Income Tax in Australia

Income Tax in Australia

Uploaded by

Riva BhattaraiCopyright:

Available Formats

Income Tax in Australia

Income Tax in Australia

Uploaded by

Riva BhattaraiOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Income Tax in Australia

Income Tax in Australia

Uploaded by

Riva BhattaraiCopyright:

Available Formats

Income tax in Australia

Income tax in Australia is the most important revenue

stream within the Australian taxation system. Income

tax is levied upon three sources of income for individual

taxpayers: personal earnings (such as salary and wages),

business income and capital gains. Collectively these three

sources of income tax account for 67% of federal government revenue and 55% of total revenue across the three

tiers of government.

or nancial institution with a TFN, in the absence of this

number, employers are required to withhold tax at the

rate of 49% (the highest marginal rate plus Medicare

levy) from the rst dollar. Likewise, banks must also

withhold the highest marginal rate of income tax on interest earned on bank accounts if the individual does not

provide their TFN to the bank. In the same way, corporate and business taxpayers are required to provide their

Income received by individuals is taxed at progressive TFN or Australian Business Number (ABN) to the bank,

rates, while income derived by companies is taxed at a otherwise the bank will be required to withhold income

at rate of 30%. Generally, capital gains are only sub- tax at the highest rate of tax.

ject to tax at the time the gain is realised. Income tax is

collected by the Australian Taxation Oce on belhalf of

2.1 Individual income tax rates (residents)

The Commissioner of Taxation.

In Australia the nancial year runs from 1 July to 30 June

of the following year. Income tax is applied to the taxable

income of a taxable entity. Taxable income is calculated,

in a broad sense, by applying allowable deductions against

the assessable income of a taxable entity.

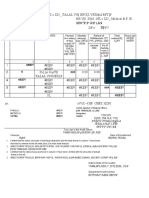

Financial year 2012-13, 201314, 2014-15[4]

The above rates do not include the Medicare levy of 1.5%

(Medicare after July 1, 2014 is paid at 2%)

Financial years 2010-11, 2011-12[5]

The above rates do not include the Medicare levy of

1.5%. For previous tax years, see individual income tax

rates for prior years.

History

Queensland introduced income tax in 1902 by the Income

Tax Act of 1902.[1]

2.2 2011-12 Flood Levy

Federal income tax was rst introduced in 1915, in order to help fund Australias war eort in the First World Due to the 20102011 Queensland oods an additional

levy was established for the nancial year 2011War.[2] Between 1915 and 1942, income taxes were ood

[6]

[2]

12.

levied at both the state and federal level.

2.3 Low Income Tax Oset

Personal Income Tax

The Low Income Tax Oset (LITO) is a tax rebate for individuals on lower incomes. From 1 July 2010 it provides

individuals earning less than $30,000 with a tax rebate of

$445. The full oset is reduced by 1.5c for every dollar of

taxable income above $37,000, meaning incomes greater

than $66,647 do not receive any benet.[7] The LITO creates an eective tax-free threshold of $16,000 for low income earners. For the 2011-2012 tax year, 70% of the

LITO entitlement is received as reduced withholding tax,

the balance is received when a tax return is lodged.

Income tax on personal income is a progressive tax. The

current tax-free threshold is $18,200, and the highest

marginal rate for individuals is 47%. In addition, most

Australians are liable to pay the Medicare levy, of which

the standard is 2% of taxable income.[3] On 10 July 2011,

the Gillard Government announced that it would increase

the tax-free threshold to $18,200 on 1 July 2012 as part

of the Clean Energy Future package, while reducing the

Low Income Tax Oset to $300.

As with many other countries, income tax is withheld

from wages and salaries in Australia, often resulting in

refunds payable to taxpayers. A nine-digit tax le num- 2.4 Income tax for Minors

ber (TFN) must be quoted to employers for employees to

have withholdings calculated using the various tax brack- Individuals under 18 years of age are taxed dierently

ets. While it is not an oence to fail to provide a bank from adults.[8]

1

6 FAMILY TAX BENEFIT

Combined with the $445 LITO (see above), children can

earn up to $3,333?? per year tax-free, and are not required to lodge tax returns for this amount. Eective 1

July 2011 the LITO applies only to salaried income but

not to investment income for minors. Some children and

some incomes are not aected by the children income

rates and receive the normal rate. Such as full-time/parttime employment income.

2.5

Collection

Income tax is collected by means of a withholding tax

system known as Pay-as-you-go (PAYG). For employees

with only a single job, the level of taxation at the end of

the year is close to the amount due, before deductions

are applied. Discrepancies and deduction amounts are

declared in the annual income tax return and will be part

of the refund which follows after annual assessment, or

alternatively reduce the taxation debt that may be payable

after assessment.[9]

where an indexed cost base applies (where an asset was

acquired before indexation ceased) applying the old indexation rules gives a better tax result. Capital gains realised by companies are not discounted. Capital gains

made by trust structures are usually taxed as if they were

made in the hands of the ultimate beneciary, though

there are exceptions.

The disposal of assets which have been held since before 20 September 1985 (pre-CGT assets) is exempt from

CGT.

5 Payroll Tax

State governments in Australia levy a payroll tax on the

wages outlay of employers. Typically the tax applies to

all wages above a threshold. Groups of companies may

be taxed as a single entity where their operations are signicantly integrated or related.

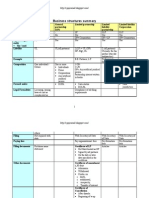

Current Payroll Tax Rates and Thresholds[10]

Queensland and the Northern Territory payroll tax rates

are eective rates on payrolls above $5.5 million and

$5.75 million respectively. All other jurisdictions levy

The company tax rate is a at 30%, though through marginal rates. Some companies are eligible for deducthe dividend imputation system Australian residents only tions, concessions and exemptions.

pay this company income tax once as shareholders of

the company on the prots distributed as dividends by

Australian-resident corporations. Double taxation relief 6 Family Tax Benet

on resident owners of resident corporations is common

in other countries. When an Australian corporation pays

For families with dependent children the income tax syscorporate income tax, franking credits are generated and

tem includes a supplementary set of rules known as Famcan then be applied to dividend payments at a maximum

ily Tax Benets (FTB) that are applied in a more comrate of 30 cents per dollar of dividend. Shareholders may

plex way by dierent departments. The benets and

then use these credits to oset their own personal income

thresholds vary depending on the number of children,

tax payable, including claiming a refund for excess credits

and which of the married partners earns the additional

left over after osetting all payable income tax.

income.

Company Tax

There are two parts, FTB-A and FTB-B.

Capital Gains Tax

Capital gains tax in Australia is part of the income tax

system rather than a separate tax. Net capital gains (after

concessions are applied) are included in a taxpayers taxable income and taxed at marginal rates. Capital Gains

applies to Individuals, Companies and any other entity

which can legally own an asset. Trusts usually pass on

their CGT (Capital Gains Tax) liability to their beneciaries. Partners are taxed separately on the CGT made

by partnerships.

In 1999 indexation on capital gains ceased and subsequently gains on assets held for more than one year are

usually reduced by a discount of 50% for individuals,

and 33% for superannuation funds. Due to ination, a

capital gains tax can be due even when no gain in purchasing power was achieved. However, in some cases

For FTB-A each family receives a payment for each child.

In 2008/9 this was

These payments are reduced by 20% for total family income over $42,559 ($45,114 for 2010/11). It plateaus

at roughly $1,300 per child until income over $94,000 is

reached, at which point it is reduced by 30%.

FTB-B pays about $3,358 if the youngest child is under 5,

$2,339 if 5..15. Only one payment for the youngest child

is made. The payment is means tested on the income of

the parent with the lower income, reducing by 20% for

income over $4,526 ($4,745 for 2010/11).

Income is calculated more strictly for FTB purposes. For

example, investment losses are considered to be income

for the purpose of FTB, and salary sacrice superannuation contributions are also counted as income.

There are other benets related to this, for example the

8.2

Residence

2009 stimulus package included payments to those who business activity. An activity which is not a business acreceived FTB-B.

tivity is more likely to be a hobby and income is not taxThe full system is more complex, and some information able. Other examples of business activities include illecan be found on the websites of the Australian Tax Oce, gal activities such as burglary, smuggling and illegal drug

dealing and income from these activities is taxable.

Centrelink, and the Family Assistance Oce.

Other forms of ordinary income include 'adventure or

concern in the nature of trade', which is a single activity that is not part of a taxpayers normal income earning

activities however may be considered a business in itself.

These can include generating a prot from a prot making scheme,[22] and prot earned from activities that go

beyond the mere realisation of an asset in an enterpris7 Eective Marginal Tax Rates

ing manner. Income from investment or property is also

classied as ordinary income and can include: rent from

Because reductions of means tested benets are additive, a lease, interest on a loan, dividends and royalties

they can lead to a very high eective marginal tax rate of When assessing the amount of ordinary income, only the

tax. For example, a person with children earning $95,000 prots are counted based on a notional basis.

would be taxed at a marginal rate of 39% including medicare, and lose 30c per extra dollar earned from the FTB-A

benet, an eective marginal tax rate of 69%. [17]

Contrary to the FTBs name, as from 1 July 2009 it

will not be possible to claim FTB payments through

the taxation system.[16] All payments will be handled by

Centrelink.

If other means tested allowances are payable (e.g. child 8.2 Residence

care benets, superannuation co-contribution, payments

for a disability etc.) then the eective rate can be over

Residents of Australia for income tax purposes are sub100%.[18]

ject to income tax on income from all sources,[23] whereas

The means testing reects a policy of targeting welfare to non-residents for income tax purposes are only subject to

people in need. However, some argue that this creates a income tax in Australia on their income from Australian

work disincentive for middle-class families.[19] Further, sources.

Australias means-tested tax and spending programs are

There are four tests to determine whether an individual is

extraordinarily complex.[20]

a resident for income tax purposes. An individual can be

classied as a resident for taxation purposes if they are

making contributions to a Commonwealth superannua8 Legal Framework

tion fund, in Australia for more than half the year, have

their domicile or permanent place of abode in Australia

Income tax is payable on assessable income, which falls or nally if they dwell permanently or for a considerable

under two broad categories: ordinary income (Income time in Australia.

Tax Assessment Act 1997 (Cth) s 6-5)(ITAA97) and A company will be considered an Australian resident for

statutory income. (cite references)

taxation purposes if it falls under any of the following

three criteria: incorporated in Australia, carries on business in Australia and central management and control is

8.1 Ordinary Income

in Australia or carries on business in Australian and it is

controlled by Australian resident shareholders.

Ordinary income requires a benet in money or moneys

There are other issues when considering residence in reworth. This can include for example the reduction in an

lation to the source of income. Personal exertion income

existing liability. There must be a nexus with an income

is derived where the services are performed and for a

earning activity, such as income from personal exertion,

prot making activity income is where the contract is perfrom a prot making activity or from investment or propformed. Property income is derived where the property

erty. In addition receipts that are of a capital nature, volis located, interest income where the money is lent and

untary income and gifts are not classied as ordinary individend income where the paying company is located.

come.

Normal or ordinary proceeds from a business activity are

classied as ordinary income. A business includes any

profession, trade, employment, vocation or calling, but

does not include occupation as an employee.[21] Activities of a commercial nature that are carried on regularly

and in an organised, systematic way, on a large scale or

with view to prot will generally be considered to be a

9 See also

Constitutional basis of taxation in Australia

10

11

References

[1] Income Tax Act of 1902 (2 Edw VII, No 10)". Queensland Historical Acts. Australasian Legal Information Institute. Retrieved 22 March 2014.

[2] A brief history of Australias tax system Department of

the Treasury

[3] What is the Medicare levy?". Medicare levy essentials.

ATO. 30 June 2008. Retrieved 2009-03-09.

[4] Individual income tax rates. Rates and calculators.

ATO. 1 July 2014. Retrieved 2015-02-18.

[5] Individual income tax rates. Rates and calculators.

ATO. 5 July 2010. Retrieved 2011-07-08.

[6] Flood levy information for individuals. Rates and calculators. ATO. 28 June 2011. Retrieved 2011-07-08.

[7] Household Assistance Package - tax reforms: Lowincome tax oset. Australia Taxation Oce. Retrieved

on 15 September 2012.

[8] Income of individuals under the age of 18. Australian

Taxation Oce. Retrieved on 15 September 2012.

[9] Australian Taxation Oce website on PAYG withholding

[10] 2012-13 Overview of State Taxes. Western Australia

Department of Treasury. Retrieved 2013-05-21.

[11] Rates and thresholds. Payroll tax. NSW Government

Oce of State Revenue. Retrieved 2009-07-23.

[12] Payroll Tax in Queensland. Payroll Tax. QLD Government Oce of State Revenue. Retrieved 2012-08-31.

[13] General Information fact sheet (PDF). Pay-roll Tax

Forms and Brochures. Government of Western Australia

Department of Treasury and Finance. Retrieved 201505-15.

[14] Rates and thresholds. Retrieved 2011-04-23.

[15]

[16] Australian Government, Family Assistance Oce, How

you can get paid

[17] Based on gures from earlier sections in this article.

[18] Andrew, Brian 2007. The contribution of eective

marginal tax rates to work disincentives.

[19] Dockery, et. al. 2006 Welfare reform, housing assistance

and eective marginal tax rates

[20] AMP. Trends in eective marginal tax rates 1996-97 to

2006-07

[21] Income Tax Assessment Act 1997 (Cth) s 995-1. Commonwealth Consolidated Acts. Retrieved on 15 September 2012.

[22] Income Tax Assessment Act 1997 (Cth) s 15-15. Commonwealth Consolidated Acts. Retrieved on 15 September 2012.

[23] Income Tax Assessment Act 1997 (Cth) s 6-5(2). Commonwealth Consolidated Acts. Retrieved on 15 September 2012.

EXTERNAL LINKS

11 External links

Australian Income Tax Calculator (mobile compatible)

Australian Personal Income Tax Calculator

12

12.1

Text and image sources, contributors, and licenses

Text

Income tax in Australia Source: https://en.wikipedia.org/wiki/Income_tax_in_Australia?oldid=673421142 Contributors: JackofOz, JerryFriedman, Terjepetersen, Graeme Bartlett, Horatio, Neutrality, Icd, Shiftchange, Reinthal, Smalljim, Cmdrjameson, Gary, Mo0, John

Quiggin, CJ, Kirkbroadhurst, Noetica, Matilda, Rjwilmsi, JAW, Morphh, Kerry Raymond, Arthur Rubin, Fram, Mb99, SmackBot, Monkeyblue, Ashill, Rrius, Hew~enwiki, Kevin Ryde, Darren Wickham, Squilibob, MichaelBillington, Dl2000, Argon233, J-wonder, Surturz,

Member N, Harish victory, Josef K, Mchaer, STBot, Glennobrien, Asterix.wins, Spathaky, Psydexzerity, Squids and Chips, IAmTheCoinMan, Sintaku, Yintan, Mangostar, Tuntable, ConsumerClone, Wprlh, Robchez, Abyard, Mhockey, Sbabones, Mitch Ames, Funkywinders,

Addbot, Raymond88824, Habanero-tan, ScottoJames, LilHelpa, PuppyOnTheRadio, Widetree45, Hunarian, EmausBot, Dewritech, K6ka,

Aeonx, H3llBot, ClueBot NG, BG19bot, Carlytebbet, Louey37, Khazar2, Rekowo, Majorcache, ElliePan and Anonymous: 117

12.2

Images

File:Flag_of_Australia.svg Source: https://upload.wikimedia.org/wikipedia/en/b/b9/Flag_of_Australia.svg License: Public domain Contributors: ? Original artist: ?

File:Wiki_letter_w_cropped.svg Source: https://upload.wikimedia.org/wikipedia/commons/1/1c/Wiki_letter_w_cropped.svg License:

CC-BY-SA-3.0 Contributors:

Wiki_letter_w.svg Original artist: Wiki_letter_w.svg: Jarkko Piiroinen

12.3

Content license

Creative Commons Attribution-Share Alike 3.0

You might also like

- Bilant Lb. Engleza ModelDocument5 pagesBilant Lb. Engleza ModelklarckkentNo ratings yet

- Unswl036 297x210 Law Juris Doctor Guide 2018 Web SpreadDocument23 pagesUnswl036 297x210 Law Juris Doctor Guide 2018 Web SpreadblairzhangNo ratings yet

- The Compliance Guide To Financial PromotionsDocument10 pagesThe Compliance Guide To Financial PromotionsWH100% (1)

- The A To Z of Employment PracticeDocument714 pagesThe A To Z of Employment PracticengamoloNo ratings yet

- The Exponential Law FirmDocument9 pagesThe Exponential Law FirmRyan McCleadNo ratings yet

- Taxation Chapter 5 - 8Document117 pagesTaxation Chapter 5 - 8Hồng Hạnh NguyễnNo ratings yet

- Taxation in AustraliaDocument1,181 pagesTaxation in AustraliaTimore Francis0% (1)

- Company Law TextbookDocument921 pagesCompany Law Textbookzacharyswartz26No ratings yet

- Sage Pastel Accounting Payroll and HR Tax Guide For 2013/2014Document52 pagesSage Pastel Accounting Payroll and HR Tax Guide For 2013/2014Patty PetersonNo ratings yet

- Property Studies Postgrad Real Estate June 2016Document20 pagesProperty Studies Postgrad Real Estate June 2016takuva03No ratings yet

- MAC2602 001 2018 4 B PDFDocument248 pagesMAC2602 001 2018 4 B PDFVusi Mazibuko0% (1)

- PastelDocument56 pagesPastelCindy Macpherson0% (1)

- Ipaper For Book NID#41987Document443 pagesIpaper For Book NID#41987bfelix100% (1)

- LU19 - Tax Administration ActDocument25 pagesLU19 - Tax Administration ActVincent Mutumwa8oo9wooNo ratings yet

- Tax Policy ConceptsDocument17 pagesTax Policy Conceptseriazalikiharata100% (1)

- Business Structures SummaryDocument5 pagesBusiness Structures SummaryMrudula V.100% (2)

- Tax Administration 2021 OecdDocument355 pagesTax Administration 2021 OecdscorpioboyNo ratings yet

- Corporate Governance PresentationDocument146 pagesCorporate Governance PresentationCompliance CRG100% (1)

- 2012 Financial Services Fact BookDocument259 pages2012 Financial Services Fact BookThe Partnership for a Secure Financial Future100% (3)

- SA Income Tax Guide - UnknownDocument723 pagesSA Income Tax Guide - UnknownElias KehayiasNo ratings yet

- 2011 Sydney Law School Postgraduate GuideDocument144 pages2011 Sydney Law School Postgraduate GuideShamir GuptaNo ratings yet

- Companies Act 71 of 2008Document197 pagesCompanies Act 71 of 2008whkhumalo100% (1)

- Internet Entrepreneurship Survival GuideDocument29 pagesInternet Entrepreneurship Survival GuideboyhermesNo ratings yet

- CV Review Top CVDocument4 pagesCV Review Top CVIlyas HabibiNo ratings yet

- Beginners Guide To Power BiDocument80 pagesBeginners Guide To Power BishailenderojhaNo ratings yet

- Canadian Investment Tax BookletDocument29 pagesCanadian Investment Tax BookletNeel Roberts100% (2)

- Sources of Law in Australia Lecture Slides - Revised On February 24Document23 pagesSources of Law in Australia Lecture Slides - Revised On February 24尹米勒No ratings yet

- What Next?: Making Smarter Career ChoicesDocument0 pagesWhat Next?: Making Smarter Career Choicesmoisescu.raduNo ratings yet

- Understanding Investments Theories and StrategiesDocument76 pagesUnderstanding Investments Theories and StrategiesFinancial WisdomNo ratings yet

- WW Corporate Tax Guide 2005Document1,108 pagesWW Corporate Tax Guide 2005LFNo ratings yet

- Canadian Personal Tax ChecklistDocument4 pagesCanadian Personal Tax ChecklistNeel RobertsNo ratings yet

- Guide To Save Tax in UKDocument8 pagesGuide To Save Tax in UKCyrus KhanNo ratings yet

- Accounting For Non AccountantsDocument66 pagesAccounting For Non Accountantsআম্লান দত্ত100% (2)

- Careers in Financial Markets 2010-2011 PDFDocument100 pagesCareers in Financial Markets 2010-2011 PDFtrop41No ratings yet

- Personal Exemptions: UK: Income Tax ExemptionsDocument4 pagesPersonal Exemptions: UK: Income Tax ExemptionsLuiza ŢîmbaliucNo ratings yet

- Elements of Corporate TaxationDocument4 pagesElements of Corporate Taxationreggie1010No ratings yet

- Ncome Tax: Business StructuresDocument51 pagesNcome Tax: Business StructuresGab VillahermosaNo ratings yet

- Running Head: INCOME TAXDocument9 pagesRunning Head: INCOME TAXKashif MalikNo ratings yet

- CTP 3 UnitsDocument53 pagesCTP 3 Unitsjdivyadharshini131202No ratings yet

- Estate Tax After The Fiscal Cliff: Collaborative Financial Solutions, LLCDocument4 pagesEstate Tax After The Fiscal Cliff: Collaborative Financial Solutions, LLCJanet BarrNo ratings yet

- Name: Course: Prepared By: Dr. Jessie N. DiazDocument11 pagesName: Course: Prepared By: Dr. Jessie N. DiazPrince Isaiah JacobNo ratings yet

- TaxationDocument2 pagesTaxationIanNo ratings yet

- Income Taxation in The PhilippinesDocument4 pagesIncome Taxation in The PhilippinesjenxxacadsNo ratings yet

- Corporate Income Taxes and Tax RatesDocument38 pagesCorporate Income Taxes and Tax RatesShaheen ShahNo ratings yet

- X 70 15 PDFDocument32 pagesX 70 15 PDFkunalwarwickNo ratings yet

- Withholding TaxDocument4 pagesWithholding TaxTudor KingNo ratings yet

- What Is IncomeDocument6 pagesWhat Is Incomejustine joi WrightNo ratings yet

- Summary of Thailand-Tax-Guide and LawsDocument34 pagesSummary of Thailand-Tax-Guide and LawsPranav BhatNo ratings yet

- Unit 2Document5 pagesUnit 2piyush.birru25No ratings yet

- Unit 1Document5 pagesUnit 1piyush.birru25No ratings yet

- Tax System: BY Arpita Pali Prachi Jaiswal Mansi MahaleDocument30 pagesTax System: BY Arpita Pali Prachi Jaiswal Mansi MahaleSiddharth SharmaNo ratings yet

- Module 4 - Income TaxationDocument6 pagesModule 4 - Income TaxationLumbay, Jolly MaeNo ratings yet

- Vaishnavi ProjectDocument72 pagesVaishnavi ProjectAkshada DhapareNo ratings yet

- What Type of Information Is Necessary To Complete A Tax ReturnDocument4 pagesWhat Type of Information Is Necessary To Complete A Tax ReturnDianna RabadonNo ratings yet

- DocumentDocument1 pageDocumentjoeyrosario817No ratings yet

- Lecture 1 - Introduction To Income TaxDocument27 pagesLecture 1 - Introduction To Income TaxMimi kupiNo ratings yet

- module 1 Overview of Income tax lawDocument10 pagesmodule 1 Overview of Income tax lawsabirmessi1019No ratings yet

- CHAPTERDocument20 pagesCHAPTERsanchitNo ratings yet

- Presentation1 TaxDocument27 pagesPresentation1 Taxzerubabel abebeNo ratings yet

- International Tax EnvironmentDocument14 pagesInternational Tax EnvironmentAnonymous VstguMKrb50% (2)

- G.R. Nos. 206079-80Document63 pagesG.R. Nos. 206079-80Jericho CapitoNo ratings yet

- This Study Resource Was: Lecture Handout For Chapter 12Document6 pagesThis Study Resource Was: Lecture Handout For Chapter 12rifa hanaNo ratings yet

- OD119393245620383000Document1 pageOD119393245620383000cpkaseraNo ratings yet

- Income From Capital GainDocument13 pagesIncome From Capital GainDeepak Patil100% (1)

- Instant Download Payroll Accounting 2019 29th Edition Bernard J. Bieg PDF All ChapterDocument84 pagesInstant Download Payroll Accounting 2019 29th Edition Bernard J. Bieg PDF All Chapterzhorekissou70100% (1)

- Lease Contract Against CODDocument2 pagesLease Contract Against CODAntonieto BNo ratings yet

- ch2 Version1-2Document59 pagesch2 Version1-2yea okayNo ratings yet

- Tax Ch02Document10 pagesTax Ch02GabriellaNo ratings yet

- IndividualDocument14 pagesIndividualKenneth Bryan Tegerero TegioNo ratings yet

- 10 Personal Financial Plan Template-1Document2 pages10 Personal Financial Plan Template-1Emirish PNo ratings yet

- PremiumPaidStatement 2022-2023 LicDocument1 pagePremiumPaidStatement 2022-2023 LicHemant BhoriaNo ratings yet

- Destruction FormDocument2 pagesDestruction FormHanabishi RekkaNo ratings yet

- Goods and Services Tax: Introduction To Excel Based Template For Data Upload in Java Offline ToolDocument28 pagesGoods and Services Tax: Introduction To Excel Based Template For Data Upload in Java Offline ToolBharath NaniNo ratings yet

- Fesco Online BillDocument2 pagesFesco Online BillWaqar AkramNo ratings yet

- Power Bank of Empire City 15th PAYROLL: For The Period ofDocument3 pagesPower Bank of Empire City 15th PAYROLL: For The Period ofGas dela RosaNo ratings yet

- NJ Seller's Residencey CertificateDocument2 pagesNJ Seller's Residencey CertificateAndrew LiputNo ratings yet

- Sales 32 2023 24Document1 pageSales 32 2023 24Bharat AutomobileNo ratings yet

- Eastern Telecommunications Philippines v. CIRDocument1 pageEastern Telecommunications Philippines v. CIRMarcella Maria KaraanNo ratings yet

- Invoice E2018226816Document3 pagesInvoice E2018226816amjadbonusNo ratings yet

- Pan Card India: Guidelines and InstructionsDocument5 pagesPan Card India: Guidelines and InstructionsMayank SardanaNo ratings yet

- DR - Bharucha Pay Bill May-11Document22 pagesDR - Bharucha Pay Bill May-11Nayan BharuchaNo ratings yet

- CIR Vs Citytrust Investment Phil IncDocument14 pagesCIR Vs Citytrust Investment Phil IncLea AndreleiNo ratings yet

- Full JKSC Online DT Summary Nov 20Document172 pagesFull JKSC Online DT Summary Nov 20Shubham ManikpuriNo ratings yet

- Ea 14Document4 pagesEa 14Nicole BatoyNo ratings yet

- GST Return FilingDocument9 pagesGST Return FilingSanthosh K SNo ratings yet

- Frances Leah Sapla - OKDocument3 pagesFrances Leah Sapla - OKKelvin Jay Sebastian SaplaNo ratings yet

- Tax Planning & ManagementDocument7 pagesTax Planning & Managementoffer manNo ratings yet

- TAXATION 2 Chapter 8 Percentage Tax PDFDocument4 pagesTAXATION 2 Chapter 8 Percentage Tax PDFKim Cristian MaañoNo ratings yet

- SLSP Presentation BIRDocument52 pagesSLSP Presentation BIRprecy.calusaNo ratings yet