0 ratings0% found this document useful (0 votes)

331 viewsTime Value of Money Class Exercisese

This document discusses the time value of money and contains 18 practice problems related to concepts like future value, present value, compound interest, annuities, and loans. Specifically, it covers calculating future and present values for single and multiple cash flows with simple and compound interest, determining borrowing amounts based on interest rates, and choosing between lump sum payments and annuities. The problems provide calculations and scenarios to illustrate key time value of money formulas and their application to investments, loans, and financial decision making.

Uploaded by

Rohan JangidCopyright

© © All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

0 ratings0% found this document useful (0 votes)

331 viewsTime Value of Money Class Exercisese

This document discusses the time value of money and contains 18 practice problems related to concepts like future value, present value, compound interest, annuities, and loans. Specifically, it covers calculating future and present values for single and multiple cash flows with simple and compound interest, determining borrowing amounts based on interest rates, and choosing between lump sum payments and annuities. The problems provide calculations and scenarios to illustrate key time value of money formulas and their application to investments, loans, and financial decision making.

Uploaded by

Rohan JangidCopyright

© © All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

You are on page 1/ 2

TIME VALUE OF MONEY

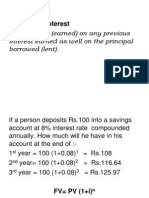

Section 1: Future Value (Compounding) of a single amount

1) Suppose that the 200000 are placed in a Fixed deposit of a bank at 5%

interest rate. How much shall it grow at the end of three years, assuming

compounding interest?

2) If you deposited Rs. 55650 in a bank, which was paying a 15% rate of

interest on a ten year time deposit, how much would the deposit grow at

the end of 10 years

3) You invest Rs 5,000 today. You will earn 8% interest. How much will you

have in 4 years? (Pick the closest answer)

Rs 6,802.50

Rs

6,843.00 Rs

3,675

4) You have Rs 450,000 to invest. If you think you can earn 7%, how much

could you accumulate in 10 years? (Pick the closest answer)

1 Rs 25,415

Rs

722,610

Rs

722,610 885150

5) If a commodity costs Rs.500 now and inflation is expected to go up at the

rate of 10% per year, how much will the commodity cost in 5 years?

1 Rs 805.25

Rs

3,052.55

Cannot

tell from this information

Section 2: Future Value (Multiple Compounding)

6) How much will be in an account at the end of five years the amount

deposited today is Rs 10,000 and interest is 8% per year, compounded

semi-annually?

7) Calculate the compound value when Rs. 10,000 is invested for 3 years and

10% per annum is compounded on quarterly basis

8) How much does a deposit of Rs. 40,000 grow in 10 years at the rate of 6%

interest and compounding is done monthly. Determine the amount at the

end of 10 years.

Section 3: Present Value of a Single Amount

9) Shyam expects to get Rs. 1000 after one year, at the rate of 10%.

Calculate the Present value for this amount.

10)

Rahul has an option to receive the value of Rs. 800, today for a

debenture, having a Face value of Rs. 1000 carrying interest of 10% per

annum or on maturity with Face value, where the debenture falls due for

payment after three years. Calculate the present value today and should

he redeem the debenture today or wait for 3 years.

Section 4: Present value of a series of different cash flows

11)

A project involves an initial investment of Rs. 8,00,000 and

generates net cash flows as follows: At end of Year 1 Rs. 200,000, Year 2:

Rs. 400,000 & Year 3: Rs. 600,000. What is the total present value of the

future cash flows where the cost of capital or interest rate is 9%? Also,

what is the Net Present Value?

Time Value of Money

Page 1

Section 5: Present Value of an Annuity

12)

Calculate the present value of an annuity of Rs. 5,000 received

annually for four years, when the discounting factor is 10%.

13)

Suppose you are determined that you can afford to pay Rs. 360000

per annum for 3 years towards a new Car. The finance company offers you

a going rate of interest is 12 per cent per annum for 3 years. How much

can you borrow?

Section 6: Miscellaneous applications

14)

An executive is about to retire at the age of 60. His employer has

offered him two post retirement options

a. Rs 20,00,000 lump sum

b. Rs 2,50,000 for 10 years

Assuming 10% as the interest, which is a better option?

15)

ABC has borrowed Rs. 30, 00,000 from Canbank Home finance Ltd

to finance the purchase of a house for 15 years. The rate of interest on

such loan is 24% per annum. Compute the annual instalment.

16)

You deposit Rs 2,000 in recurring account each year for 5 years. If

interest on this recurring account is 4%, how much will you have at the

end of those 5 years?

1 Rs 10,000

2 Rs 10,832.60

Rs 8,903.60

17)

Your father has promised to give you $ 1, 00,000 in cash on your

25th birthday. Today is your 16th birthday. He wants to know the following:

If he decides to make annual payment into a fund after one year,

how much will each be if fund pays 8%?

If he decides to invest a lump sum in the account after one year and

let it compound annually, how much will the lump sum be at 8%?

If in (a) the payments are made in the beginning of the year, how

much will be the value of annuity at 8%?

18)

Effective interest rate : Four banks offer their annual rates of

interest for their deposit schemes. Which rate would you suggest for every

rupee of investment?

Basis of Compounding

Interest rate

Yearly

12%

Half yearly

11.75%

Quarterly

11.50%

Monthly

11.25%

Time Value of Money

Page 2

You might also like

- RPEB I Numericals With Solutions - For Students NewNo ratings yetRPEB I Numericals With Solutions - For Students New3 pages

- Advanced Financial Planning Case Studies ForNo ratings yetAdvanced Financial Planning Case Studies For19 pages

- Template - Ted and Alice House Purchase Decision - Future Cars Incorporated - Session 2No ratings yetTemplate - Ted and Alice House Purchase Decision - Future Cars Incorporated - Session 29 pages

- Chapter 5 - Time Value of Money-Student Version100% (1)Chapter 5 - Time Value of Money-Student Version8 pages

- FPSB India - Retirement Module Sample Paper - Simplified Solution Using Calculator - March 2013No ratings yetFPSB India - Retirement Module Sample Paper - Simplified Solution Using Calculator - March 20139 pages

- Question Paper Security Analysis I (211)No ratings yetQuestion Paper Security Analysis I (211)21 pages

- ImranOmer - 37 - 15663 - 4 - Time Value Money Practice Questions (Revised)No ratings yetImranOmer - 37 - 15663 - 4 - Time Value Money Practice Questions (Revised)3 pages

- Sample Questions and Answers in Extinguishment and Contracts67% (3)Sample Questions and Answers in Extinguishment and Contracts17 pages

- Questionnaire: (To The Employees, Customers, Deposit Holders of Public Sector Banks & Private Sector Banks in Bangalore)No ratings yetQuestionnaire: (To The Employees, Customers, Deposit Holders of Public Sector Banks & Private Sector Banks in Bangalore)8 pages

- The Code of Agrarian Reform of The PhilippinesNo ratings yetThe Code of Agrarian Reform of The Philippines12 pages

- PCSO v. New Dagupan Metro Gas Corp., GR 173171. July 11, 2012No ratings yetPCSO v. New Dagupan Metro Gas Corp., GR 173171. July 11, 201210 pages

- ICICI Bank Services - Wealth ManagementNo ratings yetICICI Bank Services - Wealth Management11 pages

- Uptown Flats: Rental Application ReceiptNo ratings yetUptown Flats: Rental Application Receipt1 page

- The Facts: Spouses Mariano Z. Velarde and Avelina D. Velarde, GEORGE RAYMUNDO, RespondentsNo ratings yetThe Facts: Spouses Mariano Z. Velarde and Avelina D. Velarde, GEORGE RAYMUNDO, Respondents39 pages

- Financing Against Gold Backed Collateral-Instructions For MfbsNo ratings yetFinancing Against Gold Backed Collateral-Instructions For Mfbs4 pages

- Last Six Months Banking Finance and Economy Current Affairs PDFNo ratings yetLast Six Months Banking Finance and Economy Current Affairs PDF111 pages

- TG Protection of Debtors Under Standard SecuritiesNo ratings yetTG Protection of Debtors Under Standard Securities2 pages