Winfield Case

Winfield Case

Uploaded by

Abhinandan SinghCopyright:

Available Formats

Winfield Case

Winfield Case

Uploaded by

Abhinandan SinghOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Winfield Case

Winfield Case

Uploaded by

Abhinandan SinghCopyright:

Available Formats

Winfield Refuse

management, Inc.

Raising Debt vs. Equity

Abhinandan Singh (MP15003)

Financial Management II

XLRI PGDM 2015-18 Batch

Winfield Refuse Management, Inc. : Raising Debt

vs. Equity

Executive Summary:

Winfield Reuse Management, a vertically integrated, non-hazardous waste

management company is going for a major acquisition and has to take a

decision whether to finance through Debt or Equity. The company started in

1972 as a two-truck operation in Creve Coeur, Missouri and by 2012; it had

acquired 22 landfills and 26 transfer stations and material recovery facilities,

which served 33 collection operations. Winfields board had adhered to a

consistent policy of avoiding long term debt. The business was done through

the steady cash flows and raising equity whenever required. Since early

1990s the firm had been making small acquisitions by acquiring companies

which would extend its geographical reach and creating economies of scale

with existing facilities. Most of the company operation was in the Midwest

and with other bigger companies indulging in consolidation strategy; it

required to maintain a competitive position on a regional basis which was

only possible through acquisition.

Acquiring a firm like MPIS (Mott-Pliese Integrated Solutions), a waste

management company serving parts of Ohio, Indiana, Tennessee, and

Pennsylvania will increase their footprint in Midwest and also provide an

entry into mid-Atlantic region. MPIS had a strong management team

producing 12-13% operating margins every year and the acquisition bid was

$125 million and was also ready to accept 25% of purchase price in Winfield

stock. At an earlier Board meeting most of the board members refused to

accept the proposal of financing this deal through long term debt and

suggested equity to be a better option to generate the revenue. As a chief

financial officer Mamie Sheene was of the opinion that debt financing would

be a better option and had to convince the Board members. In this case we

have to analyze which financing option would be better for a company in

terms of finance as well as strategy.

Important Facts and Figures

Waste Management industry was highly fragmented and most of the players

were private. All the companies in this sector aimed to achieve economies of

scale and acquisition spree was going on in the business. Winfield being a

regional player in Midwest region wanted to consolidate its position and also

enter into other region. Acquisition cost was estimated to be $125 million

1 | Page

Financial Management II

XLRI PGDM 2015-18 Batch

and was large enough which required external financing. Opting for Equity, it

was estimated that a common stock could be issued at $17.75 per share and

net proceeds to Winfield would be $16.67 per Share. 7.5 million shares would

be required for MPIS.

Companys performance had been steady and the company reliably paid

dividends but in last 2-3 years performance had been disappointing and

dividend had not increased.

If the firm goes for Bond, it could sell $125 million in bonds to a

Massachusetts Insurance company. Annual interest rate would be 6.5% and

would mature in 15 years. Annual principal repayments would be required,

leaving $37.5 million outstanding at majority.

When going for Equity it would dilute the EPS to $1.91, and debt would bump

the EPS to $2.51. The EBIT for the combined Winfield MPIS was expected to

be $66 million.

Problem Statement

What would be the appropriate financing structure for the investment

decision-Raising capital through Debt or Equity?

How the Debt or Equity decision would affect the shareholders and how

EPS (Earnings per share) would be affected in both the cases.

Should the firm goes for entire financing through debt or through

Equity or a combination of both.

Return on Equity before taking this decision

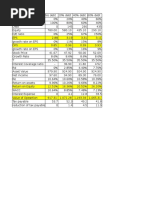

ROE = Net Income in 2011(26350) / Average Stockholders Equity (685380)

= 3.84%

Possible Solutions

A. Financing entirely through Debt with Interest

payment and Final Principal Payment on Maturity

2 | Page

Financial Management II

XLRI PGDM 2015-18 Batch

Under this option the entire capital is to be financed through Debt with yearly

interest payments and principal payment is done only on maturity. The

yearly interest payment comes out to be $8.125 million with an interest rate

of 6.5% on a principal of $125 million. As tax benefit will be reaped by the

firm on interest payment so Net Interest Payment comes out to be 5.28 (65%

of 8.125). The Net present value comes out to be $98.26 million at a

discounting rate of 6.5%.

Earnings per Share - $2.51

B. Financing entirely through Debt with Fixed Principal

payment of $6.25 Million and Interest payment on

Present Principal Amount and Outstanding Principal

Payment on Maturity

3 | Page

Financial Management II

XLRI PGDM 2015-18 Batch

Under this option the entire capital is to be financed through Debt with yearly

interest payments and fixed principal payment of $6.5 million. The left over

principal payment of $37.5 million is done on maturity. The yearly interest

payment comes out to be $8.125 million for the first year and a decreasing

interest payments every year with decreasing Principal with an interest rate

of 6.5% every year. As tax benefit will be reaped by the firm on interest

payment so Net Interest Payment comes out to be 5.28 (65% of 8.125) for

the first year and similarly for other years. The Net present value comes out

to be $106.07 million at a discounting rate of 6.5%.

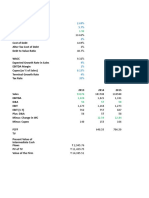

C. Financing Entirely through Equity

4 | Page

Financial Management II

XLRI PGDM 2015-18 Batch

Earnings per Share - $1.91

Under this option the entire capital is to be financed through equity with

yearly dividend payments of $7.5 million and maturity value will be given

after 15 years. The dividend per share has been assumed to be $1 per share

and with total 7.5 million shares; the dividend paid each year comes out to

be $7.5 million.

With price earnings ratio of other firms given and expected Earnings per

share given for Winfield, the expected market price comes out to be 20.17.

Calculating the terminal value gives a value of 151.25. Some assumptions

have also been taken.

Risk free rate assumed to be 4% (taken from US past year data). Stock price

return also assumed to be 13.4% on the basis of actual data from various

finance agencies. As the firm dependency on market performance is minimal

so a low beta has been used for the calculation. On calculating Cost of Equity

was foind out to be 6.82%. On discounting the payments for the 15 years at

a discounting arte of 6.82%, NPV came out to be $125.31.

Return on Equity = Net Income/Average Stockholders Equity

Net Income = 42,900 (Thousand of Dollars)

Average Stockholders Equity = 685380+75000 = 760580

So ROE = 42900/760580 = 5.64%

5 | Page

Financial Management II

XLRI PGDM 2015-18 Batch

D.Financing through Debt and Equity (Debt -75% and

Equity 25%)

Under this option the capital is to be financed through both equity and debt

with 25:75 Ratio. The yearly dividend payments come out to be $1.88 million

and maturity value will be given after 15 years. The dividend per share has

been assumed to be $1 per share and with total 1.88 million shares; the

dividend paid each year comes out to be $1.88 million.

On discounting the payments made towards Equity at a Cost of Equity of

6.82% the NPV comes out to be $31.33 million

75% of the capital is to be financed through Debt with only interest

payments every year and principal payment to be made after 15 years. The

NPV for the Debt payments at a discounting rate of 6.5% comes out to be

$73.70 million.

Thus Net NPV for this option comes out to be $105.03 million.

6 | Page

Financial Management II

XLRI PGDM 2015-18 Batch

Conclusion

Various

Financing

Options

Through Debt

with

Fixed

Principal

Payment

NPV

$98.26

million

EPS

ROE

Through

Debt

with

only

Interest

payment

$106.07

million

$2.51

5.48%

Through

Equity

Through Debt

Equity ratio

of 75:25

$125.31

million

$1.91

5.64%

$105.03

million

Considering all the above calculations into account we find that NPV is least

for the option Debt with interest payment and principal payment at end of

maturity. Also the EPS (earnings per share) for this option is the highest with

a value of $2.51. Even though return on Equity is not the highest in this case

but overall this option looks better.

Thus I would recommend going for the Debt option.

7 | Page

You might also like

- Hill Country Solution ExcelDocument1 pageHill Country Solution Excelankujai88No ratings yet

- Pacific Grove Spice Company Case Write UpDocument3 pagesPacific Grove Spice Company Case Write UpVaishnavi Gnanasekaran100% (4)

- Case 34 - The Wm. Wrigley Jr. CompanyDocument72 pagesCase 34 - The Wm. Wrigley Jr. CompanyQUYNH100% (1)

- Icwim PDFDocument2 pagesIcwim PDFWolfgangNo ratings yet

- Ocean Carries HBS Case StudyDocument4 pagesOcean Carries HBS Case StudyRatul EsrarNo ratings yet

- New Heritage DollDocument4 pagesNew Heritage Dolls_gonzalez75No ratings yet

- Accounting and Bookkeeping Business PlanDocument45 pagesAccounting and Bookkeeping Business PlanDOZYENo ratings yet

- Winfield ManagementDocument5 pagesWinfield Managementmadhav1111No ratings yet

- Gulf Oil ExhibitsDocument20 pagesGulf Oil Exhibitsaskpeeves1No ratings yet

- Group 12 - Automation Consulting ServicesDocument1 pageGroup 12 - Automation Consulting ServicesRISHABH GUPTANo ratings yet

- Harley DavidsonDocument5 pagesHarley DavidsonpagalinsanNo ratings yet

- Larry Steffen-Valuing Stock Options in A Compensation PackageDocument4 pagesLarry Steffen-Valuing Stock Options in A Compensation PackageAbhinandan Singh0% (2)

- Chapter 7 Solution of Fundamental of Financial Accouting by EDMONDS (4th Edition)Document152 pagesChapter 7 Solution of Fundamental of Financial Accouting by EDMONDS (4th Edition)Awais Azeemi50% (4)

- Anandam Manufacturing CompanyDocument9 pagesAnandam Manufacturing CompanyAijaz AslamNo ratings yet

- Case Study 4 Winfield Refuse Management, Inc.: Raising Debt vs. EquityDocument5 pagesCase Study 4 Winfield Refuse Management, Inc.: Raising Debt vs. EquityAditya DashNo ratings yet

- Case Study 4Document8 pagesCase Study 4Ojas GuptaNo ratings yet

- Submitted To: Submitted By: Dr. Kulbir Singh Vinay Singh 201922106 Aurva Bhardwaj 201922066 Deepanshu Gupta 201922069 Sameer Kumbhalwar 201922097Document3 pagesSubmitted To: Submitted By: Dr. Kulbir Singh Vinay Singh 201922106 Aurva Bhardwaj 201922066 Deepanshu Gupta 201922069 Sameer Kumbhalwar 201922097Aurva BhardwajNo ratings yet

- Hill Country Snack Foods CoDocument1 pageHill Country Snack Foods CoKriti AhujaNo ratings yet

- Midland Case CalculationsDocument24 pagesMidland Case CalculationsSharry_xxx60% (5)

- Winfield Refuse ManagementDocument13 pagesWinfield Refuse ManagementAnshul Sehgal100% (3)

- Midland Energy Group A5Document3 pagesMidland Energy Group A5Deepesh Moolchandani0% (1)

- Assignment #2 Workgroup E IttnerDocument8 pagesAssignment #2 Workgroup E IttnerAziz Abi AadNo ratings yet

- Hill Country Snack Foods Co - UDocument4 pagesHill Country Snack Foods Co - Unipun9143No ratings yet

- Winfield Refuse ManagementDocument13 pagesWinfield Refuse Managementnishant JaiswalNo ratings yet

- Case Study: Hill Country Snack Foods " HCSF " (With Soluion )Document12 pagesCase Study: Hill Country Snack Foods " HCSF " (With Soluion )Kamran Shabbir50% (2)

- Bidding For Hertz Leveraged Buyout, Spreadsheet SupplementDocument12 pagesBidding For Hertz Leveraged Buyout, Spreadsheet SupplementAmit AdmuneNo ratings yet

- Mehak Bluntly MediaDocument18 pagesMehak Bluntly Mediahimanshu sagarNo ratings yet

- FIN 370 Final Exam 30 Questions With AnswersDocument11 pagesFIN 370 Final Exam 30 Questions With Answersassignmentsehelp0% (1)

- 13 Earned Value ManagementDocument9 pages13 Earned Value ManagementAbhinandan Singh100% (1)

- Teuer Furniture (A)Document14 pagesTeuer Furniture (A)Abhinandan SinghNo ratings yet

- Saatchi&SaatchiDocument5 pagesSaatchi&SaatchiAbhinandan SinghNo ratings yet

- Flash Memory IncDocument7 pagesFlash Memory IncAbhinandan SinghNo ratings yet

- Accounting IAS Model Answers Series 2 2010Document17 pagesAccounting IAS Model Answers Series 2 2010Aung Zaw HtweNo ratings yet

- DBBL ChargesDocument9 pagesDBBL ChargesAhmadullah Sohag100% (1)

- Winfieldpresentationfinal 130212133845 Phpapp02Document26 pagesWinfieldpresentationfinal 130212133845 Phpapp02Sukanta JanaNo ratings yet

- Continental CarriersDocument10 pagesContinental Carriersnipun9143No ratings yet

- Corporate Finance - Hill Country Snack FoodDocument11 pagesCorporate Finance - Hill Country Snack FoodNell MizunoNo ratings yet

- Case Study - Linear Tech - Christopher Taylor - SampleDocument9 pagesCase Study - Linear Tech - Christopher Taylor - Sampleakshay87kumar8193No ratings yet

- Winfield Refuse Management Inc. Raising Debt vs. EquityDocument13 pagesWinfield Refuse Management Inc. Raising Debt vs. EquitynmenalopezNo ratings yet

- Continental CarriersDocument4 pagesContinental CarriersNIkhil100% (2)

- Teuer Furniture Case AnalysisDocument3 pagesTeuer Furniture Case AnalysisPankaj KumarNo ratings yet

- This Study Resource Was: 1 Hill Country Snack Foods CoDocument9 pagesThis Study Resource Was: 1 Hill Country Snack Foods CoPavithra TamilNo ratings yet

- Hampton Suggested AnswersDocument5 pagesHampton Suggested Answersenkay12100% (3)

- Winfield PPT 27 FEB 13Document13 pagesWinfield PPT 27 FEB 13prem_kumar83g100% (4)

- Winfield RefuseDocument5 pagesWinfield RefuseAbhishek BaratamNo ratings yet

- Hill Country SnackDocument8 pagesHill Country Snackkiller dramaNo ratings yet

- Linear TechnologyDocument4 pagesLinear TechnologySatyajeet Sahoo100% (2)

- Midland Energy A1Document30 pagesMidland Energy A1CarsonNo ratings yet

- 01 - Midland AnalysisDocument7 pages01 - Midland AnalysisBadr Iftikhar100% (1)

- Jones Electrical DistributionDocument5 pagesJones Electrical DistributionAsif AliNo ratings yet

- Guna Fibres Working CapitalDocument5 pagesGuna Fibres Working CapitalRahul KumarNo ratings yet

- Case Analysis - Cost of CapitalDocument5 pagesCase Analysis - Cost of CapitalHazraphine LinsoNo ratings yet

- Finance Case - Blaine KitchenwareDocument8 pagesFinance Case - Blaine KitchenwareodaiissaNo ratings yet

- Question 1Document9 pagesQuestion 1Minh HàNo ratings yet

- Group2 - Clarkson Lumber Company Case AnalysisDocument3 pagesGroup2 - Clarkson Lumber Company Case AnalysisDavid WebbNo ratings yet

- Cooper Case SolutionsDocument6 pagesCooper Case SolutionsDarshan Salgia100% (1)

- Linear Technology Payout Policy Case 3Document4 pagesLinear Technology Payout Policy Case 3Amrinder SinghNo ratings yet

- Session 10 Simulation Questions PDFDocument6 pagesSession 10 Simulation Questions PDFVAIBHAV WADHWA0% (1)

- Example MidlandDocument5 pagesExample Midlandtdavis1234No ratings yet

- Midland WACCDocument2 pagesMidland WACCDeniz Minican100% (3)

- Midland CaseDocument5 pagesMidland CaseJessica Bill100% (3)

- Tire City Inc.Document6 pagesTire City Inc.Samta Singh YadavNo ratings yet

- LinearDocument6 pagesLinearjackedup211No ratings yet

- Dividend Policy at Linear TechnologyDocument9 pagesDividend Policy at Linear TechnologySAHILNo ratings yet

- Afm-Unit 1Document26 pagesAfm-Unit 1joelmanoj98No ratings yet

- NO Soal: Tipe 1Document24 pagesNO Soal: Tipe 1AdirtnNo ratings yet

- WinfieldDocument4 pagesWinfieldMOHIT SINGHNo ratings yet

- Financial Management Notes 1Document55 pagesFinancial Management Notes 1Praduman SharmaNo ratings yet

- FIN222 Autumn2016 Tutorials Tutorial 8Document8 pagesFIN222 Autumn2016 Tutorials Tutorial 8HELENANo ratings yet

- FIN 370 Final Exam - AssignmentDocument11 pagesFIN 370 Final Exam - AssignmentstudentehelpNo ratings yet

- G GeniusDocument26 pagesG GeniusAbhinandan SinghNo ratings yet

- Use More SoapsDocument9 pagesUse More SoapsAbhinandan SinghNo ratings yet

- Category Management 2Document9 pagesCategory Management 2Abhinandan SinghNo ratings yet

- Starbucks Deliveringcustomerservice 160222181028Document11 pagesStarbucks Deliveringcustomerservice 160222181028Abhinandan SinghNo ratings yet

- World CSR Congress: Integrating Sustainability Into A Global OrganizationDocument12 pagesWorld CSR Congress: Integrating Sustainability Into A Global OrganizationAbhinandan SinghNo ratings yet

- Visualmerchandising 121126111353 Phpapp02Document145 pagesVisualmerchandising 121126111353 Phpapp02Abhinandan SinghNo ratings yet

- Merve BEKTAŞ Didem ŞAHİN Sara OsmanoğluDocument22 pagesMerve BEKTAŞ Didem ŞAHİN Sara OsmanoğluAbhinandan SinghNo ratings yet

- Batiste 2in1 Dry Shampoo & Conditioner: Refreshes Roots and Targets Dryness For Gorgeously Soft, Conditioned HairDocument11 pagesBatiste 2in1 Dry Shampoo & Conditioner: Refreshes Roots and Targets Dryness For Gorgeously Soft, Conditioned HairAbhinandan SinghNo ratings yet

- Hola Kola Case StudyDocument8 pagesHola Kola Case StudyAbhinandan Singh100% (1)

- General Motors and Its SuppliersDocument8 pagesGeneral Motors and Its SuppliersAbhinandan SinghNo ratings yet

- Freelancing ListDocument29 pagesFreelancing ListAbhinandan SinghNo ratings yet

- Apple Case Analysis V3Document6 pagesApple Case Analysis V3Abhinandan SinghNo ratings yet

- Setting The Rules Dean BakerDocument11 pagesSetting The Rules Dean BakerOccupyEconomicsNo ratings yet

- Banking and Finance EssayDocument2 pagesBanking and Finance EssayRox31No ratings yet

- Dark Horse & Investment Pick From Smart InvestmentDocument2 pagesDark Horse & Investment Pick From Smart InvestmentMukesh Gupta100% (2)

- Capital Budgeting SumsDocument6 pagesCapital Budgeting SumsDeep DebnathNo ratings yet

- Accidental InsuranceDocument33 pagesAccidental InsuranceHarinarayan PrajapatiNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Mayank GandhiNo ratings yet

- National Bank of Pakistan Product Key Fact Statement: 2% of Adjustment Amount + FEDDocument3 pagesNational Bank of Pakistan Product Key Fact Statement: 2% of Adjustment Amount + FEDMuhammad TauseefNo ratings yet

- G.O.No.282, Dated 26 October 2015.: Government of Tamil Nadu 2015Document2 pagesG.O.No.282, Dated 26 October 2015.: Government of Tamil Nadu 2015Gowtham Raj50% (2)

- Banking Institutions History Classifications and FunctionsDocument13 pagesBanking Institutions History Classifications and FunctionsJessielyn GialogoNo ratings yet

- Entrepreneurship Development Program Available in BangladeshDocument22 pagesEntrepreneurship Development Program Available in BangladeshAriful IslamNo ratings yet

- 2 Ndquarter 11Document2 pages2 Ndquarter 11abigail zipaganNo ratings yet

- PEE Assignment 1Document2 pagesPEE Assignment 1Wilfred ThomasNo ratings yet

- SH FormsDocument42 pagesSH FormsRajeev KumarNo ratings yet

- Eureeca PDFDocument8 pagesEureeca PDFAmir Al-AmirNo ratings yet

- Presentation On Types of DepositDocument17 pagesPresentation On Types of DepositSumit Samtani0% (2)

- GP Chargeback GuideDocument9 pagesGP Chargeback Guidetigohan0% (1)

- Problem Set PpeDocument11 pagesProblem Set PpeHdhsiaihagatataNo ratings yet

- Rules of Debit and CreditDocument4 pagesRules of Debit and CreditGlesa SalienteNo ratings yet

- Economics (Simple and Compound Interest#2)Document17 pagesEconomics (Simple and Compound Interest#2)api-2636776733% (3)

- Alm CanaraDocument12 pagesAlm CanaraMohmmedKhayyumNo ratings yet

- Problems Solved Pay Back PeriodDocument7 pagesProblems Solved Pay Back PeriodAfthab Muhammed67% (3)

- Case Study SolutionDocument10 pagesCase Study SolutionSidra ArshadNo ratings yet

- Paper Analysis of NTA UGC - NET COMMERCE December 2019 PDFDocument7 pagesPaper Analysis of NTA UGC - NET COMMERCE December 2019 PDFVikram DograNo ratings yet

- June 11 DipIFR AnswersDocument10 pagesJune 11 DipIFR AnswersjaimaakalikaNo ratings yet

- Permission For Deposit of Goods in A Warehouse UnderDocument1 pagePermission For Deposit of Goods in A Warehouse UnderWelcome 1995No ratings yet