F 1040 Sa

F 1040 Sa

Uploaded by

PrekelCopyright:

Available Formats

F 1040 Sa

F 1040 Sa

Uploaded by

PrekelOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

F 1040 Sa

F 1040 Sa

Uploaded by

PrekelCopyright:

Available Formats

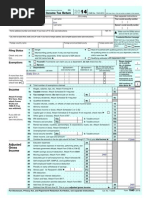

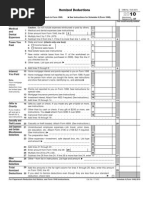

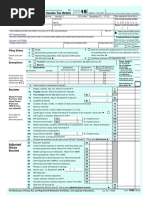

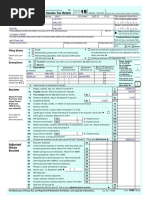

SCHEDULE A

(Form 1040)

OMB No. 1545-0074

Itemized Deductions

Department of the Treasury

Internal Revenue Service (99)

Information

about Schedule A and its separate instructions is at www.irs.gov/schedulea.

Attach to Form 1040.

Name(s) shown on Form 1040

Medical

and

Dental

Expenses

Taxes You

Paid

Interest

You Paid

Note.

Your mortgage

interest

deduction may

be limited (see

instructions).

Caution. Do not include expenses reimbursed or paid by others.

1 Medical and dental expenses (see instructions) . . . . .

1

2 Enter amount from Form 1040, line 38

2

3 Multiply line 2 by 10% (.10). But if either you or your spouse was

3

born before January 2, 1950, multiply line 2 by 7.5% (.075) instead

4 Subtract line 3 from line 1. If line 3 is more than line 1, enter -0- . .

5 State and local (check only one box):

a

Income taxes, or

. . . . . . . . . . .

5

b

General sales taxes

6 Real estate taxes (see instructions) . . . . . . . . .

6

7 Personal property taxes . . . . . . . . . . . . .

7

8 Other taxes. List type and amount

8

9 Add lines 5 through 8 . . . . . . . . . . . . . . . .

10 Home mortgage interest and points reported to you on Form 1098 10

11 Home mortgage interest not reported to you on Form 1098. If paid

to the person from whom you bought the home, see instructions

and show that persons name, identifying no., and address

15

19

20

27

11

12 Points not reported to you on Form 1098. See instructions for

special rules . . . . . . . . . . . . . . . . .

12

13 Mortgage insurance premiums (see instructions) . . . . .

13

14 Investment interest. Attach Form 4952 if required. (See instructions.) 14

15 Add lines 10 through 14 . . . . . . . . . . . . . . .

Gifts to

16 Gifts by cash or check. If you made any gift of $250 or more,

see instructions . . . . . . . . . . . . . . . .

16

Charity

17 Other than by cash or check. If any gift of $250 or more, see

If you made a

gift and got a

instructions. You must attach Form 8283 if over $500 . . .

17

benefit for it,

18 Carryover from prior year . . . . . . . . . . . .

18

see instructions.

19 Add lines 16 through 18 . . . . . . . . . . . . . . .

Casualty and

Theft Losses

2014

Attachment

Sequence No. 07

Your social security number

20 Casualty or theft loss(es). Attach Form 4684. (See instructions.) .

Job Expenses 21 Unreimbursed employee expensesjob travel, union dues,

and Certain

job education, etc. Attach Form 2106 or 2106-EZ if required.

Miscellaneous

21

(See instructions.)

Deductions

22 Tax preparation fees . . . . . . . . . . . . .

22

23 Other expensesinvestment, safe deposit box, etc. List type

and amount

Other

Miscellaneous

Deductions

24

25

26

27

28

23

Add lines 21 through 23 . . . . . . . . . . . .

24

Enter amount from Form 1040, line 38 25

Multiply line 25 by 2% (.02) . . . . . . . . . . .

26

Subtract line 26 from line 24. If line 26 is more than line 24, enter -0- .

Otherfrom list in instructions. List type and amount

28

29 Is Form 1040, line 38, over $152,525?

Total

Itemized

No. Your deduction is not limited. Add the amounts in the far right column

for lines 4 through 28. Also, enter this amount on Form 1040, line 40.

Deductions

.

Yes. Your deduction may be limited. See the Itemized Deductions

Worksheet in the instructions to figure the amount to enter.

30 If you elect to itemize deductions even though they are less than your standard

deduction, check here . . . . . . . . . . . . . . . . . . .

For Paperwork Reduction Act Notice, see Form 1040 instructions.

Cat. No. 17145C

29

Schedule A (Form 1040) 2014

You might also like

- Chapter 10 MERGEDDocument10 pagesChapter 10 MERGEDola69% (13)

- Example Tax ReturnDocument6 pagesExample Tax Returnapi-252304176No ratings yet

- Income Tax Fundamentals Chapter 4 Comprehensive Problem 1Document2 pagesIncome Tax Fundamentals Chapter 4 Comprehensive Problem 1AU Sharma0% (1)

- Week 2 Form 1040Document2 pagesWeek 2 Form 1040Linda100% (2)

- F 1040Document2 pagesF 1040Kevin RowanNo ratings yet

- NATH f1040Document2 pagesNATH f1040Spencer NathNo ratings yet

- FD-Schedule C-Profit or Loss From Business (Sole Prop)Document2 pagesFD-Schedule C-Profit or Loss From Business (Sole Prop)Anthony Juice Gaston BeyNo ratings yet

- Form 1040Document2 pagesForm 1040Jessi100% (7)

- Tax Return ProjectDocument62 pagesTax Return ProjectGiovaniPerez100% (1)

- MAG'Impact: The High-Performance Impactor: Cubicity and SimplicityDocument5 pagesMAG'Impact: The High-Performance Impactor: Cubicity and SimplicityPrekelNo ratings yet

- XA750S Operations Manual Rev 1.0 (En)Document292 pagesXA750S Operations Manual Rev 1.0 (En)PrekelNo ratings yet

- SCH 200 Atomic Structure and Chemical BondingDocument88 pagesSCH 200 Atomic Structure and Chemical BondingJohn Wanyoike Makau100% (4)

- Itemized Deductions: Medical and Dental ExpensesDocument1 pageItemized Deductions: Medical and Dental Expensesapi-173610472No ratings yet

- Individual Tax Return Problem 2 Form 1040 Schedule ADocument1 pageIndividual Tax Return Problem 2 Form 1040 Schedule AHenry PhamNo ratings yet

- F 1040 SaDocument2 pagesF 1040 Saljens09No ratings yet

- Itemized Deductions: Medical and Dental ExpensesDocument1 pageItemized Deductions: Medical and Dental ExpensesnuseNo ratings yet

- F1040sa 2013Document2 pagesF1040sa 2013Sarah KuldipNo ratings yet

- U.S. Nonresident Alien Income Tax Return: Please Print or TypeDocument5 pagesU.S. Nonresident Alien Income Tax Return: Please Print or TypepdizypdizyNo ratings yet

- F 1040 SaDocument1 pageF 1040 Sahgfed4321No ratings yet

- F 1041Document2 pagesF 1041pdizypdizyNo ratings yet

- Child and Dependent Care Expenses: (If You Have More Than Two Care Providers, See The Instructions.)Document2 pagesChild and Dependent Care Expenses: (If You Have More Than Two Care Providers, See The Instructions.)api-173610472No ratings yet

- U.S. Individual Income Tax ReturnDocument2 pagesU.S. Individual Income Tax ReturnHamzah B ShakeelNo ratings yet

- Amended U.S. Individual Income Tax Return: Use Part III On The Back To Explain Any ChangesDocument2 pagesAmended U.S. Individual Income Tax Return: Use Part III On The Back To Explain Any ChangesKel TranNo ratings yet

- Child and Dependent Care Expenses: (If You Have More Than Two Care Providers, See The Instructions.)Document2 pagesChild and Dependent Care Expenses: (If You Have More Than Two Care Providers, See The Instructions.)Sarah KuldipNo ratings yet

- TaxReturn PDFDocument7 pagesTaxReturn PDFChristine WillisNo ratings yet

- 1040x2 PDFDocument2 pages1040x2 PDFolddigger100% (1)

- FTF1301242185129Document3 pagesFTF1301242185129Donna SchatzNo ratings yet

- FTF1302745105156Document5 pagesFTF13027451051562sly4youNo ratings yet

- U.S. Individual Income Tax ReturnDocument2 pagesU.S. Individual Income Tax Returnapi-173610472No ratings yet

- FTF1327867575806Document3 pagesFTF1327867575806erzahler0% (1)

- Schauer 2013 Tax ReturnDocument3 pagesSchauer 2013 Tax ReturnDetroit Free Press0% (1)

- Alternative Minimum Tax IndividualsDocument2 pagesAlternative Minimum Tax IndividualshujiNo ratings yet

- IRS Publication Form 8889Document2 pagesIRS Publication Form 8889Francis Wolfgang UrbanNo ratings yet

- F 1040Document2 pagesF 1040Sue BosleyNo ratings yet

- Certain Cash Contributions For Typhoon Haiyan Relief Efforts in The Philippines Can Be Deducted On Your 2013 Tax ReturnDocument6 pagesCertain Cash Contributions For Typhoon Haiyan Relief Efforts in The Philippines Can Be Deducted On Your 2013 Tax ReturnStephanie YatesNo ratings yet

- U.S. Individual Income Tax Return 1040A: Filing StatusDocument3 pagesU.S. Individual Income Tax Return 1040A: Filing StatusYosbanyNo ratings yet

- 2022 Draft Schedule ADocument2 pages2022 Draft Schedule ARiley CareNo ratings yet

- Foreign Tax Credit: A B C D eDocument2 pagesForeign Tax Credit: A B C D eSamer Mira BazziNo ratings yet

- U.S. Individual Income Tax ReturnDocument2 pagesU.S. Individual Income Tax Returnapi-310622354No ratings yet

- Certain Cash Contributions For Typhoon Haiyan Relief Efforts in The Philippines Can Be Deducted On Your 2013 Tax ReturnDocument6 pagesCertain Cash Contributions For Typhoon Haiyan Relief Efforts in The Philippines Can Be Deducted On Your 2013 Tax Returnapi-252942620No ratings yet

- f1040 Draft 2015Document3 pagesf1040 Draft 2015Anonymous IpryXQAKZNo ratings yet

- TaxDocument9 pagesTaxKuan ChenNo ratings yet

- Chapter 4 For FilingDocument9 pagesChapter 4 For Filinglagurr100% (1)

- Form 1040Document3 pagesForm 1040Peng Jin0% (1)

- Profit or Loss From Business: Schedule C (Form 1040) 09Document2 pagesProfit or Loss From Business: Schedule C (Form 1040) 09Dunk7No ratings yet

- U.S. Individual Income Tax ReturnDocument3 pagesU.S. Individual Income Tax Returnyupper2014No ratings yet

- Form 1040Document2 pagesForm 1040karthu48No ratings yet

- f1040 PDFDocument3 pagesf1040 PDFjc75aNo ratings yet

- Alice Tax FormDocument6 pagesAlice Tax FormShrey MangalNo ratings yet

- Chapter 12 TR Assignment Kelsey EwellDocument22 pagesChapter 12 TR Assignment Kelsey Ewellapi-272863459No ratings yet

- Certain Cash Contributions For Typhoon Haiyan Relief Efforts in The Philippines Can Be Deducted On Your 2013 Tax ReturnDocument3 pagesCertain Cash Contributions For Typhoon Haiyan Relief Efforts in The Philippines Can Be Deducted On Your 2013 Tax ReturnSarah Kuldip50% (4)

- F1040sa - 2003 Yenni OeyDocument1 pageF1040sa - 2003 Yenni Oeylib202No ratings yet

- Self-Employment Tax: Schedule SeDocument2 pagesSelf-Employment Tax: Schedule SeFahad Khan SaqibiNo ratings yet

- U.S. Individual Income Tax ReturnDocument2 pagesU.S. Individual Income Tax ReturnadrianaNo ratings yet

- 1040 Exam Prep - Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep - Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- J.K. Lasser's Your Income Tax 2019: For Preparing Your 2018 Tax ReturnFrom EverandJ.K. Lasser's Your Income Tax 2019: For Preparing Your 2018 Tax ReturnNo ratings yet

- J.K. Lasser's Small Business Taxes 2012: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2012: Your Complete Guide to a Better Bottom LineNo ratings yet

- JK Lasser's Small Business Taxes 2010: Your Complete Guide to a Better Bottom LineFrom EverandJK Lasser's Small Business Taxes 2010: Your Complete Guide to a Better Bottom LineNo ratings yet

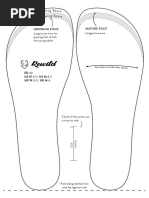

- RewildEN 42Document1 pageRewildEN 42PrekelNo ratings yet

- K4 Crane: Meeting The Toughest Capacity Demands and Environmental ConditionsDocument2 pagesK4 Crane: Meeting The Toughest Capacity Demands and Environmental ConditionsPrekelNo ratings yet

- Using Pulleys With Electric MotorsDocument12 pagesUsing Pulleys With Electric MotorsPrekelNo ratings yet

- 1496744869amplitude Gauge Instructions PDFDocument1 page1496744869amplitude Gauge Instructions PDFPrekelNo ratings yet

- Tower Crane Litronic: The Smart AssistantDocument24 pagesTower Crane Litronic: The Smart AssistantPrekelNo ratings yet

- Crane Manufacturing: Bespoke and Highly Customised New Build CranesDocument2 pagesCrane Manufacturing: Bespoke and Highly Customised New Build CranesPrekelNo ratings yet

- Industrial Vibrators: The Worldwide Leader in Vibration TechnologyDocument49 pagesIndustrial Vibrators: The Worldwide Leader in Vibration TechnologyPrekel100% (1)

- Coroners Court of Queensland Findings of InquestDocument45 pagesCoroners Court of Queensland Findings of InquestPrekelNo ratings yet

- BCD Measurement Guide: (Bolt Circle Diameter)Document1 pageBCD Measurement Guide: (Bolt Circle Diameter)PrekelNo ratings yet

- Lines and Planes in Space (Sect. 12.5)Document10 pagesLines and Planes in Space (Sect. 12.5)PrekelNo ratings yet

- Determining Plane of The Building Wall (33.930.080) : City of Portland Oregon - Bureau of Development ServicesDocument3 pagesDetermining Plane of The Building Wall (33.930.080) : City of Portland Oregon - Bureau of Development ServicesPrekelNo ratings yet

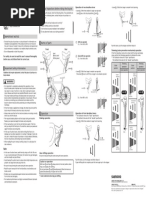

- Dual Control Lever: User's Manual Regular Inspections Before Riding The BicycleDocument1 pageDual Control Lever: User's Manual Regular Inspections Before Riding The BicyclePrekelNo ratings yet

- Crane Applications CatalogueDocument29 pagesCrane Applications CataloguePrekelNo ratings yet

- Daylight Plane Inspection: Building DivisionDocument8 pagesDaylight Plane Inspection: Building DivisionPrekelNo ratings yet

- Culture and Plane Crashes: A Cross-Country Test of The Gladwell HypothesisDocument13 pagesCulture and Plane Crashes: A Cross-Country Test of The Gladwell HypothesisPrekelNo ratings yet

- NTSB Takes Unusual Step To Address Plane CrashDocument5 pagesNTSB Takes Unusual Step To Address Plane CrashPrekelNo ratings yet

- Powerscreen Wear Parts GuideDocument7 pagesPowerscreen Wear Parts GuidePrekelNo ratings yet

- Evoquip Wear Parts Guide WebDocument23 pagesEvoquip Wear Parts Guide WebPrekel100% (1)

- Changes in The Board of Directors of CD A S As of 25 September 2019 PDFDocument1 pageChanges in The Board of Directors of CD A S As of 25 September 2019 PDFPrekelNo ratings yet

- 02 en F-Board Floor Insulation PDFDocument1 page02 en F-Board Floor Insulation PDFPrekelNo ratings yet

- 3 MultiSensor ToolDocument14 pages3 MultiSensor ToolAndres DiazNo ratings yet

- Chemistry PreviousDocument3 pagesChemistry Previouspdpr1215No ratings yet

- Key Factors Affecting Sewing Production Efficiency and The Ways of Improvement of A Denim FactoryDocument41 pagesKey Factors Affecting Sewing Production Efficiency and The Ways of Improvement of A Denim FactoryMd.Sohel RanaNo ratings yet

- Conduit 5Document42 pagesConduit 5dediNo ratings yet

- Queueing Theory - SlidesDocument40 pagesQueueing Theory - Slidesanjanadas2701No ratings yet

- The Coffee House-Group 8Document18 pagesThe Coffee House-Group 8Thanh Huyền TrầnNo ratings yet

- SRPT 30 and SRPT 40A RPU Transmitters ManualDocument48 pagesSRPT 30 and SRPT 40A RPU Transmitters ManualMiguel Angel Cara RiosNo ratings yet

- 4 - Braga Et Al vs. Abaya, GR No. 223076, Sept 13, 2016Document9 pages4 - Braga Et Al vs. Abaya, GR No. 223076, Sept 13, 2016Michelle CatadmanNo ratings yet

- Reading Comprehension - What Is A BarbieDocument1 pageReading Comprehension - What Is A Barbieabbyreader07No ratings yet

- 6 Week AdrianDocument14 pages6 Week AdrianAdrian SzNo ratings yet

- DOSHA SAMYAM & PAPAMYAM in MATCHING - SreenivasdesabhatlaDocument5 pagesDOSHA SAMYAM & PAPAMYAM in MATCHING - SreenivasdesabhatlaNatarajan ViswanathanNo ratings yet

- Google Privacy Policy en-GBDocument31 pagesGoogle Privacy Policy en-GBAmanNo ratings yet

- Celtec Membrane For High-Temperature PEM Fuel CellsDocument2 pagesCeltec Membrane For High-Temperature PEM Fuel CellsGustoveNo ratings yet

- Updated Resume SeetaDocument3 pagesUpdated Resume SeetaAnushaNo ratings yet

- Hawk Cementing Unit SLSHDocument2 pagesHawk Cementing Unit SLSHClayton NalleyNo ratings yet

- Condica Betoane MGDocument4 pagesCondica Betoane MGStefan MyncyNo ratings yet

- XR30C - XR30D: Digital Controller With Off Cycle DefrostDocument4 pagesXR30C - XR30D: Digital Controller With Off Cycle DefrostJennifer Eszter SárközyNo ratings yet

- Miroslav Popovic - Communication Protocol Engineering - CRC Press (2006)Document447 pagesMiroslav Popovic - Communication Protocol Engineering - CRC Press (2006)Prueba 123No ratings yet

- Butler - Et - Al-2016-Worldviews - On - Evidence-Based - Nursing (Systematic Review Protocol)Document9 pagesButler - Et - Al-2016-Worldviews - On - Evidence-Based - Nursing (Systematic Review Protocol)SILVIA ANGELA GUGELMINNo ratings yet

- Kemppi Mastertig MlsDocument10 pagesKemppi Mastertig MlsCynthia MillerNo ratings yet

- MFM-Corporate Law NotesDocument72 pagesMFM-Corporate Law NotesjyotijagtapNo ratings yet

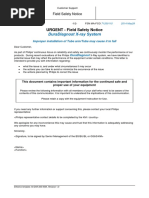

- Urgent - Field Safety Notice: Duradiagnost X-Ray SystemDocument2 pagesUrgent - Field Safety Notice: Duradiagnost X-Ray SystemSteven Alexander Neira EcheverríaNo ratings yet

- Tubing Pipe Dimensions Weight ChartDocument1 pageTubing Pipe Dimensions Weight ChartTahiruddin AhmedNo ratings yet

- Industrial Training Report: Aravali College of Engineering and ManagementDocument5 pagesIndustrial Training Report: Aravali College of Engineering and ManagementShubh9560No ratings yet

- Hitec University Taxila Cantt Technical Report Writing Assignment #2 Section "A"Document4 pagesHitec University Taxila Cantt Technical Report Writing Assignment #2 Section "A"Bilal KhalidNo ratings yet

- 4 International Strategic Management ADocument111 pages4 International Strategic Management AKiran RimalNo ratings yet

- Spray WaterDocument10 pagesSpray Watervinay956No ratings yet

- Chameli Project 2Document48 pagesChameli Project 2U niq ue SkYNo ratings yet

- Ransomware - Ransomware Protection GuideDocument7 pagesRansomware - Ransomware Protection GuideDeep PNo ratings yet