IENG 577 Homework 3: and Payables To Be 10% of The Cost of Goods Sold. Billingham's Marginal Corporate Tax Rate Is

IENG 577 Homework 3: and Payables To Be 10% of The Cost of Goods Sold. Billingham's Marginal Corporate Tax Rate Is

Uploaded by

Abdu AbdoulayeCopyright:

Available Formats

IENG 577 Homework 3: and Payables To Be 10% of The Cost of Goods Sold. Billingham's Marginal Corporate Tax Rate Is

IENG 577 Homework 3: and Payables To Be 10% of The Cost of Goods Sold. Billingham's Marginal Corporate Tax Rate Is

Uploaded by

Abdu AbdoulayeOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

IENG 577 Homework 3: and Payables To Be 10% of The Cost of Goods Sold. Billingham's Marginal Corporate Tax Rate Is

IENG 577 Homework 3: and Payables To Be 10% of The Cost of Goods Sold. Billingham's Marginal Corporate Tax Rate Is

Uploaded by

Abdu AbdoulayeCopyright:

Available Formats

IENG 577

Homework 3

Due: September 28, Monday

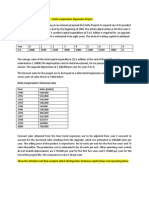

Billingham Packaging is considering expanding its production capacity by purchasing a new

machine, the XC-750. The cost of the XC-750 is $2.75 million. Unfortunately, installing this

machine will take several months and will partially disrupt production. The firm has just

completed a $50,000 feasibility study to analyze the decision to buy the XC-750, resulting in the

following estimates:

Marketing: Once the XC-750 is operating next year, the extra capacity is expected to

generate $10 million per year in additional sales, which will continue for the 10-year life of

the machine.

Operations: The disruption caused by the installation will decrease sales by $5 million this

year. Once the machine is operating next year, the cost of goods for the products produced by

the XC-750 is expected to be 70% of their sale price. The increased production will require

additional inventory on hand of $1 million to be added in year 0 and depleted in year 10.

Human Resources: The expansion will require additional sales and administrative personnel

at a cost of $2 million per year.

Accounting: The XC-750 will be depreciated via the straight-line method over the 10-year

life of the machine. The firm expects receivables from the new sales to be 15% of revenues

and payables to be 10% of the cost of goods sold. Billinghams marginal corporate tax rate is

35%.

a. Determine the incremental earnings from the purchase of the XC-750.

b. Determine the free cash flow from the purchase of the XC-750.

c. If the appropriate cost of capital for the expansion is 10%, compute the NPV of the purchase.

You can put your answers in an Excel spreadsheet, and print out the spreadsheet.

You might also like

- Capital Budgeting ProblemsDocument9 pagesCapital Budgeting ProblemsMark De Jesus0% (1)

- Solution q1 in q3 CapitalAssetPricingModelHomeworkDocument14 pagesSolution q1 in q3 CapitalAssetPricingModelHomeworkAbdu AbdoulayeNo ratings yet

- CAF 1 - Accounting For PartnershipDocument48 pagesCAF 1 - Accounting For PartnershipAhsan Kamran100% (1)

- Billingham Packaging Is Considering Expanding Its Production CapDocument1 pageBillingham Packaging Is Considering Expanding Its Production CapAmit PandeyNo ratings yet

- NPV & Capital Budgeting QuestionsDocument8 pagesNPV & Capital Budgeting QuestionsAnastasiaNo ratings yet

- Bài Tập Buổi 4 (Updated)Document4 pagesBài Tập Buổi 4 (Updated)Minh NguyenNo ratings yet

- Exercises 270919Document3 pagesExercises 270919Kim AnhNo ratings yet

- Question of Capital BudgetingDocument7 pagesQuestion of Capital Budgeting29_ramesh170100% (2)

- Chapter 9Document13 pagesChapter 9ppantin0430No ratings yet

- If The Coat FitsDocument4 pagesIf The Coat FitsAngelica Olesco100% (1)

- Report On Sinclair CompanyDocument5 pagesReport On Sinclair CompanyVictor LimNo ratings yet

- Assignment 1Document5 pagesAssignment 1kamrulkawserNo ratings yet

- 05 Exercises On Capital BudgetingDocument4 pages05 Exercises On Capital BudgetingAnshuman AggarwalNo ratings yet

- Problem 7 24Document3 pagesProblem 7 24Nitin ChoudharyNo ratings yet

- Buckingham Packaging Is Considering Expanding Its Production Capacity by PurchasingDocument1 pageBuckingham Packaging Is Considering Expanding Its Production Capacity by PurchasingAmit PandeyNo ratings yet

- Corporate Finance I: Home Assignment 2 Due by January 30Document2 pagesCorporate Finance I: Home Assignment 2 Due by January 30RahulNo ratings yet

- Mba800 HW5Document2 pagesMba800 HW5Melissa FosterNo ratings yet

- TMA-02 Fall 2021-2022 Semester IDocument9 pagesTMA-02 Fall 2021-2022 Semester IMahdy TabbaraNo ratings yet

- Tutorial Problems - Capital BudgetingDocument6 pagesTutorial Problems - Capital BudgetingMarcoBonaparte0% (1)

- HW 1, FIN 604, Sadhana JoshiDocument40 pagesHW 1, FIN 604, Sadhana JoshiSadhana JoshiNo ratings yet

- HW Week 5 Fin/571Document5 pagesHW Week 5 Fin/571trelvisd0% (1)

- ANGELICADocument7 pagesANGELICAAngel Reconalla Lapadan100% (2)

- Case 2Document1 pageCase 2Saurabh SinghNo ratings yet

- Investment DecisionsDocument11 pagesInvestment DecisionsAditya SahooNo ratings yet

- Rev PB SheetDocument10 pagesRev PB SheetPatriqKaruriKimbo100% (1)

- Capital Budgeting Assignment QuestionsDocument3 pagesCapital Budgeting Assignment QuestionsNgaiza3No ratings yet

- PracticeQuestions-Qbank-Part I-FM-IIDocument7 pagesPracticeQuestions-Qbank-Part I-FM-IISonakshi BhatiaNo ratings yet

- Exam Qstns PDFDocument31 pagesExam Qstns PDFGaming BuddyNo ratings yet

- Chapter 10 - Capital Budgeting - ProblemsDocument4 pagesChapter 10 - Capital Budgeting - Problemsbraydenfr05No ratings yet

- Prep Quiz 8Document6 pagesPrep Quiz 8karol nicole valero melo100% (1)

- Project Management & Economics: Sessions 14 & 15 ExerciseDocument4 pagesProject Management & Economics: Sessions 14 & 15 ExerciseTown Obio EteteNo ratings yet

- FM Assignment N0.1Document4 pagesFM Assignment N0.1Hafiz Usman ShariefNo ratings yet

- D10 CacDocument4 pagesD10 CacaskermanNo ratings yet

- F9FM SQB Qs - d07Document40 pagesF9FM SQB Qs - d07Erclan50% (2)

- Capital Expenditure DecisionDocument4 pagesCapital Expenditure DecisionSayan MitraNo ratings yet

- TH HĐNSV Buổi 5Document2 pagesTH HĐNSV Buổi 5Dỹ KhangNo ratings yet

- Infosys LTD Standalone Audit Report To Shareholders For FY 2019Document3 pagesInfosys LTD Standalone Audit Report To Shareholders For FY 2019Sundarasudarsan RengarajanNo ratings yet

- Required:: Project A Would CostDocument10 pagesRequired:: Project A Would CostSad CharlieNo ratings yet

- NPV SumsDocument2 pagesNPV SumsSunitha RamNo ratings yet

- Accounting For Managers-Assignment MaterialsDocument4 pagesAccounting For Managers-Assignment MaterialsYehualashet TeklemariamNo ratings yet

- NPV Practice CompleteDocument5 pagesNPV Practice CompleteShakeel AslamNo ratings yet

- Business Finance Decisions: Certified Finance and Accounting Professional Stage ExaminationsDocument4 pagesBusiness Finance Decisions: Certified Finance and Accounting Professional Stage ExaminationsRamzan AliNo ratings yet

- Revques t3 Sub 2011Document37 pagesRevques t3 Sub 2011Rod Lester de GuzmanNo ratings yet

- Part 2 Capital Budgeting Concepts - Qs 16 Mar 2024Document20 pagesPart 2 Capital Budgeting Concepts - Qs 16 Mar 2024Ayame KusuragiNo ratings yet

- Capital Structure Question BankDocument5 pagesCapital Structure Question BankQuestionscastle Friend100% (1)

- 2009-01-06 043437 GoodDocument3 pages2009-01-06 043437 GoodAlthea LandichoNo ratings yet

- Making Capital Investment Decisions Home Work Problem - SolutionDocument1 pageMaking Capital Investment Decisions Home Work Problem - SolutionParixit DahalNo ratings yet

- Practice Questions For FM Investment Appraisal 2021Document3 pagesPractice Questions For FM Investment Appraisal 2021jamesonkundaNo ratings yet

- Cash Flows-Capbud PDFDocument2 pagesCash Flows-Capbud PDFErjohn PapaNo ratings yet

- Cima C01 Samplequestions Mar2013Document28 pagesCima C01 Samplequestions Mar2013Abhiroop Roy100% (1)

- FIN515 W3 Problem SetDocument3 pagesFIN515 W3 Problem Sethy_saingheng_7602609No ratings yet

- Tutorial 6 QuestionsDocument1 pageTutorial 6 QuestionsJKFNo ratings yet

- Homework - Cash Flow PrinciplesDocument2 pagesHomework - Cash Flow PrinciplesCristina Maria ConstantinescuNo ratings yet

- Asad NotesDocument15 pagesAsad NotesassadjavedNo ratings yet

- Cap BudgDocument5 pagesCap BudgShahrukhNo ratings yet

- Chapter 08 Questions and ProblemsDocument6 pagesChapter 08 Questions and ProblemshuynhhangocthuNo ratings yet

- MAS Synchronous May 13 Part 2Document4 pagesMAS Synchronous May 13 Part 2Marielle GonzalvoNo ratings yet

- Cash Flow Analysis - Delta Co Problems - Docx + RepcoDocument2 pagesCash Flow Analysis - Delta Co Problems - Docx + RepcoAnjali ChopraNo ratings yet

- 305 Final Exam Cram Question PackageDocument14 pages305 Final Exam Cram Question PackageGloriana FokNo ratings yet

- Cost & Managerial Accounting II EssentialsFrom EverandCost & Managerial Accounting II EssentialsRating: 4 out of 5 stars4/5 (1)

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionNo ratings yet

- 21St Century Computer Solutions: A Manual Accounting SimulationFrom Everand21St Century Computer Solutions: A Manual Accounting SimulationNo ratings yet

- Yip Phaal ProbertDocument12 pagesYip Phaal ProbertAbdu AbdoulayeNo ratings yet

- Homework 1Document8 pagesHomework 1Abdu AbdoulayeNo ratings yet

- Ch2 - Descriptive Statistics - Tabular and Graphical PresentationsDocument47 pagesCh2 - Descriptive Statistics - Tabular and Graphical PresentationsAbdu Abdoulaye100% (1)

- Exam 1 Chpt3 Stugy GuideDocument7 pagesExam 1 Chpt3 Stugy GuideAbdu AbdoulayeNo ratings yet

- Exam 1 Chpt3 Stugy GuideDocument7 pagesExam 1 Chpt3 Stugy GuideAbdu AbdoulayeNo ratings yet

- Lab 2 Part 2-Ataya ExcelDocument1 pageLab 2 Part 2-Ataya ExcelAbdu AbdoulayeNo ratings yet

- SPLM Licensing InstallDocument9 pagesSPLM Licensing InstallAbdu AbdoulayeNo ratings yet

- Beaumont Metric SidDocument17 pagesBeaumont Metric SidAbdu AbdoulayeNo ratings yet

- 1.0 Data Representation SlidesDocument137 pages1.0 Data Representation SlidesAbdu AbdoulayeNo ratings yet

- IMSE Research Plan Spring 2017Document1 pageIMSE Research Plan Spring 2017Abdu AbdoulayeNo ratings yet

- Global Warming: Coal Natural Gas Oil Biomass Nuclear Power Wind Power Solar Power OtherDocument2 pagesGlobal Warming: Coal Natural Gas Oil Biomass Nuclear Power Wind Power Solar Power OtherAbdu AbdoulayeNo ratings yet

- Class 5Document1 pageClass 5Abdu AbdoulayeNo ratings yet

- Hammock Product StructureDocument4 pagesHammock Product StructureAbdu AbdoulayeNo ratings yet

- High Throughput Sortation DevicesDocument16 pagesHigh Throughput Sortation DevicesAbdu AbdoulayeNo ratings yet

- Abdallah Albarrak HW - 7Document1 pageAbdallah Albarrak HW - 7Abdu AbdoulayeNo ratings yet

- LevelDocument2 pagesLevelAbdu AbdoulayeNo ratings yet

- Evelyn and Jacky Lewy VDocument1 pageEvelyn and Jacky Lewy VAbdu AbdoulayeNo ratings yet

- Material HandlingDocument91 pagesMaterial HandlingAbdu AbdoulayeNo ratings yet

- Performance Evaluation of Disposable Sampler For InhalableDocument71 pagesPerformance Evaluation of Disposable Sampler For InhalableAbdu AbdoulayeNo ratings yet

- Production Flow SystemsDocument42 pagesProduction Flow SystemsAbdu AbdoulayeNo ratings yet

- 1.0 Data Representation SlidesDocument137 pages1.0 Data Representation SlidesAbdu AbdoulayeNo ratings yet

- Commissioner v. Algue, G.R. No. L-28896, 1988Document2 pagesCommissioner v. Algue, G.R. No. L-28896, 1988Jeffrey Medina100% (1)

- Air Asia CaseDocument19 pagesAir Asia CaseNarinderNo ratings yet

- BS Accountancy Problem 10: Financial ManagementDocument5 pagesBS Accountancy Problem 10: Financial ManagementJeanell GarciaNo ratings yet

- Nestle India Annual Report 2020Document136 pagesNestle India Annual Report 2020Pooja PandeyNo ratings yet

- Ivanhoe ElectricDocument45 pagesIvanhoe ElectricForexliveNo ratings yet

- NPO SolutionsDocument6 pagesNPO Solutionswhoaskedx69No ratings yet

- De LUNA Let's Analyze Activity 1Document4 pagesDe LUNA Let's Analyze Activity 1Jamille Ruth De LunaNo ratings yet

- Salary Slip 3Document1 pageSalary Slip 3musazahbi7090No ratings yet

- Itr 2 in Excel Format With Formula For A.Y. 2010 11Document12 pagesItr 2 in Excel Format With Formula For A.Y. 2010 11Shakeel sheoranNo ratings yet

- Practice Questions For BAAC 550 Question 1 Property, Plant and Equipment (15 Marks, 15 Minutes)Document19 pagesPractice Questions For BAAC 550 Question 1 Property, Plant and Equipment (15 Marks, 15 Minutes)Jasmine HuangNo ratings yet

- Table No 102Document2 pagesTable No 102ssfinservNo ratings yet

- Depreciation and Error Analysis A Depreciation Schedule For Semi PDFDocument1 pageDepreciation and Error Analysis A Depreciation Schedule For Semi PDFAnbu jaromiaNo ratings yet

- Cattle Farm Business Plan ExampleDocument39 pagesCattle Farm Business Plan ExampleHung VuNo ratings yet

- Part 5Document4 pagesPart 5Kath LeynesNo ratings yet

- Tesla FinModelDocument58 pagesTesla FinModelPrabhdeep Dadyal100% (1)

- Far Chapter 1 8Document26 pagesFar Chapter 1 8Elijah Jian NaresNo ratings yet

- FRA Assignment: (Type The Company Name)Document7 pagesFRA Assignment: (Type The Company Name)Sydenham SquareNo ratings yet

- PPE - SlidesDocument43 pagesPPE - SlidesLilia NangoloNo ratings yet

- Grant Thornton Business COmbination PDFDocument51 pagesGrant Thornton Business COmbination PDFPuneet SharmaNo ratings yet

- Far - LiabilitiesDocument12 pagesFar - LiabilitiesahihihihiNo ratings yet

- CF Assignment Maruti SuzukiDocument6 pagesCF Assignment Maruti SuzukiRuchika SinghNo ratings yet

- Module 4 - Adjusting The Accounts Accrual Basis of AccountingDocument20 pagesModule 4 - Adjusting The Accounts Accrual Basis of AccountingShaneNo ratings yet

- Chapter 6Document71 pagesChapter 6Messa Marianka80% (5)

- 2022 Tax ComputationDocument7 pages2022 Tax ComputationGeo Mosaic Diaz (Jiyu)No ratings yet

- 3rd Quarter Tle ReviewerDocument4 pages3rd Quarter Tle ReviewersincflixdodgeNo ratings yet

- Unofficial Answers To The Uniform Certified Public Accountants Ex PDFDocument254 pagesUnofficial Answers To The Uniform Certified Public Accountants Ex PDFSweet EmmeNo ratings yet

- Materi Stock Investing Mastery Untuk PesertaDocument162 pagesMateri Stock Investing Mastery Untuk PesertaHaikal LimansahNo ratings yet

- National Taiwan UniversityDocument28 pagesNational Taiwan UniversityOng Yong Xin, SeanneNo ratings yet

- 01make Decisions in Legal ContextDocument17 pages01make Decisions in Legal ContextrameNo ratings yet