0 ratings0% found this document useful (0 votes)

230 viewsForm 2

Form 2

Uploaded by

Ganesh DasaraRamu Aanikala received a monthly pay slip from Telangana State Power Generation Corporation for the month of December 2016. His net pay was Rs. 96,069 after deductions including Rs. 11,712 for EPF contribution, Rs. 21,200 for income tax, and Rs. 200 each for professional tax and flag day fund. Additional details provided in the pay slip included gross salary for the year of Rs. 1,542,184 and income tax payable of Rs. 244,659.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Form 2

Form 2

Uploaded by

Ganesh Dasara0 ratings0% found this document useful (0 votes)

230 views1 pageRamu Aanikala received a monthly pay slip from Telangana State Power Generation Corporation for the month of December 2016. His net pay was Rs. 96,069 after deductions including Rs. 11,712 for EPF contribution, Rs. 21,200 for income tax, and Rs. 200 each for professional tax and flag day fund. Additional details provided in the pay slip included gross salary for the year of Rs. 1,542,184 and income tax payable of Rs. 244,659.

Original Description:

Form

Original Title

Form2

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Ramu Aanikala received a monthly pay slip from Telangana State Power Generation Corporation for the month of December 2016. His net pay was Rs. 96,069 after deductions including Rs. 11,712 for EPF contribution, Rs. 21,200 for income tax, and Rs. 200 each for professional tax and flag day fund. Additional details provided in the pay slip included gross salary for the year of Rs. 1,542,184 and income tax payable of Rs. 244,659.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

230 views1 pageForm 2

Form 2

Uploaded by

Ganesh DasaraRamu Aanikala received a monthly pay slip from Telangana State Power Generation Corporation for the month of December 2016. His net pay was Rs. 96,069 after deductions including Rs. 11,712 for EPF contribution, Rs. 21,200 for income tax, and Rs. 200 each for professional tax and flag day fund. Additional details provided in the pay slip included gross salary for the year of Rs. 1,542,184 and income tax payable of Rs. 244,659.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

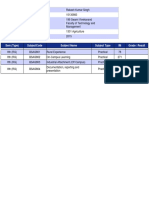

TELANGANA STATE POWER GENERATION CORPORATION LTD

KOTHAGUDEM THERMAL POWER STATION : PALONCHA

PAY SLIP FOR THE MONTH OF DECEMBER 2016

Emp. ID : 01073130 Department : SHIFT PAN No : AILPA5333M

Name : RAMU AANIKALA Designation : ADE GPF /EPF No : NZ/WGL/42545/00862

Bank : STATE BANK OF HYDERABAD,PALONCHA A/C No : 62268735133 :

Earnings (Rs.) Deductions (Rs.) Recoveries (Rs.)

BASIC PAY 84,245.00 Ee PF contribution 11,712.00

D.A. ( 15.849 %) 13,352.00 Prof Tax - split period 200.00

H.R.A ( 14.50 %) 12,216.00 Income Tax 21,200.00

GENERATION ALLOWANCE 15,771.00 GIS 120.00

DUST ALLOWANCE 275.00 SFMS 100.00

CUG ALLOWANCE 56.00 Flag day fund 200.00

PLF ALLOWANCE 2,256.00

TELANGANA INCREMENT 1,430.00

Total 129,601.00 Total 33,532.00 Total 0.00

Net Pay (Rs.) 96,069.00

Leave Balances Loan Balance Form 16 Perks/Other Income

Gross Salary 1,542,184.00

Balance 1,542,184.00

Empmnt tax (Prof Tax) 2,400.00

Aggrg Deduction 2,400.00

Incm under Hd Salary 1,539,784.00

Gross Tot Income 1,539,784.00

Agg of Chapter VI 164,675.00

Total Income 1,375,110.00

Tax on total Income 237,533.00

Tax payable and surcharge 244,659.00

Tax deducted so far 181,100.00

Income Tax 21,200.00

.

This is a SAP generated Payslip. For any discrepancy, please contact respective DDO/ERP Help desk ( Mobile : 9493120061, erphelpdesk@tsgenco.co.in. )

PROJECT TSSHAKTHI greets and extend thanks for the support. Your suggestions will help improve further.

You might also like

- Indiabulls Securities LimitedDocument1 pageIndiabulls Securities Limitedraj200224No ratings yet

- E Ticket ReceiptDocument3 pagesE Ticket ReceiptNEERUNo ratings yet

- 0129450730004260Document3 pages0129450730004260Deependra Singh100% (1)

- WWW - Luonline.in Newform Exam Form With PreviousDetails - Aspx PDFDocument1 pageWWW - Luonline.in Newform Exam Form With PreviousDetails - Aspx PDFAman VermaNo ratings yet

- 1e8c62 PDFDocument4 pages1e8c62 PDFGanesh Dasara0% (2)

- Assignment 1Document1 pageAssignment 1p mehrok0% (2)

- ÍÏ!$È.95 Î Íln Dè2Uî: Tan Chor SengDocument11 pagesÍÏ!$È.95 Î Íln Dè2Uî: Tan Chor SengTan chor sengNo ratings yet

- Telangana State Power Generation Corporation LTD Bhadradri Thermal Power Project: ManuguruDocument1 pageTelangana State Power Generation Corporation LTD Bhadradri Thermal Power Project: ManuguruSuresh DoosaNo ratings yet

- Form 1Document1 pageForm 1Ganesh DasaraNo ratings yet

- Sal Jan18 PDFDocument1 pageSal Jan18 PDFRaghava SharmaNo ratings yet

- April Elect Bill PDFDocument1 pageApril Elect Bill PDFAbhijitNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Arvind MiraseNo ratings yet

- Compu PDFDocument4 pagesCompu PDFMihir ThakkarNo ratings yet

- UnknownDocument1 pageUnknownAjit KumarNo ratings yet

- Deductions (B) Earnings (A) : Print Date: 03.11.2019, Print Time: 20:51:14Document1 pageDeductions (B) Earnings (A) : Print Date: 03.11.2019, Print Time: 20:51:14Fire SuperstarNo ratings yet

- View PDFServletDocument1 pageView PDFServletDevansh MishraNo ratings yet

- PANform PDFDocument1 pagePANform PDFsagar KumarNo ratings yet

- .NP 2077 Result With MarksheetDocument2 pages.NP 2077 Result With MarksheetSAMIM ANSARI0% (1)

- EMS ResultDocument1 pageEMS ResultRitvikNo ratings yet

- Gail SF s5Document6 pagesGail SF s5sunny KumarNo ratings yet

- VTU ResultDocument1 pageVTU Resultwaqar sarwarNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Himanshu JainNo ratings yet

- Statement of Account - 18 - 03 - 14 PDFDocument2 pagesStatement of Account - 18 - 03 - 14 PDFShantesh AroraNo ratings yet

- Invoice 1Document1 pageInvoice 1Anupam PriyamNo ratings yet

- Digital Customer Copy: I Confirm ThatDocument2 pagesDigital Customer Copy: I Confirm ThatTarun KumarNo ratings yet

- Student ResultDocument4 pagesStudent ResultRakesh MauryaNo ratings yet

- Tripura State Electricity Corporation Ltd. (A GOVT. of Tripura Enterprise)Document1 pageTripura State Electricity Corporation Ltd. (A GOVT. of Tripura Enterprise)Anonymous nrvHJVz9No ratings yet

- HP 15q APU Dual Core E2 - (4 GB/1 TB HDD/Windows 10 Home) 15q-by010AU LaptopDocument1 pageHP 15q APU Dual Core E2 - (4 GB/1 TB HDD/Windows 10 Home) 15q-by010AU LaptopvscomputersNo ratings yet

- Od126520774203945000 1 PDFDocument2 pagesOd126520774203945000 1 PDFMuthukumaresan ANo ratings yet

- Acctstmt LDocument3 pagesAcctstmt LIshwaryaNo ratings yet

- Loan Account Statement For LACHD00039394344Document4 pagesLoan Account Statement For LACHD00039394344abhishek parasarNo ratings yet

- Examination Hall Ticket PDFDocument2 pagesExamination Hall Ticket PDFZunaid PathanNo ratings yet

- Leave Revised FloricelDocument2 pagesLeave Revised FloricelLJ AggabaoNo ratings yet

- Tax Invoice: Vijaya Indane Gas AGENCY (0000125369)Document2 pagesTax Invoice: Vijaya Indane Gas AGENCY (0000125369)Venkat DaimondNo ratings yet

- StatementDocument4 pagesStatementSUBHAM CHAKRABORTYNo ratings yet

- NVPI1167676 - ForeClosure Archna VajeDocument2 pagesNVPI1167676 - ForeClosure Archna VajeVARUN KALENo ratings yet

- Acknowledgement 1572947362960Document3 pagesAcknowledgement 1572947362960grand physicist100% (1)

- PAN Application Acknowledgment Receipt For Form 49A (Physical Application)Document1 pagePAN Application Acknowledgment Receipt For Form 49A (Physical Application)Shamshavali ButaladinniNo ratings yet

- Biju Patnaik University of Technology, OdishaDocument2 pagesBiju Patnaik University of Technology, OdishaMd Taslim Kausar khanNo ratings yet

- Msu PDFDocument2 pagesMsu PDFTaarak Mehta Ka Ooltah ChashmahNo ratings yet

- Rtps-Reesa 2023 93322 PDFDocument2 pagesRtps-Reesa 2023 93322 PDFSakhil AhesanNo ratings yet

- British CouponDocument45 pagesBritish CouponKakouris AndreasNo ratings yet

- UnknownDocument2 pagesUnknownSudip MondalNo ratings yet

- Commercial Invoice: Tape Drive FailedDocument1 pageCommercial Invoice: Tape Drive FailedKhang DươngNo ratings yet

- Print PDFDocument2 pagesPrint PDFAmit SanjanaNo ratings yet

- Appointment Preparation of SlsDocument4 pagesAppointment Preparation of SlsSai CharanNo ratings yet

- Summary of Current Charges Amount (RS.) : Bill Enquiries: 3033 7777 or 377Document4 pagesSummary of Current Charges Amount (RS.) : Bill Enquiries: 3033 7777 or 377rahuljaiswal20097313No ratings yet

- New Student Admission FormDocument1 pageNew Student Admission FormVansh ShuklaNo ratings yet

- Printed by SYSUSER: A/C No: 8767561000Document2 pagesPrinted by SYSUSER: A/C No: 8767561000Mukul AggarwalNo ratings yet

- Admit CardDocument2 pagesAdmit CardArjun KhuranaNo ratings yet

- Quotation - S01783 - Al Faisal UniversityDocument2 pagesQuotation - S01783 - Al Faisal UniversityahmedNo ratings yet

- Maharashtra State Electricity Distribution Co. LTD.: For Any Queries On This Bill Please Contact MSEDCL CallDocument1 pageMaharashtra State Electricity Distribution Co. LTD.: For Any Queries On This Bill Please Contact MSEDCL CallAkash PatilNo ratings yet

- Printed by SYSUSER: Dial Toll Free 1912 For Bill & Supply ComplaintsDocument1 pagePrinted by SYSUSER: Dial Toll Free 1912 For Bill & Supply ComplaintsKaran Veer SinghNo ratings yet

- Mrunal PDFDocument4 pagesMrunal PDFPrajwal LanjewarNo ratings yet

- Invoice 191Document1 pageInvoice 191Ayan SinhaNo ratings yet

- Address Proof (Electricity Bill)Document1 pageAddress Proof (Electricity Bill)Ashok BhatNo ratings yet

- Print PDFDocument1 pagePrint PDFArjun KohliNo ratings yet

- PAN Application Acknowledgment Receipt For Form 49A (Physical Application)Document1 pagePAN Application Acknowledgment Receipt For Form 49A (Physical Application)S CYBER CAFENo ratings yet

- Loan Account Statement For LUCHD00037184487Document4 pagesLoan Account Statement For LUCHD00037184487abhishek parasarNo ratings yet

- Invoice For PO#868Document4 pagesInvoice For PO#868Didik Tri WahyudiNo ratings yet

- Sta. Cruz Elementary SchoolDocument1 pageSta. Cruz Elementary SchoolLourence Jay EvioNo ratings yet

- FormDocument1 pageFormGanesh DasaraNo ratings yet

- Form PDFDocument1 pageForm PDFRaghava SharmaNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruGanesh DasaraNo ratings yet

- Memo - No.Dir (HR) /COM (Adm) /DS (E) /AS (Estt-I) /PO.P/99/2O 14-4, Dt.26.O3.2019Document1 pageMemo - No.Dir (HR) /COM (Adm) /DS (E) /AS (Estt-I) /PO.P/99/2O 14-4, Dt.26.O3.2019Ganesh DasaraNo ratings yet

- Steam Turbines Start UpDocument30 pagesSteam Turbines Start UpVILLANUEVA_DANIEL2064100% (2)

- A Study On Damages in Alloyed Super Heater Tubes of Thermal Power StationDocument5 pagesA Study On Damages in Alloyed Super Heater Tubes of Thermal Power StationGanesh DasaraNo ratings yet

- Of Of: Documents The PostDocument14 pagesOf Of: Documents The PostGanesh DasaraNo ratings yet

- Ugc PRC 2016 PDFDocument8 pagesUgc PRC 2016 PDFGanesh DasaraNo ratings yet

- Tentative Training Schedule For The Month of July-2019 To The Employees of Apgenco, Aptransco, Apspdcl and Apepdcl at Apgenco Training InstituteDocument3 pagesTentative Training Schedule For The Month of July-2019 To The Employees of Apgenco, Aptransco, Apspdcl and Apepdcl at Apgenco Training InstituteGanesh DasaraNo ratings yet

- TFGGHDocument25 pagesTFGGHGanesh DasaraNo ratings yet

- ContactUs PDFDocument2 pagesContactUs PDFGanesh DasaraNo ratings yet

- Boe Total ResultsDocument26 pagesBoe Total ResultsGanesh DasaraNo ratings yet

- Rrfeff : I ,,,,CNRD .,.:, - I-I#c ADocument1 pageRrfeff : I ,,,,CNRD .,.:, - I-I#c AGanesh DasaraNo ratings yet

- 2018 07 20 11 14 23 177 - 1532065463177 - XXXPC3536X - Acknowledgement PDFDocument1 page2018 07 20 11 14 23 177 - 1532065463177 - XXXPC3536X - Acknowledgement PDFGanesh DasaraNo ratings yet

- Tentative Training Schedule For The Month of September - 2018 To The Employees of Apgenco, Aptransco, Apspdcl Apepdcl at Apgenco Training InstituteDocument3 pagesTentative Training Schedule For The Month of September - 2018 To The Employees of Apgenco, Aptransco, Apspdcl Apepdcl at Apgenco Training InstituteGanesh DasaraNo ratings yet

- Daily Generation Report: 14-06-2019: Thermal Power StationsDocument1 pageDaily Generation Report: 14-06-2019: Thermal Power StationsGanesh DasaraNo ratings yet

- Schedule of Premium (Amount in RS.)Document4 pagesSchedule of Premium (Amount in RS.)Ganesh DasaraNo ratings yet

- No. of Persons: No. of Laddus:: Special Entry Darshan Receipt ( .300/-)Document1 pageNo. of Persons: No. of Laddus:: Special Entry Darshan Receipt ( .300/-)Ganesh DasaraNo ratings yet

- 2463 PDFDocument5 pages2463 PDFGanesh DasaraNo ratings yet

- Payment Receipt: Payment Id: 221417204 Merchant Transaction Indentifier: 20167842Document1 pagePayment Receipt: Payment Id: 221417204 Merchant Transaction Indentifier: 20167842Ganesh DasaraNo ratings yet

- 3264 PDFDocument1 page3264 PDFGanesh DasaraNo ratings yet

- INB Reference Number Debit Transaction Status: IRH9383931 12-Nov-2018 (09:41 PM IST) ScheduledDocument1 pageINB Reference Number Debit Transaction Status: IRH9383931 12-Nov-2018 (09:41 PM IST) ScheduledGanesh DasaraNo ratings yet

- 3264 PDFDocument1 page3264 PDFGanesh DasaraNo ratings yet

- 12 - Chapter 6 PDFDocument13 pages12 - Chapter 6 PDFGanesh DasaraNo ratings yet

- Akixxxxx0p c15 PDFDocument1 pageAkixxxxx0p c15 PDFGanesh DasaraNo ratings yet

- 6446 PDFDocument15 pages6446 PDFGanesh DasaraNo ratings yet

- SPDCL: Your Electricity Bill For The Month of September-2018Document1 pageSPDCL: Your Electricity Bill For The Month of September-2018Ganesh DasaraNo ratings yet

- Registration FeeDocument1 pageRegistration FeeanakinNo ratings yet

- Sajjan Precision Castings: Terms & ConditionsDocument1 pageSajjan Precision Castings: Terms & ConditionsHarpal SinghNo ratings yet

- Welcome To Transport Department Government of Telangana - IndiaDocument1 pageWelcome To Transport Department Government of Telangana - IndiaPrakash ReddyNo ratings yet

- TD 513796-EnDocument13 pagesTD 513796-EnIT TLiNo ratings yet

- Direct TaxDocument12 pagesDirect TaxAkhi RajNo ratings yet

- Earnings Deductions Reimbursements: Nexteer Automotive India PVT LTD Payslip For The Month of April 2021Document1 pageEarnings Deductions Reimbursements: Nexteer Automotive India PVT LTD Payslip For The Month of April 2021Nanha-Munna swaggerNo ratings yet

- (Solved) Respond To The Following Question in Your Textbook C - 2-26 - Carl... - Course HeroDocument3 pages(Solved) Respond To The Following Question in Your Textbook C - 2-26 - Carl... - Course HeroJdkrkejNo ratings yet

- Ac Moshood Sodiq Oluwapelumi June, 2022 232971907 FullstmtDocument1 pageAc Moshood Sodiq Oluwapelumi June, 2022 232971907 FullstmtSo di keyNo ratings yet

- 3 RD Semester Fee ReceiptDocument4 pages3 RD Semester Fee ReceiptKuldeepNo ratings yet

- Post Date Value Date Narration Cheque Details Debit Credit BalanceDocument3 pagesPost Date Value Date Narration Cheque Details Debit Credit BalancevishalNo ratings yet

- NDSR47 24-25 Intas Pharmaceuticals LTDDocument1 pageNDSR47 24-25 Intas Pharmaceuticals LTDankitndsrenggNo ratings yet

- Check - INVOICE 12600000799Document2 pagesCheck - INVOICE 12600000799Ronei DelinaNo ratings yet

- Questionnaire... GST.Document1 pageQuestionnaire... GST.MUJEEB RAHIMAN KATTALINo ratings yet

- Bank Reconciliation: Sir. JP MoralesDocument30 pagesBank Reconciliation: Sir. JP MoralesAshley Niña Lee Hugo100% (1)

- P&L AccountDocument13 pagesP&L AccountRajneesh Sehgal100% (1)

- Soa 1727926478336Document3 pagesSoa 1727926478336andemkavitha27No ratings yet

- Fee Schedule For Class IX 2024 2025Document2 pagesFee Schedule For Class IX 2024 2025Sam PaulNo ratings yet

- Art Integrated Activity Source DocumntsDocument9 pagesArt Integrated Activity Source DocumntsFabzrocks FareehaNo ratings yet

- Disbursement Voucher: Provincial Agrarian Reform OfficeDocument30 pagesDisbursement Voucher: Provincial Agrarian Reform OfficeDIVINE JES ALFEREZNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)SUNIL PATELNo ratings yet

- Takenaka Vs CirDocument1 pageTakenaka Vs Cirstargazer0732No ratings yet

- Thesis On Atm CardsDocument5 pagesThesis On Atm Cardsbrittanypopemadison100% (2)

- Brazil's Transfer Pricing Differences Create Challenges For CorporationsDocument3 pagesBrazil's Transfer Pricing Differences Create Challenges For CorporationsMega VionythaNo ratings yet

- Statement of Accounts AmansieDocument1 pageStatement of Accounts AmansieAgyei MichimelandNo ratings yet

- Form312 PDFDocument3 pagesForm312 PDFSaad AhmedNo ratings yet

- Module 1a - Cash & CEDocument36 pagesModule 1a - Cash & CEChen HaoNo ratings yet

- Cash Receipt Register Report Detail 0024 - PASIRANDocument1 pageCash Receipt Register Report Detail 0024 - PASIRANandry hardianNo ratings yet

- Business Taxation Solman Tabag@garcia PDFDocument42 pagesBusiness Taxation Solman Tabag@garcia PDFJoey Abraham100% (1)