Chapter 12

Chapter 12

Uploaded by

LBL_LowkeeCopyright:

Available Formats

Chapter 12

Chapter 12

Uploaded by

LBL_LowkeeCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Chapter 12

Chapter 12

Uploaded by

LBL_LowkeeCopyright:

Available Formats

Chapter12

RiskandRefinementsinCapitalBudgeting

Instructors Resources

Overview

Chapters10and11developedthemajordecisionmakingaspectsofcapitalbudgeting.Cashflowsand

budgetingmodelshavebeenintegratedanddiscussedinprovidingtheprinciplesofcapitalbudgeting.

However,therearemorecomplexissuesbeyondthosepresented.Chapter12expandscapitalbudgeting

toconsiderriskwithsuchmethodsasscenarioanalysisandsimulation.Capitalbudgetingtechniques

usedtoevaluateinternationalprojects,aswellasthespecialrisksmultinationalcompaniesface,arealso

presented.Additionally,twobasicriskadjustmenttechniquesareexamined:certaintyequivalentsand

riskadjusteddiscountrates.Thechapterpresentsstudentswithseveralexamplesoftheapplicationofrisk

basedrefinementswhencapitalbudgetingintheirprofessionalandpersonallife.

Suggested Answer to Opener in Review Question

ThechapteropenerandtheFocusonEthicsboxinthischapterdescribedsomeoftheconsequences

oftheaccidentatBPsDeepwaterHorizonoilrig.ItisplausiblethatengineersandanalystsatBP

couldhaveimaginedaworstcasescenarioinwhichamajorspilloccurredatoneofthefirms

offshorerigs.HowmightathoroughscenarioanalysishaveinfluencedBPsoffshoredrilling

activities?

AnincreaseinthecostofcapitalmeansthatthemarketisdiscountingBPscashflowsatahigherrate.

ThatincludescashflowsfromBPsexistinginvestmentsaswellasinvestmentsthatthemarkethad

anticipatedthatBPwouldmakeinthefuture(andhencehadalreadybeenincorporated,atleastpartially,

intoBPsstockprice).Wehaveseenthatanincreaseinthediscountrateleadstoadeclineinthepresent

valueofacashflowstream,soitislogicalthatajumpinBPscostsofcapitalwouldbeassociatedwitha

majordropinthefirmsoverallvalue.

IfBPanalystshadimaginedthecostsofamajoroilspillasaworstcasescenario,itseemslikelythatBP

wouldhavetakenwhateverstepswerenecessarytopreventsuchanaccident.Thecashinflowsgenerated

byanoffshoreplatformareswampedbythecostsofamajorspill.Notallaccidentsarepreventable,of

course,butthefactthatBPengineerscouldnotquicklystoptheflowofoilintotheGulfofMexico

suggeststhatanaccidentofthetypethatoccurredontheoilrighadnotbeenplannedforinadvance.

2012PearsonEducation,Inc.PublishingasPrenticeHall

Chapter12RiskandRefinementsinCapitalBudgeting250

Answers to Review Questions

1. There is usually a significant degree of uncertainty associated with capital budgeting projects. There is the usual

business risk along with the fact that future cash flows are an estimate and do not represent exact values. The

uncertainly of each project cash flow stream will be different and thus each project has its own unique risk. This

uncertainty exists for both independent and mutually exclusive projects. The risk associated with any single

project has the capability to change the entire risk of the firm. The firms assets are like a portfolio of assets. If

an accepted capital budgeting project has a risk different from the average risk of the assets in the firm, it will

cause a shift in the overall risk of the firm.

2012PearsonEducation,Inc.PublishingasPrenticeHall

Chapter12RiskandRefinementsinCapitalBudgeting251

2. Risk, in terms of cash inflows from a project, is the variability of expected cash flows, hence the expected

returns, of the given project. The breakeven cash inflow the level of cash inflow necessary in order for the

project to be acceptable may be compared with the probability of that inflow occurring. When comparing two

projects with the same breakeven cash inflows, the project with the higher probability of occurrence is less

risky.

3. a.

Scenario analysis uses a number of possible inputs (cash inflows) to assess their impact on

the firms net present value (NPV) return. Scenario analysis can be used to evaluate the impact on return of

simultaneous changes in a number of variables, such as cash inflows, cash outflows, and the cost of capital,

resulting from differing assumptions relative to economic and competitive conditions. In capital budgeting,

the NPVs are frequently estimated for the pessimistic, most likely, and optimistic cash flow estimates. By

subtracting the pessimistic outcome NPV from

the optimistic outcome NPV, a range of NPVs can be determined.

b. Simulationisastatisticallybasedapproachusingrandomnumberstosimulatevariouscashflows

associatedwiththeproject,calculatingtheNPVorinternalrateofreturn(IRR)onthebasisof

thesecashflows,andthendevelopingaprobabilitydistributionofeachprojectsrateofreturns

basedonNPVorIRRcriterion.

4. a.

Multinational companies (MNCs) must consider the effect of exchange rate risk, the risk that the exchange

rate between the dollar and the currency in which the projects cash flows are denominated will reduce the

projects future cash flows. If the value of the dollar depreciates relative to that currency, the dollar value of

the projects cash flows will increase as a result. Firms can use hedging to protect themselves against this

risk in the short term; for the long term, financing the project using local currency can minimize this risk.

b. Politicalrisk,theriskthataforeigngovernmentsactionswilladverselyaffecttheproject,makes

internationalprojectsparticularlyrisky,becauseitcannotbepredictedinadvance.Totakethis

riskintoaccount,managersshouldeitheradjustexpectedcashflowsoruseriskadjusteddiscount

rateswhenperformingthecapitalbudgetinganalysis.Adjustmentofcashflowsisthepreferred

method.

c.

Taxlawsdifferfromcountrytocountry.Becauseonlyaftertaxcashflowsarerelevantforcapital

budgetingdecisions,managersmustaccountforalltaxespaidtoforeigngovernmentsandconsider

theeffectofanyforeigntaxpaymentsonthefirmsU.S.taxliability.

d. Transferpricingreferstothepriceschargedbyacorporationssubsidiariesforgoodsandservices

tradedbetweenthem;thepricesarenotsetbytheopenmarket.Intermsofcapitalbudgeting

decisions,managersshouldbesurethattransferpricesaccuratelyreflectactualcostsand

incrementalcashflows.

e.

MNCscannotevaluateinternationalcapitalprojectsfromonlyafinancialperspective.The

strategicviewpointoftenisthedeterminingfactorindecidingwhetherornottoundertakea

project.Infact,aprojectthatislessacceptablethananotheronapurelyfinancialbasismay

bechosenforstrategicreasons.SomereasonsforMNCforeigninvestmentincludecontinued

marketaccess,theabilitytocompetewithlocalcompanies,politicaland/orsocialreasons

(forexample,gainingfavorabletaxtreatmentinexchangeforcreatingnewjobsinacountry),

andachievementofaparticularcorporateobjectivesuchasobtainingareliablesourceofraw

materials.

5. Risk-adjusted discount rates (RADRs) reflect the return that must be earned on a given project in order to

adequately compensate the firms owners. The relationship between RADRs and the capital asset pricing model

2012PearsonEducation,Inc.PublishingasPrenticeHall

252Gitman/ZutterPrinciplesofManagerialFinance,Thirteenth Edition

(CAPM) is a purely theoretical concept. The expression used to value the expected rate of return of a security ki

(ki RF [b (km RF)]) is rewritten substituting an asset for a security. Because real corporate assets are not

traded in efficient markets and estimation of a market return, km, for a portfolio of such assets would be

difficult, the CAPM is not used for real assets.

6. A firm whose stock is actively traded in security markets generally does not increase in value through

diversification. Investors themselves can more efficiently diversify their portfolio by holding a variety of stocks.

Since a firm is not rewarded for diversification, the risk of a capital budgeting project should be considered

independently rather than in terms of their impact on the total portfolio of assets. In practice, management

usually follows this approach and evaluates projects based on their total risk.

7. RADRs are most often used in practice for two reasons: (1) financial decision makers prefer using rate of

return-based criteria, and (2) they are easy to estimate and apply. In practice, risk is subjectively categorized

into classes, each having a RADR assigned to it. Each project is then subjectively placed in the appropriate risk

class.

8. A comparison of NPVs of unequal-lived mutually exclusive projects is inappropriate because it may lead to an

incorrect choice of projects. The annualized net present value (ANPV) converts the NPV

of unequal-lived projects into an annual amount that can be used to select the best project.

9. Real options are opportunities embedded in real assets that are part of the capital budgeting process. Managers

have the option of implementing some of these opportunities to alter the cash flow and risk of a given project.

Examples of real options include:

Abandonmentthe option to abandon or terminate a project prior to the end of its planned life.

Flexibilitythe ability to adopt a project that permits flexibility in the firms production process, such as being

able to reconfigure a machine to accept various types of inputs.

Growththe option to develop follow-on projects, expand markets, expand or retool plants, and so on, that

would not be possible without implementation of the project that is being evaluated.

Timingthe ability to determine the exact timing of when various action of the project will be undertaken.

10.

Strategic NPV incorporates the value of the real options associated with the project while traditional NPV

includes only the identifiable relevant cash flows. Using strategic NPV could alter the final accept/reject

decision. It is likely to lead to more accept decisions since the value of the options is added to the traditional

NPV, as shown in the following equation.

NPVstrategicNPVtraditionalValueofrealoptions

11.

Capital rationing is a situation where a firm has only a limited amount of funds available for capital

investments. In most cases, implementation of the acceptable projects would require more capital than is

available. Capital rationing is common for a firm, since unfortunately most firms do not have sufficient capital

available to invest in all acceptable projects. In theory, capital rationing should not exist because firms should

accept all projects with positive NPVs or IRRs greater than the cost of capital. However, most firms operate

with finite capital expenditure budgets and must select the best from all acceptable projects, taking into account

the amount of new financing required to fund these projects.

12. The IRR approach and the NPV approach to capital rationing both involve ranking projects on the basis of

IRRs. Using the IRR approach, a cut-off rate and a budget constraint are imposed. The NPV first ranks projects

by IRR and then takes into account the present value of the benefits from each project in order to determine the

combination with the highest overall net present value. The benefit of the NPV approach is that it guarantees a

2012PearsonEducation,Inc.PublishingasPrenticeHall

Chapter12RiskandRefinementsinCapitalBudgeting253

maximum dollar return to the firm, whereas the IRR approach does not.

2012PearsonEducation,Inc.PublishingasPrenticeHall

254Gitman/ZutterPrinciplesofManagerialFinance,Thirteenth Edition

Suggested Answer to Focus on Practice Box: The Monte Carlo

Method: The Forecast Is for Less Uncertainty

AMonteCarlosimulationprogramrequirestheusertofirstbuildanExcelspreadsheetmodelthat

capturestheinputvariablesfortheproposedproject.Whatissuesandwhatbenefitscantheuser

derivefromthisprocess?

AgoodMonteCarlosimulationrequiresreasonablyaccurateestimatesofdata,includingprojectedsales

figures,productioncosts,associatedoverhead,marketingcosts,andothercostsrelatedtotheproject.

Gatheringthistypeofdatafornumerousprojectscanbeexpensiveintermsofemployeehours.However,

anysoundevaluationofaprojectwilleventuallyrequiresuchinformationgatheringbeforeadecisioncan

bemade.ThebenefitoftheMonteCarloprogramisthatitcanquicklyprovidearangeofprobableoutcomes

asthepotentialinputsarevaried.Forexample,ifthemarketingvariableisincreased,theeffectonpossible

salesoutcomecanbequicklydemonstrated.

Butevenbeyondthequickanalysisoftheeffectofchangingaprojectvariableisthattheneedforaccurate

andreasonableestimateswillforceprojectdeveloperstospendsometimeandefforttodeveloptheproper

dataforinputintotheMonteCarloprogram.Workingdiligentlytofindreliablecostestimatesandmarketing

estimatescanonlyenhancetheviabilityofaproposedprojectifitmeetsthecompanysselectioncriteria.

Suggested Answer to Focus on Ethics Box:

Ethics and the Cost of Capital

Istheultimategoalofthefirm,tomaximizethewealthoftheownersforwhomthefirmisbeing

operated,ethical?

Itisnotthegoalthatmakesmaximizationofshareholderwealthethicalorunethical,itisactionsofthe

financialmanagerinpursuitofthisgoalthatdictatesthelevelofethics.

Whymightethicalcompaniesbenefitfromalowercostofcapitalthanlessethicalcompanies?

Ifethicalbehaviorreducestheriskofinvestinginacompany(e.g.,reducesthevolatilityofthefirmscash

flows),ethicalcompaniesshouldbenefitmorefromalowercostofcapitalthanlessethicalcompanies.

Answers to Warm-Up Exercises

E12-1.

Sensitivity analysis

Answer: Usingthe12%costofcapitaltodiscountallofthecashflowsforeachscenariotoyieldthe

followingNPVs,resultinginaNPVrangeof$19,109.78:

Pessimistic

MostLikely

Optimistic

$3,283.48

$6,516.99

$15,826.30

2012PearsonEducation,Inc.PublishingasPrenticeHall

Chapter12RiskandRefinementsinCapitalBudgeting255

E12-2.

Using IRR as selection criteria

Answer: Theminimumamountofannualcashinflowneededtoearn8%is$11,270.54

N5,I8%,PV$45,000

SolveforPMT$11,270.54

TheIRRoftheprojectis12.05%.

N5,PV$45,000,PMT$12,500

SolveforI$12.05%

TheprojectisacceptablesinceitsIRRexceedsthefirms8%costofcapital.Sincetherequired

cashflowismuchlessthantheanticipatedcashflow,onewouldexpecttheIRRtoexceedthe

requiredrateofreturn.

E12-3.

Risk-adjusted discount rates

Answer: ProjectSourdoughRADR7.0%

N7,I7%,PMT$5,500

SolveforPV$29,641.09

NPVPVnInitialinvestment

NPV$29,641.09$12,500

NPV$17,141.09

ProjectGreekSaladRADR8.0%

N7,I8%,PMT$4,000

SolveforPV$20,825.48

NPVPVnInitialinvestment

NPV$20,825.48$7,500

NPV$13,325.48

YeastimeshouldselectProjectSourdough.

E12-4.

ANPV

Answer: YoumayuseafinancialcalculatortodeterminetheIRRofeachproject.Choosetheproject

withthehigherIRR.

ProjectM

Step1:

FindtheNPVoftheproject

NPVMKeystrokes

CF0$35,000,CF1$12,000,CF2$25,000,CF3$30,000

SetI8%

SolveforNPV$21,359.55

Step2:

FindtheANPV

2012PearsonEducation,Inc.PublishingasPrenticeHall

256Gitman/ZutterPrinciplesofManagerialFinance,Thirteenth Edition

N3,I8,PV$21,359.55

SolveforPMT$8,288.22

2012PearsonEducation,Inc.PublishingasPrenticeHall

Chapter12RiskandRefinementsinCapitalBudgeting257

ProjectN

Step1:

FindtheNPVoftheproject

NPVMKeystrokes

CF0$55,000,CF1$18,000,CF2$15,000,CF3$25,000

CF4$10,000,CF5$8,000,CF6$5,000,CF7$5,000

SetI8%

SolveforNPV$13,235.82

Step2:

FindtheANPV

N7,I8,PV$13,235.82

SolveforPMT$2,542.24

BasedonANPV,youshouldadviseOutcast,Inc.tochooseProjectM.

E12-5.

NPV profiles

Answer: Theinvestmentopportunityschedule(IOS)inthisproblemdoesnotallowustodeterminethe

maximumNPVallowedbythebudgetconstraint.InordertodeterminewhethertheIOS

maximizestheNPVforLongchampsElectric,wewillneedtoknowtheNPVforeachofthe

sixprojects.However,itdoesappearlikelythatLongchampsElectricwillmaximizefirmvalue

byselectingProject4(IRR11%),Project2(IRR10%),andProject5(IRR9%).Thetotal

investmentinthesethreeprojectswillbe$135,000,leaving$15,000excesscashforfuture

investmentopportunities.

Solutions to Problems

P121. Recognizingrisk

LG1;Basic

a.andb.

Project

Risk

Reason

Low

Thecashflowsfromtheprojectcanbeeasilydeterminedsince

thisexpenditureconsistsstrictlyofoutflows.Theamountisalso

relativelysmall.

Medium

ThecompetitivenatureoftheindustrymakesitsothatCaradine

willneedtomakethisexpendituretoremaincompetitive.Therisk

isonlymoderatesincethefirmalreadyhasclientsinplacetouse

thenewtechnology.

Medium

Sincethefirmisonlypreparingaproposal,theircommitmentat

thistimeislow.However,the$450,000isalargesumofmoney

forthecompanyanditwillimmediatelybecomeasunkcost.

2012PearsonEducation,Inc.PublishingasPrenticeHall

258Gitman/ZutterPrinciplesofManagerialFinance,Thirteenth Edition

High

AlthoughthispurchaseisintheindustryinwhichCaradine

normallyoperates,theyareencounteringalargeamountofrisk.

Thelargeexpenditure,thecompetitivenessoftheindustry,andthe

politicalandexchangeriskofoperatinginaforeigncountryaddto

theuncertainty.

Note:Otheranswersarepossibledependingontheassumptionsastudentmaymake.Thereistoo

littleinformationgivenaboutthefirmandindustrytoestablishadefinitiveriskanalysis.

2012PearsonEducation,Inc.PublishingasPrenticeHall

Chapter12RiskandRefinementsinCapitalBudgeting259

P122. Breakevencashflows

LG2;Intermediate

a.

N12,I14%,PV$35,000

SolveforPMT$6,183.43

b. N12,I10%,PV$35,000

SolveforPMT$5,136.72

Therequiredcashflowperyearwoulddecreaseby$1,047.27.

P123. Breakevencashinflowsandrisk

LG2;Intermediate

a.

ProjectX

ProjectY

N5,I15%,PMT$10,000

N5,I15%,PMT$15,000

SolveforPV33,521.55

SolveforPV$50,282.33

NPV PVinitialinvestment

NPV PVinitialinvestment

NPV $33,521.55$30,000

NPV $50,282.33$40,000

NPV $3,521.55

NPV $10,282.33

b. ProjectX

c.

ProjectY

N5,I15%,PV$30,000

N5,I15%,PV$40,000

SolveforPMT$8,949.47

SolveforPMT$11,932.62

ProjectX

ProjectY

Probability60%

Probability25%

d. ProjectYismoreriskyandhasahigherpotentialNPV.ProjectXhaslessriskandlessreturn

whileProjectYhasmoreriskandmorereturn,thustheriskreturntradeoff.

e.

ChooseProjectXtominimizelosses;toachievehigherNPV,chooseProjectY.

P124. Basicscenarioanalysis

LG2;Intermediate

a.

RangeA$1,800$200$1,600 RangeB$1,100$900$200

b.

NPVs

Outcome

ProjectA

ProjectB

Pessimistic

$6,297.29

$337.79

Mostlikely

513.56

513.56

7,324.41

1,364.92

Optimistic

2012PearsonEducation,Inc.PublishingasPrenticeHall

260Gitman/ZutterPrinciplesofManagerialFinance,Thirteenth Edition

Range

c.

$13,621.70

$1,702.71

AlthoughthemostlikelyoutcomeisidenticalforProjectAandB,theNPVrangevaries

considerably.

d. Projectselectionwoulddependupontheriskdispositionofthemanagement.(Aismorerisky

thanBbutalsohasthepossibilityofagreaterreturn.)

2012PearsonEducation,Inc.PublishingasPrenticeHall

Chapter12RiskandRefinementsinCapitalBudgeting261

P125. Scenarioanalysis

LG2;Intermediate

a.

RangeP$1,000$500$500

RangeQ$1,200$400$800

b.

NPVs

c.

Outcome

ProjectP

ProjectQ

Pessimistic

$72.28

$542.17

Mostlikely

1,608.43

1,608.43

Optimistic

3,144.57

4,373.48

RangeP$3,144.57$72.28$3,072.29

RangeQ$4,373.48($542.17)$4,915.65

Eachcomputerhasthesamemostlikelyresult.ComputerQhasbothagreaterpotentialloss

andagreaterpotentialreturn.Therefore,thedecisionwilldependontheriskdispositionof

management.

P126. PersonalFinance:Impactofinflationoninvestments

LG2;Easy

a.c.

Investment

Cash Flows

Year

Current

NPV (a)

Higher

Inflation

NPV (b)

Lower

Inflation

NPV (c)

(7,500)

(7,500)

(7,500)

(7,500)

2,000

1,878

1,860

1,896

2,000

1,763

1,731

1,797

2,000

1,656

1,610

1,703

1,500

1,166

1,123

1,211

1,500

1,095

1,045

1,148

$ 58

$ (131)

$ 254

Total NPV

d. AstheinflationraterisestheNPVofagivensetofcashflowsdeclines.

P127. Simulation

LG2;Intermediate

a.

OgdenCorporationcoulduseacomputersimulationtogeneratetherespectiveprofitability

distributionsthroughthegenerationofrandomnumbers.Bytyingvariouscashflowassumptions

2012PearsonEducation,Inc.PublishingasPrenticeHall

262Gitman/ZutterPrinciplesofManagerialFinance,Thirteenth Edition

togetherintoamathematicalmodelandrepeatingtheprocessnumeroustimes,aprobability

distributionofprojectreturnscanbedeveloped.Theprocessofgeneratingrandomnumbers

andusingtheprobabilitydistributionsforcashinflowsandoutflowsallowsvaluesforeach

ofthevariablestobedetermined.Theuseofthecomputeralsoallowsformoresophisticated

simulationusingcomponentsofcashinflowsandoutflows.Substitutionofthesevaluesinto

themathematicalmodelyieldstheNPV.Thekeyliesinformulatingamathematicalmodel

thattrulyreflectsexistingrelationships.

b. Theadvantagestocomputersimulationsincludethedecisionmakersabilitytoview

acontinuumofriskreturntradeoffsinsteadofasinglepointestimate.Thecomputer

simulation,however,isnotfeasibleforriskanalysis.

P128. RiskadjusteddiscountratesBasic

LG4;Intermediate

a.

ProjectE

N4,I15%,PMT$6,000

SolveforPV$17,129.87

NPV$17,129.87$15,000

NPV$2,129.87

ProjectF

CF0$11,000,CF1$6,000,CF2$4,000,CF3$5,000,CF4$2,000

SetI15%

SolveforNPV$1,673.05

ProjectG

CF0$19,000,CF1$4,000,CF2$6,000,CF3$8,000,C44$12,000

SetI15%

SolveforNPV$1,136.29

ProjectE,withthehighestNPV,ispreferred.

b. RADRE0.10(1.80(0.150.10))0.19

RADRF0.10(1.00(0.150.10))0.15

RADRG0.10(0.60(0.150.10))0.13

c.

ProjectE

N4,I19%,PMT$6,000

SolveforPV$15,831.51

NPV$15,831.51$15,000

NPV$831.51

ProjectF

2012PearsonEducation,Inc.PublishingasPrenticeHall

Chapter12RiskandRefinementsinCapitalBudgeting263

Sameasinparta,$1,673.05

ProjectG

CF0$19,000,CF1$4,000,CF2$6,000,CF3$8,000,CF4$12,000

SetI13%

SolveforNPV$2,142.93

Rank

Project

2012PearsonEducation,Inc.PublishingasPrenticeHall

264Gitman/ZutterPrinciplesofManagerialFinance,Thirteenth Edition

d. Afteradjustingthediscountrate,eventhoughallprojectsarestillacceptable,theranking

changes.ProjectGhasthehighestNPVandshouldbechosen.

P129. RiskadjusteddiscountratesTabular

LG4;Intermediate

a.

ProjectA

N5,I8%,PMT$7,000

SolveforPV$27,948.97

NPV$27,948.97$20,000

NPV$7,948.97

ProjectB

N5,I14%,PMT$10,000

SolveforPV$34,330.81

NPV$34,330.81$30,000

NPV$4,330.81

ProjectA,withthehigherNPV,shouldbechosen.

b. ProjectAispreferabletoProjectB,sincetheNPVofAisgreaterthantheNPVofB.

P1210. PersonalFinance:Mutuallyexclusiveinvestmentandrisk

LG4;Intermediate

a.

N6,I8.5%,PMT$3,000

SolveforPV13,660.76

NPV$13,660.76$10,000

NPV$3,660.76

b. N6,I10.5%,PMT$3,800

SolveforPV$16,310.28

NPV$16,31.28$12,000

NPV$4,310.28

c.

UsingNPVasherguide,Larashouldselectthesecondinvestment.IthasahigherNPV.

d. Thesecondinvestmentisriskier.Thehigherrequiredreturnimpliesahigherriskfactor.

P1211. RiskadjustedratesofreturnusingCAPM

LG4;Challenge

a.

rX7%1.2(12%7%)7%6%13%

rY7%1.4(12%7%)7%7%14%

NPVcalculationforX:

N4,I13%,PMT$30,000

SolveforPV89,234.14

2012PearsonEducation,Inc.PublishingasPrenticeHall

Chapter12RiskandRefinementsinCapitalBudgeting265

NPV$89,234.14$70,000

NPV$19,234.14

NPVcalculationforY:

CF0$78,000,CF1$22,000,CF2$32,000,CF3$38,000,CF4$46,000

SetI14%

SolveforNPV$18,805.82

b. TheRADRapproachprefersProjectYoverProjectX.TheRADRapproachcombinesthe

riskadjustmentandthetimeadjustmentinasinglevalue.TheRADRapproachismostoften

usedinbusiness.

P1212. RiskclassesandRADR

LG4;Basic

a.

ProjectX

CF0$180,000,CF1$80,000,CF2$70,000,CF3$60,000,

CF4$60,000,CF5$60,000

SetI22%

SolveforNPV$14.930.45

ProjectY

CF0$235,000,CF1$50,000,CF2$60,000,

CF3$70,000,CF4$80,000,CF5$90,000

SetI13%

SolveforNPV$2,663.99

ProjectZ

CF0$310,000,CF1$90,000,CF2$90,000,CF3$90,000,

CF4$90,000,CF5$90,000

[or,CF0$310,000,CF1$90,000,F15]

SetI15%

SolveforNPV$8,306.04

b. ProjectsXandYareacceptablewithpositiveNPVs,whileProjectZwithanegativeNPVis

not.ProjectX,withthehighestNPV,shouldbeundertaken.

P1213. UnequallivesANPVapproach

LG5;Intermediate

a.

MachineA

CF0$92,000,CF1$12,000,CF2$12,000,CF3$12,000,

2012PearsonEducation,Inc.PublishingasPrenticeHall

266Gitman/ZutterPrinciplesofManagerialFinance,Thirteenth Edition

CF4$12,000,CF5$12,000,CF6$12,000

[or,CF0$92,000,CF1$12,000,F16]

SetI12%

SolveforNPV$42,663.11

MachineB

CF0$65,000,CF1$10,000,CF2$20,000,CF3$30,000,CF4$40,000

SetI12%

SolveforNPV$6,646.58

MachineC

CF0$100,500,CF1$30,000,CF2$30,000,

CF3$30,000,CF4$30,000,CF5$30,000

[or,CF0$105,000,CF1$30,000,F15]

SetI12%

SolveforNPV$7,643.29

Rank

Machine

(NotethatMachineAisnotacceptableandcouldberejectedwithoutanyadditionalanalysis.)

b. MachineA

N6,I12%,PV$42,663.11

SolveforANPV(PMT)$10,376.77

MachineB

N4,I12%,PV$6,646.58

SolveforANPV(PMT)$2,188.28

MachineC

N5,I12%,PV$7,643.29

SolveforANPV(PMT)$2,120.32

Rank

Machine

2012PearsonEducation,Inc.PublishingasPrenticeHall

Chapter12RiskandRefinementsinCapitalBudgeting267

c.

MachineBshouldbeacquiredsinceitoffersthehighestANPV.Notconsideringthe

differenceinprojectlivesresultedinadifferentrankingbasedinpartonMachineCs

NPVcalculations.

P1214. UnequallivesANPVapproach

LG5;Intermediate

a.

ProjectX

CF0$78,000,CF1$17,000,CF2$25,000,CF3$33,000,CF4$41,000

SetI14%

SolveforNPV$2,698.32

ProjectY

CF0$52,000,CF1$28,000,CF2$38,000

SetI14%

SolveforNPV$1,801.17

ProjectZ

CF0$66,000,CF1$15,000,CF2$15,000,CF3$15,000,CF4$15,000,

CF5$15,000,CF6$15,000,CF7$15,000,CF8$15,000

[or,CF0$66,000,CF1$15,000,F18]

SetI14%

SolveforNPV$3,582.96

Rank

Project

b. ProjectX

N4,I14%,PV$

SolveforANPV(PMT)$9,260.76

ProjectY

N2,I14%,PV$1801.17

SolveforANPV(PMT)$1,093.83

ProjectZ

N5,I14%,PV$3582.96

SolveforANPV(PMT)$1,043.65

Rank

Project

X

2012PearsonEducation,Inc.PublishingasPrenticeHall

268Gitman/ZutterPrinciplesofManagerialFinance,Thirteenth Edition

c.

ProjectYshouldbeacquiredsinceitoffersthehighestANPV.Notconsideringthedifference

inprojectlivesresultedinadifferentrankingbasedprimarilyontheunequallivesofthe

projects.

P1215. UnequallivesANPVapproach

LG5;Intermediate

a.

Sell

CF0$200,000,CF1$200,000,CF2$250,000

SetI12%

SolveforNPV$177,869.90

License

CF0$200,000,CF1$250,000,CF2$100,000

CF3$80,000,CF4$60,000,CF5$40,000

SetI12%

SolveforNPV$220,704.25

Manufacture

CF0$450,000,CF1$200,000,CF2$250,000,CF3$200,000,

CF4$200,000,CF5$200,000,CF6$200,000

[or,CF0$450,000,CF1$200,000,F11,

CF2$250,000,F21,CF3$200,000,F34]

SetI12%

SolveforNPV$412,141.16

Rank

Alternativ

e

Manufactur

e

License

Sell

b. Sell

N2,I12%,PV$

2012PearsonEducation,Inc.PublishingasPrenticeHall

Chapter12RiskandRefinementsinCapitalBudgeting269

SolveforANPV(PMT)$105,245.28

License

N5,I12%,PV$220,704.25

SolveforANPV(PMT)$61,225.51

Manufacture

N6,I12%,PV$412,141.16

SolveforANPV(PMT)$100,243.33

c.

Rank

Alternati

ve

Sell

Manufact

ure

License

ComparingtheNPVsofprojectswithunequallivesgivesanadvantagetothoseprojectsthat

generatecashflowsoverthelongerperiod.ANPVadjustsforthedifferencesinthelengthof

theprojectsandallowsselectionoftheoptimalproject.Thistechniqueimplicitlyassumes

thatallprojectscanbeselectedagainattheirconclusionaninfinitenumberoftimes.

P1216. NPVandANPVdecisions

LG5;Challenge

a. b.

Unequal-Life Decisions

Annualized Net Present Value (ANPV)

Cost

Annual Benefits

Life

Sony

$(2,350)

$(2,700)

$900

3 years

Terminal value

Required rate of return

a.

Samsung

$400

9.0%

$1,000

4 years

$350

9.0%

CF0$2,350,CF1$900,CF2$900,CF3$900+$400$1,300

SetI9%

SolveforNPV$237.04

b. N3,I9%,PV$237.04

SolveforANPV(PMT)$93.64

c.

CF0$2,700,CF1$1,000,CF2$1,000,CF3$1,000,CF4$1,000+$350$1,350

SetI9%

2012PearsonEducation,Inc.PublishingasPrenticeHall

270Gitman/ZutterPrinciplesofManagerialFinance,Thirteenth Edition

SolveforNPV$787.67

d. N4,I9%,PV$787.67

SolveforANPV(PMT)$243.13

e.

RichardandLindashouldselecttheSonysetbecauseitsANPVof$243.13isgreaterthanthe

$93.64ANPVofSamsung.

P1217. RealoptionsandthestrategicNPV

LG6;Intermediate

a.

Valueofrealoptionsvalueofabandonmentvalueofexpansionvalueofdelay

Valueofrealoptions(0.25$1,200)(0.30$3,000)(0.10$10,000)

Valueofrealoptions$300$900$1,000$2,200

NPVstrategicNPVtraditionalValueofrealoptions1,7002,200$500

b. DuetotheaddedvaluefromtheoptionsReneshouldrecommendacceptanceofthecapital

expendituresfortheequipment.

c. Ingeneralthisproblemillustratesthatbyrecognizingthevalueofrealoptionsaprojectthat

wouldotherwisebeunacceptable(NPVtraditional0)couldbeacceptable(NPVstrategic0).Itis

thusimportantthatmanagementidentifyandincorporaterealoptionsintotheNPVprocess.

P1218. CapitalrationingIRRandNPVapproaches

LG6;Intermediate

a.

RankbyIRR

Project

IRR

InitialInvestment

TotalInvestment

$2,500,000

$2,500,000

23%

22

800,000

3,300,000

20

1,200,000

4,500,000

19

18

17

16

ProjectsF,E,andGrequireatotalinvestmentof$4,500,000andprovideatotalpresentvalue

of$5,200,000,andthereforeanNPVof$700,000.

b. RankbyNPV(NPVPVInitialinvestment)

Project

F

A

NPV

$500,000

400,000

Initial Investment

$2,500,000

5,000,000

2012PearsonEducation,Inc.PublishingasPrenticeHall

Chapter12RiskandRefinementsinCapitalBudgeting271

C

B

D

G

E

300,000

300,000

100,000

100,000

100,000

2,000,000

800,000

1,500,000

1,200,000

800,000

ProjectAcanbeeliminatedbecausewhileithasanacceptableNPV,itsinitialinvestment

exceedsthecapitalbudget.ProjectsFandCrequireatotalinitialinvestmentof$4,500,000

andprovideatotalpresentvalueof$5,300,000andanetpresentvalueof$800,000.However,

thebestoptionistochooseProjectsB,F,andG,whichalsousetheentirecapitalbudgetand

provideanNPVof$900,000.

c.

Theinternalrateofreturnapproachusestheentire$4,500,000capitalbudgetbutprovides

$200,000lesspresentvalue($5,400,000$5,200,000)thantheNPVapproach.Sincethe

NPVapproachmaximizesshareholderwealth,itisthesuperiormethod.

d. ThefirmshouldimplementProjectsB,F,andG,asexplainedinpartc.

P1219. CapitalRationingNPVApproach

LG6;Intermediate

Project

PV

A

B

C

D

E

F

G

$384,000

210,000

125,000

990,000

570,000

150,000

960,000

Initial Investment

Total Investment

$100,000

$100,000

$100,000

$800,000

$200,000

$1,000,000

b. TheoptimalgroupofprojectsisProjectsC,F,andG,resultinginatotalnetpresentvalueof

$235,000.ProjectGwouldbeacceptedfirstbecauseithasthehighestNPV.Itsselection

leavesenoughofthecapitalbudgettoalsoacceptProjectCandProjectF.

P1220. Ethicsproblem

LG4;Challenge

Studentanswerswillvary.Somestudentsmightarguethatcompaniesshouldbeheldaccountable

foranyandallpollutionthattheycause.Otherstudentsmaytakethelargerviewthattheappropriate

goalshouldbethereductionofoverallpollutionlevels,andthatcarboncreditsareawayto

achievethatgoal.Fromaninvestorstandpoint,carboncreditsallowthepollutingfirmtomeet

legalobligationsinthemostcosteffectivemanner,thusimprovingthebottomlineforthe

companyandinvestor.

2012PearsonEducation,Inc.PublishingasPrenticeHall

272Gitman/ZutterPrinciplesofManagerialFinance,Thirteenth Edition

Case

Casestudiesareavailableonwww.myfinancelab.com.

Evaluating Cherone Equipments Risky Plans for Increasing Its Production

Capacity

a.

1. Plan X

CF0$2,700,000,CF1$470,000,CF2$610,000

CF3$950,000,CF4$970,000,CF5$1,500,000

SetI12%

SolveforNPV$349,715.18

PlanY

CF0$2,100,000,CF1$380,000,CF2$700,000

CF3$800,000,CF4$600,000,CF5$1,200,000

SetI12%

SolveforNPV$428,968.70

2012PearsonEducation,Inc.PublishingasPrenticeHall

Chapter12RiskandRefinementsinCapitalBudgeting273

2. Usingafinancialcalculator,theIRRsare:

IRRX16.22%

IRRY18.82%

BothNPVandIRRfavorselectionofProjectY.TheNPVislargerby$79,254

($428,969$349,715)andtheIRRis2.6%higher.

b.

Plan X

CF0$2,700,000,CF1$470,000,CF2$610,000

CF3$950,000,CF4$970,000,CF5$1,500,000

SetI13%

SolveforNPV$261,105.40

PlanY

CF0$2,100,000,CF1$380,000,CF2$700,000

CF3$800,000,CF4$600,000,CF5$1,200,000

SetI15%

SolveforNPV$225,412.37

TheRADRNPVfavorsselectionofProjectX.

Ranking

Plan

NPV

IRR

RADRs

c.

Both NPV and IRR achieved the same relative rankings. However, making risk adjustments through the

RADRs caused the ranking to reverse from the nonrisk-adjusted results. The final choice would be to select

Plan X since it ranks first using the risk-adjusted method.

d.

Plan X

Valueofrealoptions0.25$100,000$25,000

NPVstrategicNPVtraditionalValueofrealoptions

NPVstrategic$261,105.40$25,000$286,105.40

PlanY

Valueofrealoptions0.20$500,000$100,000

NPVstrategicNPVtraditionalValueofrealoptions

NPVstrategic$225,412.37$100,000$325,412.37

e.

With the addition of the value added by the existence of real options, the ordering of the projects is reversed.

Project Y is now favored over Project X using the RADR NPV for the traditional NPV.

f.

Capital rationing could change the selection of the plan. Since Plan Y requires only $2,100,000 and Plan X

requires $2,700,000, if the firms capital budget was less than the amount needed to invest in Project X, the firm

2012PearsonEducation,Inc.PublishingasPrenticeHall

274Gitman/ZutterPrinciplesofManagerialFinance,Thirteenth Edition

would be forced to take Y to maximize shareholders wealth subject to the budget constraint.

Spreadsheet Exercise

TheanswertoChapter12sIsisCorporationspreadsheetproblemislocatedontheInstructorsResource

Centeronthetextbookscompanionwebsiteatwww.pearsonhighered.com/ircundertheInstructorsManual.

Group Exercise

Groupexercisesareavailableonwww.myfinancelab.com.

Riskwithinlongterminvestmentdecisionsisthetopicofthischapter.Theinvestmentprojectsofthe

previoustwochapterswillnowhaveriskvariablesintroduced.Thecashflowsestimatedpreviouslywill

nowbecharacterizedbyalackofcertainty.Eachestimateddollarflowisnowassignedthreepossible

levelsforthreepossiblestatesoftheworlds:pessimistic,mostlikelyandoptimistic.Originalestimates

serveasthemostlikelyvalueandtheothersareplacedaroundthisvalue.

Analysisoftheseestimatesbeginswithacalculationoftherangesforeachoutcome.AsimplifiedRADR

isthencalculatedusingthepreviouslydetermineddiscountrate.TheriskadjustedNPVisthencalculated.

Thefinaltaskistocompletethisthreechapterodyssey.

UsinginformationfromChapters10,11,and12,thegroupsareaskedtodefendtheirchoiceofinvestment

projects.Aspointedoutintheassignment,groupsshouldusethisassignmenttodefendtheirchoicesinthe

formofdocumentsaspresentedtotheirboardofdirectors.Thisconclusionshouldsummarizeallthework

doneacrossthechaptersandstudentsshouldtakeprideinthequantityoftheireffort.Itworkswelltohave

eachstudentgrouppresenttheirprojectanddecisiontotheremainderoftheclass,whocanbeviewedasa

boardofdirectors.

Integrative Case 5: Lasting Impressions Company

IntegrativeCase5involvesacompletelongterminvestmentdecision.TheLastingImpressionsCompany

isacommercialprinterfacedwithareplacementdecisioninwhichtwomutuallyexclusiveprojectshave

beenproposed.Thedataforeachpresshavebeendesignedtoresultinconflictingrankingswhenconsidering

theNPVandIRRdecisiontechniques.Thecaseteststhestudentsunderstandingofthetechniquesaswell

asthequalitativeaspectsofriskandreturndecisionmaking.

a.

1.

Calculation of initial investment for Lasting Impressions Company:

PressA

PressB

Installedcostofnewpress

Costofnewpress

Installationcosts

$830,000

$640,000

40,000

20,000

2012PearsonEducation,Inc.PublishingasPrenticeHall

Chapter12RiskandRefinementsinCapitalBudgeting275

Totalcostnewpress

$870,000

$660,000

Aftertaxproceedssaleofoldasset

Proceedsfromsaleofoldpress

420,000

420,000

121,600

121,600

Taxonsaleofoldpress*

Totalproceedssaleofoldpress

(298,400)

Changeinnetworkingcapital**

Initialinvestment

*

Saleprice

$420,000

Bookvalue

116,000

Gain

$304,000

Taxrate(40%)

90,400

$662,000

$361,600

121,600

Bookvalue$400,000[(0.200.320.19)$400,000]$116,000

**

Cash

$25,400

Accountsreceivable

120,000

Inventory

(20,000)

Increaseincurrentassets

$125,400

Increaseincurrentliabilities

(35,000)

Increaseinnetworkingcapital

$90,400

2. Depreciation

Year

Cost

Rate

Depreciation

$870,000

0.20

$174,000

870,000

0.32

278,400

870,000

0.19

165,300

870,000

0.12

104,400

870,000

0.12

104,400

870,000

0.05

43,500

PressA

1

(298,400)

$870,000

2012PearsonEducation,Inc.PublishingasPrenticeHall

276Gitman/ZutterPrinciplesofManagerialFinance,Thirteenth Edition

PressB

1

$660,000

0.20

$132,000

660,000

0.32

211,200

660,000

0.19

125,400

660,000

0.12

79,200

660,000

0.12

79,200

660,000

0.05

33,000

$660,000

ExistingPress

1

$400,000

0.12(Yr.4)

$48,000

400,000

0.12(Yr.5)

48,000

400,000

0.05(Yr.6)

20,000

0

$116,000

Operatingcashinflows

Year

Earnings

before

Depreciation

andTaxes

Depre

ciation

Earnings Earnings

before

after

Taxes

Taxes

Old

Cash

Flow

Cash

Flow

Existing

Press

1

$120,000

$48,000

$72,000

$43,200

$91,200

120,000

48,000

72,000

43,200

91,200

120,000

20,000

100,000

60,000

80,000

120,000

120,000

72,000

72,000

120,000

120,000

72,000

72,000

2012PearsonEducation,Inc.PublishingasPrenticeHall

Incre

mental

Cash

Flow

Chapter12RiskandRefinementsinCapitalBudgeting277

PressA

1

$250,000

$174,000

$76,000

$45,600

$219,600

$91,200 $128,400

270,000

278,400

8,400

5,040

273,360

91,200

182,160

300,000

165,300

134,700

80,820

246,120

80,000

166,120

330,000

104,400

225,600

135,360

239,760

72,000

167,760

370,000

104,400

265,600

159,360

263,760

72,000

191,760

43,500

43,500

26,100

17,400

17,400

Earnings

before

Depreciation

andTaxes

Depre

ciation

$210,000

$132,000

$78,000

$46,800

$178,800

$91,200 $87,600

210,000

211,200

1,200

720

210,480

91,200 119,280

210,000

125,400

84,600

50,760

176,160

80,000 96,160

210,000

79,200

130,800

78,480

157,680

72,000 85,680

210,000

79,200

130,800

78,480

157,680

72,000 85,680

33,000

33,000

19,800

13,200

0 13,200

Year

Earnings Earnings

before

after

Taxes

Taxes

Incre

mental

Cash

Flow

Old

Cash

Flow

Cash

Flow

PressB

3. Terminalcashflow

PressA

PressB

Aftertaxproceedssaleofnewpress

Proceedsonsaleofnewpress

$400,000

$330,000

Taxonsaleofnewpress*

(142,600)

(118,800)

Totalproceedsnewpress

$257,400

$211,200

Aftertaxproceedssaleofoldpress

Proceedsonsaleofoldpress

Taxonsaleofoldpress**

(150,000)

(150,000)

60,000

60,000

2012PearsonEducation,Inc.PublishingasPrenticeHall

278Gitman/ZutterPrinciplesofManagerialFinance,Thirteenth Edition

Totalproceedsoldpress

(90,000)

90,400

$257,800

$121,200

Changeinnetworkingcapital

Terminalcashflow

PressB

PressA

Saleprice

$400,000

Less:Bookvalue(Yr.6)

Gain

0.40

Tax

$142,600

Saleprice

Taxrate

Tax

Saleprice

Less:Bookvalue(Yr.6)

Gain

Taxrate

Tax

$150,000

Less:Bookvalue(Yr.6)

Gain

43,500

$356,500

Taxrate

**

(90,000)

0

$150,000

0.40

$60,000

2012PearsonEducation,Inc.PublishingasPrenticeHall

$330,000

33,000

$297,000

0.40

$118,800

Chapter12RiskandRefinementsinCapitalBudgeting279

CashFlows

Year

PressA

PressB

($662,000)

$128,400

($361,600)

$87,600

182,160

119,280

166,120

96,160

167,760

85,680

5*

449,560

206,880

Initialinvestment

1

Year5

PressA

PressB

Operatingcashflow

$191,760

$85,680

Terminalcashinflow

257,800

121,200

Total

$449,560

$206,880

b.

PressA

c.

Relevant cash flow

CumulativeCashFlows

Year

PressA

PressB

$128,400

$87,600

310,560

206,880

476,680

303,040

644,440

388,720

2012PearsonEducation,Inc.PublishingasPrenticeHall

280Gitman/ZutterPrinciplesofManagerialFinance,Thirteenth Edition

1,094,000

595,600

2012PearsonEducation,Inc.PublishingasPrenticeHall

Chapter12RiskandRefinementsinCapitalBudgeting281

1. PressA: 4years[(662,000644,440)191,760]

Payback 4(17,560191,760)

Payback 4.09years

PressB: 3years[(361,600303,040)85,680]

Payback 3(58,56085,680)

Payback 3.68years

2. PressA

CF0$662,000,CF1$128,400,CF2$182,160,CF3$166,120,

CF4$167,760,CF5$449,560

SetI14%

SolveforNPV$35,738.82

PressB

CF0$361,600,CF1$87,600,CF2$119,280,CF3$96,160,

CF4$85,680,CF5$206,880

SetI14%

SolveforNPV$30,105.88

3. IRR:

PressA: 15.8%

PressB: 17.1%

d.

2012PearsonEducation,Inc.PublishingasPrenticeHall

282Gitman/ZutterPrinciplesofManagerialFinance,Thirteenth Edition

DataforNPVProfile

NPV

DiscountRate

PressA

PressB

0%

$432,000

$234,000

14%

35,455

29,953

15.8%

17.1%

Whenthecostofcapitalisbelowapproximately15%.PressAispreferredoverPressB,

whileatcostsgreaterthan15%,PressBispreferred.Sincethefirmscostofcapitalis14%,

conflictingrankingsexist.PressAhasahighervalueandisthereforepreferredoverPressB

usingNPV,whereasPressBsIRRof17.1%causesittobepreferredoverPressA,whose

IRRis15.8%usingthismeasure.

e.

a.

If the firm has unlimited funds, Press A is preferred.

b. Ifthefirmissubjecttocapitalrationing,PressBmaybepreferred.

f.

The risk would need to be measured by a quantitative technique such as certainty equivalents or risk-adjusted

discount rates. The resultant NPV of Press A could then be compared to the risk-adjusted NPV of Press B and a

decision made.

2012PearsonEducation,Inc.PublishingasPrenticeHall

You might also like

- Solution CH 09-SubramanyamDocument34 pagesSolution CH 09-SubramanyamErna hk100% (1)

- CH 10.risk and Refinements in Capital BudgetingDocument27 pagesCH 10.risk and Refinements in Capital BudgetingTria_Octaviant_8507100% (1)

- Working at BairesDevDocument23 pagesWorking at BairesDevAlex Torres GNo ratings yet

- Laporan Keuangan (Audited) PT Timah TBK 2022Document153 pagesLaporan Keuangan (Audited) PT Timah TBK 2022MIA JUARAGROUPNo ratings yet

- Chapter 6 - The Analysis of Investment ProjectsDocument16 pagesChapter 6 - The Analysis of Investment ProjectsAbdul Fattaah Bakhsh 1837065No ratings yet

- Chapter 11Document45 pagesChapter 11LBL_Lowkee100% (3)

- Gitman 12e 525314 IM ch10rDocument27 pagesGitman 12e 525314 IM ch10rSadaf ZiaNo ratings yet

- Toaz - Info Chapter 12 PRDocument34 pagesToaz - Info Chapter 12 PRtaponic390No ratings yet

- M12 Gitm4380 13e Im C12 PDFDocument23 pagesM12 Gitm4380 13e Im C12 PDFGolamSarwar0% (1)

- Sec e - Cma Part 2Document4 pagesSec e - Cma Part 2shreemant muniNo ratings yet

- A. The Importance of Capital BudgetingDocument98 pagesA. The Importance of Capital BudgetingShoniqua JohnsonNo ratings yet

- Chapter 10Document39 pagesChapter 10Bhavesh RathodNo ratings yet

- Odule Apital Udgeting: 2. Learning Outcomes 3. Module Tasks 4. Module Overview and DiscussionDocument0 pagesOdule Apital Udgeting: 2. Learning Outcomes 3. Module Tasks 4. Module Overview and Discussionsilvi88No ratings yet

- Lecture 6 Application of Money Time RelationDocument9 pagesLecture 6 Application of Money Time Relationnouman215988No ratings yet

- In BusinessDocument6 pagesIn BusinessAli ButtNo ratings yet

- Capital Budgeting at Birla CementDocument61 pagesCapital Budgeting at Birla Cementrpsinghsikarwar0% (1)

- Jbe 2flawsDocument15 pagesJbe 2flawsDr. Muhammad Mazhar IqbalNo ratings yet

- CMA Exam Review - Part 2 - Section E - Investment DecisionsDocument3 pagesCMA Exam Review - Part 2 - Section E - Investment Decisionsaiza eroyNo ratings yet

- Chap 11 Solutions of EOC ProblemsDocument29 pagesChap 11 Solutions of EOC ProblemsibrahimNo ratings yet

- Risk and Refinements in Capital BudgetingDocument75 pagesRisk and Refinements in Capital BudgetingdhfbbbbbbbbbbbbbbbbbhNo ratings yet

- FM - Module 3Document11 pagesFM - Module 3Alok Arun MohapatraNo ratings yet

- FFM Chapter 8Document5 pagesFFM Chapter 8Dawn CaldeiraNo ratings yet

- Risk and Refinements in Capital BudgetingDocument39 pagesRisk and Refinements in Capital BudgetingMelissa Cabigat Abdul KarimNo ratings yet

- TMP - 5567 PK10 191431902Document16 pagesTMP - 5567 PK10 191431902Pijus BiswasNo ratings yet

- Risk and ReturnDocument8 pagesRisk and Returnkrishnabadhe20No ratings yet

- Case StudyDocument10 pagesCase StudyAmit Verma100% (1)

- MAFA Notes Old SyllabusDocument61 pagesMAFA Notes Old SyllabusDeep JoshiNo ratings yet

- Definition of Capital BudgetingDocument6 pagesDefinition of Capital Budgetingkaram deenNo ratings yet

- A. The Importance of Capital BudgetingDocument34 pagesA. The Importance of Capital BudgetingMutevu SteveNo ratings yet

- Capital Budgeting - IMPORTANT PDFDocument8 pagesCapital Budgeting - IMPORTANT PDFsalehin1969No ratings yet

- Risk and Refinements of Capital BudgetingDocument36 pagesRisk and Refinements of Capital BudgetingRichelle Copon-Toledo50% (2)

- Risk and Refinement in Capital BudgetingDocument51 pagesRisk and Refinement in Capital BudgetingRitesh Lashkery50% (2)

- Module 4 - The Cost of CapitalDocument10 pagesModule 4 - The Cost of CapitalMarjon DimafilisNo ratings yet

- 12 LasherIM Ch12Document23 pages12 LasherIM Ch12asgharhamid75% (4)

- Fin650:Project Appraisal: Lecture 4-5 Project Appraisal Under Uncertainty and Appraising Projects With Real OptionsDocument46 pagesFin650:Project Appraisal: Lecture 4-5 Project Appraisal Under Uncertainty and Appraising Projects With Real OptionsAnik IslamNo ratings yet

- Unit One-Risk Analysis and The Optimal Capital BudgetDocument27 pagesUnit One-Risk Analysis and The Optimal Capital BudgetTakudzwa GwemeNo ratings yet

- Financial ManagementDocument20 pagesFinancial ManagementGAURAV SHARMA100% (1)

- Corporate Finance Is An Area of Finance Dealing With The Financial Decisions Corporations Make and The Tools and Analysis Used To Make These DecisionsDocument21 pagesCorporate Finance Is An Area of Finance Dealing With The Financial Decisions Corporations Make and The Tools and Analysis Used To Make These DecisionsPalash JainNo ratings yet

- FM Section CDocument21 pagesFM Section CchimbanguraNo ratings yet

- Assignment - Project AppraisalDocument25 pagesAssignment - Project Appraisalveenamathew100% (2)

- WACC: Practical Guide For Strategic Decision-Making - Part 5: Project Selection - How To Choose The Right Project and Make Effective ComparisonsDocument4 pagesWACC: Practical Guide For Strategic Decision-Making - Part 5: Project Selection - How To Choose The Right Project and Make Effective ComparisonsbuttsahibNo ratings yet

- Solutions Nss NC 12Document15 pagesSolutions Nss NC 12Nguyễn Quốc TháiNo ratings yet

- Capital Budgeting - Adv IssuesDocument21 pagesCapital Budgeting - Adv IssuesdixitBhavak DixitNo ratings yet

- Chap 09 Prospective AnalysisDocument35 pagesChap 09 Prospective AnalysisHiếu Nhi TrịnhNo ratings yet

- Chapter 9 Capital BudgetinDocument184 pagesChapter 9 Capital BudgetinKatherine Cabading InocandoNo ratings yet

- Chap 11 Problem SolutionsDocument46 pagesChap 11 Problem SolutionsNaufal FigoNo ratings yet

- Practical Financial Management 7th Edition Lasher Solutions ManualDocument25 pagesPractical Financial Management 7th Edition Lasher Solutions Manualillegalgreekish.ibdz100% (30)

- Capital Budgeting Techniques and Project AnalysisDocument7 pagesCapital Budgeting Techniques and Project AnalysisVic CinoNo ratings yet

- CH 13 SolDocument32 pagesCH 13 SolSungho LeeNo ratings yet

- Semi-Finals Fin 3Document3 pagesSemi-Finals Fin 3Bryan Lluisma100% (1)

- All PPTsDocument84 pagesAll PPTsaashima madaanNo ratings yet

- Lecturenote - 1762467632financial Management-Chapter ThreeDocument22 pagesLecturenote - 1762467632financial Management-Chapter ThreeJOHNNo ratings yet

- Capital Budgeting: Net Present ValueDocument3 pagesCapital Budgeting: Net Present Valuepratibha2031No ratings yet

- The Basics of Capital Budgeting: Answers To End-Of-Chapter QuestionsDocument46 pagesThe Basics of Capital Budgeting: Answers To End-Of-Chapter QuestionsAndrew Chipwalu100% (1)

- MBA5903 - Study Unit 4 - Capital Investment Decision - 2024Document9 pagesMBA5903 - Study Unit 4 - Capital Investment Decision - 2024Katlego MonyaeNo ratings yet

- Comparison of methods 5Document19 pagesComparison of methods 5omarsahamadNo ratings yet

- A. The Importance of Capital BudgetingDocument34 pagesA. The Importance of Capital BudgetingRusty SodomizerNo ratings yet

- Financial Strategy FailuresDocument4 pagesFinancial Strategy FailuresNayeemul IslamNo ratings yet

- The Basics of Capital Budgeting Evaluating Cash Flows: Answers To Selected End-Of-Chapter QuestionsDocument16 pagesThe Basics of Capital Budgeting Evaluating Cash Flows: Answers To Selected End-Of-Chapter Questionsadaiya1672887No ratings yet

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- Analytical Corporate Valuation: Fundamental Analysis, Asset Pricing, and Company ValuationFrom EverandAnalytical Corporate Valuation: Fundamental Analysis, Asset Pricing, and Company ValuationNo ratings yet

- Discounted Cash Flow Budgeting: Simplified Your Path to Financial ExcellenceFrom EverandDiscounted Cash Flow Budgeting: Simplified Your Path to Financial ExcellenceNo ratings yet

- What Is An AtheistDocument62 pagesWhat Is An AtheistLBL_LowkeeNo ratings yet

- Comprehensive Finance Review - 2008Document47 pagesComprehensive Finance Review - 2008LBL_LowkeeNo ratings yet

- Comprehensive Finance Review - Chapters 1 - 6Document18 pagesComprehensive Finance Review - Chapters 1 - 6LBL_LowkeeNo ratings yet

- Review For Exam 2Document40 pagesReview For Exam 2LBL_LowkeeNo ratings yet

- Chapter 08Document58 pagesChapter 08LBL_LowkeeNo ratings yet

- Chapter 07Document29 pagesChapter 07LBL_LowkeeNo ratings yet

- Comprehensive Review - 2011Document78 pagesComprehensive Review - 2011LBL_LowkeeNo ratings yet

- Finance Final Review - 2012Document37 pagesFinance Final Review - 2012LBL_LowkeeNo ratings yet

- Pretest - Chapters 2 3 5 6 7Document66 pagesPretest - Chapters 2 3 5 6 7LBL_LowkeeNo ratings yet

- Chapter 05 GitmanDocument69 pagesChapter 05 GitmanLBL_LowkeeNo ratings yet

- Chapter 10Document42 pagesChapter 10LBL_Lowkee100% (1)

- Chapter 03Document54 pagesChapter 03LBL_LowkeeNo ratings yet

- Chapter 02Document17 pagesChapter 02LBL_LowkeeNo ratings yet

- Chapter 06 GitmanDocument38 pagesChapter 06 GitmanLBL_LowkeeNo ratings yet

- Chapter 09 GitmanDocument15 pagesChapter 09 GitmanLBL_Lowkee100% (1)

- Chapter 07 GitmanDocument35 pagesChapter 07 GitmanLBL_LowkeeNo ratings yet

- Balance Sheet: Direct Appeal LLCDocument2 pagesBalance Sheet: Direct Appeal LLCJames VargaNo ratings yet

- Valuation of Investment PropertiesDocument25 pagesValuation of Investment PropertiesmeriyenyNo ratings yet

- Chapter 6Document2 pagesChapter 6lawrence-15-2019813060No ratings yet

- Food Services Manager Sample ResumeDocument1 pageFood Services Manager Sample ResumesmshaidrNo ratings yet

- Baldrige Cybersecurity Excellence Builder v1.1Document40 pagesBaldrige Cybersecurity Excellence Builder v1.1James TelbinNo ratings yet

- MKTG Canadian 2nd Edition Lamb Test BankDocument39 pagesMKTG Canadian 2nd Edition Lamb Test Bankodettedieupmx23m100% (27)

- SIPB Stage-1 Check List For Incentives Under Bihar Industrial Investment Promotion Policy, 2016Document1 pageSIPB Stage-1 Check List For Incentives Under Bihar Industrial Investment Promotion Policy, 2016SAMRAT SILNo ratings yet

- Sample Dissertation Project ProposalDocument8 pagesSample Dissertation Project ProposalWriteMyPaperFastMurfreesboro100% (1)

- FDICapital Formatted 20170922 Final WDocument32 pagesFDICapital Formatted 20170922 Final Wrishitmughalempire23No ratings yet

- Understanding Generation Z For Effective On BoardingDocument21 pagesUnderstanding Generation Z For Effective On BoardingAymen DrissNo ratings yet

- Operations StructureDocument1 pageOperations StructurePranit GaikarNo ratings yet

- Assignment 9M's ChecklistDocument4 pagesAssignment 9M's ChecklistShamsur RahmanNo ratings yet

- 1 PB PDFDocument7 pages1 PB PDFsai101No ratings yet

- Target Operating Model Customer Service 1Document5 pagesTarget Operating Model Customer Service 1VINENNo ratings yet

- ENTREPDocument35 pagesENTREPCatherine MempinNo ratings yet

- Account StatementDocument12 pagesAccount Statementpancard2323No ratings yet

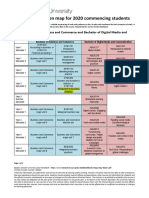

- B2027 Bachelor of Business and Commerce and Bachelor of Digital Media and CommunicationDocument1 pageB2027 Bachelor of Business and Commerce and Bachelor of Digital Media and CommunicationQueNo ratings yet

- SQA System ArchitectureDocument11 pagesSQA System ArchitectureEuclid Jay CorpuzNo ratings yet

- أثر تطبيق نظام إدارة الجودة iso 9001 على تحسين أداء قطاع الصناعة التقليدية والحرف دراسة حالة مؤسسة - datte el ghazel - بسكرةDocument17 pagesأثر تطبيق نظام إدارة الجودة iso 9001 على تحسين أداء قطاع الصناعة التقليدية والحرف دراسة حالة مؤسسة - datte el ghazel - بسكرةlearneenglish940No ratings yet

- Form 1023.non ProfitDocument28 pagesForm 1023.non ProfitLawrence BolindNo ratings yet

- IATF - International Automotive Task ForceDocument23 pagesIATF - International Automotive Task ForceKaran MalhiNo ratings yet

- OTS ProfileDocument14 pagesOTS ProfileasadnawazNo ratings yet

- Royalty and Fees For Technical Services PDFDocument106 pagesRoyalty and Fees For Technical Services PDFanandarchayaNo ratings yet

- Ajinomoto Group 2020Document84 pagesAjinomoto Group 2020Trinh AnhNo ratings yet

- Annual Confidential Report Form PDFDocument18 pagesAnnual Confidential Report Form PDFmarchkotNo ratings yet

- Case Study AnalysisDocument4 pagesCase Study AnalysisZohaib Ahmed JamilNo ratings yet

- Order 110-2746 Wrist S14-22elecDocument1 pageOrder 110-2746 Wrist S14-22elecjesus davidNo ratings yet

- R&D Procedure - Control of Drawing Engg Specification P1Document1 pageR&D Procedure - Control of Drawing Engg Specification P1sumanNo ratings yet