RJR

RJR

Uploaded by

liyulongCopyright:

Available Formats

RJR

RJR

Uploaded by

liyulongOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

RJR

RJR

Uploaded by

liyulongCopyright:

Available Formats

MEMO

RJR Nabisco

BY: Yuxiang Fan, Da Luo, Di Jia, Tiantao Zheng

Executive Summary

Three strategies of RJR Nabisco are presented by different acquirers. The following memo is

trying to work out the strategy that gives the highest valuation of the firm.

Values of RJR under Different Scenarios

In order to calculate the value of the company, we first need to unlever to derive beta asset or

return on asset. As the EBIT/Int. Exp. of RJR falls on BBB, the beta debt is 0.151 for both 1986 and 87.

So the beta asset can be given in the following table.

Year

1986

1987

D

E

V

Beta D

Beta E

Beta A

11389

5312

16701

0.151

1.24

0.497

10823

6038

16861

0.151

0.67

0.337

Average Beta Asset

0.417

Average Return on Asset

11.92%

Then we need to relever to calculate beta equity under different debt ratios across time, using

beta E=beta A + (beta A- beta D) D/E

We adopt WACC (APV can also be applied in this case, which is equivalent to WACC) to

calculate the value of RJR under the strategy given by pre-bid, Management Group, and KKR

respectively. After working out Rd and Re with CAPM, we use

WACC=Rd* (1-Tc) *D/V + Re*E/V

to calculate the different WACCs of each period. Here we have made an assumption that the corporate tax

rate is constant at 35%. We also estimate that there is an assumed debt of $5000 million in 1988. Then we

may use the WACCs to discount the FCFs of each period. The sum of the present values will be the total

value of company. We also work out the share prices given the growth rate of 0%, 2% and 4% after 1998.

The calculating process can be seen in the appendices.

Values of RJR Under Different Strategies ($/share)

Growth Rate

Pre-bid Strategy

Management Group Strategy

KKR Strategy

0%

115.02

118.48

115.63

2%

127.32

129.34

128.64

4%

145.83

145.81

148.22

The Reasons That Accounts for Differences

The differences in the value of the three operating plans are mainly from capital structure

and operating strategy used by two bidders. Both bidders believed that the value of stock was

undervalued by the market and the cash flow of RJR was strong and stable, which can utilize more

aggressive capital structure to save taxes and therefore increasing value of the company. Besides,

KKR and the Management Group thought that the operating strategy used by company could not

maximize the shareholders value. The Management Group believed that stock market undervalued

the strong and stable cash flow generated from tobacco business and market did not fully value its

food business since its connection with selling tobacco. In addition, during that time, food industry

was experiencing a major restructuring and revaluation and Johnson had experience selling food

assets. Therefore, the Management Groups strategy was to sell RJRs food business and take

tobacco business private. The Management Group believed that the new strategy would eliminate

undervaluation and generate more gains for shareholders. Moreover, this strategy was financed by

long term debt, which resulted in greater valuation because of tax shield. However, KKRs strategy

was to keep all of the tobacco business and most of food business because KKR thought that

retaining food business and operating it correctly would generate more value than just selling it.

Also, KKRs strategy took more debt, which led to higher tax shield and valuation. Thus, the

operating strategy and capital structure are the major drivers for the difference among three plans.

Evaluation of the Special Committees Auction

Special Committees use of an auction for the sale of RJR Nabisco is very reasonable and

protective to RJR Nabiscos shareholders. Such auction will benefit shareholders value by

allowing all potential buyers to compete with their highest bid offer. Moreover, this auction will

promote a quick and smooth buyout process as it gives a specific deadline to bid. This would

prevent the joint-bid case by KKR and Management Group that lasted for a year. If all parties are

privately negotiating with one another, the bidding process would be prolonged which would not

benefit shareholders interest. However, one drawback of such auction is that competition will

drive the valuation of RJR Nabisco very high, meaning that after the buyout, RJR Nabisco would

incur a significant amount of debt, which might damage remaining shareholders longer term

value.

Through our analysis, the operating strategy and capital structure are the major drivers for

the difference among three plans, since more debt would lead to higher tax shield and therefore

higher valuation.

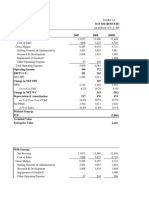

Appendix

You might also like

- Tad OMalley Case Analysis Guidelines - Carlos RamosNo ratings yetTad OMalley Case Analysis Guidelines - Carlos Ramos6 pages

- Science Technology Company Case Memo (TobyOdenheim)100% (1)Science Technology Company Case Memo (TobyOdenheim)4 pages

- Hampton Exhibits and Pro Formas For Students0% (2)Hampton Exhibits and Pro Formas For Students19 pages

- Cases RJR Nabisco 90 & 91 - Assignment QuestionsNo ratings yetCases RJR Nabisco 90 & 91 - Assignment Questions1 page

- RJR Nabisco Holdings Capital CorporationNo ratings yetRJR Nabisco Holdings Capital Corporation3 pages

- This Spreadsheet Supports Analysis of The Case, "American Greetings" (Case 43)No ratings yetThis Spreadsheet Supports Analysis of The Case, "American Greetings" (Case 43)52 pages

- This Study Resource Was: 1 Hill Country Snack Foods CoNo ratings yetThis Study Resource Was: 1 Hill Country Snack Foods Co9 pages

- The Relative Pricing of High-Yield Debt: The Case of RJR Nabisco Holdings Capital Corporation100% (1)The Relative Pricing of High-Yield Debt: The Case of RJR Nabisco Holdings Capital Corporation24 pages

- Berkshire Partners Bidding For Carter S Group 6No ratings yetBerkshire Partners Bidding For Carter S Group 621 pages

- DC 51: Busi 640 Case 3: Valuation of Airthread ConnectionsNo ratings yetDC 51: Busi 640 Case 3: Valuation of Airthread Connections4 pages

- Business Strategy+Black+Bay+Project+-+Group+28No ratings yetBusiness Strategy+Black+Bay+Project+-+Group+282 pages

- Great Eastern Shipping Company Limited (Case Study) : Submitted To:-Submitted ByNo ratings yetGreat Eastern Shipping Company Limited (Case Study) : Submitted To:-Submitted By6 pages

- PhilAm LIFE vs. Secretary of Finance Case DigestNo ratings yetPhilAm LIFE vs. Secretary of Finance Case Digest2 pages

- 10 Manufacturers Hanover Trust Vs GuerreroNo ratings yet10 Manufacturers Hanover Trust Vs Guerrero157 pages

- Bonds Payable and Investments in Bonds: ObjectivesNo ratings yetBonds Payable and Investments in Bonds: Objectives45 pages

- Government of Andhra Pradesh Commercial Taxes DepartmentNo ratings yetGovernment of Andhra Pradesh Commercial Taxes Department2 pages

- A Study On Technical Analysis of New Private Sector Banking Stocks in IndiaNo ratings yetA Study On Technical Analysis of New Private Sector Banking Stocks in India14 pages

- Strategic Management and Business Policy Globalization Innovation and Sustainability 14th Edition Wheelen Solutions Manual100% (25)Strategic Management and Business Policy Globalization Innovation and Sustainability 14th Edition Wheelen Solutions Manual20 pages

- CH 06 - Risk, Return, and The Capital Asset Pricing ModelNo ratings yetCH 06 - Risk, Return, and The Capital Asset Pricing Model60 pages

- Kunci Jawaban Vidcon Pertemuan 4 (4PAK51)No ratings yetKunci Jawaban Vidcon Pertemuan 4 (4PAK51)7 pages

- Checks Issued by City of Boise Idaho - 14No ratings yetChecks Issued by City of Boise Idaho - 1431 pages

- Tad OMalley Case Analysis Guidelines - Carlos RamosTad OMalley Case Analysis Guidelines - Carlos Ramos

- Science Technology Company Case Memo (TobyOdenheim)Science Technology Company Case Memo (TobyOdenheim)

- This Spreadsheet Supports Analysis of The Case, "American Greetings" (Case 43)This Spreadsheet Supports Analysis of The Case, "American Greetings" (Case 43)

- This Study Resource Was: 1 Hill Country Snack Foods CoThis Study Resource Was: 1 Hill Country Snack Foods Co

- The Relative Pricing of High-Yield Debt: The Case of RJR Nabisco Holdings Capital CorporationThe Relative Pricing of High-Yield Debt: The Case of RJR Nabisco Holdings Capital Corporation

- DC 51: Busi 640 Case 3: Valuation of Airthread ConnectionsDC 51: Busi 640 Case 3: Valuation of Airthread Connections

- Great Eastern Shipping Company Limited (Case Study) : Submitted To:-Submitted ByGreat Eastern Shipping Company Limited (Case Study) : Submitted To:-Submitted By

- Bonds Payable and Investments in Bonds: ObjectivesBonds Payable and Investments in Bonds: Objectives

- Government of Andhra Pradesh Commercial Taxes DepartmentGovernment of Andhra Pradesh Commercial Taxes Department

- A Study On Technical Analysis of New Private Sector Banking Stocks in IndiaA Study On Technical Analysis of New Private Sector Banking Stocks in India

- Strategic Management and Business Policy Globalization Innovation and Sustainability 14th Edition Wheelen Solutions ManualStrategic Management and Business Policy Globalization Innovation and Sustainability 14th Edition Wheelen Solutions Manual

- CH 06 - Risk, Return, and The Capital Asset Pricing ModelCH 06 - Risk, Return, and The Capital Asset Pricing Model