0 ratings0% found this document useful (0 votes)

45 viewsEib Finances - Sheet1

Eib Finances - Sheet1

Uploaded by

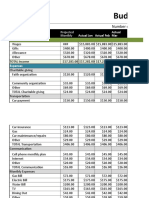

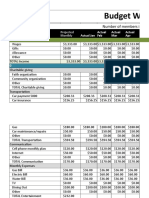

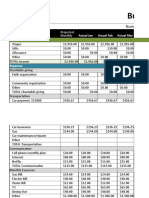

api-359849819This document outlines a one year plan with projected monthly and annual income statements for a new business over three years. In year one, the business projects $43,400 in sales but significant start-up costs result in a net loss of $27,519 for the year. In years two and three, sales are projected to double each year while costs increase modestly, leading to net profits of $2,318 and $16,978 respectively as the business becomes established.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Eib Finances - Sheet1

Eib Finances - Sheet1

Uploaded by

api-3598498190 ratings0% found this document useful (0 votes)

45 views1 pageThis document outlines a one year plan with projected monthly and annual income statements for a new business over three years. In year one, the business projects $43,400 in sales but significant start-up costs result in a net loss of $27,519 for the year. In years two and three, sales are projected to double each year while costs increase modestly, leading to net profits of $2,318 and $16,978 respectively as the business becomes established.

Original Title

eib finances - sheet1

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

This document outlines a one year plan with projected monthly and annual income statements for a new business over three years. In year one, the business projects $43,400 in sales but significant start-up costs result in a net loss of $27,519 for the year. In years two and three, sales are projected to double each year while costs increase modestly, leading to net profits of $2,318 and $16,978 respectively as the business becomes established.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

45 views1 pageEib Finances - Sheet1

Eib Finances - Sheet1

Uploaded by

api-359849819This document outlines a one year plan with projected monthly and annual income statements for a new business over three years. In year one, the business projects $43,400 in sales but significant start-up costs result in a net loss of $27,519 for the year. In years two and three, sales are projected to double each year while costs increase modestly, leading to net profits of $2,318 and $16,978 respectively as the business becomes established.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

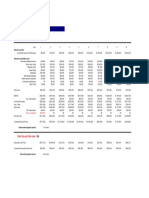

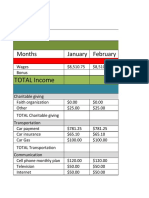

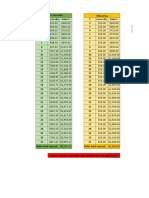

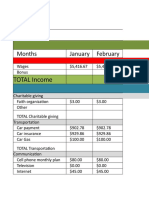

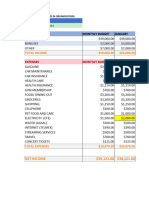

One Year Plan January February March April May June July August September October November December

July August September October November December Year 1 Year 2 Year 3

Income Sales

Sales $5,400.00 $5,200.00 $4,000.00 $3,000.00 $2,700.00 $2,700.00 $2,700.00 $2,700.00 $3,000.00 $3,500.00 $4,000.00 $4,500.00 $43,400.00 $86,800.00 $130,200.00

Net Sales $5,400.00 $5,200.00 $4,000.00 $3,000.00 $2,700.00 $2,700.00 $2,700.00 $2,700.00 $3,000.00 $3,500.00 $4,000.00 $4,500.00 $43,400.00 $86,800.00 $130,200.00

Cost of Goods Sold $1,998.00 $1,924.00 $1,480.00 $1,110.00 $999.00 $999.00 $999.00 $999.00 $1,110.00 $1,295.00 $1,480.00 $1,665.00 $16,058.00 $32,116.00 $48,174.00

Gross Profit $3,402.00 $3,276.00 $2,520.00 $1,890.00 $1,701.00 $1,701.00 $1,701.00 $1,701.00 $1,890.00 $2,205.00 $2,520.00 $2,835.00 $27,342.00 $54,684.00 $82,026.00

Operating Expenses

Salary & Payroll Taxes $30.00 $30.00 $30.00 $30.00 $30.00 $30.00 $30.00 $30.00 $30.00 $30.00 $30.00 $30.00 $360.00 $720.00 $1,080.00

Insurance $209.00 $209.00 $209.00 $209.00 $209.00 $209.00 $209.00 $209.00 $209.00 $209.00 $209.00 $209.00 $2,508.00 $5,016.00 $7,524.00

Food Truck $583.34 $583.34 $583.34 $583.34 $583.34 $583.34 $583.34 $583.34 $583.34 $583.34 $583.34 $583.34 $7,000.08 $14,000.16 $21,000.24

Gas $1.30 $1.30 $1.30 $1.30 $1.30 $1.30 $1.30 $1.30 $1.30 $1.30 $1.30 $1.30 $15.60 $31.20 $46.80

Depreciation $7.50 $7.50 $7.50 $7.50 $7.50 $7.50 $7.50 $7.50 $7.50 $7.50 $7.50 $7.50 $90.00 $180.00 $270.00

Utilities $90.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $90.00 $90.00 $90.00

Start Up Cost $30,000.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $30,000.00 $30,000.00 $30,000.00

Total Expenses $30,921.14 $921.14 $921.14 $921.14 $921.14 $921.14 $921.14 $921.14 $921.14 $921.14 $921.14 $921.14 $41,053.68 $52,107.36 $63,161.04

Net Income from Operations -$27,519.14 $2,354.86 $1,598.86 $968.86 $779.86 $779.86 $779.86 $779.86 $968.86 $1,283.86 $1,598.86 $1,913.86 -$13,711.68 $2,576.64 $18,864.96

Net Profit Before Taxes -$27,519.14 $2,354.86 $1,598.86 $968.86 $779.86 $779.86 $779.86 $779.86 $968.86 $1,283.86 $1,598.86 $1,913.86 -$13,711.68 $2,576.64 $18,864.96

Taxes $0.00 $235.49 $159.89 $96.89 $77.99 $77.99 $77.99 $77.99 $96.89 $128.39 $159.89 $191.39 $0.00 $257.67 $1,886.50

Net Profit After Taxes -$27,519.14 $2,119.37 $1,429.97 $871.97 $871.97 $871.97 $871.97 $871.97 $871.97 $1,155.47 $1,438.97 $1,722.47 -$13,711.68 $2,318.97 $16,978.46

You might also like

- Druthers Forming Answer KeyDocument3 pagesDruthers Forming Answer KeyDesventes AdrienNo ratings yet

- Instruction For Nantucket NectarsDocument4 pagesInstruction For Nantucket NectarsTanaporn Suwanchaiyong100% (1)

- Trusts and Estates Outline - THDocument87 pagesTrusts and Estates Outline - THj100% (4)

- Income Projection Statement TemplateDocument4 pagesIncome Projection Statement TemplateJune AguinaldoNo ratings yet

- Proyeccion FinancieraDocument1 pageProyeccion FinancieraFelixCoutiñoCorderoNo ratings yet

- Financial PlanDocument86 pagesFinancial PlanVõ Thị Ngọc HuyềnNo ratings yet

- FINC 721 Project 3Document6 pagesFINC 721 Project 3Sameer BhattaraiNo ratings yet

- MAT-20013 All-Store Profit and Loss StatementDocument1 pageMAT-20013 All-Store Profit and Loss Statementpro mansaNo ratings yet

- Preuitt Zikia ExalleymasteryDocument12 pagesPreuitt Zikia Exalleymasteryapi-377100996No ratings yet

- Ingreso Liabilidad: Gastos TotalDocument7 pagesIngreso Liabilidad: Gastos TotalᎬᏞᏉᎥᏁ TrinidadNo ratings yet

- Financial Plan For Meet Green: Locally Grown Produce, Chemical-And Preservative-Free GroceriesDocument6 pagesFinancial Plan For Meet Green: Locally Grown Produce, Chemical-And Preservative-Free Groceriesramsha nishatNo ratings yet

- Jaxworks PaybackAnalysis1Document1 pageJaxworks PaybackAnalysis1Jo Ann RangelNo ratings yet

- 4 TiposDocument4 pages4 TiposCarlos BernadacNo ratings yet

- Profit and Loss - MAIN D-OEUVRE - OUTSOURCINGDocument3 pagesProfit and Loss - MAIN D-OEUVRE - OUTSOURCINGelnathanbakemoNo ratings yet

- Profit and Loss Statement - StatementDocument1 pageProfit and Loss Statement - StatementTirta syah putra AlamNo ratings yet

- Informe Impo 484Document27 pagesInforme Impo 484Julieta TaveraNo ratings yet

- Flujo de Caja Proyectado1Document8 pagesFlujo de Caja Proyectado1CHARLES WILLIAM SALAZAR SANCHEZNo ratings yet

- Financial ModelDocument6 pagesFinancial ModelGarvit JainNo ratings yet

- Boutique Hotel Financial ModelDocument15 pagesBoutique Hotel Financial ModelNgọcThủy0% (1)

- Akm 233Document6 pagesAkm 233wahdah ulin nafisahNo ratings yet

- Feed. LerhetDocument35 pagesFeed. LerhetfuadzeyniNo ratings yet

- Robinson Final BudgetDocument12 pagesRobinson Final Budgetapi-427077889No ratings yet

- Mendez Emily ExcelmasteryDocument8 pagesMendez Emily Excelmasteryapi-377243899No ratings yet

- Crédito Al Consumo: 30 - Octubre - 2020Document3 pagesCrédito Al Consumo: 30 - Octubre - 2020Alberic Meza AyalaNo ratings yet

- Pre SupuestoDocument8 pagesPre SupuestoMarco Antonio AlanisNo ratings yet

- Perez Diego ExcelmasteryDocument12 pagesPerez Diego Excelmasteryapi-377101163No ratings yet

- Assignment 5 Kelli CoplinDocument3 pagesAssignment 5 Kelli Coplinapi-267765589No ratings yet

- Rojas Rosario ExcelmasteryDocument12 pagesRojas Rosario Excelmasteryapi-377244071No ratings yet

- Netflix Financial StatementsDocument2 pagesNetflix Financial StatementsGoutham RaoNo ratings yet

- PÍA NIF EQUIPO 14 Hoteles City ExpressDocument146 pagesPÍA NIF EQUIPO 14 Hoteles City ExpressYarely GonzálezNo ratings yet

- Propose Business Plan For Prototypes Developed Through GreenAIDocument11 pagesPropose Business Plan For Prototypes Developed Through GreenAItrueoflifeNo ratings yet

- MES Saldo Deuda Interes IVA Pago Adelanto Saldo FinalDocument11 pagesMES Saldo Deuda Interes IVA Pago Adelanto Saldo FinalDaniel RamírezNo ratings yet

- Group 3Document12 pagesGroup 3Anthony HoseinNo ratings yet

- Planilha Soros Com GaleDocument3 pagesPlanilha Soros Com Galewelligtonsantos0No ratings yet

- Financial Plan TemplateDocument8 pagesFinancial Plan Templatenomaden_09No ratings yet

- Daily Sales & LaborDocument1 pageDaily Sales & LaborGraficos Y masNo ratings yet

- End of Year (1) Annual O & M (2) Annual Dep (3) Annual Cost (4 2+3)Document1 pageEnd of Year (1) Annual O & M (2) Annual Dep (3) Annual Cost (4 2+3)amanuel mindaNo ratings yet

- ThorntonDocument22 pagesThorntonapi-427253189No ratings yet

- Cash Flow Forecasting TemplateDocument41 pagesCash Flow Forecasting TemplateAdil Javed CHNo ratings yet

- Tugas Kelompok 5 - Studi Kasus Franklin LumberDocument30 pagesTugas Kelompok 5 - Studi Kasus Franklin LumberAgung IswaraNo ratings yet

- Food Truck Financial ProjectionsDocument68 pagesFood Truck Financial ProjectionsAmy Bersalona-DimapilisNo ratings yet

- Balance General de 8 ColumnasDocument4 pagesBalance General de 8 ColumnasJavier Ignacio ValdiviaNo ratings yet

- Magana Jose Excel MasteryDocument12 pagesMagana Jose Excel Masteryapi-377101001No ratings yet

- Conta 19 Lunes 2023Document4 pagesConta 19 Lunes 2023Danna RomanNo ratings yet

- Mayorga Brayan ExcelmasteryDocument12 pagesMayorga Brayan Excelmasteryapi-377088945No ratings yet

- ProfitLoss July - September 202Document2 pagesProfitLoss July - September 202descowley04No ratings yet

- Cash Flow ForecastDocument5 pagesCash Flow ForecastKSXNo ratings yet

- Amy pdf2Document2 pagesAmy pdf2api-353707316No ratings yet

- Pla de Trading 2021Document5 pagesPla de Trading 2021Patricia M. RodríguezNo ratings yet

- Learning Excel FCCDocument19 pagesLearning Excel FCCwvansh5051No ratings yet

- Projected Cash BudgetDocument2 pagesProjected Cash Budgetapi-464285260No ratings yet

- Trabajo Conta Clase 2Document37 pagesTrabajo Conta Clase 2marmolejobbpapirrinNo ratings yet

- Case Study Cashflow Financials (4 Months)Document5 pagesCase Study Cashflow Financials (4 Months)Jeremy smithNo ratings yet

- Asb Calculator v11Document2 pagesAsb Calculator v11msa_2011No ratings yet

- 1st Partial Information Afps Ag200Document16 pages1st Partial Information Afps Ag200pbtzrt7szyNo ratings yet

- FranciscoDocument22 pagesFranciscoapi-427260473No ratings yet

- Long-Term Savings CalculatorDocument52 pagesLong-Term Savings CalculatorRomina Flores-TatiniNo ratings yet

- Item Monthly Expenditure Saving Send Home Total Income NeededDocument6 pagesItem Monthly Expenditure Saving Send Home Total Income NeededShashank MallepulaNo ratings yet

- Monthly Income $1,450.00: Jan Feb Mar Apr May JunDocument8 pagesMonthly Income $1,450.00: Jan Feb Mar Apr May JunLutfi PuadNo ratings yet

- 5.3 Estado de Flujo CorregidoDocument3 pages5.3 Estado de Flujo CorregidoBrenda GonzálezNo ratings yet

- Superannuation ExamplesDocument4 pagesSuperannuation ExampleschandpesNo ratings yet

- ThankyouletterDocument1 pageThankyouletterapi-359849819No ratings yet

- RefrencesheetDocument1 pageRefrencesheetapi-359849819No ratings yet

- Benjamin Mach: StudentDocument1 pageBenjamin Mach: Studentapi-359849819No ratings yet

- CoverletterDocument1 pageCoverletterapi-359849819No ratings yet

- Eib SlidesDocument13 pagesEib Slidesapi-359849819No ratings yet

- Law Commission Rejects Right To Recall' and Right To RejectDocument269 pagesLaw Commission Rejects Right To Recall' and Right To RejectLive LawNo ratings yet

- Summary of Ifrs 5Document4 pagesSummary of Ifrs 5Divine Epie Ngol'esuehNo ratings yet

- Securities Markets: Learning ObjectivesDocument31 pagesSecurities Markets: Learning ObjectivesFrancisca FusterNo ratings yet

- Raising Capitals: Fundamentals of Corporate Finance Ross, Westerfield & Jordan 8 EditionDocument21 pagesRaising Capitals: Fundamentals of Corporate Finance Ross, Westerfield & Jordan 8 EditionSheikh RakinNo ratings yet

- Ethiopia TaxDocument60 pagesEthiopia TaxvillaarbaminchNo ratings yet

- #RWRI Second Order ThoughtsDocument6 pages#RWRI Second Order ThoughtsonlineprofessorNo ratings yet

- ACL Cables Annual Report 2016-17Document132 pagesACL Cables Annual Report 2016-17Thushianthan KandiahNo ratings yet

- Cash Book FormatDocument5 pagesCash Book FormatCandice BoodooNo ratings yet

- Semester: B. Com - V Semester Name of The Subject: Financial Market & Institutions Unit-1Document61 pagesSemester: B. Com - V Semester Name of The Subject: Financial Market & Institutions Unit-1Sparsh JainNo ratings yet

- Lecture 3 IFRS 9 Financial Instruments Financial Assets at Fair Value Through Profit or LossDocument11 pagesLecture 3 IFRS 9 Financial Instruments Financial Assets at Fair Value Through Profit or LossKhulekani SbonokuhleNo ratings yet

- A Project Report ON "Customer Preference and Satisfaction Level For Credit Schemes Offered by The Varachha Co-Operative Bank"Document109 pagesA Project Report ON "Customer Preference and Satisfaction Level For Credit Schemes Offered by The Varachha Co-Operative Bank"Ankit Malani100% (1)

- Summer Training Project Report On Study of Life Insurance PoliciesDocument88 pagesSummer Training Project Report On Study of Life Insurance PoliciesSatish Sandhu0% (1)

- 7 Steps Template of Financial Statements and Modeling and ValuationDocument113 pages7 Steps Template of Financial Statements and Modeling and ValuationBurzes BatliwallaNo ratings yet

- BU6009 Assessment 3Document4 pagesBU6009 Assessment 3Sana MohdNo ratings yet

- RIC Volume I Do IVDocument164 pagesRIC Volume I Do IVVlada Guarana JankovicNo ratings yet

- McKinley V Board of Governors AIG Production 4 January 2013 Heavily Redacted (Lawsuit #3a)Document908 pagesMcKinley V Board of Governors AIG Production 4 January 2013 Heavily Redacted (Lawsuit #3a)Vern McKinleyNo ratings yet

- Rivera Vs Espiritu 1232002Document5 pagesRivera Vs Espiritu 1232002Clee Ayra CarinNo ratings yet

- SPINK Auction 18024 - RHODESIA 1910-13 DOUBLE HEAD ISSUE THE ROYAL PALM' COLLECTIONDocument84 pagesSPINK Auction 18024 - RHODESIA 1910-13 DOUBLE HEAD ISSUE THE ROYAL PALM' COLLECTIONMitar Miric100% (1)

- Taxation - Sample QuestionsDocument9 pagesTaxation - Sample QuestionsCecille TaguiamNo ratings yet

- Form PDF 197504840210823Document9 pagesForm PDF 197504840210823jassramgarhia2812No ratings yet

- Risk Analysis Project FinanceDocument181 pagesRisk Analysis Project Financeshah_harshit25100% (1)

- Dec-13 Leasing Vs Borrowing SolutionDocument1 pageDec-13 Leasing Vs Borrowing Solutiondon_mahinNo ratings yet

- Important McqsDocument23 pagesImportant McqsAmit ChaudhryNo ratings yet

- Handbook of Malaysian Taxation Ii - Dec2020 - Mac2021!2!1Document208 pagesHandbook of Malaysian Taxation Ii - Dec2020 - Mac2021!2!1aunisyuasriNo ratings yet

- Bulk and Block Deals Made On Sep 11, 2023Document6 pagesBulk and Block Deals Made On Sep 11, 2023Tarun MondalNo ratings yet

- Group 1 Eh2208bDocument6 pagesGroup 1 Eh2208bMimi MohsinNo ratings yet

- Construction AccountDocument21 pagesConstruction AccountSureshkumaryadavNo ratings yet

- Chapter 17 Capital Budgeting For The Multinational CorporationDocument24 pagesChapter 17 Capital Budgeting For The Multinational CorporationAgatha SekarNo ratings yet