Chapter 10

Chapter 10

Uploaded by

Judith Salome BasquinasCopyright:

Available Formats

Chapter 10

Chapter 10

Uploaded by

Judith Salome BasquinasOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Chapter 10

Chapter 10

Uploaded by

Judith Salome BasquinasCopyright:

Available Formats

INCOME TAXATION 6TH Edition (BY: VALENCIA & ROXAS)

SUGGESTED ANSWERS

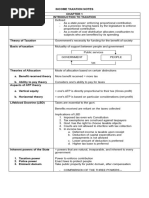

Chapter 10: Basic Income Tax Patterns

86

CHAPTER 10

BASIC INCOME TAX PATTERNS

Problem 10 1 TRUE OR FALSE

1. True

2. False - General professional partnerships are tax-exempt.

3. False Not taxable income the Philippines because the passive income is earned outside

the Philippines.

4. True

5. False The excess of personal exemption over compensation income is to be deducted

from net income from business.

6. True

7. False Decrease by creditable taxes.

8. True

9. False passive income is not subject for deductions.

10. True

11. False There should be a combination of various income subject to the same tax rate

irrespective of personal exemption.

12. False Taxable only for income earned within.

13. False net income or income from operation.

14. False resident alien could also opt for OSD.

15. False Only P50,000. Siblings are not allowed for additional exemptions.

16. False could claim P150,000.

Problem 10 2

1. A 7. C

2. B 8. A

3. D 9. A

4. B 10. A

5. D 11. B

6. D 12. A

Problem 10 3 D

Gross compensation income (P167,500 +P22,500) P190,000

Less: Personal exemption single 50,000

Net taxable compensation income P140,000

Tax on P140,000 P22,500

Less: Withholding tax 22,500

Net tax payable P - 0 -

Problem 10 4 C

Gross compensation income P 90,000

Net business income (P200,000 x 60%) 120,000

Total net income before personal exemption P210,000

Less: Personal exemption 50,000

Net taxable income P160,000

Problem 10 5 B

INCOME TAXATION 6TH Edition (BY: VALENCIA & ROXAS)

SUGGESTED ANSWERS

Chapter 10: Basic Income Tax Patterns

87

Net income for the first quarter (P50,000 + P60,000 + P70,000) P180,000

Less: Optional standard deduction (P180,000 x 40%) 72,000

Net taxable income first quarter P108,000

Note: No personal exemption yet is allowed to be deducted in the quarterly income tax. The

Personal exemption is to be deducted in the 4

th

quarter in the adjusted ITR.

Problem 10 6 D

Gross profit P1,000,000

Less: Operating expenses 400,000

Net taxable income P 600,000

Problem 10 7 D

Net taxable income (P5,500,000 P2,000,000) P3,500,000

Multiplied by corporate income tax rate 30%

Income tax due and payable P1,050,000

Less: Income tax paid 900,000

Net tax payable P 150,000

Problem 10 8 C

Minimum corporate income tax (P23,500,000 + P1,500,000) x 2%* P 500,000

Less: Income tax paid 500,000

Net tax refund P - 0 -

The minimum corporate income tax is greater than the normal tax.

Problem 10 9

Compensation P 250,000

Business income (P500,000 + P600,000) P1,100,000

Less: Business expenses (P200,000 + P300,000) 500,000 600,000

Dividend income earned outside the Philippines 100,000

Net taxable income before personal exemption P 950,000

Note: the dividend income within is subject to final withholding tax of 10%, and as such, is no

longer required to be reported in the annual tax return.

Problem 10 10

Compensation P 250,000

Business income P 500,000

Less: Business expenses 200,000 300,000

Net taxable income before personal exemption P 550,000

Note: the dividend income is subject to final withholding tax of 10%, and as such, is no longer

required to be reported in the annual tax return.

Problem 10 11

Business income P 500,000

Business expenses ( 200,000)

Net taxable income P 300,000

INCOME TAXATION 6TH Edition (BY: VALENCIA & ROXAS)

SUGGESTED ANSWERS

Chapter 10: Basic Income Tax Patterns

88

Note: Foreign corporation is taxable only for income within. Dividend income earned within is

taxable in the Philippines but shall not be included as part of the annual ITR because such

dividend is subject of final tax.

Problem 10 12

Total salary income (P16,000 + P4,000) x 12 P240,000

First three quarters taxable business income (P300,000 + P90,000) 390,000

Last quarters net taxable business income 110,000

Total net income before personal exemption P740,000

Less: Personal exemption single 50,000

Net taxable income P690,000

Income tax on P500,000 P125,000

Income tax on excess (P190,000 x 32%) 60,800

Total income tax per ITR P185,800

Add: Final withholding tax on interest income 2,000

Annual income tax P187,800

Problem 10 13

Answers for 1 and 2 QUARTERS

First Second Third Fourth

Gross profit 40% of sales 200,000 240,000 160,000 360,000

Rent income 30,000 30,000 30,000 30,000

Total gross profit 230,000 270,000 180,000 390,000

Operating expenses before int. & cont. (120,000) (150,000) (100,000) (160,000)

Deductible interest expense* (5,050) (6,700) (10,050) (8,400)

Contribution deductible in full . (20,000) . (40,000)

Net taxable income 104,950 93,300 69,950 181,600

Multiplied by corp. income tax rate 30% 30% 30% 30%

Quarterly income tax due and payable 31,485 27,990 20,985 54,480

Interest expense 10,000 10,000 15,000 15,000

Less: Tax differential (int. income x 33%) 4,950 3,300 4,950 6,600

*Deductible interest expense 5,050 6,700 10,050 8,400

Answer for 3

Royalty income (P60,000 x 20%) P12,000

Interest income (P15,000 + P10,000 + P15,000 + P20,000) x 10% 12,000

Total passive income tax P24,000

Problem 10 14

Business income P 7,500,000

Itemized allowable deductions ( 4,000,000)

Capital gains 200,000

Passive income earned outside the Philippines 100,000

Net taxable income P 3,800,000

Multiplied by corporate income tax rate 30%

Income tax due P 1,140,000

Less: Total income taxes paid in the previous quarters P800,000

Income tax withheld per BIR form 2307 40,000 840,000

INCOME TAXATION 6TH Edition (BY: VALENCIA & ROXAS)

SUGGESTED ANSWERS

Chapter 10: Basic Income Tax Patterns

89

Income tax still due and payable P 300,000

You might also like

- New Form 2550 M - Monthly VAT Return P 1-2Document3 pagesNew Form 2550 M - Monthly VAT Return P 1-2Pearl Reyes64% (14)

- MC Donalds HRM Case StudyDocument8 pagesMC Donalds HRM Case StudyNikhil Singh100% (2)

- Groupwork 13: Team Gorgeous 3 Chapter 13 Simple Ordinary AnnuityDocument4 pagesGroupwork 13: Team Gorgeous 3 Chapter 13 Simple Ordinary AnnuityAdliana ColinNo ratings yet

- HW 5 SolDocument19 pagesHW 5 SolTDLemonNh100% (1)

- Deductions From Gross Income: Income Taxation 6Th Edition (By: Valencia & Roxas) Suggested AnswersDocument12 pagesDeductions From Gross Income: Income Taxation 6Th Edition (By: Valencia & Roxas) Suggested AnswersMichael Reyes75% (4)

- Chapt-13 Income Taxes - Partnerships, Estates & TrustsDocument11 pagesChapt-13 Income Taxes - Partnerships, Estates & Trustshumnarvios100% (6)

- Chapt 12+Income+Tax+ +corporations2013fDocument15 pagesChapt 12+Income+Tax+ +corporations2013fLouie De La Torre100% (4)

- Chapt 11+Income+Tax+ +individuals2013fDocument13 pagesChapt 11+Income+Tax+ +individuals2013fiamjan_10180% (15)

- Chapt-10 Basic Tax PatternsDocument4 pagesChapt-10 Basic Tax Patternshumnarvios100% (3)

- Chapter 13 - Mixed 2013Document9 pagesChapter 13 - Mixed 2013JB RealizaNo ratings yet

- Chapt-5 Exclude From Gross IncomeDocument4 pagesChapt-5 Exclude From Gross IncomehumnarviosNo ratings yet

- Cost AccountingDocument32 pagesCost AccountingInu Ya ShaNo ratings yet

- Bond Retirement Prior To Maturity A. Illustration 1 - Straight LineDocument27 pagesBond Retirement Prior To Maturity A. Illustration 1 - Straight Linephoebelyn acdogNo ratings yet

- Chapt-3 Concepts of IncomeDocument4 pagesChapt-3 Concepts of Incomehumnarvios50% (2)

- Fringe Benefits Tax: Income Taxation 7Th Edition (By: Valencia & Roxas) Suggested AnswersDocument8 pagesFringe Benefits Tax: Income Taxation 7Th Edition (By: Valencia & Roxas) Suggested AnswersJuan Frivaldo100% (2)

- Chapter 13-A DraftDocument29 pagesChapter 13-A DraftRouve BontuyanNo ratings yet

- RC Nirc, Ra, Nra-Etb Nra-Netb: Taxpayer Tax Base Source of Taxable IncomeDocument7 pagesRC Nirc, Ra, Nra-Etb Nra-Netb: Taxpayer Tax Base Source of Taxable IncomeGwyneth GloriaNo ratings yet

- Case Analysis - BalderosaDocument3 pagesCase Analysis - BalderosajenNo ratings yet

- Chapter 13 Mixed Business TransactionsDocument10 pagesChapter 13 Mixed Business TransactionsGeraldNo ratings yet

- Losses: Income Taxation 6Th Edition (By: Valencia & Roxas) Suggested AnswersDocument4 pagesLosses: Income Taxation 6Th Edition (By: Valencia & Roxas) Suggested AnswersJane Manumpay50% (4)

- Income Taxation Valencia Roxas Tax Chapter 14: Income Taxes of Estates &trustsDocument11 pagesIncome Taxation Valencia Roxas Tax Chapter 14: Income Taxes of Estates &trustsSharn Linzi Buan Montaño83% (6)

- Week 7 Module 7 TAX2 - Business and Transfer Taxation - PADAYHAGDocument23 pagesWeek 7 Module 7 TAX2 - Business and Transfer Taxation - PADAYHAGfernan opeliñaNo ratings yet

- Lecture Chapter 6 Introduction To The Value Added TaxDocument16 pagesLecture Chapter 6 Introduction To The Value Added TaxChristian PelimcoNo ratings yet

- Final Exam Taxation 101Document8 pagesFinal Exam Taxation 101Live LoveNo ratings yet

- Final Activity Income TaxationDocument6 pagesFinal Activity Income TaxationPrincess MarianoNo ratings yet

- Final Income TaxationDocument15 pagesFinal Income TaxationElizalen MacarilayNo ratings yet

- Questions p2Document15 pagesQuestions p2Let it be100% (1)

- De Leon, Bianca MhaeDocument7 pagesDe Leon, Bianca MhaeBianca Mhae De LeonNo ratings yet

- AC 2202 - Notes (1 TO 4)Document40 pagesAC 2202 - Notes (1 TO 4)SMT awesomeNo ratings yet

- CRS Chapter 9 RIT Inclusions To Gross IncomeDocument60 pagesCRS Chapter 9 RIT Inclusions To Gross Incomesheryl ann dizonNo ratings yet

- True or FalseDocument4 pagesTrue or FalseRhona Basong100% (1)

- Retrospectively in The First Set of Financial Statements Authorized For Issue AfterDocument7 pagesRetrospectively in The First Set of Financial Statements Authorized For Issue Aftermax pNo ratings yet

- Chapter 10 SCMDocument15 pagesChapter 10 SCMAliyah Francine Gojo CruzNo ratings yet

- Alvero Assessment 5Document12 pagesAlvero Assessment 5Jameela KateNo ratings yet

- Other Percentage Tax (Opt) : As Amended by TRAIN LAWDocument73 pagesOther Percentage Tax (Opt) : As Amended by TRAIN LAWmoshi kpop cartNo ratings yet

- Notes in Business Law by Fidelito Soriano PDF 16Document2 pagesNotes in Business Law by Fidelito Soriano PDF 16Getty Reagan Dy0% (2)

- Armhyla Olivar FM Taxation 8Document4 pagesArmhyla Olivar FM Taxation 8Grace Umbaña YangaNo ratings yet

- Income Tax AcivitiesDocument7 pagesIncome Tax AcivitiesRoNnie RonNieNo ratings yet

- Income Taxation Departmental ExamDocument21 pagesIncome Taxation Departmental ExamAngela AquinoNo ratings yet

- Test Bank - Income Taxation-CparDocument5 pagesTest Bank - Income Taxation-CparStephanie Ann TubuNo ratings yet

- Tax 2 Flexible Obtl Midyear 2021Document13 pagesTax 2 Flexible Obtl Midyear 2021Jamaica DavidNo ratings yet

- GAM For NGAs Volume I PDFDocument493 pagesGAM For NGAs Volume I PDFnicah100% (1)

- Chapter 11 (Income Tax of Individuals)Document12 pagesChapter 11 (Income Tax of Individuals)libraolrackNo ratings yet

- Chapt-11 Income Tax - IndividualsDocument10 pagesChapt-11 Income Tax - Individualshumnarvios100% (4)

- Income Tax of Individuals: Income Taxation 5Th Edition (By: Valencia & Roxas)Document10 pagesIncome Tax of Individuals: Income Taxation 5Th Edition (By: Valencia & Roxas)Aiden PatsNo ratings yet

- Chapter 11-Income Taxation by E. ValenciaDocument10 pagesChapter 11-Income Taxation by E. ValenciaLeonard Cabuyao100% (1)

- Chapter 12 (Income Tax On Corporations)Document10 pagesChapter 12 (Income Tax On Corporations)libraolrackNo ratings yet

- Chapt-12 Income Tax - CorporationsDocument8 pagesChapt-12 Income Tax - Corporationshumnarvios86% (7)

- Chapter 11 - Vat On Services 2013Document10 pagesChapter 11 - Vat On Services 2013Jean Chel Perez Javier100% (3)

- Chapt 10 - Mixed Business TransactionsDocument6 pagesChapt 10 - Mixed Business TransactionsGemine Ailna Panganiban NuevoNo ratings yet

- Chapt 14+Income+Taxes+ +estates+ 26+trusts2013fDocument11 pagesChapt 14+Income+Taxes+ +estates+ 26+trusts2013fLouie De La Torre100% (1)

- Chapter 14 - Percentage Taxes2013Document11 pagesChapter 14 - Percentage Taxes2013JB RealizaNo ratings yet

- Chapt 8 Deduct From Gross IncomeDocument12 pagesChapt 8 Deduct From Gross IncomeLester Aguinaldo100% (1)

- Chapt 8 Deduct From Gross IncomeDocument10 pagesChapt 8 Deduct From Gross IncomeKeysi02No ratings yet

- Answer Key Ch8Document12 pagesAnswer Key Ch8Zarah RoveroNo ratings yet

- Chapter 11 TaxDocument11 pagesChapter 11 Taxkp_popinjNo ratings yet

- Chapter 11 - Percentage Taxes (Valencia)Document8 pagesChapter 11 - Percentage Taxes (Valencia)Rose CastilloNo ratings yet

- Tax 2Document8 pagesTax 2Genel Christian DeypalubosNo ratings yet

- Tax Chapter 8 Deduct From Gross IncomeDocument14 pagesTax Chapter 8 Deduct From Gross Incomemacklyn220% (1)

- Chapter 7 - Business Taxes2013Document8 pagesChapter 7 - Business Taxes2013PrincessAngelaDeLeon100% (1)

- Chap 3 Concepts of Income2013Document8 pagesChap 3 Concepts of Income2013Quennie Jane Siblos100% (1)

- ch8 - TaxDocument18 pagesch8 - TaxMarxie Marcus AlvarezNo ratings yet

- Sprint HighwayDocument15 pagesSprint Highwayamirulaiman99No ratings yet

- The 15 Essential Marketing Masterclasses For Your Small Business by Dee BlickDocument29 pagesThe 15 Essential Marketing Masterclasses For Your Small Business by Dee BlickCapstone Publishing100% (1)

- Persona 4 Max Social LinkDocument16 pagesPersona 4 Max Social LinkDavidNo ratings yet

- What Is Product Costing-SAPDocument45 pagesWhat Is Product Costing-SAPManoj Kanwar Rathore89% (9)

- UV EXPRESS ROUTE (Central Office2) PDFDocument3 pagesUV EXPRESS ROUTE (Central Office2) PDFWed CornelNo ratings yet

- Easement of Right of WayDocument7 pagesEasement of Right of WayJoanne Pauline Ochea100% (1)

- Kanohar Electricals Limited: Ra BillDocument2 pagesKanohar Electricals Limited: Ra BillAnoop Dikshit100% (1)

- Ficciindiarealestatedirectory2011 130612043303 Phpapp01Document138 pagesFicciindiarealestatedirectory2011 130612043303 Phpapp01Anonymous Nl41INVNo ratings yet

- Steve Wilson Math 131 Linear Programming Problem Number 2Document17 pagesSteve Wilson Math 131 Linear Programming Problem Number 2Jujuz Cassie DbskNo ratings yet

- Assignment 5 - CH 10 - The Cost of Capital PDFDocument6 pagesAssignment 5 - CH 10 - The Cost of Capital PDFAhmedFawzy0% (1)

- Capital Budgeting: Replacement Chain Method and Equivalent Annual AnnuityDocument6 pagesCapital Budgeting: Replacement Chain Method and Equivalent Annual AnnuityM Hammad SaeedNo ratings yet

- Air Waybill: Routing and DestinationDocument2 pagesAir Waybill: Routing and DestinationJerod SmithNo ratings yet

- Iggy and SwaggyDocument3 pagesIggy and SwaggyJerah TorrejosNo ratings yet

- Sesi 2-1 Indivara - Risk in Financing Multifinance Company v1.4Document15 pagesSesi 2-1 Indivara - Risk in Financing Multifinance Company v1.4Nur Ulfawati HadiNo ratings yet

- EDGAR Search Results: Italy Republic of Cik#Document3 pagesEDGAR Search Results: Italy Republic of Cik#MarcoBarisonNo ratings yet

- Rural Marketing ImportanceDocument3 pagesRural Marketing Importanceoindrila dasguptaNo ratings yet

- Annual Report 2018 2019 - NewDocument344 pagesAnnual Report 2018 2019 - NewwellawalalasithNo ratings yet

- Fishbone DiagramDocument1 pageFishbone DiagramAsri Marwa UmniatiNo ratings yet

- ConclusionDocument28 pagesConclusionAhmet BabayevNo ratings yet

- Chapter 9 - Mole ConceptDocument4 pagesChapter 9 - Mole ConcepthanifNo ratings yet

- Price Lists - DGL - Phase-II - Monthly PDFDocument1 pagePrice Lists - DGL - Phase-II - Monthly PDFkashieNo ratings yet

- M.P. Power Generating Company Limited (MPPGCL)Document4 pagesM.P. Power Generating Company Limited (MPPGCL)Anshuman AgrawalNo ratings yet

- Operating CostingDocument22 pagesOperating CostingNeelabh Kumar50% (2)

- Basics of Engineering Economy, 1e: CHAPTER 12 Solutions ManualDocument15 pagesBasics of Engineering Economy, 1e: CHAPTER 12 Solutions Manualttufan1No ratings yet

- Project Management BookDocument13 pagesProject Management BookNahidul Islam100% (2)

- NCKU - Designing Service Delivery SystemsDocument19 pagesNCKU - Designing Service Delivery SystemsEduardo Spiller100% (1)

- Edc Unit Wise QuestionsDocument2 pagesEdc Unit Wise QuestionsMuppala Chiranjeevi0% (1)

- Special Economic Zone (SEZ) PresentationDocument23 pagesSpecial Economic Zone (SEZ) Presentation2roxyNo ratings yet