Indian Institute of Management, Kozhikode: Course Term Credits Instructor

Indian Institute of Management, Kozhikode: Course Term Credits Instructor

Uploaded by

Anjali LakraCopyright:

Available Formats

Indian Institute of Management, Kozhikode: Course Term Credits Instructor

Indian Institute of Management, Kozhikode: Course Term Credits Instructor

Uploaded by

Anjali LakraOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Indian Institute of Management, Kozhikode: Course Term Credits Instructor

Indian Institute of Management, Kozhikode: Course Term Credits Instructor

Uploaded by

Anjali LakraCopyright:

Available Formats

Page 1 of 2

INDIAN INSTITUTE OF MANAGEMENT, KOZHIKODE

IIM Kozhikode Campus P.O. Kozhikode- 673 570

Course FM I

Term II of 2010-11

Credits 3

Instructor S S S Kumar

This is your gateway to the world of finance and this course aims to equip you with the basic

tools and techniques necessary to be a complete manager irrespective of which specialization

you opt for. In this course we focus mostly on the principles of valuation both financial as well

as real assets.

Objective

The objective of this course is to impart the skill-set required to do the first-cut valuation

exercises.

Course conduct

We will start off understanding the context - financial markets and then we will pick up the

necessary skills required to take up valuation exercises - the concept of time value of money in

detail. Then apply the principles to value (a) real investments (popularly known as capital

budgeting) and (b) financial investments (stocks and bonds). While analyzing the investments we

will use the economic profit concept in lieu of the accounting profits with which you were

familiar with. Since no financial decision-making is devoid of risk we will see the concept of

(beta) risk, and the relation between risk and return. The course will end with an introductory

treatment of derivatives and their application to real investments.

The tentative session plan:

Sl. Topic Likely Major readings

No no.

of

classes

1 Introduction 1 BMA 1, BMA 15 & 16; Handout

2 Time value concepts 3 BMA 3

3 Capital Budgeting techniques 3 BMA 2 and 6; Handout

4 Capital Budgeting - estimating 2 BMA 7

cashflows

5 Principles of valuation bond 2 BMA 4; Handout

valuation

6 Principles of valuation stock 2 BMA 5

valuation

7 Risk and return 3 BMA 8 & 9

8 Cost of capital 2 BMA 10

9 Risk analysis in capital budgeting 2 BMA 11

10 Introduction to derivatives and real 2 BMA 21 & 23

options

Page 2 of 2

The above number of classes works out to 22 classes each of 75 mts duration. The remaining

classes (around 2) will act as cushion against any spillovers that I certainly foresee to happen. The

pedagogy is a two-phase model concept discussion session followed by a session that makes

you put to use the concepts by working out exercises/caselets. Past students experience indicate

that doing problems soon after the material is covered in class is the best way to learn finance.

The problems and exercises that will be used in the class are graded according to level of

difficulty but are taken from the books mentioned in the references list.

Grading

We will follow relative grading. Based on the nature of the component I may award a letter grade

directly or first give marks and then convert in to letter grades if required. All tests and quizzes

will be closed book, unless announced otherwise. You are not allowed to use your

laptops/palmtops/or any electronic gadget except the calculator you normally use in the class.

The weightage for various components are as follows:

Assignments and Surprise Quizzes 25%

Class Tests 20%

Mid term Exam 20%

End Term Exam 35%

1. Assignments will be predominantly problem sets may be from your text book or other

sets distributed in the class. I expect you to work in groups of three according to your roll

numbers. I may not insist on submission every-time and mostly you will be evaluated

based on surprise a quiz in the class.

2. The class tests will be of 45mt to 60 mt duration. In the past the test contents varied from

MCQs to caselets and it will not be announced a priori as to what comprises the test.

Most probable time points for conducting the tests - at the end of topics 2, 6 and/or 8 and

you will be informed in advance as to when the test will be conducted.

3. All the evaluated exam papers, test papers, quiz papers and assignments that will be

distributed to you should be retained by you till the final grades are announced.

Attendance

Your attendance will be governed by the PGP rules. Retests or reexaminations etc., will be guided

by the relevant items from PGP Handbook that are in force.

Make sure you attend every class with a calculator.

Reference Books

1. Principles of Corporate Finance by Brealey, Myers & Allen 9/e

2. Corporate Finance by Ross, Westerfield and Jaffe

3. Corporate Finance by Aswath Damodaran

4. Financial Management by I M Pandey

5. Financial Management by Prasannachandra

You might also like

- Nüve - Ot 32VS Service ManualDocument50 pagesNüve - Ot 32VS Service ManualIvan Villena Chuman100% (4)

- Lista Nepravilnih Glagola Sa PrevodomDocument5 pagesLista Nepravilnih Glagola Sa PrevodomOlivera Vidar100% (3)

- Global Management and Politics Financial Reporting and Performance Measurement Prof. Jonathan BerkovitchDocument4 pagesGlobal Management and Politics Financial Reporting and Performance Measurement Prof. Jonathan BerkovitchFanny BozziNo ratings yet

- MGTA02 Course Outline - Winter 2023 - Arif Toor (Intro To Business)Document12 pagesMGTA02 Course Outline - Winter 2023 - Arif Toor (Intro To Business)Karine DaghlianNo ratings yet

- CAPM® in Depth: Certified Associate in Project Management Study Guide for the CAPM® ExamFrom EverandCAPM® in Depth: Certified Associate in Project Management Study Guide for the CAPM® ExamNo ratings yet

- A Murder Is Announced: Teacher's NotesDocument5 pagesA Murder Is Announced: Teacher's NotesИлона СергеевнаNo ratings yet

- Ms-05-Management of Machines and MaterialsDocument19 pagesMs-05-Management of Machines and Materialszordotcom100% (2)

- Syllabus 2 2023Document4 pagesSyllabus 2 2023Dinesh KumarNo ratings yet

- Theory QuestionsDocument256 pagesTheory QuestionsSachin Kumar100% (1)

- Lazer - Syllabus FSA - OY - 2023 - RUNIDocument5 pagesLazer - Syllabus FSA - OY - 2023 - RUNIכפיר בר לבNo ratings yet

- 293 Financial Accounting - COURSE OUTLINEDocument7 pages293 Financial Accounting - COURSE OUTLINEsilenteyesNo ratings yet

- Modul Finance 2020 PDFDocument96 pagesModul Finance 2020 PDFMutiaraMorentNo ratings yet

- Adm 3350 2022 SyllabusDocument14 pagesAdm 3350 2022 SyllabusjbearmcdonaldsNo ratings yet

- A1 Syllabus BA 629 Spring 2019 - Section 1 - MorningDocument19 pagesA1 Syllabus BA 629 Spring 2019 - Section 1 - MorninggauriNo ratings yet

- Comm 308 OutlineDocument5 pagesComm 308 Outlineadcyechicon123No ratings yet

- School of Business & Economics Department of Accounting & FinanceDocument4 pagesSchool of Business & Economics Department of Accounting & FinanceMd JonaidNo ratings yet

- Institute of Business Administration-Karachi Financial Management (Fin401) Course Outline Updated ONLINE Spring 2020Document4 pagesInstitute of Business Administration-Karachi Financial Management (Fin401) Course Outline Updated ONLINE Spring 2020Ghina ShaikhNo ratings yet

- Course Outline FIN 421 BRAC University - BBADocument7 pagesCourse Outline FIN 421 BRAC University - BBASaiyan IslamNo ratings yet

- Module Handbook 2017/2018: Banking Academy of Vietnam Finance FacultyDocument6 pagesModule Handbook 2017/2018: Banking Academy of Vietnam Finance FacultyVũ Thị Lan HươngNo ratings yet

- Final Year - Business Management Information Booklet 2022-23Document33 pagesFinal Year - Business Management Information Booklet 2022-23Rammani MandalNo ratings yet

- Outline New Financial Management by Farah YasserDocument6 pagesOutline New Financial Management by Farah YasserLaiba KhalidNo ratings yet

- A. Financial Management 13Document5 pagesA. Financial Management 13Honey EditsNo ratings yet

- FIN 444 Spring 2017 (Evening) SyllabusDocument4 pagesFIN 444 Spring 2017 (Evening) Syllabus04071990No ratings yet

- Ecn 212 - SyllabusDocument6 pagesEcn 212 - SyllabusGeorge BeainoNo ratings yet

- ACCT5170 Syllabus - 2023Document7 pagesACCT5170 Syllabus - 2023bafsvideo4No ratings yet

- Allama Iqbal Open University, Islamabad (Department of Business Administration)Document7 pagesAllama Iqbal Open University, Islamabad (Department of Business Administration)Mosal WassiNo ratings yet

- Silabi Ifm MMDocument4 pagesSilabi Ifm MMNenden DeaNo ratings yet

- Acc. Course OutlineDocument5 pagesAcc. Course OutlineNoor DeenNo ratings yet

- UT Dallas Syllabus For Aim6334.501.07s Taught by Liliana Hickman-Riggs (llh017100)Document12 pagesUT Dallas Syllabus For Aim6334.501.07s Taught by Liliana Hickman-Riggs (llh017100)UT Dallas Provost's Technology GroupNo ratings yet

- North East University Bangladesh: Course SyllabusDocument5 pagesNorth East University Bangladesh: Course SyllabusSrawar Jahan TareqNo ratings yet

- Financial Management (FN-550) : Course IntroductionDocument5 pagesFinancial Management (FN-550) : Course IntroductionAsadEjazButtNo ratings yet

- FARSyllabusDocument3 pagesFARSyllabusmoawad650No ratings yet

- Wa0001.Document356 pagesWa0001.josphatgitathaNo ratings yet

- Course Syllabus: MGT 142 (FDocument4 pagesCourse Syllabus: MGT 142 (FMaria Romelyn MontajesNo ratings yet

- MBA 5250 E (F2022) Course Outline (Bruce Millar)Document11 pagesMBA 5250 E (F2022) Course Outline (Bruce Millar)Chintan PatelNo ratings yet

- 2.2.1 Course Docket Financial ManagementDocument121 pages2.2.1 Course Docket Financial ManagementSara ZafarNo ratings yet

- B.F. by S.K As at 5 May 2005Document355 pagesB.F. by S.K As at 5 May 2005John Munene Karoki100% (2)

- FINN 200 - Intermediate Finance-Bushra NaqviDocument4 pagesFINN 200 - Intermediate Finance-Bushra NaqviazizlumsNo ratings yet

- Audit & Assurance Study Guide 2015Document26 pagesAudit & Assurance Study Guide 2015Maddie Green100% (1)

- Course Outline Aacsb Mba 611 Management AccountingDocument6 pagesCourse Outline Aacsb Mba 611 Management AccountingNishant TripathiNo ratings yet

- 132 Studymat FM Nov 2009Document72 pages132 Studymat FM Nov 2009Ashish NarulaNo ratings yet

- Finance Module OutlineDocument5 pagesFinance Module OutlinemihsovyaNo ratings yet

- Fnce203 - Tu JunDocument4 pagesFnce203 - Tu JunYing SunNo ratings yet

- Silabus SPM PDFDocument4 pagesSilabus SPM PDFMamamaNo ratings yet

- b47b7c26 Syllabus CF1 CLCDocument8 pagesb47b7c26 Syllabus CF1 CLCKhánh LyNo ratings yet

- Allama Iqbal Open University, Islamabad Warning: (Department of Business Administration)Document7 pagesAllama Iqbal Open University, Islamabad Warning: (Department of Business Administration)NadeemAdilNo ratings yet

- Financial Markets and Valuation: Course PurposeDocument7 pagesFinancial Markets and Valuation: Course PurposeVishakha ChopraNo ratings yet

- 415-1x - L00 - Video 3 - Introduction To Modern Finance-EnDocument2 pages415-1x - L00 - Video 3 - Introduction To Modern Finance-EnDaveYepestNo ratings yet

- Ahore Chool OF Conomics: Cost Accounting (ACC-302)Document8 pagesAhore Chool OF Conomics: Cost Accounting (ACC-302)he20003009No ratings yet

- UT Dallas Syllabus For Aim6202.597.09s Taught by Ramachandran Natarajan (Nataraj)Document8 pagesUT Dallas Syllabus For Aim6202.597.09s Taught by Ramachandran Natarajan (Nataraj)UT Dallas Provost's Technology GroupNo ratings yet

- UT Dallas Syllabus For Aim6202.mbc.07f Taught by Ramachandran Natarajan (Nataraj)Document8 pagesUT Dallas Syllabus For Aim6202.mbc.07f Taught by Ramachandran Natarajan (Nataraj)UT Dallas Provost's Technology GroupNo ratings yet

- Scott Besley and Eugene F. Brigham. Essentials of Managerial Finance. 14 Edition. USA: Thomson, South-WesternDocument2 pagesScott Besley and Eugene F. Brigham. Essentials of Managerial Finance. 14 Edition. USA: Thomson, South-WesternominNo ratings yet

- All About CfaDocument8 pagesAll About CfaLethalNo ratings yet

- Lect Plan Financial ManagementDocument4 pagesLect Plan Financial Managementlokesh_arya1No ratings yet

- Syllabus - FSA - Fall 2020 - Section 004Document7 pagesSyllabus - FSA - Fall 2020 - Section 004RanjeetaTiwariNo ratings yet

- SYLLABUS-Cost & Management AccountingDocument3 pagesSYLLABUS-Cost & Management AccountinglakshmiNo ratings yet

- Department of Business Administration: Course DescriptionDocument4 pagesDepartment of Business Administration: Course DescriptionSadia FarahNo ratings yet

- IFRS - ManualDocument4 pagesIFRS - ManualLawin HassanNo ratings yet

- Corporate Finance - LSE - MBA1Document7 pagesCorporate Finance - LSE - MBA1Umme Laila JatoiNo ratings yet

- Allama Iqbal Open University, Islamabad (Department of Business Administration)Document7 pagesAllama Iqbal Open University, Islamabad (Department of Business Administration)WasifNo ratings yet

- Accounting MGT-130 FALL - 2019Document4 pagesAccounting MGT-130 FALL - 2019Sajid Ali100% (1)

- m405 01 2195443yy5t6t25Document3 pagesm405 01 2195443yy5t6t25Orlan RodriguezNo ratings yet

- financial statements analysisDocument4 pagesfinancial statements analysismisheleiNo ratings yet

- UT Dallas Syllabus For Fin6310.501.10f Taught by Yexiao Xu (Yexiaoxu)Document7 pagesUT Dallas Syllabus For Fin6310.501.10f Taught by Yexiao Xu (Yexiaoxu)UT Dallas Provost's Technology GroupNo ratings yet

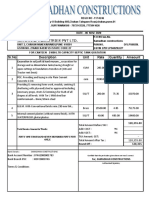

- Fixed Monthly Fee:: USA UK 2.5 1 4 1.75Document3 pagesFixed Monthly Fee:: USA UK 2.5 1 4 1.75Anjali LakraNo ratings yet

- #GST Twitter Search Data (Limited To 200 Tweets) - Raw DataDocument170 pages#GST Twitter Search Data (Limited To 200 Tweets) - Raw DataAnjali LakraNo ratings yet

- NOT To FILL Translation For The OFII FormDocument1 pageNOT To FILL Translation For The OFII FormAnjali LakraNo ratings yet

- Dvanced Market ResearchDocument5 pagesDvanced Market ResearchAnjali LakraNo ratings yet

- Employee EngagementDocument37 pagesEmployee EngagementAnjali LakraNo ratings yet

- Game TheoryDocument4 pagesGame TheoryAnjali LakraNo ratings yet

- Advanced Methods in Marketing Research Prof. Atanu Adhikari: SL No. Roll No NameDocument2 pagesAdvanced Methods in Marketing Research Prof. Atanu Adhikari: SL No. Roll No NameAnjali LakraNo ratings yet

- Text Book(s) Text Book(s) Text Book(s) : TH TH THDocument4 pagesText Book(s) Text Book(s) Text Book(s) : TH TH THAnjali LakraNo ratings yet

- Manjira River EMDocument2 pagesManjira River EMAnjali LakraNo ratings yet

- Design ThinkihhngDocument35 pagesDesign ThinkihhngAnjali LakraNo ratings yet

- Ankita Akeni Tybaf - Blackbook - Demonetization - ProjectDocument48 pagesAnkita Akeni Tybaf - Blackbook - Demonetization - ProjectSaikumar PillamariNo ratings yet

- Branded Water Bottle IndustryDocument32 pagesBranded Water Bottle IndustryHeemanish Midde100% (1)

- Acknowledgment SampleDocument4 pagesAcknowledgment Sampletsul venusNo ratings yet

- India-International Mathematical Olympiad Training Camp-2011Document4 pagesIndia-International Mathematical Olympiad Training Camp-2011Himansu MookherjeeNo ratings yet

- Ak09911 PDFDocument18 pagesAk09911 PDFrallu. ralucaNo ratings yet

- REPORT4Document31 pagesREPORT4Kaleab EndaleNo ratings yet

- BRIST Product Portfolio 2022 v20221014Document24 pagesBRIST Product Portfolio 2022 v20221014Семен КопыловNo ratings yet

- Placement: Key FeaturesDocument7 pagesPlacement: Key FeaturesNaveen Silveri100% (1)

- Omnibus Certification of Authenticity and Veracity of DocumentsDocument1 pageOmnibus Certification of Authenticity and Veracity of DocumentsWendell SorianoNo ratings yet

- MKT7490 - en Interpon Redox Brochure - v2Document12 pagesMKT7490 - en Interpon Redox Brochure - v2jmcastellviNo ratings yet

- Cagri Karaciklar Benign Soft Tissue TumorsDocument5 pagesCagri Karaciklar Benign Soft Tissue TumorsÇağrıNo ratings yet

- EarthworkDocument54 pagesEarthworkNurul AmiraNo ratings yet

- Chapter 9. Scale Deposition, Removal, and Prevention (Energi)Document11 pagesChapter 9. Scale Deposition, Removal, and Prevention (Energi)Anonymous tTk3BfaHNo ratings yet

- Steel MakingDocument35 pagesSteel MakingBharichalo007No ratings yet

- MASONRYDocument12 pagesMASONRYEVANS KIPNGETICH100% (1)

- ECO261 Sheet 2Document6 pagesECO261 Sheet 2Hugo CopperfieldNo ratings yet

- Pendekatan Genre Based Dalam Pengajaran Bahasa IngDocument1 pagePendekatan Genre Based Dalam Pengajaran Bahasa IngbobiNo ratings yet

- Shortlisted Candidates For 2nd RoundDocument6 pagesShortlisted Candidates For 2nd RoundJodNo ratings yet

- 6) Air Contains Smoke Dust Germs and Water VaporDocument4 pages6) Air Contains Smoke Dust Germs and Water Vaporkabirdubal232No ratings yet

- Auto Line Industries PVT LTD.: Total Invoice Amount in WordsDocument3 pagesAuto Line Industries PVT LTD.: Total Invoice Amount in WordsV. S. suryawanshiNo ratings yet

- Bf-Tu Mapping Ehp 2-3 F Erp 6 v9Document9 pagesBf-Tu Mapping Ehp 2-3 F Erp 6 v9Bharti JainNo ratings yet

- SOLIDWORKS Simulation 2019 ValidationDocument140 pagesSOLIDWORKS Simulation 2019 Validationluansaldanha100% (3)

- Ipe 504 Group 1Document15 pagesIpe 504 Group 1favourbudex2No ratings yet

- Hospitalpharmacyreport Intravenousadmixtures 120313054528 Phpapp01Document69 pagesHospitalpharmacyreport Intravenousadmixtures 120313054528 Phpapp01Yulian 53No ratings yet

- Best Home Appliances Company in Cuttack OdishaDocument20 pagesBest Home Appliances Company in Cuttack Odishaalok jyotiNo ratings yet