f56 - 2011 J Lew Fiduciary

f56 - 2011 J Lew Fiduciary

Uploaded by

phard2345Copyright:

Available Formats

f56 - 2011 J Lew Fiduciary

f56 - 2011 J Lew Fiduciary

Uploaded by

phard2345Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

f56 - 2011 J Lew Fiduciary

f56 - 2011 J Lew Fiduciary

Uploaded by

phard2345Copyright:

Available Formats

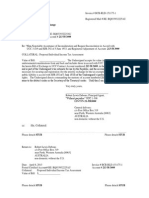

56

Form

(Rev. December 2011)

Department of the Treasury

Internal Revenue Service

Notice Concerning Fiduciary Relationship

OMB No. 1545-0013

(Internal Revenue Code sections 6036 and 6903)

Identification

Part I

Name of person for whom you are acting (as shown on the tax return)

Decedents social security no.

Identifying number

PATRICK WAYNE HARDING

98-0624588

Address of person for whom you are acting (number, street, and room or suite no.)

224 SHELDON HEATH ROAD

City or town, state, and ZIP code (If a foreign address, see instructions.)

BIRMINGHAM UNITED KINGDOM B26 2RY

Fiduciarys name

Jack Lew d/b/a UNITED STATES SECRETARY OF THE TREASURY

Address of fiduciary (number, street, and room or suite no.)

1500 PENNSYLVANIA AVENUE, NW

City or town, state, and ZIP code

Telephone number (optional)

WASHINGTON D.C. 20220, UNITED STATES

Section A. Authority

1

Authority for fiduciary relationship. Check applicable box:

a

Court appointment of testate estate (valid will exists)

b

Court appointment of intestate estate (no valid will exists)

Court appointment as guardian or conservator

c

d

Valid trust instrument and amendments

e

Bankruptcy or assignment for the benefit or creditors

f Other. Describe Appointment of Fiduciary

2a If box 1a or 1b is checked, enter the date of death

2b If box 1c1f is checked, enter the date of appointment, taking office, or assignment or transfer of assets

Section B. Nature of Liability and Tax Notices

3

Type of taxes (check all that apply):

Excise

Other (describe)

Federal tax form number (check all that apply): a

e

1040, 1040-A, or 1040-EZ f

1041

g

If your authority as a fiduciary does not cover all years or tax periods, check here .

and list the specific years or periods

If the fiduciary listed wants a copy of notices or other written communications (see the instructions) check this box . . . .

and enter the year(s) or period(s) for the corresponding line 4 item checked. If more than 1 form entered on line 4h, enter the

form number.

Income

Gift

Estate

Generation-skipping transfer

706 series b

709 c

1120 h

Other (list)

940

Employment

941, 943, 944

Complete only if the line 6 box is checked.

If this item

is checked:

4a

4c

4e

4g

4h:

If this item

is checked:

Enter year(s) or period(s)

Enter year(s) or period(s)

4b

4d

4f

4h:

4h:

For Paperwork Reduction Act and Privacy Act Notice, see the separate instructions.

Cat. No. 16375I

Form 56 (Rev. 12-2011)

Form 56 (Rev. 12-2011)

Page

Court and Administrative Proceedings

Part II

Name of court (if other than a court proceeding, identify the type of proceeding and name of agency)

Date proceeding initiated

Address of court

Docket number of proceeding

City or town, state, and ZIP code

Date

Time

a.m.

Place of other proceedings

p.m.

Signature

Part III

I certify that I have the authority to execute this notice concerning fiduciary relationship on behalf of the taxpayer.

Please

Sign

Here

Fiduciarys signature

Title, if applicable

Date

Form 56 (Rev. 12-2011)

You might also like

- Authorization of AgentDocument1 pageAuthorization of AgentrndvdbNo ratings yet

- Mastering Securities Lending DocumentationDocument2 pagesMastering Securities Lending Documentationphard234550% (4)

- Treasury Dept 56 Notice of CorrectionDocument1 pageTreasury Dept 56 Notice of CorrectionS Pablo August100% (2)

- Ss 5Document1 pageSs 5elhorseboxo100% (1)

- 203 Sample Midterm1Document4 pages203 Sample Midterm1Marilyne Jin67% (3)

- Notice Concerning Fiduciary Relationship of Financial InstitutionDocument2 pagesNotice Concerning Fiduciary Relationship of Financial InstitutionNor100% (7)

- RecentTransactions - 033-140 162459 - 20230121181600Document1 pageRecentTransactions - 033-140 162459 - 20230121181600Nirosha. GunawardenaNo ratings yet

- Buczek Habeas Corpus Petition 54 & 121 & 141Document68 pagesBuczek Habeas Corpus Petition 54 & 121 & 141Bob Hurt100% (1)

- MACN-A018 - Universal Affidavit of Termination of All CORPORATE FINAL16Document4 pagesMACN-A018 - Universal Affidavit of Termination of All CORPORATE FINAL16clyne dacosta alleyne100% (1)

- IRS Form W-9Document4 pagesIRS Form W-9Gary S. Wolfe100% (2)

- DR Dennis KimbroDocument1 pageDR Dennis Kimbrophard2345No ratings yet

- Non-Negotiable Bill of Exchange: CC: File, CollateralDocument1 pageNon-Negotiable Bill of Exchange: CC: File, Collateralphard2345100% (2)

- Black Card Insurance GuideDocument84 pagesBlack Card Insurance Guidephard2345No ratings yet

- Mitsubishi IC Pneumatic Forklift PDFDocument5 pagesMitsubishi IC Pneumatic Forklift PDFfdpc1987No ratings yet

- Matthews Interview of Fidel Castro (1957, Three Part Set)Document16 pagesMatthews Interview of Fidel Castro (1957, Three Part Set)Cuba5259100% (1)

- Semetrice Lashun Valentine C/o Office of Secretary of Treasury: 1500 Pennsylvania Avenue, NW Washington DC, 20220-0001Document2 pagesSemetrice Lashun Valentine C/o Office of Secretary of Treasury: 1500 Pennsylvania Avenue, NW Washington DC, 20220-0001Doir100% (3)

- f56 Instructions Sample FilledDocument2 pagesf56 Instructions Sample Filledfroman1960100% (4)

- Notice Concerning Fiduciary Relationship: IdentificationDocument2 pagesNotice Concerning Fiduciary Relationship: IdentificationAnonymous puqCYDnQNo ratings yet

- F 843Document1 pageF 843Manjula.bs100% (2)

- F 4852Document2 pagesF 4852Goodinespressurewashing100% (2)

- UCC1 House Lien Template ExampleDocument2 pagesUCC1 House Lien Template Examplebwypsllcaz100% (1)

- Bureau of The Public Debt LetterDocument1 pageBureau of The Public Debt Letterjoe100% (4)

- Common Carry Declaration: National/Citizen, (Chose One)Document1 pageCommon Carry Declaration: National/Citizen, (Chose One)Antwain Utley100% (1)

- 1071 Substitute Sav4239 RedemptionDocument3 pages1071 Substitute Sav4239 Redemptiondouglas jones100% (3)

- Standard Form 1199A - Direct Deposit Sign-Up FormDocument1 pageStandard Form 1199A - Direct Deposit Sign-Up Formaiyi.wu100% (1)

- Form 4029Document2 pagesForm 4029Brett Baldwin100% (1)

- Instructions For Completing The SF 1199A (Direct Deposit Form)Document1 pageInstructions For Completing The SF 1199A (Direct Deposit Form)donald trump100% (1)

- W8Ben With US Mailing (FILLABLE)Document2 pagesW8Ben With US Mailing (FILLABLE)Veronica Mtz100% (2)

- Michael - 20160607 - 0001Document6 pagesMichael - 20160607 - 0001PriyaSiranELNo ratings yet

- SSA-89 Form (2022)Document2 pagesSSA-89 Form (2022)Melys Alamont100% (2)

- f56 - 2002 Old Form 56FDocument2 pagesf56 - 2002 Old Form 56FMike Sisco50% (2)

- Tax Information Authorization: Form (Rev. January 2021) Department of The Treasury Internal Revenue ServiceDocument1 pageTax Information Authorization: Form (Rev. January 2021) Department of The Treasury Internal Revenue ServiceJohnArb100% (1)

- Form 2848Document3 pagesForm 2848Animation and Explainer Video100% (1)

- 4506 TDocument3 pages4506 Tteddy roosevelt100% (1)

- Accounting Instructions 3Document1 pageAccounting Instructions 3Ely Danel100% (1)

- Eviction Notice To Quit Template FormDocument3 pagesEviction Notice To Quit Template Form5rprjnsd2bNo ratings yet

- Power of Attorney and Declaration of RepresentativeDocument2 pagesPower of Attorney and Declaration of RepresentativeEri Takata100% (1)

- Ssa 7050Document4 pagesSsa 7050tobehode100% (3)

- F 8832Document6 pagesF 8832IRS67% (3)

- Change To Domestic Employer Identification Number (EIN) Assignment by Toll-Free PhonesDocument3 pagesChange To Domestic Employer Identification Number (EIN) Assignment by Toll-Free Phonespeteycosta100% (1)

- US Internal Revenue Service: f56f AccessibleDocument2 pagesUS Internal Revenue Service: f56f AccessibleIRS75% (4)

- Substitute Form W-8BEN (Individuals)Document1 pageSubstitute Form W-8BEN (Individuals)hector100% (1)

- Form 56 Remittance FormDocument13 pagesForm 56 Remittance Formcristine gomobar100% (2)

- Indemnity ClauseDocument1 pageIndemnity ClauseTerence Lim100% (1)

- Substitute Form W-8BEN (Individuals)Document1 pageSubstitute Form W-8BEN (Individuals)hectorNo ratings yet

- Production of Financial Documents For IRS and FinCENDocument8 pagesProduction of Financial Documents For IRS and FinCENJoshua Sygnal Gutierrez100% (5)

- Individual Indian Money (IIM) Instructions For Disbursement of Funds and Change of AddressDocument4 pagesIndividual Indian Money (IIM) Instructions For Disbursement of Funds and Change of AddressshawnNo ratings yet

- FS Form 1455Document5 pagesFS Form 14552Plus100% (3)

- Ps 8165Document4 pagesPs 8165AmorRah El100% (1)

- Form 8821Document1 pageForm 8821Samuel FarrellNo ratings yet

- F 4852Document2 pagesF 4852IRS100% (1)

- Affidavit of OwnershipDocument1 pageAffidavit of OwnershipBar Ri100% (1)

- F 1040 VDocument2 pagesF 1040 VNotarys To Go50% (2)

- Change of Address: Complete This Part To Change Your Home Mailing AddressDocument2 pagesChange of Address: Complete This Part To Change Your Home Mailing AddressTrevor100% (1)

- W8 FormDocument1 pageW8 FormMattia Perosino100% (1)

- Form 3: United States Securities and Exchange Commission Initial Statement of Beneficial Ownership of SecuritiesDocument1 pageForm 3: United States Securities and Exchange Commission Initial Statement of Beneficial Ownership of SecuritiesJesus Velazquez Jr100% (1)

- WCSM Us Automobile Ownership 2 3Document5 pagesWCSM Us Automobile Ownership 2 3Carlos Huertas100% (1)

- IRS 8832 Classification-09-41 PDFDocument11 pagesIRS 8832 Classification-09-41 PDFLexu100% (7)

- Ssa-Withdrawal-521 FormDocument2 pagesSsa-Withdrawal-521 Formdouglas jones100% (3)

- Secured Party Creditor Form: Please Note: ExampleDocument5 pagesSecured Party Creditor Form: Please Note: ExampleBrother NorthStatNo ratings yet

- Act of Expatriation and Oath of AllegianceDocument1 pageAct of Expatriation and Oath of AllegianceCurry, William Lawrence III, agent100% (1)

- F2848 - Power of Attorney and Declaration of Representative - InstructionsDocument6 pagesF2848 - Power of Attorney and Declaration of Representative - InstructionsAutochthon Gazette100% (6)

- 3 POWER OF ATTORNEY DebtorDocument2 pages3 POWER OF ATTORNEY DebtorJoseph_Carapuc_1850100% (1)

- Registered Mail # RB XXX XXX XXX Us: in Camera Civilian Due Process RequiredDocument2 pagesRegistered Mail # RB XXX XXX XXX Us: in Camera Civilian Due Process RequiredDUTCH551400100% (3)

- FRM W8DM HRDocument2 pagesFRM W8DM HRmiscribe100% (1)

- The Constitutional Case for Religious Exemptions from Federal Vaccine MandatesFrom EverandThe Constitutional Case for Religious Exemptions from Federal Vaccine MandatesNo ratings yet

- You Tune MoorsDocument1 pageYou Tune Moorsphard2345100% (1)

- Declaration of IndependenceDocument5 pagesDeclaration of IndependenceBeverly Hand100% (1)

- There Are Only Seven Stories in FictionDocument2 pagesThere Are Only Seven Stories in Fictionphard23450% (1)

- TRUSTEER AGREEMENT - OdtDocument5 pagesTRUSTEER AGREEMENT - Odtphard2345100% (1)

- The Following Is A Minimal Miranda WarningDocument2 pagesThe Following Is A Minimal Miranda Warningphard2345100% (1)

- Team Leader Workbook (Team Nanban) TMRGDocument172 pagesTeam Leader Workbook (Team Nanban) TMRGIvan Narki Marković100% (1)

- Family NumbersDocument1 pageFamily Numbersphard2345No ratings yet

- The Book of God: Product DetailsDocument1 pageThe Book of God: Product Detailsphard2345No ratings yet

- 1922 Styles Manual SOVEREIGNSDocument246 pages1922 Styles Manual SOVEREIGNSBlue SkyWatcher83% (6)

- SCIENCE Reveals The RACE of Egyptian Sphinx With PROOF!Document1 pageSCIENCE Reveals The RACE of Egyptian Sphinx With PROOF!phard2345No ratings yet

- 2002 Hague Conference On PILDocument26 pages2002 Hague Conference On PILphard2345No ratings yet

- History of Development of Banking in PakistanDocument4 pagesHistory of Development of Banking in PakistanRamsha ZahidNo ratings yet

- 5-Money Growth and Inflation 2020Document85 pages5-Money Growth and Inflation 2020Việt HươngNo ratings yet

- KadientDocument14 pagesKadientScott WangNo ratings yet

- Tax TableDocument6 pagesTax TableNickford AcidoNo ratings yet

- Malaysian IdentityDocument33 pagesMalaysian IdentityAzizulNo ratings yet

- TAX Management: Assignment #3Document6 pagesTAX Management: Assignment #3Samreen TanveerNo ratings yet

- Tvs Company ProfileDocument5 pagesTvs Company ProfileGunupur PeopleNo ratings yet

- Cover Letter - HCL FoundationDocument2 pagesCover Letter - HCL FoundationSanny KumarNo ratings yet

- Qi Gong Registration FormDocument1 pageQi Gong Registration Formcoastalmed100% (1)

- Comprehensive Economic Cooperation Agreement India MalaysiaDocument8 pagesComprehensive Economic Cooperation Agreement India MalaysiarahmatillaNo ratings yet

- Img20230112 12351067Document1 pageImg20230112 12351067Narinder SinghNo ratings yet

- Current State of Japanese Business in IndiaDocument13 pagesCurrent State of Japanese Business in IndiaPayal KathiawadiNo ratings yet

- Contemporary WorldDocument5 pagesContemporary WorldRosemarie Jumalon100% (1)

- Krugman EssayDocument18 pagesKrugman EssaySonya PervezNo ratings yet

- Amazon's Slogan Is "Work Hard. Have Fun. Make History." It's Meant ToDocument3 pagesAmazon's Slogan Is "Work Hard. Have Fun. Make History." It's Meant ToPraveen SuyalNo ratings yet

- Chapter-1: 1.1 Overview of Fast Food IndustriesDocument33 pagesChapter-1: 1.1 Overview of Fast Food Industriesglorydharmaraj100% (2)

- Iccr QuestionsDocument4 pagesIccr QuestionsEASSANo ratings yet

- Philippine Carpet MFG Vs TaguamonDocument1 pagePhilippine Carpet MFG Vs Taguamonbrendamanganaan100% (1)

- Difference Between Primary and Secondary Cost ElementDocument2 pagesDifference Between Primary and Secondary Cost Elementatsc68100% (1)

- Beta Saham 20171229 enDocument12 pagesBeta Saham 20171229 enAgung AryaNo ratings yet

- K. J. Somaiya Jr. College of Science & Commerce, Vidyavihar, Mumbai-400077. Year Plan For S.Y.J.C. 2015-2016 Environment Education Month Dates TopicDocument4 pagesK. J. Somaiya Jr. College of Science & Commerce, Vidyavihar, Mumbai-400077. Year Plan For S.Y.J.C. 2015-2016 Environment Education Month Dates TopicJai GuptaNo ratings yet

- AH100-3000 CatalogueDocument229 pagesAH100-3000 CatalogueoldtimerstudioNo ratings yet

- 17 OligopolyDocument46 pages17 OligopolyDhaval Pandya0% (1)

- Wilan Company ProfileDocument29 pagesWilan Company ProfileRobert Geofrey BautistaNo ratings yet

- 2017 Fee-Help Booklet AccDocument32 pages2017 Fee-Help Booklet AccGlowstarNo ratings yet

- DEBU026EN (Web) PDFDocument244 pagesDEBU026EN (Web) PDFCamilo Andres SuarezNo ratings yet