31st Annual Return 2013 14

31st Annual Return 2013 14

Uploaded by

اختر نعمانCopyright:

Available Formats

31st Annual Return 2013 14

31st Annual Return 2013 14

Uploaded by

اختر نعمانOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

31st Annual Return 2013 14

31st Annual Return 2013 14

Uploaded by

اختر نعمانCopyright:

Available Formats

FUTURISTIC SOLUTIONS LIMITED

{ 1 }

Board of Directors

Mr. Mandeep Sandhu

Mrs. Sangeeta Sandhu

Major Gen. Charanjit Singh Panag (Retd.)

Mr. Shalabh Ahuja

Company Secretary

Mr. Rajesh Kumar

Auditors

M/s BGJC & Associates

Chartered Accountants

202, 2

nd

Floor, Raj Tower-1, G.K- II

Alaknanda Community Centre,

New Delhi-110019

Bankers

Andhra Bank, Green Park, New Delhi-110016

Registrar and Share Transfer Agent

Beetal Financial & Computer Services (P) Ltd.

Beetal House, 3rd Floor, 99 Madangir,

Behind Local Shopping Centre,

Near Dada Harkushdas Mandir,

New Delhi-110062

Registered Office

M-50, Second Floor,

M-Block Market, Greater Kailash-1

New Delhi-110048

FUTURISTIC SOLUTIONS LIMITED

{ 2 }

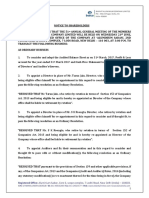

NOTICE

Notice is hereby given that the 31

st

Annual General Meeting of the members of Futuristic Solutions Limited

will be held on Wednesday, the 10

th

Day of September, 2014, at 10:00 A.M. at India Habitat Centre Lodhi Road,

New Delhi - 110003, to transact the following business:-

ORDINARY BUSINESS:

1. To receive, consider and adopt the Audited Balance Sheet as at 31st March 2014 and the Profit & Loss

Account for the year ended on that date and the Reports of the Board of Directors and Auditors thereon.

2. To appoint a Director in place of Mrs. Sandhu Sandhu(DIN NO. 00115443), who retires by rotation and is

eligible for re-appointment.

3. To consider the appointment of Statutory Auditors and if thought fit, to pass with or without modification(s)

the following resolution as Ordinary Resolution:

"RESOLVED THAT pursuant to the provisions of Section 139 of the Companies Act, 2013, M/s BGJC &

Associates, Chartered Accountants, the retiring auditors be and are hereby re-appointed as the Statutory

Auditors of the Company, to hold office from the conclusion of this Annual General Meeting until the conclusion

of the next Annual General Meeting of the company on such remuneration as shall be fixed by the Board of

directors of the Company."

SPECIAL BUSINESS:

ITEM NO.-1

To appoint Mr. Shalabh Ahuja (DIN NO. 01075671) an Independent director and if consider fit pass with or without

modification (s) the following resolution as an ordinary resolution:

"RESOLVED THAT Pursuant to the Provision of Sec. 149,152 read with Schedule IV and other applicable

provision of the Companies Act, 2013 and companies appointment (Appointment and qualification of directors)

Rule 2014 including any Statutory modification(s) or re-enactment thereof for the time being in force and clause 49

of the Listing Agreement and in respect of whom company has received a notice U/s 160 of the Companies

Act,2013 from a member proposing his candidature for the office of director, be and is hereby appointed as an

independent director of a company to hold office for 3 years for a term up to conclusion of the 34th Annual General

Meeting of the company in the calendar year 2017.

ITEM NO.-2

To appoint Major General Charanjit Singh Panag (DIN NO. 00022546) an Independent director and if consider fit

pass with or without modification (s) the following resolution as an ordinary resolution:

"RESOLVED THAT Pursuant to the provision of Sec. 149,152 read with Schedule IV and other applicable

provision of the Companies Act, 2013 and companies appointment (Appointment and qualification of directors)

Rule 2014 including any Statutory modification(s) or re-enactment thereof for the time being in force and clause 49

of the Listing Agreement and in respect of whom company has received a notice U/s 160 of the Companies

Act,2013 from a member proposing his candidature for the office of director, be and is hereby appointed as an

independent director of a company to hold office for 3 years for a term up to for a term up to conclusion of the 34th

Annual General Meeting of the company in the calendar year 2017.

ITEM NO.-3

To appoint Mrs. Anita Ahuja (DIN NO.00705004) an Independent director and if consider fit pass with or without

modification (s) the following resolution as an ordinary resolution:

"RESOLVED THAT Pursuant to the provision of Sec. 149,152 read with Schedule IV and other applicable

provision of the Companies Act, 2013 and companies appointment (Appointment and qualification of directors)

Rule 2014 including any Statutory modification(s) or re-enactment thereof for the time being in force and clause 49

FUTURISTIC SOLUTIONS LIMITED

{ 3 }

of the Listing Agreement and in respect of whom company has received a notice U/s 160 of the Companies

Act,2013 from a member proposing his candidature for the office of director, be and is hereby appointed as an

independent director of a company to hold office for 5 years for a term up to for a term up to conclusion of the 36th

Annual General Meeting of the company in the calendar year 2019.

ITEAM NO.-4

To appoint Mrs. Kuldip Sandhu (DIN NO. 00115595) as a rotational director and if consider fit pass with or without

modification (s) the following resolution as an ordinary resolution:

"RESOLVED THAT due notice in writing having been received from a member under Section 160 of Companies

Act,2013 of his intention to propose Mrs. Kuldip Sandhu for appointment as a rotational director and Mrs. Kuldip

Sandhu be and is hereby appointed as a rotational director of the company."

ITEM NO.-5

To adopt new Article of Association of the company containing regulation in conformity with Companies Act, 2013

and in this regard to consider if thought fit to pass with or without modification (s) the following resolution as Special

Resolution:

"RESOLVED THAT Pursuant to the Provision of Sec. 14 of the Companies Act, 2013 read with Companies

(Incorporation Rule 2014 including any statutory modification(s) or re-enactment thereof for time being in force) the

draft regulation contained in the Article of Association submitted to this meeting be and is hereby approved and

adopted in substitution of the entire regulations contained in the existing Article of Association of the company.

FURTHER RESOLVED THAT Mr. Mandeep Sandhu Managing director of the company be and is hereby

authorized to take all necessary actions and take all such necessary steps proper expedient to give effect to this

resolution".

EXPLANATORY STATEMENT PUSUANT TO PROVISION OF SECTION 102(1) OF THE

COMPANIES ACT, 2013

ITEM NO.-1

Mr. Shalabh Ahuja (DIN NO. 01075671) is the independent director of the company has held the position as such

for 3 years.

The Securities and Exchange Board of india has amended Clause 49 of the Listing Agreement inter-alia stipulating

the condition for appointment of Independent directors by listed Company.

It is proposed to appoint Mr. Shalabh Ahuja as an Independent director under Sec 149 of the Companies Act, 2013

and clause 49 of Listing Agreement to hold office for a period of 3 years for a term up to conclusion of the 34th

Annual General Meeting of the company in calendar year 2017.

Mr. Shalabh Ahuja is not disqualified from being appointed as a director in terms of section 164 of the companies

Act,2013 and has given consent to act a director.

The Company has received notice in writing from members alongwith the deposit of request amount U/s 160 of the

Companies Act,2013 proposing the candidature of each of Mr. Shalabh Ahuja for the office of director of the

company.

The Company has received declaration from Mr. Shalabh Ahuja that he meets the criteria of Independent director

as prescribed both under Sub Sec (6) of Section 149 of the Companies Act,2013 and Under Clause 49 of the Listing

Agreement.

In the opinion of Board Mr. Shalabh Ahuja fulfills the conditions for appointment as Independent director as

specified in the Act and the listing Agreement Mr. Shalabh Ahuja is Independent director of the management.

Brief resume of Mr. Shalabh Ahuja nature of expertise in specific functional areas and names of companies in which

he holds directorship and membership/Chairmanship of Board committees, shareholding and relationship, between

FUTURISTIC SOLUTIONS LIMITED

{ 4 }

directors inter-se stipulated under clause 49 of the listing agreement with stock exchange are provided in the corporate

governance report forming part of Annual Report.

Copy of draft letters for respective appointment are available at registered office of the company for inspection by

members of the company.

This statement may also be regarded as a disclosure under clause 49 of the Listing Agreement with the stock

exchange.

Mr. Shalabh Ahuja is interested in the resolution set out respectively at (Special Business) Item No 1 of the notice

with regard to their respective appointment.

The relatives of Mr. Shalabh Ahuja may be deemed to be interested in the resolution set out respectively at Item No.

1 of the notice, to extent of their shareholding interest, if any, in the company.

Save and except of above , none of directors/key managerial personnel of the company/their relatives are in any way

concerned or interested financial or otherwise in these resolutions.

The Board of directors command to pass the aforesaid resolution as an ordinary resolution.

ITEM NO.- 2

Major General (Retd.) C.S.Panag (DIN NO. 00022546) is the independent director of the company has held the position

as such for 3 years.

The Securities and Exchange Board of india has amended Clause 49 of the Listing Agreement inter-alia stipulating

the condition for appointment of Independent directors by listed Company.

It is proposed to appoint Major General (Retd.) C.S.Panag as an Independent director under Sec 149 of the

Companies Act, 2013 and clause 49 of Listing Agreement to hold office for a period of 3 years for a term up to

conclusion of the 34th Annual General Meeting of the company in calendar year 2017.

Major General (Retd.) C.S.Panag is not disqualified from being appointed as a director in terms of section 164 of the

companies Act,2013 and has given consent to act a director.

The Company has received notice in writing from members alongwith the deposit of request amount U/s 160 of the

Companies Act, 2013 proposing the candidature of each of Major General (Retd.) C.S.Panag for the office of

director of the company.

The Company has received declaration from Major General (Retd.) C.S.Panag that he meets the criteria of Independent

director as prescribed both under Sub Sec (6) of Section 149 of the Companies Act,2013 and Under Clause 49 of

the Listing Agreement.

In the opinion of Board Major General (Retd.) C.S.Panag fulfills the conditions for appointment as Independent

director as specified in the Act and the listing Agreement Major General (Retd.) C.S.Panag is Independent directors

of the management.

Brief resume of Major General (Retd.) C.S.Panag nature of expertise in specific functional areas and names of

companies in which he holds directorship and membership/Chairmanship of Board committees, shareholding and

relationship, between directors inter-se stipulated under clause 49 of the listing agreement with stock exchange are

provided in the corporate governance report forming part of Annual Report.

Copy of draft letter for respective appointment is available at registered office of the company for inspection by

members of the company.

This statement may also be regarded as a disclosure under clause 49 of the Listing Agreement with the stock

exchange.

Major General (Retd.) C.S.Panag is interested in the resolution set out respectively at (Special Business) Item No 2

of the notice with regard to their respective appointment.

The relatives of Major General C.S.Panag may be deemed to be interested in the resolution set out respectively at

Item No. 2 of the notice, to extent of their shareholding interest, if any, in the company.

FUTURISTIC SOLUTIONS LIMITED

{ 5 }

Save and except of above , none of directors/key managerial personnel of the company/their relatives are in any way

concerned or interested financial or otherwise in these resolutions.

The Board of directors command to pass the aforesaid resolution as an ordinary resolution.

ITEM NO.-3

Mrs. Anita Ahuja (DIN NO.00705004) is the independent director of the company has held the position as such for

5 years.

The Securities and Exchange Board of india has amended Clause 49 of the Listing Agreement inter-alia stipulating

the condition for appointment of Independent directors by listed Company.

It is proposed to appoint Mrs. Anita Ahuja as an Independent director under Sec 149 of the Companies Act, 2013

and clause 49 of Listing Agreement to hold office for a period of 5 years for a term up to conclusion of the 36th

Annual General Meeting of the company in calendar year 2019.

Mrs. Anita Ahuja is not disqualified from being appointed as a director in terms of section 164 of the companies

Act,2013 and has given consent to act a director.

The Company has received notice in writing from members alongwith the deposit of request amount U/s 160 of the

Companies Act, 2013 proposing the candidature of each Mrs. Anita Ahuja for the office of director of the company.

The Company has received declaration from Mrs. Anita Ahuja that he meets the criteria of Independent director as

prescribed both under Sub Sec (6) of Section 149 of the Companies Act,2013 and Under Clause 49 of the Listing

Agreement.

In the opinion of Board Mrs. Anita Ahuja fulfills the conditions for appointment as Independent director as

specified in the Act and the listing Agreement Mrs. Anita Ahuja is Independent directors of the management.

Brief resume of Mrs. Anita Ahuja nature of expertise in specific functional areas and names of companies in which

he holds directorship and membership/Chairmanship of Board committees, shareholding and relationship, between

directors inter-se stipulated under clause 49 of the listing agreement with stock exchange are provided in the corporate

governance report forming part of Annual Report.

Copy of draft letter for respective appointment is available at registered office of the company for inspection by

members of the company.

This statement may also be regarded as a disclosure under clause 49 of the Listing Agreement with the stock

exchange.

Mrs. Anita Ahuja is interested in the resolution set out respectively at (Special Business) Item No 3 of the notice with

regard to their respective appointment.

The relatives of Mrs. Anita Ahuja may be deemed to be interested in the resolution set out respectively at Item No.

3 of the notice, to extent of their shareholding interest, if any, in the company.

Save and except of above , none of directors/key managerial personnel of the company/their relatives are in any way

concerned or interested financial or otherwise in these resolutions.

The Board of directors command to pass the aforesaid resolution as an ordinary resolution.

ITEAM NO.-4

Mrs. Kuldip Sandhu (DIN NO. 00115595) is being appointed as rotational director of the company.

Mrs. Kuldip Sandhu is not disqualified from being appointed as a director in terms of section 164 of the companies

Act,2013 and has given consent to act a directors.

The Company has received notice in writing from members along with the deposit of request amount U/s 160 of the

Companies Act, 2013 proposing the candidature of each Mrs. Kuldip Sandhu for the office of director of the

company.

FUTURISTIC SOLUTIONS LIMITED

{ 6 }

The Company has received declaration from Mrs. Kuldip Sandhu that she meets the criteria of director as prescribed

under Section 160 of the Companies Act, 2013.

In the opinion of Board Mrs. Kuldip Sandhu fulfills the conditions for appointment as a rotational director as

specified in the Act and the listing Agreement is directors of the management.

Brief resume of Mrs. Kuldip Sandhu nature of expertise in specific functional areas and names of companies in

which she hold directorship and membership/Chairmanship of Board committees, shareholding and relationship,

between directors inter-se stipulated under clause 49 of the listing agreement with stock exchange are provided in the

corporate governance report forming part of Annual Report.

Copy of draft letter for respective appointment is available at registered office of the company for inspection by

members of the company.

This statement may also be regarded as a disclosure under clause 49 of the Listing Agreement with the stock

exchange.

Mr. Mandeep Sandhu and Mrs. Sangeeta Sandhu are interested in the resolution set out respectively at (Special

Business) Item No 4 of the notice with regard to their respective appointment.

The relatives of Mrs. Kuldip Sandhu may be deemed to be interested in the resolution set out respectively at Item No.

4 of the notice, to extent of their shareholding interest, if any, in the company.

Save and except of above , none of directors/key managerial personnel of the company/their relatives are in any way

concerned or interested financial or otherwise in these resolutions.

The Board of directors command to pass the aforesaid resolution as an ordinary resolution.

ITEM NO.-5

The Existing Article of Association (AOA) of the company are based on Companies Act,1956 and several regulations

in the existing AOA contain reference to specific Sections of the Companies Act,1956 and some regulation in the

existing AOA are no longer in conformity with the prevailing Companies Act,2013.

The Act is now largely in force September 12, 2013. The Monastery of Corporate affairs has notified 98 section for

implementation subsequently, on March 26 2014 MCA notified most of the remaining section (barring those provision

which require sanction/permission of the National Company Law Tribunal such as a variation in right of shareholders

and reduction in share Capital etc. However substantive Section of the Act which deals with general working of

company stand notified.

With coming in to force of the Act several regulation of the existing AOA require alteration or deletion in several

Articles, given this position it is considered expedient to wholly replace the existing AOA by new set of Articles.

The new AOA to be substituted in place of existing AOA are based on Table F of the Act which set out the model

set of AOA for a Company Limited by Shares. Shareholders attentions are invited on certain silent feature of new

AOA of the company.

The proposed new drafts of AOA are available on the company's website for perusal by the shareholders.

None of directors/key managerial personnel of the company/their relatives are in any way concerned or interested

financial or otherwise in these resolutions.

By order of the Board of Directors

For Futuristic Solutions Limited

Sd/-

Place : New Delhi Rajesh Kumar

Dated : 06/08/20142009 (Company Secretary)

FUTURISTIC SOLUTIONS LIMITED

{ 7 }

NOTES:-

1) A MEMBER ENTITLED TO ATTEND AND VOTE IS ENTITLED TO APPOINT A PROXY TO ATTEND

AND VOTE INSTEAD OF HIMSELF / HERSELF AND THE PROXY NEED NOT TO BE THE MEMBER OF

THE COMPANY. THE INSTRUMENT OF PROXY SHOULD, HOWEVER, BE DEPOSITED AT THE

REGISTERED OFFICE OF THE COMPANY NOT LESS THAN 48 HOURS BEFORE THE SCHEDULED

TIME OF THE MEETING.

A person can act as a proxy on behalf of members not exceeding fifty and holding in aggregate not exceeding

10% of total Share Capital of the company carrying voting rights. A member holding more than 10% of the

total share capital of the company carrying voting rights may appoint a single person as proxy and such person

shall not act as proxy for any other person or shareholder.

Corporate members intending to send their authorized representative to attend the meeting are requested to

send to the company a certified copy of board resolution authorizing their representative to attend and vote on

their behalf at the meeting.

Brief resume of directors including those proposed to be appointed /or re-appointed, nature of their expertise in

specific functional area, name of company in which they hold directorship and membership/chairmanship of

board committees, shareholding and relationship between director inter-se as stipulated under clause 49 of the

listing agreement with the stock exchanges, provided in corporate governance report forming part of the

annual report.

2) The Explanatory Statement pursuant to Section 102(1) of the Companies Act, 2013, relating to special

Business, if any, to be transacted at the meeting is annexed hereto.

3) Members / Proxies are requested to bring their attendance slip along with their copy of Annual Report to the

meeting.

4) In case of joint holders attending the meeting, only such joint holder who is higher in the order of names will

be entitled to vote.

5) Members who hold shares in dematerialized form are requested to bring their Client ID (Demat A/C No.) and

DP ID numbers for easy identification of attendance at the meeting.

6) Members are requested to notify the changes in their Address, if any.

7) Shareholders are requested to bring their copy of Annual Report to the meeting.

8) All documents referred to in the accompanying Notice and Explanatory statement are open for inspection at

the Registered Office of the Company during the office hours up to the date of Annual General Meeting

between 10.00 a.m. and 12.00 p.m.

9) Pursuant to the requirements of the listing agreement with the stock exchange, on Corporate Governance, the

information required to be given, in case of the appointment of a new director or re-appointment of a director,

is given in Annexure to the Corporate Governance Report.

10) Member who have not registered their email addresses so far are requested to register their email address for

receiving all communication including Annual Report, Notice Circulars etc. from the company electronically.

11) The Register of Members and Share Transfer register will remain closed from from 8th September to 10th

September 2014 (both days inclusive for the purpose of Annual General Meeting for the financial year ended

31st March 2014.

12) Voting through electronic means

In compliance with provision of Section 108 of the Act, 2013 and rule 20 of the Companies (Management

and Administration) 2014, the company is pleased to provide to its members, the facility to exercise their

right to vote at Thirty First Annual General Meeting by electronics means and business may be transacted

through e-voting services provided by Central Securities Depository Limited (CSDL).

FUTURISTIC SOLUTIONS LIMITED

{ 8 }

The instructions for e-voting are as under.

In case a member receive an email from CSDL for members whose email IDs are registered with the company/

their respective DPs):

The e-Voting process to be followed by the shareholders to cast their votes:

(A) In case of members receiving e-mail:

(i) Log on to the e-voting website www.evotingindia.com

(ii) Click on "Shareholders" tab.

(iii) Now, select the Electronic Voting Sequence Number - 140811017 along with "COMPANY NAME"

from the drop down menu and click on "SUBMIT"

(iv) Now Enter your User ID (For CDSL: 16 digits beneficiary ID, For NSDL: 8 Character DP ID

followed by 8 Digits Client ID, Members holding shares in Physical Form should enter Folio Number

registered with the Company and then enter the Captcha Code as displayed and Click on Login.

(v) If you are holding shares in Demat form and had logged on to www.evotingindia.com and casted

your vote earlier for EVSN of any company, then your existing password is to be used. If you are a

first time user follow the steps given below.

(vi) Now, fill up the following details in the appropriate boxes:

For Members holding shares For Members holding shares

in Demat Form in Physical Form

PAN* Enter your 10 digit alpha-numeric *PAN issued by Income Tax Department

(Applicable for both demat shareholders as well as physical shareholders)

DOB# Enter the Date of Birth as recorded in your demat account or in the company

records for the said demat account or folio in dd/mm/yyyy format.

Dividend Enter the Dividend Bank Details as recorded in your demat account or in

Bank Details# the company records for the said demat account or folio.

*Members who have not updated their PAN with the Company/Depository Participant are requested

to use the <Default Value> in the PAN field.

# Please enter any one of the details in order to login. In case either of the details are not recorded

with the depository please enter the <Default Value> in the Dividend Bank details field.

(vii) After entering these details appropriately, click on "SUBMIT" tab.

(viii) Members holding shares in physical form will then reach directly the EVSN (140811017) selection

screen. However, members holding shares in demat form will now reach 'Password Creation' menu

wherein they are required to mandatorily enter their login password in the new password field.

Kindly note that this password is to be also used by the demat holders for voting for resolutions of

any other company on which they are eligible to vote, provided that company opts for e-voting

through CDSL platform. It is strongly recommended not to share your password with any other

person and take utmost care to keep your password confidential.

(ix) For Members holding shares in physical form, the details can be used only for e-voting on the

resolutions contained in this Notice.

(x) Click on the relevant EVSN 140811017 on which you choose to vote.

(xi) On the voting page, you will see Resolution Description and against the same the option "YES/NO"

for voting. Select the option YES or NO as desired. The option YES implies that you assent to the

Resolution and option NO implies that you dissent to the Resolution.

(xii) Click on the "Resolutions File Link" if you wish to view the entire Resolutions.

FUTURISTIC SOLUTIONS LIMITED

{ 9 }

(xiii) After selecting the resolution you have decided to vote on, click on "SUBMIT". A confirmation box

will be displayed. If you wish to confirm your vote, click on "OK", else to change your vote, click on

"CANCEL" and accordingly modify your vote.

(xiv) Once you "CONFIRM" your vote on the resolution, you will not be allowed to modify your vote.

(xv) You can also take out print of the voting done by you by clicking on "Click here to print" option on

the Voting page.

(xvi) If Demat account holder has forgotten the changed password then Enter the User ID and Captcha

Code click on Forgot Password & enter the details as prompted by the system.

(xvii) Institutional shareholders (i.e. other than Individuals, HUF, NRI etc.) are required to log on to

https://www.evotingindia.com and register themselves as Corporates. After receiving the login details

they have to link the account(s) which they wish to vote on and then cast their vote. They should

upload a scanned copy of the Board Resolution and Power of Attorney (POA) which they have issued

in favour of the Custodian, if any, in PDF format in the system for the scrutinizer to verify the same.

(B) In case of members receiving the physical copy:

Please follow all steps from sl. no. (i) to sl. no. (xvii) above to cast vote.

(C) The evoting period begins on September 5th (10.00 A.M) 2014 and end on September 6th (6.00 P.M)

2014 During this period shareholders' of the Company, holding shares either in physical form or in

dematerialized form, as on the cut-off date 8th day August 2014 , may cast their vote electronically. The

e-voting module shall be disabled by CDSL for voting thereafter.

(D) In case you have any queries or issues regarding e-voting, you may refer the Frequently Asked Questions

("FAQs") and e-voting manual available at www.evotingindia.com under help section or write an email to

helpdesk.evoting@cdslindia.com.

The voting right in proportion to their shares of the paid up share capital of the company as on cut -off

date 8th day August 2014 .

Parul & Associates Company Secretary (Member ship No. 30717) Delhi has been appointed as the

scrutinizer the e-voting process in fair and transparent manner.

The scrutinizer shall within 3 days from the conclusion of voting will unblock the votes in presence of two

witness who are not in employment in the company be submit the report to the company's chairman.

The result shall be declared in the Annual General Meeting of the Company. Result declared along with

scrutinizer result shall be placed on the company's web site and CDSL web site within 2 days from the

date of passing resolution at Annual General Meeting.

ITEM NO. 1

As required under the Listing Agreement the Particulars of Independent Director who is proposed to be re-appointed

at the Annual General Meeting are given below:

NAME : MR. SHALABH AHUJA

DIN NO. : 01075671

AGE : 56 Years (12/09/1958)

QUALIFICATION : B.E (Hons) Civil Engineering from BITS Pilani

NO. OF SHARES HELD IN THE COMPANY : Nil

EXPERIENCE : 29 or more years having experience in the operation of

business & substantial experience in the field of Civil

Contracts.

Remuneration : Not paid any remuneration

Mr. Shalabh Ahuja is one of the Non Executive Independent directors of the Futuristic Solutions Limited possessing

wide knowledge and experience in various fields and providing leadership and direction to the company.

FUTURISTIC SOLUTIONS LIMITED

{ 10 }

ITEM NO. 2

As required under the Listing Agreement the Particulars of Independent Director who is proposed to be re-appointed

at the Annual General Meeting are given below:

NAME : MAJOR GENERAL (RETD.) C.S. PANAG

DIN NO. : 00022546

AGE : 71 Years (23/09/1943)

QUALIFICATION :

NO. OF SHARES HELD IN THE COMPANY : 2750

EXPERIENCE : 39 or more years having experience in the Administration

of business. Strategic, Operational and Logistic Planning,

Budgetary, Human Resource Management, Infrastructure

Development, Social Development, Land acquisition and

liaison with civil and foreign administration.

Remuneration : Not paid any remuneration

Major General Charanjit Singh Panag is one of the Non Executive Independent directors of the Futuristic Solutions

Limited possessing wide knowledge and experience in various fields and providing leadership and direction to the

company.

ITEM NO. 3

As required under the Listing Agreement the Particulars of Independent Director who is proposed to be re-appointed

at the Annual General Meeting are given below:

NAME : MRS. ANITA AHUJA

DIN NO. : 00705004

QUALIFICATION : B.A (Hons)

NO. OF SHARES HELD IN THE COMPANY : Nil

EXPERIENCE : 25 or more years having experience in the operation

of business .

Remuneration : Not paid any remuneration

Mrs. Anita Ahuja is one of the Non Executive Independent directors of the Futuristic Solutions Limited possessing

wide knowledge and experience in various fields and providing leadership and direction to the company.

ITEM NO. 4

As required under the Listing Agreement the Particulars of Rotational Director who is proposed to be appointed at

the Annual General Meeting are given below:

NAME : MRS. KULDIP SANDHU

DIN NO. : 00115595

AGE : 77 Years (17/09/1937)

QUALIFICATION : B.A (Hons)

NO. OF SHARES HELD IN THE COMPANY : Nil

EXPERIENCE : 35 or more years having experience in the

Administration of business.

Remuneration : Not paid any remuneration

Mrs. Kuldip Sandhu is one of the Non Executive rotational directors of the Futuristic Solutions Limited possessing

wide knowledge and experience in business management fields and providing leadership and direction to the company.

By order of the Board of Directors

For Futuristic Solutions Limited

Sd-

Place : New Delhi Rajesh Kumar

Dated : 06/08/2014 (Company Secretary)

FUTURISTIC SOLUTIONS LIMITED

{ 11 }

DIRECTORS REPORT

Dear Members,

Your directors have pleasure in presenting this 31

st

(Thirty First) Annual Report together with the Audited Accounts

of the Company for the financial year ended 31

st

March 2014.

Financial Highlights:

The financial highlights for the year ended 31st March 2014 under review are as follows:

(Rs. In Lakhs)

Year ended Year ended

Particulars 31-03-2014 31-03-2013

Total Income 61.74 236.33

Profit/ (Loss) before Interest, Depreciation and Tax (15.36) (234.02)

Interest 31.26 47.96

Profit/ (Loss) after interest but before Depreciation and Tax (46.62) (281.98)

Exceptional Item - 341.00

Depreciation 2.54 2.99

Profit/ (Loss) before Tax (49.16) 56.03

Provision for Taxation 2.39 17.09

Profit/ (Loss) after Tax (51.55) 38.94

Transfer to Statutory Reserve Fund - 7.79

Proposed dividend and tax thereon - 60.86

Balance Carried to Balance Sheet (51.55) Nil

Performance:

During the year, your Company has not made a good progress due to slow down in the economy and has recorded

Net Loss after tax Rs. (51.55 Lacs). The Total income of the Company is Rs. 61.74 Lacs as compared to 236.33

Lacs during the previous year. The operating Loss for the current financial year are Rs. (49.16) Lacs, decrease over

the previous year by 187.73%, which were Rs. 56.03 Lacs as on 31.03.2013.

Dividend:

Your Board of Directors of the company has not recommended any dividend for the financial year 2013-14.

Public Deposits:

During the year, your Company has not invited any fixed deposit from the public in terms of provision of Section

58A of the Companies Act, 1956, read with the Companies (Acceptance of Deposit) rules 1975.

Composition of Audit Committee:

Composition of Audit committee has already been described in the Corporate Governance Report of the Company

for the Financial Year 2013-14.

Board of Directors:

In accordance with the provisions of the Companies Act, 1956, and the Articles of Association of the Company,

Mrs. Sangeeta Sandhu is liable to retire by rotation as director at the ensuing Annual General Meeting of the

Company and being eligible, offers herself for re-appointment at the ensuing Annual General Meeting of the Company.

Directors' Responsibility Statement:

In terms of Section 217(2AA) of the Companies Act, 1956, the Board of Directors confirms that:

In preparation of the Annual Accounts for Financial Year ended 31st March 2014, the applicable Accounting

Standards have been followed along with proper explanation relating to material departures;

We have selected such accounting policies and applied them consistently and made judgments and estimates that

are reasonable and prudent so as to give a true and fair view of the state of affairs of the Company as on 31st

March, 2014 and of the Loss for the year ended on that date;

We have taken proper and sufficient care for the maintenance of adequate accounting records in accordance with

the provisions of the Companies Act, 1956, for safeguarding the assets of the Company and for preventing and

detecting fraud and other irregularities; and

We have prepared the Annual Accounts for the Financial Year ended 31st March 2014 on a 'going concern' basis.

Corporate Governance:

Your Company reaffirms its commitment to good Corporate Governance practices. Pursuant to Clause 49 of the

Listing Agreement with the Bombay Stock Exchange Limited and Delhi Stock Exchange Limited, Corporate

FUTURISTIC SOLUTIONS LIMITED

{ 12 }

Governance Report and Auditors Certificate regarding compliance of conditions of Corporate Governance are

enclosed and form an integral part of this report.

Further, a certificate from the CFO of the company in pursuance of Clause 49 of the Listing Agreement with Stock

Exchange was placed before the Board.

Management Discussion & Analysis Report

A report on Management Discussion and Analysis, as required under Clause 49 of the Listing Agreement, is enclosed

and forms an integral part of this report.

Auditors and Auditors' Report

M/s. BGJC & Associates, Chartered Accountants, Statutory Auditors of the Company hold office until the conclusion

of the ensuing Annual General Meeting and being eligible, offer themselves for re-appointment. The Auditors have

furnished a certificate to the effect that their re-appointment, if made, at the Annual General Meeting, will be within

the limits prescribed under section 139 (1) of the Companies Act, 2013, and they are not disqualified for such

reappointment within the meaning of Section 141(3) of the said Act. They have also confirmed that they hold a

valid peer review certificate as prescribed under Clause 41(1)(h) of the Listing Agreement. Members are requested to

consider their appointment for a period of one year i.e. up to next Annual General Meeting .

The Audit committee and Board of Directors have recommended the appointment of M/s. BGJC & Associates,

Chartered Accountants as the Statutory Auditors of your Company.

The notes to accounts, referred to in the Auditors' Report are self explanatory and therefore do not call for any

further comments.

Particulars As Per Section 217 of The Companies Act, 1956

(a) Particulars of Employees:

None of the employees of the company was drawing in excess of the limits by the companies Act, 1956 and rules

made there under.

(b) Particulars of energy, technology, and foreign exchange:

Energy Conservation - The operations of the Company are not energy intensive.

Technology Absorption - Not applicable

Foreign Exchange Earnings - NIL

Foreign Exchange outgoings - NiL

Cash Flow Statement:

Cash flow statement for the financial year 2013-14 prepared in accordance with Accounting Standards (AS-3)

issued by the Institute of Chartered Accountants of India, forms part of this Report

Corporate Social Responsibility:

Corporate Social responsibility has always been integral part of Futuristic Solutions Limited' vision and cornerstone

of our core value of good corporate citizenship.

Reserve Bank of India Guidelines

Your Company continues to comply with all the requirements prescribed by the Reserve Bank of India, from time to

time, as applicable to it.

Acknowledgement

The Board wishes to place on record its appreciation to the contribution made by the employees of the Company

during the year under review. Your Directors thank the customers, clients, Bankers, vendors and other business

associates for their continued support in the Company's growth. The Directors also wish to thank the Government

Authorities, Financial Institutions and Shareholders for their cooperation and assistance extended to the Company.

For and on behalf of the Board

For Futuristic Solutions Limited

Sd/-

Place : New Delhi Mandeep Sandhu

Dated : 06/08/2014 (Chairman)

FUTURISTIC SOLUTIONS LIMITED

{ 13 }

CERTIFICATE ON COMPLIANCE WITH THE CONDITIONS OF CORPORATE

GOVERNANCE UNDER CLAUSE 49 (VII) OF THE LISTING AGREEMENT

To The Members of Futuristic Solutions Limited

We have examined the compliance conditions of corporate governance by Futuristic Solutions Limited for the

Financial year ended March 31, 2014 as stipulated in Clause 49 of the Listing Agreement of the said Company with

stock exchanges in India.

The compliance of conditions of Corporate Governance is the responsibility of the management. Our examination

was limited to procedures and implementation thereof, adopted by the Company for ensuring compliance of the

conditions of Corporate Governance. It is neither an audit nor an expression of opinion on the financial statements

of the Company.

In our opinion and to the best of our information and according to the explanations given to us, we certify that the

Company has complied with the conditions of Corporate Governance as stipulated in the above mentioned Listing

Agreement.

We state that no investor grievance is pending for a period exceeding 15 days against the company as per records

maintained by the Company, Shareholders'/investors' Grievance Committee.

We further state that such compliance is neither an assurance as to the future viability of the Company nor the

efficiency or effectiveness with which the management has conducted the affairs of the Company.

For Parul and Associates

Company Secretaries

Sd/-

Place : New Delhi Parul

Dated : 06/08/2014 C.P. No. 11610

FUTURISTIC SOLUTIONS LIMITED

{ 14 }

CORPORATE GOVERNANCE REPORT

1. COMPANY'S PHILOSOPHY ON CODE OF CORPORATE GOVERNANCE:

Corporate Governance is about commitment to values, ethical business conduct and about considering all

stakeholders' interest in conduct of business. Transparency and accountability are the two basic tenets of

Corporate Governance. Your Company continues to lay great emphasis on the broad principles of Corporate

Governance. Futuristic Solutions Limited philosophy on Corporate Governance is stated below:

At Futuristic Solutions Limited, we believe in adopting the 'best practices' followed in the area of Corporate

Governance across various geographies. We emphasize the need for transparency and accountability in our

businesses, in order to protect the interests of our stakeholders.

Corporate Governance is a continuous journey towards sustainable value creation for all the stakeholders,

which is driven by following values:

Our vision is to be the most trusted partner for every stakeholder and we are committed to provide fair,

transparent and equitable treatment to our stakeholders.

Our core value system is guided by the principles of accountability, transparency, timely disclosure and

dissemination of price sensitive information and matters of interest to the investors ensuring compliance with

the applicable acts, laws, rules and regulations and conducting business in a best ethical manner.

Accordingly,Corporate Governance stands on the aforesaid broad pillars of transparency, fairness in action,

accountability and responsibility towards all the stakeholders.

Securities and Exchange Board of India has issued guidelines on the Corporate Governance for all listed

companies through Clause 49 of the Listing Agreement. At Futuristic Solutions Limited, we are not only

committed to follow the prescribed corporate practices embodied in various regulatory provisions but also the

best national practices. We also believe that good governance practices flow from the culture and mindset of

the top management and percolate down in the organization.

The Corporate Governance in the Company has been further strengthened through the adoption

of the following:

Ensure that quantity, quality and frequency of financial and managerial information, which management

shares with the Board, fully places the Board members in control of the Company's affairs;

Ensure that the Board exercises its fiduciary responsibilities towards Shareholders and Creditors, thereby

ensuring high accountability;

Ensure that the extent to which the information is disclosed to present and potential investors is maximized

and ensure that the Board, the Employees and all concerned are fully committed to maximizing long-term

value to the Shareholders and the Company.

Ensure timely flow of information to the board and its committee to enable them discharges their function

effectively.

Constitution of a board of directors of appropriate composition, size varied expertise and commitment to

discharge their responsibilities and duties.

Compliance with all rules and regulations.

2. BOARD OF DIRECTORS:

The Directors of your Company are eminent people from various fields and are also conscious of following the

good governance practices. The Board oversees as to how the management serves and protects the long-term

interests of all the stakeholders.

(A) The Board of Directors of your Company comprises of 4 directors consisting of 1 Executive Director and

3 Non-Executive Directors out of which 2 Directors are independent directors as on 31st March 2014. In

the Financial Year 2013-14, 12 meetings of Board of Directors were held. The Category, composition,

attendance of each director at the Board Meeting, last Annual General Meeting, and the number of other

Directorship(s), membership(s)/Chairmanship(s) of Committees of each Director in various Companies is

given herein below:

The composition of the Board is in consonance with Clause 49 of the Listing Agreement, entered into

with the Stock Exchanges and in accordance with the provisions of the Companies Act, 2013 .

FUTURISTIC SOLUTIONS LIMITED

{ 15 }

All Independent Directors have confirmed to the Board that they qualify to be independent as per the

definition of 'Independent Director' stipulated in Clause 49 (I)(A)(iii) of the Listing Agreement and Section

149(6) of the Act. These confirmations have been placed before the Board.

None of the Directors hold directorships in more than 20 companies. None of the Directors is serving as

a Member of more than ten committees or as the Chairman of more than five committees across all the

public companies of which he is a Director. Necessary disclosures regarding committee positions in other

public companies as on March 31, 2014 have been made by the Directors.

The composition of board of directors, Attendance of directors at the board meeting and last Annual General

Meeting, Directorship in other Public Limited Companies and Membership in committee are as follows:

Name of Director No. of Board Attended No. of No. of No. of

meetings at last AGM Directorship Committee Committee

attended (28.09.13) in other position position

company(ies) held in held in

Company as Company as

Chairman Member

Promoter Director (Executive)

Mr. Mandeep Sandhu 10 Yes 6 None None

Promoter Director (Non-Executive)

Mrs. Sangeeta Sandhu 12 Yes 5 None 3

Non-Executive Independent Directors

Maj. Gen. Charanjit Singh Panag (Retd.) 12 Yes 3 None 3

Mr. Shalabh Ahuja 12 Yes 2 3 3

Excluding private, foreign and companies registered under section 25 of the companies Act, 1956.

(B) Number of Board Meetings held and dates:

During the Financial Year 2013-14, the Board of Directors met 12 times. The dates of the meetings are 10th

April 2013, 30th May 2013, 10th July 2013, 5th August 2013, 26th August 2013, , 8th October 2013, 25th

October 2013, 15th November 2013,13th December 2013 ,8th January 2014, 23rd January 2014, 31st

January 2014.

(C) Code of Conduct:

In pursuance of Clause 49 of the Listing Agreement, the Board has approved the 'Code of Conduct for Board

of Directors and Senior Management' and the same has been circulated. The Directors and the senior

management personnel have given their declarations confirming compliance of the provisions of the above

Code of Conduct

3. AUDIT COMMITTEE:

(A) Composition, Name of Members and Chairman:

The Audit Committee, as on 31st March 2014 At present the committee comprises of 3 Non-Executive

Directors out of which two are independent Directors viz. Maj. Gen. (Retd) Charanjit Singh Panag,

Mrs.Sangeeta Sandhu and Mr. Shalabh Ahuja is the Chairman of the Committee, in conformity with the

requirements of section 292A of the Companies Act,1956 and Clause 49 of the Listing Agreement.

The Composition of the Audit Committee and attendance of Directors at the Audit Committee meetings

held on 30th May 2013, 5th day of August 2013, ,25th October 2013, 23rd January 2014 is given

herein below:

Sl. Name of Director Category No. of Meetings

No. Held Attended

1. Mr. Shalabh Ahuja Chairman 4 4

2. Maj. Gen. Charanjit Singh Panag (Retd.) Member 4 4

3. Mrs. Sangeeta Sandhu Member 4 4

FUTURISTIC SOLUTIONS LIMITED

{ 16 }

Notes:

1. The requisite quorum was present at every meeting of Audit Committee of the Board.

2. Mr. Rajesh Kumar has been appointed as a compliance officer and Secretary to the company w.e.f. 1st

day of August 2012.

Terms of Reference:

(B) Terms of Reference:

The term of reference of the Audit committee are in line with those specified under section 292A of the

companies Act,1956 and clause 49 of the listing agreement. The audit committee review the internal

audit including internal control mechanism, financial reporting and financial management policies of the

company and adequacy of the same. The committee also oversees the financial statement with particular

emphasis on accounting policies and practices, significant adjustment ,major accounting entries involving

estimate based on exercise of judgment by the management ,related party transaction ,compliance with

accounting standards and other legal requirement concerning financial statement ,before the same are

submitted to the board .The committee recommend and reviews the terms of appointments, nature

scope of duties of statutory and internal auditor of the company.

(C) Powers of Audit Committee:

To investigate any activity with in terms of reference.

To seek information from any employee.

To obtain outside legal or other professional advice.

To secure attendance of outsiders with relevant expertise, if it considers necessary.

(D) Functions of Audit Committee:

Overseeing of the Company's financial reporting process and the disclosure of its financial information

to ensure that the financial statement is correct, sufficient and credible.

Recommending the appointment and removal of external (statutory) auditor. Fixation of audit fee

and also approval for payment of any other services.

Reviewing with the management the annual financial statements before submission to the Board,

focusing primarily on;

Any changes in accounting policies and practices.

Major accounting entries based on exercise of judgment by management.

Qualifications in draft audit report.

Significant adjustments arising out of audit.

The going concern assumption.

Compliance with accounting standards.

Compliance with Stock Exchange and legal requirements concerning financial statements.

Any related party transactions i.e. transactions of the Company of material nature, with promoters,

their subsidiaries, the management or relatives etc.

Reviewing with the management and external and internal auditors, about the adequacy of internal

control system.

Reviewing the adequacy of internal audit function, including the structure of the internal audit

department, staffing and seniority of the official heading the department, reporting structure, coverage

frequency of internal audit.

Discussion with Internal Auditors of any significant findings and follow up thereon.

Reviewing the findings of any internal investigations by the internal auditors into matters where

there is suspected fraud or irregularity or a failure of internal control systems of a material nature

and reporting to the Board.

FUTURISTIC SOLUTIONS LIMITED

{ 17 }

Discussion with the external auditors before the audit commences, of the scope and nature of audit

and as well as have post audit discussion to ascertain any area of concern.

Reviewing the Company's financial and risk management policies.

To look into the reasons for substantial defaults in the payment to the depositors, debenture holders,

shareholders (in case of non-payment of declared dividends) and creditors.

To act as link between the statutory, internal auditors and the Board of Directors.

To review reports of the internal audit department and recommend to the Board to decide about

the scope of its work including the examination of major items of expenditure.

Generally to ensure that tendencies for extravagance, if any, are checked.

4. REMUNERATION COMMITTEE:

Terms of Reference: The Remuneration Committee has been constituted to recommend/review the

remuneration and sitting fees of Executive directors and non executive director.

Composition, Meeting and Attendance: The Remuneration Committee comprises of three Non-Executive

Directors out of which two are Independent directors viz. Maj. Gen. (Retd.) Charanjit Singh Panag, Mr.

Shalabh Ahuja and Mrs.Sangeeta Sandhu. The Chairman of the committee is Mr. Shalabh Ahuja. The terms

of reference stipulated by the Board to the Remuneration Committee are same as contained under Clause 49

of the standard listing agreement.

The attendance of Directors at the Remuneration Committee Meetings held and is given herein below:

Sl. Name of Director Category No. of No. of

No. Meetings Held Meetings Attended

1. Mr. Shalabh Ahuja Chairman 1 1

2. Maj. Gen. Charanjit Singh Panag (Retd.) Member 1 1

3. Mrs. Sangeeta Sandhu Member 1 1

The annual remuneration paid to Mr. Mandeep Sandhu, the Managing Director of the Company in the

financial year 2013-14 is as follows:

Salary Rs. 15,50,000/-

During the financial year (2013-14) under review, the Company has not paid any remuneration/Fees to any

Non-Executive Directors

5. SHAREHOLDERS'/INVESTORS' GRIEVANCE COMMITTEE:

The Investor Grievance Committee was constituted specifically to review the compliance of rule and regulations

to redress investor grievances to provide suggestion and to expedite the process of Share transfers, transmission

etc. At present this committee comprises of 3 Non-Executive Directors out of which two are independent

directors viz. Maj. Gen. (Retd.) Charanjit Singh Panag, Mr.Shalabh Ahuja and Mrs Sangeeta Sandhu. The

Chairman of the Committee is Mr.Shalabh Ahuja. The terms of reference stipulated by the Board to the

Shareholders'/Investors' Grievance Committee are same as contained under Clause 49 of the standard listing

agreement.

In Compliance with the SEBI guidelines the Company has appointed M/s Beetal Financial & Computers

Services Pvt. Ltd. as RTA (Registered Transfer Agent) w.e.f. 31st Jan 2002 to look after the share transfer,

transmission, transposition, issuance of duplicate share certificate, share dematerialization etc. independently

under the supervision and control of the Shareholders'/Investors' Grievance Committee.

The Committee Meeting held during the year 20th May 2013, 12th day of August 2013, 12th November 2013,

19th February 2014 are as follows

FUTURISTIC SOLUTIONS LIMITED

{ 18 }

Sl. Name of Director Category No. of No. of

No. Meetings Held Meetings Attended

1. Mr. Shalabh Ahuja Chairman 4 4

2 Maj. Gen. Charanjit Singh Panag Member 4 4

3. Mrs. Sangeeta Sandhu Member 4 4

Investor Services:

(a) Share Transfer Process

The Company's shares, which are in compulsory dematerialized (demat) list, are transferable through the

depository system. Shares in physical form are processed by Registrar and Transfer Agent, M/s Beetal

Financial & Computers Services Pvt. Ltd. The share transfers are processed within a period of 15 days

from the date of receipt of the transfer documents by M/s Beetal Financial & Computers Services Pvt.

Ltd.

(b) Investor Help-desk

Share transfers and all other investors related activities are attended to and processed at the office of our

Registrar and Transfer Agents viz. M/s Beetal Financial & Computers Services Pvt. Ltd. Their address is

given in the section on Shareholders Information.

Mr. Rajesh Kumar, Company Secretary is appointed as Compliance Officer in terms of Clause 47 of the

Listing Agreement w.e.f. 1st day of August 2012.

Number of Shareholders complaints received and redressed:

The total numbers of complaints received and resolved to the satisfaction of shareholders during the year

under review were NIL. There was no complaint pending to be resolved as on 31st March 2014.

6. Disclosures:

A. Related party Transaction:

There are no materially significant related party transactions with the Company's promoters, Management,

Directors and their relatives which may have potential conflict with interest of the Company at large.

Transactions with related parties have been shown in "Note No. 27 to the Notes to the Accounts of the

company".

B. Disclosure of Accounting Treatment:

Disclosure of accounting treatment there has not been any significant changes in accounting policies

during the year.

C. Risk management:

The Company has a well-defined risk management framework in place. Further, it has established

procedures to periodically place before the Board, the risk assessment and minimization procedures

being followed and the steps taken by it to mitigate these risks

D. Compliance by the Company:

There are no instances of non-compliance by the Company on any matters related to capital market, nor

have any penalty/strictures been imposed by the Stock Exchanges or SEBI or any other statutory authority

on any matter relating to capital market during the Financial Year ended on 31st March 2014.

7. Certificate on Corporate Governance:

The Company has obtained a Certificate from Parul & Associates, Practicing Company Secretary regarding

Compliance of conditions of Corporate Governance as stipulated in Clause 49 of the Listing Agreement and

the same is annexed.

FUTURISTIC SOLUTIONS LIMITED

{ 19 }

8. Selection of Independent Directors

Considering the requirement of skill sets on the Board, eminent people having an independent standing in their

respective field/profession, and who can effectively contribute to the Company's business and policy decisions

are considered by the Nomination and Remuneration Committee, for appointment, as Independent Directors

on the Board. The Committee, inter alia, considers qualification, positive attributes, area of expertise and

number of Directorships and Memberships held in various committees of other companies by such persons.

The Board considers the Committee's recommendation, and takes appropriate decision.

Every Independent Director, at the first meeting of the Board in which he participates as a Director and

thereafter at the first meeting of the Board in every financial year, gives a declaration that he meets the criteria

of independent directors as provided under law.

9. Meetings of Independent Directors

The Company's Independent Directors meet at least once in every financial year without the presence of

Executive Directors or management personnel. Such meetings are conducted informally to enable Independent

Directors to discuss matters pertaining to the Company's affairs and put forth their views to the Independent

Director.

The Independent Directors takes appropriate steps to present Independent Directors' views to the Chairman

and Managing Director.

10. Code of Business Conduct and Ethics for Directors/ Management Personnel

The Code of Business Conduct and Ethics for Directors/Management Personnel ('the Code'), as adopted by the

Board, is a comprehensive Code applicable to Directors and Management Personnel. The Code, while laying

down in detail, the standards of business conduct, ethics and governance centres around the following theme:

'The Company's Board and Management Personnel are responsible for, and are committed to, setting the

standards of conduct contained in this Code and for updating these standards, as appropriate, to ensure their

continuing relevance, effectiveness and responsiveness to the needs of local and other stakeholders as also to

reflect corporate, legal and regulatory developments. This Code should be adhered to in letter and in spirit'

A copy of the Code has been put on the Company's website (www.fsl.co.in). The Code has been circulated

to Directors and Management Personnel, and its compliance is affirmed by them annually.

FUTURISTIC SOLUTIONS LIMITED

{ 20 }

CEO/CFO CERTIFICATION:

(Pursuant to Clause 49(V) of Listing Agreement)

In terms of Clause 49 (v) of the Listing Agreement, Managing Director and Chief Financial officer of the Company

has certified to the Board that:

They have reviewed financial statements and the cash flow statement for the year and to the best of knowledge and

belief and that these statements do not contain any materially untrue statement, omit any material fact or contain

statements that might be misleading, statements present a true and fair view of the Company and are in compliance

with the existing accounting standards, applicable laws and regulations.

No fraudulent, illegal, violative transactions entered into by the Company during the year.

They accept responsibility for establishing and maintaining internal controls and have evaluated the effectiveness of

the internal control systems of the company and have disclosed to the auditors and the Audit Committee, deficiencies

in the design or operation of internal controls, if any, of which they are aware and the steps they have taken or

propose to take to rectify these deficiencies.

They have indicated to the Auditors and the Audit Committee the significant changes in internal control, significant

changes in accounting policies during the year and that the same have been disclosed in the notes to the financial

statements and instances of significant fraud of which they have become aware and the involvement therein, if any,

of the management or an employee having a significant role in the Company's internal control system.

For and on behalf of the Board

For Futuristic Solutions Limited

Sd/-

Place : New Delhi Mandeep Sandhu

Dated : 06.08.2014 (Managing Director)

Sd/-

Umesh Kumar Gupta

(Chief Finance officer)

FUTURISTIC SOLUTIONS LIMITED

{ 21 }

11. GENERAL BODY MEETINGS:

Last three Annual General Meetings (AGM)

Particular Time Date Year Venue

28

th

AGM 11.30 A.M. 08-08-2011 2010-11 M-50, IInd Floor,

M-BlockMarket,

Greater Kailash-1,

New Delhi-110048

29

th

AGM 11.30 A.M. 28-09-2012 2011-12 Indian Habitat

Centre Lodi Road

New Delhi-110003

30th AGM 11.30 A.M. 28-09-2013 2012-13 Indian Habitat

Centre Lodi Road

New Delhi-110003

For the year ended 31.03.2014, no ordinary or special resolutions were passed by the shareholders

through postal ballot.

12. MEANS OF COMMUNICATIONS

Effective communication of information is an essential component of Corporate Governance. It is a process of

sharing information, ideas, thoughts, opinions and plans to all stakeholders which promotes management -

shareholder relations. The Company regularly interacts with shareholders through multiple channels of

communication such as results announcement, annual reports, media releases, Company's website and through

green initiatives.

13. QUARTERLY RESULTS

The unaudited quarterly/half yearly financial results are announced within forty five days of the end of the

quarter. The audited annual financial results are announced within sixty days of the close of the financial year

as per the requirements of the Clause 41 of the Listing Agreement. The aforesaid financial results are sent to

BSE Limited (BSE) and Delhi Stock Exchange Limited where the Company's shares are listed, immediately

after these are approved by the Board. These results are thereafter published with in forty eight hours in The

Financial Express (English) and Jansatta (Hindi).

14. WEBSITE

The Company's website www.fsl.co.in provides information about its business. It is the primary source of

information to the shareholders, customers, analysts other stakeholders of the Company and to general public

at large. It also contains a separate dedicated section 'Investor Relations' where shareholders' information is

available. Further financial results, Annual Reports, Shareholding Pattern, official news releases, quarterly

report on Corporate Governance and other general information about the Company is also available on the

website.

15. ANNUAL REPORT

Annual Report containing, inter alia, Directors' Report, Auditors' Report, Audited Annual Accounts, Financial

Statements and other important information is circulated to Members of the Company prior to the AGM. The

Report on Management Discussion and Analysis forms part of the Annual Report. The Annual Report of the

Company is also available on the website of the Company in a user friendly and downloadable format.

FUTURISTIC SOLUTIONS LIMITED

{ 22 }

16. REMINDER TO SHAREHOLDER

Individual reminders are sent each year to those shareholders whose dividends have remained unclaimed. The

information on unclaimed dividend is also posted on the website of the Company as aforesaid.

17. CORPORATE FILING AND DISSEMINATION SYSTEM

In compliance with Clause 52 of the Listing Agreement entered with Stock Exchanges, the financial results,

shareholding pattern and quarterly report on Corporate Governance are filed electronically through portal,

website www.listing.bseindia.com. This is managed and maintained by BSE.

18. PRICE SENSITIVE INFORMATION

All price sensitive information and such other matters which in the opinion of the Company are of importance

to the shareholders are promptly intimated to the Stock Exchanges.

19. General shareholder information

AGM Date : 10

th

September 2014

Time : 10:00 A.M.

Venue : Indian Habitat Centre, Lodhi Road, New Delhi-110003

Financial Year 1

st

April 2013 to 31

st

March 2014.

Financial Calendar:

For the year ended 31st March, 2014 quarterly results were announced on:

Results for the quarter ended June 2013 : 5th August, 2013

Results for the quarter ended September 2013 : 25th october, 2013

Results for the quarter ended December 2013 : 23rd January, 2014

Results for year ended March 2014 : 21st May, 2014

For the year ended 31st March, 2015, the tentative announcement dates are:

Results for the quarter ended June 2014 : First week of August 2014

Results for the quarter ended September 2014 : First week of November 2014

Results for the quarter ended December 2014 : First week of February 2015

Results for year ended March 2015 : Third week of May 2015

Next Annual General Meeting : September 2015

Dates of Book Closure: From 8

th

September to 10

th

September 2014 (both days inclusive) for the purpose

of Annual General Meeting of the company.

Name of the Stock Exchanges on which the equity shares of the company are listed : BSE and DSE.

Status of Listing Fee: Listing fee for BSE and DSE has been paid up to the financial year 2014-15.

Market Price Data: Monthly high and low of the equity shares of the Company trading volume are as follows

from April 2013 to March 2014.

FUTURISTIC SOLUTIONS LIMITED

{ 23 }

Ser. Name of High Price Low Price No. of

No. Month Shares traded

1 April 2013 36.00 33.75 2,04,172

2 May 2013 37.00 35.00 93,661

3 June 2013 37.55 35.25 2,13,459

4 July 2013 40.50 37.50 2,78,465

5 August 2013 39.30 36.40 1,89,044

6 September 2013 40.15 38.00 27,566

7 October 2013 40.50 39.50 26,930

8 November 2013 40.75 40.50 19,850

9 December 2013 41.00 40.70 10,000

10 January 2014 41.45 40.90 50,062

11 February 2014 41.45 41.00 7,662

12 March 2014 43.80 41.50 13,570

Demat ISIN No: INE241F01011

Distribution of shareholding:

Shareholding of Number % of No. of Share % of

Nominal value of share- Shares Amount Share-

of Rs. Shareholders holding (Rs.) holding

UPTO- 5000 96 76.80 5,530 55,300 .052

5001-10000 4 3.20 2833 28,330 .027

10001-20000 8 6.40 11606 1,16,060 .110

20001-30000 4 3.20 10,801 1,08,010 .103

30001-40000 2 1.60 7059 70,590 0.067

40001-50000 1 .80 4200 42,000 0.040

50001-100000 1 .80 10,000 1,00,000 .0955

100001 and above 9 7.20 1,04,21,418 10,42,14,180 99.50

Total 125 100.00 10473447 10,47,34,470 100.00

Shareholding Pattern as on 31st March, 2014:

Shareholders Category Number of Shares Percentage

Promoter's Holding

-Indian Promoters 62,73,878 59.903

Institutional Investors/Banks,FIs Nil Nil

Private Corporate Bodies 38,568 0.368

Indian Public 31,78,179 30.34

NRIs/OCBs 9,82,312 9.379

Clearing Member 510 0.005

Total 10473447 100.00

FUTURISTIC SOLUTIONS LIMITED

{ 24 }

Registrar & Share Transfer Agents:

M/s. Beetal Financial & Computers Services Pvt. Ltd.

99, Madangir, 3rd Floor, Behind Local Shopping Complex,

Near Dada Harsukhdas Mandir, New Delhi-110062.

System of Share Transfer/Dematerialisation/rematerialisation etc:

The aforementioned RTA has its own infrastructure commensurate with the work undertaken and is manned

by skilled and trained staff.

Dematerialization of shares and liquidity: Company's shares are now in Compulsory Demat category. As

on 31st March 2014, 99.83% of the shares of the Company have been dematerialized. The Equity Shares are

listed on Bombay Stock Exchange and Delhi Stock Exchanges.

Outstanding Warrants GDRs/ADRs, and Convertible Bonds, Conversion date and likely impact on equity:

Not Applicable

Plant Locations: Not Applicable

Address for correspondence:

Company

Futuristic Solutions Limited

The Company Secretary

M-50, IInd Floor,M Block Market

Greater Kailash-1, New Delhi-110048

OR

Registrar & Share Transfer Agent

M/s Beetal Financial & Computers Services Pvt. Ltd.

99, Madangir, III Floor, Behind Local Shopping

Complex, Near Dada Harkushdas Mandir, New

Delhi-110062

FUTURISTIC SOLUTIONS LIMITED

{ 25 }

DECLARATION REGARDING COMPLIANCE BY BOARD MEMBERS AND SENIOR

MANAGEMENT PERSONNEL WITH THE COMPANY'S CODE OF CONDUCT

This is to confirm that all the Members of the Board of directors of the Company and the Senior Management have

affirmed their compliance with the Code of conduct laid down for the Directors and Senior Management of the

Company for the Financial Year ended March 31, 2014.

This certificate is being given in compliance with the requirements of clause 49(I)(d)(ii) of the Listing Agreement

entered in to with the stock Exchanges.

For and on behalf of the Board of Directors

Sd/-

Place:New Delhi Mandeep Sandhu

Date: 06/08/2014 (Managing Director)

PURSUANT TO THE REQUIREMENTS OF THE LISTING AGREEMENT WITH THE STOCK

EXCHANGES ON CORPORATE GOVERNANCE, THE INFORMATION REQUIRED TO BE GIVEN,

IN CASE OF THE APPOINTMENT OF A NEW DIRECTOR OR RE-APPOINTMENT OF A DIRECTOR,

IS GIVEN AS FOLLOWS:

Name of the Director : Mrs. Sangeeta Sandhu

Date of Birth : 20/06/1964

Qualification : B.A

Expertise in Specific functional area : She has over 16 years experience in the

field of Assets Reconstruction Business.

Date of Appointment : 09/10/2000

Name of the other Companies in : Moral Holdings Limited

which she holds Directorships Mishry Holdings Limited

Futuristic Remedies Limited

Diana Euro Chem Private Limited

Name of the Committees of the : Audit Committee

Companies of which she holds Share Holders Grievances Committee

Memberships / Chairmanships Remuneration committee

Shareholding in the Company : 46,517

FUTURISTIC SOLUTIONS LIMITED

{ 26 }

MANAGEMENT DISCUSSIONS AND ANALYSIS REPORT

(1) GLOBAL ECONOMIC CONDITIONS - RESURGENCE WITH CONTINUING DOWNSIDE RISKS

Global growth was subdued in the whole of F.Y. 2013-14. The sluggishness was driven to a large extent by

counterbalancing of improvement in some advanced economies, especially the US and Japan with appreciably

weaker domestic demand and slower growth in several key emerging market economies, including China and

India as well as by a more protracted recession in the euro area. New risks to global recovery had also arisen

from fiscal discord in the US and uncertainties arising from expectations related to withdrawal from

unconventional monetary easing by advanced economies.

The global activity broadly strengthened during the second half of F.Y. 2013-14 largely on account of recovery

in the advanced economies. Economic expansion in the US was gaining firmer footing and would further aid

recovery in global activity and trade. However, activity in many emerging market economies disappointed in a

less favorable external financial environment, although they continued to contribute more than two-thirds of

global growth. Their output growth is expected to be lifted by stronger exports to advanced economies and

currency depreciation. However, tightening monetary policy and financial conditions in the event of faster than

anticipated withdrawal of monetary accommodation by advanced economies could pose a risk for emerging

markets. There are risks to activity from lower.

The global inflation remains benign with stagnant labour markets and stable commodity prices. However, upside

risks to global crude oil prices remain from rising geo-political uncertainties in oil producing regions. Inflation has

continued to be low in advanced economies as well as large emerging markets aided by high unemployment and

large spare capacities. In the emerging markets the inflation remained high, though tightening of monetary policy

and weakening output are expected to help generate disinflationary momentum. The divergent trends in inflation

between advanced economies and emerging markets pose an added risk to global growth.

(2) INDUSTRY STRUCTURE AND DEVELOPMENTS:

Asset quality continues to be a major concern for Scheduled Commercial Banks (SCBs). The Gross NPA ratio

of SCBs increased to 4.20% of the total advances as at end September 2013 from 3.40% of March 2013. The

restructured standard advances also increased to 6.00% of total advances as at end September 2013 from

5.80% of March 2013. Overall the stressed advances rose significantly to 10.20% of total advances as at end

September 2013 from 9.20% of March 2013. To control the deteriorating asset quality in the banking system,

the Reserve Bank of India implemented several developmental measures during FY 2013-14 including

improvement in the system's ability to deal with corporate.

The Company's primary business is to provide "Futuristic Solutions" to the clients' current problems. As reported

by the Government of India, the amount of existing NPA's of various banks and financial institutions are to the

tune of about Rs. 1,10,000 crores. Besides this, the quantum of claims and counter claims, arising out of

various contractual obligations are many times of this figure. All these clients could restructure their assets

using our services. As the business of Asset Reconstruction is a relatively a new field, a very small percentage

of the total volume of business targeted by us could generate impressive turnover.

The management of the Futuristic Solutions Limited has been engaged in the business of Securitization &

Asset Reconstruction for more than past 17 years. The company has been acquiring non-performing assets