0 ratings0% found this document useful (0 votes)

Construion Contract IAS

Uploaded by

Ashraf ValappilMiracle Construct Inc. signed a fixed price $12 million contract to construct the tallest building in the country over three years. In the first year, they incurred $5.5 million in costs including $1 million in site labor, $3 million in materials, $500,000 in depreciation of equipment, and $1 million in marketing. They estimate it will cost another $5.5 million to complete the project.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

Construion Contract IAS

Uploaded by

Ashraf Valappil0 ratings0% found this document useful (0 votes)

Miracle Construct Inc. signed a fixed price $12 million contract to construct the tallest building in the country over three years. In the first year, they incurred $5.5 million in costs including $1 million in site labor, $3 million in materials, $500,000 in depreciation of equipment, and $1 million in marketing. They estimate it will cost another $5.5 million to complete the project.

Original Description:

i

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Miracle Construct Inc. signed a fixed price $12 million contract to construct the tallest building in the country over three years. In the first year, they incurred $5.5 million in costs including $1 million in site labor, $3 million in materials, $500,000 in depreciation of equipment, and $1 million in marketing. They estimate it will cost another $5.5 million to complete the project.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

Construion Contract IAS

Uploaded by

Ashraf ValappilMiracle Construct Inc. signed a fixed price $12 million contract to construct the tallest building in the country over three years. In the first year, they incurred $5.5 million in costs including $1 million in site labor, $3 million in materials, $500,000 in depreciation of equipment, and $1 million in marketing. They estimate it will cost another $5.5 million to complete the project.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1/ 3

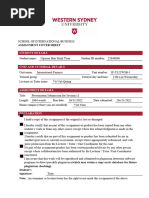

Construction Contracts IAS 11

1. Miracle Construct Inc. is executing a gigantic project of constructing

the tallest building in the country. The project is expected to take three

years to complete.

The company has signed a fixed price contract of $12,000,000 for the

construction of this prestigious tower. The details of the costs incurred

to date in the first year are

Site labor costs

$1,000,0

00

Cost of construction material

3,000,00

0

Depreciation of special plant and equipment used

in-contracting to build the tallest building

500,0

00

Marketing and selling costs to get the tallest

building-in the country the right exposure

1,000,0

00

Total

$5,500,0

00

Total contract cost estimated to complete

$5,500,0

00

Required

Calculate the percentage of completion and the amounts of revenue,

costs, and profits to be recognized under IAS 11.

1. Lazy Builders Inc. has incurred the following contract costs in the first

year on a two-year fixed price contract for $4.0 million to construct a

bridge:

Material cost = $2 million

Other contract costs (including site labor costs) = $1 million

Cost to complete = $2 million

How much profit or loss should Lazy Inc. recognize in the first year of

the three-year construction contract?

(a) Loss of $0.5 million prorated over two years.

(b) Loss of $1.0 million (expensed immediately).

(c) No profit or loss in the first year and deferring it to second year.

(d) Since 60% is the percentage of completion, recognize 60% of loss

(i.e., $0.6 million).

2. Brilliant Inc. is constructing a skyscraper in the heart of town and has

signed a fixed price two-year contract for $21.0 million with the local

authorities. It has incurred the following cost relating to the contract by

the end of first year:

Material cost = $5 million

Labor cost = $2 million

Construction overhead = $2 million

Marketing costs = $0.5 million

Depreciation of idle plant and equipment = $0.5 million

At the end of the first year, it has estimated cost to complete the

contract = $9 million.

What profit or loss from the contract should Brilliant Inc. recognize at

the end of the first year?

(a) $1.5 million (9/18 3.0)

(b) $1.0 million (9/18 2.0)

(c) $1.05 million (10/19 2.0)

(d) $1.28 million (9.5/18.5 2.5)

3. Mediocre Inc. has entered into a very profitable fixed price contract for

constructing a high-rise building over a period of three years. It incurs

the following costs relating to the contract during the first year:

Cost of material = $2.5 million

Site labor costs = $2.0 million

Agreed administrative costs as per contract to be reimbursed by the

customer = $1 million

Depreciation of the plant used for the construction = $0.5 million

Marketing costs for selling apartments when they are ready = $1.0

million

Total estimated cost of the project = $18 million

The percentage of completion of this contract at the year-end is

(a) 50% (= 6.0/18.0)

(b) 27% (= 4.5/16.5)

(c) 25% (= 4.5/18.0)

(d) 39% (= 7.0/18)

4. A construction company is in the middle of a two-year construction

contract when it receives a letter from the customer extending the

contract by a year and requiring the construction company to increase

its output in proportion of the number of years of the new contract to

the previous contract period.

This is allowed in recognizing additional revenue according to IAS 11 if

(a) Negotiations have reached an advanced stage and it is probable

that the customer will accept the claim.

(b) The contract is sufficiently advanced and it is probable that the

specified performance

Standards will be exceeded or met.

(c) It is probable that the customer will approve the variation and the

amount of revenue

arising from the variation and the amount of revenue can be reliably

measured.

(d) It is probable that the customer will approve the variation and the

amount of revenue

arising from the variation, whether the amount of revenue can be

reliably measured or not.

5. A construction company signed a contract to build a theater over a

period of two years, and with this contract also signed a maintenance

contract for five years. Both the contracts are negotiated as a single

package and are closely interrelated to each other.

The two contracts should be

(a) Combined and treated as a single contract.

(b) Segmented and considered two separate contracts.

(c) Recognized under the completed contracted method.

(d) Treated differentlythe building contract under the completed

contract method and

maintenance contract under the percentage of completion method.

You might also like

- Long Quiz:: Construction Contracts Name: Date: Professor: Section: Score100% (1)Long Quiz:: Construction Contracts Name: Date: Professor: Section: Score12 pages

- Irregularities, Frauds and the Necessity of Technical Auditing in Construction IndustryFrom EverandIrregularities, Frauds and the Necessity of Technical Auditing in Construction IndustryNo ratings yet

- Field Guide for Construction Management: Management by Walking AroundFrom EverandField Guide for Construction Management: Management by Walking Around4.5/5 (4)

- Property, Plant and Equipment: Chapter 23 AnswerNo ratings yetProperty, Plant and Equipment: Chapter 23 Answer34 pages

- Kieso - Inter - ch10 - Ifrs Psak Ppe RevNo ratings yetKieso - Inter - ch10 - Ifrs Psak Ppe Rev59 pages

- CIMA F2 Text Supplement Construction PDFNo ratings yetCIMA F2 Text Supplement Construction PDF18 pages

- Accounting For Special Transactions Final Grading ExaminationNo ratings yetAccounting For Special Transactions Final Grading Examination9 pages

- Quiz On Construction Contracts 11.19.2022No ratings yetQuiz On Construction Contracts 11.19.20227 pages

- Second Period-Quiz 2 Chapter 7: Construction Contracts: Name: Date: Professor: Section: ScoreNo ratings yetSecond Period-Quiz 2 Chapter 7: Construction Contracts: Name: Date: Professor: Section: Score10 pages

- Acc110p2quiz 2answers Construction Contracts 1 PDF FreeNo ratings yetAcc110p2quiz 2answers Construction Contracts 1 PDF Free10 pages

- Long Term Construction Contract Discussion GuideNo ratings yetLong Term Construction Contract Discussion Guide2 pages

- Activity 5 Long Term Construction ContractsNo ratings yetActivity 5 Long Term Construction Contracts4 pages

- Long-Term Construction Contracts (Special Revenue Recognition) JLM Illustrative Problems Problem 1100% (2)Long-Term Construction Contracts (Special Revenue Recognition) JLM Illustrative Problems Problem 15 pages

- Long Term Construction Contracts Special Revenue Recognition JLM Illustrative Problems Problem 1 PDF FreeNo ratings yetLong Term Construction Contracts Special Revenue Recognition JLM Illustrative Problems Problem 1 PDF Free5 pages

- Heriot-Watt University School of The Built Environment Construction Financial Management (D31Cg) Tutorial QuestionsNo ratings yetHeriot-Watt University School of The Built Environment Construction Financial Management (D31Cg) Tutorial Questions7 pages

- Contract Administration Exam Revision NotesNo ratings yetContract Administration Exam Revision Notes14 pages

- 9506 - Long Term Construction Contracts (1)No ratings yet9506 - Long Term Construction Contracts (1)5 pages

- Identify The Choice That Best Completes The Statement or Answers The QuestionNo ratings yetIdentify The Choice That Best Completes The Statement or Answers The Question10 pages

- 6thtest Bank-Long Term Construction ContractNo ratings yet6thtest Bank-Long Term Construction Contract15 pages

- The Contractor Payment Application Audit: Guidance for Auditing AIA Documents G702 & G703From EverandThe Contractor Payment Application Audit: Guidance for Auditing AIA Documents G702 & G703No ratings yet

- Raise Based On Best Practices and Additional Repsonsibilty Allowance Based On Students Achievement and School PerformanceNo ratings yetRaise Based On Best Practices and Additional Repsonsibilty Allowance Based On Students Achievement and School Performance1 page

- Value-Based Strategy For Industrial Products: John L. Forbis and T. MehtaNo ratings yetValue-Based Strategy For Industrial Products: John L. Forbis and T. Mehta19 pages

- Ust Jpia Inventories Reviewer Ca51010 PDFNo ratings yetUst Jpia Inventories Reviewer Ca51010 PDF10 pages

- Differential Cost Analysis Relevant CostingNo ratings yetDifferential Cost Analysis Relevant Costing10 pages

- Transfer Pricing and Divisional Performance100% (1)Transfer Pricing and Divisional Performance12 pages

- Charging For Civil Engineering Services: Central Colleges CE513No ratings yetCharging For Civil Engineering Services: Central Colleges CE5134 pages

- Lecture 5 and 6 - Marginal Absorption CostingNo ratings yetLecture 5 and 6 - Marginal Absorption Costing23 pages

- Property and Equipment Accounting (Chapter 3)No ratings yetProperty and Equipment Accounting (Chapter 3)19 pages

- Transaction MR22-Cost Component Split in A Single Cost Component.No ratings yetTransaction MR22-Cost Component Split in A Single Cost Component.4 pages

- Luxury: Landscape of Business AdministrationNo ratings yetLuxury: Landscape of Business Administration33 pages

- 22049896 - Presentation Submission for session 11 - Nguyễn Hữu Minh TuấnNo ratings yet22049896 - Presentation Submission for session 11 - Nguyễn Hữu Minh Tuấn11 pages