p2 (Int) CR Mt2a Qs j09

p2 (Int) CR Mt2a Qs j09

Uploaded by

Kyaw Htin WinCopyright:

Available Formats

p2 (Int) CR Mt2a Qs j09

p2 (Int) CR Mt2a Qs j09

Uploaded by

Kyaw Htin WinOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

p2 (Int) CR Mt2a Qs j09

p2 (Int) CR Mt2a Qs j09

Uploaded by

Kyaw Htin WinCopyright:

Available Formats

Monitoring Test MT2A

Corporate

Reporting

(International)

P2CR-MT2A-X09-Q

Time allowed 1.5 hours

BOTH questions are compulsory and MUST be attempted.

Do NOT open this paper until instructed by the supervisor.

Accountancy Tuition Centre Ltd

ATC

INTERNATIONAL

Accountancy Tuition Centre (International Holdings) Ltd 2009 2

BOTH questions are compulsory and MUST be attempted.

1 IFRS 3 Business Combinations was first issued by the IASB in 2004 as a replacement for IAS

22. It was then subsequently amended by the IASB in 2008. The original standard changed

the accounting requirements of business combinations in many ways, it also introduced new

definitions relating to business combinations, whilst the revised 2008 further changed the

method of accounting for business combinations.

Required:

(a) (i) Define goodwill in accordance with IFRS 3; (2 marks)

(ii) State the accounting treatment of both positive goodwill and a gain

from a bargain purchase; (5 marks)

(iii) State the accounting treatment of a deferred consideration and a

contingent consideration, relating to business combinations, in

accordance with IFRS 3. (4 marks)

(b) Oliver is a company which produces a range of compact office furniture specially

designed for firms with limited office space.

Oliver is keen to expand into new business areas and has identified a potential

target, Heldon. Oliver has decided that the best date for the investment is 1 July

2009 but has not yet decided on the percentage of shares to be acquired.

Oliver has performed a business valuation in which it has valued a 50% holding. Its

intention is that the cost of the investment will be made up as follows.

$50,000 cash payable on 1 July 2009

$50,000 cash payable on 1 July 2011

20,000 $1 shares with an agreed value of $3.25 each (in the draft accounts the

premium on this issue has been credited to the share premium account)

Heldon operates in a jurisdiction where the tax authority does not allow expenses

for the setting up of doubtful debt provisions as a deduction against taxable profit

and taxes interest on a cash basis. The rate of tax is 30%. Heldon does not account

for deferred tax in its own accounts.

Heldon has a December year-end. Oliver has obtained budgeted accounts of Heldon

for the year ended 31

st

December 2009.

Accountancy Tuition Centre (International Holdings) Ltd 2009 3

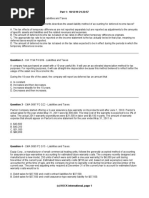

Information from the draft forecast accounts for Heldon for the year ended 31

December 2009 is provided below.

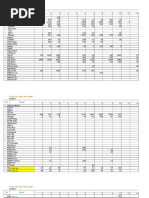

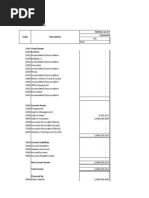

Budgeted accounts for the year ended 31 December 2009

Statement of financial position

Heldon

$000

Non-current assets 700

Current assets 390

_____

1,090

_____

Share capital 100

Retained earnings 140

Revaluation reserve 40

Current liabilities 200

Loan 610

_____

1,090

_____

Statement of comprehensive income

Heldon

$000

Profit before tax 145

Tax (45)

___

Profit after tax 100

Proposed dividend (20)

___

Retained profit 80

___

Preliminary investigations into Heldon have identified the following issues.

Non current assets

The non-current assets balance of Heldon include industrial buildings with a cost of

$250,000 which were acquired on 1 January 2004. Heldons policy is not to

depreciate buildings, whereas Oliver has a strict depreciation policy with a useful

economic life of fifty years for such buildings. A full years charge is taken in the

year of acquisition.

Under the tax regime operating in the country tax allowable depreciation on

industrial buildings is calculated on a 15% reducing balance basis. The tax authority

allows companies to claim a full years charge in the year of acquisition irrespective

of the date of acquisition.

Also included in non-current assets is a plot of land at a value of $320,000. This

valuation was carried out three years ago and current market conditions indicate that

$285,000 is a more realistic value. This plot of land is not being depreciated. It

originally cost $280,000. The land sits in a region that the government has

designated for special aid through the provision of tax breaks. The tax base of the

land is $250,000.

Accountancy Tuition Centre (International Holdings) Ltd 2009 4

The balance of the non current assets have a tax base equal to their carrying value

Receivables

Heldon has a very wide range of customers and a summary of the receivables

ledger as at 31 December 2008 is as follows.

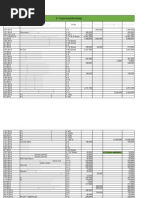

Over 6-12 3-6

1 year months months Current Total

$ $ $ $ $

13,000 5,000 26,000 53,500 97,500

13.3% 5.1% 26.7% 54.9% 100%

The accounts of Heldon contain a doubtful debt allowance based on the following

formula.

Age % provided

Over one year 20%

6-12 months 10%

Olivers accountants believe that this provision is very optimistic. They would

prefer to bring Heldon into line with Olivers policy which is as follows.

Age % provided

Over one year 100%

6-12 months 40%

3-6 months 10%

The budgeted gross receivables are $111,000 as at 1 July 2009 and $117,000 as at

31 December 2009 (these figures are before deducting any allowance). The net

receivables figures actually included in the draft accounts are after calculating the

doubtful debt allowance in accordance with Heldons accounting policy. The aged

receivables analysis will not be available in respect of the balances at 1

st

July 2009

but Oliver has discovered that the profile has been quite stable for some time.

Loan

The loan represents a sum of $500,000 borrowed two years ago plus two years

interest at $55,000 per annum accrued on a straight-line basis. Under the terms of

the loan Heldon does not make interest payments but will settle the liability with a

single sum of $775,000 payable 5 years after the date upon which the loan was first

raised. Current interest rates have fallen to 10%. The tax authority recognises

interest on a cash basis.

Cost of Capital

The cost of capital to be used in any discounting calculations is 10%.

Non-controlling interest

Are to be valued at the proportionate share of the fair value of the identifiable net

assets, it is not credited with its share of goodwill.

Accountancy Tuition Centre (International Holdings) Ltd 2009 5

Required:

Calculate the goodwill arising on acquisition on the assumption that Oliver

acquires 50% of Heldon on 1

st

July 2009. (The calculation should be performed

in accordance with all relevant accounting standards. Assume that the tax base

of all assets and liabilities is equal to their carrying value except where the

question indicates otherwise) (14 marks)

(25 marks)

2 In the Framework for the preparation and presentation of financial statements the IASB has

developed a conceptual approach to financial reporting which includes the application of a

substance over form approach. This concept was included in the original IAS 1 Disclosure of

accounting policies as a consideration which should govern the selection of accounting

policies and in IAS 1 (revised) Presentation of financial statements where it is seen as a key

component of the reliability of information.

The following information relates to separate companies

(i) A car manufacturer, A Inc, supplies cars to a dealer, B Inc, on a consignment basis.

The terms of the deal allow either party to have the cars returned or, at the option of

A Inc, transferred to another dealer. B has to pay a monthly rental of 2% of the cost

of the car and has to arrange insurance.

When a car is sold to the public, B has to pay the lower of:

the original list price of the car when it was supplied; or

the current list price less the monthly charges to date.

B must also pay for the cars (on the same terms) if they remain unsold after three

months.

(ii) A property company, C Inc, sells some of its properties to D Inc, the subsidiary of a

bank. D is financed by loans from the bank.

C and D enter into a management contract whereby C agrees to manage the

properties in return for a management charge set at a level to absorb all of Ds

profits. Properties cannot be sold without the agreement of C and the management

charge is adjusted to ensure any profits or losses on disposal revert to C.

(iii) F Inc is a brewer which supplies beer to outlets in the UK. The Group has entered

into arrangements with a number of banks to advance loans to third party UK

outlets. These arrangements are both guaranteed and subsidised by the Group to

enable the Brewing division to obtain a beer supply agreement with the outlets.

Such agreements are generally cancellable at 3 months notice. Amounts advanced

by banks in accordance with these arrangements are reflected in the reported assets

and liabilities of the Group only to the extent that liabilities are known to exist in

respect of such guarantees.

Accountancy Tuition Centre (International Holdings) Ltd 2009 6

Required:

(a) Explain briefly how each of the above transactions should be accounted for.

(9 marks)

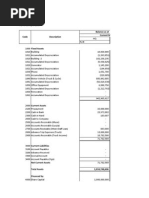

(b) The following transactions relate to the year end financial statements of G, an

incorporated entity.

(i) Properties held for resale

The draft year-end statement of financial position includes a material balance

properties held for resale included in current assets.

This consists of two properties as follows:

Net book

Value

$000

Head office 2,050

Warehouse 1,003

G plans to leaseback both these properties after the sale. The head office is

expected to raise $2,000,000, which is slightly lower than its fair value of

$2,075,000, and the leaseback will be for five years (after this the building has to be

sold to the government as it will have to be demolished to make way for a new ring

road). The purchasers have agreed to reduce the future lease instalments from their

market rate of $115,000 per annum to $100,000 per annum to reflect the relatively

low sales price. The warehouse is to be leased back for its estimated remaining life

of twenty years. The purchaser has agreed to pay $1,150,000 (which is 5% above

fair value) and will then lease it back for $85,000 per annum, payable in advance.

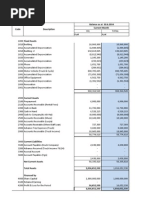

(ii) Loans issued in the year. Two new loans were taken out in the last few

days of the year.

(a) A $1,000,000 bond was issued for ten years with the interest rate

agreed as follows.

Year Interest

%

1 (next year) 8

2 8

3 8

4 10

5 10

6 10

7 13

8 13

9 13

10 13

(The financial controller of G has advised you that the interest

rate implicit in the transaction is 10.06%.)

Accountancy Tuition Centre (International Holdings) Ltd 2009 7

(b) A second loan was taken out for $470,000 (with issue costs of

$20,000) and this is redeemable at its par value of $1,000,000 in

ten years time. The coupon interest rate is 3% although the true

interest rate is believed to be 13.23%.

Required:

For each of these transactions:

comment briefly on appropriate accounting treatments, mentioning

alternatives where appropriate;

highlight how the transactions should initially be recorded; and

explain the total impact on the statement of comprehensive income

setting out the detailed journals for next year

(11 marks)

(c) The IASC issued IAS 39 Financial Instruments :recognition and measurement after

a long delay. IAS 39 has recently been revised and the IASB has also issued

implementation guidance and questions and answers in relation to the application of

IAS 39 due to the difficulty of accounting for financial instruments.

Required:

Explain the inadequacies of traditional accounting methods in dealing with

Financial Instruments. (5 marks)

(25 marks)

End of Question Paper

You might also like

- FMGT 1321 Midterm 1 Review Questions: InstructionsDocument7 pagesFMGT 1321 Midterm 1 Review Questions: InstructionsAnnabelle Wu0% (1)

- Questions & Solutions ACCTDocument246 pagesQuestions & Solutions ACCTMel Lissa50% (4)

- Accounting Papers of Ibp Part TwoDocument64 pagesAccounting Papers of Ibp Part TwoTehreem Ali50% (2)

- FAR MockBoard (NFJPIA) - 2017Document9 pagesFAR MockBoard (NFJPIA) - 2017ken100% (1)

- Lecture 5 Events After The Reporting Period Multiple ChoiceDocument7 pagesLecture 5 Events After The Reporting Period Multiple ChoiceJeane Mae Boo0% (1)

- Workbook Answer Key: 1 That's My Kind of Friend!Document16 pagesWorkbook Answer Key: 1 That's My Kind of Friend!Ben Aguilar AguilaNo ratings yet

- AZ Secy/State App For Attorneys' Fees vs. AZGOPDocument11 pagesAZ Secy/State App For Attorneys' Fees vs. AZGOPpaul weichNo ratings yet

- PreviewDocument106 pagesPreviewCoach-NeilKhayechNo ratings yet

- Corporate Reporting (International) : P2CR-MT2A-X09-A Answers & Marking SchemeDocument11 pagesCorporate Reporting (International) : P2CR-MT2A-X09-A Answers & Marking SchemeKyaw Htin WinNo ratings yet

- Comprehensiveexam eDocument10 pagesComprehensiveexam eNghiaBuiQuangNo ratings yet

- AICPA Released Questions FAR 2015 DifficultDocument33 pagesAICPA Released Questions FAR 2015 DifficultAZNGUY100% (2)

- ADV2Document3 pagesADV2Rommel RoyceNo ratings yet

- Ecomprehensiveexam eDocument12 pagesEcomprehensiveexam eDominic SociaNo ratings yet

- Test 3 No AnswersDocument5 pagesTest 3 No AnswersYosuke NekomuraNo ratings yet

- Paper 12 - Company Accounts and Audit Syl2012Document116 pagesPaper 12 - Company Accounts and Audit Syl2012sumit4up6rNo ratings yet

- Disclaimer: © The Institute of Chartered Accountants of IndiaDocument35 pagesDisclaimer: © The Institute of Chartered Accountants of IndiajaimaakalikaNo ratings yet

- SBR1-Handout-2024-25Document31 pagesSBR1-Handout-2024-25shaikh RizwanNo ratings yet

- Prac 1 Final PreboardDocument10 pagesPrac 1 Final Preboardbobo kaNo ratings yet

- Financial Accounting Mock Test PaperDocument7 pagesFinancial Accounting Mock Test PaperBharathFrnzbookNo ratings yet

- December 2002 ACCA Paper 2.5 QuestionsDocument11 pagesDecember 2002 ACCA Paper 2.5 QuestionsUlanda2No ratings yet

- Great Zimbabwe University Faculty of CommerceDocument5 pagesGreat Zimbabwe University Faculty of CommerceTawanda Tatenda HerbertNo ratings yet

- ComprehensiveexamDocument14 pagesComprehensiveexamLeah Baker100% (1)

- Review and Evaluate Financial Management Processes: Submission DetailsDocument9 pagesReview and Evaluate Financial Management Processes: Submission Detailsrida zulquarnainNo ratings yet

- Kieso ch3Document48 pagesKieso ch3i82jenneNo ratings yet

- Case Set 7 - Subsequent Events and Going ConcernDocument5 pagesCase Set 7 - Subsequent Events and Going ConcernTimothy WongNo ratings yet

- 105 DepaDocument12 pages105 DepaLA M AENo ratings yet

- Ias 8 Accounting PoliciesDocument6 pagesIas 8 Accounting Policiesibrahim AhmedNo ratings yet

- 1773006669aaa - LPS 4 - Q PDFDocument2 pages1773006669aaa - LPS 4 - Q PDFAhmad Ali AyubNo ratings yet

- Nfjpia Nmbe Far 2017 AnsDocument9 pagesNfjpia Nmbe Far 2017 AnsSamieeNo ratings yet

- FM Assignment 2Document3 pagesFM Assignment 2Vundi RohitNo ratings yet

- DL PT1Q F3 201301Document14 pagesDL PT1Q F3 201301MpuTitasNo ratings yet

- Taxation Management AssignmentDocument11 pagesTaxation Management AssignmentniraliNo ratings yet

- Comprehensive Exam EDocument10 pagesComprehensive Exam Ejdiaz_646247100% (1)

- Taxation Management AssignmentDocument12 pagesTaxation Management AssignmentJaspreetBajajNo ratings yet

- Consalidated Statement of Profit and LossDocument40 pagesConsalidated Statement of Profit and LossG. DhanyaNo ratings yet

- LU4 - Financial Instruments Slides LessonDocument18 pagesLU4 - Financial Instruments Slides LessonVuqueia RamosNo ratings yet

- Nfjpia Nmbe Far 2017 Ans-1Document10 pagesNfjpia Nmbe Far 2017 Ans-1Stephen ChuaNo ratings yet

- Assessment Test 1Document3 pagesAssessment Test 1Arslan AhmadNo ratings yet

- Tax PDFDocument13 pagesTax PDFMinie KimNo ratings yet

- Quiz Test 1 InacDocument9 pagesQuiz Test 1 Inac21125244No ratings yet

- Practice Question - Financial Statement AnalsysiDocument5 pagesPractice Question - Financial Statement AnalsysiAsadullah SherNo ratings yet

- Questions Answers: Operating Activities, Investment, Financing Activities Zero Debit Telephone and Credit CashDocument3 pagesQuestions Answers: Operating Activities, Investment, Financing Activities Zero Debit Telephone and Credit CashPranav SharmaNo ratings yet

- 3 RdyrDocument6 pages3 RdyrErikaNo ratings yet

- Lecture 5. Depreciation, Bad Debts, Provision For Doubtful DebtsDocument32 pagesLecture 5. Depreciation, Bad Debts, Provision For Doubtful DebtsazizbektokhirbekovNo ratings yet

- FAR ReviewDocument9 pagesFAR ReviewJude Vincent VittoNo ratings yet

- Acctg11e SM CH11Document52 pagesAcctg11e SM CH11titirNo ratings yet

- ACCA Strategic Business ReportingDocument6 pagesACCA Strategic Business ReportingWajiha NaveedNo ratings yet

- Original 1436552353 VICTORIA ProjectDocument12 pagesOriginal 1436552353 VICTORIA ProjectShashank SharanNo ratings yet

- Formation of Compan 1Document23 pagesFormation of Compan 1fopafranckell11No ratings yet

- National Mock Board Examination 2017 Financial Accounting and ReportingDocument9 pagesNational Mock Board Examination 2017 Financial Accounting and ReportingSam0% (1)

- Practical QuestionsDocument70 pagesPractical Questionskritika MahatoNo ratings yet

- Paper 18Document65 pagesPaper 18sjsjsj20061606No ratings yet

- 2023 AFRM1 Question BankDocument8 pages2023 AFRM1 Question BankKieu Anh Bui LeNo ratings yet

- IAS 12 Income Taxes (2021)Document18 pagesIAS 12 Income Taxes (2021)Tawanda Tatenda HerbertNo ratings yet

- ACCT 557 Final ExamDocument18 pagesACCT 557 Final Examlynnturner123No ratings yet

- Notes To The Company Accounts: 37 Accounting PoliciesDocument7 pagesNotes To The Company Accounts: 37 Accounting PoliciesManu KmrNo ratings yet

- Financial Management: Thursday 9 June 2011Document9 pagesFinancial Management: Thursday 9 June 2011catcat1122No ratings yet

- 5 6053042764831000707Document16 pages5 6053042764831000707SoNam ZaNgmoNo ratings yet

- Realtors Notes Merge-5Document2 pagesRealtors Notes Merge-5noufalchekzNo ratings yet

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 3.5 out of 5 stars3.5/5 (2)

- June'16 Sales QtyDocument61 pagesJune'16 Sales QtyKyaw Htin WinNo ratings yet

- Lcci BS 1Document17 pagesLcci BS 1Kyaw Htin WinNo ratings yet

- Purchase Cash Paid To ESI Date 18.7.2015 RichDocument9 pagesPurchase Cash Paid To ESI Date 18.7.2015 RichKyaw Htin WinNo ratings yet

- Purchase Cash Paid To ESI Date 11.7.15 RichDocument11 pagesPurchase Cash Paid To ESI Date 11.7.15 RichKyaw Htin WinNo ratings yet

- MKN BudgetDocument1 pageMKN BudgetKyaw Htin WinNo ratings yet

- K1 ExpenseDocument30 pagesK1 ExpenseKyaw Htin WinNo ratings yet

- Lcci BS 1Document17 pagesLcci BS 1Kyaw Htin WinNo ratings yet

- Hercule Monthly AC APR 2014 11.5.2014Document38 pagesHercule Monthly AC APR 2014 11.5.2014Kyaw Htin WinNo ratings yet

- Hercule Monthly AC JUNE 2014Document34 pagesHercule Monthly AC JUNE 2014Kyaw Htin WinNo ratings yet

- Hercule Monthly AC Nov 2012 Dec 2012Document19 pagesHercule Monthly AC Nov 2012 Dec 2012Kyaw Htin WinNo ratings yet

- P2CR-Session18 j09Document14 pagesP2CR-Session18 j09Kyaw Htin WinNo ratings yet

- Hercule Monthly AC-FEB.2013Document19 pagesHercule Monthly AC-FEB.2013Kyaw Htin WinNo ratings yet

- Hercule Monthly AC-JUNE.2013Document20 pagesHercule Monthly AC-JUNE.2013Kyaw Htin WinNo ratings yet

- RTDocument58 pagesRTKyaw Htin WinNo ratings yet

- Objective: Session 07 - Ias 41 AgricultureDocument10 pagesObjective: Session 07 - Ias 41 AgricultureKyaw Htin WinNo ratings yet

- P2CR (Int) SOverview j09Document2 pagesP2CR (Int) SOverview j09Kyaw Htin WinNo ratings yet

- Resolution Writing Guide As Revised 2013Document5 pagesResolution Writing Guide As Revised 2013api-324734160No ratings yet

- How To Bypass Strict Firewalls On Public Wifi Hotspots and Restricted NetworksDocument4 pagesHow To Bypass Strict Firewalls On Public Wifi Hotspots and Restricted NetworksistioploiaNo ratings yet

- RetaliatoryDocument3 pagesRetaliatoryjoseph aelred hernandezNo ratings yet

- Qayamat Ke Din Ki NashaniaDocument59 pagesQayamat Ke Din Ki NashaniaIrfan Ahmed KhanNo ratings yet

- Food Beverage OutletsDocument18 pagesFood Beverage OutletsSahil KashyapNo ratings yet

- Action Plan On Early Registration 2020 2021Document2 pagesAction Plan On Early Registration 2020 2021ERICA JEAN ROSADA100% (6)

- Bart Said: "I Won't Do It Again, Dad".: Reporting VerbsDocument2 pagesBart Said: "I Won't Do It Again, Dad".: Reporting VerbsAna Losada PérezNo ratings yet

- ReviewerDocument20 pagesReviewerCharm MiraNo ratings yet

- Introduction To TrustsDocument36 pagesIntroduction To TrustsKamugisha JshNo ratings yet

- Complaint at Law, Nowlin v. Pritzker, No. 1:20-cv-01229-MMM-JEH (C.D. Ill. June 15, 2020)Document47 pagesComplaint at Law, Nowlin v. Pritzker, No. 1:20-cv-01229-MMM-JEH (C.D. Ill. June 15, 2020)RHTNo ratings yet

- Q: Do I Need To Open Any Ports or Configure My Network To: Use The Smart Bridge?Document4 pagesQ: Do I Need To Open Any Ports or Configure My Network To: Use The Smart Bridge?m4004No ratings yet

- BULLYINGDocument22 pagesBULLYINGmahima sajanNo ratings yet

- 20 Minutes PDPR ModuleDocument31 pages20 Minutes PDPR ModuleNanthini SuppiahNo ratings yet

- Heat TransferDocument42 pagesHeat TransferKundan KumarNo ratings yet

- Pre Immersion12 Q3 SLM 2Document10 pagesPre Immersion12 Q3 SLM 2WilmerNo ratings yet

- Miscellaneous Services Form PCCDocument3 pagesMiscellaneous Services Form PCCjamesbond50No ratings yet

- United States v. Edwin Walker White, 377 F.2d 908, 4th Cir. (1967)Document5 pagesUnited States v. Edwin Walker White, 377 F.2d 908, 4th Cir. (1967)Scribd Government DocsNo ratings yet

- (PDF) Modern Hebrew Poetry: A Bilingual Anthology Full OnlineDocument1 page(PDF) Modern Hebrew Poetry: A Bilingual Anthology Full OnlineAneta ZarnowskaNo ratings yet

- CSC Q3 0202 - PS - Community Dynamics and Process ElementsDocument37 pagesCSC Q3 0202 - PS - Community Dynamics and Process ElementsNylana Cañedo del CastilloNo ratings yet

- ANEMISH GUPTA Resumenew-1Document4 pagesANEMISH GUPTA Resumenew-1hrinvestoravenueNo ratings yet

- The Wanderer by Craig Williamson (Transl.)Document6 pagesThe Wanderer by Craig Williamson (Transl.)Cristina de la CruzNo ratings yet

- HY BEAUTY SALON 2024 (Simple)Document31 pagesHY BEAUTY SALON 2024 (Simple)sukalova.danielaNo ratings yet

- Program Confereng2024Document29 pagesProgram Confereng2024amocatoNo ratings yet

- CHAPTER 2 Business Model SampleDocument10 pagesCHAPTER 2 Business Model SampleIh YanNo ratings yet

- File 2. Synopsis Work Flow and Synopsis TemplateDocument3 pagesFile 2. Synopsis Work Flow and Synopsis TemplateMohit PandeyNo ratings yet

- Play and Learn Character Awards 2024Document4 pagesPlay and Learn Character Awards 2024Anj TaalaNo ratings yet

- in The Beginning... (Genesis 1: 1 - 2: 25)Document11 pagesin The Beginning... (Genesis 1: 1 - 2: 25)logosbiblestudy100% (1)