Coi Pmjjby

Coi Pmjjby

Uploaded by

ashok1259Copyright:

Available Formats

Coi Pmjjby

Coi Pmjjby

Uploaded by

ashok1259Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Coi Pmjjby

Coi Pmjjby

Uploaded by

ashok1259Copyright:

Available Formats

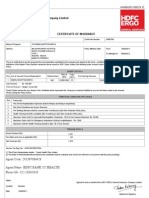

Group Insurance Scheme for

Pradhan Mantri Jeevan Jyoti Bima Yojana

UIN: 105G146V01

CERTIFICATE OF INSURANCE

ICICI PRUDENTIAL LIFE INSURANCE COMPANY LIMITED

ICICI Prulife Towers, 1089, Appasaheb Marathe Marg,

Prabhadevi, Mumbai- 400 025

This policy is a ONE YEAR RENEWABLE TERM Policy.

Name Of Scheme

Master Policy Number

Name of the Master Policyholder (Proposer)

Address of the Master Policyholder

Name of the Life Assured

Date of birth of the Life Assured (as per KYC

document)

Age of the Life Assured as on Policy

Commencement Date/ Renewal Date

Member Identification Number

Savings Bank Account Number

Aadhaar Number

Sum Assured

Date of Commencement of Cover

Date of Termination of Cover

Annual Renewal Date of Master Policy

PAN No

Folio No

Nominee

Premium

Group Insurance Scheme for Pradhan Mantri Jeevan Jyoti Bima Yojana

00002273

ICICI Bank Limited

ICICI Bank Towers, Bandra Kurla Complex, Bandra (E) Maharashtra

Mumbai 400051

MR ASHOK KRISHNA K .

15 Aug 1984

31

037601512566

037601512566

200000

01 Jun 2015

31 May 2016

01 Jun 2016

BDQPK2386B

KODEBOYINASAISMARAN

330

Premium Payment Mode

Yearly

The Master Policyholder has applied vide proposal dated 01 Jun 2015 to ICICI Prudential Life Insurance Company Limited

(hereinafter referred to as the Company) for grant of the Benefits specified herein.

Benefits payable and other conditions : as specified in the Master policy document and this certificate

Please Note : The Cover to the Members will terminate if the Master Policyholder surrenders the policy or does not pay the due

premium before the Annual Renewal Date of the Master Policy. As this is a group policy, the members cover will cease if the

member ceases to be a member of the group. The premium is guaranteed for the period of cover and subject to change on

policys annual renewal date.

In case there are any differences in interpretation of the benefits payable, premium, terms and conditions mentioned in

this Certificate of Insurance, the terms of the Master Policy shall prevail. For complete details, please refer to the policy

document as available with the Master Policyholder.

Signed for and on behalf of the ICICI Prudential Life Insurance Company Limited, at MUMBAI on 01 Jun 2015

Authorised Signatory

This is a summary of the Master Policy issued to the Master Proposer and contains important terms and conditions about the

Benefits.

Group Insurance Scheme for

Pradhan Mantri Jeevan Jyoti Bima Yojana

UIN: 105G146V01

Terms and Conditions of the Policy:

1. Definitions:

Unless excluded by or repugnant to the context: -

a.

b.

c.

d.

e.

f.

g.

h.

i.

"Beneficiary" means the insured Member or the person nominated by the Member as the recipient of the benefits under

the Rules of the Scheme.

"Benefits" means the Cover provided to the Members, under the Master Policy.

"Cover" means the Group Term Insurance and provided to a Member under this Master Policy.

"Master Policyholder" means the Participating Bank under the Pradhan Mantri Jeevan Jyoti Bima Yojana.

"Company" means ICICI Prudential Life Insurance Company Limited which expression shall include its successors and

assigns.

"Group" means a group of Members accepted by the Company as constituting a Group for the purpose of the Master

Policy.

"Date of commencement of Cover" means

I. the date of commencement of cover for the individual members under the Master Policy.

II. at the time of issuance of the Master Policy the date of acceptance of risk subject to receipt of member data and

premium towards these members.

III. for new members joining during the term of the Master Policy, will be the date of acceptance of risk subject to

receipt of Member data and premium towards these members. Member Data means the necessary details of the

Members required to provide risk cover including a self-certificate of good health in a form acceptable to the

Company.

"Terminal date" means the date when a Member attains the Terminal age as per last birthdate or the date on which he

ceases to be a Member of the Scheme whichever is earlier.

"Terminal Age" is the age as stipulated by the Master Policyholder under Rules of Scheme, on which the Membership

ceases.

2. Eligibility for Membership:

a) Persons who are at least the minimum age at entry (last birthday) and not more than the maximum age at entry (nearer

birthday) or the Terminal Age, whichever is lower, as specified under the Rules of Scheme, as on the Policy

Commencement Date, will be eligible for Membership of the Scheme.

b) Persons who join the Group on or after the Policy Commencement date shall be eligible for Membership of the

Schemeby payment of full Annual premium for prospective cover along with a self-certificate of good health in a form

acceptable to the Company, subject to them being within the age limits specified above.

c) The eligibility of a Member to join the scheme as specified in (a) and (b) above is subject to the Company receiving an

intimation of eligibility of the Member and premium amount within 30 days of the Member becoming eligible.

d) The cover of a Member shall terminate on an annual renewal date upon the happening of any of the following events

and no benefit will become payable thereunder:I. On attaining Terminal age on annual renewal date.

II. Closure of account with Master Policy holder or insufficiency of balance to keep the insurance in force.

III. If Master Policy is terminated/discontinued for any reason

IV. he/she ceases to satisfy any of the eligibility criteria;

V. he/ she ceases to be a Member for whatsoever reason;

VI. his/her relationship with the Master Policyholder ceases for any reason whatsoever;

Group Insurance Scheme for

Pradhan Mantri Jeevan Jyoti Bima Yojana

UIN: 105G146V01

3. Benefits payable under the Policy:

a) Provided the cover is in force, on death of a member during policy term, death benefit equal to the sum assured will be

payable to the nominee of such member.

b) No benefit shall be payable on maturity of the policy.

4. Premium:

a) Premium under the Master Policy is payable in advance for each Member.

b) Premium shall be payable with respect to each member covered under the Policy. The Master Policyholder shall be

responsible for such premium payment.

5. Termination of Life Insurance:

The cover of a Member shall terminate on an annual renewal date upon the happening of any of the following events and no

benefit will become payable thereunder:a)

b)

c)

d)

e)

f)

On attaining Terminal age (as specified under the Rules of scheme) on annual renewal date.

Closure of account with Master Policy holder or insufficiency of balance to keep the insurance in force.

If Master Policy is terminated/discontinued for any reason

he/she ceases to satisfy any of the eligibility criteria; s

he/ she ceases to be a Member for whatsoever reason;

his/her relationship with the Master Policyholder ceases for any reason whatsoever;

In case a Member is covered under this Scheme through more than one Bank account, and premium is received inadvertently,

insurance cover will be restricted to Rs. 2 (two) Lakh and the premium shall be liable to be forfeited.

In the event of the personal statement/ declaration of good health, if any or any other factor relating to the insurability of a life not

being to the satisfaction of the Company, it may terminate the Cover for such a person/ Member. The decision of the Company

thereon shall be final and binding on the Master Policyholder and the Member.

The Master Policyholder and the Company reserve the right to discontinue the scheme at any time or to amend the Rules thereof

on any annual renewal date subject to giving 1 (one) months notice. Any amendment to the Rules of the Scheme will be done

based on mutual agreement between the Master Policy holder and the Company. On discontinuance of Scheme by the

government, the Master Policyholder and the Company may decide to terminate the policy.

6. Payment of Claim:

The claim payment will be as per Scheme Rules. The Master Policyholder will raise claims to avail Benefits with the following

documents:

a)

b)

c)

d)

Claim intimation form

Member Policy Schedule, as applicable

Death certificate issued by the local authority in case of death claim

Any other documents or information as may be required by the Company for processing of the claim depending on the

cause of the claim

e) The Company reserves the right to call for additional information, documents or particulars, in such form and manner as

the Company would prescribe, and the Benefits would be paid only after receipt of such additional information,

documents or particulars.

f) The claim payment will be made to the account of the member.

g) All claims payments will be made in Indian currency in accordance with the prevailing exchange control regulations and

other relevant laws and regulations in India.

h) The settlement of claim is subject to correct information provided by the member related to his/her personal information

& in declaration of good health, if applicable. The Company reserves the right to reject the claim of a member in case

incorrect information related to member is provided for the Cover. The decision of the Company regarding the settlement

of the Cover shall be binding on the Master Policyholder.

Group Insurance Scheme for

Pradhan Mantri Jeevan Jyoti Bima Yojana

UIN: 105G146V01

7. Non-disclosure and Fraud:

In case of non-disclosure and fraud, the policy shall be cancelled immediately, subject to the non-disclosure/fraud being

established by the Company in accordance with Section 45 of the Insurance Laws (amendment) Act, 2015.

8. Customer service

If at any time you need any clarification or assistance, please contact your relationship manager.

By mail at:

Address: ICICI Prudential Life Insurance Co. Ltd.,

Group Service Desk

Ground Floor & Upper Basement,

Unit No. 1A & 2A, RahejaTipco Plaza,

Rani Sati Marg, Malad (East),

Mumbai - 400 097

Maharashtra.

E-mail : grouplife@iciciprulife.com

You might also like

- Chapter 3 Tax AnswersDocument55 pagesChapter 3 Tax Answersawby04100% (2)

- ZTE H1600 Maintenance Management GuideDocument109 pagesZTE H1600 Maintenance Management Guideandreasmon100% (1)

- QLD Police Operational Procedures ManualDocument71 pagesQLD Police Operational Procedures Manuala0% (1)

- JPM - Insurance PrimerDocument104 pagesJPM - Insurance Primerbrettpeven67% (3)

- Accounting of Insurance CompaniesDocument8 pagesAccounting of Insurance CompaniesShishir Dhamija100% (1)

- SR Insights Non Convertible Debentures Entry Routes For Foreign InvestorsDocument8 pagesSR Insights Non Convertible Debentures Entry Routes For Foreign InvestorsHimashu DhakedNo ratings yet

- Co Branding AgreementDocument3 pagesCo Branding AgreementSheena C.No ratings yet

- Know Your Customer (Kyc) Form (For Individual Only)Document5 pagesKnow Your Customer (Kyc) Form (For Individual Only)rayuduicwaNo ratings yet

- Investigation Into Carding, Handcuffing of U of O StudentDocument50 pagesInvestigation Into Carding, Handcuffing of U of O StudentMatt GergyekNo ratings yet

- Visa Vertical and Horizontal Analysis ExampleDocument9 pagesVisa Vertical and Horizontal Analysis Examplechad salcidoNo ratings yet

- Lending Functions of A BankDocument15 pagesLending Functions of A BankJhalak MaheshwariNo ratings yet

- Offer LetterDocument10 pagesOffer LetterAtul SharmaNo ratings yet

- Companies - Database Puerto RicoDocument648 pagesCompanies - Database Puerto RicoGp MishraNo ratings yet

- City County of Honolulu A L PDFDocument318 pagesCity County of Honolulu A L PDFSalvacion Ojeda VillaverdeNo ratings yet

- Pradhan Mantri Suraksha Bima Yojana: Certificate of Insurance (COI)Document1 pagePradhan Mantri Suraksha Bima Yojana: Certificate of Insurance (COI)cscnurpurNo ratings yet

- LoanagreementDocument13 pagesLoanagreementKiran KumarNo ratings yet

- Netflix - Hustling For More in India's Crowded OTT SpaceDocument23 pagesNetflix - Hustling For More in India's Crowded OTT SpaceGiancarloRicardNo ratings yet

- Employee Background Verification SystemsDocument5 pagesEmployee Background Verification Systemsmohitgarg080% (1)

- Bandhan - A Travelling AppDocument29 pagesBandhan - A Travelling AppSaeeyda Islam PapiyaNo ratings yet

- Reverse Charge Mechanism in GST Regime With Chart – Updated Till Date - Taxguru - inDocument19 pagesReverse Charge Mechanism in GST Regime With Chart – Updated Till Date - Taxguru - inAjit GuptaNo ratings yet

- Advantages of Color Sensor - Disadvantages of Color SensorDocument1 pageAdvantages of Color Sensor - Disadvantages of Color SensorDexter ChinembiriNo ratings yet

- Approved Camera List - Jan172022Document22 pagesApproved Camera List - Jan172022Waled SamraNo ratings yet

- SCHEME Food Products HCDocument4 pagesSCHEME Food Products HC114912No ratings yet

- Card FAQ: The City Bank LTDDocument13 pagesCard FAQ: The City Bank LTDJisan ProdhanNo ratings yet

- India Prepares - July 2012 (Vol.1 Issue 9)Document76 pagesIndia Prepares - July 2012 (Vol.1 Issue 9)India Prepares100% (1)

- Uniform Traffic Citation E04061709 VIOLATOR - RedactedDocument1 pageUniform Traffic Citation E04061709 VIOLATOR - Redactedsavannahnow.comNo ratings yet

- Overseas Direct InvestmentDocument61 pagesOverseas Direct InvestmentSutonu BasuNo ratings yet

- ReleaseNotes UFED PA 7.20Document9 pagesReleaseNotes UFED PA 7.20Henry Nicolas Caballero TorresNo ratings yet

- Non ExclusivePurchasingAgencyAgreement PDFDocument17 pagesNon ExclusivePurchasingAgencyAgreement PDFPaul RoskellNo ratings yet

- Implementation of Fraud Detection in P2P Lending Using Text AnalyticsDocument18 pagesImplementation of Fraud Detection in P2P Lending Using Text AnalyticsHimanshu DarganNo ratings yet

- Ignou Useful FormsDocument54 pagesIgnou Useful Formscnuthalapati100% (1)

- Analysis of Deposit Scheme (F)Document81 pagesAnalysis of Deposit Scheme (F)Kuriakose GeorgeNo ratings yet

- Probation in Petty OffencesDocument9 pagesProbation in Petty OffencesKranthi Kiran TalluriNo ratings yet

- Shareholders List DSML 08Document1,256 pagesShareholders List DSML 08Amit PoddarNo ratings yet

- Free TravelDocument2 pagesFree Travelssr1170No ratings yet

- Invoice Order #5055201803Document1 pageInvoice Order #5055201803olajide100% (1)

- GPS and GSM Based Vehicle Tracking SystemDocument11 pagesGPS and GSM Based Vehicle Tracking Systemmeghana jagadish4No ratings yet

- Whistle Blowing PDFDocument21 pagesWhistle Blowing PDFAbdul MuqeetNo ratings yet

- Application For Radio Station LicenseDocument1 pageApplication For Radio Station LicenseUlyssis RL CariñoNo ratings yet

- Lic ScamDocument13 pagesLic ScamSneha Karan JagtapNo ratings yet

- Co Beneficary AgreementDocument9 pagesCo Beneficary AgreementManojkumar NairNo ratings yet

- CRPF Irctc Mou News Report-2Document26 pagesCRPF Irctc Mou News Report-2Vignesh Subbanna100% (1)

- Dirbs Sop 050319Document44 pagesDirbs Sop 050319Azeem AbbasNo ratings yet

- zq610-zq620 User ManualDocument125 pageszq610-zq620 User ManualPiedmontNo ratings yet

- Aimil LTD.,: The Troubleshooting Manual Compression Testing MachineDocument6 pagesAimil LTD.,: The Troubleshooting Manual Compression Testing Machinevasudeva yasasNo ratings yet

- Government Applications of Biometric Technologies: Border & Aviation SecurityDocument23 pagesGovernment Applications of Biometric Technologies: Border & Aviation Securityniharika anuNo ratings yet

- Presentasi VeriFone CombineDocument135 pagesPresentasi VeriFone CombineTsaqif Alfatan NugrahaNo ratings yet

- SBI Ka Checklistfor Non-Personel CA Open Karne Ke LiyeDocument13 pagesSBI Ka Checklistfor Non-Personel CA Open Karne Ke LiyeDeepakNo ratings yet

- What My Family Should KnowDocument26 pagesWhat My Family Should KnowsivaNo ratings yet

- Bajaj InsuranceDocument2 pagesBajaj InsuranceHemant SinghNo ratings yet

- CV Loan AgreementDocument17 pagesCV Loan AgreementankitNo ratings yet

- Certificate of InsuranceDocument4 pagesCertificate of Insurancekurundwadesandy007No ratings yet

- LIC's New One Year Renewal Group Term Assurance Plan - IDocument3 pagesLIC's New One Year Renewal Group Term Assurance Plan - Ilove05kumar05No ratings yet

- Benefits On DeathDocument16 pagesBenefits On DeathnaitikNo ratings yet

- Sales Brochure LIC GCLIDocument5 pagesSales Brochure LIC GCLIRKNo ratings yet

- A. SBI Life - Pradhan Mantri Jeevan Jyoti Bima Yojana: Advantages SecurityDocument7 pagesA. SBI Life - Pradhan Mantri Jeevan Jyoti Bima Yojana: Advantages Securitymuduliajitesh1001No ratings yet

- Kotak Endowment PlanDocument2 pagesKotak Endowment PlanMichael GreenNo ratings yet

- Sbi Life - Pradhan Mantri Jeevan Jyoti Bima Yojana (Uin: 111G102V01)Document1 pageSbi Life - Pradhan Mantri Jeevan Jyoti Bima Yojana (Uin: 111G102V01)Doel MajumderNo ratings yet

- Assurance PlanDocument1 pageAssurance Planswetaagarwal2706No ratings yet

- Super Cash GainDocument2 pagesSuper Cash GainElangovan PurushothamanNo ratings yet

- Life Stay Smart Plan BrochureDocument2 pagesLife Stay Smart Plan BrochureBadi SudhakaranNo ratings yet

- Part A Welcome To Max Life Insurance: Page 1 of 21Document21 pagesPart A Welcome To Max Life Insurance: Page 1 of 21ZafarNo ratings yet

- HDFC Life Group Term Insurance Proposal FormDocument5 pagesHDFC Life Group Term Insurance Proposal FormPrince Kumar BhartiNo ratings yet

- Savings Assurance PlanDocument1 pageSavings Assurance Planrajeshdubey7No ratings yet

- LIC PM Vaya Vandana YojanaDocument6 pagesLIC PM Vaya Vandana YojanaShaji MathewNo ratings yet

- Preferred Term Plan: Financial Protection For Your Loved Ones. AssuredDocument7 pagesPreferred Term Plan: Financial Protection For Your Loved Ones. AssuredpankajzapNo ratings yet

- JeevanBeema AkashDocument2 pagesJeevanBeema Akashakashuniversal20No ratings yet

- Reliance Group Credit Shield Plan: Security, Guaranteed!Document6 pagesReliance Group Credit Shield Plan: Security, Guaranteed!Mahipal YadavNo ratings yet

- Ancient Indian History & Culture-Ilovepdf-Compressed PDFDocument244 pagesAncient Indian History & Culture-Ilovepdf-Compressed PDFashok1259No ratings yet

- Payment ReceiptDocument1 pagePayment Receiptashok1259No ratings yet

- Drakyula by ViswaPrasadDocument111 pagesDrakyula by ViswaPrasadashok1259100% (1)

- SW 15july2016Document58 pagesSW 15july2016ashok1259No ratings yet

- 2016 World Qualification Event: Daily ScheduleDocument2 pages2016 World Qualification Event: Daily Scheduleashok1259No ratings yet

- BCCI Rules and RegulationsDocument32 pagesBCCI Rules and Regulationsashok1259No ratings yet

- Senior Quality Assurance Engineer (India)Document2 pagesSenior Quality Assurance Engineer (India)ashok1259No ratings yet

- Degree of CurvatureDocument2 pagesDegree of Curvatureashok1259No ratings yet

- Taurus - Sun SignDocument1 pageTaurus - Sun Signashok1259No ratings yet

- E StatementDocument1 pageE Statementashok1259No ratings yet

- Sprint Build Key Issue TypeDocument8 pagesSprint Build Key Issue Typeashok1259No ratings yet

- Active Machine Owner Machine Name: R8M9HZK1Document6 pagesActive Machine Owner Machine Name: R8M9HZK1ashok1259No ratings yet

- o S.r0$,/.,r.: R'.L Z JQF 1.Document1 pageo S.r0$,/.,r.: R'.L Z JQF 1.ashok1259No ratings yet

- Correction Data Sheet DT-39105: 1 Solution/ProposalDocument4 pagesCorrection Data Sheet DT-39105: 1 Solution/Proposalashok1259No ratings yet

- N::: Nt::tet:t T T Nt:tnttyt:t T:T: TT:TT:NTDT NDocument2 pagesN::: Nt::tet:t T T Nt:tnttyt:t T:T: TT:TT:NTDT Nashok1259No ratings yet

- RedBus Ticket 36339397Document1 pageRedBus Ticket 36339397ashok1259No ratings yet

- Ashokkrishna 5533137C20: Date of Joining: Mar-25-2014Document1 pageAshokkrishna 5533137C20: Date of Joining: Mar-25-2014ashok1259No ratings yet

- 20 TH Anniversary HotlineDocument40 pages20 TH Anniversary HotlineMahdian KlampNo ratings yet

- Insurance Management System ReportDocument11 pagesInsurance Management System Reportfcmitc0% (1)

- Mafv 2017 09Document2 pagesMafv 2017 09emirav2No ratings yet

- US Interest Rates Outlook 2011 - Tug of WarDocument122 pagesUS Interest Rates Outlook 2011 - Tug of WarGeouzNo ratings yet

- A017 r03.00+-+Orana+Engineering+Capability+StatementDocument7 pagesA017 r03.00+-+Orana+Engineering+Capability+Statementgraceenggint8799No ratings yet

- Samsung Group StructureDocument20 pagesSamsung Group StructureJose Flores100% (2)

- Monica Caballero Ortiz - Monica OrtizDocument10 pagesMonica Caballero Ortiz - Monica OrtizLJ Avila LayronNo ratings yet

- Accounts GRP 1 BitsDocument40 pagesAccounts GRP 1 BitskalyanikamineniNo ratings yet

- CusIIEcLQjSrCCBHCxI0sA Week 1 Comprehensive Example Worksheet 2Document3 pagesCusIIEcLQjSrCCBHCxI0sA Week 1 Comprehensive Example Worksheet 2harsh.chopra700No ratings yet

- Lingani PS - Final Unpriced BOQDocument86 pagesLingani PS - Final Unpriced BOQandileNo ratings yet

- Lecture 5 - Bidding, Conctractual and Technical InformationDocument32 pagesLecture 5 - Bidding, Conctractual and Technical InformationLouise LuyNo ratings yet

- KCCDocument17 pagesKCCSarabjit SinghNo ratings yet

- Niharika Mahakur SipDocument94 pagesNiharika Mahakur Sipdurgamadhab.1412No ratings yet

- DRY CARGO CHARTERING - Group Two SyllabusDocument4 pagesDRY CARGO CHARTERING - Group Two SyllabusDeepak ShoriNo ratings yet

- 2GO Travel - Itinerary ReceiptDocument5 pages2GO Travel - Itinerary ReceiptsalazartezzaNo ratings yet

- HDFC ERGO General Insurance Company LimitedDocument6 pagesHDFC ERGO General Insurance Company LimitedShibani DesaiNo ratings yet

- 3i Infotech - InsuranceDocument26 pages3i Infotech - InsuranceeevengNo ratings yet

- Philhealth EPRSDocument47 pagesPhilhealth EPRSEdison FloresNo ratings yet

- Tender Document Electro Mechanical Systemfor Ballast HopperDocument92 pagesTender Document Electro Mechanical Systemfor Ballast HopperAshutosh TripathiNo ratings yet

- Customer Retention & Relationship Management - Muzammil Mohammed Shareef-1Document128 pagesCustomer Retention & Relationship Management - Muzammil Mohammed Shareef-1Fazeel AhmedNo ratings yet

- Indiana Life Cliff Notes NEWDocument35 pagesIndiana Life Cliff Notes NEWDenise CampbellNo ratings yet

- Agent Code: 201587086428 Agent Name: HDFC Bank CC Health Phone No: 022-28561818Document2 pagesAgent Code: 201587086428 Agent Name: HDFC Bank CC Health Phone No: 022-28561818djsheruNo ratings yet