Unit 1

Unit 1

Uploaded by

Monika SaxenaCopyright:

Available Formats

Unit 1

Unit 1

Uploaded by

Monika SaxenaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Unit 1

Unit 1

Uploaded by

Monika SaxenaCopyright:

Available Formats

ACM302

INCOME-TAX (AY 2014-15)

UNIT-I

UNIT I

Lesson 1

An overview of Income-tax

Objectives

to introduce Income-tax Act

to understand the different fundamental definitions of various terms used in

Income-tax Act.

Introduction:

Income tax is charged on income in India. However, every receipt does not

constitute the taxable income as per income tax act, 1961. There is a difference

between receipt and income. If a person receives money on account of a

transaction it would be called as receipt but it will not be taxable fully unless no

other expenses are incurred by the person to derive such receipt. The receipt will

be taxable when it converts into income. A receipt convert into income by

deducting expenses from receipt. For example a person sells a house property for

Rs.2 lacs, under Income-tax Act Rs.2 lacs will not be fully taxable instead of his

receipt of Rs.2 lacs, the cost of acquisition of the house property will be deducted

and remaining amount would be taxable. In case of salaried class person, the

entire amount of salary received from employer is not included under the head

salary, whereas some deduction available under this head will be allowed to

determine the income from salary. With the help of the above discussion, it can be

concluded that income tax is charged on income not on receipt.

In India income tax is governed by Income-tax Act 1961 which came into force on

1.4.1962 in India. Income tax Rules 1962, The Finance Act and CBDT circulars

are also considered to solve the complications of income tax.

Fundamental Definitions:

(a) Income

The term income infact, has not been defined in the Income tax Act, 1961, so as

to make a layman understand what it really means. According to the various courts

decision any sum received regularly with a definite source, is called as income.

However , section 2(24) of the Act , an interpretation clause , states as to what is

included in income for the purpose of taxation , to understand the meaning of the

term , the item included in income may be looked upon at. They are:

(i) Profit and gain

(ii) Dividend

(iii) Voluntary contribution received by (a) a trust, created wholly or partly for

charitable or religious purpose; or (b) an institution established wholly or partly for

such purposes; or (c) a scientific research association; or (d) a sport and game

association.

1.1

ACM302

INCOME-TAX (AY 2014-15)

UNIT-I

(iv) Perquisites or profit, available in lieu of salary that is taxable in the head of

salary.

(v) Any allowances (a) to meet the expenses exclusively for the performance of his

duties; or (b) to meet his personal expenses at the place where he performs his

duties.

(vi) Benefits or perquisites obtained by a director or by a person having substantial

interest in any company or relatives of a director or such a person.

(vii) Profit of business and profession, chargeable to tax.

(viii) Profit on sale of a license granted under the imports (control) order, 1955.

(ix) Cash assistance received against export under any scheme of the government

of India.

(x) Capital gain, chargeable to tax.

(xi) Profit and gain of a mutual insurance company or a co-operative society.

(xii) Any winning from lottery, cross-word puzzle, horse races, card games or

games of gambling or betting.

(xiii) Any sum received by an assessee from his employees as contribution to any

provident fund and supper-annuation fund or any fund created for welfare of such

employee.

(xiv) Remuneration or interest, salary, bonus, commission received by a partner

from the firm under the limit of deduction, u/s 40(b).

(xv) Any sum realized in the previous year, which had been allowed as a

deduction earlier year .e.g., recovery of bad debt.

(xvi) Any duty of custom or excise repaid or repayable as drawback to any person

against exports under the custom and central excise drawback rules, 1971.

(xvii) Any sum received under a keyman insurance policy including the sum

received by way of bonus on such policy (w.e.f. 1.10.1996).

(xviii) ) Any sum received under an insurance policy issued after 31.03.2003 but

before 01.04.2012 in respect of which the premium payable for any of the years

during the term of the policy exceeds 20% of the sum assured. Any sum received

under an insurance policy issued after 31.3.2012 in respect of which the premium

payable for any of the years during the terms of the policy exceeds 10% of the

actual capital sum assured.

(xix) any sum received by an individual, or a Hindu undivided family from any

person on or after 1-9-2004 in cash or by a cheque or draft or by any other mode

or by way of credit, otherwise than by way of consideration for goods and services

if such income exceeds Rs.50,000. Under this clause, amount received due to

natural love and affection, gratuity, pension, bonuses paid by the employer to the

legal dependent of deceased employee are not included.

Thus, it is evident from the item included in section 2(24) that the term income is

an extensive term in the income-tax Act, 1961.Infact income means a monetary

income derived from definite source, such as

(1) Salaries;

(2) House property;

(3) Business or profession;

(4) Capital gain; and

1.2

ACM302

INCOME-TAX (AY 2014-15)

UNIT-I

(5) Other sources

These sources are known as heads of income.

Important rules regarding incomes

The following rules must be taken into consideration very carefully while

calculating the income under the Income-tax Act;

(1) Legality of income. Any income, whether legal or illegal, is taxable in the

income tax, provided it is a taxable income. It is immaterial that a particular income

should not be taxable if such income is derived from an illegal source. Any income

earned from an illegal source will also be treated as income, provided otherwise it

is a taxable income. For example an income earned by a prostitute is also taxable

under Income-tax Act.

(2) Nature of receipt. Lump sum receipt is also considired as income. Arrears of

pay (salary) come into this category. It is not essential that income should be

received at regular interval like weekly, monthly, quarterly or annually. If any

income derived occasionally, e.g. capital gain or any casual income, that will also

be treated as income as per rules of income tax.

(3) Source of income. Income should be received from outside. Only such

incomes are charged to tax in the Income-tax Act, 1961, that are derived from the

outside source. In other words, income earned on account of transaction made by

an individual or any assessee with some outsider, i.e., other than assessee, shall

be chargeable to income tax. For example if a club refunds the subscription to its

member this income will not be taxable in the hand of member.

(4) Form of receipt. It is not necessary that income must be received in the form

of money, receipt in kind or service, having money equivalent, can also be income

but such form of income must be measured in term of money. For example,

perquisites taxable under the head of salary come into this category.

(5) Right to receive income. If there is a dispute regarding the title of the income,

the recipient of such income is liable to pay tax. For example, A and B claim the

title of a property which is let out, but A, receives the rent of this house. Although,

the title of the property is under dispute but as per the income tax rules, this

income will be taxable in the hand of A who is the receiver of the rent.

(6) Constitution of income. Personal gifts, presents, pin money, dharmada, etc.,

do not constitute income.

(7) Relief as income. Mere relief from expenses is not income. As per the

provisions of Income-tax Act 1961, a person is not charged to tax on what his

pocket saves but on what goes into his pocket. For example, where the manager

1.3

ACM302

INCOME-TAX (AY 2014-15)

UNIT-I

of accompany foregoes his remuneration, it will not be treated as income in the

hand of the company.

(8) Time of receipt. Whether a particular receipt is income or not, it would be

decided at the time of receipt, if an amount is not recognized as income at its first

instance, afterwards also it will not be considered as income,. For example,

advance money whenever it is forfeited will not be included in the income on the

basis of this concept.

(9) Earning of income. Under income tax, income is charged to tax on earned as

well as receipt basis. If an assessee has earned an income but it is not actually

received by the assessee it would also be taxable because he is entitled to receive

it. For example, interest on National Savings Certificate is taxable under the head

income from other sources on the basis as described above.

(10) Charge on income. Where under a legal obligation, a charge is created on

the income of a person, and then to the extent of such charges, it will not be

considered as his income provided charge is a legal one not voluntary created by

the assessee to avoid the tax.

(b) Agricultural income

The term agricultural income has been defined in section 2(1A) of the Income-tax

Act. According to it, the agricultural income pertains to;

(1) Any rent or revenue derived from land, situated in India and used for

agricultural purposes.

(2) Any income derived from such land by;

(a) Agricultural operation; or

(b) Any activity ordinarily employed for making the agricultural produce fit for

the Market; or

(c) The sale of agricultural produce, raised.

(3) Any income derived from any building, in which any activity mentioned in above

Para 2(b) is carried on, provided that:

(a) The building is on or in the immediate vicinity of the land and is being used by

the cultivator or the receiver of rent as a dwelling house or as a store;

(b) (i)some rent or local tax is levied upon such land in India , which is assessed

by the government authorities and recovered by them; or

(ii) If no local tax is levied, then that land must be situated outside a maximum of 8

kms. of the local limit of any Municipality or Cantonment Board or within the local

limit of any Municipality or Cantonment Board having a population of not less than

10000.

The Financial Act, 2013 has defined the area in the Act itself rather than making a

reference to the notification.

1.4

ACM302

INCOME-TAX (AY 2014-15)

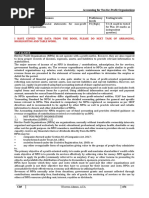

Population (Municipality or Cantonments Board)

(i)

10,000 but not exceeding 1 Lac.

(ii)

morethan 1 Lac. But not exceeding 10 Lac.

(iii)

morethan 10 Lac.

UNIT-I

Distance (in Km.)

2 Kms.

6 Kms.

8 Kms.

It has also been clarified that population shall mean the population according to

last preceding census of which the relevant figures have been published before

the first day of the previous year.

Thus, it is evident from the above that the essential elements of agricultural

income are:

i.

the income must have been received from the land

ii.

the land must have been situated in India and

iii.

The land must have been used for agricultural purpose.

Kinds of Agricultural income

The following are five kinds of agricultural income:

1. Rent or revenue derived from land used for agricultural purpose.

2. Income derived from cultivation of land.

3. Income derived from such land, used for the performance of any activity,

ordinarily employed to make the produce fit for the market.

4. Income derived from sale of produce by the cultivator or the receiver of rent

in kind.

5. Income derived from any building used for agricultural operations.

Non-agricultural Income

The following incomes, in spite of being concerned with land, are not treated to be

agricultural incomes as the land is not used for agricultural purpose in such cases.

These are:

1) income from dairy farms

2) Income from markets.

3) Income from sale of water for irrigation purpose.

4) Royalty income from mines, e.g, coal, stone, etc.

5) Income from fisheries.

6) Income from land used for storing agricultural products.

7) Remuneration received by manager of agricultural farms.

8) Income from sale of earth from making bricks.

9) Dividend from a company engaged in agricultural activities.

10) Income from self-grown grass, trees and bamboos.

11) Income from such grazing grounds whose cattle are not used for any

purpose.

12) Income from butter and cheese making.

13) Income from poultry farming.

14) Maintenance allowance charged on agricultural land.

15) Income from interest on arrears of rent of agricultural land.

16) Income from supply of water.

1.5

ACM302

INCOME-TAX (AY 2014-15)

UNIT-I

17) Income from purchasing standing crop.

Partly agricultural income

Sometimes there is composite income, which is partially agricultural and partially

non-agricultural, for determining the non-agricultural income chargeable to tax, the

market value of any agricultural produce which has been raised by the assessee

and which has been utilized as a raw material in such business, shall be deducted.

No further deduction shall be made in respect of cost of cultivation incurred by the

asessee as a cultivator.

The rules for ascertaining share of agricultural income (partly agricultural income)

in total income are given below:

Sources of total income

1. income from growing and

manufacturing of tea in

India

1. Income from growing and

manufacturing

of

centrifuged

latex

or

cencex from rubber in

India

2. Income from sale of coffee

grown and cured by the

seller in India.

3. income from the sale of

coffee

grown,

Cured,

Roasted and grounded by

the seller in India, with or

without mixing of Chicory

or

other

Flavorings

Ingredients,

Agricultural

income

60%

Non-agricultural

income

40%

65%

35%

75%

25%

60%

40%

Inclusion of agricultural income in total income

Agricultural income is totally exempted from liabilities to income tax. But, with

effect from the assessment year 1974-75, it has become a factor in computing tax

on the non-agricultural income of an individual, Hindu Undivided Family ,

association of person and artificial juridical person whose total income (excluding

agricultural income) exceeds the minimum taxable limit (i.e. Rs.2,50,000 in case of

senior citizens (age of 60 years or more but less than 80 years), Rs. 5,00,000 in

case of super senior citizen (who is age of 80 years or more) and Rs.2, 00,000 in

other case ) and the net agricultural income exceeds Rs.5000. The agricultural

1.6

ACM302

INCOME-TAX (AY 2014-15)

UNIT-I

income is included in the total income for computing the rate of tax. However, as

discussed earlier, such inclusion is applicable only to the individual assessee

having non-agricultural of more than 2,50,000; Rs. 5,00,000 or 2, 00,000 as the

case may be and the net agricultural income of more than Rs.5000.

Example:

A cultivator, whose non- agricultural income is Rs.1,00,000 and net agricultural

income is Rs.7000, will not pay tax. But, a cultivator having non- agricultural

income of Rs.2, 40,000, he is not a senior citizen and agricultural income of

Rs.8000 will have to pay income tax and his agricultural income shall be added to

his total income for the purpose of determining income tax rates.

Computation of net agricultural income

The various rules, pertaining to computation of net agricultural income, are here as

under;

(1) Rent received from agricultural land. It shall be determined like the

income from other source. Expenses which are incurred for earning such

income will be deducted.

(2) Calculation of agricultural income. This shall be calculated in the same

way as the computation of profit or gains from the business or profession

are done and the same deductions shall be permissible. It does not include

the rent of agricultural land and the income earned from the residential

house used for the purpose of agricultural activities.

(3) Income of the agriculturists house. If the cultivator uses the dwelling

house for the purpose of his personal residence, income from the

cultivators house shall be computed like the income from house property

and the some deduction shall be permissible.

(4) Agricultural income of association of person or body of individuals.

Where the assesse is a member of an association of person or body of

individuals (except H.U.F, a company and a firm) and the association and

or body is not liable to pay tax under this Act but has any association of

person or body of individuals, such income is computed in accordance with

the rules and the share of the asessee in the association of person or body

of individuals or the loss is regarded as the association of person or body of

individuals of the assessee.

(5) Sustaining agricultural losses instead of income. If agricultural loss is

sustained in some year instead of income, it can be made up in the same

previous year from the other source of agriculture.

(6) Payment of income tax by an assessee to the government. If any

income tax is paid by an assessee to the state government, for the

agricultural income earned by him, shall be deducted while computing the

agricultural income.

(7) Loss arrived at while calculating agricultural income. If, while

calculating the net agricultural income, some loss is occurred then

agricultural income shall be treated as NIL and this loss cannot be made

up from the income of other source.

1.7

ACM302

INCOME-TAX (AY 2014-15)

UNIT-I

Self Check Questions

State whether the following are the agricultural income or not:

(i)

Income derived from grazing of cattle, in agricultural land, required

for agricultural activities.

(ii)

Income derived from sale of forest trees of spontaneous growing

nature.

(iii)

Income from interest on arrear of rent, payable in respect of

agricultural land.

(iv)

Income received as dividend amounting to Rs.500 from a company

whose entire profits constitute agricultural income.

(v)

Income received as dividend of Rs.200 from the tea company,

whose 40% profit was charged to income tax and the 60%

constituted agricultural income.

(vi)

Income derived from leasing of land assessed to land revenue in

India for agricultural purpose.

ANSWER

(i)

It is agricultural income as it is directly concerned with agricultural

activities.

(ii)

As none of the agricultural operations are performed on trees and they

are self grown, income from sale of such trees shall not be agricultural

income.

(iii)

As the income is not directly linked with the agricultural land, thus it is

not an agricultural income.

(iv)

It is not an agricultural income as the dividend arises out of holding of

shares and not from the land, used for the agricultural purposes.

(v)

As the dividend arise out of holding of shares, no matter whether the

company, declaring profit, earned them from agricultural land or not.

(vi)

This income is completely of agricultural nature, as it is directly related

with land, leased out of agricultural purpose.

(c) Person

According to section 2(31) of the Income-tax Act person includes;

(1) an individual, a natural human being, e.g., male or female, minor, etc;

(2) a Hindu undivided family ;

(3) a company ;

(4) a firm;

(5) an association of person or a body of individuals whether incorporated or

not;

(6) a local authority

1.8

ACM302

INCOME-TAX (AY 2014-15)

UNIT-I

(7) every artificial juridical person, not falling any of the priding sub-clauses,

e.g., a statutory corporation, university, etc.

(d) Assessee

Sec. 2(7) of the Income-tax Act deals with the term assessee. Assessee means a

person who is liable to pay tax or any other sum of money, such as penalty, etc.

under the Income-tax Act. The tax or any such sum may be payable on the

persons own income or for minor, insane, deceased, successor or any foreigner.

In general any tax payer under this act is an assessee. The term assessee under

Income-tax Act includes:

(1) The person who is liable to pay any tax.

(2) The person who is liable to any other sum of money, such as penalty, fines

interest etc.

(3) The person taking up legal formalities for any other persons income and

paying tax on it.

(4) The person who is deemed to be assessee under any provision of the

income tax act.

(5) The person who is deemed to be defaulter under any provision of the

income tax act.

(6) The person who have proceeds with the refund of tax, paid by themselves

or on account of some other.

Deemed Assessee

A deemed assessee is liable to pay income tax on income of other person. For

example, legal representative, who inherit the property on the death, is deemed

assessee in respect of his assessment.

Assessee in Default

A person has to fulfill the legal obligation under income tax act to pay tax on behalf

of other. If he fails in it due to which income tax department suffers a loss of

revenue, such person has to compensate this loss. For this loss, he is called

assessee in default.

(e) Causal income

Causal income is that income the receipt of which is accidental and without any

stipulation. It is in nature of an expected wind fall. The examples of such income

are;(a) winning from lottery, (b) winning from cross-word puzzles, (c) winning from

card games,(d) winning from other games of any sort, (e) winning from gambling

or betting of any form of nature.

Exceptions of casual income. The casual income does not include;

(i)

Capital gain

(ii)

Receipt arising from business or profession or occupation.

(iii)

Bonus, gratuity, perquisites, etc.

1.9

ACM302

INCOME-TAX (AY 2014-15)

(iv)

UNIT-I

Amount received on account of voluntary retirement.

Other provisions.

(i) No expenses are deductible for casual income

(ii) Instead of casual income, if it is a loss then set off losses is not permitted.

(iii) If the winning from horse- race exceeds Rs. 5,000, tax will be deducted at

source as per prescribed rates.

(iv) If the winning from any lottery, cross-word puzzles, card games etc. exceeds

Rs. 10,000, tax will be deducted at source as per prescribed rates.

Self Check Questions

State whether the following receipt are casual income:

(i)

Mr. X received Rs.5000 for acting once as an arbitrator without any

stipulation as to remuneration.

(ii)

Mr. Y received Rs.5000 for acting as an arbitrator with a clear and

definite stipulation for the said remuneration.

(iii)

Mr. X a decree holder, received interest of Rs.500 under an order of

court granting stay of execution of the decree on judgment- debtor

Mr. Y.

(iv)

Mr. X is in the service of Mr.Y. Mr Ys son was lost and Mr. X traced

him out without any stipulation of reward but Mr. Y gave him a

reward of Rs. 500.

Answer

Examining casual income

(i)

The receipt is of a casual and non recurring nature as there was no

stipulation for remuneration.

(ii)

Mr. Y was offered a definite remuneration for acting as an arbitrator and

he accepted the work of the remuneration, hence the receipt is not of a

casual income.

(iii)

Interest of Rs.500 received by the decree- holder is not a casual

income.

(iv)

It is of casual income and non recurring nature as there was no

stipulation for the reward.

(f) Assessment Year

According to section 2(9) of the income tax act an assessment year means the

period of 12 months commencing on 1st day of April every year and ending on 31st

day of the March of the next year. This period is fixed by law and the income tax is

charged upon the income of the previous year. For instance, the current

assessment year 2014-2015 which commenced on 1st April, 2014 will end on 31st

March, 2015.

1.10

ACM302

INCOME-TAX (AY 2014-15)

UNIT-I

(g) Previous year

Section 3 of the income tax act defines this term as the duration of 12 months

immediately preceding the assessment year. The previous year will be uniform for

all the assessee, with effect from the assessment year 1989-90. Before it the

assesse used to maintain their previous year at their Will, e.g. Diwali year,

calendar year, etc.

Further if any business or profession commence on any date, falling in the midst of

the financial year, the previous year will commence from such date of setting up

and will end on the next coming 31st March. In such a case the term of previous

year may be less than 12 months.

For example, a business started on 23rd November, 2013 in this case the previous

year shall commence on 23rd November, 2013 and shall end on 31st March 2014.

It will include only 4 months and 8 days.

At present also there is no compulsion on any assessee to close the account on

31st March only. Assessee may close the account on an date different from 31st

March. However, he would be required to present his account on 31 st March also,

for the income tax purpose. If any assessee closes the account at the different

date from 31st March, he would be required to find out income as per accounting

year and financial year both.

Exception to the Rule

The following are some exception to the rule that income tax is charged on the

income of the previous year during the assessment year;

(1) Income of shipping companies - In case of non resident being shipping

companies if they do not have any agent in India.

(2) Income of person going abroad - In case of person going abroad from

India and not coming back, the tax shall be levied on his income during

current year.

(3) Transfer of property - Every transfer of property shall liable to pay tax in

the current year, in which it transfers.

(4) Closure of business - In case of the closer of business the tax upon the

income of such business, shall be payable in the current year of its earning.

(h) Gross total income

It is a general concept that before computing the total income the gross total

income has to be computed. The term is meant with that income which is

computed in accordance with the provisions of the income tax act, before making

any deduction under section 80C to 80U. In other words, the Net income arrived at

under various heads of income is called gross total income.

1.11

ACM302

INCOME-TAX (AY 2014-15)

UNIT-I

(i) Total income

Total income is also known as the taxable income. Total income refers to the

income arrived at after deducting the permissible deduction under section 80 from

the gross total income. It is calculated by adding incomes of all Heads and their

allowing deduction from 80C to 80 U.

Income from Salaries+ Income from House property+ Income from Business or

Profession+ Income from Capital gain+ Income from Other sources- deduction

under section 80C to 80U.

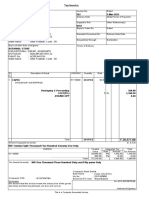

Distinguish between gross total income and total income

S.NO.

Basis

1

Deduction

Gross Total Income

Total Income

The total of various heads of The

total

income

is

income

is

gross

total computed after deducting

income.

the deduction explained

under sec. 80C to 80U from

the gross total income.

2

Computation Tax is not computed on the Tax is always computed on

of tax

basis of the gross total the basis of total income.

income.

3

Rounding

Gross total income is not Total income is calculated

off

brought to the nearest rupee upto the nearest rupee or

or ten rupee unit.

ten rupee unit.

4

Amount

Gross total income is more Total income is mostly less

than the total income

than the gross total income.

Practical Exercise

Exercise 1.

Mr. Tilok Chand Bothra commenced the following business on the

following dates and accounting period was under;

(1) Readymade cloth business: 1st October, 2012 (Diwali year),

(2) Iron business 1st April, 2013 (financial year).

(3) Sugar business: 1st July, 2013 (1st July to 30th June).

(4) Cement business: 1st January, 2014 (calendar year).

In each case, what will be the assessment year and what period will be treated as

the previous year for the relevant assessment year.

Solution

Case Period of previous year

no.

1

1st October, 2012 to 31st March 2013

2

1st April, 2013 to 31st March 2014

3

1st July, 2013 to 31st March 2014

4

1st January 2014 to 31st March 2014

Assessment year

2013-2014

2014-2015

2014-2015

2014-2015

1.12

ACM302

INCOME-TAX (AY 2014-15)

UNIT-I

Exercise 2.

Which period will be treated as the previous year for the income purpose for the

assessment year 2014-2015 in the following cases?

(1) Amit starts a new business on 1st November, 2013 and prepares final

account on 30th June, 2014.

(2) Amita joined service in a company on 1st January, 2014 at Rs.12000 per

month. Her increment in salary will be on 1st January, 2015.

(3) Ashish maintains his account on the basis of financial year.

(4) Abhay is a registered doctor and keeps his income & expenditure account

on calendar year .

(5) Aruna bought a house on 1st August, 2013 and let-out at Rs.6000 per

month.

Solution:

Case

Period of previous year

no.

1

1st November, 2013 to 31st March 2014

2

1st January, 2014 to 31st March 2014

3

1st April, 2013 to 31st March 2014

4

1st April, 2013 to 31st March 2014

5

1st August ,2013 to 31st March 2014

Assessment

year

2014-2015

2014-2015

2014-2015

2014-2015

2014-2015

Exercise 3.

A sugar factory crushed 41000 quintal of sugarcane during the previous year out

of which 6000 quintal of cane was produced on its own farm at a cost of

Rs.440000. The remaining sugarcane was purchased from the market at the

following rates:

20000 quintal @ Rs.93 per quintal

5000 quintal @ Rs.94 per quintal

10000 quintal @ Rs.96 per quintal

During the previous year, the factory earned a total profit of Rs.350000. You are

required to determine separately the agricultural and non-agricultural income.

Solution:

Computation of Agricultural and Non-Agricultural incomes.

Rs.

Cost of sugarcane purchased from the market:

(1) 20000 quintal @ Rs.93 per quintal

(2) 5000 quintal @ Rs.94 per quintal

(3) 10000 quintal @ Rs.96 per quintal

Average market price =

Rs.3290000

35000quental

1860000

470000

960000

3290000

= Rs.94 per quintal

Market value of cane produced (6000 quintal Rs.94)

564000

440000

124000

1.13

ACM302

INCOME-TAX (AY 2014-15)

Less: cost of cane grown on own farm

Agricultural Income

Total profit

Less Agricultural Income

UNIT-I

350000

124000

226000

Non- Agricultural Income

Self Check Question

Q.1

What is income tax? What are the basis and procedure of charging income

tax?

Or

Income tax is charged on income but there is no definition of the term

income under the income tax act; rather it only provide as to what is

included in income. Discuss

Or

Income tax is a tax on income and not on receipt. Discuss this statement

and explain the main characteristics of the term income.

Or

What is income? Explain the fundamental principal of determining income.

Or

What is income? How can you divide heads of income?

Q2.

Explain the following terms

(i)

(ii)

(iii)

(iv)

Person

Assessee

Deemed Assessee

Assessee in Default as per the income tax act ,1961

Q3.

Income tax is charged on the income of the previous year during the

assessment year. State the exception to this general rule.

Or

What is the previous year? Under what circumstances income of a person

can be assessed in the same year in which it is derived?

Or

What do you mean by term assessment year and previous year? Explain.

Or

Distinguish between previous year and assessment year. State the

exemption of previous year.

Q4.

Define the term gross total income and total income. Also distinguish

between them.

Or

What do you understand by income? Distinguish between gross total

income and total income.

1.14

ACM302

INCOME-TAX (AY 2014-15)

UNIT-I

Lesson 2

Determination of Residential Status & Tax Liabilities

Objectives

1. To determine the residential status of an assessee

2. To discuss the tax liabilities on the basis of residence

Residence and tax liabilities

Residence of An Assessee

As per the income tax act, tax assessed on the assessees income on the basis of

his residential status according to the residence, there are three categories of

assessee:

(1) Resident

(2) Not ordinarily resident and

(3) Non-resident

To decide upon the residential status of an assessee, the Act holds certain

condition divided as under :

I. Basic Condition [SEC. 6(1)]

(A) A person has lived for total number of 182 days or more in the previous

year, in India.

OR

(B) A person has during the preceding 4 years, lived in India for a total period of

365 days or more and has lived for 60 or more days, during the previous

year, in India.

Exceptions

(i) if a person (Indian citizen), as a member of the crew of an Indian ship,

goes outside India in the previous year for the purpose of employment,

then the limit of 60 days (as stated in B above) is extended to 182 days.

For this purpose, employment includes self employment or profession or

business provided work has been done outside India. [CIT Vs O. Abdul

Rasak (2011) 198 Taxman I (Kerala)]

(ii) if a Indian citizen person or a person of Indian origin, living outside India,

comes as a visit to India in the previous year, the limit of 60 days (as

stated in B above) is extended to 182 days.

II. ADDITIONAL CONDITIONS

(A) A person has satisfied, at least one basic condition for at least 2 years, out

of the immediately preceding 10 years.

1.15

ACM302

INCOME-TAX (AY 2014-15)

UNIT-I

and

(B) A person has stayed for 730 days or more during the immediately

preceding 7 years, in India.

Residential status of various types of Assessee

Residential status may easily be decided upon with the help of following chart:

Assessee

Resident

Not

ordinarily Non-resident

resident

Individual

If any one of the basic If any one of the If none of the basic

condition and both the basic condition and condition is satisfied.

additional

conditions none

of

the

are satisfied.

additional condition

are satisfied.

Hindu

(1) If the business is (1) If the business If the business is

undivided

controlled

by and is controlled by and controlled by and

family

managed partially or managed in India.

managed

wholly

wholly in India.

(2) The Karta of the outside India.

(2) The Karta of the H.U.F does not

H.U.F. satisfies both satisfy none of the

additional

conditions additional

applicable in case of conditions as in

individual.

case of individuals.

Partnership If the control and It is never a not If the entire control

firm

or management

is ordinarily resident.

and management is

association situated

wholly

or

situated

outside

of persons partially in India during

India.

the previous year.

Company

If it is an Indian It is never a not If it is not Indian

company; or

ordinarily resident

company; and its

If its entire control and

entire control and

management

is

management

is

situated in India during

situated

outside

the previous year.

India during the

previous year.

Incidence of residence on tax liability

The scope of total liabilities, according to the residential status, is as under:

(1) Tax liabilities of resident. The following incomes form part of total income in

case of resident in India:

(i) Income received in India like income from business situated in India.

(ii) Income deemed to be received in India like interest accrued on debentures of

Indian company.

(iii) Income accrued or arisen in India like service rendered in India but amount

received outside India.

1.16

ACM302

INCOME-TAX (AY 2014-15)

UNIT-I

(iv) Income deemed to be accrued or arisen in India like service rendered outside

India in case of government employee.

(v) Income accrued outside India like rent from house property situated outside

India.

(2) Tax liabilities of not-ordinarily resident. The following incomes form part of total

income in case of not-ordinarily resident in India:

(i) Income received in India

(ii) Income deemed to be received in India

(iii) Income accrued or arisen in India

(iv)Income deemed to be accrued or arisen in India

(v) Income accrued outside India from a business or profession controlled from

India.

(3) Tax liabilities of non- resident. The following incomes form part of total income

in case of non- resident in India.

(i) Income received in India

(ii) Income deemed to be received in India

(iii) Income accrued or arisen in India

(iv)Income deemed to be accrued or arisen in India

The following table may be of great use in highlighting the tax incidence in brief:

Items of income

Resident Not

Nonordinarily

resident

resident

(i) Income received in India whether

Taxable

Taxable

Taxable

earned anywhere.

(ii) Income earned in India whether

Taxable

Taxable

Taxable

received anywhere

(iii) Income from business or profession Taxable

Taxable

Not

outside India which is controlled from

Taxable

India.

(iv) Income earned and received

Taxable

Not Taxable Not

outside India.

Taxable

(v) Income from business or profession Taxable

Not Taxable Not

outside India which is controlled from

Taxable

outside India.

(vi) Past untaxed income brought to

Not

Not Taxable Not

India.

Taxable

Taxable

1.17

ACM302

INCOME-TAX (AY 2014-15)

UNIT-I

Practical Exercise

Exercise 1.

Shri Krishna was born in Lahore in 1946. He is residing in America since June

1965. He came to India on 1st October 2013 for visiting purpose and left India on

28th March, 2014. Determine the residential status of Shri Krishna for the

assessment year 2014-2015.

Solution :

There is an exception of the basic condition in case of a person of Indian origin. It

means that either assessee or either of his parent or any of his grand parent was

born in un-divided India, the exception is related to days of stay of the person

during the visited period, i.e., at least 182 days .

Shri Krishna stayed in India for 180 days during the previous year

(31+30+31+31+29+28) hence; he is a non-resident for the assessment year 20142015.

Exercise 2.

Shri Amitabh Bachchan went to America on April 1,2013 a film shooting. Due to ill

health he had to stay there just after shooting. He came back to India on 25 th

September, 2013. He had to go again on 8th December, 2013 and return India on

15th February, 2014. Is Shri Amitabh Bachchan resident in India for the

assessment year 2014-2015?

Solution

Shri Amitabh Bachchan was not in India for at least 182 days (actual stay 121

days) during the previous year but has been in India at least 365 days during four

years preceding the previous year. Hence, he is non-resident in India. He went out

of India for employment purpose; therefore, he is entitled to the benefit of 182 days

instead of 60 days.

Exercise 3.

Mr. Shiva has the following income for the previous year ending on 31st March,

2014:

(1) Income from salary from govt. of India (taxable)

Rs.60,000

(2) Interest from a foreign company received in

America and deposited in a bank there

Rs.20,000

(3) Income from house property in India received in

America

Rs.10,000

(4) Interest on debentures from an Indian company

Received in New York and spent there

Rs.15,000

(5) Income was earned in America and received there

but brought in India

Rs.18,000

1.18

ACM302

INCOME-TAX (AY 2014-15)

UNIT-I

(6) Income from business in Mumbai managed in America

(7) Income from business in New York (controlled from

Delhi head office

(8) His brother gifted him from New York

(9) Dividend from a domestic company (gross)

Rs.22,000

Rs.10,000

Rs.10,000

Rs. 2,000

Compute his taxable income, if he is (a) resident,(b) not ordinary resident and (c)

non-resident.

Solution:

Computation of taxable income of Mr. Shiva

Assessment year 2014-2015

Items of income

(1) Income from salary from govt. of India

(taxable)

(2) Interest from a foreign company received in

America and deposited in a bank there

(3) Income from house property in India

received in America

(4) Interest on debentures from an Indian

company Received in New York and spent there

(5) Income was earned in America and received

there But bought in India

(6) Income from business in Mumbai managed

in America

(7) Income from business in New York

(controlled from Delhi head office)

(8) His brother gifted him from New York

(9) Dividend from a domestic company (gross)

Taxable income

Resident Not

ordinary

resident

Rs.

Rs.

60000

60000

Nonresident.

20000

10000

10000

10000

15000

15000

15000

18000

22000

22000

22000

10000

10000

Exempt

155000

Exempt

117000

Exempt

107000

Rs.

60000

Self Check Question

Q1.

How is residence of assessee determined, for the purpose of income tax ?

Explain the incidence of residence on tax liability?

Or

What are the different categories of assessee according to their status?

Discuss each of them in brief.

Or

The incidence of income tax depends on the residential status of a person.

Explain.

1.19

ACM302

INCOME-TAX (AY 2014-15)

UNIT-I

Or

How is the tax liabilities of an assessee determine with reference to his

residence? Explain.

Q2.

(1) Mr. Shiva from America, worked as an executive engineer in India from

April, 2003 to Feb. 2013, he went to Nepal on deputation. He came to India

in June, 2014 and on 31 July 2014 shifted his family to Nepal which he had

left in India. What shall be his position for tax liability during the 2014-2015?

(2) Mr. Anand living in America was appointed executive engineer in India

on 1st April 2003. On 28th October 2013 he proceeded to Nepal. Where

under the government of Nepal, in a technical directorate, he worked on

deputation for three years. In this duration his family remained in India. In

the tax assessment year 2014-2015, describe his position regarding

residence.

(3) American resident Mr. Johnson was appointed executive engineer in

India 1st April 2000. On 28 Feb., 2008 he return to America but left his

family here in India. He came back to India on 31st May, 2013 and on 1st

July, 2013, shifted his family too, from America. On coming back to India he

took up his post on 1st February, 2014. For the previous year 2013-2014,

describe his position regarding residence.

Ans: (1) Non-resident, (2) Resident, (3) Non-resident

Q 3.

Following are the income of Mr. Ajay, for the previous year 2013-2014:

Rs.

(1) Profit of a business in New York received in India

8000

(2) Income from house property in Iran received in India

12000

(3) Income from house property in Pakistan deposited in a

bank there

15000

(4) Income from business in Pakistan (controlled from

India ) deposited in a bank

8500

(5) Out of the business profit (mentioned in item no.4)

Profit brought to India

6500

(6) Income accrued in India but received in England

8000

(7) Income from business in Indore

22000

(8) Agriculture income in India

6200

(9) Income from agriculture in England (the entire income

spent on the education of children in London)

6800

(10) Past untaxed foreign income brought to India in the

previous year

3000

You are required to compute taxable income of Mr. Ajay for the

assessment year 2014-2015 if he is (a) resident,(b) not ordinary resident

and (c) non-resident.

1.20

ACM302

INCOME-TAX (AY 2014-15)

UNIT-I

Ans: (i) Rs. 80,300 (ii) Rs. 58,500 (iii) Rs. 50,000

Q4. Following are the income of Shri Kamal Anand, for the previous year 20132014:

Rs.

(1)

(2)

(3)

Dividend from the Indian company

Profit from business in Japan received in India

Profit from business in Pakistan deposit in a bank

there. This business is controlled from India

(4) Profit from business in Indore

(controlled by London head office)

(5) Interest received from a non-resident Mr.Abdul

on the loan provided to him for a business carried

on in India

(6) Income was earned in America and received there,

but brought in India

(7) Share of income from Indian partnership firm

(8) Income from house property in India received

in America (calculated)

(9) Interest on debentures of Indian company received in Dubai

(10) Capital gain on sale of agriculture land situated in Ajmer

10,000

12,000

20,000

11,000

5,000

8,000

15,000

12,000

5,000

8,000

Compute his taxable income if he is: (a) ordinarily resident (b) not ordinarily

resident(c) non-resident

Ans: (i) Rs. 81,000 (ii) Rs. 73,000 (iii) Rs. 53,000

1.21

ACM302

INCOME-TAX (AY 2014-15)

UNIT-I

Lesson -3

Exempted incomes

Objectives

1. To explain the exempted incomes from tax

In the Income tax Act, some of the incomes have been exempted from tax liability.

These are known as the Exempted incomes. These may be divided into the

following categories:

I. Fully Exempted incomes

Such incomes which neither are included in the total income, nor any income tax

is levied upon them are known as fully exempted incomes e.g., income from

agriculture, casual income, income of the educational institute not for profit,

bravery awards, etc.

II. Exempted incomes in the form of rebate on average rate

There are some income which are exempt from tax but are considered for

determining the rate of tax, are included in the income, e.g., the share of profit of

a member in an association of person, etc.

Fully Exempted Incomes

The following incomes are neither included in total income nor income tax is

payable on them:

(1) Agricultural income {sec.10 (1)}. Any income from land, situated in India

which is used for agricultural purpose is fully exempt.

(2) Receipt from Hindu undivided family [sec. 10(2)]. The share of income

of an individual as member of H.U.F. received from H.U.F. is fully exempt

from tax except in case of converted property.

(3) Share of a partner in firms income [sec. 10(2A)]. The share of profit of a

partner in the firm shall be exempt. The share of a partner in the firm will be

computed by dividing the taxable profit of the firm in the same proportion in

the profit sharing ratio mentioned in the partnership deed. If a partner

receives interest, salary, commission or other remuneration from his firm, it

will be taxable under business or profession.

(4) Leave travel concession [sec. 10(5)]. Any leave travel concession to an

Indian citizen from his employer in connection with his proceeding to any

place in India will be exempt as per the following provision:

(a) The maximum limit permitted by government is first class A.C. train

fare or actual amount spent, whatever is less.

(b) The exemption stated above, can be availed for two journeys

performed in a block of four calendar years.

(c) If such exemption is not availed in a block of four years, whether for

both journey or one journey then the amount of one journey will be

1.22

ACM302

INCOME-TAX (AY 2014-15)

UNIT-I

exempt in the first year of the next block of four year. In other words,

maximum one year journey can be carried forward.

(d) If the journey is not performed after taking leave travel concession

the entire amount received by employee shall be taxable.

(e) The amount exempt under this clause shall not exceed the amount

of expenses actually incurred for the purpose of such travel.

(f) For leave travel concession family includes the spouse and children

of the individual and the parents, brother and sisters of the individual

or any of the them, entirely or mainly dependent on the individual.

(g) Leave travel concession shall be allowed for maximum of two

children with effect from 1-10-1998. However, this rule shall not be

applicable to those children whose birth are before 1-10-1998 and

also in case of multiple birth after one child.

(5) Allowance and perquisites outside India (sec. 10(7) ). Any amount

received by any Indian citizen from the government of India for rendering

the service outside India are fully exempted. The exemption is available

only for Indian citizen and the employee of the government of India.

(6) Gratuity [sec (10(10)]. Gratuity is a kind of retiring benefit. It means a gift

or present for service. Income tax is not concerned with whether an

employee is getting gratuity according to the provisions of respective Act,

made for the same or not. It is concerned only whether the sum received by

the employee on account of gratuity is taxable or not.

For the purpose of calculating taxable and tax free portion of gratuity, the

employees are divided into the following three categories:

(a) Government employees. In case of central and state or local

government employees but excluding employees of statutory

corporation, entire amount received on death cum retirement gratuity

is exempt.

(b) Employees covered by the Payment of Gratuity Act, 1972. The

Payment of Gratuity Act,1972 is applicable to workmen of

government, semi-government, private organization, mines , oilfield

and such private organizations where 10 or more workers are

employed . The amount of such gratuity is exempt from tax as per

the following option :

15 days average salary completed years of service

Or

Maximum amount 10,00,000

Or

Actual amount of gratuity received.

The least amount among the above options will be exempted and remaining

amount shall be taxable.

1.23

ACM302

INCOME-TAX (AY 2014-15)

UNIT-I

Explanation.

(i) salary include for this purpose basic pay and dearness allowance (whether it is

under the terms of employment or not ) but does not include any other item in the

salary,e.g., any bonus, commission , house rent allowance, overtime wages or any

other taxable allowances. Salary last drawn (or say basic pay and dearness

allowance, last drawn) by the employee is considered for this purpose, for

calculating average salary, salary last drawn is divided by 26,i.e., maximum

number of working days in a month . Completed year of service is calculated by

rounding of 6 or more months into a full year service. (ii) The ceiling limit is

Rs.10,00,000 it means this is the maximum amount which may be exempted.

(iii) Gratuity actually received by the employee is the final option.

(c) Employees not covered by the Payment of Gratuity Act, 1972. In case of other

non-government employee the least of the following shall be exempt:

Actual gratuity received;

Or

Half months of salary completed year of service

Or

Maximum amount Rs. 10,00,000

Explanation of half month salary and completed years of service. Salary

includes basic pay, dearness allowance (if DA is under the terms of employment)

and fixed percentage of commission on turnover but excludes all other

components of salary like bonus, H.R.A.,etc.

Here completed year of the service shall be calculated by ignoring month served

over completed year. Half month salary shall be calculated on the basis of salary

drawn in preceding 10 months of retirement or death, leaving the month of

retirement or death.

(7) Pension [10(10A)]. Usually there are two types of pension, viz.,

superannuated and family pension. Former is taxable under the head of income

from salary while family pension is taxable under the head of income from other

sources, Superannuated pension is received by employee who is alive after

retirement but family pension is made for the dependent of deceased employees.

Monthly pension is taxable in case of all types of employee whether government or

non government while pension or family pension received from U.N.O. is exempt,

The person, who is entitled to get pension can commute the same instead of

getting monthly. When an employee gets commuted his pension, the lump sum

received on this occasion is taxable as per following provision

(a) Government employees. Any sum received in commutation of pension by

all types of Central, State, Local government employees including

Statutory Corporations and Public Sector employees is fully exempted from

tax.

(b) Non -government employees.

1.24

ACM302

INCOME-TAX (AY 2014-15)

UNIT-I

(1) if employee receives any gratuity, the commuted value of 1/3 of the total

pension will be exempted, and

(2) if employee does not receive gratuity, the commuted value of of the total

pension will be exempted .

(c) with effect from the assessment year 1997-98 (i.e., from 1st August, 1996),

any payment received by any employee in commutation of pension from a

fund set-up by Life Insurance Corporation of India or any other insurer since

1st August 1996 under a pension scheme to which contribution is made by

the individual receiving pension would be exempt from income tax.

(8) Encashment of earned leave [sec. 10(10AA)]. Amount received on account

of earned leave is exempt as per the following rules:

(a) For central or state government employees such amount would be fully

exempt.

(b) For non- government employees ( including employees of local authorities,

statutory corporation and public sector organization):

(i) Actual amount received

Or

(ii) Rs.300000

Or

(iii) 10 average monthly salary

Or

(iv) Number of months for which leaves are due or unavailed earned leave

average monthly salary.

Among the above four, whichever is least shall be exempt.

Further number of months leaves due shall not exceed one month for a completed

year of service period and the term salary and average monthly salary shall be

same as given in case c of gratuity topic under item no.6.

Leave encashment received during the service period will be fully taxable in case

of all employees.

(9) Compensation for retrenchment [sec 10(10B)]. Any compensation at the

time of retrenchment as per the Industrial Dispute Act, 1947 shall be exempt to the

extent of the least of the following:

Actual amount received

Or

Rs.500000

Or

Total years served 15 days average salary.

Here more than 6 months are rounded off to one year to calculate total years

served and average monthly salary is calculated on the basis of salary drawn in

preceding 3 months, if salary is payable on monthly basis. Further, salary includes

basic pay, all monetary receipts and monetary value of perquisites.

1.25

ACM302

INCOME-TAX (AY 2014-15)

UNIT-I

(10) Income on account of voluntary retirement [sec. 10(10c)]. The amount

received by an employee form public sector company or any other company or

any authorities established under any act or any corporation or co-operative

society or university or Indian institute of technology and specified institute of

management at the time of their voluntary retirement is exempt from tax. The

compensation under sec. 10(10c) is available upto Rs.500000. The voluntary

retirement scheme must be approved by the chief commissioner or Director

General. Under this section the least amount from the following four options will be

exempted:

Completed years of service 3 monthly salary

or

Salary of balance months of service left before voluntary retirement

or

Amount received under VRS;

or

Maximum limit Rs.500000

Explanation of salary: Salary includes basic pay, D.A (if it is under the term of

service ) and fixed % of commission on sales.

(11) Payment from Provident Fund [sec. 10(11) and 10(12)]. If any employee

gets any amount from recognized provident fund or statutory provident fund at any

time, it will be exempted.

(12) House Rent Allowance [sec. 10(13A)]. The following amount shall be

exempted:

Actual H.R.A.

or

Rent paid -10 % of salary

or

of salary (if house is situated at Mumbai, Kolkata, Delhi, Chennai);

or

2/5 of salary (if house is situated in any other city other than

mentioned above).

Here salary means total of basic pay, dearness allowance (if under the terms of

employment) and percentage of commission fixed on sales.

The house rent allowance paid to High Court and Supreme Court judges is fully

exempt. But in following cases the house rent allowance is fully taxable

(i)

If the residential accommodation occupied by the employee is

owned by him;

(ii)

If the employee has not actually incurred expenses of rent

regarding residential accommodation occupied by him;

(iii)

Finally, the employee pays rent which is not more than the 10%

of his salary.

1.26

ACM302

INCOME-TAX (AY 2014-15)

UNIT-I

(13) Special allowance [sec.10 (14)]. If any special allowance is given for

performance of official duties, then it will be fully exempt. However, if any amount

is saved then it will be taxable. Example of such allowances are conveyance

allowance, travelling allowance, daily allowance, uniform allowance, etc.

(14) Life insurance money [sec. 10(10D)] Any sum received at the time of

maturity of the policy (either lapse of time or death) including bonus money shall

be exempt.

However, the amount shall not be exempt in the following cases

(i)

Amount received under a keyman insurance policy.

(ii)

Any sum received under an insurance policy issued after 31.03.2003 but

before 01.04.2013 in respect of which the premium payable for any of the

years during the term of policy exceeds 20% of the actual sum insured.

However in this case if the sum is received on the death of a person it

shall be exempt.

(iii)

Any sum received under an insurance policy issued after 31.3.2012 in

respect of which the premium payable for any of the years during the

terms of the policy exceeds 10% of the actual capital sum assured. This

limit has been increased to 15 percent for insurance (if policy is issued on

or after April 01, 2013) on t he life of any person who is

(a) A person with disability or a person with severe disability as referred

to in section 80U or

(b) Suffering from disease or ailment as specified in the rules made

under section 80DDB.

(15) Interest on certain securities [sec. 10(15)] Interest income on certain

securities, bonds, saving certificates, as notified by central government is fully

exempt. For example interest on post office saving bank account, interest on 7%

capital investment bond ; interest on post office cumulative time deposited; interest

on special bearer bonds, 1991; interest on national defense gold bonds,1980 ;

interest on national plan certificate ; interest on relief bond ; post office cash

certificates; etc.

(16) Education scholarships [sec. 10(16)]. Any scholarships to meet the cost of

education are fully exempt, whether received from any government or private

organization.

(17) Allowances to M.Ps., M.L.As. and M.L.Cs. [sec. 10(17)].

(a) In case of M.Ps. all allowances ( including daily allowance ) are exempt from

tax.

(b) Daily allowance to any M.L.As. and M.L.Cs is fully exempt. Any constituency

allowance received by a member of any state legislature under any act or rules

made by that state legislature will also be exempted from tax.

(18) Award or Reward[ sec.10(17A)]. Any reward by any government or

approved institution is fully exempt.

1.27

ACM302

INCOME-TAX (AY 2014-15)

UNIT-I

(19) Income of local authority [sec. 10(20)]. Entire income of local authority

(village panchayat, municipality corporation and nagar nigam, etc.) is exempt from

tax except that arising from the supply of commodity or service other than water

and electricity outside its jurisdiction area.

(20) Income of registered trade union [sec. 10(24)]. Any income of registered

trade union arising from the house property or other sources is fully exempt.

(21) Income of schedule tribes [sec. 10(26)]. Income of member of schedule

tribes, residing in Nagaland, Manipur, Tripura, Sikkim, Arunachal Pradesh and

Mizoram from any source is fully exempt.

(22) Subsidy from tea-board

[sec. 10(30)]. Any subsidies receive by an

assessee indulged in the business of growing and manufacturing tea in India, is

fully exempt.

(23) Subsidy received by planter [sec. 10(31)]. If an assessee gets any subsidy

from rubber board, coffee or spices board in connection with growing and

manufacturing rubber coffee cardamom or any other commodity in India under any

scheme for explanation or replacement of rubber plants, coffee plants, etc. is

exempt.

(24) Minors income [sec. 10(32)]. From the tax assessment year 1993-94 every

individual, on inclusion of his minor childrens income in his income, shall be

entitled to a basic exemption of Rs.1500 per annum per child or actual income

which ever is less .

(25) Income from units of unit scheme, 1964 [sec. 10(33)]. Any income from

transfer of unit of the unit scheme 1964 of the unit trust of India, where the transfer

takes place on or after 01.04.2002, is fully exempt. The benefit of exemption is

available to an investor and not to a person holding units as a stock in trade in

business.

(26) Dividend income [sec. 10(34)]. Income by way of dividend received from a

domestic company (Indian company) is fully exempt.

(27) Income from units [sec. 10(35)]. Income received in respect of a mutual

fund specified under section 10(23D) or units from the administration of the

specified undertaking or unit from the specified company is fully exempt.

(28) Income from transfer of listed equity share [sec. 10(36)]. Any income

arising from the transfer of a long term capital assets being an eligible equity share

in company purchased on or after 1st March 2003 and before 31st March,2004 and

held for period of 12 months or more is fully exempt .

1.28

ACM302

INCOME-TAX (AY 2014-15)

UNIT-I

(29) Long term capital gain on transfer of listed equity share or a unit [sec.

10(38)]. If the following conditions are satisfied the capital gain shall be exempt:

(i) Equity share in a company or units of an equity oriented fund are long term

capital assets.

(ii) The transfer or sale of such equity share or units is entered into after 30th

September, 2004.

(iii) Such transaction is chargeable to securities transaction tax.

(30) Claim under Bhopal gas leak disaster [sec10 (10BB)]. Any such claim

received are exempt from tax.

(31) Exemption to the shareholder on account of Buy-back of shares [10

(34A)] Income arising to a shareholder in respect of buy-back of unlisted shares

by the company will be exempt from tax. This exemption is available only in those

cases where additional income tax is payable on distributes income U/S 115 QA

by the company opting for buy-back of unlisted shares.

(32) Income received from Securitization trust [10 (35A)] Any income received by

an investor from a securitization trust will be exempt. The exemption is however,

available only in respect of distributed income referred to in section 115TA.

Practical Exercise

Exercise 1.

After serving for 28 years and 7 months in Laxmi enterprises, Gwalior, Mr.

Raghuvans, who is covered under Payment of Gratuity Act 1972, retires from the

service on 30th June. 2013. The company paid him gratuity of Rs.42000, his

monthly basic salary at the time of retirement was Rs.1600 and D.A. Rs.480.

You are required to calculate the amount of gratuity exempt as per the provisions

of income tax act, for the assessment year 2014-2015.

Solution:

In this case, 29 years will be taken as completed year of service.

The amount of gratuity exempt will be the least of the following:

(i) 15 days average salary completed year of service

Here,

salary = B.P.1600 + D.A.480 = Rs.2080

15 days average salary = 2080 15/26 = Rs.1200

Total salary = 1200 29years = Rs.34800

(ii) Maximum amount Rs.10,00,000

(iii) Actual amount of gratuity received = Rs.42000

Hence out of Rs.42000 recieved as gratuity, Rs.34800 will be exempt and

Rs.42000 - Rs.34800 = Rs.7200 will be taxable.

1.29

ACM302

INCOME-TAX (AY 2014-15)

UNIT-I

Exercise 2.

Mr. K.G. Hajela retired on 1st January, 2014 after serving for 30 years and

11months. He received salary Rs.4800 p.m. from 1-2-2013 to 31-12-2013. He

received D.A. @ Rs.1200p.m. (forming part of salary for computation of retirement

benefit) and 2.5% commission on turnover achieved by him. Turnover achieved by

Mr. Hajela during last 10 months preceding the month in which he retired was

Rs.500000. He received a gratuity of Rs.450000. Compute the exempted amount

of gratuity for the assessment year 2014-2015.

Solution:

Calculation of average monthly salary:

(i) 10months salary (4800 10)

(ii) D.A. (under the term of employment) (1200 10)

(iii) Fixed commission on turnover [500000 5/200]

Rs.48000

Rs.12000

Rs.12500

Rs.72500

Average monthly salary= Rs.72500 /10 months= Rs.7250.

The amount of gratuity exempt will be the least of the following alternative

(i) Actual amount of gratuity received =Rs.450000

(ii) Maximum amount Rs.10,00,000

(iii) Half months salary completed year of service

Rs.7250/2 30years = Rs.3625 30years = Rs.108750

Hence, Rs.108750 will be exempt and remaining Rs.450000-Rs.108750=

Rs.341250 will be taxable.

Exercise 3.

Mr. Shekhawat is getting a pension of Rs.2000 per month from a company. During

the previous year 2013-14, he received Rs.123000 on account of his 2/3 pension

commuted. You are required to calculate the exempted amount of commuted

pension if (a) he also received gratuity; and (b) he did not receive gratuity.

Solution:

(a) When Mr. Shekhawat received gratuity:

Commuted value of 2/3 pension= Rs.123000

Value of full pension= Rs.123000 3/2= Rs.184500

Exempted amount= 1/3 of full pension,i.e., Rs.61500

(b) When Mr. Shekhawat did not received gratuity

Commuted value of 2/3 pension= Rs.123000

Value of full pension= Rs.123000 3/2= Rs.184500

Exempted amount= 1/2 of full pension,i.e., Rs.92500

1.30

ACM302

INCOME-TAX (AY 2014-15)

UNIT-I

Exercise 4.

Find out the amount of H.R.A., which shall be taxable under the head of income

from salary in each of the following cases for the assessment year 2014-2015.

(a) Basic Pay Rs.2500 p.m., commission Rs.10000 for the full year calculated

as fixed percentage on sales. H.R.A. is Rs.600p.m., actual rent paid by the

assessee Rs.500p.m., house is situated at Gwalior.

(b) Basic Pay Rs.2000 p.m., D.A. is 50% of Basic Pay (considered for retiring

benefits) H.R.A. is Rs.700 p.m., actual rent paid by the assessee Rs.1000

p.m., house is situated at Delhi.

Solution:

(a)

(i) H.R.A. (Rs.60012)

(ii) rent paid over 10% of salary (6000-4000)

(iii) 50% of salary because house is situated at Gwalior

[(250012) +10000] 40%

Rs.

7200

2000

16000

The least amount Rs.2000 will be exempt and remaining amount Rs.7200Rs.2000= Rs.5200 will be treated as income under the head income from salary

(b)

(i) H.R.A. (Rs.70012)

(ii) Rent paid over 10% of salary (12000-3600)

(iii) 40% of salary because house is situated at Delhi

[(200012) +24000] 50%

Rs

8400

8400

18000

The least amount Rs.8400, this is the actual H.R.A. received hence entire H.R.A.

will be exempted.

Exercise 5.

Mr. D.S. Thakur is employed in a public company and is paid a sum of Rs.700000

on VRS approved by the government. The normal age of retirement in the

company is 60 years and Mr. D.S. Thakur who was 48 years at time of retirement

had completed 20 years of service. His monthly salary at the time of retirement

was as follows:

B.P. Rs.10000; D.A. Rs.8000 ;( 50% included for retiring benefits); H.R.A.

Rs.2000; T.A. Rs.600.

What would be the exempted amount of compensation under the Income Tax Act?

Solution:

Salary =Rs.10000 + Rs.4000 = Rs.14000.

(a) Completed years of service 3 monthly salary

= 20 3 14000 = Rs.840000.

Or

(b) Salary of balance months service = 14000144 = Rs.2016000

Or

(c) Amount received under VRS = Rs.700000

1.31

ACM302

INCOME-TAX (AY 2014-15)

UNIT-I

Or

(d) Maximum limit = Rs.500000

The least amount is Rs.500000. therefore exempted amount would be Rs.500000

and taxable amount will be Rs.700000- Rs.500000 = Rs.200000.

Exercise 6.

Shri Prakash retired on 1st January 2014 after serving 34 years 9 months in

accompany. From the following detail, compute taxable amount of earned leave :

(a) Salary per month Rs.15000 from 1st January 2013 to 31st December 2013.

(b) Leave granted 1.5 month for each year of service.

(c) Leave taken during service 30 months.

(d) Balance of leave in account 21 months.

(e) Rs.168000 received for encashment of earned leave on retirement.

Solution:

(a) Leave (one month for leave for each completed year of service

(b) Leave availed

(c) Leave due (34 months-30 months)

34 months

30 months

4 months

Now the exempted amount would be least amount of the following :

(a) Amount of encashment received

Rs.168000

(b) 10 months average salary (Rs.1500010 months)

Rs.150000

(c) Cash equivalent to 4 months average salary (Rs.150004) Rs. 60000

(d) Maximum limit of exemption

Rs.300000

Least amount is Rs.60000 therefore taxable amount of encashment earned leave

will be (Rs.168000- Rs.60000), i.e. Rs.108000.

Self Check Question

1. State the incomes to which the Income- tax Act does not apply.

2. Describe the exempted incomes for the employee and also give an

account of exempted income for the institution.

3. Under the income tax act some income are fully exempt from tax while

some incomes are partially exempt. Discuss this statement.

1.32

ACM302

INCOME-TAX (AY 2014-15)

UNIT-I

DIRECT TAX CODE (DTC)

Direct Taxes Code Bill, 2010 is intended to replace the 50 year old Income Tax

Act of 1961.

The current Income Tax Act, enacted in 1961, had replaced the preindependence Income Tax Act of 1922.

The government had announced its intension to introduce a revised and

simplified Income Tax Bill while presenting the Union Budget for 2005-2006.

In a surprise move and to the disappointment of tax payers, the government

has fixed the implementation of the DTC to April 1, 2012. DTC bill was tabled

in parliament on 3oth August, 2010.

Proposed bill has 319 sections and 22 schedules against 298 sections and 14

schedules in existing IT Act

Once enacted, DTC will replace archaic Income Tax Act and will change the tax

structure of the country.

However, many provisions in Income Tax Act will be a part of DTC as well.

SALIENT FEATURES OF THE DIRECT TAXES CODE

1. Removal of most of the tax saving schemes - DTC removes most of the

categories of exempted income. Equity Mutual Funds (ELSS), Term deposits,

NSC (National Savings certificates), Unit Linked Insurance Plans (ULIPs), Long

term infrastructures bonds, house loan principal repayment, stamp duty and

registration fees on purchase of house property will lose tax benefits.

2. New tax saving schemes: Tax saving based investment limit remains

1,00,000 but another 50,000 has been added just for pure life insurance (Sum

insured is at least 20 times the premium paid) , health insurance, mediclaims

policies and tuition fees of children. But the one lakh investment can now only

be done in provident fund, superannuation fund, gratuity fund and new

pension scheme (NPS).

1.33

ACM302

INCOME-TAX (AY 2014-15)

UNIT-I

3. EEE and EET: The Direct Tax Code (DTC), meant to replace the existing

Income Tax Act, proposes to introduce the exempt-exempt-taxation (EET)