Learner Guide

Learner Guide

Uploaded by

narasi64Copyright:

Available Formats

Learner Guide

Learner Guide

Uploaded by

narasi64Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Learner Guide

Learner Guide

Uploaded by

narasi64Copyright:

Available Formats

Working together for a skilled tomorrow

Learning Materials

Unit Standard Title:

Interpret basic financial statements

Unit Standard No:

10388

Unit Standard Credits:

NQF Level:

Learner Guide

This outcomes-based learning material was

developed by

INHLE Business Solutions

and reviewed by

Metropolitan Life and

Momentum

with funding from INSETA in October 2003.

The material is generic in nature.

Its purpose is to serve as a guide for the further development

and customization of company-specific, learner-specific

and situation-specific learning interventions.

Disclaimer:

Whilst every effort has been made to ensure that the learning material is accurate, INSETA takes no responsibility

for any loss or damage suffered by any person as a result of the reliance upon the information contained herein.

INSMAT final materials

31/10/03

Unit Standard No.10388

Page 2

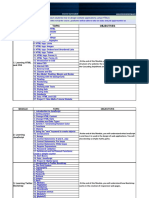

Table of Contents

INTRODUCTION AND OVERVIEW OF THE MODULE...................................................................5

THE PURPOSE OF THIS MODULE.......................................................................................................5

THE TEACHING STRATEGY..................................................................................................................5

CRITICAL CROSS FIELD AND DEVELOPMENTAL OUTCOMES....................................................................6

MASTERING THE STUDY MATERIAL..........................................................................................................6

SPECIFIC OUTCOME 1.........................................................................................................................8

ANALYSE THE BASIC ELEMENTS OF AN INCOME AND EXPENDITURE STATEMENT...........8

INCOME AND EXPENDITURE STATEMENTS..................................................................................9

1.1.

1.2.

1.3.

INCOME........................................................................................................................................9

EXPENDITURE.............................................................................................................................9

THE PURPOSE OF AN INCOME AND EXPENDITURE STATEMENT....................................9

CASE STUDY 1.1: THE INCOME AND EXPENDITURE STATEMENT OF A PRIVATE

INDIVIDUAL..........................................................................................................................................10

EXERCISE 1.1.........................................................................................................................................11

CASE STUDY 1.2: THE INCOME AND EXPENDITURE STATEMENT OF A COMPANY.........12

SOURCES OF INCOME AND EXPENDITURE.................................................................................14

FINANCIAL VIABILITY.......................................................................................................................21

SPECIFIC OUTCOME 2.......................................................................................................................29

ANALYSE THE BASIC ELEMENTS OF A BALANCE SHEET..........................................................29

2.1. THE PURPOSE OF A BALANCE SHEET...............................................................................................30

COMMON ELEMENTS OF A BALANCE SHEET............................................................................30

THE CAPITAL EMPLOYED SECTION.........................................................................................................30

EMPLOYMENT OF CAPITAL SECTION......................................................................................................31

NOTES TO THE BALANCE SHEET............................................................................................................31

2.2 THE ANALYSIS OF BALANCE SHEETS................................................................................................34

2.3. THE CONCEPT OF AN ASSET..............................................................................................................37

2.4. THE CONCEPT OF A LIABILITY..........................................................................................................39

SPECIFIC OUTCOME 3.......................................................................................................................49

COMPILE A PERSONAL ASSETS AND LIABILITIES STATEMENT...............................................49

3.1. COMPILING A PERSONAL ASSETS AND LIABILITIES STATEMENT................................50

EXERCISE 3.1............................................................................................................................................50

3.2. SITUATIONS WHERE AN ASSETS AND LIABILITIES STATEMENT ARE REQUIRED..................................52

THE ADVANTAGES OF KEEPING SUCH RECORDS.......................................................................................52

SPECIFIC OUTCOME 4.......................................................................................................................56

USING THE EVIDENCE IN FINANCIAL STATEMENTS TO MAKE A FINANCIAL DECISION..56

CASE STUDY 4.1. BAGS OF HAMMERS (PTY) LTD ..................................................................................57

CASH FLOW AND LIQUIDITY.....................................................................................................................66

INSMAT final materials

31/10/03

Unit Standard No.10388

Page 3

Introduction and overview of the module

The purpose of this module

Welcome to the Unit Standard: Interpreting Basic Financial Statements with INSQA

The purpose of the module is to provide learners with knowledge and skills to enable

them to interpret basic financial statements of companies.

The teaching strategy

The focus of our teaching role is on facilitating your learning experiences toward

achieving specific assessment criteria. Furthermore, for each of the topics that

comprise this module, the learning experiences are designed with the aim of enabling

you to master the learning content at a predetermined competence level.

LEARNING OUTCOMES, ASSESSMENT CRITERIA AND LEVELS OF MASTERY

Each topic dealt with in this module contains a statement of the learning outcomes

that we wish to accomplish for the particular topic. In broad terms these tell you about

the knowledge and skills we expect you to have mastered by the time you have

completed your study of each topic. The assessment criteria indicate a required end

result, which is what you should be able to do once you have completed the study

unit. The formulated assessment criteria are based on various levels of mastery that

you are required to achieve when mastering the study material. The required levels

of mastery for this module vary from knowledge and comprehension to the

integration of knowledge under given circumstances. The following levels of mastery

are distinguished for the purposes of this module (Please note that these levels are

not exact duplications of those provided by SAQA, but summaries thereof.):

Level 1: Knowledge and comprehension

This calls for a knowledge and understanding of facts, methods, processes and

structures and an ability to list and explain them. It involves memorising as well as an

awareness, immediate discovery, recall or recognition of relevant information in

various forms. A limited degree of interpretation is required.

Level 2: Application

This calls for a knowledge and understanding of the background and of related topics

and the ability to apply rules, principles, techniques and methods to a problem in

order to find a solution based on the information that is provided.

Level 3:Integration

This calls for a full factual knowledge of the topic, of the background and of related

topics and an ability to carry out integration functions, such as analysis,

interpretation, synthesis and evaluation. It includes the application of multidisciplinary knowledge and problem solving in cases where there are various

acceptable solutions. In this sense it constitutes creative thinking, comprising fluency,

flexibility, originality, critical awareness and independent thought.

The module is aimed at critical cross-field and development outcomes that are the

objectives of the module. They aim to facilitate your mastery of the subject matter by

applying a cross-section of skills and assist your development with defined

outcomes.

INSMAT final materials

31/10/03

Unit Standard No.10388

Page 4

Critical Cross Field and Developmental Outcomes

You are able to identify, solve problems and make decisions based on the information

in basic financial statements.

You are able to communicate effectively using visual, mathematics and language

skills in the modes of oral and written presentation when evaluating the strengths and

weaknesses of an entity.

You are able to organise and manage yourself effectively compiling a personal assets

and liabilities statement.

Mastering the study material

This module requires careful and dedicated study. You must become proficient in the

interpretation and analysis of basic financial statements, which requires diligence and

thoroughness.

INSMAT final materials

31/10/03

Unit Standard No.10388

Page 5

Specific Outcomes

This module is made up of four specific outcomes, which are further broken out into

assessment criteria. The four specific outcomes are:

SO1: Analyse the basic elements of an income

and expenditure statement

SO2: Analyse the basic elements of a balance

sheet

SO3: Compile a personal assets and liabilities

statement

SO4: Use the evidence in financial statements to

make a financial decision

Exercise questions are included as you progress through the Specific Outcome.

A Self-Assessment questionnaire will be given to conclude the Specific Outcome.

INSMAT final materials

31/10/03

Unit Standard No.10388

Page 6

Specific Outcome 1

Analyse the basic elements of an income and expenditure

statement

Learning outcomes

By the end of this module you should be able to do, define or provide the following;

1. The purposes of an income and expenditure statement are explained and an

indication is given of how often these statements are required for two case

studies.

2. Sources of income and expenditure are identified for three different types of

financial statements.

3. Sources of income and expenditure are explained with reference to an

income and expenditure statement.

4. Three income and expenditure statements are examined and evaluated in

terms of financial viability of the enterprise.

INSMAT final materials

31/10/03

Unit Standard No.10388

Page 7

Income and expenditure statements

Income and expenditure statements are a report of the money you made and the

money that you spent during a period of time. You can do a statement for a month, a

quarter or a year or any time period.

Definitions

1.1.

Income

For the purposes of this module, income is defined as money that has been made

within the time period of the statement. It is an important accounting concept to

correctly account for income within the time period of the financial statement. This

means that you should include in your income calculation money that you have made

but not yet received. For example, if you were a trader and sold goods but had not

yet received the money (because you had given your customer some credit terms)

you should nonetheless include the sale as income for the period, even if the

customer only pays you after the end of the period.

1.2.

Expenditure

For the purposes of this module, expenditure is defined as the costs that have been

incurred within the time period of the statement. As with the concept of income, you

should accrue for expenditures incurred within the time-period even if you have not

paid for them. If, for example, you were doing a household income and expenditure

statement for the end of September and you had not received your water and lights

bill nor paid it for September, you should nonetheless include it (or a reasonable

estimate) in the income and expenditure statement for September. This ensures that

you have an accurate statement of the real expenditures incurred within the period.

At the end of the income and expenditure statement, you subtract Expenditure from

Income and the remaining portion is what an enterprise would call Profit. If

expenditures were more than Income, the negative difference is what an enterprise

would call Loss.

1.3.

The purpose of an Income and Expenditure Statement

The purpose of an Income and Expenditure Statement is to clearly show how

much money was made and how much was spent within a given time period.

Obviously, it is much better to have money left over when you subtract Expenditure

from Income. Users of financial statements find them to be an endless mine of

information on which they can base realistic business and economic decisions.

Legislation requires that when doing the financial statements of a company, certain

specific requirements regarding the disclosure of information must be met. According

to the Companies Act 61 of 1973 a companys financial statements have to be drawn

up in accordance with generally accepted accounting practice (GAAP) as well as the

specific requirements of schedule 4. In this module you are not expected to know the

specific requirements but an awareness of the common elements will assist you in

understanding financial statements.

INSMAT final materials

31/10/03

Unit Standard No.10388

Page 8

CASE STUDY 1.1: The Income and Expenditure Statement of a private

individual.

Sunny is a private individual who works in an office as a consultant. She wishes to

obtain a loan from Big Sharks bank to finance the purchase of a new car. Big Sharks

has requested that Sunny produce an income and expenditure statement to

demonstrate to them that she has the income necessary to meet the repayments of

the loan which amount to R1000 per month.

Sunny has drawn up the following statement:

Statement of Income and Expenditure for Sunny

For the period 1 Jan 2003 to 31 Dec 2003

Income

Annual Salary after Taxation

Expenditure

Bond Repayments on House

Food

Clothing

Water & Lights

Telephone

Entertainment

Funds Remaining

R

100,000

R30, 000

R20, 000

R5, 000

R5, 000

R2, 000

R4, 000

R26, 000

From this statement, Big Sharks bank can easily see that Sunny has sufficient money

left over after her expenses have been deducted to meet the loan repayments. (12 x

R1, 000 = R12, 000 per annum)

Normally an individual is only required to produce a statement like this either for, as

in the case study, a bank loan or sometimes when completing a tax return. There is

no requirement for an individual to produce the statement on an annual basis as

required for companies by the Companies Act of 1973.

It is, however, a good personal management tool and a wise person would compile

such a statement and keep a good eye on it on a regular basis.

INSMAT final materials

31/10/03

Unit Standard No.10388

Page 9

Exercise 1.1

State how often Sunny in the case study above has to produce an income and

expenditure account

INSMAT final materials

31/10/03

Unit Standard No.10388

Page 10

Case Study 1.2: The Income and Expenditure Statement of a company

FLAVAZZ Ltd

Flavazz Ltd produces the chemical flavours used to flavour foodstuffs. They have

been in operation since 1958 and continue to run as a family owned private business.

Because they are incorporated as a company, they are required to produce Annual

Financial Statements. Interested parties, such as the owners of the company, clients

and suppliers who do business with them and SARS, the Receiver of Revenue, may

review these financial statements and make decisions on the results accordingly.

Flavazz Ltd

Statement of Income and Expenditure

For the period 1 September 2002 to 31 October 2003

Sales

Less: Purchases

Gross Profit

Less: Expenditure

Accounting Fees

Cleaning Materials

Computer Expenses

Motor & Travel

Rental of Factory Premises

Stationery & Office Expenses

Staff Refreshments

Salaries

Staff Training

UIF

Workmans Compensation

Net Profit

R

1,500,000

700,000

800,000

1,200

5,000

20,000

50,000

200,000

20,000

10,000

400,000

1,000

4,000

4,000

84,800

The Accountant for Flavazz Ltd is responsible for ensuring that the figures contained

in the Statement of Income and Expenditure are accurate and reflect a true position

of the finances of the company. The Accountant must also produce these financial

statements annually after the year end (which in Flavazz Ltds case is the 31

October)

INSMAT final materials

31/10/03

Unit Standard No.10388

Page 11

Exercise 1.1

Indicate how often income and expenditure statements are required for companies

INSMAT final materials

31/10/03

Unit Standard No.10388

Page 12

Sources of income and expenditure

Income and expenditure sources are as varied as the types of industries and

businesses in operation. People too, derive their income and spend their money in all

possible ways. The ways of income are many and varied: it is your task to identify

these in the financial statements and be able to recognise the income from the costs.

CASE STUDY 1.3: Teddys Toys Inc

Teddys Toys has a shop in a shopping mall. They sell toys, educational devices and

childrens party tricks. Teddy, the proprietor, has had the following statement of

income and expenditure prepared for tax purposes.

Teddys Toys Inc

Statement of Income and Expenditure

For the period 1 March 2002 to 28 February 2003

Sales

Cost of Sales

Opening Stock

Add: Purchases

Less: Closing Stock

Gross Profit

Less: Expenditure

Accounting Fees

Cleaning Materials

Computer Expenses

Motor & Travel

Rental of Retail Premises

Stationery & Office Expenses

Salaries

UIF

Workmans Compensation

Net Profit

R

150,000

50,000

5,000

51,500

6,500

100,000

1,200

5,000

2,000

5,000

20,000

2,000

20,000

450

200

44,150

In the case study above, expenditures incurred in generating sales include the

purchases of goods for resale, called purchases. Note that purchases in accounting

terms have a specific meaning: it means the costs incurred in acquiring goods for

resale. It does not include other costs, such as the ones listed in the Expenditure

section. These must be disclosed separately.

The Cost of Sales calculation, which is Opening Stock Add Purchases Less Closing

Stock, is calculated and subtracted from sales to give Gross Profit. Gross Profit is an

indication of the profitability of operations, not including other expenses and

overheads. In a retail environment, for example, as the business purchases goods for

resale, you would not include the cost of rental of premises. This is because it is

counter-intuitive to directly attribute the cost of renting the shop to any given sale. It is

therefore more logical to show rental of premises in the Expenditures section. This is

not a hard-and-fast rule though: depending on the operating environment and the

type of costing that is being done, in some cases it is possible to apportion a rental

overhead to the cost of production.

INSMAT final materials

31/10/03

Unit Standard No.10388

Page 13

Exercise 1.2

Identify the sources of income and expenditure for Teddys Toys Inc.

INSMAT final materials

31/10/03

Unit Standard No.10388

Page 14

Case Study 1.4: Ferrys Fast Foods

Ferrys fast foods is a vendor of burgers, fries, chicken and cold drinks. They cater

mainly to the lunchtime crowd in the office park where their outlet is situated.

Below is a copy of Ferrys Fast Foods Income Statement prepared by their

accountant for tax purposes.

Ferrys Fast Foods

Statement of Income and Expenditure

For the period 1 March 2002 to 28 February 2003

Sales

Add: Purchases

Gross Profit

R

350, 000

80, 000

270, 000

Less: Expenditure

Accounting Fees

Cleaning Materials

Motor & Travel

Rental of Retail Premises

Salaries

UIF

Workmans Compensation

Net Profit

1, 500

7, 000

4, 000

40, 000

80, 000

450

200

136, 850

INSMAT final materials

31/10/03

Unit Standard No.10388

Page 15

Exercise 1.3

Identify the sources of income and expenditure for Ferrys Fast Foods

INSMAT final materials

31/10/03

Unit Standard No.10388

Page 16

Case Study 1.5: Risk Insurance Consultants

Risk Insurance Consultants cater to the short-term insurance market. They sell

policies for medical, motor and household insurance. They have an office in a citycentre office block.

Risk Insurance Consultants

Statement of Income and Expenditure

For the period 1 March 2002 to 28 February 2003

Commission Received

R

350, 000

Less: Expenditure

Accounting Fees

Computer Expenses

Depreciation

Motor & Travel

Rental of Office Premises

Salaries

Telephone & Internet

UIF

Workmans Compensation

Net Loss

1, 500

20, 000

3, 000

24, 000

50, 000

200, 000

40, 000

3, 500

3, 500

(6, 500)

INSMAT final materials

31/10/03

Unit Standard No.10388

Page 17

Exercise 1.4

Firstly, identify the sources of income and expenditure for Risk Insurance Consultants

and when you have identified these sources provide and explanation of each of these

sources that you have identified.

INSMAT final materials

31/10/03

Unit Standard No.10388

1. Identify

Page 18

the Sources of Income and Expenditure

INSMAT final materials

31/10/03

Unit Standard No.10388

Page 19

Now explain these sources of Income and Expenditure

INSMAT final materials

31/10/03

Unit Standard No.10388

Page 20

Financial Viability

The concept of the going concern is an important accounting concept. Financial

Statements are usually prepared with the assumption that the enterprise is a going

concern, without evidence to the contrary. This assumption implies that the business

will continue its operations for the foreseeable future.

Financial viability implies that:

The concern will continue its operations in the foreseeable future.

The enterprise is sufficiently profitable (or will be in the future) to continue its

operations.

There is inherent worth in continuing operations. This is related to the concept of

ongoing profits. It is important to note that sometimes companies do not make a

profit every year especially in the first few years of operations. A

businessperson would examine financial statements for their financial viability

and also take a view on the inherent worth. A full assessment or analysis of a

company does not just look at one year in isolation: many years of operational

results need to be examined for a fundamental analysis.

INSMAT final materials

31/10/03

Unit Standard No.10388

Page 21

Exercise 1.6

Examine Case Study 1.3 Teddys Toys, Case Study 1.4 Ferrys Foods and Case

Study 1.5 Risk Consultants. From the evidence evaluate whether the businesses are

currently financially viable. You should look at the profit or loss each statement shows

and decide whether the company is viable based on the evidence.

INSMAT final materials

31/10/03

Unit Standard No.10388

Page 22

Self-Assessment

Take some time to reflect on what you have learnt in this module and assess

your knowledge against the following pointers. Write down your answers.

Should you not be able to complete each of these statements, go back to your

notes and check on your understanding. You can also discuss the answers

with a colleague.

o

o

o

o

o

Can you explain the purpose of an income and expenditure statement?

Can you indicate how often these statements are required?

Can you identify sources of income and expenditure?

Can you explain sources of income and expenditure?

Can you evaluate financial statements in terms of financial viability?

INSMAT final materials

31/10/03

Unit Standard No.10388

Page 23

Summative Assessment

In the following exercise carefully read each statement and decide which answer

or statement best matches the question. Indicate this by marking it onto the

answer sheet provided after the questions.

1. Income is:

a) Money that the enterprise has made within the timeperiod under review

b) Money the enterprise collected within the timeperiod under review

c) Money the company had to spend within the timeperiod under review

d) Money the company will spend next year

e) All of the above

2. Expenditure is:

a) Costs that will be incurred next year

b) Costs that the company incurred during the timeperiod under review

c) Costs the company was supposed to incur during the timeperiod under

review

d) Money the company actually spent during the timeperiod under review

e) (a) and (b)

3. Profit is

a) The money a company made in total

b) The money an enterprise has in its bank account

c) The positive difference between income and expenditure

d) The amount of money the company paid to creditors

e) The money the company spent

4. A Company shows a loss when

a) Income exceeds expenditure

b) The company made too much money

c) Expenditure exceeds income

d) The company paid out too much

e) The owner took too much money

INSMAT final materials

31/10/03

Unit Standard No.10388

Page 24

5. The purpose of an Income and Expenditure Statement is

a) To prove you have a company

b) to clearly show how much money was made and how much was spent within

a given time period

c) to clearly show the amount of money the company owes is creditors

d) to clearly show who owns a company

e) to show what the company owns

6. It is better to

a) Have more income than expenditure

b) Have more income than assets

c) Have less income than costs

d) Have less income than debtors

e) Not make money because you just have to pay taxes

7. An individual is required to produce Financial Statements

a) Every year

b) When asked to do so by an external party

c) Every six months

d) Every month

e) Never

8. A company is required to produce Financial Statements

a) Every year

b) When asked to do so by an external party

c) Every six months

d) Every month

e) Never

9. Purchases mean

a) All money spent

b) The losses a company makes

c) The cost of goods acquired for resale

d) Net Expenditure

e) All of the above

INSMAT final materials

31/10/03

Unit Standard No.10388

Page 25

10. The calculation for Cost of Sales is:

a) Opening Stock Less Purchases and Closing Stock

b) Opening Stock Add Purchases Less Closing Stock

c) Income less Purchases less Closing Stock

d) Purchases Less Opening Stock

e) All of the above

INSMAT final materials

31/10/03

Unit Standard No.10388

Page 26

Module 1

Answer Sheet

Question

1.1.

1.2.

1.3.

1.4.

1.5.

1.6.

1.7.

1.8.

1.9.

1.10.

INSMAT final materials

Answer

A

31/10/03

Unit Standard No.10388

Page 27

Specific Outcome 2

Analyse the basic elements of a balance sheet

Learning Outcomes

By the end of this module you should be able to perform, complete and understand

the following;

1. The purpose of a balance sheet is explained and an indication is given of how

often a balance sheet is necessary for two case studies.

2. A balance sheet is analysed and evaluated in terms of equity or financial net

worth.

3. The concept of an asset is explained and the assets in a balance sheet are

classified in terms of fixed and current assets.

4. The concept of a liability is explained and the liabilities in a balance sheet are

classified in terms of long term and current liabilities.

5. Balance sheets for an entity are compared and evaluated in terms of

performance over two years and a decision is made based on evidence in the

balance sheet.

INSMAT final materials

31/10/03

Unit Standard No.10388

Page 28

2.1. The purpose of a balance sheet

The purpose of a balance sheet is to reflect the financial position of a company or

enterprise at a point in time. It is different from a statement of income & expenditure

in that the balance sheet is as at a specific date, whereas the income statement is for

a period of time. Usually, the income statement will cover, say, a financial year, and

the corresponding balance will reflect the financial position on the last day of the year

under review.

As part of the Annual Financial Statements, companies are required to produce

Balance Sheets every year. Individuals need not prepare balance sheets unless

requested to do so by a bank or the Receiver of Revenue.

Common Elements of a balance sheet

A balance sheet is separated into two distinct parts: The Capital Employed section

and the Employment of Capital section. Based on the basic accounting equation

A=O+L (Assets = Owners Equity + Liabilities), the two sections of the balance sheet

reflect the calculation of the equation. Sometimes it is indistinct which part of the

balance sheet belongs to which part of the accounting equation. In theory, the Capital

Employed section represents the O part, in other words, the Owners equity part. The

Employment of Capital section is made up of the other two parts, Assets Liabilities.

It can be confusing as to why sometimes Liabilities especially, are shown in the

Capital Employed part and not in the Employment of Capital. It is not within the range

of this module to go into the complexities of long-term financing, but suffice to say

that simply speaking, the money that the owner of a business puts into the business,

or retains as profits, is shown in the Capital Employed Section, and the rest is shown

in the Employment of Capital Section.

The Capital Employed section

The Capital Employed section reflects the money the owner has put into the

business. This, as mentioned above, is the owners investment in the operation.

It usually consists of the share capital of the business (if it is a company: certain

forms of trading operations such as sole traders or partnerships, do not have share

capital, but reflect the investment of the traders/partners.)

Share Capital

This is the Equity of the business. Usually, a company is incorporated with an

authorised share capital that is divided amongst the owners of the business. These

shares, as in publicly traded companies on the stock exchange, are tradable in

certain circumstances and can be bought and sold. They reflect the division of

ownership and profit sharing. If you own shares in a company, you are entitled to a

share of profits in proportion to your share holding. Often, companies pay out profits

from operations in the form of dividends. Note too, that a company is not forced to

pay out dividends; the managers of the company may retain profits within the

company to achieve and further the companys objectives. The board of directors

must consider whether to pay out or retain profits, which has an impact on the trading

price of the shares. Obviously (although this is not necessarily a direct relationship)

the more that companies pay out in dividends, the happier shareholders will be and

that would raise demand for shares, thereby increasing the share price.

INSMAT final materials

31/10/03

Unit Standard No.10388

Page 29

Employment of Capital section

The term employment of capital means what has been done with the money that

the owners of the business have invested in the operations. This is the calculation of

net Assets less Liabilities.

A primary feature of a balance sheet, as indicated in the name of the statement, is

that it MUST balance. If a balance sheet does not balance, it is not a balance sheet!

Notes to the Balance sheet

In terms of disclosure as required the Companies Act 61 of 1973, there are many

items that are disclosed in a companys Annual Financial Statements. Often, how the

figures that appear on the balance sheet are arrived at are shown in Notes to the

Balance Sheet. An example of a common note would be the calculation of

depreciation for Fixed Assets.

INSMAT final materials

31/10/03

Unit Standard No.10388

Page 30

Exercise 2.1

Indicate how often balance sheets are required for the following two case studies:

Case Study 2.1. Orange Fruits Ltd

Orange Fruits Ltd imports and exports fruit. They are incorporated as a Limited

Company. How often would they be required to produce a balance sheet?

INSMAT final materials

31/10/03

Unit Standard No.10388

Page 31

Case Study 2.2 Sally Swales

Sally is an individual who wishes to lend money from Big Sharks Bank. They have

requested a balance sheet from her in order to assess her financial situation.

Indicate how often Sally would normally be required to produce her balance sheet.

INSMAT final materials

31/10/03

Unit Standard No.10388

Page 32

2.2 The Analysis of balance sheets

Balance sheets are invaluable tools for the analysis of companies net worth. By

understanding and interpreting the clues within the balance sheet, the analyst can

evaluate the value of the company, and make decisions accordingly.

Group discussion

In groups, discuss who would look a balance sheet and why. Make notes for

yourself.

INSMAT final materials

31/10/03

Unit Standard No.10388

Page 33

Case study 2.1 Rubys Shoes CC

Rubys Shoes sells shoes and footwear through a shop in a shopping mall. They are

incorporated as a close corporation and have been trading for 8 years. The

accountant has compiled the annual financial statements, which contains the

following balance sheet.

Rubys Shoes CC

Balance Sheet as at 28 February 2003

R

Capital Employed

Share Capital

Loan Account: Ruby Tuesday

100

24, 400

24, 500

Long-Term Liabilities

Financial Agreement on Motor Vehicle

Total Capital Employed

25, 000

50, 500

Employment Of Capital

Fixed Assets

Furniture & Fittings

Motor Vehicles

50, 000

10, 000

40, 000

Current Assets

Cash

Debtors

3, 500

2, 000

1, 500

Current Liabilities

Creditors

Net Current Assets

3, 000

3, 000

500

Total Employment of Capital

50, 500

INSMAT final materials

31/10/03

Unit Standard No.10388

Page 34

Exercise 2.2.

Analyse the equity of Rubys Shoes, indicating what the equity is comprised of

INSMAT final materials

31/10/03

Unit Standard No.10388

Page 35

2.3. The Concept of an Asset

Assets are things that the business owns. They can take the form of Fixed Assets,

which are the things used in the production of income, like office furniture and

equipment, motor vehicles, tools and machinery, or software on the computers, or

Current Assets. Current assets are generally short-term collectibles and can be

liquidated within a period of less than 3 months. Debtors, cash in bank, fixed deposits

and suchlike, all comprise the companys current assets.

Note that particularly these days, fixed assets need not be physical assets. The

special section of intellectual property laws allows that patents, copyrights, research

and development and suchlike are regarded as intellectual assets, and as such do

not have a physical presence, but do have a real value to the business.

An important implication of Fixed Assets is that the value of the asset is written down

over a period of years through the calculation of the mechanism called depreciation.

Depreciation is charged to the income statement as an expense. For example, the

Receiver of Revenue allows that motor vehicles may be written down over a 4-year

period. That means that the value of the car is charged to the income statement over

four years. It is beyond the scope of this module to examine the complexities of

depreciation in detail, but it is important for you to know that the value of Fixed Assets

decreases with time through the calculation of depreciation.

In Summary:

Fixed Assets

o Last longer than 3 months

o Are depreciated according to the allowances permitted by the Receiver

Current Assets

o Last less than 3 months

o Are not depreciated

INSMAT final materials

31/10/03

Unit Standard No.10388

Page 36

Exercise 2.3

Classify the following list of Assets into Fixed and Current Assets

Asset

Tick For Fixed

Tick for

Assets

Current

Assets

A Chair

Computer Software

A Tractor

Cash at Bank

24-hour notice account

A Debtor

A Computer

A Motor Vehicle

A Building

A Desk

A Filing Cabinet

INSMAT final materials

31/10/03

Unit Standard No.10388

Page 37

2.4. The Concept of a Liability

Liabilities are debts that the company owes. This may take the form of an overdraft to

the bank, creditors due for payment, or other loans the company may have taken.

Long-term Liabilities

Long-term liabilities of the company are reflected in the Capital Employed section of

the balance sheet. These consist of debts that the company as acquired which have

to be paid off in periods longer than the current year. An example would be the bond

or mortgage loan on a property that the company purchased. Another example, in a

listed company, would be debentures. These are special loan instruments that the

company can issue to raise finance, and must be repaid to the investors.

Current Liabilities

Current Liabilities, like current assets, are short-term liabilities that are expected to be

repaid within a period of three months. The most common current liabilities that you

will see on a balance sheet are creditors or accounts payable, and bank overdrafts or

short-term loans.

INSMAT final materials

31/10/03

Unit Standard No.10388

Page 38

Exercise 2.3.

Classify the following items into either long-term or current liabilities

Liability

Mortgage bond

Accounts payable

Bank overdraft

Loan from owners brother

Finance agreement on Motor vehicle

INSMAT final materials

Tick for Long-term

Tick for Current

31/10/03

Unit Standard No.10388

Page 39

Crooked Als Tobacconists Ltd

Crooked Als Tobacconists have three retail outlets in shopping malls in

Bloemfontein. They supply tobacco, cigarettes and smoking accessories to

customers. Crooked Als was incorporated as a limited company in 1993.

Examine the following balance sheets for Crooked Als Tobacconists Ltd for the

two years 2000 and 2001

Crooked Als Tobacconists Ltd

Balance Sheet as at 28 February 2001

Capital Employed

Share Capital

R

100

Retained Income b/f

Add: Retained income from current year

Net Retained Income

30, 000

195, 400

225, 400

Total Capital Employed

225, 500

Employment Of Capital

Fixed Assets

Furniture & Fittings

Office Equipment

Computer Equipment

Motor Vehicles

223, 000

10, 000

13, 000

20, 000

180, 000

Current Assets

Cash

Accounts Receivable

5, 500

5, 000

500

Current Liabilities

Creditors

Net Current Assets

3, 000

3, 000

2, 500

Total Employment of Capital

INSMAT final materials

225, 500

31/10/03

Unit Standard No.10388

Crooked Als Tobacconists Ltd

Balance Sheet as at 28 February 2002

Capital Employed

Share Capital

Page 40

R

100

Retained Income b/f

Add: Retained income from current year

Net Retained Income

225, 400

50, 000

275, 400

Long Term Liabilities

Mortgage bond

203, 300

Total Capital Employed

478, 700

Employment Of Capital

Fixed Assets

Furniture & Fittings

Land & Buildings

Office Equipment

Computer Equipment

Motor Vehicles

481, 000

8, 000

300, 000

8, 000

15, 000

150, 000

Current Assets

Cash

Accounts Receivable

2, 700

2, 000

700

Current Liabilities

Creditors

Net Current Liabilities

6, 000

6, 000

2, 300

Total Employment of Capital

478, 700

Compare and evaluate the two balance Sheets for Crooked Als Tobacconists for

the two years. Discern what major activities have taken place in this time. Make

decisions based on evidence in the balance sheet as to:

o Profitability

o Financial viability

o Ongoing prospects

INSMAT final materials

31/10/03

Unit Standard No.10388

Page 41

INSMAT final materials

31/10/03

Unit Standard No.10388

Page 42

Self-Assessment

Take some time to reflect on what you have learnt in this module and assess

your knowledge against the following pointers. Write down your answers.

Should you not be able to complete each of these statements, go back to your

notes and check on your understanding. You can also discuss the answers

with a colleague.

o

o

o

o

o

Explain the purpose of a balance sheet and indicate how often a balance

sheet is necessary

Analyse and evaluate a balance sheet in terms of equity or financial worth

Explain the concept of an asset and classify assets in terms of fixed and

current assets

Explain the concept of a liability and classify liabilities in terms of longterm and current liabilities

Compare balance sheets and evaluate in terms of performance and make

decisions based on evidence in the balance sheet

INSMAT final materials

31/10/03

Unit Standard No.10388

Page 43

Summative Assessment

In the following exercise carefully read each statement and decide which answer

or statement best matches the question. Indicate this by marking it onto the

answer sheet provided after the questions.

2.1. Which of the following is/are correct?

a) A business's resources are termed its assets.

b) Liabilities are the claims of external parties.

c) Parties who provide goods on credit are known as trade creditors.

d) All of the above.

e) (a) and (b)

2.1. A debtor

a) Owns Assets

b) Is someone you owe money to

c) Need not pay you

d) Owes you money

e) None of the above

2.2. Liabilities are

a) Things you own

b) Things you bought

c) Debts you owe

d) (a) and (b)

e) None of the above

2.3. Fixed Assets

a) Last longer than 3 Months

b) Are written down over a period of time

c) Last less than 3 months

d) (a) and (b)

e) None of the above

INSMAT final materials

31/10/03

Unit Standard No.10388

Page 44

2.4. Expenditure which must be shown on a companys Income statement

a) Is made up of the personal costs of the owner

b) Is made up of costs incurred in the ordinary course of business

c) Is the same as last year

d) Is not necessarily disclosable

e) None of the above

2.5. Financial viability implies that

a) You would expect the enterprise to fail

b) You expect the company to continue as a going concern

c) You can see the company earns money

d) The company makes sufficient profits

e) (b) and (d)

2.6. The purpose of a balance sheet

a) is to hide money from the Receiver of Revenue

b) to prove the company makes a profit

c) to reflect the financial position of a company at a point in time

d) (a) and (c)

e) All of the above

2.7. A company is required to produce a balance sheet

a) Every month

b) All the time

c) Every Year

d) Whenever it is asked to

e) (a) and (d)

2.8. The Basic Accounting Equation is

a) A= O + L

b) O = A + L

c) L = A - O

d) None of the above

INSMAT final materials

31/10/03

Unit Standard No.10388

Page 45

e) (a) and (c)

2.9. A balance sheet

a) Is a statement of financial position at a specific point in time

b) Is a statement of financial position for a whole period of time

c) Shows how much money a company made

d) Must balance

e) (a) and (d)

2.10. The equity of a company

a) Is comprised of the money a company made

b) Is comprised of a companys assets

c) Is comprised of the owners investment in the company

d) Is made up of the share capital and reserves of the company

e) (c) and (d)

INSMAT final materials

31/10/03

Unit Standard No.10388

Page 46

Module 2

Answer Sheet

Question

2.1.

2.2.

2.3.

2.4.

2.5.

2.6.

2.7.

2.8.

2.9.

2.10.

INSMAT final materials

Answer

A

31/10/03

Unit Standard No.10388

Page 47

Specific Outcome 3

Compile a personal assets and liabilities statement

Learning Outcomes

By the end of this module you should be able to demonstrate knowledge in and

describe situations where;

1. A personal assets and liabilities statement is compiled based on own financial

situation over the past year.

2. The situations when an assets and liabilities statement are required are listed

and an indication is given of the advantages of keeping such records

INSMAT final materials

31/10/03

Unit Standard No.10388

Page 48

3.1. Compiling a personal assets and liabilities statement

Exercise 3.1.

Compile a personal assets and liabilities statement for the past year based on your

own financial situation.

First, list all of your assets. Remember, as we learnt in SO2, assets are things that

you own. Include things such as personal equipment, like a hi-fi or tv, assets such as

your motorcar or anything that reflects your financial worth.

If you dont know the exact value of an asset, estimate it. Base the estimate on the

initial cost of the asset. Remember, the value of an asset diminishes over time, so if

you include something that is a couple of years old, base your estimation/ calculation

on that.

Next, list your liabilities. You may owe money to your brother: list that. You may owe

money on a car, so include that in the list.

Assets

Total of Assets

INSMAT final materials

31/10/03

Unit Standard No.10388

Liabilities

Page 49

Total Of Liabilities

Net Worth given by Total of Assets Less

Liabilities

INSMAT final materials

31/10/03

Unit Standard No.10388

Page 50

3.2. Situations where an assets and liabilities statement are

required

You may need to compile an asset and liabilities statement

When applying for a bank loan

When required by the Receiver of Revenue

For personal records

The advantages of keeping such records

It is always advantageous to keep track of your personal net worth. This allows

you to assess your financial situation when making decisions, for example, to

obtain a loan. It allows you to see at a glance, whether or not, for the loan

example, you could afford to repay the loan. It also allows you to present the

records easily as you might be required to do. It is a relatively simple exercise to

keep the records up-to-date with each new purchase of goods. It means that you

can see at a glance how much your things are worth and how much you owe

others.

INSMAT final materials

31/10/03

Unit Standard No.10388

Page 51

Summative Assessment

3.1. List the situations where you might be required to produce a personal statement

of Assets and Liabilities

3.2. List the advantages of keeping such records

INSMAT final materials

31/10/03

Unit Standard No.10388

Page 52

Self Assessment

Take some time to reflect on what you have learnt in this module and assess

your knowledge against the following pointers. Write down your

answers. Should you not be able to complete each of these statements,

go back to your notes and check on your understanding. You can also

discuss the answers with a colleague.

Compile a personal assets and liabilities statement

List the situations where these might be required

List the advantages of keeping such records

INSMAT final materials

31/10/03

Unit Standard No.10388

Page 53

INSMAT final materials

31/10/03

Unit Standard No.10388

Page 54

Specific Outcome 4

Using the evidence in financial statements to make a financial

decision

Learning Outcomes

By the end of this module, you should be able to complete, explain and understand

the following;

1. The financial strengths and weaknesses of an entity are analysed and

suggestions are made of ways to improve income and reduce costs.

2. 4.2.The concept of a cost to income ratio is explained and suggestions are

made on how to improve the ratio.

3. The relationship between turnover, income, revenue, sales/earnings and profit

is explained with examples.

4. The concept of cash flow is explained in terms of liquidity.

INSMAT final materials

31/10/03

Unit Standard No.10388

Page 55

4.1. Analysis of financial strengths and weaknesses of an entity

Case Study 4.1. Bags of Hammers (Pty) Ltd

Bags of Hammers (Pty) Ltd have three retail outlets in the Johannesburg are offering

hardware, gardening equipment, plant hire, tools and outdoor furniture. The standard

shop format is that of the emporium: Bags of Hammers takes warehouse space,

converting it into a retail environment which stocks as much as is feasibly possible

into the space. They usually try to select warehouse space that offers easy parking

and convenient access from highways, so that customers can load up their motor

vehicles, particularly as some of the items that Bags of Hammers can be heavy-duty

and large.

Bags of Hammers is a cash-driven business, as they take cash at the tills and pay

suppliers on consignment. This means that the suppliers are paid when the goods

are sold. Bags of Hammers though, do offer terms to the construction trade.

Bags of Hammers (Pty) Ltd

Income Statement for the year ended 28 February 2003

R

Turnover

Opening Stock

Purchases

Closing Stock

Gross Profit

Operating Expenditure

Accounting Fees

Bad Debts

Computer Expenses

Consumables

Depreciation

Interest Paid on Overdraft

Legal Fees

Motor & Travel

Rental

Stationery & Office Supplies

Salaries & Wages

Sundry Expenses

Income before Taxation

Company Taxation

Retained Income for the year

Retained Income Brought Forward

Retained Income Carried Forward

INSMAT final materials

R

3, 500, 000

1, 530, 000

200, 000

1, 500, 000

170, 000

2, 070, 000

1, 430, 500

15, 000

50, 000

20, 000

5, 000

30, 000

40, 000

25, 000

30, 000

500, 000

2, 500

710, 000

3, 000

639, 500

255, 800

383, 700

430, 000

813, 700

31/10/03

Unit Standard No.10388

Page 56

R

Capital Employed

Issued Share Capital

Retained Income

100, 000

813, 700

913, 700

850, 000

1, 563, 700

Long Term Liabilities

Total Capital Employed

Employment of Capital

Fixed Assets

Current Assets

Stock

Trade Debtors

Current Liabilities

Trade Creditors

Bank Overdraft

Net Current Assets

Total Employment of Capital

INSMAT final materials

963, 700

970, 000

170, 000

800, 000

170, 000

50, 000

120, 000

800, 000

1, 563, 700

31/10/03

Unit Standard No.10388

Page 57

Exercise 4.4. Analyse the financial strengths and weaknesses of

Bags of Hammers and suggest ways to improve income and

reduce costs

1. .

INSMAT final materials

31/10/03

Unit Standard No.10388

Page 58

4.2. The concept of cost to income ratio

The cost to income ratio is an important indicator of the value of the company. It is

used a lot in investment analysis to ascertain how easily the company can increase

profits. If the cost to income ratio is very low, it means that margins are small and that

the company must increase turnover by large volumes to attain relatively small

increases in profit.

The cost to income ratio is derived as follows

Net Costs

Income

Example 4.2.1

T-Square Inc has an annual income of R500, 000, derived from the sales of drawing

equipment. Their net costs are R300, 000.

T-Square Incs cost to income ratio is therefore

300, 000

500, 000 = 3/5 (or expressed as a ratio, 3:5)

To interpret this: for every R100 worth of sales, T-Square Inc makes R40 profit. This

means that in the current example, T-Square Inc made R200, 000 worth of profits

from R500, 000 worth of sales.

INSMAT final materials

31/10/03

Unit Standard No.10388

Page 59

Exercise 4.2

Suggest ways that a company could go about improving the cost to income ratio

INSMAT final materials

31/10/03

Unit Standard No.10388

Page 60

4.3. The relationship between turnover, income, revenue,

sales/earnings and profit

Turnover, income, revenue, sales/earnings and profit are all commonly used terms in

accounting and finance. We will discuss and define each of these terms, and give

examples to demonstrate how each of these is derived. We will develop the example

of Freedom Life Insurance Corporation to demonstrate each of the terms to you

4.3.1. Turnover

Turnover is the term used to describe the sales or income that the company earned

from pursuing its operations. In a retail or selling organisation, this would be the sales

that the company made from retailing to third parties. In an insurance-type

organisation, turnover might be derived from commissions, or the sales of policies.

Turnover is usually the first item that appears on a company income statement.

Freedom Life Insurance Corporation

Income Statement for the year ended

28 February 2003

Commissions Earned

R

1, 000, 000

The item Commissions Earned represents the turnover of Freedom Life Insurance

Corporation

4.3.2 Income

Income can be viewed as the net receipts received from the operations of the

business. It excludes the money received from extraordinary items. Extraordinary

items are significant, material transactions that would not be defined as normal

transactions for the company. An example would be the sale of a company which the

holding company holds title to.

4.3.2 Revenue

Revenue is all the money that the company received in the course of its business. It

includes earnings from extraordinary items, as defined above. Also included would be

interest earned on cash balances in bank accounts, as well as income from

subsidiaries

4.3.4 Sales/Earnings

The sales/Earnings ratio considers the relationship between sales, which are derived

from the ordinary operations of the business, and the net earnings of the company,

which include extraordinary items and interest. The Sales/Earning ratio indicates

what proportion of income comes from normal day-to-day business and which comes

from other business. Consider, as a demonstration, a company that has very small

trading sales, but declares large earnings due to the profit on sale of land that it

owned. If you looked at the income statement, it may appear that the company was

doing very well and earning a lot of money. But in fact, the directors may be

disposing of company assets that might affect the future earnings of the company.

4.3.5. Profit

Profit is the difference between Income and Expenses. In a public company, the

profits of the company are regarded as available for distribution. This is what the

shareholders of the company will receive as dividends, assuming that the directors

dont retain earnings for the purposes of furthering the businesss aims.

INSMAT final materials

31/10/03

Unit Standard No.10388

Page 61

Example 4.3. Harrys Eggs Pty Ltd

Harrys Eggs is the largest supplier of chicken and chicken products in the major

metropolitan areas. They have been in business for twenty-eight years. During the

year under review, Harry, the major stockholder, decided to rationalise the companys

holdings and sold off a large chicken farm to his main competitor. Harry had owned

the farm for twenty-five years, and had had no outstanding mortgages on it. The full

amount of the proceeds from the sale of the farm has been disclosed as an

extraordinary item

Harrys Eggs (Pty) Ltd

Income Statement for the Year Ended 28 February 2002

Item No

Item

1

Turnover

2

Other Operating Income

3

Net Operating Income

4

Expenditure

5

Profit from Operations

6

Extraordinary Item

Income from Subsidiary

7

Net Earnings before Taxation

8

Company Taxation

9

Net Profit available for Distribution

Note

1

2

3

4

5

6

R 000s

100,876

120

100, 996

50, 996

50, 000

4, 000

150, 000

204, 000

75, 000

129, 000

Notes to the income statement

Note 1

Turnover

Turnover is derived from the ordinary operations of the enterprise. This consists of

the sale and supply of chicken and chicken by-products to retail outlets in the major

metropolitan areas of South Africa.

Note 2

Interest Received

Interest received is derived from cash balances held at bank for the year under

review

Note 3

Expenditure

Expenditure is made up of ordinary expenditure incurred in the course of operations.

Note 4

Extraordinary Item

During the year under review, the company disposed of land, buildings and farm

equipment making up Farm 42, Cockerel Drive, Hennops River. The company has

decided to rationalise its holdings in farmland and will continue to do so in the

foreseeable future.

INSMAT final materials

31/10/03

Unit Standard No.10388

Page 62

Note 5

Income from Subsidiary

Harrys Eggs has a controlling interest in its subsidiary, Walky-Talkies (Pty) Ltd.

The income derived from the operations of this subsidiary has been disclosed.

Note 6

Company Taxation

The expense charged to the income statement represents the calculation of ordinary

and secondary company taxation for the year under review.

Last of all, the Profit available for distribution is the monies that will be paid out to

shareholders as dividends. It is important to notice where this is placed: dividends

are paid out of the profits after tax. This is because it would prejudice the Receiver of

Revenues claim on company profits if the taxation charges were calculated after

distribution. It would be possible to take all of the money out of the company and not

leave the taxman his share, which he would not approve of.

INSMAT final materials

31/10/03

Unit Standard No.10388

Page 63

Cash Flow and liquidity

The final statement in the Annual Financial Statements is the cash flow statement.

For reference sakes, an old name for this was the Source and Application of Funds

(which links up with the exercises that you did in SO1 of this module). The cash flow

statement is aimed at showing interested parties where money came from and where

it went. When a cash flow statement is done, non-cash items, such as the

depreciation expense, are removed from the calculation to reflect the movement of

cash through the enterprise.

The concept of liquidity can be understood as such: if, for example, your family has

three houses, but no money in the bank, your family might suffer a cash flow

problem. Technically speaking, the family is wealthy: it has a net asset value of the

sum of the values of the houses (assuming there are no liability claims over it). But

with no money in the bank, liquidity is a problem, as all the money the family has is

tied up in the houses. When you have cash in the bank, you are said to be liquid.

When you dont have cash in the bank, but your money is tied up in assets, you are

said to be illiquid. The concept of current assets in SO2 refers: current assets are

easily liquidated (within three months). That means you expect the cash within a

short period of time.

So, the concept of cash flow in terms of liquidity is how much money is coming into

and going out of your bank account.

INSMAT final materials

31/10/03

Unit Standard No.10388

Page 64

Self-Assessment

Take some time to reflect on what you have learnt in this module and assess

your knowledge against the following pointers. Write down your answers.

Should you not be able to complete each of these statements, go back to your

notes and check on your understanding. You can also discuss the answers

with a colleague.

Analyse the financial strengths and weaknesses of an entity and suggest

ways to improve income and reduce costs

Explain the concept of the cost to income ratio and suggest how to improve

the ratio

Explain the relationship between turnover, income, revenue, sales/earnings

and profit

Explain the concept of cash flow in terms of liquidity

INSMAT final materials

31/10/03

Unit Standard No.10388

Page 65

Summative Assessment

In the following exercise carefully read each statement and decide which answer

or statement best matches the question. Indicate this by marking it onto the

answer sheet provided after the questions.

4.1. You can improve a companys income by

a) Spending less

b) Advertising and Marketing

c) Cutting Costs

d) Reducing Debt

e) None of the above

4.2. You can reduce costs by

a) Starting a marketing campaign

b) Collecting Debts outstanding

c) Opening a new branch

d) Negotiating Discounts

e) (b) and (e)

4.3. The cost to income ratio

a) Is an indication of company profitability

b) Helps reduce debts

c) Shows when financial statements are due

d) Tests current assets

e) None of the above

4.4. The sales/earnings ratio

a) Includes costs

b) Includes profits

c) Is an indication of profitability

d) (a) and (c)

e) (a) and (b)

4.5. The term Cash flow refers to

a) The sales of goods and services

b) The amount of money the company made

c) How much money comes in and goes out of the company

d) None of the above

e) All of the above

INSMAT final materials

31/10/03

Unit Standard No.10388

Page 66

Module 4

Answer Sheet

Question

4.1.

4.2.

4.3.

4.4.

4.5.

INSMAT final materials

Answer

A

31/10/03

You might also like

- M04 SpreadsheetDocument67 pagesM04 Spreadsheetgashaw mekonnen0% (1)

- Strategic Analysis of DucatiDocument17 pagesStrategic Analysis of DucatiMuhammad Sajid Saeed100% (5)

- BR - OpenLoop - PETs Playbook - English - Open LoopDocument79 pagesBR - OpenLoop - PETs Playbook - English - Open LoopCleórbete SantosNo ratings yet

- Risk Assessment TemplateDocument5 pagesRisk Assessment TemplateAnonymous iI88Lt100% (1)

- Decoy Effect: A Marketing PhenomenonDocument18 pagesDecoy Effect: A Marketing PhenomenonGUNJAN GUPTANo ratings yet

- Commercial Diplomacy and International BusinessDocument42 pagesCommercial Diplomacy and International BusinessLoredana GheorgheNo ratings yet

- Learning Guide Disign FinalDocument72 pagesLearning Guide Disign FinalKalkidan ZerihunNo ratings yet

- TM01 Apply Object-Oriented Programming Language SkillsDocument102 pagesTM01 Apply Object-Oriented Programming Language SkillsCherinet dubaleNo ratings yet

- Administer Financial AccountsDocument27 pagesAdminister Financial AccountsBiruk HabtamuNo ratings yet

- M03-Configuring and Using InternetDocument67 pagesM03-Configuring and Using InternetDaneal DemekeNo ratings yet

- Computer Aided Design Course Code: 3341904Document7 pagesComputer Aided Design Course Code: 3341904Dhaval UpadhyayNo ratings yet

- Create Technical DocumentationLO2Document9 pagesCreate Technical DocumentationLO2birhanugirmay559No ratings yet

- EOS Web and Multimedia L3 & L4Document97 pagesEOS Web and Multimedia L3 & L4bayushNo ratings yet

- Admas University Meskel Campus: Learning GuideDocument36 pagesAdmas University Meskel Campus: Learning GuideTihitna TirunehNo ratings yet

- LO6 - Creating Database Macros & ModulesDocument9 pagesLO6 - Creating Database Macros & ModulesHabtamu Hailemariam AsfawNo ratings yet

- Establish and Maintain Accural Accounting System AdmaDocument34 pagesEstablish and Maintain Accural Accounting System Admaeliyas mohammedNo ratings yet

- Certificate in Web Design: Course OverviewDocument6 pagesCertificate in Web Design: Course OverviewEzekiel BarnabasNo ratings yet

- Vacancy Announcements For Staff AddDocument1 pageVacancy Announcements For Staff AddcobbymarkNo ratings yet

- EOS Accounts and Budget Support Level IIIDocument91 pagesEOS Accounts and Budget Support Level IIINigatu Mekonnen Bulga100% (1)

- M05 Install. SADocument49 pagesM05 Install. SAgashaw mekonnenNo ratings yet

- M04-Labor and Material SchedulesDocument62 pagesM04-Labor and Material Schedulesteferada53No ratings yet

- Creating Database Objects TvetDocument89 pagesCreating Database Objects Tvetmohammed ahmedNo ratings yet

- SIGTAS & New IRC Forms - AmDocument24 pagesSIGTAS & New IRC Forms - AmAnnahMaso100% (2)

- M02 Personal ComputerDocument116 pagesM02 Personal Computergashaw mekonnenNo ratings yet

- M03-Operate Personal ComputerDocument89 pagesM03-Operate Personal Computerbilisummaa100% (1)

- 6int 2008 Dec ADocument6 pages6int 2008 Dec ACharles_Leong_3417No ratings yet

- Chapter 1: Accounting Information Systems: An OverviewDocument12 pagesChapter 1: Accounting Information Systems: An Overviewaji marufNo ratings yet

- Module 06 Operate Word Processing Application GetinetDocument79 pagesModule 06 Operate Word Processing Application GetinetSoli Mondo100% (1)

- Asse's PackDocument14 pagesAsse's PackDereje GerluNo ratings yet

- Bei3 M1Document132 pagesBei3 M1kassa mamoNo ratings yet

- Establish and Maintain Accural Accounting SystemDocument26 pagesEstablish and Maintain Accural Accounting SystemAlebel AyalnehNo ratings yet

- Level IV Data Base Administration Model CurriculumDocument74 pagesLevel IV Data Base Administration Model CurriculumAmanuel KassaNo ratings yet

- M09 Access & Use InterDocument82 pagesM09 Access & Use Intergashaw mekonnen100% (1)

- Hardware & Network Servicing Level III: UC 10:-Apply Quality ControlDocument38 pagesHardware & Network Servicing Level III: UC 10:-Apply Quality ControlTechalewNo ratings yet

- LO1 Write An SQL Statement To Retrieve and Sort Data: Using Basic Structured Query LanguageDocument78 pagesLO1 Write An SQL Statement To Retrieve and Sort Data: Using Basic Structured Query LanguageGalaxy teckNo ratings yet

- Develop and Use Complex Spreed SheetDocument53 pagesDevelop and Use Complex Spreed Sheetdawit TerefeNo ratings yet

- Design Program Logic NewDocument111 pagesDesign Program Logic NewAyansa ErgibaNo ratings yet

- Module 08 Access & Use Database Application FrewDocument59 pagesModule 08 Access & Use Database Application FrewSoli Mondo100% (1)

- M04 SpreadsheetDocument51 pagesM04 SpreadsheetbayushNo ratings yet

- Bed 212 Course MaterialDocument149 pagesBed 212 Course MaterialJoshua OkoliNo ratings yet

- Professional Practice AccountingDocument16 pagesProfessional Practice AccountingAwetahegn HagosNo ratings yet

- M05 - Build Simple WebsitesDocument181 pagesM05 - Build Simple WebsitesGizaw TadesseNo ratings yet

- MO 19 Delivering and Monitoring A Service To Customer 2 2Document70 pagesMO 19 Delivering and Monitoring A Service To Customer 2 2Kalkidan ZerihunNo ratings yet

- Learning Guide No 1Document66 pagesLearning Guide No 1henokNo ratings yet

- Module 3 Develop System Infrastructure Design PlanDocument32 pagesModule 3 Develop System Infrastructure Design PlanbantegiziazNo ratings yet

- TM04 Producing Basic Server-Side Scrip For Dynamic Web PageDocument90 pagesTM04 Producing Basic Server-Side Scrip For Dynamic Web PageCherinet dubale100% (1)

- Ass's PackDocument14 pagesAss's PackbayushNo ratings yet

- Ministry of Education Sector: Economic Infrastructure Sub Sector: Information Technology Occupation: Hardware and Network Servicing Level IVDocument17 pagesMinistry of Education Sector: Economic Infrastructure Sub Sector: Information Technology Occupation: Hardware and Network Servicing Level IVc100% (1)

- Level 3 Coc ProjectDocument4 pagesLevel 3 Coc ProjectmetadelNo ratings yet

- It Support Service l1 Model CurriculumDocument115 pagesIt Support Service l1 Model CurriculumZelalem SeyoumNo ratings yet

- Maintain Inventory of Information TechnologyDocument36 pagesMaintain Inventory of Information Technologydesta bulatoNo ratings yet

- Module & Sesion Plan IIDocument23 pagesModule & Sesion Plan IIGODNo ratings yet

- Course Syllabus-Fundamentals of Accounting IDocument4 pagesCourse Syllabus-Fundamentals of Accounting ITewodrose Teklehawariat BelayhunNo ratings yet

- Module 1-2nd YearDocument38 pagesModule 1-2nd YearMax DomonNo ratings yet

- Determine Suitability of Database FunctionalityDocument9 pagesDetermine Suitability of Database FunctionalityderejeNo ratings yet

- LO1 Write An SQL Statement To Retrieve and Sort DataDocument10 pagesLO1 Write An SQL Statement To Retrieve and Sort DataGalaxy teck100% (1)

- Ethiopian TVET System: LG CodeDocument6 pagesEthiopian TVET System: LG CodeFitawu TekolaNo ratings yet

- LO4 - Creating Database ReportDocument45 pagesLO4 - Creating Database ReportHabtamu Hailemariam AsfawNo ratings yet

- Accessing and Using Internet For Level 1Document98 pagesAccessing and Using Internet For Level 1yabibalNo ratings yet

- Customer Service JobsDocument6 pagesCustomer Service JobsAbdul RafayNo ratings yet

- Determining Suitability of Database Functionality and ScalabilityDocument27 pagesDetermining Suitability of Database Functionality and ScalabilityAmanuel KassaNo ratings yet

- Maintaining IT Equipment and Consumable 2015Document63 pagesMaintaining IT Equipment and Consumable 2015Habte Gmedhin100% (1)

- Produce Business DocumentsDocument21 pagesProduce Business DocumentsBayew silie100% (1)

- ProjectDocument28 pagesProjectderbeNo ratings yet

- Generic - Financial Reporting and AnalysisDocument149 pagesGeneric - Financial Reporting and Analysismartin ntsako mathebulaNo ratings yet

- Capital Budgeting: Cyrk Assets Cyrk Assets Chapter 8 1/18/2001 03:58:00 PMDocument5 pagesCapital Budgeting: Cyrk Assets Cyrk Assets Chapter 8 1/18/2001 03:58:00 PMnarasi64No ratings yet

- Helpsource: Ganapathi Subramaniam, Cisa, Cism, Has RecentlyDocument1 pageHelpsource: Ganapathi Subramaniam, Cisa, Cism, Has Recentlynarasi64No ratings yet

- Business Ethics Policy Checklist: This Is Complemented by Business Ethics Policy Example and Business Fraud ManagementDocument2 pagesBusiness Ethics Policy Checklist: This Is Complemented by Business Ethics Policy Example and Business Fraud Managementnarasi64No ratings yet

- Fixed Asset VeificationDocument12 pagesFixed Asset Veificationnarasi64No ratings yet

- Risk Plan ExcelDocument14 pagesRisk Plan ExcelJanaka WempathiNo ratings yet

- Training Programs - IcebreakersDocument23 pagesTraining Programs - Icebreakersnarasi64No ratings yet

- 00 Audit ProcessDocument1 page00 Audit Processnarasi64No ratings yet

- Total Receipts 1633256118 1772878194 1408749425 569257252 5.1E+008Document10 pagesTotal Receipts 1633256118 1772878194 1408749425 569257252 5.1E+008narasi64No ratings yet

- Risk and Issue Log: Ref: - / - / RILDocument1 pageRisk and Issue Log: Ref: - / - / RILnarasi64No ratings yet

- Chapter 10 Investment Function in Bank NewDocument34 pagesChapter 10 Investment Function in Bank NewNguyễn Mạnh Thắng100% (1)

- Osstmm (Open Source Security Testing MethdologyDocument16 pagesOsstmm (Open Source Security Testing MethdologyKuros4kiNo ratings yet

- Ballou 01Document25 pagesBallou 01avilesfabianNo ratings yet

- Career Climber CV TemplateDocument1 pageCareer Climber CV TemplateMunhbayar ZayabatarNo ratings yet

- Concepts and Review of LiteratureDocument40 pagesConcepts and Review of Literaturezeeshan shaikhNo ratings yet

- Class 2 Order To Cash Cycle Notes Part 2Document4 pagesClass 2 Order To Cash Cycle Notes Part 2mohammed almoorNo ratings yet

- SGS MIN 1317 Laboratory Quality Control Summary SLIM enDocument2 pagesSGS MIN 1317 Laboratory Quality Control Summary SLIM enErnie246No ratings yet

- London Business SchoolDocument4 pagesLondon Business SchoolDomino234No ratings yet

- Entrepreneurship AssignmentDocument5 pagesEntrepreneurship Assignmentm.shehrooz23No ratings yet

- Chapter 4 Q Summer 2020Document16 pagesChapter 4 Q Summer 2020Thiện Võ NgọcNo ratings yet