Ahspy8053e 2014-15

Ahspy8053e 2014-15

Uploaded by

kzx08110Copyright:

Available Formats

Ahspy8053e 2014-15

Ahspy8053e 2014-15

Uploaded by

kzx08110Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Ahspy8053e 2014-15

Ahspy8053e 2014-15

Uploaded by

kzx08110Copyright:

Available Formats

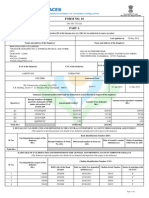

FORM NO.

16

[See rule 31(1)(a)]

PART A

Certificate under Section 203 of the Income-tax Act, 1961 for tax deducted at source on salary

Certificate No. AKOGDPH

Last updated on

Name and address of the Employer

14-Jun-2014

Name and address of the Employee

AMBOSELI PROFESSIONAL ASSOCIATES PRIVATE LIMITED

135 & 136, RAHEJA ARCADE,

KORAMANGALA, BANGALORE - 560095

Karnataka

+(91)-25505348

sari@amboselihr.com

AJAY REDDY YERRI

4-801-A-1, MAHATMA NAGAR, YERRAGUNTLA, KADAPA 516309 Andhra Pradesh

PAN of the Deductor

TAN of the Deductor

AAECA2762J

BLRA11117B

PAN of the Employee

Employee Reference No.

provided by the Employer

(If available)

AHSPY8053E

CIT (TDS)

Assessment Year

The Commissioner of Income Tax (TDS)

Room No. 59, H.M.T. Bhawan, 4th Floor, Bellary Road ,

Ganganagar, Bangalore - 560032

2014-15

Period with the Employer

From

To

01-Apr-2013

31-Mar-2014

Summary of amount paid/credited and tax deducted at source thereon in respect of the employee

Quarter(s)

Receipt Numbers of original

quarterly statements of TDS

under sub-section (3) of

Section 200

Q1

XQEXXEQE

32448.00

468.00

468.00

Q2

EIKXCSCE

122346.00

3055.00

3055.00

Q3

QARCKGDF

122346.00

3055.00

3055.00

Q4

QQQGGIDB

122346.00

7523.00

7523.00

399486.00

14101.00

14101.00

Total (Rs.)

Amount of tax deposited / remitted

(Rs.)

Amount of tax deducted

(Rs.)

Amount paid/credited

I. DETAILS OF TAX DEDUCTED AND DEPOSITED IN THE CENTRAL GOVERNMENT ACCOUNT THROUGH BOOK ADJUSTMENT

(The deductor to provide payment wise details of tax deducted and deposited with respect to the deductee)

Book Identification Number (BIN)

Sl. No.

Tax Deposited in respect of the

deductee

(Rs.)

Receipt Numbers of Form

No. 24G

DDO serial number in Form no.

24G

Date of transfer voucher Status of matching

(dd/mm/yyyy)

with Form no. 24G

Total (Rs.)

II. DETAILS OF TAX DEDUCTED AND DEPOSITED IN THE CENTRAL GOVERNMENT ACCOUNT THROUGH CHALLAN

(The deductor to provide payment wise details of tax deducted and deposited with respect to the deductee)

Sl. No.

Tax Deposited in respect of the

deductee

(Rs.)

Challan Identification Number (CIN)

BSR Code of the Bank

Branch

Date on which Tax deposited Challan Serial Number

(dd/mm/yyyy)

Status of matching with

OLTAS*

468.00

0510050

05-07-2013

05034

1018.00

0510050

02-08-2013

02009

1019.00

0510050

03-09-2013

03005

1018.00

0510050

01-10-2013

01003

Page 1 of 2

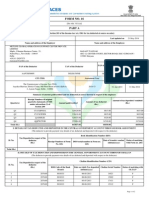

Certificate Number: AKOGDPH

Sl. No.

TAN of Employer: BLRA11117B

Tax Deposited in respect of the

deductee

(Rs.)

PAN of Employee: AHSPY8053E

Assessment Year: 2014-15

Challan Identification Number (CIN)

BSR Code of the Bank

Branch

Date on which Tax deposited Challan Serial Number

(dd/mm/yyyy)

Status of matching with

OLTAS*

1018.00

0510050

05-11-2013

05048

1018.00

0510050

03-12-2013

03017

1019.00

0510050

03-01-2014

03008

2508.00

0510050

04-02-2014

04007

2508.00

0510050

04-03-2014

04014

10

2507.00

0510050

28-03-2014

28010

Total (Rs.)

14101.00

Verification

I, SARITHA UDAY KODIMANIYANDA, son / daughter of CHINNAPPA THAMMAIAH MULLENGADA working in the capacity of DIRECTOR (designation) do hereby

certify that a sum of Rs. 14101.00 [Rs. Fourteen Thousand One Hundred and One Only (in words)] has been deducted and a sum of Rs. 14101.00 [Rs. Fourteen

Thousand One Hundred and One Only] has been deposited to the credit of the Central Government. I further certify that the information given above is true,

complete and correct and is based on the books of account, documents, TDS statements, TDS deposited and other available records.

Place

BANGALORE

Date

02-Jul-2014

Designation: DIRECTOR

(Signature of person responsible for deduction of Tax)

Full Name:SARITHA UDAY KODIMANIYANDA

Notes:

1. Part B (Annexure) of the certificate in Form No.16 shall be issued by the employer.

2. If an assessee is employed under one employer during the year, Part 'A' of the certificate in Form No.16 issued for the quarter ending on 31st March of the financial year shall contain the details

of tax deducted and deposited for all the quarters of the financial year.

3. If an assessee is employed under more than one employer during the year, each of the employers shall issue Part A of the certificate in Form No.16 pertaining to the period for which such

assessee was employed with each of the employers. Part B (Annexure) of the certificate in Form No. 16 may be issued by each of the employers or the last employer at the option of the assessee.

4. To update PAN details in Income Tax Department database, apply for 'PAN change request' through NSDL or UTITSL.

Legend used in Form 16

* Status of matching with OLTAS

Legend

Description

Definition

Unmatched

Deductors have not deposited taxes or have furnished incorrect particulars of tax payment. Final credit will be reflected only when payment

details in bank match with details of deposit in TDS / TCS statement

Provisional

Provisional tax credit is effected only for TDS / TCS Statements filed by Government deductors."P" status will be changed to Final (F) on

verification of payment details submitted by Pay and Accounts Officer (PAO)

Final

In case of non-government deductors, payment details of TDS / TCS deposited in bank by deductor have matched with the payment details

mentioned in the TDS / TCS statement filed by the deductors. In case of government deductors, details of TDS / TCS booked in Government

account have been verified by Pay & Accounts Officer (PAO)

Overbooked

Payment details of TDS / TCS deposited in bank by deductor have matched with details mentioned in the TDS / TCS statement but the

amount is over claimed in the statement. Final (F) credit will be reflected only when deductor reduces claimed amount in the statement or

makes new payment for excess amount claimed in the statement

Signature Not Verified

Digitally signed by

SARITHA UDAY

Date: 2014.07.02 17:08:58

IST

Page 2 of 2

You might also like

- Basic Carding Tutorial 1 PDFDocument3 pagesBasic Carding Tutorial 1 PDFjamo christine100% (1)

- Form 16 by Tcs PDFDocument5 pagesForm 16 by Tcs PDFAnonymous utPqL6jA3i40% (5)

- Form No. 16: Part ADocument5 pagesForm No. 16: Part APunitBeriNo ratings yet

- Form 16Document2 pagesForm 16SIVA100% (1)

- Samsung India Electronics Pvt. LTD.: Signature Not VerifiedDocument7 pagesSamsung India Electronics Pvt. LTD.: Signature Not VerifiedGajendra Singh RaghavNo ratings yet

- Form 16 Word FormatDocument4 pagesForm 16 Word FormatVenkee Sai100% (1)

- Tax GoshwaraDocument2 pagesTax GoshwaraasfandjanNo ratings yet

- Kaushik Sarkar Form 16 DynProDocument5 pagesKaushik Sarkar Form 16 DynProKaushik SarkarNo ratings yet

- Cfupm8774e 2016-17Document2 pagesCfupm8774e 2016-17Sukanta ParidaNo ratings yet

- 255 PartA PDFDocument2 pages255 PartA PDFRamyaMeenakshiNo ratings yet

- Sungf9tIqDhAO64RjsPj Form16 PartADocument2 pagesSungf9tIqDhAO64RjsPj Form16 PartARAJIV RANJAN PRIYADARSHINo ratings yet

- ADEPJ433Document2 pagesADEPJ433ravibhartia1978No ratings yet

- QUA05242 Form16Document5 pagesQUA05242 Form16saurabhNo ratings yet

- PrintTax14 PDFDocument2 pagesPrintTax14 PDFarnieanuNo ratings yet

- ADRPD2454Document2 pagesADRPD2454ravibhartia1978No ratings yet

- Form 16 PDFDocument5 pagesForm 16 PDFJoshua Hicks100% (1)

- LetterDocument2 pagesLetterShiv Kiran SademNo ratings yet

- A 40029127 Part-ADocument2 pagesA 40029127 Part-Adeepak_cool4556No ratings yet

- 14374752Document2 pages14374752Anshul MehtaNo ratings yet

- Ahrpv0731f 2013-14Document2 pagesAhrpv0731f 2013-14Shiva KumarNo ratings yet

- Shashank Kantheti Hyd 12 13Document5 pagesShashank Kantheti Hyd 12 13kshashankNo ratings yet

- PDFDocument5 pagesPDFdhanu1434No ratings yet

- Form 16Document6 pagesForm 16anon_825378560No ratings yet

- Form16 - 01 - Fy 2012-13 - GLT3578Document6 pagesForm16 - 01 - Fy 2012-13 - GLT3578SanjayKumarNo ratings yet

- ReadDocument8 pagesReadRochan VijayakumarNo ratings yet

- 260912GJ GGDocument6 pages260912GJ GGVipul SapraNo ratings yet

- Form 16Document22 pagesForm 16Ajay Chowdary Ajay ChowdaryNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToMohammed MohieNo ratings yet

- Form 16Document2 pagesForm 16Mithun KumarNo ratings yet

- Form 16: Jakson Engineers LimitedDocument5 pagesForm 16: Jakson Engineers LimitedAnit SinghNo ratings yet

- FKMPS9021Q Q3 2016-17Document2 pagesFKMPS9021Q Q3 2016-17Hannan SatopayNo ratings yet

- Gopal G. Trivedi - (108-108) - (2011 - 2012) - Form24Document2 pagesGopal G. Trivedi - (108-108) - (2011 - 2012) - Form24Gopal TrivediNo ratings yet

- Form 16Document3 pagesForm 16Alla VijayNo ratings yet

- Form 16A: Summary of Tax Deducted at Source in Respect of DeducteeDocument1 pageForm 16A: Summary of Tax Deducted at Source in Respect of DeducteeVinayak BadagiNo ratings yet

- Certificate No.:: Tax Deduction Account No. of The DeductorDocument8 pagesCertificate No.:: Tax Deduction Account No. of The DeductorcmtssikarNo ratings yet

- Form16 - 02 - Fy 2014-15 - 1964Document5 pagesForm16 - 02 - Fy 2014-15 - 1964nrp_rahulNo ratings yet

- Acknowledgement UnlockedDocument1 pageAcknowledgement UnlockedcachandhiranNo ratings yet

- XXXPH2966X ITRV - UnlockedDocument1 pageXXXPH2966X ITRV - UnlockedVivek HaldarNo ratings yet

- Form 16: Wipro LimitedDocument5 pagesForm 16: Wipro Limiteddeepak9976No ratings yet

- Form 16Document4 pagesForm 16Aruna Kadge JhaNo ratings yet

- XXXPD3353X Itrv PDFDocument1 pageXXXPD3353X Itrv PDFDaljeet KaurNo ratings yet

- Form16Document5 pagesForm16er_ved06No ratings yet

- f16-23Document5 pagesf16-23aadvin1971No ratings yet

- Expense Report 1nov2013Document2 pagesExpense Report 1nov2013KandanNo ratings yet

- 2015 10 16 13 40 48 407 - 1444983048407 - XXXPP3489X - ITRV - Unlocked PDFDocument1 page2015 10 16 13 40 48 407 - 1444983048407 - XXXPP3489X - ITRV - Unlocked PDFMadhabi MohapatraNo ratings yet

- Sudha Singh Itr V 13Document1 pageSudha Singh Itr V 13Anurag SinghNo ratings yet

- 212619X Form16Document1 page212619X Form16Ajay KumarNo ratings yet

- FORM16Document5 pagesFORM16sunnyjain19900% (1)

- 1 - Form 16Document5 pages1 - Form 16premsccNo ratings yet

- CP 16523370Document1 pageCP 16523370MaYank AdilNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Manogya SharmaNo ratings yet

- Form16_2023_2024Document8 pagesForm16_2023_2024richsantosh163No ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification Formbha_goNo ratings yet

- Form No.16A: Tax Information Network of Income Tax Department Certificate No.: GVVIPLDocument2 pagesForm No.16A: Tax Information Network of Income Tax Department Certificate No.: GVVIPLcool_rdNo ratings yet

- 2316 JAKEDocument1 page2316 JAKEJM HernandezNo ratings yet

- Income Tax Payment Challan: PSID #: 20391652Document1 pageIncome Tax Payment Challan: PSID #: 20391652Tanvir AhmedNo ratings yet

- DSCN - Shree AutomotiveDocument24 pagesDSCN - Shree AutomotiveNikhilesh BhattacharyyaNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToAstro Shalleneder GoyalNo ratings yet

- Gross Total Income (1+2c) 4: Import Previous VersionDocument4 pagesGross Total Income (1+2c) 4: Import Previous Versionbalajiv_mailNo ratings yet

- Computerised Payroll Practice Set Using MYOB AccountRight: Australian EditionFrom EverandComputerised Payroll Practice Set Using MYOB AccountRight: Australian EditionNo ratings yet

- Rivera V Peoples BankDocument2 pagesRivera V Peoples Bankjrvyee100% (1)

- Agricultral DefinitionsDocument15 pagesAgricultral DefinitionsShahid MehmoodNo ratings yet

- Chapter 7Document7 pagesChapter 7Ronan MonzonNo ratings yet

- Document Attestation ChecklistDocument2 pagesDocument Attestation Checklistamannain1No ratings yet

- Balance of Payments - GDSDocument17 pagesBalance of Payments - GDSArunim YadavNo ratings yet

- Top 20000 Private Corp. and Top 5000 Individual TaxpayersDocument7 pagesTop 20000 Private Corp. and Top 5000 Individual TaxpayersJolina HenoguinNo ratings yet

- MFG en Case Study Downscaling of Commercial Banks and Its Impact On Their Performance A Case Study of Akiba Commercial Bank Acb in Tanzania Apr 2007Document30 pagesMFG en Case Study Downscaling of Commercial Banks and Its Impact On Their Performance A Case Study of Akiba Commercial Bank Acb in Tanzania Apr 2007etebark h/michaleNo ratings yet

- ADVT DIST No.-06 2019 01.08.2019.Document15 pagesADVT DIST No.-06 2019 01.08.2019.hkaruvathilNo ratings yet

- 010722-List A Sbi IrbDocument31 pages010722-List A Sbi Irbinfo.girisanNo ratings yet

- Select Product GuideDocument10 pagesSelect Product GuideRaghav SharmaNo ratings yet

- Quarterly and Monthly Mutual Fund ReportDocument17 pagesQuarterly and Monthly Mutual Fund ReportDhuraivel GunasekaranNo ratings yet

- Capital Structure and Its Impact On ProfitabilityDocument26 pagesCapital Structure and Its Impact On ProfitabilityRajesh Mer100% (1)

- 6.time and Value of SupplyDocument54 pages6.time and Value of SupplyRahul GhosaleNo ratings yet

- Effects of Pyramid SchemesDocument11 pagesEffects of Pyramid SchemesZak OnyiegoNo ratings yet

- Authorization Letter For Receiving ATM CDocument1 pageAuthorization Letter For Receiving ATM CAshish Sharma100% (1)

- Microsoft Excel Sheet For Calculating Various Financial Formula by Jack KarnesDocument42 pagesMicrosoft Excel Sheet For Calculating Various Financial Formula by Jack KarnesVikas AcharyaNo ratings yet

- Sudhir Kochhar: Foreign LC Advising and LC Transfer Cases Handling Outward RemmitancesDocument4 pagesSudhir Kochhar: Foreign LC Advising and LC Transfer Cases Handling Outward Remmitancessudhir.kochhar3530No ratings yet

- CB Bank AssignmentDocument16 pagesCB Bank AssignmentHan Myo100% (1)

- George Washington Powerpoint Part 1Document21 pagesGeorge Washington Powerpoint Part 1api-245320078No ratings yet

- BFI Sample CommerceDocument24 pagesBFI Sample CommerceMAREESWARAN KNo ratings yet

- Proforma Invoice S10006282560Document2 pagesProforma Invoice S10006282560Ikhsan Eka PutraNo ratings yet

- 16 11 09 Guide Book Credit Scoring ToolkitDocument25 pages16 11 09 Guide Book Credit Scoring ToolkitHelmy Widjaja0% (1)

- Financial CapitalDocument7 pagesFinancial Capitaljackie555No ratings yet

- Financial Institutions, Functions and Importance.: Prepared By: Dr. Albert C. RocesDocument12 pagesFinancial Institutions, Functions and Importance.: Prepared By: Dr. Albert C. RocesAMNo ratings yet

- Unit 9Document9 pagesUnit 9Prasun KumarNo ratings yet

- Caps, Floors, SwapDocument3 pagesCaps, Floors, SwapFransiskus Saut Sandean Sinaga100% (1)

- Chapter 1 Current Multinational Challenges and The Global Economy Multiple Choice and True/ False Questions 1.1 The Global Financial MarketplaceDocument10 pagesChapter 1 Current Multinational Challenges and The Global Economy Multiple Choice and True/ False Questions 1.1 The Global Financial Marketplacequeen hassaneenNo ratings yet

- DHFL Project Final PDFDocument78 pagesDHFL Project Final PDFChinmay VangeNo ratings yet

- Chapter 2 - Credit Analysis - Sv2.0Document107 pagesChapter 2 - Credit Analysis - Sv2.0pvu19112004No ratings yet