0 ratings0% found this document useful (0 votes)

56 viewsAMLA W Amendments

AMLA W Amendments

Uploaded by

thebluesharpieThis document is the Republic Act No. 9160, also known as the Anti-Money Laundering Act of 2001 passed by the Philippine Congress. The act defines money laundering and establishes penalties for committing money laundering offenses. It also declares it the policy of the State to protect bank accounts and ensure the Philippines is not used for money laundering from unlawful activities. The act defines key terms including "covered persons", "covered transactions", "monetary instruments", and "unlawful activity".

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

AMLA W Amendments

AMLA W Amendments

Uploaded by

thebluesharpie0 ratings0% found this document useful (0 votes)

56 views20 pagesThis document is the Republic Act No. 9160, also known as the Anti-Money Laundering Act of 2001 passed by the Philippine Congress. The act defines money laundering and establishes penalties for committing money laundering offenses. It also declares it the policy of the State to protect bank accounts and ensure the Philippines is not used for money laundering from unlawful activities. The act defines key terms including "covered persons", "covered transactions", "monetary instruments", and "unlawful activity".

Original Description:

AMLA w Amendments

Original Title

AMLA w Amendments

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

This document is the Republic Act No. 9160, also known as the Anti-Money Laundering Act of 2001 passed by the Philippine Congress. The act defines money laundering and establishes penalties for committing money laundering offenses. It also declares it the policy of the State to protect bank accounts and ensure the Philippines is not used for money laundering from unlawful activities. The act defines key terms including "covered persons", "covered transactions", "monetary instruments", and "unlawful activity".

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

56 views20 pagesAMLA W Amendments

AMLA W Amendments

Uploaded by

thebluesharpieThis document is the Republic Act No. 9160, also known as the Anti-Money Laundering Act of 2001 passed by the Philippine Congress. The act defines money laundering and establishes penalties for committing money laundering offenses. It also declares it the policy of the State to protect bank accounts and ensure the Philippines is not used for money laundering from unlawful activities. The act defines key terms including "covered persons", "covered transactions", "monetary instruments", and "unlawful activity".

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 20

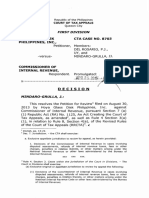

REPUBLIC ACT NO.

9160 September 29, 2001

AN ACT DEFINING THE CRIME OF MONEY LAUNDERING, PROVIDING

PENALTIES THEREFOR AND FOR OTHER PURPOSES

Be it enacted by the Senate and House of Representatives of the Philippines in

Congress assembled:

Section 1. Short Title. This Act shall be known as the "Anti-Money Laundering

Act of 2001."

Section 2. Declaration of Policy. It is hereby declared the policy of the State to

protect and preserve the integrity and confidentiality of bank accounts and to

ensure that the Philippines shall not be used as a money laundering site for the

proceeds of any unlawful activity. Consistent with its foreign policy, the State

shall extend cooperation in transnational investigations and prosecutions of

persons involved in money laundering activities whenever committed.

Section 3. Definitions. For purposes of this Act, the following terms are hereby

defined as follows:

"(a) Covered persons, natural or juridical, refer to:

"(1) banks, non-banks, quasi-banks, trust entities, foreign exchange

dealers, pawnshops, money changers, remittance and transfer

companies and other similar entities and all other persons and their

subsidiaries and affiliates supervised or regulated by the Bangko

Sentral ng Pilipinas (BSP);

"(2) insurance companies, pre-need companies and all other

persons supervised or regulated by the Insurance Commission (IC);

"(3) (i) securities dealers, brokers, salesmen, investment houses and

other similar persons managing securities or rendering services as

investment agent, advisor, or consultant, (ii) mutual funds, close-end

investment companies, common trust funds, and other similar

persons, and (iii) other entities administering or otherwise dealing in

currency, commodities or financial derivatives based thereon,

valuable objects, cash substitutes and other similar monetary

instruments or property supervised or regulated by the Securities

and Exchange Commission (SEC);

"(4) jewelry dealers in precious metals, who, as a business, trade in

precious metals, for transactions in excess of One million pesos

(P1,000,000.00);

"(5) jewelry dealers in precious stones, who, as a business, trade in

precious stones, for transactions in excess of One million pesos

(P1,000,000.00);

"(6) company service providers which, as a business, provide any of

the following services to third parties: (i) acting as a formation agent

of juridical persons; (ii) acting as (or arranging for another person to

act as) a director or corporate secretary of a company, a partner of a

partnership, or a similar position in relation to other juridical persons;

(iii) providing a registered office, business address or

accommodation, correspondence or administrative address for a

company, a partnership or any other legal person or arrangement;

and (iv) acting as (or arranging for another person to act as) a

nominee shareholder for another person; and

"(7) persons who provide any of the following services:

(i) managing of client money, securities or other assets;

(ii) management of bank, savings or securities accounts;

(iii) organization of contributions for the creation, operation or

management of companies; and

(iv) creation, operation or management of juridical persons or

arrangements, and buying and selling business entities.

"Notwithstanding the foregoing, the term covered persons

shall exclude lawyers and accountants acting as independent

legal professionals in relation to information concerning their

clients or where disclosure of information would compromise

client confidences or the attorney-client relationship: Provided,

That these lawyers and accountants are authorized to practice

in the Philippines and shall continue to be subject to the

provisions of their respective codes of conduct and/or

professional responsibility or any of its amendments."

(b) 'Covered transaction' is a transaction in cash or other equivalent

monetary instrument involving a total amount in excess of Five hundred

thousand pesos (PhP 500,000.00) within one (1) banking day.

"(b-1) 'Suspicious transaction' are transactions with covered institutions,

regardless of the amounts involved, where any of the following

circumstances exist:

1. there is no underlying legal or trade obligation, purpose or economic

justification;

2. the client is not properly identified;

3. the amount involved is not commensurate with the business or financial

capacity of the client;

4. taking into account all known circumstances, it may be perceived that

the client's transaction is structured in order to avoid being the subject of

reporting requirements under the Act;

5. any circumstances relating to the transaction which is observed to

deviate from the profile of the client and/or the client's past transactions

with the covered institution;

6. the transactions is in a way related to an unlawful activity or offense

under this Act that is about to be, is being or has been committed; or

7. any transactions that is similar or analogous to any of the foregoing."

(c) "Monetary Instrument" refers to:

(1) coins or currency of legal tender of the Philippines, or of any

other country;

(2) drafts, checks and notes;

(3) securities or negotiable instruments, bonds, commercial papers,

deposit certificates, trust certificates, custodial receipts or deposit

substitute instruments, trading orders, transaction tickets and

confirmations of sale or investments and money marked

instruments; and

(4) other similar instruments where title thereto passes to another by

endorsement, assignment or delivery.

(d) "Offender" refers to any person who commits a money laundering

offense.

(e) "Person" refers to any natural or juridical person.

(f) "Proceeds" refers to an amount derived or realized from an unlawful

activity.

(g) "Supervising Authority" refers to the appropriate supervisory or

regulatory agency, department or office supervising or regulating the

covered institutions enumerated in Section 3(a).

(h) "Transaction" refers to any act establishing any right or obligation or

giving rise to any contractual or legal relationship between the parties

thereto. It also includes any movement of funds by any means with a

covered institution.

"(i) Unlawful activity refers to any act or omission or series or

combination thereof involving or having direct relation to the following:

"(1) Kidnapping for ransom under Article 267 of Act No. 3815,

otherwise known as the Revised Penal Code, as amended;

"(2) Sections 4, 5, 6, 8, 9, 10, 11, 12, 13, 14, 15 and 16 of Republic

Act No. 9165, otherwise known as the Comprehensive Dangerous

Drugs Act of 2002;

"(3) Section 3 paragraphs B, C, E, G, H and I of Republic Act No.

3019, as amended, otherwise known as the Anti-Graft and Corrupt

Practices Act;

"(4) Plunder under Republic Act No. 7080, as amended;

"(5) Robbery and extortion under Articles 294, 295, 296, 299, 300,

301 and 302 of the Revised Penal Code, as amended;

"(6) Jueteng and Masiao punished as illegal gambling under

Presidential Decree No. 1602;

"(7) Piracy on the high seas under the Revised Penal Code, as

amended and Presidential Decree No. 532;

"(8) Qualified theft under Article 310 of the Revised Penal Code, as

amended;

"(9) Swindling under Article 315 and Other Forms of Swindling under

Article 316 of the Revised Penal Code, as amended;

"(10) Smuggling under Republic Act Nos. 455 and 1937;

"(11) Violations of Republic Act No. 8792, otherwise known as the

Electronic Commerce Act of 2000;

"(12) Hijacking and other violations under Republic Act No. 6235;

destructive arson and murder, as defined under the Revised Penal

Code, as amended;

"(13) Terrorism and conspiracy to commit terrorism as defined and

penalized under Sections 3 and 4 of Republic Act No. 9372;

"(14) Financing of terrorism under Section 4 and offenses

punishable under Sections 5, 6, 7 and 8 of Republic Act No. 10168,

otherwise known as the Terrorism Financing Prevention and

Suppression Act of 2012:

"(15) Bribery under Articles 210, 211 and 211-A of the Revised

Penal Code, as amended, and Corruption of Public Officers under

Article 212 of the Revised Penal Code, as amended;

"(16) Frauds and Illegal Exactions and Transactions under Articles

213, 214, 215 and 216 of the Revised Penal Code, as amended;

"(17) Malversation of Public Funds and Property under Articles 217

and 222 of the Revised Penal Code, as amended;

"(18) Forgeries and Counterfeiting under Articles 163, 166, 167, 168,

169 and 176 of the Revised Penal Code, as amended;

"(19) Violations of Sections 4 to 6 of Republic Act No. 9208,

otherwise known as the Anti-Trafficking in Persons Act of 2003;

"(20) Violations of Sections 78 to 79 of Chapter IV, of Presidential

Decree No. 705, otherwise known as the Revised Forestry Code of

the Philippines, as amended;

"(21) Violations of Sections 86 to 106 of Chapter VI, of Republic Act

No. 8550, otherwise known as the Philippine Fisheries Code of

1998;

"(22) Violations of Sections 101 to 107, and 110 of Republic Act No.

7942, otherwise known as the Philippine Mining Act of 1995;

"(23) Violations of Section 27(c), (e), (f), (g) and (i), of Republic Act

No. 9147, otherwise known as the Wildlife Resources Conservation

and Protection Act;

"(24) Violation of Section 7(b) of Republic Act No. 9072, otherwise

known as the National Caves and Cave Resources Management

Protection Act;

"(25) Violation of Republic Act No. 6539, otherwise known as the

Anti-Carnapping Act of 2002, as amended;

"(26) Violations of Sections 1, 3 and 5 of Presidential Decree No.

1866, as amended, otherwise known as the decree Codifying the

Laws on Illegal/Unlawful Possession, Manufacture, Dealing In,

Acquisition or Disposition of Firearms, Ammunition or Explosives;

"(27) Violation of Presidential Decree No. 1612, otherwise known as

the Anti-Fencing Law;

"(28) Violation of Section 6 of Republic Act No. 8042, otherwise

known as the Migrant Workers and Overseas Filipinos Act of 1995,

as amended by Republic Act No. 10022;

"(29) Violation of Republic Act No. 8293, otherwise known as the

Intellectual Property Code of the Philippines;

"(30) Violation of Section 4 of Republic Act No. 9995, otherwise

known as the Anti-Photo and Video Voyeurism Act of 2009;

"(31) Violation of Section 4 of Republic Act No. 9775, otherwise

known as the Anti-Child Pornography Act of 2009;

"(32) Violations of Sections 5, 7, 8, 9, 10(c), (d) and (e), 11, 12 and

14 of Republic Act No. 7610, otherwise known as the Special

Protection of Children Against Abuse, Exploitation and

Discrimination;

"(33) Fraudulent practices and other violations under Republic Act

No. 8799, otherwise known as the Securities Regulation Code of

2000; and

"(34) Felonies or offenses of a similar nature that are punishable

under the penal laws of other countries."

"(j) Precious metals shall mean gold, silver, platinum, palladium,

rhodium, ruthenium, iridium and osmium. These include alloys of precious

metals, solders and plating chemicals such as rhodium and palladium

plating solutions and potassium gold cyanide and potassium silver cyanide

and silver cyanide in salt solution.

"(k) Precious stones shall mean diamond, ruby, emerald, sapphire, opal,

amethyst, beryl, topaz, and garnet that are used in jewelry making,

including those formerly classified as semi-precious stones."

SEC. 4. Money Laundering Offense. Money laundering is committed by any

person who, knowing that any monetary instrument or property represents,

involves, or relates to the proceeds of any unlawful activity:

"(a) transacts said monetary instrument or property;

"(b) converts, transfers, disposes of, moves, acquires, possesses or

uses said monetary instrument or property;

"(c) conceals or disguises the true nature, source, location,

disposition, movement or ownership of or rights with respect to said

monetary instrument or property;

"(d) attempts or conspires to commit money laundering offenses

referred to in paragraphs (a), (b) or (c);

"(e) aids, abets, assists in or counsels the commission of the money

laundering offenses referred to in paragraphs (a), (b) or (c) above;

and

"(f) performs or fails to perform any act as a result of which he

facilitates the offense of money laundering referred to in paragraphs

(a), (b) or (c) above.

"Money laundering is also committed by any covered person who, knowing

that a covered or suspicious transaction is required under this Act to be

reported to the Anti-Money Laundering Council (AMLC), fails to do so."

Section 5. Jurisdiction of Money Laundering Cases. The regional trial courts

shall have jurisdiction to try all cases on money laundering. Those committed by

public officers and private persons who are in conspiracy with such public officers

shall be under the jurisdiction of the Sandiganbayan.

SEC. 6. Prosecution of Money Laundering.

"(a) Any person may be charged with and convicted of both the

offense of money laundering and the unlawful activity as herein

defined.

"(b) The prosecution of any offense or violation under this Act shall

proceed independently of any proceeding relating to the unlawful

activity."

""SEC. 7. Creation of Anti-Money Laundering Council (AMLC). The Anti-Money

Laundering Council is hereby created and shall be composed of the Governor of

the Bangko Sentral ng Pilipinas as Chairman, the Commissioner of the Insurance

Commission and the Chairman of the Securities and Exchange Commission, as

members. The AMLC shall act unanimously in the discharge of its functions as

defined hereunder:

"(1) to require and receive covered or suspicious transaction reports from

covered institutions;

"(2) to issue orders addressed to the appropriate Supervising Authority or

the covered institutions to determine the true identity of the owner of any

monetary instrument or preperty subject of a covered transaction or

suspicious transaction report or request for assistance from a foreign

State, or believed by the Council, on the basis fo substantial evidence, to

be, in whole or in part, wherever located, representing, involving, or related

to directly or indirectly, in any manner or by any means, the proceeds of an

unlawful activitity.

"(3) to institute civil forfeiture proceedings and all other remedial

proceedings through the Office of th Solicitor General;

"(4) to cause the filing of complaints with the Department of Justice or the

Ombudsman for the prosecution of money laundering offenses;

"(5) to investigate suspicious transactions and covered transactions

deemed suspicious after an investigation by AMLC, money laundering

activities and other violations of this Act;

"(6) to apply before the Court of Appeals, ex parte, for the freezing of any

monetary instrument or property alleged to be laundered, proceeds from,

or instrumentalities used in or intended for use in any unlawful activity as

defined in Section 3(i) hereof;

"(7) to implement such measures as may be necessary and justified under

this Act to counteract money laundering;

"(8) to receive and take action in respect of, any request from foreign

states for assistance in their own anti-money laundering operations

provided in this Act;

"(9) to develop educational programs on the pernicious effects of money

laundering, the methods and techniques used in the money laundering, the

viable means of preventing money laundering and the effective ways of

prosecuting and punishing offenders;

"(10) to enlist the assistance of any branch, department, bureau, office,

agency, or instrumentality of the government, including government-owned

and -controlled corporations, in undertaking any and all anti-money

laundering operations, which may include the use of its personnel, facilities

and resources for the more resolute prevention, detection, and

investigation of money laundering offenses and prosecution of offenders;

and

"(11) to impose administrative sanctions for the violation of laws, rules,

regulations, and orders and resolutions issued pursuant thereto."

"(12) to require the Land Registration Authority and all its Registries of

Deeds to submit to the AMLC, reports on all real estate transactions

involving an amount in excess of Five hundred thousand pesos

(P500,000.00) within fifteen (15) days from the date of registration of the

transaction, in a form to be prescribed by the AMLC. The AMLC may also

require the Land Registration Authority and all its Registries of Deeds to

submit copies of relevant documents of all real estate transactions."

Section 8. Creation of a Secretariat. The AMLC is hereby authorized to

establish a secretariat to be headed by an Executive Director who shall be

appointed by the Council for a term of five (5) years. He must be a member of the

Philippine Bar, at least thirty-five (35) years of age and of good moral character,

unquestionable integrity and known probity. All members of the Secretariat must

have served for at least five (5) years either in the Insurance Commission, the

Securities and Exchange Commission or the Bangko Sentral ng Pilipinas (BSP)

and shall hold full-time permanent positions within the BSP.

SEC. 9. Prevention of Money Laundering; Customer Identification Requirements

and Record Keeping

(a) Customer Identification, - Covered institutions shall establish and

record the true identity of its clients based on official documents. They

shall maintain a system of verifying the true identity of their clients and, in

case of corporate clients, require a system of verifying their legal existence

and organizational structure, as well as the authority and identification of

all persons purporting to act on their behalf.

The provisions of existing laws to the contrary notwithstanding, anonymous

accounts, accounts under fictitious names, and all other similar accounts

shall be absolutely prohibited. Peso and foreign currency non-checking

numbered accounts shall be allowed. The BSP may conduct annual testing

solely limited to the determination of the existence and true identity of the

owners of such accounts.

(b) Record Keeping All records of all transactions of covered institutions

shall be maintained and safely stored for five (5) years from the date of

transactions. With respect to closed accounts, the records on customer

identification, account files and business correspondence, shall be

preserved and safety stored for at least five (5) years from the dates when

they were closed.

"(c) Reporting of Covered and Suspicious Transactions. Covered

persons shall report to the AMLC all covered transactions and suspicious

transactions within five (5) working days from occurrence thereof, unless

the AMLC prescribes a different period not exceeding fifteen (15) working

days.

"Lawyers and accountants acting as independent legal professionals are

not required to report covered and suspicious transactions if the relevant

information was obtained in circumstances where they are subject to

professional secrecy or legal professional privilege.

"Should a transaction be determined to be both a covered transaction and

a suspicious transaction, the covered institution shall be required to report

the same as a suspicious transaction.

"When reporting covered or suspicious transactions to the AMLC, covered

institutions and their officers and employees shall not be deemed to have

violated Republic Act No. 1405, as amended, Republic Act No. 6426, as

amended, Republic Act No. 8791 and other similar laws, but are prohibited

from communicating, directly or indirectly, in any manner or by an means,

to any person, the fact that a covered or suspicious transaction report was

made, the contents thereof, or any other information in relation thereto. In

case of violation thereof, the concerned officer and employee of the

covered institution shall be criminally liable. However, no administrative,

criminal or civil proceedings, shall lie against any person for having made a

covered or suspicious transaction report in the regular performance of his

duties in good faith, whether or not such reporting results in any criminal

prosecution under this Act of any other law.

"When reporting covered or suspicious transactions to the AMLC, covered

persons and their officers and employees are prohibited from

communicating, directly or indirectly, in any manner or by any means, to

any person or entity, the media, the fact that a covered or suspicious

transaction has been reported or is about to be reported, the contents of

the report, or any other information in relation thereto. Neither may such

reporting be published or aired in any manner or form by the mass media",

electronic mail, or other similar devices. In case of violation thereof, the

concerned officer and employee of the covered person and media shall be

held criminally liable."

"SEC. 10. Freezing of Monetary Instrument or Property. Upon a verified ex

parte petition by the AMLC and after determination that probable cause exists

that any monetary instrument or property is in any way related to an unlawful

activity as defined in Section 3(i) hereof, the Court of Appeals may issue a freeze

order which shall be effective immediately, and which shall not exceed six (6)

months depending upon the circumstances of the case: Provided, That if there is

no case filed against a person whose account has been frozen within the period

determined by the court, the freeze order shall be deemed ipso facto lifted:

Provided, further, That this new rule shall not apply to pending cases in the

courts. In any case, the court should act on the petition to freeze within twenty-

four (24) hours from filing of the petition. If the application is filed a day before a

nonworking day, the computation of the twenty-four (24)-hour period shall

exclude the nonworking days.

"A person whose account has been frozen may file a motion to lift the freeze

order and the court must resolve this motion before the expiration of the freeze

order.

"No court shall issue a temporary restraining order or a writ of injunction against

any freeze order, except the Supreme Court."

SEC. 11. Authority to Inquire into Bank Deposits. Notwithstanding the

provisions of Republic Act No. 1405, as amended; Republic Act No. 6426, as

amended; Republic Act No. 8791; and other laws, the AMLC may inquire into or

examine any particular deposit or investment, including related accounts, with

any banking institution or non-bank financial institution upon order of any

competent court based on an ex parte application in cases of violations of this

Act, when it has been established that there is probable cause that the deposits

or investments, including related accounts involved, are related to an unlawful

activity as defined in Section 3(i) hereof or a money laundering offense under

Section 4 hereof; except that no court order shall be required in cases involving

activities defined in Section 3(i)(1), (2), and (12) hereof, and felonies or offenses

of a nature similar to those mentioned in Section 3(i)(1), (2), and (12), which are

Punishable under the penal laws of other countries, and terrorism and conspiracy

to commit terrorism as defined and penalized under Republic Act No. 9372."

"The Court of Appeals shall act on the application to inquire into or examine any

deposit or investment with any banking institution or non-bank financial institution

within twenty-four (24) hours from filing of the application."

"To ensure compliance with this Act, the Bangko Sentral ng Pilipinas may, in the

course of a periodic or special examination, check the compliance of a Covered

institution with the requirements of the AMLA and its implementing rules and

regulations."

"For purposes of this section, related accounts shall refer to accounts, the funds

and sources of which originated from and/or are materially linked to the monetary

instrument(s) or property(ies) subject of the freeze order(s)."

"A court order ex parte must first be obtained before the AMLC can inquire into

these related Accounts: Provided, That the procedure for the ex parte application

of the ex parte court order for the principal account shall be the same with that of

the related accounts."

"The authority to inquire into or examine the main account and the related

accounts shall comply with the requirements of Article III, Sections 2 and 3 of the

1987 Constitution, which are hereby incorporated by reference

Section 12. Forfeiture Provisions.

"(a) Civil Forfeiture. Upon determination by the AMLC that probable

cause exists that any monetary instrument or property is in any way related

to an unlawful activity as defined in Section 3(i) or a money laundering

offense under Section 4 hereof, the AMLC shall file with the appropriate

court through the Office of the Solicitor General, a verified ex parte petition

for forfeiture, and the Rules of Court on Civil Forfeiture shall apply.

"The forfeiture shall include those other monetary instrument or property

having an equivalent value to that of the monetary instrument or property

found to be related in any way to an unlawful activity or a money

laundering offense, when with due diligence, the former cannot be located,

or it has been substantially altered, destroyed, diminished in value or

otherwise rendered worthless by any act or omission, or it has been

concealed, removed, converted, or otherwise transferred, or it is located

outside the Philippines or has been placed or brought outside the

jurisdiction of the court, or it has been commingled with other monetary

instrument or property belonging to either the offender himself or a third

person or entity, thereby rendering the same difficult to identify or be

segregated for purposes of forfeiture.

"(b) Claim on Forfeited Assets. Where the court has issued an order of

forfeiture of the monetary instrument or property in a criminal prosecution

for any money laundering offense defined under Section 4 of this Act, the

offender or any other person claiming an interest therein may apply, by

verified petition, for a declaration that the same legitimately belongs to him

and for segregation or exclusion of the monetary instrument or property

corresponding thereto. The verified petition shall be filed with the court

which rendered the judgment of forfeiture, within fifteen (15) days from the

date of the finality of the order of forfeiture, in default of which the said

order shall become final and executor. This provision shall apply in both

civil and criminal forfeiture.

"(c) Payment in Lieu of Forfeiture. Where the court has issued an order

of forfeiture of the monetary instrument or property subject of a money

laundering offense defined under Section 4, and said order cannot be

enforced because any particular monetary instrument or property cannot,

with due diligence, be located, or it has been substantially altered,

destroyed, diminished in value or otherwise rendered worthless by any act

or omission, directly or indirectly, attributable to the offender, or it has been

concealed, removed, converted, or otherwise transferred to prevent the

same from being found or to avoid forfeiture thereof, or it is located outside

the Philippines or has been placed or brought outside the jurisdiction of the

court, or it has been commingled with other monetary instruments or

property belonging to either the offender himself or a third person or entity,

thereby rendering the same difficult to identify or be segregated for

purposes of forfeiture, the court may, instead of enforcing the order of

forfeiture of the monetary instrument or property or part thereof or interest

therein, accordingly order the convicted offender to pay an amount equal

to the value of said monetary instrument or property. This provision shall

apply in both civil and criminal forfeiture."

Section 13. Mutual Assistance among States.

(a) Request for Assistance from a Foreign State. Where a foreign

State makes a request for assistance in the investigation or prosecution of

a money laundering offense, the AMLC may execute the request or refuse

to execute the same and inform the foreign State of any valid reason for

not executing the request or for delaying the execution thereof. The

principles of mutuality and reciprocity shall, for this purpose, be at all times

recognized.

(b) Power of the AMLC to Act on a Request for Assistance from a

Foreign State. The AMLC may execute a request for assistance from a

foreign State by: (1) tracking down, freezing, restraining and seizing assets

alleged to be proceeds of any unlawful activity under the procedures laid

down in this Act; (2) giving information needed by the foreign State within

the procedures laid down in this Act; and (3) applying for an order of

forfeiture of any monetary instrument or property in the court: Provided,

That the court shall not issue such an order unless the application is

accompanied by an authenticated copy of the order of a court in the

requesting State ordering the forfeiture of said monetary instrument or

properly of a person who has been convicted of a money laundering

offense in the requesting State, and a certification of an affidavit of a

competent officer of the requesting State stating that the conviction and the

order of forfeiture are final and then no further appeal lies in respect or

either.

(c) Obtaining Assistance from Foreign States. The AMLC may make

a request to any foreign State for assistance in (1) tracking down, freezing,

restraining and seizing assets alleged to be proceeds of any unlawful

activity; (2) obtaining information that it needs relating to any covered

transaction, money laundering offense or any other matter directly or

indirectly, related thereto; (3) to the extent allowed by the law of the

Foreign State, applying with the proper court therein for an order to enter

any premises belonging to or in the possession or control of, any or all of

the persons named in said request, and/or search any or all such persons

named therein and/or remove any document, material or object named in

said request: Provided, That the documents accompanying the request in

support of the application have been duly authenticated in accordance with

the applicable law or regulation of the foreign State; and (4) applying for an

order of forfeiture of any monetary instrument or property in the proper

court in the foreign State: Provided, That the request is accompanied by an

authenticated copy of the order of the regional trial court ordering the

forfeiture of said monetary instrument or property of a convicted offender

and an affidavit of the clerk of court stating that the conviction and the

order of forfeiture are final and that no further appeal lies in respect of

either.

(d) Limitations on Request for Mutual Assistance. The AMLC may

refuse to comply with any request for assistance where the action sought

by the request contravenes any provision of the Constitution or the

execution of a request is likely to prejudice the national interest of the

Philippines unless there is a treaty between the Philippines and the

requesting State relating to the provision of assistance in relation to money

laundering offenses.

(e) Requirements for Requests for Mutual Assistance from Foreign

State. A request for mutual assistance from a foreign State must (1)

confirm that an investigation or prosecution is being conducted in respect

of a money launderer named therein or that he has been convicted of any

money laundering offense; (2) state the grounds on which any person is

being investigated or prosecuted for money laundering or the details of his

conviction; (3) gives sufficient particulars as to the identity of said person;

(4) give particulars sufficient to identity any covered institution believed to

have any information, document, material or object which may be of

assistance to the investigation or prosecution; (5) ask from the covered

institution concerned any information, document, material or object which

may be of assistance to the investigation or prosecution; (6) specify the

manner in which and to whom said information, document, material or

object detained pursuant to said request, is to be produced; (7) give all the

particulars necessary for the issuance by the court in the requested State

of the writs, orders or processes needed by the requesting State; and (8)

contain such other information as may assist in the execution of the

request.

(f) Authentication of Documents. For purposes of this Section, a

document is authenticated if the same is signed or certified by a judge,

magistrate or equivalent officer in or of, the requesting State, and

authenticated by the oath or affirmation of a witness or sealed with an

official or public seal of a minister, secretary of State, or officer in or of, the

government of the requesting State, or of the person administering the

government or a department of the requesting territory, protectorate or

colony. The certificate of authentication may also be made by a secretary

of the embassy or legation, consul general, consul, vice consul, consular

agent or any officer in the foreign service of the Philippines stationed in the

foreign State in which the record is kept, and authenticated by the seal of

his office.

(g) Extradition. The Philippines shall negotiate for the inclusion of

money laundering offenses as herein defined among extraditable offenses

in all future treaties.

SEC. 14. Penal Provisions. (a) Penalties for the Crime of Money Laundering.

The penalty of imprisonment ranging from seven (7) to fourteen (14) years and a

fine of not less than Three million Philippine pesos (Php3,000,000.00) but not

more than twice the value of the monetary instrument or property involved in the

offense, shall be imposed upon a person convicted under Section 4(a), (b), (c)

and (d) of this Act.

"The penalty of imprisonment from four (4) to seven (7) years and a fine of not

less than One million five hundred thousand Philippine pesos (Php1,500,000.00)

but not more than Three million Philippine pesos (Php3,000,000.00), shall be

imposed upon a person convicted under Section 4(e) and (f) of this Act.

"The penalty of imprisonment from six (6) months to four (4) years or a fine of not

less than One hundred thousand Philippine pesos (Php100,000.00) but not more

than Five hundred thousand Philippine pesos (Php500,000.00), or both, shall be

imposed on a person convicted under the last paragraph of Section 4 of this Act.

(a) Penalties for the Crime of Money Laundering. The penalty of

imprisonment ranging from seven (7) to fourteen (14) years and a fine of

not less than Three million Philippine pesos (Php 3,000,000.00) but not

more than twice the value of the monetary instrument or property involved

in the offense, shall be imposed upon a person convicted under Section

4(a) of this Act.

The penalty of imprisonment from four (4) to seven (7) years and a fine of

not less than One million five hundred thousand Philippine pesos (Php

1,500,000.00) but not more than Three million Philippine pesos (Php

3,000,000.00), shall be imposed upon a person convicted under Section

4(b) of this Act.

The penalty of imprisonment from six (6) months to four (4) years or a fine

of not less than One hundred thousand Philippine pesos (Php 100,000.00)

but not more than Five hundred thousand Philippine pesos (Php

500,000.00), or both, shall be imposed on a person convicted under

Section 4(c) of this Act.

(b) Penalties for Failure to Keep Records. The penalty of imprisonment

from six (6) months to one (1) year or a fine of not less than One hundred

thousand Philippine pesos (Php 100,000.00) but not more than Five

hundred thousand Philippine pesos (Php 500,000.00), or both, shall be

imposed on a person convicted under Section 9(b) of this Act.

"(c) Malicious Reporting. Any person who, with malice, or in bad faith,

reports or files a completely unwarranted or false information relative to

money laundering transaction against any person shall be subject to a

penalty to six (6) months to four (4) years imprisonment and a fine of not

less than One hundred thousand Philippine pesos (Php100,000.00) but not

more than Five hundred thousand Philippine pesos (Php500,000.00), at

the discretion of the court: Provided, That the offender is not entitled to

avail the benefits of the Probation Law.

"If the offender is a corporation, association, partnership or any juridical

person, the penalty shall be imposed upon the responsible officers, as the

case may be, who participated in, or allowed by their gross negligence, the

commission of the crime. If the offender is a juridical person, the court may

suspend or revoke its license. If the offer is an alien, he shall, in addition to

the penalties herein prescribed, be deported without further proceedings

after serving the penalties herein prescribed. If the offender is a public

official or employee, he shall, in addition to the penalties prescribed herein,

suffer perpetual or temporary absolute disqualification from office, as the

case may be.

"Any public official or employee who is called upon to testify and refuses to

do the same or purposely fails to testify shall suffer the same penalties

prescribed herein.

"(d) Breach of Confidentiality. The punishment of imprisonment ranging

from three (3) to eight (8) years and a fine of not less than Five hundred

thousand Philippine pesos (Php500,000.00) but not more than One million

Philippine pesos (Php1,000,000.00) shall be imposed on a person

convicted for a violation under Section 9(c). In the case of a breach of

confidentiality that is published or reported by media, the responsible

reporter, writer, president, publisher, manager and editor-in-chief shall be

liable under this Act.

"(e) The penalty of imprisonment ranging from four (4) to seven (7) years

and a fine corresponding to not more than two hundred percent (200%) of

the value of the monetary instrument or property laundered shall be

imposed upon the covered person, its directors, officers or pesonnel who

knowingly participated in the commission of the crime of money

laundering.

"(f) Imposition of Administrative Sanctions. The imposition of the

administrative sanctions shall be without prejudice to the filing of criminal

charges against the persons responsible for the violation.

"After due notice and hearing, the AMLC shall, at its discretion, impose

sanctions, including monetary penalties, warning or reprimand, upon any

covered person, its directors, officers, employees or any other person for

the violation of this Act, its implementing rules and regulations, or for

failure or refusal to comply with AMLC orders, resolutions and other

issuances. Such monetary penalties shall be in amounts as may be

determined by the AMLC to be appropriate, which shall not be more than

Five hundred thousand Philippine pesos (P500,000.00) per violation.1wphi1

"The AMLC may promulgate rules on fines and penalties taking into

consideration the attendant circumstances, such as the nature and gravity

of the violation or irregularity.

"(g) The provision of this law shall not be construed or implemented in a

manner that will discriminate against certain customer types, such as

politically-exposed persons, as well as their relatives, or against a certain

religion, race or ethnic origin, or such other attributes or profiles when used

as the only basis to deny these persons access to the services provided by

the covered persons. Whenever a bank, or quasi-bank, financial institution

or whenever any person or entity commits said discriminatory act, the

person or persons responsible for such violation shall be subject to

sanctions as may be deemed appropriate by their respective regulators."

Section 15. Prohibitions Against Political Harassment. This Act shall not be

used for political prosecution or harassment or as an instrument to hamper

competition in trade and commerce.

No case for money laundering may be filed against and no assets shall be

frozen, attached or forfeited to the prejudice of a candidate for an electoral office

during an election period.

Section 16. Restitution. Restitution for any aggrieved party shall be governed

by the provisions of the New Civil Code.

Section 17. Implementing Rules and Regulations. Within thirty (30) days from

the effectivity of this Act, the Bangko Sentral ng Pilipinas, the Insurance

Commission and the Securities and Exchange Commission shall promulgate the

rules and regulations to implement effectivity the provisions of this Act. Said rules

and regulations shall be submitted to the Congressional Oversight Committee for

approval.

Covered institutions shall formulate their respective money laundering prevention

programs in accordance with this Act including, but not limited to, information

dissemination on money laundering activities and its prevention, detection and

reporting, and the training of responsible officers and personnel of covered

institutions.

Section 18. Congressional Oversight Committee. There is hereby created a

Congressional Oversight Committee composed of seven (7) members from the

Senate and seven (7) members from the House of Representatives. The

members from the Senate shall be appointed by the Senate President based on

the proportional representation of the parties or coalitions therein with at least

two (2) Senators representing the minority. The members from the House of

Representatives shall be appointed by the Speaker also based on proportional

representation of the parties or coalitions therein with at least two (2) members

representing the minority.

The Oversight Committee shall have the power to promulgate its own rules, to

oversee the implementation of this Act, and to review or revise the implementing

rules issued by the Anti-Money Laundering Council within thirty (30) days from

the promulgation of the said rules.

Section 19. Appropriations Clause. The AMLC shall be provided with an initial

appropriation of Twenty-five million Philippine pesos (Php 25,000,000.00) to be

drawn from the national government. Appropriations for the succeeding years

shall be included in the General Appropriations Act.

"SEC. 20. Non-intervention in the Bureau of Internal Revenue (BIR) Operations.

Nothing contained in this Act nor in related antecedent laws or existing

agreements shall be construed to allow the AMLC to participate in any manner in

the operations of the BIR."

"SEC. 21. The authority to inquire into or examine the main account and the

related accounts shall comply with the requirements of Article III, Sections 2 and

3 of the 1987 Constitution, which are hereby incorporated by reference. Likewise,

the constitutional injunction against ex post facto laws and bills of attainder shall

be respected in the implementation of this Act."

Section 22. Separability Clause. If any provision or section of this Act or the

application thereof to any person or circumstance is held to be invalid, the other

provisions or sections of this Act, and the application of such provision or section

to other persons or circumstances, shall not be affected thereby.

Section 23. Repealing Clause. All laws, decrees, executive orders, rules and

regulations or parts thereof, including the relevant provisions of Republic Act No.

1405, as amended; Republic Act No. 6426, as amended; Republic Act No. 8791,

as amended and other similar laws, as are inconsistent with this Act, are hereby

repealed, amended or modified accordingly.

SEC. 24. Effectivity. -- This Act shall take effect fifteen (15) days after its

complete publication in the Official Gazette or in at least two (2) national

newspapers of general circulation.

The provisions of this Act shall not apply to deposits and investments made prior

to its effectivity.

Approved,

You might also like

- (As Modified) : Lyceum Northwestern University College of Law Dagupan CityDocument10 pages(As Modified) : Lyceum Northwestern University College of Law Dagupan CityMona LizaNo ratings yet

- Republic Vs GlasglowDocument2 pagesRepublic Vs GlasglowSonia Mae C. BalbabocoNo ratings yet

- Republic Act No. 9160 The Anti-Money Laundering Act of 2001Document11 pagesRepublic Act No. 9160 The Anti-Money Laundering Act of 2001May TanNo ratings yet

- Querubin Vs QuerubinDocument9 pagesQuerubin Vs QuerubinMack Hale Bunagan100% (1)

- Tiu V NLRCDocument6 pagesTiu V NLRCFreah Genice TolosaNo ratings yet

- CTA 8703 (Hoya) - DividendsDocument33 pagesCTA 8703 (Hoya) - DividendsJerwin DaveNo ratings yet

- Tuazon Labor RevDocument78 pagesTuazon Labor RevianlaynoNo ratings yet

- LanuzaDocument3 pagesLanuzaGhee MoralesNo ratings yet

- SSC Vs Rizal Poultry and Livestock AsstnDocument7 pagesSSC Vs Rizal Poultry and Livestock Asstngilbert213No ratings yet

- Banking Laws Case DigestDocument4 pagesBanking Laws Case DigestAl Shannen Nicole LabraNo ratings yet

- General Garments Corp Vs Director of PatentsDocument5 pagesGeneral Garments Corp Vs Director of Patentsanjo020025No ratings yet

- Pleading - Ariola - Specific Perforamnce - 7october2019Document3 pagesPleading - Ariola - Specific Perforamnce - 7october2019Paul AriolaNo ratings yet

- Consumer Act of The PhilippinesDocument2 pagesConsumer Act of The PhilippinesPaul AdvinculaNo ratings yet

- Tax 2Document25 pagesTax 2Inna Marie CaylaoNo ratings yet

- OCA Circular No. 51 2011Document2 pagesOCA Circular No. 51 2011caparubrubNo ratings yet

- Corporate Practice: No ClassDocument8 pagesCorporate Practice: No ClassReyshanne Joy B MarquezNo ratings yet

- Regional Trial CourtDocument2 pagesRegional Trial CourtAnonymous SBT3XU6INo ratings yet

- Alano Vs Magud-LogmaoDocument22 pagesAlano Vs Magud-LogmaoCharmaine MejiaNo ratings yet

- 03 Champion Spark v. SandersDocument2 pages03 Champion Spark v. SandersNenzo CruzNo ratings yet

- Citytrust Banking vs. VillanuevaDocument10 pagesCitytrust Banking vs. VillanuevaMaria Cherrylen Castor Quijada0% (1)

- Amado Carumba V CADocument1 pageAmado Carumba V CACharles RiveraNo ratings yet

- BDocument2 pagesBSean ArcillaNo ratings yet

- Civil Law Review II Syllabus 2019Document2 pagesCivil Law Review II Syllabus 2019Ma BelleNo ratings yet

- Apodaca Vs NLRCDocument2 pagesApodaca Vs NLRCJan MartinNo ratings yet

- BAR POINTERS FOR REVIEW 2019 MERCANTILE HBPDocument79 pagesBAR POINTERS FOR REVIEW 2019 MERCANTILE HBPMark Jason Crece AnteNo ratings yet

- POEA SEC 2010 AmendmentsDocument44 pagesPOEA SEC 2010 AmendmentscesarjruyNo ratings yet

- Specpro Rule 88 FullTextDocument16 pagesSpecpro Rule 88 FullTextChrissy SabellaNo ratings yet

- Banking SyllabusDocument6 pagesBanking SyllabusmarawrawrawrNo ratings yet

- Lampano - ALMAQUER Position PaperDocument5 pagesLampano - ALMAQUER Position PaperGerald HernandezNo ratings yet

- 09 Narra Nickel Mining Vs Redmont Consolidated Mines (2015)Document53 pages09 Narra Nickel Mining Vs Redmont Consolidated Mines (2015)Janine RegaladoNo ratings yet

- Norma Del Socorro Vs ErnstDocument12 pagesNorma Del Socorro Vs ErnstWella JaneNo ratings yet

- Case Digests 090619Document224 pagesCase Digests 090619NMNGNo ratings yet

- Deed of Assignment of Shares VHA-JTualDocument3 pagesDeed of Assignment of Shares VHA-JTualJerome MoradaNo ratings yet

- 1 - Michel Lhuillier Pawnshop V CIRDocument8 pages1 - Michel Lhuillier Pawnshop V CIRReah CrezzNo ratings yet

- DfggyuujjDocument2 pagesDfggyuujjJornel MandiaNo ratings yet

- Subscribed and Sworn ToDocument1 pageSubscribed and Sworn ToRowena Mae MenciasNo ratings yet

- Iglesia Evangelica Vs Bishop LazaroDocument15 pagesIglesia Evangelica Vs Bishop LazaroMark John Geronimo BautistaNo ratings yet

- Answer To ComplaintDocument2 pagesAnswer To ComplaintPhenix Joyce PagdatoNo ratings yet

- Wood Technology Corp v. Equitable Bank G.R. 153867Document6 pagesWood Technology Corp v. Equitable Bank G.R. 153867Dino Bernard LapitanNo ratings yet

- 3) Pua vs. Deyto PDFDocument10 pages3) Pua vs. Deyto PDFresjudicataNo ratings yet

- Affidavit ComplaintDocument2 pagesAffidavit ComplaintLouisPNo ratings yet

- NTC Vs COADocument7 pagesNTC Vs COAjan panerioNo ratings yet

- Brew Master International Inc vs. Naflu-OkDocument3 pagesBrew Master International Inc vs. Naflu-OkDianne Esidera RosalesNo ratings yet

- Banogon vs. ZernaDocument5 pagesBanogon vs. ZernaPablo EschovalNo ratings yet

- Chapter 1 Cases RianoDocument479 pagesChapter 1 Cases RianoAnonymous 4WA9UcnU2XNo ratings yet

- Betoy V Coliflores AM No. MTJ-05-1608Document9 pagesBetoy V Coliflores AM No. MTJ-05-1608Kliehm NietzscheNo ratings yet

- Nov 2017 - PDFDocument4 pagesNov 2017 - PDFSam MaulanaNo ratings yet

- G.R. No. 212735, December 05, 2018 CIR Vs NEGROS CONSOLIDATED FARMERS MULTI-PURPOSE COOPERATIVEDocument10 pagesG.R. No. 212735, December 05, 2018 CIR Vs NEGROS CONSOLIDATED FARMERS MULTI-PURPOSE COOPERATIVEJavieNo ratings yet

- 35 Chaves V GonzalesDocument4 pages35 Chaves V Gonzalesjuan aldabaNo ratings yet

- City of Baguio Vs BusuegoDocument4 pagesCity of Baguio Vs BusuegocharmssatellNo ratings yet

- Radiowealth Finance Company vs. PalileoDocument4 pagesRadiowealth Finance Company vs. PalileoNullus cumunisNo ratings yet

- Gacutana Fraile vs. DomingoDocument2 pagesGacutana Fraile vs. DomingoKristine CentinoNo ratings yet

- Airborne Maintenance and Allied Services Inc. vs. Arnulfo M. EgosDocument2 pagesAirborne Maintenance and Allied Services Inc. vs. Arnulfo M. EgosMonyeen SesanteNo ratings yet

- Syllabus in CommRev.08.03.2020Document16 pagesSyllabus in CommRev.08.03.2020jenzmiNo ratings yet

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDocument8 pagesBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledmifajNo ratings yet

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDocument13 pagesBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledJustine Dawn Garcia Santos-TimpacNo ratings yet

- Anti-Money Laundering ActDocument12 pagesAnti-Money Laundering ActLouise SigridNo ratings yet

- Ra 9160, As Amended by Ra 9194, Ra 10167, & Ra 10365 (Amla)Document8 pagesRa 9160, As Amended by Ra 9194, Ra 10167, & Ra 10365 (Amla)Agnes80% (5)

- Anti Money Laundering ActDocument17 pagesAnti Money Laundering ActJimboy FernandezNo ratings yet

- Anti-Money Laundering Act of 2000Document18 pagesAnti-Money Laundering Act of 2000Iah LincoNo ratings yet

- Cta Directory PDFDocument1 pageCta Directory PDFthebluesharpieNo ratings yet

- Takoyaki RecipeDocument1 pageTakoyaki RecipethebluesharpieNo ratings yet

- Azcona v. JamandreDocument9 pagesAzcona v. JamandrethebluesharpieNo ratings yet

- Hahn v. CADocument6 pagesHahn v. CAthebluesharpieNo ratings yet

- Smith Bell V CADocument9 pagesSmith Bell V CAthebluesharpieNo ratings yet

- Dyer v. Eastern TrustDocument39 pagesDyer v. Eastern TrustthebluesharpieNo ratings yet

- 5-Ronquillo V CaDocument4 pages5-Ronquillo V CaoneriegenexiiiNo ratings yet

- Filinvest v. CADocument16 pagesFilinvest v. CAthebluesharpieNo ratings yet

- Hahn v. CADocument6 pagesHahn v. CAthebluesharpieNo ratings yet

- Rubio V CADocument5 pagesRubio V CAthebluesharpieNo ratings yet

- Chua V VictorioDocument9 pagesChua V VictoriothebluesharpieNo ratings yet

- Solid Homes V TanDocument8 pagesSolid Homes V TanthebluesharpieNo ratings yet

- Cannu V GalangDocument15 pagesCannu V GalangthebluesharpieNo ratings yet

- Supreme Court: Noe Villanueva For Petitioner. Jose Beltran For Private RespondentsDocument13 pagesSupreme Court: Noe Villanueva For Petitioner. Jose Beltran For Private RespondentsthebluesharpieNo ratings yet

- Macasaet V MacasaetDocument17 pagesMacasaet V MacasaetthebluesharpieNo ratings yet

- G.R. No L-42283 (Angeles Vs Calasanz)Document5 pagesG.R. No L-42283 (Angeles Vs Calasanz)Jomz ArvesuNo ratings yet

- Roxas V AlcantaraDocument5 pagesRoxas V AlcantarathebluesharpieNo ratings yet

- Ace-Agro V CADocument11 pagesAce-Agro V CAthebluesharpieNo ratings yet

- Rustan Pulp V IACDocument11 pagesRustan Pulp V IACthebluesharpieNo ratings yet

- De Castro & Cagampang Law Offices For Petitioners. Nelson A. Loyola For Private RespondentsDocument7 pagesDe Castro & Cagampang Law Offices For Petitioners. Nelson A. Loyola For Private RespondentsthebluesharpieNo ratings yet

- Central Bank V BicharaDocument11 pagesCentral Bank V BicharathebluesharpieNo ratings yet

- Solid Homes V TanDocument8 pagesSolid Homes V TanthebluesharpieNo ratings yet

- Lorenzo Shipping Corp. V BJ MarthelDocument14 pagesLorenzo Shipping Corp. V BJ MarthelthebluesharpieNo ratings yet

- Nakpil and Sons Vs CADocument17 pagesNakpil and Sons Vs CARachelle DomingoNo ratings yet

- Supreme Court: Ubaldo C. Lalin For Respondent Laureano Bros. Co., IncDocument5 pagesSupreme Court: Ubaldo C. Lalin For Respondent Laureano Bros. Co., IncthebluesharpieNo ratings yet

- Bullying Is A Sensitive Issue Particularly in The PhilippinesDocument1 pageBullying Is A Sensitive Issue Particularly in The PhilippinesStan BTOB,BTS,TXTNo ratings yet

- Bharat Filling Station and Anr Vs Indian Oil Corpod030385COM741120Document11 pagesBharat Filling Station and Anr Vs Indian Oil Corpod030385COM741120Shubham Jain ModiNo ratings yet

- AML CTF ComplianceDocument17 pagesAML CTF ComplianceajayNo ratings yet

- Forensic Accounting - Chap - 02Document31 pagesForensic Accounting - Chap - 02John Carlo CialanaNo ratings yet

- KULT Divinity Lost - Deck of TraitsDocument356 pagesKULT Divinity Lost - Deck of TraitsViktor FerreiraNo ratings yet

- # 10 Defences 1 Failure or Proof PDFDocument16 pages# 10 Defences 1 Failure or Proof PDFDinesh Kannen KandiahNo ratings yet

- Persons Chalc PC Finals - Atty. LegardaDocument175 pagesPersons Chalc PC Finals - Atty. LegardaOshNo ratings yet

- G.R. No. 93335, Sept 13, 1990, Enrile vs. Amin, 189 SCRA 573 - Crim2-CDDocument4 pagesG.R. No. 93335, Sept 13, 1990, Enrile vs. Amin, 189 SCRA 573 - Crim2-CDMarnil MagaraoNo ratings yet

- CS Unit-3Document58 pagesCS Unit-3Dr-Samson ChepuriNo ratings yet

- Latest Supreme Court Judgment On Cross Examination of WitnessesDocument40 pagesLatest Supreme Court Judgment On Cross Examination of Witnesseslawwebin100% (1)

- Rts List of Useful Websites For Help and Guidance Jan 2017Document2 pagesRts List of Useful Websites For Help and Guidance Jan 2017viyankareem12No ratings yet

- How To Use Social Media ResponsiblyDocument2 pagesHow To Use Social Media ResponsiblyEmelita Riego RodelasNo ratings yet

- Gloria Dy v. People of The Philippines: Estafa Do Not Exist, It Effectively Says That There Is No Crime. There IsDocument1 pageGloria Dy v. People of The Philippines: Estafa Do Not Exist, It Effectively Says That There Is No Crime. There IsHezro Inciso CaandoyNo ratings yet

- Berks Co Human Svcs DirectoryDocument178 pagesBerks Co Human Svcs Directoryjoshcamp1No ratings yet

- Anticipatory Bail DraftDocument8 pagesAnticipatory Bail DraftmayankNo ratings yet

- Lesson Plan 2 in MAPEH 9Document2 pagesLesson Plan 2 in MAPEH 9Michael Angelo ViñasNo ratings yet

- Research Ethics Approval FormDocument9 pagesResearch Ethics Approval FormAlok Anand Narayan TripathiNo ratings yet

- Irac SDocument2 pagesIrac Sapi-448102723No ratings yet

- Grade 9 Module 5Document8 pagesGrade 9 Module 5alisoncielo45No ratings yet

- United States v. Nelson Frias, 39 F.3d 391, 2d Cir. (1994)Document6 pagesUnited States v. Nelson Frias, 39 F.3d 391, 2d Cir. (1994)Scribd Government DocsNo ratings yet

- Op ThunderboltDocument6 pagesOp ThunderboltPratyush Kumar SinghNo ratings yet

- Cyber Crimes - An Indian Perspective: Ms - Preeti JainDocument20 pagesCyber Crimes - An Indian Perspective: Ms - Preeti JainsfddsaNo ratings yet

- Complaint Sheet FormatDocument2 pagesComplaint Sheet Formatlorenzo castilNo ratings yet

- Essay 1Document1 pageEssay 1Ronnah Mae MalinayNo ratings yet

- Drug EducationDocument3 pagesDrug EducationHera Jan Rej MaglayaNo ratings yet

- JWG LLM IEG V 4 4.6.2016 Final 1 Amend Federal Verifyed Complaint Feb 17, 2014Document44 pagesJWG LLM IEG V 4 4.6.2016 Final 1 Amend Federal Verifyed Complaint Feb 17, 2014mikekvolpeNo ratings yet

- Invalid Forensic Science Testimony and Wrongful ConvictionsDocument97 pagesInvalid Forensic Science Testimony and Wrongful ConvictionsTlecoz Huitzil100% (1)

- GK NotesDocument26 pagesGK NotesAbhidhaNo ratings yet

- Flores Vs JovenDocument3 pagesFlores Vs JovenCoyzz de GuzmanNo ratings yet