Appendix B - Seed Accelerator Programme Financial Model

Appendix B - Seed Accelerator Programme Financial Model

Uploaded by

Shumba MutumwaCopyright:

Available Formats

Appendix B - Seed Accelerator Programme Financial Model

Appendix B - Seed Accelerator Programme Financial Model

Uploaded by

Shumba MutumwaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Appendix B - Seed Accelerator Programme Financial Model

Appendix B - Seed Accelerator Programme Financial Model

Uploaded by

Shumba MutumwaCopyright:

Available Formats

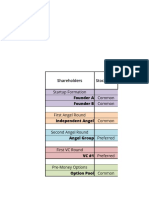

Appendix B: Seed Accelerator Programme Financial Model - Overall

Sample Seed Accelerator Financial

Model

Average Investment

Average Equity

Number of Deals

Post-money Valuation

Total Funding Required

$20,000

6%

20

$333,333

$400,000

Large Exit %

Good Exit %

Money back %

Losers %

5%

20%

25%

50%

Invested

Total Proceeds

$400,000

$1,400,000

Return

10-year return IRR

Accelerator Share at Exit Value at Exit

Accelerator Share Total Return

0.50%

$100,000,000

$500,000

$500,000

2.00%

$10,000,000

$200,000

$800,000

4.00%

$500,000

$20,000

$100,000

$0

$0

$0

3.50

13.35%

Appendix B: Seed Accelerator Programme Financial Model - IRRs

Fund at 10 years

Fund at 7 years

Value at exit

Pct held

Multiple

IRR

Initial Investment

0

1

2

3

4

5

6

7

8

9

10

year

Quick Exit

Case 1

$550,000

5.00%

Good exit

Case 2

$10,000,000

1.00%

Big exit

Omnisio Example

Case 3

Case 4

$100,000,000

$15,000,000

0.50%

6.00%

Massive exit

Case 5

$1,000,000,000

0.10%

3.5

13.35%

3.5

19.60%

1.375

37.50%

5

49.53%

25

37.97%

45

4400.00%

50

47.88%

-$400,000

-$400,000

-$20,000

$27,500

-$20,000

-$20,000

-$20,000

$900,000

-$20,000

$100,000

$1,400,000

$1,400,000

$500,000

$1,000,000

Appendix B: Seed Accelerator Programme Financial Model - IRRs

ssive exit

Case 5

000,000,000

0.10%

50

47.88%

-$20,000

$1,000,000

Appendix B: Seed Accelerator Programme Financial Model - IRRs

You might also like

- Startup Accelerator - Business PlanDocument19 pagesStartup Accelerator - Business PlanJeffMagnusson80% (46)

- How To Raise A Venture Capital Fund: The Essential Guide on Fundraising and Understanding Limited PartnersFrom EverandHow To Raise A Venture Capital Fund: The Essential Guide on Fundraising and Understanding Limited PartnersNo ratings yet

- Cruise Automation Y Combinator ApplicationDocument8 pagesCruise Automation Y Combinator ApplicationJohana Mb100% (1)

- Venture StudioDocument6 pagesVenture StudioAnil Kumar PrasannaNo ratings yet

- Venture Studio Structures (Downloadable From Website)Document16 pagesVenture Studio Structures (Downloadable From Website)mberenstein100% (1)

- Founders Pocket Guide Cap TableDocument10 pagesFounders Pocket Guide Cap TableVenkatesh Mahalingam100% (1)

- Venture Studios - The Future of Venture Capital and Startup CreationDocument21 pagesVenture Studios - The Future of Venture Capital and Startup CreationJazeer JamalNo ratings yet

- BlueBook - A Startup Valuation StoryDocument5 pagesBlueBook - A Startup Valuation StoryBlueBook100% (4)

- Sequoia's Investment Memo - The Infovore's DilemmaDocument8 pagesSequoia's Investment Memo - The Infovore's Dilemmamaanas50% (2)

- Accelerator ProgramDocument13 pagesAccelerator ProgramFahad Saud0% (1)

- Supercharge Your Startup Valuation: A comprehensive guide for entrepreneurs and investors to value Startups and ScaleupsFrom EverandSupercharge Your Startup Valuation: A comprehensive guide for entrepreneurs and investors to value Startups and ScaleupsNo ratings yet

- Copying Y CombinatorDocument34 pagesCopying Y CombinatorJed Christiansen94% (16)

- Tech Cocktail's 2012 Startup Accelerator Report Presented by .CODocument20 pagesTech Cocktail's 2012 Startup Accelerator Report Presented by .COFrank Gruber75% (4)

- Framework of YCombinatorDocument34 pagesFramework of YCombinatorPradeep KumarNo ratings yet

- Startup Valuation For DummiesDocument7 pagesStartup Valuation For DummiesPradeep Jain100% (2)

- Startup StudioDocument10 pagesStartup StudioASHOK100% (1)

- Venture Capital ValuationDocument8 pagesVenture Capital Valuationgnachev_4100% (5)

- Cap Table Modeling TemplateDocument11 pagesCap Table Modeling TemplateAde Hk100% (1)

- Startup Studio - Fledgling Innovative IdeaDocument6 pagesStartup Studio - Fledgling Innovative IdeaASHOKNo ratings yet

- GSSN StudioCapitalEfficiency WhitepaperDocument23 pagesGSSN StudioCapitalEfficiency WhitepapermberensteinNo ratings yet

- Road to a Venture Capital Career: Practical Strategies and Tips to Break Into The IndustryFrom EverandRoad to a Venture Capital Career: Practical Strategies and Tips to Break Into The IndustryRating: 5 out of 5 stars5/5 (2)

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursFrom EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursRating: 4.5 out of 5 stars4.5/5 (8)

- The Business Accelerator Vs HubDocument68 pagesThe Business Accelerator Vs HubAlina Comanescu100% (1)

- TechstarsDocument4 pagesTechstarsfirstroundts100% (1)

- Copying Y Combinator - Appendix A - List of Seed AcceleratorsDocument5 pagesCopying Y Combinator - Appendix A - List of Seed AcceleratorsJed Christiansen100% (1)

- Iaccelerator Business Plan Nov 5 2010Document48 pagesIaccelerator Business Plan Nov 5 2010Brigit Helms50% (2)

- Seed-DB - List of Seed Accelerator Programs PDFDocument6 pagesSeed-DB - List of Seed Accelerator Programs PDFebmarta100% (1)

- Plug & Play Turkey - ShortDocument15 pagesPlug & Play Turkey - ShortArda Kutsal100% (1)

- The Start-Up Guru: Y Combinator's Paul Graham - PaulDocument4 pagesThe Start-Up Guru: Y Combinator's Paul Graham - Paulapi-13873003100% (2)

- Accelerator, Joint Guide To Develop Acceleration ProgrammesDocument53 pagesAccelerator, Joint Guide To Develop Acceleration ProgrammesLuisLazo100% (2)

- Wharton Venture CapitalDocument9 pagesWharton Venture CapitalMarthy Ravello50% (2)

- The Strategy Accelerator - New Business Models Based On Competitive AdvantageDocument16 pagesThe Strategy Accelerator - New Business Models Based On Competitive AdvantageAlfredGriffioen100% (4)

- Startup Fundraising 101Document15 pagesStartup Fundraising 101Bernard Moon100% (5)

- Startup ValuationDocument16 pagesStartup ValuationVaidehi sonawani50% (2)

- Startup Fundraising 101Document8 pagesStartup Fundraising 101CrowdfundInsider100% (1)

- Ix Strategic Plan Startup AcceleratorDocument61 pagesIx Strategic Plan Startup AcceleratorMarcos Vasconcelos CostaNo ratings yet

- A Guide To Venture Capital Term SheetsDocument22 pagesA Guide To Venture Capital Term Sheetsmlieberman0% (10)

- A Look Inside AcceleratorsDocument24 pagesA Look Inside AcceleratorsAjay Sadyal67% (3)

- Understanding The Startup Funding Game DraftDocument19 pagesUnderstanding The Startup Funding Game DraftkasmodiaNo ratings yet

- Corporate Accelerator enDocument28 pagesCorporate Accelerator enjigarcshahNo ratings yet

- PWC - AcceleratorDocument29 pagesPWC - Acceleratorgerardkok100% (1)

- Start-Up HandbookDocument36 pagesStart-Up HandbookUIUCOTM100% (8)

- Raising Seed Capital: Steve Schlafman (@schlaf) RRE VenturesDocument82 pagesRaising Seed Capital: Steve Schlafman (@schlaf) RRE Venturesrezurekt100% (3)

- The Startup To Venture Capital Financing StoryDocument8 pagesThe Startup To Venture Capital Financing StoryBlueBook100% (2)

- Understanding Valuation: A Venture Investor's PerspectiveDocument5 pagesUnderstanding Valuation: A Venture Investor's Perspectiveapi-3764496100% (2)

- Early-Stage Startup Valuation - Jeff FaustDocument15 pagesEarly-Stage Startup Valuation - Jeff FausthelenaNo ratings yet

- Venture CapitalDocument34 pagesVenture CapitalAnu NigamNo ratings yet

- Startup Accelerator Rankings Methodology & Companion Report - Kellogg School of Management NorthwesternDocument4 pagesStartup Accelerator Rankings Methodology & Companion Report - Kellogg School of Management NorthwesternFrank Gruber50% (2)

- The Startup FactoriesDocument39 pagesThe Startup FactoriesNesta89% (9)

- Startup The Rise of AcceleratorDocument39 pagesStartup The Rise of Acceleratoranomis2011No ratings yet

- Investment Process at VC FirmsDocument60 pagesInvestment Process at VC FirmsEvgeniy Shlieffier100% (2)

- Good IncubationDocument51 pagesGood IncubationNestaNo ratings yet

- Stages of Company Development and Investor TypesDocument5 pagesStages of Company Development and Investor TypesLuis DiazNo ratings yet

- BCG - Corporate Venture Capital (Oct - 2012)Document21 pagesBCG - Corporate Venture Capital (Oct - 2012)ddubyaNo ratings yet

- Startup Best Practices PDFDocument92 pagesStartup Best Practices PDFRdW992049RdWNo ratings yet

- Raising Money WhitepaperDocument8 pagesRaising Money WhitepaperPokyGangNo ratings yet

- Venture Capital - Fund Raising and Fund StructureDocument52 pagesVenture Capital - Fund Raising and Fund StructureSimon ChenNo ratings yet

- Business Acceleration 2.0: The strategic acceleration of successful startupsFrom EverandBusiness Acceleration 2.0: The strategic acceleration of successful startupsRating: 4 out of 5 stars4/5 (1)

- Aquatic Weeds (Control)Document4 pagesAquatic Weeds (Control)Shumba MutumwaNo ratings yet

- Think Tanks in South Asia: Analysing The Knowledge-Power InterfaceDocument39 pagesThink Tanks in South Asia: Analysing The Knowledge-Power InterfaceShumba MutumwaNo ratings yet

- Alphabetical Index of The Laws of BotswanaDocument15 pagesAlphabetical Index of The Laws of BotswanaShumba Mutumwa100% (1)

- Air Botswana (Transition)Document3 pagesAir Botswana (Transition)Shumba MutumwaNo ratings yet

- Administrative Districts: Arrangement of Sections Section 1. Short Title 2. Administrative DistrictsDocument1 pageAdministrative Districts: Arrangement of Sections Section 1. Short Title 2. Administrative DistrictsShumba MutumwaNo ratings yet

- Applied Laws (Continuation)Document1 pageApplied Laws (Continuation)Shumba MutumwaNo ratings yet

- Act No. Date of Publication Date of CommencementDocument1 pageAct No. Date of Publication Date of CommencementShumba MutumwaNo ratings yet

- Agricultural Charges: Arrangement of SectionsDocument9 pagesAgricultural Charges: Arrangement of SectionsShumba MutumwaNo ratings yet

- Alphabetical Index of Subsidiary LegislationDocument48 pagesAlphabetical Index of Subsidiary LegislationShumba MutumwaNo ratings yet

- Appeal Tribunal (Supplementary Provisions) ActDocument1 pageAppeal Tribunal (Supplementary Provisions) ActShumba MutumwaNo ratings yet

- E F Rev 114 BEAMDocument1 pageE F Rev 114 BEAMShumba MutumwaNo ratings yet

- FB11Document2 pagesFB11Shumba MutumwaNo ratings yet

- LASER Human Resource PlanningDocument3 pagesLASER Human Resource PlanningShumba MutumwaNo ratings yet