07-17-2015

07-17-2015

Uploaded by

Gabriel AlmeidaCopyright:

Available Formats

07-17-2015

07-17-2015

Uploaded by

Gabriel AlmeidaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

07-17-2015

07-17-2015

Uploaded by

Gabriel AlmeidaCopyright:

Available Formats

010/R1/04F014

Citibank Client Services

014

PO Box 769013

San Antonio, TX 78245-9013

000

CITIBANK, N. A.

Account

134704875

Statement Period

Jun 22 - Jul 19, 2015

GABRIEL ALEJANDRO ALMEIDA BAROJA

59 E VAN BUREN ST

CHICAGO IL

60605-1230

Page 1 of 3

COLLEGE STUDENT ACCOUNT AS OF JULY 19, 2015

Checking

Regular Checking

Balance

$1,232.74

Effective October 2, 2015, the Citibank service called "Quicken" will no longer be

available, or offered, through Citibank. This impacts and discontinues the following

Citibank services through Quicken for online bill payments, online account transfers, and

automated downloads. This does not affect any transactions done directly through

Citibank or Citibank Online.

SUGGESTIONS AND RECOMMENDATIONS

Citibank's Privacy Notice is now available to view. On the Download Recent Statement page, select the Legal and

Marketing Notices link for your most recent statement, then select the Legal Notice link to view the Privacy Notice.

COLLEGE STUDENT ACCOUNT RATES AND CHARGES

.

.

Citibank gives you the benefit of lower charges and better rates as you maintain higher balance levels.

When determining your rates and charges for this statement period, Citibank considered your average

balances during the month of June in all of your qualifying accounts that you asked us to combine. These

balances may be in accounts that are reported on other statements.

Rates and Charges

Rates

Monthly Service Charge

Your Combined Balance Range

$0-$1,499

Standard

None

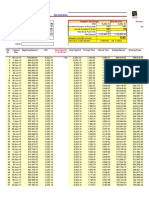

CHECKING ACTIVITY

Regular Checking

134704875

Beginning Balance:

Ending Balance:

Date Description

06/24 Payment CITI CARDS

010008 DA

07/16 Debit PIN Purchase 07/15 11:46p #8093

Ventra 221 North LaSallChicago

Total Subtracted/Added

Balance

580.74

575.74

700.00

33.00

ILUS00141

07/17 Debit PIN Purchase 10:16a #8093

Ventra 221 North LaSallChicago

Amount Added

ILUS00141

07/17 Deposit Teller

07/17 Debit PIN Purchase 10:04p #8093

Ventra 221 North LaSallChicago

Amount Subtracted

7.25

5.00

$587.99

$1,232.74

10.00

1,232.74

ILUS00141

55.25

700.00

GABRIEL ALEJANDRO ALMEIDA BAROJA

010/R1/04F014

Page 2 of 3

Account 134704875

Statement Period - Jun 22 - Jul 19, 2015

CHECKING ACTIVITY

Continued

All transaction times and dates reflected are based on Eastern Time.

CUSTOMER SERVICE INFORMATION

IF YOU HAVE QUESTIONS ON:

YOU CAN CALL:

YOU CAN WRITE:

Checking

800-274-6660

(For speech and hearing

impaired customers only

TDD: 800-945-0258)

Citibank Client Services

100 Citibank Drive

San Antonio, TX 78245-9966

Please read the paragraphs below for important information on your accounts with us. Note that some of these products may not be available in all states or in all

packages.

CHECKING AND SAVINGS

FDIC Insurance:

Products reported in CHECKING and SAVINGS are insured by the Federal Deposit Insurance Corporation. Please consult your Citibank Customer Manual for full details and

limitations of FDIC coverage.

CERTIFICATES OF DEPOSIT

Certificates of Deposit (CD) information may show dashes in certain fields if on the date of your statement your new CD was not yet funded or your existing CD renewed but is

still in its grace period.

IN CASE OF ERRORS

In Case of Errors or Questions About Your Electronic Fund Transfers:

If you think your statement or record is wrong or if you need more information about a transfer on the statement or record, telephone us or write to us at the address shown in

the Customer Service Information section on your statement as soon as possible. We must hear from you no later than 60 days after we sent you the first statement on which

the error or problem appeared. You are entitled to remedies for error resolution for an electronic fund transfer in accordance with the Electronic Fund Transfer Act and federal

Regulation E or in accordance with laws of the state where your account is located as may be applicable. See your Client Manual for details.

Give us the following information: (1) your name and account number, (2) the dollar amount of the suspected error, (3) describe the error or the transfer you are unsure

about and explain as clearly as you can why you believe there is an error or why you need more information. We will investigate your complaint and will correct any error

promptly. If we take more than 10 business days to do this we will recredit your account for the amount you think is in error, so that you will have use of the money during the

time it takes us to complete our investigation.

The following special procedures apply to errors or questions about international wire transfers or international Citibank Global Transfers to a recipient located in

a foreign country on or after October 28, 2013: Telephone us or write to us at the address shown in the Customer Service Information section on your statement as soon as

possible. We must hear from you within 180 days of the date we indicated to you that the funds would be made available to the recipient of that transfer. At the time you contact

us, we may ask for the following information: 1) your name, address and account number; 2) the name of the person receiving the funds, and if you know it, his or her telephone

number and/or address; 3) the dollar amount of the transfer; 4) the reference code for the transfer; and 5) a description of the error or why you need additional information. We

may also ask you to select a choice of remedy (credit to your account in an amount necessary to resolve the error or alternatively, a resend of the transfer in an amount

necessary to resolve the error for those cases where bank error is found). We will determine whether an error has occurred within 90 days after you contact us. If we determine

that an error has occurred, we will promptly correct that error in accordance with the error resolution procedures under the Electronic Fund Transfer Act and federal Regulation

E or in accordance with the laws of the state where your account is located as may be applicable. See your Client Manual for details.

Citibank is an Equal Housing Lender.

2015 Citigroup Inc. Citibank, N.A. Member FDIC.

Citibank with Arc Design, Checking Plus, MasterCard, Visa, Citibank Preferred Visa and MasterCard, Citibank Platinum Select, Citigold, CitiPhone Banking and Ready Credit

are registered service marks of Citigroup, Inc.

GABRIEL ALEJANDRO ALMEIDA BAROJA

010/R1/04F014

Page 3 of 3

Account 134704875

Statement Period - Jun 22 - Jul 19, 2015

TO RECONCILE YOUR CHECKBOOK WITH THIS STATEMENT, FOLLOW THESE SIMPLE RULES

1. List in your checkbook any deposits, withdrawals and service charges which are shown on

your statement, but not recorded in your checkbook. Adjust your checkbook accordingly.

Checks and Other Withdrawals Outstanding

(Made by you but not yet indicated as paid on your statement)

Number or Date

Amount

2. Mark off in your checkbook all checks paid, withdrawals, or deposits listed on your statement.

3. List and total in the "Checks and Other Withdrawals Outstanding" column at the right all

issued checks that have not been paid by Citibank together with any applicable check charges

and all withdrawals made from your account since your last statement.

4. Deduct from your checkbook balance any service or other charge (including pre-authorized

transfers or automatic deductions) that you have not already deducted.

5. Add to your checkbook balance any interest-earned deposit shown on this statement.

6. Record Closing Balance here (as shown on statement).

7. Add deposits or transfers you recorded which are not shown

on this statement.

8. Total (6 and 7 above).

9. Enter Total "Checks and Other Withdrawals Outstanding"(from right).

BALANCE

Sum of check charges

on or above if applicable

(8 less 9 should equal your checkbook balance).

Total

You might also like

- Bank Statement 4Document4 pagesBank Statement 4Jardan Nelli89% (9)

- Chase Auto TemplateDocument4 pagesChase Auto TemplateHillarie Meenach0% (1)

- Asterisk-Free Checking AccountDocument2 pagesAsterisk-Free Checking AccountViktoria Denisenko100% (1)

- Your Business Advantage Fundamentals™ Banking: Account SummaryDocument6 pagesYour Business Advantage Fundamentals™ Banking: Account SummaryH.I.M Dr. Lawiy ZodokNo ratings yet

- Michael March StatmentDocument11 pagesMichael March StatmentMucho Facerape100% (1)

- Statement 1Document4 pagesStatement 1donaldlinkous100% (1)

- Paperless StatementsDocument4 pagesPaperless StatementsAlamin009No ratings yet

- Veridian Statement of Account-7Document4 pagesVeridian Statement of Account-7Kim TranNo ratings yet

- Here's Your January 2022 Bank Statement.: Jared Liebers Unit 213 535 Magnolia Ave Long Beach CA 90802Document7 pagesHere's Your January 2022 Bank Statement.: Jared Liebers Unit 213 535 Magnolia Ave Long Beach CA 90802j cokNo ratings yet

- Estmt - 2022 08 18Document4 pagesEstmt - 2022 08 18CHRIS100% (1)

- Your Airbnb ReceiptDocument1 pageYour Airbnb ReceiptAnurag Kumar ReloadedNo ratings yet

- March 2020 PDFDocument6 pagesMarch 2020 PDFJonathan Seagull LivingstonNo ratings yet

- TD Simple Checking: Account SummaryDocument2 pagesTD Simple Checking: Account SummaryMD MasumNo ratings yet

- Gold Business Services Package: Your Business and Wells FargoDocument5 pagesGold Business Services Package: Your Business and Wells FargoM A Khan100% (1)

- Your Business Advantage Checking Bus Platinum Privileges: Account SummaryDocument1 pageYour Business Advantage Checking Bus Platinum Privileges: Account SummaryN NNo ratings yet

- 000 Citibank Client Services 040 PO Box 6201 Sioux Falls, SD 57117-6201 Citibank, N. ADocument4 pages000 Citibank Client Services 040 PO Box 6201 Sioux Falls, SD 57117-6201 Citibank, N. AMónica M. RodríguezNo ratings yet

- Statement Period: Primary Savings (ID 00)Document5 pagesStatement Period: Primary Savings (ID 00)Mark Williams100% (1)

- Amex STMTDocument1 pageAmex STMTMark GalantyNo ratings yet

- Member Statements-04302021Document2 pagesMember Statements-04302021bNo ratings yet

- Estatement - PDF FebDocument6 pagesEstatement - PDF FebBrian OdomNo ratings yet

- Your Adv Safebalance Banking: Account SummaryDocument4 pagesYour Adv Safebalance Banking: Account SummaryvanminNo ratings yet

- Modernity An Introduction To Modern Societies: Edited by Stuart Hall, David Held, Don Hubert, and Kenneth ThompsonDocument5 pagesModernity An Introduction To Modern Societies: Edited by Stuart Hall, David Held, Don Hubert, and Kenneth Thompson123zetu8No ratings yet

- Your Bofa Core Checking: Account SummaryDocument1 pageYour Bofa Core Checking: Account Summaryquannbui95No ratings yet

- List - 7A61-4644-A052-2DC6F490F851-listDocument4 pagesList - 7A61-4644-A052-2DC6F490F851-listKelly WellsNo ratings yet

- Aliyu STTMNTDocument2 pagesAliyu STTMNTShelvya ReeseNo ratings yet

- 000 Citibank, N. A. Citibank Client Services PO Box 769013 013 San Antonio, TX 78245-9013Document4 pages000 Citibank, N. A. Citibank Client Services PO Box 769013 013 San Antonio, TX 78245-9013giaNo ratings yet

- Rendered DDA Account Statements - 5 - 24 - 2022 - DAVID N VARGADocument6 pagesRendered DDA Account Statements - 5 - 24 - 2022 - DAVID N VARGAInvestment CompanyNo ratings yet

- Statements 9126Document6 pagesStatements 9126Liseth Ortiz50% (2)

- ListDocument6 pagesListalonsoNo ratings yet

- 000 Citibank Client Services 000 PO Box 6201 Sioux Falls, SD 57117-6201 Citibank, N. ADocument4 pages000 Citibank Client Services 000 PO Box 6201 Sioux Falls, SD 57117-6201 Citibank, N. AKeiver jimenezNo ratings yet

- Checking Summary: Jpmorgan Chase Bank N.A. Ohio/West Virginia Markets P O Box 2618 0 Baton Rouge, La 70826-0 180Document1 pageChecking Summary: Jpmorgan Chase Bank N.A. Ohio/West Virginia Markets P O Box 2618 0 Baton Rouge, La 70826-0 180Abhishek VNo ratings yet

- Account Summary Contact UsDocument2 pagesAccount Summary Contact Ustomiwande6No ratings yet

- Citibank Client Services 013 PO Box 6201 000 Sioux Falls, SD 57117-6201 Citibank, N. ADocument8 pagesCitibank Client Services 013 PO Box 6201 000 Sioux Falls, SD 57117-6201 Citibank, N. Amy nameNo ratings yet

- BBAV Bank StatementDocument1 pageBBAV Bank StatementYouns T100% (1)

- 04-10-2015 PDFDocument4 pages04-10-2015 PDFWa Riz LaiNo ratings yet

- March Statement Minimum Payment Due: $25.00 New Balance As of 03/11/21: $94.56 Payment Due Date: 04/09/21Document3 pagesMarch Statement Minimum Payment Due: $25.00 New Balance As of 03/11/21: $94.56 Payment Due Date: 04/09/21RajaNo ratings yet

- Justin Hermanson: 231 Valley Farms Street Santa Monica, CA 90403Document2 pagesJustin Hermanson: 231 Valley Farms Street Santa Monica, CA 90403Gary Joel Galva BlancoNo ratings yet

- Document PDFDocument3 pagesDocument PDFsawadogojustinNo ratings yet

- Chase DecDocument5 pagesChase DecamatobertrumNo ratings yet

- Checking: Savings: Loans:: Cheryl Ziegler 621 Thompson Ave PO BOX 2531 NYSSA, OR 97913-0531Document3 pagesChecking: Savings: Loans:: Cheryl Ziegler 621 Thompson Ave PO BOX 2531 NYSSA, OR 97913-0531Robert TinderNo ratings yet

- Statement PDFDocument6 pagesStatement PDFadam myersNo ratings yet

- Kyle L Sullivan Game Creek Video LLC 23 Executive DR HUDSON NH 03051-494499Document2 pagesKyle L Sullivan Game Creek Video LLC 23 Executive DR HUDSON NH 03051-494499Валентина Швечикова100% (1)

- RetrievedocumentDocument6 pagesRetrievedocumentDylan Tomas KastelNo ratings yet

- Chase-Ashlee James WarfieldDocument5 pagesChase-Ashlee James WarfieldANGELA WALLNo ratings yet

- Anna Brockle PDFDocument1 pageAnna Brockle PDFNoticias FarándulasNo ratings yet

- Your Adv Safebalance Banking: Account SummaryDocument4 pagesYour Adv Safebalance Banking: Account SummaryBrunaJamillyNo ratings yet

- JuneDocument10 pagesJunewinstonnelsonNo ratings yet

- Hilary Stonewall 107 N Oak ST Freemansburg Pa 18017-0000 Account 6789067948Document2 pagesHilary Stonewall 107 N Oak ST Freemansburg Pa 18017-0000 Account 6789067948Shelvya ReeseNo ratings yet

- Citi StatementDocument6 pagesCiti StatementGus GuzNo ratings yet

- Account Statement: Mr. John DoeDocument3 pagesAccount Statement: Mr. John DoesaNo ratings yet

- Checking Account Statement: Nicholas Askevin Stanley W5101 Sunset DR MERRILL, WI 54452Document7 pagesChecking Account Statement: Nicholas Askevin Stanley W5101 Sunset DR MERRILL, WI 54452sam ujuNo ratings yet

- Your Business Advantage Fundamentals™ Banking: Account SummaryDocument4 pagesYour Business Advantage Fundamentals™ Banking: Account Summarytravis_prince_2No ratings yet

- April 12, 2019Document4 pagesApril 12, 2019Jani Sham100% (1)

- 000 Citibank Client Services 013 PO Box 6201 Sioux Falls, SD 57117-6201 Citibank, N. ADocument4 pages000 Citibank Client Services 013 PO Box 6201 Sioux Falls, SD 57117-6201 Citibank, N. AS RNo ratings yet

- Antwaun Edgecombe Bank StatementDocument3 pagesAntwaun Edgecombe Bank StatementDamion HollisNo ratings yet

- 93c3 Document 3Document14 pages93c3 Document 3NONON NICOLAS100% (1)

- January 09, 2018Document6 pagesJanuary 09, 2018Monina JonesNo ratings yet

- BB&T Bank StatementDocument7 pagesBB&T Bank StatementBraeylnn bookerNo ratings yet

- Date Description Type Amount Available: Debit Account TransactionsDocument4 pagesDate Description Type Amount Available: Debit Account TransactionsPatricia100% (1)

- Estmt - 2023 06 22Document4 pagesEstmt - 2023 06 22Susan Carr100% (1)

- Methods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeFrom EverandMethods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeNo ratings yet

- B 73 C 604 C 20110218Document4 pagesB 73 C 604 C 20110218ALine QueiRozNo ratings yet

- Letter To Donald Richie: Work, Have Commissioned It of Myself, Under No Obligation of Any Sort To Please Anyone, AdheringDocument4 pagesLetter To Donald Richie: Work, Have Commissioned It of Myself, Under No Obligation of Any Sort To Please Anyone, AdheringGabriel AlmeidaNo ratings yet

- First Few Pages of A Paper About The Chicago Artist Fred CamperDocument2 pagesFirst Few Pages of A Paper About The Chicago Artist Fred CamperGabriel AlmeidaNo ratings yet

- N N'KNDocument64 pagesN N'KNGabriel AlmeidaNo ratings yet

- School of The Art Institute of Chicago Spring 2015: ARTHI3150: The Italian Renaissance James YoodDocument6 pagesSchool of The Art Institute of Chicago Spring 2015: ARTHI3150: The Italian Renaissance James YoodGabriel AlmeidaNo ratings yet

- Benjamin On Some Motifs in Baudelaire PDFDocument22 pagesBenjamin On Some Motifs in Baudelaire PDFGabriel AlmeidaNo ratings yet

- N) (PJDocument2 pagesN) (PJGabriel AlmeidaNo ratings yet

- Narrative Section of A Successful Application: InstitutionsDocument6 pagesNarrative Section of A Successful Application: InstitutionsGabriel AlmeidaNo ratings yet

- ParksDocument13 pagesParksGabriel AlmeidaNo ratings yet

- Systems Everywhere New TopographicsDocument13 pagesSystems Everywhere New TopographicsGabriel AlmeidaNo ratings yet

- Guest Folio: Albert Bertani 225 N. Columbus Drive SUITE 6808Document1 pageGuest Folio: Albert Bertani 225 N. Columbus Drive SUITE 6808Gabriel AlmeidaNo ratings yet

- Ab PsyDocument3 pagesAb PsyGabriel AlmeidaNo ratings yet

- Schedule of Stay - GabrielDocument1 pageSchedule of Stay - GabrielGabriel AlmeidaNo ratings yet

- Alexter Boys Love Meets Hong Kong Activi PDFDocument10 pagesAlexter Boys Love Meets Hong Kong Activi PDFGabriel AlmeidaNo ratings yet

- KNNKDocument300 pagesKNNKGabriel AlmeidaNo ratings yet

- Ingman Bergman and Because He Considered That in Persona HeDocument2 pagesIngman Bergman and Because He Considered That in Persona HeGabriel AlmeidaNo ratings yet

- Buchloh FactographyDocument39 pagesBuchloh FactographyMichiel HilbrinkNo ratings yet

- Flyer Kreisel Evex 910e 1.1 enDocument2 pagesFlyer Kreisel Evex 910e 1.1 enFred LamertNo ratings yet

- Oceana Gold in The Philippines: Ten Violations That Should Prompt Its RemovalDocument34 pagesOceana Gold in The Philippines: Ten Violations That Should Prompt Its RemovalVVAFilipinasNo ratings yet

- Petroleum: Made by Duttatreya Awasthi Charan SinghDocument7 pagesPetroleum: Made by Duttatreya Awasthi Charan SinghDuttatreya AwasthiNo ratings yet

- AggregatesNewsletter 5 enDocument4 pagesAggregatesNewsletter 5 enjoguitarrasNo ratings yet

- Grassroots Restoration: Holistic Management For Villages: by Sam BinghamDocument90 pagesGrassroots Restoration: Holistic Management For Villages: by Sam BinghamRajaram DasaNo ratings yet

- Guidelines For Environmentally Sound ManagementDocument36 pagesGuidelines For Environmentally Sound ManagementDharmendra kumarNo ratings yet

- JST Suffix Prefix Chart 06 01 23Document2 pagesJST Suffix Prefix Chart 06 01 23dominhdung263168No ratings yet

- Magam Exports PVT LimitedDocument28 pagesMagam Exports PVT LimitedMrunal ShirsatNo ratings yet

- HTL With Money ManagerDocument67 pagesHTL With Money Managerkishor.kokateNo ratings yet

- RMCL Bussiness PlanDocument26 pagesRMCL Bussiness Plangrath3895No ratings yet

- Nestle - Water Management Strategy - A New Competitive Advantage EFAS 2007 Peer EdererDocument28 pagesNestle - Water Management Strategy - A New Competitive Advantage EFAS 2007 Peer EdererNora ElGharbawyNo ratings yet

- China Cocoa Chocolate Sugar Confectionery Industry Profile Isic1543Document8 pagesChina Cocoa Chocolate Sugar Confectionery Industry Profile Isic1543AllChinaReports.comNo ratings yet

- Faisal KhanDocument2 pagesFaisal Khanfaisal.khan100% (3)

- Mathematical Literacy P1 Eng - x5Document20 pagesMathematical Literacy P1 Eng - x5sibandabafana59No ratings yet

- Notice: Regulatory Waiver Requests Quarterly ListingDocument22 pagesNotice: Regulatory Waiver Requests Quarterly ListingJustia.com100% (1)

- Five Major Challenges Facing The Global Consulting Industry PDFDocument6 pagesFive Major Challenges Facing The Global Consulting Industry PDFMALOUGENo ratings yet

- TechnicalDocument59 pagesTechnicalNabilah Abdul AsuiNo ratings yet

- Cma TemplateDocument25 pagesCma TemplateSavoir PenNo ratings yet

- Seal of Good Local Governance PDFDocument17 pagesSeal of Good Local Governance PDFBeverlyMatugasDagatanNo ratings yet

- DOB Response To Zoning ChallengeDocument2 pagesDOB Response To Zoning ChallengecrainsnewyorkNo ratings yet

- Final Energy and Environment-Nkh, UbdtceDocument23 pagesFinal Energy and Environment-Nkh, UbdtcekarlNo ratings yet

- Annual Learning and Development Plan HEMS 2024Document4 pagesAnnual Learning and Development Plan HEMS 2024pg.graphics616No ratings yet

- Grandezza Brochure Torre EbrochureDocument11 pagesGrandezza Brochure Torre Ebrochureyow888.csNo ratings yet

- Political Forces Economic Forces Socio-Cultural Forces Technological Forces Environmental Forces Legal ForcesDocument2 pagesPolitical Forces Economic Forces Socio-Cultural Forces Technological Forces Environmental Forces Legal ForcesCyd Marie VictorianoNo ratings yet

- Accounting Concepts and ConventionsDocument32 pagesAccounting Concepts and ConventionsShraddha TiwariNo ratings yet

- Bri JunioDocument7 pagesBri JunioSinung Eko RaharjoNo ratings yet

- Sarah Resume 2Document2 pagesSarah Resume 2api-456055243No ratings yet

- Low-Grade Iron Ore Beneficiation Unviable - India's FIMIDocument2 pagesLow-Grade Iron Ore Beneficiation Unviable - India's FIMItrajrajNo ratings yet