Sandridge Bankruptcy

Uploaded by

ZerohedgeCopyright:

Available Formats

Sandridge Bankruptcy

Uploaded by

ZerohedgeOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Sandridge Bankruptcy

Uploaded by

ZerohedgeCopyright:

Available Formats

Case 16-32488 Document 1 Filed in TXSB on 05/16/16 Page 1 of 36

Fill in this information to identify the case:

United States Bankruptcy Court for the:

Southern District of Texas

Check if this is an

amended filing

(State)

Case number (if known):

Chapter

11

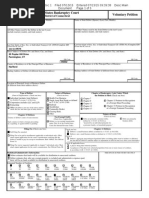

Official Form 201

Voluntary Petition for Non-Individuals Filing for Bankruptcy

04/16

If more space is needed, attach a separate sheet to this form. On the top of any additional pages, write the debtors name and the case

number (if known). For more information, a separate document, Instructions for Bankruptcy Forms for Non-Individuals, is available.

1.

Debtors Name

SandRidge Energy, Inc.

2. All other names debtor used

in the last 8 years

Include any assumed names,

trade names, and doing business

as names

3. Debtors federal Employer

Identification Number (EIN)

4. Debtors address

20-8084793

Principal place of business

Mailing address, if different from principal place

of business

123 Robert S. Kerr Avenue

Number

Street

Number

Street

P.O. Box

Oklahoma City, Oklahoma 73102

City

State

Zip Code

City

State

Zip Code

Location of principal assets, if different from

principal place of business

Oklahoma County, Oklahoma

County

Number

City

Street

State

5. Debtors website (URL)

http://sandridgeenergy.com/

6.

Corporation (including Limited Liability Company (LLC) and Limited Liability Partnership (LLP))

Type of debtor

Zip Code

Partnership (excluding LLP)

Other. Specify:

Official Form 201

Voluntary Petition for Non-Individuals Filing for Bankruptcy

page 1

Case 16-32488 Document 1 Filed in TXSB on 05/16/16 Page 2 of 36

Debtor

SandRidge Energy, Inc.

Case number (if known)

Name

7.

Describe debtors business

A. Check One:

Health Care Business (as defined in 11 U.S.C. 101(27A))

Single Asset Real Estate (as defined in 11 U.S.C. 101(51B))

Railroad (as defined in 11 U.S.C. 101(44))

Stockbroker (as defined in 11 U.S.C. 101(53A))

Commodity Broker (as defined in 11 U.S.C. 101(6))

Clearing Bank (as defined in 11 U.S.C. 781(3))

None of the above

B. Check all that apply:

Tax-exempt entity (as described in 26 U.S.C. 501)

Investment company, including hedge fund or pooled investment vehicle (as defined in 15 U.S.C.

80a-3)

Investment advisor (as defined in 15 U.S.C. 80b-2(a)(11))

C. NAICS (North American Industry Classification System) 4-digit code that best describes debtor. See

http://www.uscourts.gov/four-digit-national-association-naics-codes .

2111

8. Under which chapter of the

Bankruptcy Code is the

debtor filing?

Check One:

Chapter 7

Chapter 9

Chapter 11. Check all that apply:

Debtors aggregate noncontingent liquidated debts (excluding debts owed to

insiders or affiliates) are less than $2,566,050 (amount subject to adjustment on

4/01/19 and every 3 years after that).

The debtor is a small business debtor as defined in 11 U.S.C. 101(51D). If the

debtor is a small business debtor, attach the most recent balance sheet, statement

of operations, cash-flow statement, and federal income tax return, or if all of these

documents do not exist, follow the procedure in 11 U.S.C. 1116(1)(B).

A plan is being filed with this petition.

Acceptances of the plan were solicited prepetition from one or more classes of

creditors, in accordance with 11 U.S.C. 1126(b).

The debtor is required to file periodic reports (for example, 10K and 10Q) with the

Securities and Exchange Commission according to 13 or 15(d) of the Securities

Exchange Act of 1934. File the Attachment to Voluntary Petition for Non-Individuals

Filing for Bankruptcy under Chapter 11 (Official Form 201A) with this form.

The debtor is a shell company as defined in the Securities Exchange Act of 1934 Rule

12b-2.

Chapter 12

9. Were prior bankruptcy cases

filed by or against the debtor

within the last 8 years?

No

Yes.

List all cases. If more than 1,

attach a separate list.

Official Form 201

Case number

MM/DD/YYYY

If more than 2 cases, attach a

separate list.

10. Are any bankruptcy cases

pending or being filed by a

business partner or an

affiliate of the debtor?

When

District

District

When

Case number

MM/DD/YYYY

No

Yes.

Debtor

See Rider 1

District

Southern District of Texas

Case number, if known _______________________

Voluntary Petition for Non-Individuals Filing for Bankruptcy

Relationship

Affiliate

When

05/16/2016

MM / DD / YYYY

page 2

Case 16-32488 Document 1 Filed in TXSB on 05/16/16 Page 3 of 36

Debtor

SandRidge Energy, Inc.

Case number (if known)

Name

11. Why is the case filed in this

district?

12. Does the debtor own or have

possession of any real

property or personal property

that needs immediate

attention?

Check all that apply:

Debtor has had its domicile, principal place of business, or principal assets in this district for 180 days

immediately preceding the date of this petition or for a longer part of such 180 days than in any other

district.

A bankruptcy case concerning debtor's affiliate, general partner, or partnership is pending in this district.

1

No

Yes. Answer below for each property that needs immediate attention. Attach additional sheets if needed.

Why does the property need immediate attention? (Check all that apply.)

It poses or is alleged to pose a threat of imminent and identifiable hazard to public health or _

safety.

What is the hazard?

It needs to be physically secured or protected from the weather.

It includes perishable goods or assets that could quickly deteriorate or lose value without

attention (for example, livestock, seasonal goods, meat, dairy, produce, or securities-related

assets or other options).

Other

Where is the property?

Number

Street

City

State

Zip Code

Is the property insured?

No

Yes.

Insurance agency

Contact name

Phone

Statistical and administrative information

13. Debtor's estimation of

available funds

Check one:

Funds will be available for distribution to unsecured creditors.

After any administrative expenses are paid, no funds will be available for distribution to unsecured creditors.

14. Estimated number of

creditors

1-49

50-99

100-199

200-999

1,000-5,000

5,001-10,000

10,001-25,000

15. Estimated assets

$0-$50,000

$50,001-$100,000

$100,001-$500,000

$500,001-$1 million

$1,000,001-$10 million

$10,000,001-$50 million

$50,000,001-$100 million

$100,000,001-$500 million

25,001-50,000

50,001-100,000

More than 100,000

$500,000,001-$1 billion

$1,000,000,001-$10 billion

$10,000,000,001-$50 billion

More than $50 billion

The Debtor engages in the exploration, development, and production of oil and natural gas. The Debtor does not believe it owns or possesses any

real or personal property that poses or is alleged to pose a threat of imminent and identifiable harm to the public health or safety, but the Debtor

mentions the nature of its business here out of an abundance of caution.

Official Form 201

Voluntary Petition for Non-Individuals Filing for Bankruptcy

page 3

Case 16-32488 Document 1 Filed in TXSB on 05/16/16 Page 4 of 36

Debtor

SandRidge Energy, Inc.

Case number (if known)

Name

16. Estimated liabilities

$0-$50,000

$50,001-$100,000

$100,001-$500,000

$500,001-$1 million

$1,000,001-$10 million

$10,000,001-$50 million

$50,000,001-$100 million

$100,000,001-$500 million

$500,000,001-$1 billion

$1,000,000,001-$10 billion

$10,000,000,001-$50 billion

More than $50 billion

Request for Relief, Declaration, and Signatures

WARNING -- Bankruptcy fraud is a serious crime. Making a false statement in connection with a bankruptcy case can result in fines up to

$500,000 or imprisonment for up to 20 years, or both. 18 U.S.C. 152, 1341, 1519, and 3571.

17. Declaration and signature of

authorized representative of

debtor

The debtor requests relief in accordance with the chapter of title 11, United States Code, specified in this

petition.

I have been authorized to file this petition on behalf of the debtor.

I have examined the information in this petition and have a reasonable belief that the information is true and

correct.

I declare under penalty of perjury that the foregoing is true and correct.

Executed on

Title

18. Signature of attorney

05/16/2016

MM/ DD / YYYY

/s/ Julian M. Bott

Signature of authorized representative of debtor

Julian M. Bott

Printed name

Authorized Signatory

Date

/s/ Zack A. Clement

Signature of attorney for debtor

05/16/2016

MM/ DD/YYYY

Zack A. Clement

Printed name

Zack A. Clement PLLC

Firm name

3753 Drummond Street

Number

Street

Houston

City

Texas

State

(832) 274-7629

Contact phone

zack.clement@icloud.com

Email address

04361550

Bar number

Official Form 201

77025

ZIP Code

Texas

State

Voluntary Petition for Non-Individuals Filing for Bankruptcy

page 4

Case 16-32488 Document 1 Filed in TXSB on 05/16/16 Page 5 of 36

Fill in this information to identify the case:

United States Bankruptcy Court for the :

Southern District of Texas

(State)

Case number (if known):

11

Chapter

Check if this is an

amended filing

Rider 1

Pending Bankruptcy Cases Filed by the Debtor and Affiliates of the Debtor

On the date hereof, each of the entities listed below (collectively, the Debtors) filed a petition

in the United States Bankruptcy Court for the Southern District of Texas, Houston Division for relief

under chapter 11 of title 11 of the United States Code. The Debtors have moved for joint

administration of these cases under the case number assigned to the chapter 11 case of SandRidge

Energy, Inc.

SandRidge Energy, Inc.

4th Street Properties, LLC

Black Bayou Exploration, L.L.C.

Braniff Restaurant Holdings, LLC

CEBA Gathering, LLC

CEBA Midstream GP, LLC

CEBA Midstream, LP

Cholla Pipeline, L.P.

Cornhusker Energy, L.L.C.

FAE Holdings 389322R, LLC

Integra Energy, L.L.C.

Lariat Services, Inc.

MidContinent Resources, LLC

Mistmada Oil Company, Inc.

Pion Gathering Company, LLC

Sabino Exploration, LLC

Sagebrush Pipeline, LLC

SandRidge CO2, LLC

SandRidge Exploration and Production, LLC

SandRidge Holdings, Inc.

SandRidge Midstream, Inc.

SandRidge Operating Company

SandRidge Realty, LLC

Sierra Madera CO2 Pipeline, LLC

WTO Gas Gathering Company, LLC

Rider 1

Case 16-32488 Document 1 Filed in TXSB on 05/16/16 Page 6 of 36

Official Form 201A (12/15)

If debtor is required to file periodic reports (e.g., forms 10K and 10Q) with the Securities and Exchange Commission

pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 and is requesting relief under chapter 11 of the

Bankruptcy Code, this Exhibit "A" shall be completed and attached to the petition.

IN THE UNITED STATES BANKRUPTCY COURT

FOR THE SOUTHERN DISTRICT OF TEXAS

HOUSTON DIVISION

)

)

)

)

)

)

)

In re:

SANDRIDGE ENERGY, INC.,

Debtor.

Chapter 11

Case No. 16-________ (___)

Attachment to Voluntary Petition for Non-Individuals Filing for Bankruptcy under Chapter 11

1. If any of the debtors securities are registered under Section 12 of the Securities Exchange Act of 1934, the SEC file

number is

001-33784

2. The following financial data is the latest available information and refers to the debtors condition on

3/31/2016

(a)

Total assets

7,011,255,271

(b)

Total debts (including debts listed in 2.c., below)

3,998,058,091

(c)

Debt securities held by more than 500 holders

N/A

Approximate

number of

holders:

secured

secured

secured

secured

secured

unsecured

unsecured

unsecured

unsecured

unsecured

subordinated

subordinated

subordinated

subordinated

subordinated

$

$

$

$

$

(d)

Number of shares of preferred stock

5,650,000

(e)

Number of shares common stock

547,718,000

Comments, if any:

SandRidge Energy, Inc. does not and cannot know the precise number of beneficial holders

of any of the debt securities it has issued and does not believe that any such securities are held by more than 500

holders.

3.

Brief description of debtors business:

SandRidge Energy, Inc. is an oil and natural gas company with a

principal focus on exploration and production activities in the MidContinent and Rockies regions of the United States. It is a holding

company that conducts its principal operations through various direct

and indirect subsidiaries, including SandRidge Exploration and

Production, LLC.

4. List the names of any person who directly or indirectly owns, controls, or holds, with power to vote,

5% or more of the voting securities of debtor:

N/A

Case 16-32488 Document 1 Filed in TXSB on 05/16/16 Page 7 of 36

Case 16-32488 Document 1 Filed in TXSB on 05/16/16 Page 8 of 36

Case 16-32488 Document 1 Filed in TXSB on 05/16/16 Page 9 of 36

May 13, 2016

RESOLUTIONS

OF THE BOARD OF DIRECTORS OF

SANDRIDGE ENERGY, INC.

The members of the Board of Directors (the Board) of SandRidge Energy, Inc.,

organized and existing under the laws of the State of Delaware (collectively, the Company),

approved and adopted the following actions at the meeting of the Board held on May 13, 2016:

CHAPTER 11 FILING

WHEREAS, the Board considered advice of the management and the financial and legal

advisors of the Company regarding the liabilities and liquidity situation of the Company, the

strategic alternatives available to it, and the effect of the foregoing on the Companys business;

and

WHEREAS, the Board has had the opportunity to consult with the management and the

financial and legal advisors of the Company and fully consider each of the strategic alternatives

available to the Company.

NOW, THEREFORE, BE IT:

RESOLVED, that in the judgment of the Board, it is desirable and in the best interests of

the Company, its creditors, and other parties in interest, that the Company shall be and hereby is

authorized to file or cause to be filed a voluntary petition for relief (such voluntary petition, and

the voluntary petitions to be filed by the Companys affiliates, collectively, the Chapter 11

Cases) under the provisions of chapter 11 of title 11 of the United States Code (the Bankruptcy

Code) in a court of proper jurisdiction (the Bankruptcy Court).

RESOLVED, that the Chief Executive Officer, any Executive Vice President, any Senior

Vice President, any Vice President, or any other duly appointed officer of the Company

(collectively, the Authorized Officers), acting alone or with one or more other Authorized

Officers be, and each of them hereby is, authorized, empowered, and directed to execute and file

on behalf of the Company all petitions, schedules, lists, and other motions, papers, or documents,

and to take any and all action that they deem necessary or proper to obtain such relief, including,

without limitation, any action necessary to maintain the ordinary course operation of the

Companys business.

1 of 5

Case 16-32488 Document 1 Filed in TXSB on 05/16/16 Page 10 of 36

RESOLVED, that Julian M. Bott, an officer of the Company, shall be designated as an

Authorized Officer, and shall be authorized and empowered in the name of and on behalf of the

Company, to take or cause to be taken any and all such other and further action necessary to

commence the Chapter 11 Cases.

RETENTION OF PROFESSIONALS

RESOLVED, that each of the Authorized Officers be, and hereby is, authorized and

directed to employ the law firm of Kirkland & Ellis LLP, as general bankruptcy counsel, to

represent and assist the Company in carrying out its duties under the Bankruptcy Code, and to

take any and all actions to advance the Companys rights and obligations, including filing any

pleadings; and in connection therewith, each of the Authorized Officers, with power of

delegation, is hereby authorized and directed to execute appropriate retention agreements, pay

appropriate retainers, and to cause to be filed an appropriate application for authority to retain the

services of Kirkland & Ellis LLP.

RESOLVED, that each of the Authorized Officers be, and hereby is, authorized and

directed to employ the law firm of Zack A. Clement PLLC, as local bankruptcy counsel, to

represent and assist the Company in carrying out its duties under the Bankruptcy Code, and to

take any and all actions to advance the Companys rights and obligations, including filing any

pleadings; and in connection therewith, each of the Authorized Officers, with power of

delegation, is hereby authorized and directed to execute appropriate retention agreements, pay

appropriate retainers, and to cause to be filed an appropriate application for authority to retain the

services of Zack A. Clement PLLC.

RESOLVED, that each of the Authorized Officers be, and hereby is, authorized and

directed to employ the firm of Houlihan Lokey Capital, Inc., as financial advisor, to represent

and assist the Company in carrying out its duties under the Bankruptcy Code, and to take any and

all actions to advance the Companys rights and obligations; and in connection therewith, each of

the Authorized Officers is, with power of delegation, hereby authorized and directed to execute

appropriate retention agreements, pay appropriate retainers, and to cause to be filed an

appropriate application for authority to retain the services of Houlihan Lokey Capital, Inc.

RESOLVED, that each of the Authorized Officers be, and hereby is, authorized and

directed to employ the firm of Alvarez & Marsal Holdings, LLC, as restructuring advisor, to

represent and assist the Company in carrying out its duties under the Bankruptcy Code, and to

take any and all actions to advance the Companys rights and obligations; and in connection

therewith, each of the Authorized Officers is, with power of delegation, hereby authorized and

directed to execute appropriate retention agreements, pay appropriate retainers, and to cause to

be filed an appropriate application for authority to retain the services of Alvarez & Marsal

Holdings, LLC.

RESOLVED, that each of the Authorized Officers be, and hereby is, authorized and

directed to employ the firm of Prime Clerk LLC as notice, claims, and balloting agent and as

administrative advisor to represent and assist the Company in carrying out its duties under the

Bankruptcy Code, and to take any and all actions to advance the Companys rights and

obligations; and in connection therewith, each of the Authorized Officers, with power of

2

Case 16-32488 Document 1 Filed in TXSB on 05/16/16 Page 11 of 36

delegation, is hereby authorized and directed to execute appropriate retention agreements, pay

appropriate retainers, and to cause to be filed an appropriate application for authority to retain the

services of Prime Clerk LLC.

RESOLVED, that each of the Authorized Officers be, and hereby is, authorized and

directed to employ any other professionals to assist the Company in carrying out its duties under

the Bankruptcy Code; and in connection therewith, each of the Authorized Officers, with power

of delegation, is hereby authorized and directed to execute appropriate retention agreements, pay

appropriate retainers, and to cause to be filed an appropriate application for authority to retain the

services of any other professionals as necessary, including local bankruptcy counsel to extent

determined necessary and appropriate.

RESOLVED, that each of the Authorized Officers be, and hereby is, with power of

delegation, authorized, empowered and directed to execute and file all petitions, schedules,

motions, lists, applications, pleadings, and other papers and, in connection therewith, to employ

and retain all assistance by legal counsel, accountants, financial advisors, restructuring advisors,

and other professionals and to take and perform any and all further acts and deeds that each of

the Authorized Officers deem necessary, proper, or desirable in connection with the Companys

chapter 11 case, with a view to the successful prosecution of such case.

CASH COLLATERAL AND ADEQUATE PROTECTION

WHEREAS, each of the Company will obtain benefits from the use of collateral,

including cash collateral, as that term is defined in section 363(a) of the Bankruptcy Code

(the Cash Collateral), which is security for the Companys prepetition secured creditors

(collectively, the Secured Lenders) under its first lien revolving credit facility and second lien

notes.

RESOLVED, that in order to use and obtain the benefits of the Cash Collateral, and in

accordance with section 363 of the Bankruptcy Code, the Company will provide certain

adequate protection to the Secured Lenders (the Adequate Protection Obligations), as

documented in proposed interim and final orders (collectively, the Cash Collateral Order) and

submitted for approval to the Bankruptcy Court.

RESOLVED, that the form, terms, and provisions of the Cash Collateral Order to which

the Company is or will be subject, and the actions and transactions contemplated thereby be, and

hereby are authorized, adopted, and approved, and each of the Authorized Officers of the

Company be, and hereby is, authorized and empowered, in the name of and on behalf of the

Company, to take such actions and negotiate or cause to be prepared and negotiated and to

execute, deliver, perform, and cause the performance of, the Cash Collateral Order, and such

other agreements, certificates, instruments, receipts, petitions, motions, or other papers or

documents to which the Company is or will be a party, including, but not limited to, any security

and pledge agreement or guaranty agreement (collectively with the Cash Collateral Order, the

Cash Collateral Documents), and incur and pay or cause to be paid all fees and expenses, with

such changes, additions, and modifications thereto as the officers of the Company executing the

same shall approve, such approval to be conclusively evidenced by such officers execution and

delivery thereof.

3

Case 16-32488 Document 1 Filed in TXSB on 05/16/16 Page 12 of 36

RESOLVED, that the Company, as debtor and debtor in possession under the

Bankruptcy Code be, and hereby is, authorized to incur the Adequate Protection Obligations and

to undertake any and all related transactions on substantially the same terms as contemplated

under the Cash Collateral Documents (collectively, the Adequate Protection Transactions).

RESOLVED, that the Authorized Officers of the Company be, and they hereby are,

authorized and directed, and each of them acting alone hereby is, authorized, directed, and

empowered in the name of, and on behalf of, the Company, as debtors and debtors in possession,

to take such actions as in their discretion is determined to be necessary, desirable, or appropriate

and execute the Adequate Protection Transactions, including delivery of: (a) the Cash Collateral

Documents and such agreements, certificates, instruments, guaranties, notices, and any and all

other documents, including, without limitation, any amendments to any Cash Collateral

Documents (collectively, the Adequate Protection Documents); (b) such other instruments,

certificates, notices, assignments, and documents as may be reasonably requested by the Agents;

and (c) such forms of deposit, account control agreements, officers certificates, and compliance

certificates as may be required by the Cash Collateral Documents or any other Adequate

Protection Document.

RESOLVED, that each of the Authorized Officers of the Company be, and hereby is,

authorized, directed, and empowered in the name of, and on behalf of, the Company to file or to

authorize the Agents to file any Uniform Commercial Code (the UCC) financing statements,

any other equivalent filings, any intellectual property filings and recordation and any necessary

assignments for security or other documents in the name the Company that the Agents deem

necessary or appropriate to perfect any lien or security interest granted under the Cash Collateral

Order, including any such UCC financing statement containing a generic description of

collateral, such as all assets, all property now or hereafter acquired and other similar

descriptions of like import, and to execute and deliver, and to record or authorize the recording

of, such mortgages and deeds of trust in respect of real property of the Company and such other

filings in respect of intellectual and other property of the Company, in each case as the Agents

may reasonably request to perfect the security interests of the Agents under the Cash Collateral

Order.

RESOLVED, that each of the Authorized Officers of the Company be, and hereby is,

authorized, directed, and empowered in the name of, and on behalf of, the Company to take all

such further actions, including, without limitation, to pay or approve the payment of all fees and

expenses payable in connection with the Adequate Protection Transactions and all fees and

expenses incurred by or on behalf of the Company in connection with the foregoing resolutions,

in accordance with the terms of the Adequate Protection Documents, which shall in their sole

judgment be necessary, proper, or advisable to perform any of the Companys obligations under

or in connection with the Cash Collateral Order or any of the other Adequate Protection

Documents and the transactions contemplated therein and to carry out fully the intent of the

foregoing resolutions.

GENERAL

RESOLVED, that in addition to the specific authorizations heretofore conferred upon the

Authorized Officers, each of the Authorized Officers (and their designees and delegates) be, and

4

Case 16-32488 Document 1 Filed in TXSB on 05/16/16 Page 13 of 36

hereby is, authorized and empowered, in the name of and on behalf of the Company, to take or

cause to be taken any and all such other and further action, and to execute, acknowledge, deliver,

and file any and all such agreements, certificates, instruments, and other documents and to pay

all expenses, including but not limited to filing fees, in each case as in such officers or officers

judgment, shall be necessary, advisable, or desirable in order to fully carry out the intent and

accomplish the purposes of the resolutions adopted herein.

RESOLVED, that the Board has received sufficient notice of the actions and transactions

relating to the matters contemplated by the foregoing resolutions, as may be required by the

organizational documents of the Company, or hereby waives any right to have received such

notice.

RESOLVED, that all acts, actions, and transactions relating to the matters contemplated

by the foregoing resolutions done in the name of and on behalf of the Company, which acts

would have been approved by the foregoing resolutions except that such acts were taken before

the adoption of these resolutions, are hereby in all respects approved and ratified as the true acts

and deeds of the Company with the same force and effect as if each such act, transaction,

agreement, or certificate has been specifically authorized in advance by resolution of the Board.

RESOLVED, that each of the Authorized Officers (and their designees and delegates) be

and hereby is authorized and empowered to take all actions or to not take any action in the name

of the Company with respect to the transactions contemplated by these resolutions hereunder as

the sole shareholder, partner, member, or managing member of each direct subsidiary of the

Company, in each case, as such Authorized Officer shall deem necessary or desirable in such

Authorized Officers reasonable business judgment as may be necessary or convenient to

effectuate the purposes of the transactions contemplated herein, including causing the filing of

the Chapter 11 Cases on behalf of such entities.

Fill in this information to identify the case:

Debtor name

Case 16-32488 Document 1 Filed in TXSB on 05/16/16 Page 14 of 36

SandRidge Energy, Inc., et al.

United States Bankruptcy Court for the:

Southern

District of

Texas

(State)

Case number (If known):

Check if this is an

amended filing

Official Form 204

Chapter 11 or Chapter 9 Cases: List of Creditors Who Have the 50 Largest

Unsecured Claims and Are Not Insiders

12/15

A list of creditors holding the 50 largest unsecured claims must be filed in a Chapter 11 or Chapter 9 case. Include claims which the debtor disputes. Do not include claims by any person

or entity who is an insider, as defined in 11 U.S.C. 101(31). Also, do not include claims by secured creditors, unless the unsecured claim resulting from inadequate collateral value places

the creditor among the holders of the 50 largest unsecured claims.

Name of creditor and complete mailing address, including zip

code

Name, telephone number and email address of creditor

contact

Nature of claim

(for example,

trade debts,

Indicate if claim

bank loans,

is contingent,

professional

unliquidated, or

services, and

disputed

government

contracts)

Amount of claim

If the claim is fully unsecured, fill in only unsecured claim

amount. If claim is partially secured, fill in total claim

amount and deduction for value of collateral or setoff to

calculate unsecured claim.

Total

claim, if

partially

secured

Deduction for

value of collateral

or setoff

Unsecured

claim

WELLS FARGO

JOHN STOHLMAN, VICE PRESIDENT

1

750 N SAINT PAUL ST, SUITE 1750

DALLAS, TX 75201

WELLS FARGO

JOHN STOHLMAN, VICE PRESIDENT

PHONE: 214-756-7431

FAX:

EMAIL: JOHN.STOHLMANN@WELLSFARGO.COM

7.5%

UNSECURED

NOTES DUE

2021

$767,162,699.70

WELLS FARGO

JOHN STOHLMAN, VICE PRESIDENT

2

750 N SAINT PAUL ST, SUITE 1750

DALLAS, TX 75201

WELLS FARGO

JOHN STOHLMAN, VICE PRESIDENT

PHONE: 214-756-7431

FAX:

EMAIL: JOHN.STOHLMANN@WELLSFARGO.COM

7.5%

UNSECURED

NOTES DUE

2023

$553,697,974.29

Official Form 204

Chapter 11 or Chapter 9 Cases: List of Creditors Who Have the 50 Largest Unsecured Claims

page 1

Case 16-32488 Document 1 Filed in TXSB on 05/16/16 Page 15 of 36

Debtor

SandRidge Energy, Inc., et al.

Case Number (if known)

Name

Name of creditor and complete mailing address, including zip

code

Name, telephone number and email address of creditor

contact

Nature of claim

Indicate if claim

(for example,

is contingent,

trade debts,

unliquidated, or

bank loans,

disputed

professional

Amount of claim

If the claim is fully unsecured, fill in only unsecured claim

amount. If claim is partially secured, fill in total claim

amount and deduction for value of collateral or setoff to

calculate unsecured claim.

WELLS FARGO

JOHN STOHLMAN, VICE PRESIDENT

3

750 N SAINT PAUL ST, SUITE 1750

DALLAS, TX 75201

WELLS FARGO

JOHN STOHLMAN, VICE PRESIDENT

PHONE: 214-756-7431

FAX:

EMAIL: JOHN.STOHLMANN@WELLSFARGO.COM

8.125%

UNSECURED

NOTES DUE

2022

$531,252,586.70

WELLS FARGO

JOHN STOHLMAN, VICE PRESIDENT

4

750 N SAINT PAUL ST, SUITE 1750

DALLAS, TX 75201

WELLS FARGO

JOHN STOHLMAN, VICE PRESIDENT

PHONE: 214-756-7431

FAX:

EMAIL:

JOHN.STOHLMANN@WELLSFARGO.COM

8.75%

UNSECURED

NOTES DUE

2020

$407,576,234.04

US BANK NATIONAL ASSOCIATION

MAURI COWEN, VICE PRESIDENT

5

5555 SAN FELIPE, SUITE 1150

HOUSTON, TX 77056

US BANK NATIONAL ASSOCIATION

MAURI COWEN, VICE PRESIDENT

PHONE: 713-235-9206

FAX: 713-235-9213

EMAIL: MAURI.COWEN@USBANK.COM

7.5%

CONVERTIBLE

NOTES DUE

2023

$47,774,647.18

US BANK NATIONAL ASSOCIATION

MAURI COWEN, VICE PRESIDENT

6

5555 SAN FELIPE, SUITE 1150

HOUSTON, TX 77056

US BANK NATIONAL ASSOCIATION

MAURI COWEN, VICE PRESIDENT

PHONE: 713-235-9206

FAX: 713-235-9213

EMAIL: MAURI.COWEN@USBANK.COM

8.125%

CONVERTIBLE

NOTES DUE

2022

$40,965,088.22

ARCHROCK SERVICES LP

D. BRADLEY CHILDERS, PRESIDENT AND CHIEF

7 OPERATING OFFICER

16666 NORTHCHASE DR

HOUSTON, TX 77060-6014

ARCHROCK SERVICES LP

D. BRADLEY CHILDERS, PRESIDENT AND CHIEF

OPERATING OFFICER

PHONE: 281-836-8000

FAX: 302-655-5049

EMAIL:

TRADE

Official Form 204

Chapter 11 or Chapter 9 Cases: List of Creditors Who Have the 50 Largest Unsecured Claims

$2,035,324.64

Page 2

Case 16-32488 Document 1 Filed in TXSB on 05/16/16 Page 16 of 36

Debtor

SandRidge Energy, Inc., et al.

Case Number (if known)

Name

Name of creditor and complete mailing address, including zip

code

Name, telephone number and email address of creditor

contact

Nature of claim

Indicate if claim

(for example,

is contingent,

trade debts,

unliquidated, or

bank loans,

disputed

professional

Amount of claim

If the claim is fully unsecured, fill in only unsecured claim

amount. If claim is partially secured, fill in total claim

amount and deduction for value of collateral or setoff to

calculate unsecured claim.

POWERSECURE INC

JOHN BLUTH, SENIOR VICE PRESIDENT

8

1609 HERITAGE COMMERCE CT

WAKE FOREST, NC 27587

POWERSECURE INC

JOHN BLUTH, SENIOR VICE PRESIDENT

PHONE: 919-453-1751

FAX: 919-556-3596

EMAIL: JBLUTH@POWERSECURE.COM

TRADE

WEATHERFORD ARTIFICIAL LIFT

JUDY DUFFY

9

8866 NW LOOP 338

ODESSA, TX 79764

WEATHERFORD ARTIFICIAL LIFT

JUDY DUFFY

PHONE: 713-693-4000

FAX: 432-332-1023

EMAIL: JUDY.DUFFY@WEATHERFORD.COM

TRADE

$1,142,078.53

NATIONAL OILWELL VARCO ENTITIES

ROSANNE RODRIGUEZ, CREDIT MANAGER

10

7909 PARKWOOD CIRCLE DRIVE

HOUSTON, TX 77036

NATIONAL OILWELL VARCO ENTITIES

ROSANNE RODRIGUEZ, CREDIT MANAGER

PHONE: 307-362-3745

FAX: 713-375-3994

EMAIL: ROSANNE.RODRIGUEZ@NOV.COM

TRADE

$1,126,474.79

HALLIBURTON SERVICES

CAROLYN CLINE

11

10200 BELLAIRE BLVD.

HOUSTON, TX 77072

HALLIBURTON SERVICES

CAROLYN CLINE

PHONE: 915-567-2044

FAX: 979-567-7088

EMAIL: FDUNARACH@HALLIBURTON.COM

TRADE

$1,031,024.49

DCP MIDSTREAM LP

WOUTER VAN KEMPEN, PRESIDENT AND CHIEF

12 EXECUTIVE OFFICER

370 17TH STREET SUITE 2500

DENVER, CO 80202

DCP MIDSTREAM LP

WOUTER VAN KEMPEN, PRESIDENT AND CHIEF

EXECUTIVE OFFICER

PHONE: 720-944-0209

FAX: 303-605-2219

EMAIL: REMITTANCE@DCPMIDSTREAM.COM

TRADE

$1,012,343.76

Official Form 204

CONTINGENT

Chapter 11 or Chapter 9 Cases: List of Creditors Who Have the 50 Largest Unsecured Claims

$1,644,080.42

Page 3

Case 16-32488 Document 1 Filed in TXSB on 05/16/16 Page 17 of 36

Debtor

SandRidge Energy, Inc., et al.

Case Number (if known)

Name

Name of creditor and complete mailing address, including zip

code

Name, telephone number and email address of creditor

contact

Nature of claim

Indicate if claim

(for example,

is contingent,

trade debts,

unliquidated, or

bank loans,

disputed

professional

Amount of claim

If the claim is fully unsecured, fill in only unsecured claim

amount. If claim is partially secured, fill in total claim

amount and deduction for value of collateral or setoff to

calculate unsecured claim.

PERMIAN WELL SERVICE

KERRY ROBINSON, OPERATIONS MANAGER

13

S MAIN ST

RINGWOOD, OK 73768

PERMIAN WELL SERVICE

KERRY ROBINSON, OPERATIONS MANAGER

PHONE: 580-234-0171

FAX: 432-685-3621

EMAIL: KERRY@PERMIANSERVICES.COM

TRADE

$945,145.00

GEXPRO

KIM STEINBACH

14 9500 N ROYAL LN

SUITE 130

IRVING, TX 75063

GEXPRO

KIM STEINBACH

PHONE: 800-262-3114

FAX: 972-915-1733

EMAIL: KIM.STEINBACH@GEXPRO.COM;

CFS.ACH@GEXPRO.COM

TRADE

$823,395.58

ORR ENTERPRISES INC

RONNIE E. ORR, PRESIDENT

15

2806 TIMBER RIDGE DRIVE

DUNCAN, OK 73533

ORR ENTERPRISES INC

RONNIE E. ORR, PRESIDENT

PHONE: 580-252-5120

FAX: 580-251-9070

EMAIL: RON2806@YAHOO.COM

TRADE

$737,132.80

SES HOLDINGS LLC

JOHN D. SCHMITZ, CHAIRMAN AND CHIEF

EXECUTIVE OFFICER

16

1400 POST OAK BLVD

STE. 400

HOUSTON, TX 77056

SES HOLDINGS LLC

JOHN D. SCHMITZ, CHAIRMAN AND CHIEF

EXECUTIVE OFFICER

PHONE: 713-296-1000

FAX: 713-296-1099

EMAIL: INFO@SES-CONTRACTING.CO.UK

TRADE

UNIT DRILLING COMPANY

LARRY PINKSTON, CHIEF EXECUTIVE OFFICER AND

17 PRESIDENT

7130 S. LEWIS SUITE 1000

TULSA, OK 74136

UNIT DRILLING COMPANY

LARRY PINKSTON, CHIEF EXECUTIVE OFFICER AND

PRESIDENT

TRADE

PHONE: 918-493-7700

FAX: 918-493-7711

EMAIL: JIM.GREER@UNITCORP.COM

Official Form 204

CONTINGENT

Chapter 11 or Chapter 9 Cases: List of Creditors Who Have the 50 Largest Unsecured Claims

$723,543.80

$721,932.61

Page 4

Case 16-32488 Document 1 Filed in TXSB on 05/16/16 Page 18 of 36

Debtor

SandRidge Energy, Inc., et al.

Case Number (if known)

Name

Name of creditor and complete mailing address, including zip

code

Name, telephone number and email address of creditor

contact

Nature of claim

Indicate if claim

(for example,

is contingent,

trade debts,

unliquidated, or

bank loans,

disputed

professional

Amount of claim

If the claim is fully unsecured, fill in only unsecured claim

amount. If claim is partially secured, fill in total claim

amount and deduction for value of collateral or setoff to

calculate unsecured claim.

ERICK FLOWBACK SERVICES

MARK SNODGRASS, CHIEF EXECUTIVE OFFICER

18

12284 OK-30

ERICK, OK 73645

ERICK FLOWBACK SERVICES

MARK SNODGRASS, CHIEF EXECUTIVE OFFICER

PHONE: 405-272-3028

FAX: 405 375-5215

EMAIL:

GRANT.ROSS@ERICKFLOWBACK.COM

TRADE

$644,902.34

MIDCONTINENT EXPRESS PIPELINE LLC

SHELLY DULINSKY

19

1001 LOUISIANA STREET

HOUSTON, TX 77002

MIDCONTINENT EXPRESS PIPELINE LLC

SHELLY DULINSKY

PHONE: 713-369-9308

TRADE

FAX: 646-607-1907

EMAIL: MARIA_PAVLOU@KINDERMORGAN.COM

$638,750.00

QUINN PUMPS INC

ANTHONY CORDOVA, MANAGEMENT EXECUTIVE

20

3611 EAST HIGHWAY 158

MIDLAND, TX 79706

QUINN PUMPS INC

ANTHONY CORDOVA, MANAGEMENT EXECUTIVE

PHONE: 403-347-1128

TRADE

FAX: 432-687-2997

EMAIL: ANTHONY.CORDOVA@GE.COM

$624,713.85

REDZONE COIL TUBING LLC

WAYLIN OTT, CHIEF OPERATING OFFICER

21

701 N 1ST ST STE109

LUFKIN, TX 75901

REDZONE COIL TUBING LLC

WAYLIN OTT, CHIEF OPERATING OFFICER

PHONE: 936-632-2645

FAX: 936-632-2657

EMAIL: SGREAK@REDZONECOIL.COM

TRADE

XTREME DRILLING AND COIL SERVICES

THOMAS D. WOOD, CHIEF EXECUTIVE OFFICER

22 9805 KATY FREEWAY

SUITE 650

HOUSTON, TX 77024

XTREME DRILLING AND COIL SERVICES

THOMAS D. WOOD, CHIEF EXECUTIVE OFFICER

PHONE: 281 994-4600

FAX: 281 994-4661

EMAIL: IR@XTREMECOIL.COM

TRADE

Official Form 204

CONTINGENT

Chapter 11 or Chapter 9 Cases: List of Creditors Who Have the 50 Largest Unsecured Claims

$558,572.03

$491,407.81

Page 5

Case 16-32488 Document 1 Filed in TXSB on 05/16/16 Page 19 of 36

Debtor

SandRidge Energy, Inc., et al.

Case Number (if known)

Name

Name of creditor and complete mailing address, including zip

code

23

Name, telephone number and email address of creditor

contact

GLENN E SESSIONS & SONS INC

JOE SESSIONS, OWNER

PHONE: 970-723-4944

FAX: 970-723-8344

EMAIL:

GLENN E SESSIONS & SONS INC

JOE SESSIONS, OWNER

33492 HIGHWAY 125

WALDEN, CO 80480

Nature of claim

Indicate if claim

(for example,

is contingent,

trade debts,

unliquidated, or

bank loans,

disputed

professional

TRADE

Amount of claim

If the claim is fully unsecured, fill in only unsecured claim

amount. If claim is partially secured, fill in total claim

amount and deduction for value of collateral or setoff to

calculate unsecured claim.

CONTINGENT

$490,046.59

NALCO COMPANY

STEPHEN N. LANDSMAN, EXECUTIVE VICE

24 PRESIDENT, GENERAL COUNSEL AND SECRETARY

1601 W. DIEHL ROAD

NAPERVILLE, IL 60563-1198

NALCO COMPANY

STEPHEN N. LANDSMAN, EXECUTIVE VICE

PRESIDENT, GENERAL COUNSEL AND SECRETARY

TRADE

PHONE: 877-288-3173

FAX: 630-305-2900

EMAIL: REMITADVICE@NALCO.COM

$460,798.38

AXIP ENERGY SERVICES LP

JULIE GLASS, CREDIT AND COLLECTIONS

SUPERVISOR

25

1301 MCKINNEY, SUITE 900

FULBRIGHT TOWER

HOUSTON, TX 77010

AXIP ENERGY SERVICES LP

JULIE GLASS, CREDIT AND COLLECTIONS

SUPERVISOR

PHONE: 713-744-6100

FAX: 713-744-6101

EMAIL: AXIPCASH@AXIP.COM

TRADE

$406,785.45

SOUTHERN PLAINS ENERGY SERVICES LLC

RICK AHRBERG, OWNER

26

301 W. CHERRY

CUSHING, OK 74023

SOUTHERN PLAINS ENERGY SERVICES LLC

RICK AHRBERG, OWNER

PHONE: 918-225-3570

FAX: 403-526-6897

EMAIL: SOUTHERNPLAINSLLC@YAHOO.COM;

RJETTOIL1@YAHOO.COM

TRADE

$405,986.25

SUNSET WELL SERVICE INC

MARIANN BAGLEY, PRESIDENT

27

14507 DOGWOOD

GARDENDALE, TX 79758

SUNSET WELL SERVICE INC

MARIANN BAGLEY, PRESIDENT

PHONE: 432-561-8600

FAX: 432-561-8601

EMAIL: SUNSETWELLSERVICE@YAHOO.COM

TRADE

$375,230.14

Official Form 204

Chapter 11 or Chapter 9 Cases: List of Creditors Who Have the 50 Largest Unsecured Claims

Page 6

Case 16-32488 Document 1 Filed in TXSB on 05/16/16 Page 20 of 36

Debtor

SandRidge Energy, Inc., et al.

Case Number (if known)

Name

Name of creditor and complete mailing address, including zip

code

Name, telephone number and email address of creditor

contact

Nature of claim

Indicate if claim

(for example,

is contingent,

trade debts,

unliquidated, or

bank loans,

disputed

professional

Amount of claim

If the claim is fully unsecured, fill in only unsecured claim

amount. If claim is partially secured, fill in total claim

amount and deduction for value of collateral or setoff to

calculate unsecured claim.

LIBERTY LIFT SOLUTIONS LLC

BOBBY EVANS, PRESIDENT AND CHIEF EXECUTIVE

28 OFFICER

1250 WOODBRANCH DRIVE

HOUSTON, TX 77079

LIBERTY LIFT SOLUTIONS LLC

BOBBY EVANS, PRESIDENT AND CHIEF EXECUTIVE

OFFICER

TRADE

PHONE: 713-575-2300

FAX: 713-396-5493

EMAIL: BOBBY.EVANS@LIBERTYLIFT.COM

$356,159.56

ENERGY TRANSFER FUEL LP

KELCY L. WARREN, CHIEF EXECUTIVE OFFICER

29

800 EAST SONTERRA BOULEVARD # 250

SAN ANTONIO, TX 78258

ENERGY TRANSFER FUEL LP

KELCY L. WARREN, CHIEF EXECUTIVE OFFICER

PHONE: 210-403-7300

TRADE

FAX: 210-403-7500

EMAIL: BRENT.RATLIFF@ENERGYTRANSFER.COM

$314,197.40

RAUH OILFIELD SERVICES CO

JUDY RAUH, OWNER

30

1622 OK-132

ENID, OK 73703

RAUH OILFIELD SERVICES CO

JUDY RAUH, OWNER

PHONE: 580-796-2128

FAX: 580-796-2129

EMAIL:

DEBBIE.RUPPENTHAL@RAUHOILFIELD.COM

TRADE

$310,444.01

SPECTRUM TRACER SERVICES LLC

STEVE FAUROT, PRESIDENT

31

9111 E PINE ST #104

TULSA, OK 74115

SPECTRUM TRACER SERVICES LLC

STEVE FAUROT, PRESIDENT

PHONE: 918-933-5653

FAX: 888-853-5653

EMAIL: SFAUROT@SPECTRUMTRACER.COM

TRADE

$296,221.00

COVINGTON & BURLING LLP

STEPHEN P. ANTHONY, PARTNER

32

850 TENTH STREET, NW

WASHINGTON, DC 20001-4956

COVINGTON & BURLING LLP

STEPHEN P. ANTHONY, PARTNER

PHONE: 202-662-6000

FAX: 202 662 6291

EMAIL: SANTHONY@COV.COM

TRADE

$303,455.77

Official Form 204

Chapter 11 or Chapter 9 Cases: List of Creditors Who Have the 50 Largest Unsecured Claims

Page 7

Case 16-32488 Document 1 Filed in TXSB on 05/16/16 Page 21 of 36

Debtor

SandRidge Energy, Inc., et al.

Case Number (if known)

Name

Name of creditor and complete mailing address, including zip

code

Name, telephone number and email address of creditor

contact

RITE-WAY CONSTRUCTION LLC

LINDA LYONS

PHONE: 580-233-0738

FAX: 580-233-8363

EMAIL: LINDAL.RITEWAY@GMAIL.COM

RITE-WAY CONSTRUCTION LLC

LINDA LYONS

33

4805 E CHESTNUT AVE

ENID, OK 73701

Nature of claim

Indicate if claim

(for example,

is contingent,

trade debts,

unliquidated, or

bank loans,

disputed

professional

Amount of claim

If the claim is fully unsecured, fill in only unsecured claim

amount. If claim is partially secured, fill in total claim

amount and deduction for value of collateral or setoff to

calculate unsecured claim.

TRADE

$291,294.30

TRADE

$288,458.93

GE INTELLIGENT PLATFORMS INC

JODY MARKOPOULOS, CHIEF EXECUTIVE OFFICER

35 AND PRESIDENT

3135 EASTON TURNPIKE

FAIRFIELD, CT 06828-

GE INTELLIGENT PLATFORMS INC

JODY MARKOPOULOS, CHIEF EXECUTIVE OFFICER

AND PRESIDENT

TRADE

PHONE: 434-978-5000

FAX: 203-373-3131

EMAIL:

$286,996.22

TRI-STATE ELECTRICAL CONTRACTORS INC

LORI MASON, CONTROLLER

36

120 ROUTE 9W

HAVERSTRAW, NY 10927

TRI-STATE ELECTRICAL CONTRACTORS INC

LORI MASON, CONTROLLER

PHONE: 405-341-3043

FAX: 563-568-2888

EMAIL: ACCOUNTSRECEIVABLE@TSIG.COM

TRADE

$279,125.64

PETRO AMIGOS SUPPLY INC

TERESA CHERRY, ACCOUNTS RECEIVABLE

37

777 N ELDRIDGE PKWY #400

HOUSTON, TX 77079

PETRO AMIGOS SUPPLY INC

TERESA CHERRY, ACCOUNTS RECEIVABLE

PHONE: 281-497-0858

FAX: 281-497-1575

EMAIL: TCHERRY@PETRO-AMIGOS.COM

TRADE

$277,866.13

DELOITTE FINANCIAL ADVISORY SERVICES LLP

DELOITTE FINANCIAL ADVISORY SERVICES LLP

DAVID WILLIAMS, PRINCIPAL

PHONE: 312-486-9434

FAX: 703-842-6748

EMAIL:

DAVID WILLIAMS, PRINCIPAL

34 30 ROCKEFELLER PLAZA

NEW YORK, NY 10112-0015

Official Form 204

Chapter 11 or Chapter 9 Cases: List of Creditors Who Have the 50 Largest Unsecured Claims

Page 8

Case 16-32488 Document 1 Filed in TXSB on 05/16/16 Page 22 of 36

Debtor

SandRidge Energy, Inc., et al.

Case Number (if known)

Name

Name of creditor and complete mailing address, including zip

code

Name, telephone number and email address of creditor

contact

Nature of claim

Indicate if claim

(for example,

is contingent,

trade debts,

unliquidated, or

bank loans,

disputed

professional

Amount of claim

If the claim is fully unsecured, fill in only unsecured claim

amount. If claim is partially secured, fill in total claim

amount and deduction for value of collateral or setoff to

calculate unsecured claim.

AES DRILLING FLUIDS LLC

JIM SHERMAN, PRESIDENT

38

11767 KATY FREEWAY SUITE 230

HOUSTON, TX 77079

AES DRILLING FLUIDS LLC

JIM SHERMAN, PRESIDENT

PHONE: 888-556-4533

FAX: 281-589-7150

EMAIL: DLEJEUNE@AESFLUIDS.COM

TRADE

$274,910.62

ARCHER DIRECTIONAL DRILLING SERVICES LLC

LINDA JOHNSON

39

4005 S THOMAS ROAD

OKLAHOMA CITY, OK 73179

ARCHER DIRECTIONAL DRILLING SERVICES LLC

LINDA JOHNSON

PHONE: 405-789-3499

FAX: 936-447-5361

EMAIL: US-ADDS-AR@ARCHERWELL.COM

TRADE

$262,205.00

EXCEL STIMULATION LLC

BILL LITTRELL, OWNER

40

1 1/2 MI N ON HWY 60

FAIRVIEW, OK 73737

EXCEL STIMULATION LLC

BILL LITTRELL, OWNER

PHONE: 580-227-3701

FAX: 580-277-3703

EMAIL: EXCEL@PLDI.NET

TRADE

$246,759.26

HAAS OIL AND PARTNERS

PEDRO HAAS, DIRECTOR

41

1155 BATTERY STREET LS-7

SAN FRANCISCO, CA 94111

HAAS OIL AND PARTNERS

PEDRO HAAS, DIRECTOR

PHONE: 805-278-1800

FAX: 805-278-2255

EMAIL: HASS@HASSPETROLEUM.COM

PREPAYMENT

$222,982.34

THRU TUBING SOLUTIONS INC

ROCKY GARLOW, MANAGER

42

1501 E. 20TH STREET

ELK CITY, OK 73644

THRU TUBING SOLUTIONS INC

ROCKY GARLOW, MANAGER

PHONE: 580-225-6977

FAX: 580-225-7077

EMAIL: TTSINFO@THRUTUBING.COM

TRADE

$216,594.90

Official Form 204

Chapter 11 or Chapter 9 Cases: List of Creditors Who Have the 50 Largest Unsecured Claims

Page 9

Case 16-32488 Document 1 Filed in TXSB on 05/16/16 Page 23 of 36

Debtor

SandRidge Energy, Inc., et al.

Case Number (if known)

Name

Name of creditor and complete mailing address, including zip

code

Name, telephone number and email address of creditor

contact

Nature of claim

Indicate if claim

(for example,

is contingent,

trade debts,

unliquidated, or

bank loans,

disputed

professional

Amount of claim

If the claim is fully unsecured, fill in only unsecured claim

amount. If claim is partially secured, fill in total claim

amount and deduction for value of collateral or setoff to

calculate unsecured claim.

HAMM & PHILLIPS SERVICE INC

SHELLY DULINSKY

43

3000 E WILLOW ROAD

ENID, OK 73701

HAMM & PHILLIPS SERVICE INC

SHELLY DULINSKY

PHONE: 580-242-1876

FAX: 580-242-7339

EMAIL:

TRADE

$211,261.10

RELIANCE OILFIELD SERVICES

AUSTIN ROBERTS, PRESIDENT AND CHIEF

EXECUTIVE OFFICER

44

2100 S. UTICA AVENUE

SUITE 202

TULSA, OK 74114

RELIANCE OILFIELD SERVICES

AUSTIN ROBERTS, PRESIDENT AND CHIEF

EXECUTIVE OFFICER

PHONE: 877-909-5823

FAX: 918-512-4363

EMAIL:

TRADE

$210,308.10

BACHMAN SERVICES INC

ANGELA BACHMAN

45 2220 SOUTH PROSPECT AVENUE

PO BOX 96265

OKLAHOMA CITY, OK 73143

BACHMAN SERVICES INC

ANGELA BACHMAN, CHIEF EXECUTIVE OFFICER

PHONE: 405-677-8296

FAX: 405-677-7483

EMAIL:

TRADE

$195,268.32

ALFALFA ELECTRIC COOPERATIVE INC

DR. CARL NEWTON, PRESIDENT

46

121 E MAIN ST

CHEROKEE, OK 73728

ALFALFA ELECTRIC COOPERATIVE INC

DR. CARL NEWTON, PRESIDENT

PHONE: 580-596-3333

FAX: 580-596-2464

EMAIL: DWESSELS@AKSLC.NET

TRADE

CONTINGENT

UNDETERMINED

CALFRAC WELL SERVICES CORP

JOLENE MADRID, ACCOUNTS RECEIVABLE

47

717 17TH STREET, STE 1445

DENVER, CO 80202

CALFRAC WELL SERVICES CORP

JOLENE MADRID, ACCOUNTS RECEIVABLE

PHONE: 303-293-2931

FAX: 303-293-2939

EMAIL: JMADRID@CALFRAC.COM

TRADE

CONTINGENT

UNDETERMINED

Official Form 204

Chapter 11 or Chapter 9 Cases: List of Creditors Who Have the 50 Largest Unsecured Claims

Page 10

Case 16-32488 Document 1 Filed in TXSB on 05/16/16 Page 24 of 36

Debtor

SandRidge Energy, Inc., et al.

Case Number (if known)

Name

Name of creditor and complete mailing address, including zip

code

Name, telephone number and email address of creditor

contact

Nature of claim

Indicate if claim

(for example,

is contingent,

trade debts,

unliquidated, or

bank loans,

disputed

professional

Amount of claim

If the claim is fully unsecured, fill in only unsecured claim

amount. If claim is partially secured, fill in total claim

amount and deduction for value of collateral or setoff to

calculate unsecured claim.

BASIC ENERGY SERVICES LP

JOHN UNDERWOOD, MANAGER

48

801 CHERRY STREET, SUITE 2100

FORT WORTH, TX 76102

BASIC ENERGY SERVICES LP

JOHN UNDERWOOD, MANAGER

PHONE: 432-620-5500

FAX: 817-334-410

EMAIL: AR@BASICENERGYSERVICES.COM

TRADE

CONTINGENT

UNDETERMINED

SIMONS PETROLEUM INC

SUZANNE BODGER, COLLECTIONS MANAGER

49 210 PARK AVENUE

SUITE 1800

OKLAHOMA CITY, OK 73102

SIMONS PETROLEUM INC

SUZANNE BODGER, COLLECTIONS MANAGER

PHONE: 405-841-7349

FAX: 405-848-3508

EMAIL: SIMONSAR@SIMONSPETROLEUM.COM

TRADE

CONTINGENT

UNDETERMINED

O OG&E

SEAN TRAUSCHKE, CHIEF FINANCIAL OFFICER

50 321 N HARVEY AVE

OKLAHOMA CITY, OK 73102

OG&E

SEAN TRAUSCHKE, CHIEF FINANCIAL OFFICER

PHONE: 800-522-0280

FAX: 405-553-3743

EMAIL:

TRADE

CONTINGENT

UNDETERMINED

Official Form 204

Chapter 11 or Chapter 9 Cases: List of Creditors Who Have the 50 Largest Unsecured Claims

Page 11

Case 16-32488 Document 1 Filed in TXSB on 05/16/16 Page 25 of 36

Fill in this information to identify the case and this filing:

Debtor Name

SandRidge Energy, Inc., et al.

United States Bankruptcy Court for the:

Southern District of Texas

(State)

Case number (If known):

Official Form 202

Declaration Under Penalty of Perjury for Non-Individual Debtors

12/15

An individual who is authorized to act on behalf of a non-individual debtor, such as a corporation or partnership, must sign and submit

this form for the schedules of assets and liabilities, any other document that requires a declaration that is not included in the document,

and any amendments of those documents. This form must state the individuals position or relationship to the debtor, the identity of the

document, and the date. Bankruptcy Rules 1008 and 9011.

WARNING -- Bankruptcy fraud is a serious crime. Making a false statement, concealing property, or obtaining money or property by

fraud in connection with a bankruptcy case can result in fines up to $500,000 or imprisonment for up to 20 years, or both. 18 U.S.C.

152, 1341, 1519, and 3571.

Declaration and signature

I am the president, another officer, or an authorized agent of the corporation; a member or an authorized agent of the partnership; or

another individual serving as a representative of the debtor in this case.

I have examined the information in the documents checked below and I have a reasonable belief that the information is true and

correct:

Schedule A/B: Assets-Real and Personal Property (Official Form 206A/B)

Schedule D: Creditors Who Have Claims Secured by Property (Official Form 206D)

Schedule E/F: Creditors Who Have Unsecured Claims (Official Form 206E/F)

Schedule G: Executory Contracts and Unexpired Leases (Official Form 206G)

Schedule H: Codebtors (Official Form 206H)

Summary of Assets and Liabilities for Non-Individuals (Official Form 206Sum)

Amended Schedule

Chapter 11 or Chapter 9 Cases: Consolidated List of Creditors Who Have the 50 Largest Unsecured Claims and Are

Not Insiders (Official Form 204)

Other document that requires a declaration

I declare under penalty of perjury that the foregoing is true and correct.

Executed on

05/16/2016

MM/ DD/YYYY

/s/ Julian M. Bott

Signature of individual signing on behalf of debtor

Julian M. Bott

Printed name

Authorized Signatory

Position or relationship to debtor

Official Form 202

Declaration Under Penalty of Perjury for Non-Individual Debtors

Case 16-32488 Document 1 Filed in TXSB on 05/16/16 Page 26 of 36

IN THE UNITED STATES BANKRUPTCY COURT

FOR THE SOUTHERN DISTRICT OF TEXAS

HOUSTON DIVISION

)

)

)

)

)

)

)

In re:

SANDRIDGE ENERGY, INC.,

Debtor.

Chapter 11

Case No. 16-________ (___)

LIST OF EQUITY SECURITY HOLDERS 1

Debtor

Registered Holder

CEDE & CO. (FAST

ACCOUNT)

CEDE & CO. (FAST

ACCOUNT)

CEDE & CO (FAST

ACCOUNT)

SandRidge Energy,

Inc.

RIVERSTONE/CARLYLE

GLOBAL ENERGY &

POWER FUND IV (FT) LP

C/O RIVERSTONE

HOLDINGS

R/C ENERGY IV DYNAMIC

PARTNERSHIP LP C/O

RIVERSTONE HOLDINGS

RIVERSTONE/CARLYLE

GLOBAL ENERGY &

POWER FUND IV LP C/O

RIVERSTONE HOLDINGS

R/C DYNAMIC HOLDINGS

LP C/O RIVERSTONE

HOLDINGS

JUSTIN AARON

ANGEL ACOSTA

LUCAS ACOSTA

TONY ACOSTA

DEANNE D. ADAMS

GILBERT AGUILAR

HURBERT GENE AKERS

ROBERT AKIN

RICHARD ALDRIDGE

Type of

Equity

Security

Percentage

Held

8.5%

PREFERRED

100%

7.0%

PREFERRED

100%

COMMON

92.40%

712 5TH AVE 19TH

FLOOR

NEW YORK, NY 10019

COMMON

4.09%

712 5TH AVE 19TH

FLOOR

NEW YORK, NY 10019

COMMON

2.16%

712 5TH AVE 19TH

FLOOR

NEW YORK, NY 10019

COMMON

< 1.00%

COMMON

< 1.00%

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

Address of Equity

Holder

PO BOX 20 BOWLING

GREEN STATION

NEW YORK, NY 10004

PO BOX 20 BOWLING

GREEN STATION

NEW YORK, NY 10004

PO BOX 20 BOWLING

GREEN STATION

NEW YORK, NY 10004

712 5TH AVE 19TH

FLOOR

NEW YORK, NY 10019

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

This list serves as the disclosure required to be made by the debtor pursuant to rule 1007 of the Federal Rules of

Bankruptcy Procedure. All equity positions listed are as of the date of commencement of the chapter 11 case. Address

information for individual holders has been redacted to maintain confidentiality

Case 16-32488 Document 1 Filed in TXSB on 05/16/16 Page 27 of 36

Debtor

SandRidge Energy,

Inc.

Registered Holder

AST EXCHANGE AGENT

#16528 ARENA

RESOURCES INC C/O

CORPORATE ACTIONS

AST REORG SALE

ACCOUNT ATTN: V LUCA

ALAINA B. AULT

WILLIAM F. BABCOCK,

JR.

ANTHONY T. BAILEY, JR.

AND EMILY C. BAILEY JT

TEN/WROS

BOB BAKER

JUANITA BAKER

BRENT BARBOUR

CHERYL BARNAS

RICARDO BARRERA

TIMOTHY BARTON

BRYAN BARRETT

ERIN BEACH

ROBERT M. BEARMAN

BRENT BEAUDEAUX

NICHOLAS E. BENZOR

BETTY D. BERG

RUBEN BERNAL

LEOTA M. BETTS

JOHN BLAKENEY

AMY BLANCHARD

BERNIE BOWDEN

CARLEE E. BRANDON

A. GERALD BROWN &

GAYLA S. BROWN JT TEN

KRISTINA BURTON

BRIAN CABELLI CUST

FOR OLIVIA R. CABELLI

UGMA AZ

BRIAN D. CABELLI

DIANA L. CABELLI

RICKY CAGLE

ED CAIN

TY SCOTT CALLAHAN

CUST MONTGOMERY

CALLAHAN

ALBERT CARBAJAL

RANDLE D. CARTER

TRUMAN A. CARTER

DUVAN CASILLAS

ROSS CASILLAS

BURL CAUBLE

BENJAMIN CHANCY

CHERYL CHARGIN

Address of Equity

Holder

Type of

Equity

Security

Percentage

Held

6201 15TH AVENUE

BROOKLYN, NY 11219

COMMON

< 1.00%

COMMON

< 1.00%

COMMON

< 1.00%

REDACTED

COMMON

< 1.00%

REDACTED

COMMON

< 1.00%

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

REDACTED

COMMON

< 1.00%

REDACTED

COMMON

< 1.00%

REDACTED

COMMON

< 1.00%

REDACTED

REDACTED

REDACTED

REDACTED

COMMON

COMMON

COMMON

COMMON

< 1.00%

< 1.00%

< 1.00%

< 1.00%

REDACTED

COMMON

< 1.00%

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

6201 15TH AVE.

BROOKLYN, NY 11219

REDACTED

Case 16-32488 Document 1 Filed in TXSB on 05/16/16 Page 28 of 36

Debtor

SandRidge Energy,

Inc.

Registered Holder

GEOFFREY CHARGIN

JAMES CHOVANETZ

TATIANA A. CHRISMAN &

BILLY W. CHRISMAN JT

TEN

DONALD CLARK

COURTNEY COLE

CECIL COLLIER

SHERRILL CONLEY CUST

MONTANA A. CONLEY

SHERRILL CONLEY CUT

MADISON L. CONLEY

DALE CONNOR

WES COOPER

JAMES R. COOTS

LARRY COSHOW

DEE CRAVY

TIMOTHY CRONE

MARSHALL R. DEGROOT

CHASE M. DICKENS

BLAS ERIC DOMINGUEZ

ANDREW DRAKE

HART DROBISH

ANTHONY DRUMMOND

JENNIFER DUCK

PAULA DUNCAN

ROY J. EDGEMON

RALPH FARMER & MAVIS

J. FARMER JT TEN

JERRY FATHREE

DAVID P, FISCHLIN

GAVIN FITZGERALD

CASEY CHAD FOWLER

ROBERT JOHN FRAKES

SCOTT WILLIAM FRAKES

STEVEN DON FRAKES

BOBBY FUENTES

ORLANDO FUENTES

RANDY FUNNELL

JASON M, GAGE

LUPE GARZA

ERNEST GILBERT, JR.

JAIME GONZALEZ

GARY D, GORE CUST

FBO AARON ALTON

GORE

GARY D, GORE CUST

FBO GARRETT LEE

GORE GORE

GARY D, GORE CUST

FBO JACOB DON GORE

REDACTED

REDACTED

Type of

Equity

Security

COMMON

COMMON

REDACTED

COMMON

< 1.00%

REDACTED

REDACTED

REDACTED

COMMON

COMMON

COMMON

< 1.00%

< 1.00%

< 1.00%

REDACTED

COMMON

< 1.00%

REDACTED

COMMON

< 1.00%

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

REDACTED

COMMON

< 1.00%

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

REDACTED

COMMON

< 1.00%

REDACTED

COMMON

< 1.00%

REDACTED

COMMON

< 1.00%

Address of Equity

Holder

Percentage

Held

< 1.00%

< 1.00%

Case 16-32488 Document 1 Filed in TXSB on 05/16/16 Page 29 of 36

Debtor

Registered Holder

CAROL GOWDY

LYNAE GREELY

JOHNNY R. GREENE

E BULKELEY GRISWOLD

TR L&L CAPITAL

PARTNER 401K & PS

PLAN U/A DTD 12/12/94

FBO E BULKELEY

GRISWOLD

DAVID GROVES

GSO CAPITAL PARTNERS

LP

SandRidge Energy,

Inc.

ABEL GUTIERREZ

WILLIAM CADE HALMANN

JOE HALL

CHRISTOPHER HALTOM

JASON HAM

DEREK HAMILTON

SHANE HANES

WENDALL R. HANSEN

ALAN CLARK

HARDWICKE CUST

PHOEBE LYNN

HARDWICKE

BEVERLY A. & ASHLEY A.

HARRELL & ANDREW A.

HARRELL TR UA 04/13/99

DRAY HATFIELD

FRANCES S. HAYES

CUST. HARRISON S.

HANNA

FRANCES SUE HAYES

CUST HACKSON T.

HANNA

FRANCES SUE HAYES &

JACK HATES TR

RODNEY HENDRICKS

MARTIS HENNIG

VALERIE PARR HILL

DARRYL HINZE

CATHY G. HOBBS TR

LYLE HODNETT

ANDREW HOLMES

RONNIE IBARRA

KENNETH F. JACKSON &

GLORIA J. JACKSON TR

JOHN D. JETT

ALICIA JOHNSON

RODNEY E. JOHNSON

REDACTED

REDACTED

REDACTED

Type of

Equity

Security

COMMON

COMMON

COMMON

REDACTED

COMMON

< 1.00%

REDACTED

280 PARK AVE 11TH

FLOOR

NEW YORK, NY 100171216

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

COMMON

< 1.00%

COMMON

< 1.00%

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

REDACTED

COMMON

< 1.00%

REDACTED

COMMON

< 1.00%

REDACTED

COMMON

< 1.00%

REDACTED

COMMON

< 1.00%

REDACTED

COMMON

< 1.00%

REDACTED

COMMON

< 1.00%

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

REDACTED

COMMON

< 1.00%

REDACTED

REDACTED

REDACTED

COMMON

COMMON

COMMON

< 1.00%

< 1.00%

< 1.00%

Address of Equity

Holder

Percentage

Held

< 1.00%

< 1.00%

< 1.00%

Case 16-32488 Document 1 Filed in TXSB on 05/16/16 Page 30 of 36

Debtor

SandRidge Energy,

Inc.

Registered Holder

MICHAEL JONES &

COURTNEY JONES JT

TEN

RICHARD JONES

KYLER KANADY

KEN-DAR PARTNERSHIP

ATT: DARREL W.

WOODSON

RICKY KIRBY

MARLIN KOTZ, JR.

CARISSA LAFFOON

LONNITA LANEY

TERRY LAUGHLIN &

AMANDA LAUGHLIN JT

WROS C/O ROBERT A.

SHEPHERD

MARY LEWIS

WILLIAM J. LLOYD III

DARRELL LOCKETT

PHIL LOGSDON

RAFAEL LONGORIA

EDWARDO LOPEZ

KENDRA LOPEZ

JOSE LUJAN

CLINTON LUX

JERRY LYNCH, JR.

RICHARD MALTBY

MICHAEL MARQUEZ

ELIAS MARTINEZ

JULIAN MARTINEZ III

TOMAS MARTINEZ

JARRID MAUK

EUGENE J. MAXWELL

MARK MCCAIN

PATRICK R. MCCONN

WILLIAM MCDONALD

NEIL MCELROY

MARY MCGARITY

RICHARD MCKAY

KENNETH MCLENNAN

MARILYN MCMAHAN

DAWN MENDENHALL &

DAVID MENDENHALL JT

TEN

ALVINO MENDEZ

DENNIS MILLER

TOMMY MILLER

JOHN F. MILLWEE &

JOANN MILLWEE JT TEN

KERI MITCHELL

Address of Equity

Holder

Type of

Equity

Security

Percentage

Held

REDACTED

COMMON

< 1.00%

REDACTED

REDACTED

COMMON

COMMON

< 1.00%

< 1.00%

REDACTED

COMMON

< 1.00%

REDACTED

REDACTED

REDACTED

REDACTED

COMMON

COMMON

COMMON

COMMON

< 1.00%

< 1.00%

< 1.00%

< 1.00%

REDACTED

COMMON

< 1.00%

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

REDACTED

COMMON

< 1.00%

REDACTED

REDACTED

REDACTED

COMMON

COMMON

COMMON

< 1.00%

< 1.00%

< 1.00%

REDACTED

COMMON

< 1.00%

REDACTED

COMMON

< 1.00%

Case 16-32488 Document 1 Filed in TXSB on 05/16/16 Page 31 of 36

Debtor

SandRidge Energy,

Inc.

Registered Holder

N MALONE MITCHELL III

CUST NOAH MALONE

MITCHELL IV

DESTINE MOE

AMBROCIO MOLINA, JR.

SERGIO MOLINA

JAMES MOORE

SCOTT MOORE

JENNIFER MUNDAY

FELIX MUNOZ

NATALIE MUNSON

WESLEY MUNSON

CARLOS NATIVIDAD

DANIEL NEW

GAYLE NIVENS

GILBERT NIX

DONEETA NOWLIN

BEN NUNNALLY

TERRY ODEN

JOHN E. ORR

VINCENTE PACHECO

TERRY PALMER

PHILIP PARKER

PATRICIA PARKS

ROY D. PATTERSON

GARY PATTERSON

KIMBERLY PEMPIN

ROBERT J. PERRY TR UA

01/16/12

WILLIAM PFISTER

JON MARTIN PHILLIPS

CUST JEWEL ANN

ARNOLD

JON MARTIN PHILLIPS

CUST SLADE THOMAS

ARNOLD

JON MARTIN PHILLIPS

CUST BRADY ALAN

PEARSON

JON MARTIN PHILLIPS

CUST COLBY PEARSON

MARY ANN (POLETTI) TR

POLETTI REV LIVING

TRUST UA

VALENTE POLVON

H. M. PYLE

TERRY RAINES

AUDEN RAMIREZ

RUBEN RAMIREZ

ARMANDO RAMOS

Address of Equity

Holder

Type of

Equity

Security

Percentage

Held

REDACTED

COMMON

< 1.00%

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

REDACTED

COMMON

< 1.00%

REDACTED

COMMON

< 1.00%

REDACTED

COMMON

< 1.00%

REDACTED

COMMON

< 1.00%

REDACTED

COMMON

< 1.00%

REDACTED

COMMON

< 1.00%

REDACTED

COMMON

< 1.00%

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

REDACTED

COMMON

COMMON

COMMON

COMMON

COMMON

COMMON

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

< 1.00%

Case 16-32488 Document 1 Filed in TXSB on 05/16/16 Page 32 of 36

Debtor

SandRidge Energy,

Inc.

Registered Holder

JACKI RASOR CUST FBO

KATHRYN R, FRANCIS

SUSAN RAY

RED BRIDGE EQUITIES

ATTN: ROYCE KINNEY

CHARLES J. RENONI

JAMES REYNOLDS

ROBERT RIFFE

ROBERT RIVAS

HILARIO RODRIGUEZ

SHANNON RODRIGUEZ

DICK J. ROHLA & MARY