Company Name Trailing PE Expected Growth Standard Dev

Coca-Cola Bottling 29.18 9.50% 20.58%

Molson Inc. Ltd. 'A' 43.65 15.50% 21.88%

Anheuser-Busch 24.31 11.00% 22.92%

Corby Distilleries Ltd. 16.24 7.50% 23.66%

Chalone Wine Group Ltd. 21.76 14.00% 24.08%

Andres Wines Ltd. 'A' 8.96 3.50% 24.70%

Todhunter Int'l 8.94 3.00% 25.74%

Brown-Forman 'B' 10.07 11.50% 29.43%

Coors (Adolph) 'B' 23.02 10.00% 29.52%

PepsiCo, Inc. 33.00 10.50% 31.35%

Coca-Cola 44.33 19.00% 35.51%

Boston Beer 'A' 10.59 17.13% 39.58%

Whitman Corp. 25.19 11.50% 44.26%

Mondavi (Robert) 'A' 16.47 14.00% 45.84%

Coca-Cola Enterprises 37.14 27.00% 51.34%

Hansen Natural Corp 9.70 17.00% 62.45%

Aswath Damodaran 37

A Question

You are reading an equity research report on this sector, and the analyst claims

that Andres Wine and Hansen Natural are under valued because they have low

PE ratios. Would you agree?

" Yes

" No

! Why or why not?

Aswath Damodaran 38

Example 2: The limits of story telling

Telecom ADRs in 1999

Company Name PE Growth

PT Indosat ADR 7.8 0.06

Telebras ADR 8.9 0.075

Telecom Corporation of New Zealand ADR 11.2 0.11

Telecom Argentina Stet - France Telecom SA ADR B 12.5 0.08

Hellenic Telecommunication Organization SA ADR 12.8 0.12

Telecomunicaciones de Chile ADR 16.6 0.08

Swisscom AG ADR 18.3 0.11

Asia Satellite Telecom Holdings ADR 19.6 0.16

Portugal Telecom SA ADR 20.8 0.13

Telefonos de Mexico ADR L 21.1 0.14

Matav RT ADR 21.5 0.22

Telstra ADR 21.7 0.12

Gilat Communications 22.7 0.31

Deutsche Telekom AG ADR 24.6 0.11

British Telecommunications PLC ADR 25.7 0.07

Tele Danmark AS ADR 27 0.09

Telekomunikasi Indonesia ADR 28.4 0.32

Cable & Wireless PLC ADR 29.8 0.14

APT Satellite Holdings ADR 31 0.33

Telefonica SA ADR 32.5 0.18

Royal KPN NV ADR 35.7 0.13

Telecom Italia SPA ADR 42.2 0.14

Nippon Telegraph & Telephone ADR 44.3 0.2

France Telecom SA ADR 45.2 0.19

Korea Telecom ADR 71.3 0.44

Aswath Damodaran 39

PE, Growth and Risk

Dependent variable is: PE

R squared = 66.2% R squared (adjusted) = 63.1%

Variable Coefcient SE t-ratio prob

Constant 13.1151 3.471 3.78 0.0010

Growth rate 1.21223 19.27 6.29 # 0.0001

Emerging Market -13.8531 3.606 -3.84 0.0009

Emerging Market is a dummy: 1 if emerging market

0 if not

Aswath Damodaran 40

Is Telebras under valued?

! Predicted PE = 13.12 + 1.2122 (7.5) - 13.85 (1) = 8.35

! At an actual price to earnings ratio of 8.9, Telebras is slightly overvalued.

Aswath Damodaran 41

Relative to the entire market

Extending your sample

! If you can control for differences in risk, growth and cash ows, you can

expand your list of comparable rms signicantly. In fact, there is no reason

why you cannot bring every rm in the market into your comparable rm list.

! The simplest way of controlling for differences is with a multiple regression,

with the multiple (PE, EV/EBITDA etc) as the dependent variable, and proxies

for risk, growth and payout forming the independent variables.

! When you make this comparison, you are estimating the value of your

company relative to the entire market (rather than just a sector).

Aswath Damodaran 42

PE versus Expected EPS Growth: January 2012

Aswath Damodaran 43

PE Ratio: Standard Regression for US stocks - January 2012

Aswath Damodaran 44

Problems with the regression methodology

! The basic regression assumes a linear relationship between PE ratios and the

nancial proxies, and that might not be appropriate.

! The basic relationship between PE ratios and nancial variables itself might

not be stable, and if it shifts from year to year, the predictions from the model

may not be reliable.

! The independent variables are correlated with each other. For example, high

growth rms tend to have high risk. This multi-collinearity makes the

coefcients of the regressions unreliable and may explain the large changes in

these coefcients from period to period.

Aswath Damodaran 45

The Multicollinearity Problem

Aswath Damodaran 46

Using the PE ratio regression

! Assume that you were given the following information for Dell. The rm has

an expected growth rate of 10%, a beta of 1.20 and pays no dividends. Based

upon the regression, estimate the predicted PE ratio for Dell.

Predicted PE =

! Dell is actually trading at 18 times earnings. What does the predicted PE tell

you?

Aswath Damodaran 47

The value of growth

Time Period PE Value of extra 1% of growth Equity Risk Premium

January 2012 0.408 6.04%

January 2011 0.836 5.20%

January 2010 0.550 4.36%

January 2009 0.780 6.43%

January 2008 1.427 4.37%

January 2007 1.178 4.16%

January 2006 1.131 4.07%

January 2005 0.914 3.65%

January 2004 0.812 3.69%

January 2003 2.621 4.10%

January 2002 1.003 3.62%

January 2001 1.457 2.75%

January 2000 2.105 2.05%

Aswath Damodaran 48

Fundamentals in other markets: PE regressions across

markets

Region Regression January 2012 R squared

Europe PE = 19.57 - 2.91 Payout - 3.67 Beta 6.9%

Japan PE = 21.69 - 0.31 Expected Growth -4.12 Beta 5.3%

Emerging

Markets

PE = 15.48+ 9.03 ROE - 2.77 Beta + 2.91 Payout 4.3%

Aswath Damodaran 49

Investment Strategies that compare PE to the expected

growth rate

! If we assume that all rms within a sector have similar growth rates and risk, a

strategy of picking the lowest PE ratio stock in each sector will yield

undervalued stocks.

! Portfolio managers and analysts sometimes compare PE ratios to the expected

growth rate to identify under and overvalued stocks.

In the simplest form of this approach, rms with PE ratios less than their expected

growth rate are viewed as undervalued.

In its more general form, the ratio of PE ratio to growth is used as a measure of

relative value.

Aswath Damodaran 50

Problems with comparing PE ratios to expected growth

! In its simple form, there is no basis for believing that a rm is undervalued just

because it has a PE ratio less than expected growth.

! This relationship may be consistent with a fairly valued or even an overvalued

rm, if interest rates are high, or if a rm is high risk.

! As interest rates decrease (increase), fewer (more) stocks will emerge as

undervalued using this approach.

Aswath Damodaran 51

PEG Ratio: Denition

! The PEG ratio is the ratio of price earnings to expected growth in earnings per

share.

PEG = PE / Expected Growth Rate in Earnings

! Denitional tests:

Is the growth rate used to compute the PEG ratio

on the same base? (base year EPS)

over the same period?(2 years, 5 years)

from the same source? (analyst projections, consensus estimates..)

Is the earnings used to compute the PE ratio consistent with the growth rate

estimate?

No double counting: If the estimate of growth in earnings per share is from the current

year, it would be a mistake to use forward EPS in computing PE

If looking at foreign stocks or ADRs, is the earnings used for the PE ratio consistent with

the growth rate estimate? (US analysts use the ADR EPS)

Aswath Damodaran 52

PEG Ratio: Distribution US stocks

Aswath Damodaran 53

PEG Ratios: The Beverage Sector

Company Name Trailing PE Growth Std Dev PEG

Coca-Cola Bottling 29.18 9.50% 20.58% 3.07

Molson Inc. Ltd. 'A' 43.65 15.50% 21.88% 2.82

Anheuser-Busch 24.31 11.00% 22.92% 2.21

Corby Distilleries Ltd. 16.24 7.50% 23.66% 2.16

Chalone Wine Group Ltd. 21.76 14.00% 24.08% 1.55

Andres Wines Ltd. 'A' 8.96 3.50% 24.70% 2.56

Todhunter Int'l 8.94 3.00% 25.74% 2.98

Brown-Forman 'B' 10.07 11.50% 29.43% 0.88

Coors (Adolph) 'B' 23.02 10.00% 29.52% 2.30

PepsiCo, Inc. 33.00 10.50% 31.35% 3.14

Coca-Cola 44.33 19.00% 35.51% 2.33

Boston Beer 'A' 10.59 17.13% 39.58% 0.62

Whitman Corp. 25.19 11.50% 44.26% 2.19

Mondavi (Robert) 'A' 16.47 14.00% 45.84% 1.18

Coca-Cola Enterprises 37.14 27.00% 51.34% 1.38

Hansen Natural Corp 9.70 17.00% 62.45% 0.57

Average 22.66 13.00% 33.00% 2.00

Aswath Damodaran 54

PEG Ratio: Reading the Numbers

! The average PEG ratio for the beverage sector is 2.00. The lowest PEG ratio in

the group belongs to Hansen Natural, which has a PEG ratio of 0.57. Using

this measure of value, Hansen Natural is

" the most under valued stock in the group

" the most over valued stock in the group

! What other explanation could there be for Hansens low PEG ratio?

Aswath Damodaran 55

PEG Ratio: Analysis

! To understand the fundamentals that determine PEG ratios, let us return again

to a 2-stage equity discounted cash ow model

! Dividing both sides of the equation by the earnings gives us the equation for

the PE ratio. Dividing it again by the expected growth g

P

0

=

EPS

0

* Payout Ratio*(1+ g)* 1 !

(1+ g)

n

(1+ r)

n

"

#

$

%

&

r - g

+

EPS

0

* Payout Ratio

n

*(1+ g)

n

*(1+ g

n

)

(r -g

n

)(1+ r)

n

PEG =

Payout Ratio*(1 + g) * 1 !

(1+ g)

n

(1 + r)

n

"

#

$

%

&

g(r - g)

+

Payout Ratio

n

* (1+ g)

n

* (1+ g

n

)

g(r - g

n

)(1 + r)

n

Aswath Damodaran 56

PEG Ratios and Fundamentals

! Risk and payout, which affect PE ratios, continue to affect PEG ratios as well.

Implication: When comparing PEG ratios across companies, we are making

implicit or explicit assumptions about these variables.

! Dividing PE by expected growth does not neutralize the effects of expected

growth, since the relationship between growth and value is not linear and

fairly complex (even in a 2-stage model)

Aswath Damodaran 57

A Simple Example

! Assume that you have been asked to estimate the PEG ratio for a rm which

has the following characteristics:

Variable High Growth Phase Stable Growth Phase

Expected Growth Rate 25% 8%

Payout Ratio 20% 50%

Beta 1.00 1.00

! Riskfree rate = T.Bond Rate = 6%

! Required rate of return = 6% + 1(5.5%)= 11.5%

! The PEG ratio for this rm can be estimated as follows:

!

PEG =

0.2 * (1.25) * 1"

(1.25)

5

(1.115)

5

#

$

%

&

'

(

.25(.115 - .25)

+

0.5 * (1.25)

5

*(1.08)

.25(.115 - .08) (1.115)

5

= 115 or 1.15

Aswath Damodaran 58

PEG Ratios and Risk

Aswath Damodaran 59

PEG Ratios and Quality of Growth

Aswath Damodaran 60

PE Ratios and Expected Growth

Aswath Damodaran 61

PEG Ratios and Fundamentals: Propositions

! Proposition 1: High risk companies will trade at much lower PEG ratios than

low risk companies with the same expected growth rate.

Corollary 1: The company that looks most under valued on a PEG ratio basis in a

sector may be the riskiest rm in the sector

! Proposition 2: Companies that can attain growth more efciently by investing

less in better return projects will have higher PEG ratios than companies that

grow at the same rate less efciently.

Corollary 2: Companies that look cheap on a PEG ratio basis may be companies

with high reinvestment rates and poor project returns.

! Proposition 3: Companies with very low or very high growth rates will tend to

have higher PEG ratios than rms with average growth rates. This bias is

worse for low growth stocks.

Corollary 3: PEG ratios do not neutralize the growth effect.

Aswath Damodaran 62

PE, PEG Ratios and Risk

0

5

10

15

20

25

30

35

40

45

Lowest 2 3 4 Highest

0

0.5

1

1.5

2

2.5

PE

PEG Ratio

Risk classes

Aswath Damodaran 63

PEG Ratio: Returning to the Beverage Sector

Company Name Trailing PE Growth Std Dev PEG

Coca-Cola Bottling 29.18 9.50% 20.58% 3.07

Molson Inc. Ltd. 'A' 43.65 15.50% 21.88% 2.82

Anheuser-Busch 24.31 11.00% 22.92% 2.21

Corby Distilleries Ltd. 16.24 7.50% 23.66% 2.16

Chalone Wine Group Ltd. 21.76 14.00% 24.08% 1.55

Andres Wines Ltd. 'A' 8.96 3.50% 24.70% 2.56

Todhunter Int'l 8.94 3.00% 25.74% 2.98

Brown-Forman 'B' 10.07 11.50% 29.43% 0.88

Coors (Adolph) 'B' 23.02 10.00% 29.52% 2.30

PepsiCo, Inc. 33.00 10.50% 31.35% 3.14

Coca-Cola 44.33 19.00% 35.51% 2.33

Boston Beer 'A' 10.59 17.13% 39.58% 0.62

Whitman Corp. 25.19 11.50% 44.26% 2.19

Mondavi (Robert) 'A' 16.47 14.00% 45.84% 1.18

Coca-Cola Enterprises 37.14 27.00% 51.34% 1.38

Hansen Natural Corp 9.70 17.00% 62.45% 0.57

Average 22.66 13.00% 33.00% 2.00

Aswath Damodaran 64

Analyzing PE/Growth

! Given that the PEG ratio is still determined by the expected growth rates, risk

and cash ow patterns, it is necessary that we control for differences in these

variables.

! Regressing PEG against risk and a measure of the growth dispersion, we get:

PEG = 3.61 -.0286 (Expected Growth) - .0375 (Std Deviation in Prices)

R Squared = 44.75%

! In other words,

PEG ratios will be lower for high growth companies

PEG ratios will be lower for high risk companies

! We also ran the regression using the deviation of the actual growth rate from

the industry-average growth rate as the independent variable, with mixed

results.

Aswath Damodaran 65

Estimating the PEG Ratio for Hansen

! Applying this regression to Hansen, the predicted PEG ratio for the rm can

be estimated using Hansens measures for the independent variables:

Expected Growth Rate = 17.00%

Standard Deviation in Stock Prices = 62.45%

! Plugging in,

Expected PEG Ratio for Hansen = 3.61 - .0286 (17) - .0375 (62.45)

= 0.78

! With its actual PEG ratio of 0.57, Hansen looks undervalued, notwithstanding

its high risk.

Aswath Damodaran 66

Extending the Comparables

! This analysis, which is restricted to rms in the software sector, can be

expanded to include all rms in the rm, as long as we control for differences

in risk, growth and payout.

! To look at the cross sectional relationship, we rst plotted PEG ratios against

expected growth rates.

Aswath Damodaran 67

PEG versus Growth January 2012

Aswath Damodaran 68

Analyzing the Relationship

! The relationship in not linear. In fact, the smallest rms seem to have the

highest PEG ratios and PEG ratios become relatively stable at higher growth

rates.

! To make the relationship more linear, we converted the expected growth rates

in ln(expected growth rate). The relationship between PEG ratios and

ln(expected growth rate) was then plotted.

Aswath Damodaran 69

PEG versus ln(Expected Growth) January 2012

Aswath Damodaran 70

PEG Ratio Regression - US stocks

January 2012

Aswath Damodaran 71

Negative interceptsand problem forecasts..

! When the intercept in a multiples regression is negative, there is the possibility

that forecasted values can be negative as well. One way (albeit imperfect) is to

re-run the regression without an intercept.

Aswath Damodaran 72

Applying the PEG ratio regression

! Consider Dell again. The stock has an expected growth rate of 10%, a beta of

1.20 and pays out no dividends. What should its PEG ratio be?

! If the stocks actual PE ratio is 18, what does this analysis tell you about the

stock?

Aswath Damodaran 73

A Variant on PEG Ratio: The PEGY ratio

! The PEG ratio is biased against low growth rms because the relationship

between value and growth is non-linear. One variant that has been devised to

consolidate the growth rate and the expected dividend yield:

PEGY = PE / (Expected Growth Rate + Dividend Yield)

! As an example, Con Ed has a PE ratio of 16, an expected growth rate of 5% in

earnings and a dividend yield of 4.5%.

PEG = 16/ 5 = 3.2

PEGY = 16/(5+4.5) = 1.7

Aswath Damodaran 74

Value/Earnings and Value/Cashow Ratios

! While Price earnings ratios look at the market value of equity relative to

earnings to equity investors, Value earnings ratios look at the market value of

the operating assets of the rm (Enterprise value or EV) relative to operating

earnings or cash ows.

EV = Market value of equity + Debt Cash

! The form of value to cash ow ratios that has the closest parallels in DCF

valuation is the ratio of Firm value to Free Cash Flow to the Firm.

FCFF = EBIT (1-t) - Net Cap Ex - Change in WC

! In practice, what we observe more commonly are rm values as multiples of

operating income (EBIT), after-tax operating income (EBIT (1-t)) or EBITDA.

Aswath Damodaran 75

Value/FCFF Multiples and the Alternatives

! Assume that you have computed the value of a rm, using discounted cash

ow models. Rank the following multiples in the order of magnitude from

lowest to highest?

" EV/EBIT

" EV/EBIT(1-t)

" EV/FCFF

" EV/EBITDA

! What assumption(s) would you need to make for the Value/EBIT(1-t) ratio to

be equal to the Value/FCFF multiple?

Aswath Damodaran 76

EV/FCFF: Determinants

! Reverting back to a two-stage FCFF DCF model, we get:

FCFF

0

= Free Cashow to the rm in current year

g = Expected growth rate in FCFF in extraordinary growth period (rst n years)

WACC = Weighted average cost of capital

g

n

= Expected growth rate in FCFF in stable growth period (after n years)\

! Dividing both sides by the FCFF

V

0

=

FCFF

0

(1 + g) 1-

(1 + g)

n

(1+ WACC)

n

!

"

#

$

%

&

WACC- g

+

FCFF

0

(1+ g)

n

(1+ g

n

)

(WACC- g

n

)(1 + WACC)

n

V

0

FCFF

0

=

(1 + g) 1-

(1 + g)

n

(1 + WACC)

n

!

"

#

$

%

WACC- g

+

(1+ g)

n

(1+ g

n

)

(WACC- g

n

)(1 + WACC)

n

Aswath Damodaran 77

Illustration: Using Value/FCFF Approaches to value a rm:

MCI Communications

! MCI Communications had earnings before interest and taxes of $3356 million

in 1994 (Its net income after taxes was $855 million).

! It had capital expenditures of $2500 million in 1994 and depreciation of $1100

million; Working capital increased by $250 million.

! It expects free cashows to the rm to grow 15% a year for the next ve years

and 5% a year after that.

! The cost of capital is 10.50% for the next ve years and 10% after that.

! The company faces a tax rate of 36%.

V

0

FCFF

0

=

(1.15) 1 -

(1.15)

5

(1.105)5

!

"

#

$

%

.105 - .15

+

(1.15)

5

(1.05)

(.10 - .05)(1.105)

5

= 3 1 . 2 8

Aswath Damodaran 78

Multiple Magic

! In this case of MCI there is a big difference between the FCFF and short cut

measures. For instance the following table illustrates the appropriate multiple

using short cut measures, and the amount you would overpay by if you used

the FCFF multiple.

Free Cash Flow to the Firm

= EBIT (1-t) - Net Cap Ex - Change in Working Capital

= 3356 (1 - 0.36) + 1100 - 2500 - 250 = $ 498 million

$ Value Correct Multiple

FCFF $498 31.28382355

EBIT (1-t) $2,148 7.251163362

EBIT $ 3,356 4.640744552

EBITDA $4,456 3.49513885

Aswath Damodaran 79

Reasons for Increased Use of Value/EBITDA

1. The multiple can be computed even for rms that are reporting net losses, since

earnings before interest, taxes and depreciation are usually positive.

2. For rms in certain industries, such as cellular, which require a substantial

investment in infrastructure and long gestation periods, this multiple seems to

be more appropriate than the price/earnings ratio.

3. In leveraged buyouts, where the key factor is cash generated by the rm prior to

all discretionary expenditures, the EBITDA is the measure of cash ows from

operations that can be used to support debt payment at least in the short term.

4. By looking at cashows prior to capital expenditures, it may provide a better

estimate of optimal value, especially if the capital expenditures are unwise

or earn substandard returns.

5. By looking at the value of the rm and cashows to the rm it allows for

comparisons across rms with different nancial leverage.

Aswath Damodaran 80

Enterprise Value/EBITDA Multiple

! The Classic Denition

! The No-Cash Version

!

Value

EBITDA

=

Market Value of Equity + Market Value of Debt

Earnings before Interest, Taxes and Depreciation

!

Enterprise Value

EBITDA

=

Market Value of Equity + Market Value of Debt - Cash

Earnings before Interest, Taxes and Depreciation

Aswath Damodaran 81

Enterprise Value/EBITDA Distribution US

Aswath Damodaran 82

Enterprise Value/EBITDA : Global Data

6 times EBITDA may seem like a good rule of thumb..

Aswath Damodaran 83

But not in early 2009

Aswath Damodaran 84

The Determinants of Value/EBITDA Multiples: Linkage to

DCF Valuation

! The value of the operating assets of a rm can be written as:

! The numerator can be written as follows:

FCFF = EBIT (1-t) - (Cex - Depr) - & Working Capital

= (EBITDA - Depr) (1-t) - (Cex - Depr) - & Working Capital

= EBITDA (1-t) + Depr (t) - Cex - & Working Capital

!

EV

0

=

FCFF

1

WACC- g

Aswath Damodaran 85

From Firm Value to EBITDA Multiples

! Now the value of the rm can be rewritten as,

! Dividing both sides of the equation by EBITDA,

! Since Reinvestment = (CEx Depreciation + & Working Capital), the

determinants of EV/EBITDA are:

The cost of capital

Expected growth rate

Tax rate

Reinvestment rate (or ROC)

!

EV =

EBITDA (1- t) + Depr (t) - Cex - " Working Capital

WACC- g

!

EV

EBITDA

=

(1- t)

WACC- g

+

Depr (t)/EBITDA

WACC- g

-

CEx/EBITDA

WACC- g

-

" Working Capital/EBITDA

WACC- g

Aswath Damodaran 86

A Simple Example

! Consider a rm with the following characteristics:

Tax Rate = 36%

Capital Expenditures/EBITDA = 30%

Depreciation/EBITDA = 20%

Cost of Capital = 10%

The rm has no working capital requirements

The rm is in stable growth and is expected to grow 5% a year forever.

Aswath Damodaran 87

Calculating Value/EBITDA Multiple

! In this case, the Value/EBITDA multiple for this rm can be estimated as

follows:

Value

EBITDA

=

(1- .36)

.10 -.05

+

(0.2)(.36)

.10 -.05

-

0.3

.10 - .05

-

0

.10 - .05

= 8.24

Aswath Damodaran 88

The Determinants of EV/EBITDA

!

Tax

Rates

Reinvestment

Needs

Excess

Returns

Aswath Damodaran 89

Is this stock cheap?

! Assume that I am trying to convince you to buy a company, because it trades

at 5 times EBITDA. What are some of the questions you would ask me as a

potential buyer?

! Following through, what combination of fundamentals would make for a

cheap company on an EV/EBITDA basis:

Tax rate

Growth

Return on capital

Cost of capital/Risk

Aswath Damodaran 90

Value/EBITDA Multiple: Trucking Companies:

Is Ryder cheap?

Company Name Value EBITDA Value/EBITDA

KLLM Trans. Svcs. 114.32 $ 48.81 $ 2.34

Ryder System 5,158.04 $ 1,838.26 $ 2.81

Rollins Truck Leasing 1,368.35 $ 447.67 $ 3.06

Cannon Express Inc. 83.57 $ 27.05 $ 3.09

Hunt (J.B.) 982.67 $ 310.22 $ 3.17

Yellow Corp. 931.47 $ 292.82 $ 3.18

Roadway Express 554.96 $ 169.38 $ 3.28

Marten Transport Ltd. 116.93 $ 35.62 $ 3.28

Kenan Transport Co. 67.66 $ 19.44 $ 3.48

M.S. Carriers 344.93 $ 97.85 $ 3.53

Old Dominion Freight 170.42 $ 45.13 $ 3.78

Trimac Ltd 661.18 $ 174.28 $ 3.79

Matlack Systems 112.42 $ 28.94 $ 3.88

XTRA Corp. 1,708.57 $ 427.30 $ 4.00

Covenant Transport Inc 259.16 $ 64.35 $ 4.03

Builders Transport 221.09 $ 51.44 $ 4.30

Werner Enterprises 844.39 $ 196.15 $ 4.30

Landstar Sys. 422.79 $ 95.20 $ 4.44

AMERCO 1,632.30 $ 345.78 $ 4.72

USA Truck 141.77 $ 29.93 $ 4.74

Frozen Food Express 164.17 $ 34.10 $ 4.81

Arnold Inds. 472.27 $ 96.88 $ 4.87

Greyhound Lines Inc. 437.71 $ 89.61 $ 4.88

USFreightways 983.86 $ 198.91 $ 4.95

Golden Eagle Group Inc. 12.50 $ 2.33 $ 5.37

Arkansas Best 578.78 $ 107.15 $ 5.40

Airlease Ltd. 73.64 $ 13.48 $ 5.46

Celadon Group 182.30 $ 32.72 $ 5.57

Amer. Freightways 716.15 $ 120.94 $ 5.92

Transfinancial Holdings 56.92 $ 8.79 $ 6.47

Vitran Corp. 'A' 140.68 $ 21.51 $ 6.54

Interpool Inc. 1,002.20 $ 151.18 $ 6.63

Intrenet Inc. 70.23 $ 10.38 $ 6.77

Swift Transportation 835.58 $ 121.34 $ 6.89

Landair Services 212.95 $ 30.38 $ 7.01

CNF Transportation 2,700.69 $ 366.99 $ 7.36

Budget Group Inc 1,247.30 $ 166.71 $ 7.48

Caliber System 2,514.99 $ 333.13 $ 7.55

Knight Transportation Inc 269.01 $ 28.20 $ 9.54

Heartland Express 727.50 $ 64.62 $ 11.26

Greyhound CDA Transn Corp 83.25 $ 6.99 $ 11.91

Mark VII 160.45 $ 12.96 $ 12.38

Coach USA Inc 678.38 $ 51.76 $ 13.11

US 1 Inds Inc. 5.60 $ (0.17) $ NA

Average 5. 61

Aswath Damodaran 91

Extending to the market

US Market: January 2012

Aswath Damodaran 92

EBITDA regressions across markets

January 2012

Region Regression January 2011 R squared

Europe EV/EBITDA= 12.47 $$$$$+0.02 Interest Coverage

Ratio - 11.50 Tax Rate$ -3.31 Reinvestment Rate$$

8.9%

Japan EV/EBITDA= 3.70 $$$$$-0.01 Interest Coverage

Ratio + 8.00 Tax Rate + 3.05 Reinvestment Rate

6.6%

Emerging

Markets

EV/EBITDA= 15.01$$$- 10.70 Tax Rate$$$$$-3.04

Reinvestment Rate

2.2%

You might also like

- BU SM323 Midterm+ReviewDocument23 pagesBU SM323 Midterm+ReviewrockstarliveNo ratings yet

- Bbs ProposalDocument7 pagesBbs ProposalChandni Kayastha69% (32)

- PE Ratios PDFDocument40 pagesPE Ratios PDFRoyLadiasanNo ratings yet

- PE Regression ModellingDocument35 pagesPE Regression ModellingTanmay GuptaNo ratings yet

- Pepsico, Inc.: RecommendationDocument2 pagesPepsico, Inc.: Recommendationsasaki16No ratings yet

- Intrinsic Valuation in A Relative Valuation World .: Aswath DamodaranDocument34 pagesIntrinsic Valuation in A Relative Valuation World .: Aswath DamodaranAshish TripathiNo ratings yet

- Dividend Decesion: A Strategic PerspectiveDocument34 pagesDividend Decesion: A Strategic PerspectivePrashant MittalNo ratings yet

- The PEG Ratio: PE Ratio Divided by The Growth in Future EPSDocument40 pagesThe PEG Ratio: PE Ratio Divided by The Growth in Future EPSvirgoabhiNo ratings yet

- Determining Share Prices: Stock Share Financial Ratios Earnings YieldDocument8 pagesDetermining Share Prices: Stock Share Financial Ratios Earnings Yieldapi-3702802No ratings yet

- Relative PeDocument16 pagesRelative PeDaddha ShreetiNo ratings yet

- Valuation Cheat Sheet - Invest in Asset ProductionDocument9 pagesValuation Cheat Sheet - Invest in Asset ProductionAnonymous iVNvuRKGVNo ratings yet

- Lect 1 - Int RatesDocument37 pagesLect 1 - Int Ratesasvini001No ratings yet

- ExamDocument2 pagesExamALBERT CRUZNo ratings yet

- Stock Research Report For Yamana Gold Inc EPD As of 11/17/11 - Chaikin Power ToolsDocument4 pagesStock Research Report For Yamana Gold Inc EPD As of 11/17/11 - Chaikin Power ToolsChaikin Analytics, LLCNo ratings yet

- Chapter 8 - End - of - Chapter - Problems - SolDocument18 pagesChapter 8 - End - of - Chapter - Problems - SolGaby Tanios100% (2)

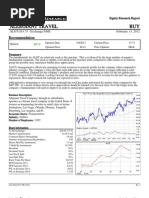

- Allegiant Travel BUY: Market Edge ResearchDocument4 pagesAllegiant Travel BUY: Market Edge Researchchdn20No ratings yet

- Chapter Company AnalysisDocument30 pagesChapter Company Analysisranbirkapoor8597No ratings yet

- Chapter 10 - 11Document16 pagesChapter 10 - 1143. Phan Thị Thanh VyNo ratings yet

- Strategic Capital Group Workshop #1: Stock Pitch CompositionDocument28 pagesStrategic Capital Group Workshop #1: Stock Pitch CompositionUniversity Securities Investment TeamNo ratings yet

- User Guide: Intrinsic Value CalculatorDocument7 pagesUser Guide: Intrinsic Value CalculatorfuzzychanNo ratings yet

- Balance Sheet Valuation Methods: Book Value MeasureDocument43 pagesBalance Sheet Valuation Methods: Book Value MeasureodvutNo ratings yet

- JPMVal 2024Document46 pagesJPMVal 2024nguyen.thanhphuong0454No ratings yet

- WK - 7 - Relative Valuation PDFDocument33 pagesWK - 7 - Relative Valuation PDFreginazhaNo ratings yet

- General Presentation GuidelinesDocument3 pagesGeneral Presentation GuidelinesMD Abu Hanif ShekNo ratings yet

- 15 Dividend DecisionDocument18 pages15 Dividend Decisionsiva19789No ratings yet

- Final SapmDocument29 pagesFinal SapmShreya ShrivastavaNo ratings yet

- Acelec 331 Midterm Exam: MC QuestionsDocument7 pagesAcelec 331 Midterm Exam: MC Questionshwo0% (1)

- Bond Analysis BestDocument36 pagesBond Analysis BestSyed Muhammad Ali SadiqNo ratings yet

- Valuation of SharesDocument51 pagesValuation of SharesSwati GoyalNo ratings yet

- Relative ValuationDocument29 pagesRelative ValuationjayminashahNo ratings yet

- 2.3.DCFmodel (1)Document14 pages2.3.DCFmodel (1)rohitsinghh.3227No ratings yet

- Chapter 13 Equity ValuationDocument33 pagesChapter 13 Equity Valuationsharktale2828No ratings yet

- Profitability Ratio Analysis and Stock Price Calculation of 10 DSE Listed Company InbangladeshDocument22 pagesProfitability Ratio Analysis and Stock Price Calculation of 10 DSE Listed Company InbangladeshMD. Hasan Al MamunNo ratings yet

- Common Stock ValuationDocument40 pagesCommon Stock ValuationAhsan IqbalNo ratings yet

- P/E Ratio Tutorial: Stock BasicsDocument5 pagesP/E Ratio Tutorial: Stock BasicsAnuradha SharmaNo ratings yet

- BS Managing Risk Group1Document12 pagesBS Managing Risk Group1Ritu BatraNo ratings yet

- How To Use The PE Ratio and PEG To Tell A StockDocument2 pagesHow To Use The PE Ratio and PEG To Tell A Stocksumanta maitiNo ratings yet

- 5 Session6 MultiplesDocument26 pages5 Session6 MultiplesAlh1990No ratings yet

- How To Pick The Terminal Multiple To Calculate Terminal Value in A DCFDocument2 pagesHow To Pick The Terminal Multiple To Calculate Terminal Value in A DCFSanjay RathiNo ratings yet

- Multiple Comparable Valuation MethodDocument6 pagesMultiple Comparable Valuation MethodMbuh DaisyNo ratings yet

- Problems On Multiplier ModelsDocument34 pagesProblems On Multiplier Modelsksh kshNo ratings yet

- ZaxiDocument2 pagesZaxiZднìđцŁ Islдм ╰⏝╯ ZднìNo ratings yet

- 3-Relative Valuation PDFDocument27 pages3-Relative Valuation PDFFlovgrNo ratings yet

- Unit IV - Dividend PolicyDocument34 pagesUnit IV - Dividend Policy126117001No ratings yet

- Learning OutcomeDocument35 pagesLearning OutcomevrushankNo ratings yet

- The Dividend Discount Model Explained: Home About Books Value Investing Screeners Value Investors Links Timeless ReadingDocument12 pagesThe Dividend Discount Model Explained: Home About Books Value Investing Screeners Value Investors Links Timeless ReadingBatul KudratiNo ratings yet

- Stock Research Report For AMAT As of 3/26/2012 - Chaikin Power ToolsDocument4 pagesStock Research Report For AMAT As of 3/26/2012 - Chaikin Power ToolsChaikin Analytics, LLCNo ratings yet

- Valuation Models: Aswath DamodaranDocument20 pagesValuation Models: Aswath Damodaranmohitsinghal26No ratings yet

- The Financial Environment:: Markets, Institutions, and Interest RatesDocument29 pagesThe Financial Environment:: Markets, Institutions, and Interest RatesTuan HuynhNo ratings yet

- Damodaran ValuationDocument229 pagesDamodaran Valuationbharathkumar_asokan100% (1)

- Investing PPDDocument19 pagesInvesting PPDsubhendumishra28No ratings yet

- Chapter 3 - Stock Valuation Methods and EMHDocument41 pagesChapter 3 - Stock Valuation Methods and EMHNurul SuhaidaNo ratings yet

- ACELEC 331 Quiz 1 Due July 13 5Document7 pagesACELEC 331 Quiz 1 Due July 13 5hotdogggggg85No ratings yet

- Ratio Analysis With PYQs Lyst4549Document17 pagesRatio Analysis With PYQs Lyst4549Akshay Singh RajputNo ratings yet

- PE Ratio Definition Price-to-Earnings Ratio Formula and ExamplesDocument1 pagePE Ratio Definition Price-to-Earnings Ratio Formula and Examplesspecul8tor10No ratings yet

- Interpretations of A Particular P/E RatioDocument3 pagesInterpretations of A Particular P/E RatioRenz ZnerNo ratings yet

- DCF AswathDocument91 pagesDCF AswathDaniel ReddyNo ratings yet

- Math 8th Class WorksheetDocument38 pagesMath 8th Class WorksheetAnuradha SharmaNo ratings yet

- RecipDocument6 pagesRecipAnuradha SharmaNo ratings yet

- MCQ - Mauryan DysantyDocument3 pagesMCQ - Mauryan DysantyAnuradha SharmaNo ratings yet

- 4.1 Species, Communities and Ecosystems: DefinitionsDocument10 pages4.1 Species, Communities and Ecosystems: DefinitionsAnuradha SharmaNo ratings yet

- RBSE Rajasthan Board Books Class 8 Maths English MediumDocument232 pagesRBSE Rajasthan Board Books Class 8 Maths English MediumAnuradha SharmaNo ratings yet

- Discussions, Decisions and Presentations: Participant ManualDocument18 pagesDiscussions, Decisions and Presentations: Participant ManualAnuradha SharmaNo ratings yet

- Sample Experience ResumeDocument2 pagesSample Experience ResumeAnuradha SharmaNo ratings yet

- Levers For Change: About UsDocument4 pagesLevers For Change: About UsAnuradha SharmaNo ratings yet

- Protiviti PDFDocument3 pagesProtiviti PDFAnuradha SharmaNo ratings yet

- Future GroupDocument6 pagesFuture GroupAnuradha SharmaNo ratings yet

- Gamesa CorporationDocument2 pagesGamesa CorporationAnuradha SharmaNo ratings yet

- Challenges and Opportunities AssociatedDocument478 pagesChallenges and Opportunities Associatednarasimma8313No ratings yet

- 2 UserList04 - 09 - 2020 - 04 - 13 - 18 - RecoverDocument32 pages2 UserList04 - 09 - 2020 - 04 - 13 - 18 - RecoverBHUMIKA RANAWATNo ratings yet

- Installation Guide System Operations - New VersionDocument259 pagesInstallation Guide System Operations - New Versionsamson joelNo ratings yet

- 22705/JAT HUMSAFAR Third Ac (3A)Document3 pages22705/JAT HUMSAFAR Third Ac (3A)Harsh GuptaNo ratings yet

- In -Plant training report formatDocument5 pagesIn -Plant training report formatturbocruzer07No ratings yet

- Opmt - Toyoto MotorsDocument14 pagesOpmt - Toyoto Motorskhushbup473No ratings yet

- Case Study of Tehri Dam Project, District Tehri Garhwal, UttarakhandDocument7 pagesCase Study of Tehri Dam Project, District Tehri Garhwal, UttarakhandpdhurveyNo ratings yet

- Rock N RollDocument41 pagesRock N RollAmirulah Yunan100% (1)

- Reflections On The Periodic Service Review - Peter BakerDocument5 pagesReflections On The Periodic Service Review - Peter BakerSarah SandersNo ratings yet

- EN ISO 23278-2009 (Replace EN 1291) PDFDocument12 pagesEN ISO 23278-2009 (Replace EN 1291) PDFThe Normal HeartNo ratings yet

- Surya The Global School: Master NotesDocument16 pagesSurya The Global School: Master Notesror ketanNo ratings yet

- Decadent Romanticism 1780 1914 1st Edition Kostas Boyiopoulos 2024 Scribd DownloadDocument84 pagesDecadent Romanticism 1780 1914 1st Edition Kostas Boyiopoulos 2024 Scribd DownloadgenicegolbalNo ratings yet

- Energy For The 21st CenturyDocument507 pagesEnergy For The 21st CenturyDaLcNo ratings yet

- Employment Agreement (Template)Document6 pagesEmployment Agreement (Template)NJNo ratings yet

- Impromptu Speech GuidelinesDocument3 pagesImpromptu Speech GuidelinesDhin CaragNo ratings yet

- SCHEME NEW 2025Document13 pagesSCHEME NEW 2025JIHUDUMIESCHOOLNo ratings yet

- Danielle Armour Resume 2017Document1 pageDanielle Armour Resume 2017daniellearmour24No ratings yet

- People Vs EmpanteDocument1 pagePeople Vs EmpanteArecarA.ReforsadoNo ratings yet

- Activity-Based Costing and Activity-Based Management: Tracing, Indirect-Cost Pools, and Cost-Allocation BasesDocument9 pagesActivity-Based Costing and Activity-Based Management: Tracing, Indirect-Cost Pools, and Cost-Allocation Basesvir1672No ratings yet

- PhilosophyDocument8 pagesPhilosophyOctavian NicolaeNo ratings yet

- Teacher and Student Online ResourcesDocument3 pagesTeacher and Student Online Resourcesbuhbuh515No ratings yet

- Translations IN The African Languages: of The Holy Qur'AnDocument9 pagesTranslations IN The African Languages: of The Holy Qur'AnМихайло ЯкубовичNo ratings yet

- Buckingham Palace: Ashirwad Moharana Swastik Samarpit SahooDocument33 pagesBuckingham Palace: Ashirwad Moharana Swastik Samarpit SahooSidhu Vinay ReddyNo ratings yet

- University of Kerala: Results of Sixth Semester B.Tech Degree Examination (2003 SCHEME)Document22 pagesUniversity of Kerala: Results of Sixth Semester B.Tech Degree Examination (2003 SCHEME)rohitraveendranNo ratings yet

- BBA III Year Human Resource Management SyllabusDocument47 pagesBBA III Year Human Resource Management SyllabusShivamNo ratings yet

- Occupational StandardsDocument16 pagesOccupational StandardsMelkamu Setie KebedeNo ratings yet

- Recommendations For Fire Station Design: Executive DevelopmentDocument37 pagesRecommendations For Fire Station Design: Executive DevelopmentArc MuNo ratings yet

- Wedding Package Updated 2013-11-15Document2 pagesWedding Package Updated 2013-11-15Helen Joy Grijaldo JueleNo ratings yet

- 2023 Schedule of Pre Week LecturesDocument2 pages2023 Schedule of Pre Week LecturesasphyxiateddollNo ratings yet